Since the beginning of the year we’ve continued to have shallow pullbacks leading the S&P 500 to TAP the 50 Day Moving Average multiple times (see above).

On Wednesday, we saw some weakness in the general indices following the release of the Fed Minutes. Will this be another reason to TAP the 50 DMA again? Time will tell, but the minutes were more of an excuse for the weakness than the reason.

If you read the text carefully, there were so few changes that they probably spent more time debating what was for lunch than when to start the taper. Here are the key points – that do not strike me as particularly hawkish:

STATEMENT POINTS:

- The sectors most adversely affected by the pandemic have shown improvement but have not fully recovered.

- Inflation has risen, largely reflecting transitory factors.

- Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

- The path of the economy continues to depend on the course of the virus.

- Risks to the economic outlook remain.

- The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run.

- With inflation having run persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer‑term inflation expectations remain well anchored at 2 percent.

- The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved.

- The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time.

- Last December, the Committee indicated that it would continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage‑backed securities by at least $40 billion per month until substantial further progress has been made toward its maximum employment and price stability goals. Since then, the economy has made progress toward these goals, and the Committee will continue to assess progress in coming meetings.

MINUTES POINTS:

- With respect to the path of net asset purchases, respondents to the Open Market Desk’s surveys of primary dealers and market participants expected communications on asset purchases to evolve gradually, with signals anticipated over coming months regarding both the Committee’s assessment of conditions constituting “substantial further progress” and details on tapering plans. Almost 60 percent of respondents anticipated the first reduction in the pace of net asset purchases to come in January.

- No decisions regarding future adjustments to asset purchases were made at this meeting.

- Most participants judged that the Committee’s standard of “substantial further progress” toward the maximum-employment goal had not yet been met.

- At the same time, most participants remarked that this standard had been achieved with respect to the price-stability goal.

- A few participants noted, however, that the transitory nature of this year’s rise in inflation, as well as the recent declines in longer-term yields and in market-based measures of inflation compensation, cast doubt on the degree of progress that had been made toward the price-stability goal since December.

- Participants agreed that the Committee would provide advance notice before making changes to its balance sheet policy.

- With respect to the effects of the pandemic, several participants indicated that they would adjust their views on the appropriate path of asset purchases if the economic effects of new strains of the virus turned out to be notably worse than currently anticipated and significantly hindered progress toward the Committee’s goals.

- July SLOOS reported that demand for C&I loans had improved over the second quarter; however, market commentary suggested that demand was still generally weak.

- The staff expected the 12‑month change in PCE prices to move down gradually over the second part of 2021, reflecting an anticipated moderation in monthly inflation rates and the waning of base effects; even so, PCE price inflation was projected to be running well above 2 percent at the end of the year.

- Over the following year, the boost to consumer prices caused by supply issues was expected to partly reverse, and import prices were expected to decelerate sharply; as a result, PCE price inflation was expected to step down to a little below 2 percent in 2022 before additional increases in resource utilization raised it to 2 percent in 2023.

- In discussing the uncertainty and risks associated with the economic outlook, many participants remarked that uncertainty was quite high, with slowing in progress on vaccinations and developments surrounding the Delta variant posing downside risks to the economic outlook.

- With regard to inflation, participants commented that recent inflation readings had been boosted by the effects of supply bottlenecks and labor shortages and were likely to be transitory.

Retail Earnings

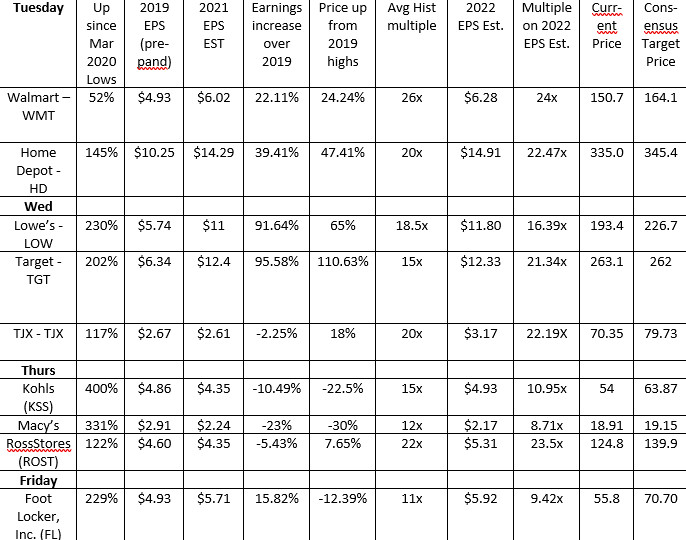

On Tuesday Morning I was on Cheddar News TV – Wake Up With Cheddar – with Baker Machado. Thanks to Baker and Ally Thompson for having me on. In this segment we covered retail earnings for Home Depot and Wal-Mart which had just come out:

