Key Market Outlook(s) and Pick(s)

On Friday, I joined Stuart Varney on Fox Business “Varney & Co” to discuss markets, tariffs, the Fed, mortgage rates, Brad Jacobs, and QXO. Thanks to Stuart and Christian Dagger for having me on:

On Wednesday, I joined Maryam Moshiri on BBC News to discuss markets, tariffs, and the 90-day pause. Thanks to Maryam and Janey Wall for having me on:

Last night I joined Maria Anneke on CNBC Indonesia to discuss markets, tariffs, and the 90-day pause. Thanks to Maria and Mauren Sakul for having me on:

Tariffs Update

Over the past couple weeks, tariffs have turned Wall Street—and frankly, the world — upside down. We saw investors puking out of stocks at any price, forced liquidations, and fear and uncertainty reaching levels not seen since the GFC or the tech wreck.

Here’s the thing: this wasn’t some widespread, systemic collapse. This was entirely man-made. Self-inflicted. And just as quickly as it started, it could end with one headline, or in typical Trump fashion, one tweet.

Sure enough, this afternoon, we got that tweet. Markets then ripped higher, posting their third-biggest single-day gain since World War II.

These past couple of weeks are exactly the kind of periods I live for. When you know what you own and understand the business behind the ticker, it’s opportunities and dislocations like this that make being in this business so rewarding. And when those opportunities do show up, as Buffett would say, “When it rains gold, pull out a bucket, not a thimble.” This time, we skipped the bucket. We decided on a wheelbarrow. And of course, you’ll never perfectly time the bottom. But 12 months from now, whether you buy $VFC at $10 or $15, or $BA at $130 or $150, it won’t matter. Either way, you’ll be smiling so wide, you could eat a banana sideways!

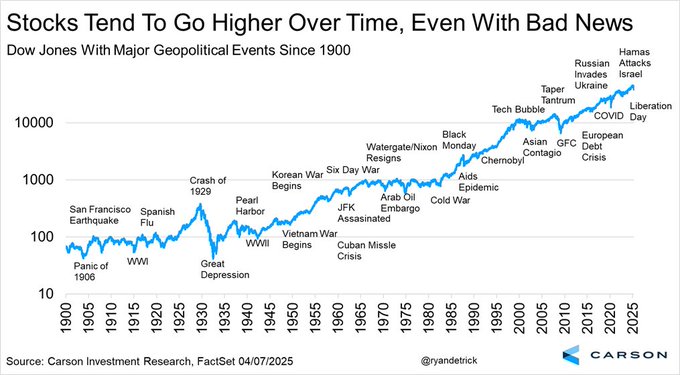

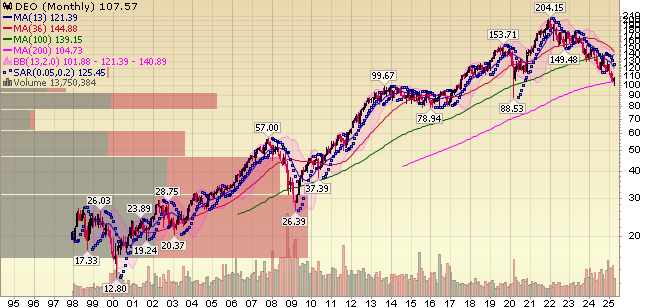

This sort of mentality, whether you call it “ice in the veins” or a lack of the FOMO gene, boils down to one of our favorite concepts here at Great Hill Capital: Zooming out! Despite all of the fear, uncertainty, and running around like it’s the end of the world, you’ll notice this barely shows up on a long-term chart. It’s nothing more than a blip on the radar.

This week, we thought it would be a good time for yet another Great Hill Capital maxim: burdening ourselves with the facts!

That is, on a company-by-company basis, looking at their tariff “perception vs. reality.” Now, with the tariff pause in effect, we can happily say: 1) those YTD peak-to-trough drawdowns look a lot different, and 2) the actual tariff exposure is now much lower.

What you’ll see is that in every case, the short-term stock drawdowns far outweigh the actual risk. In some cases, tariffs might even end up being a NET BENEFICIARY. With the 90-day pause, those selloffs now look downright silly.

Nevertheless, let’s burden ourselves with some facts…

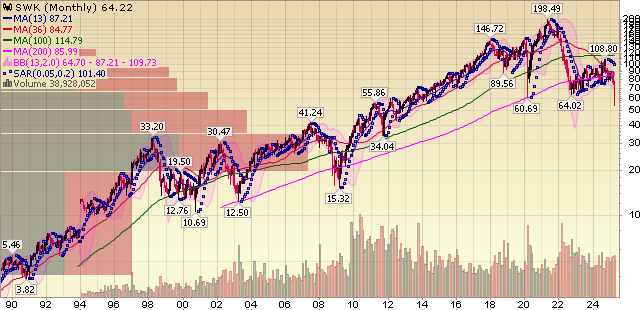

Stanley Black & Decker ($SWK)

Perception: The business will do terrible due to tariffs.