In anticipation of having to speak about all retail earnings for the week, I pulled together the following spreadsheet to put into context the current price of these stocks relative to the earnings power (data as of Monday night). The key takeaway – which I mentioned at the end of the segment – was that a lot of good news was already priced into this group:

Bank of America Survey

On Tuesday, Bank of America released its monthly “Global Fund Manager Survey.” We posted our summary here:

August Bank of America Global Fund Manager Survey Results (Summary)

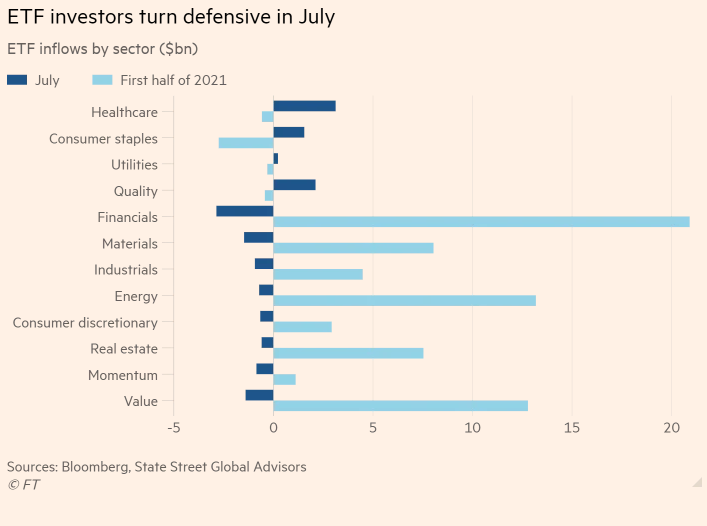

The Financial Times posted a table of fund flows that is consistent with BofA’s findings – investors moved into defensive stocks (although they are still underweight):

CHINA

One key takeaway from the survey is that “Short China Stocks” has now become a “crowded trade.”

While these numbers may change, I wanted to take a look at how analysts are thinking about the earnings power of the top 28 holdings in the popular KWEB “China Internet” ETF today (versus 60 days ago before the worst of the crackdown began). Here are the results:

The column under the date 8/18/2021 has a letter that represents the movement in 2021 earnings estimates since the most recent print (6/18/2021). “U” means 2021 estimates are UP in the last 60 days. “D” means 2021 estimates are DOWN in the last 60 days. “S” means 2021 estimates have remained the SAME in the last 60 days. The column entitled “1yr Target Est” is the Wall Street consensus 12 month price target for each stock.

The “Implied Upside Percent” column is the difference between yesterday’s closing price and the Wall Street consensus 12 month price target for each stock.

What this table is telling us is that estimates have come down. More estimates came DOWN for 2021 in the past 60 days than went UP – Down:Up – 20:6 ratio. The rest remained the same.

The cumulative 2021 earnings power of these 28 stocks was revised down by –3.69% in the past 60 days. 2022 estimates were down –3.04%.

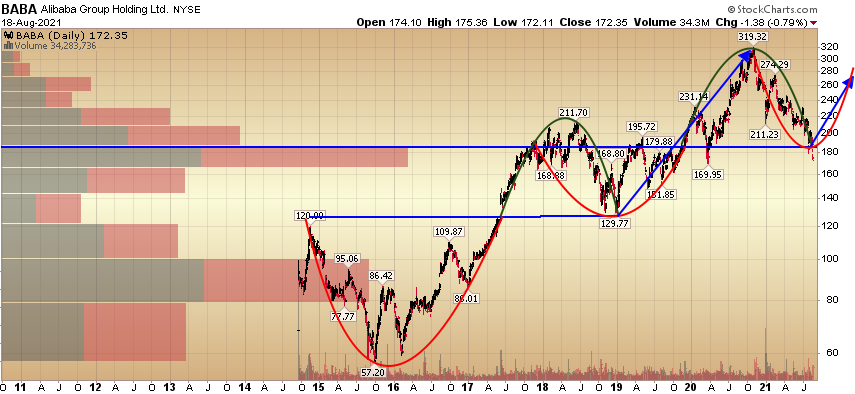

However, it is important to note that while Earnings Power was down –3.69% in the past couple of months, PRICE was down –40.32%. While earnings may come down a bit more in coming weeks, it is unlikely they will drop another 37%. With the capricious and arbitrary policy coming from the Chinese government at present, market participants have “shot first (dumped stock), and asked questions later.”

However, it is important to note that while Earnings Power was down –3.69% in the past couple of months, PRICE was down –40.32%. While earnings may come down a bit more in coming weeks, it is unlikely they will drop another 37%. With the capricious and arbitrary policy coming from the Chinese government at present, market participants have “shot first (dumped stock), and asked questions later.”

In retrospect, it will likely prove to be an overreaction (as we covered a similar Chinese environment in 2018 in last week’s note). Here is an updated chart of Alibaba that we presented in last week’s note. It’s on the skinny branches. Now we get to see if it pulls back from the brink. My bet is yes:

Now onto the shorter term view for the General Market:

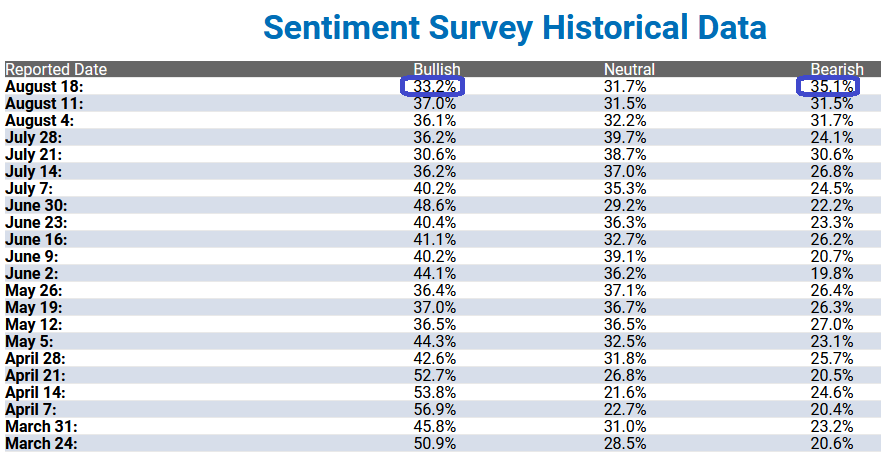

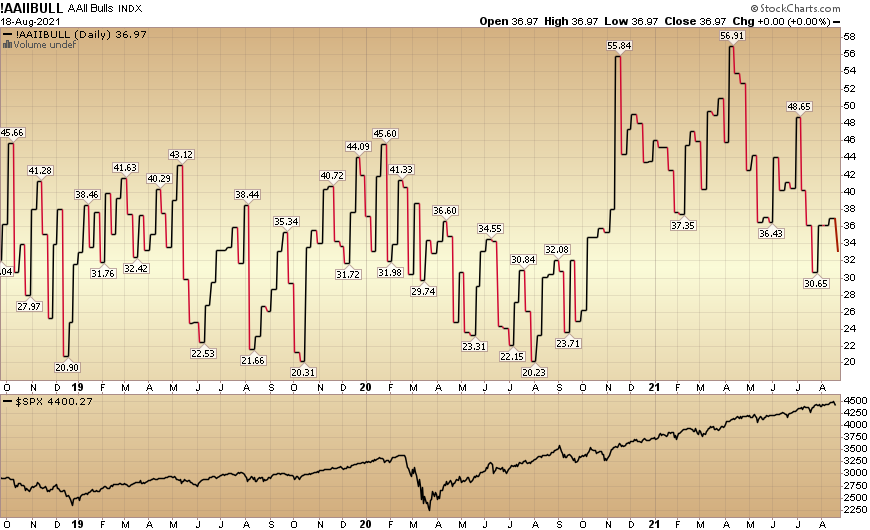

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) dropped to 33.2% from 37% last week. Bearish Percent increased to 35.1% from 31.5% last week.

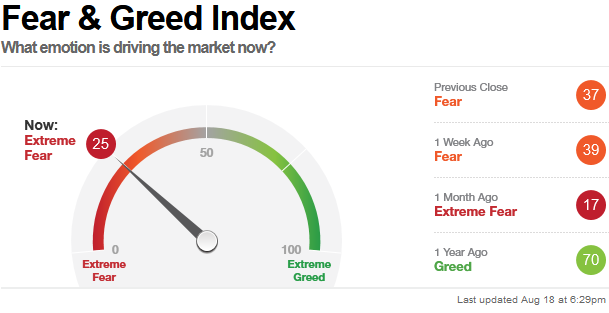

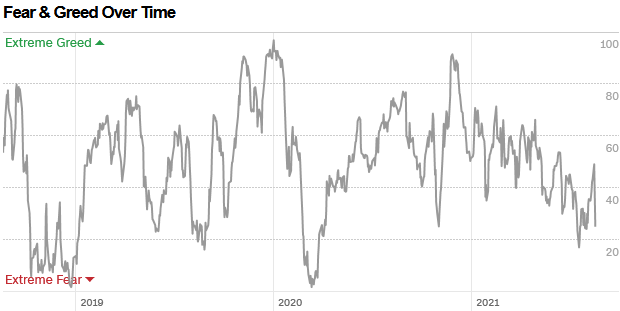

The CNN “Fear and Greed” Index dropped from 39 last week to 25 this week. Fear is present in the market. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The CNN “Fear and Greed” Index dropped from 39 last week to 25 this week. Fear is present in the market. You can learn how this indicator is calculated and how it works here: (Video Explanation)

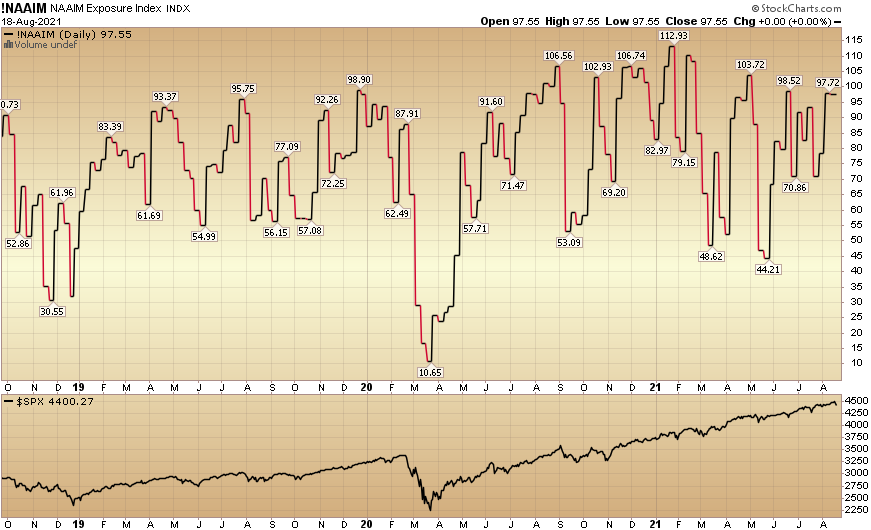

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) flat-lined at 97.55% this week from 97.2% equity exposure last week.

Our message for this week

The bottoming process is never easy (as it relates to Alibaba). But if it was easy, EVERYONE would buy quality on sale and do exceptionally well over time.

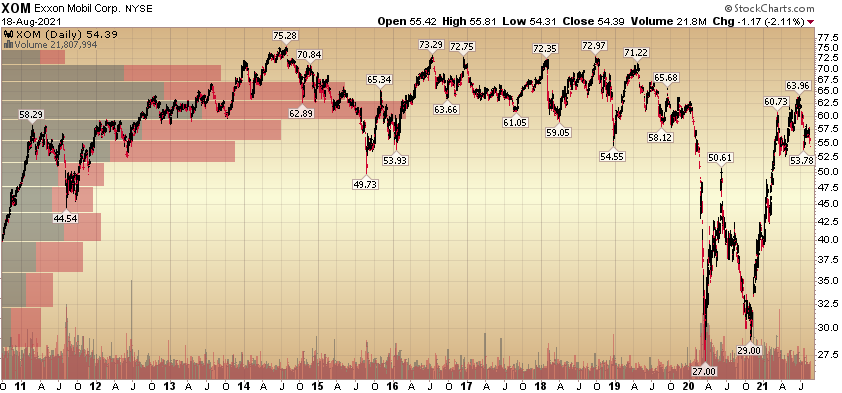

It wasn’t easy to buy Wells Fargo, Banks and Oil Stocks last year when everyone was puking them out even faster than Chinese stocks this year. But we did (Article From Sept. 24, 2020).

Here was a clip from CNBC on July 16, 2020. You can see the disbelief from the hosts when I was talking bullish on banks (and all of the technical analysts were saying, “don’t buy a downtrend”):

But “Downtrends” can turn into “Uptrends” very quickly when you know what you are buying:

It wasn’t easy to buy the stocks in the middle of the pandemic crash in late March 2020 when everyone was dumping. But we did (Article From March 19, 2020). MarketWatch picked up my note the same day. The bottom was March 20, 2020.

What’s our hedge? Time, Patience, (and sizing)…

When you buy the highest quality companies when they are on (deep discount) sale – they have a tendency to revert back to intrinsic value (as measured by their ability to generate cash) over time. This is one of the key reasons you don’t see us buying many stocks with more promises than earnings. There’s no way to identify a potential bottom with a company that doesn’t generate cash.

Remember: If there was no threat, noise, difficulty, or overshoot, there would be no dislocation (and therefore no great investment opportunity)…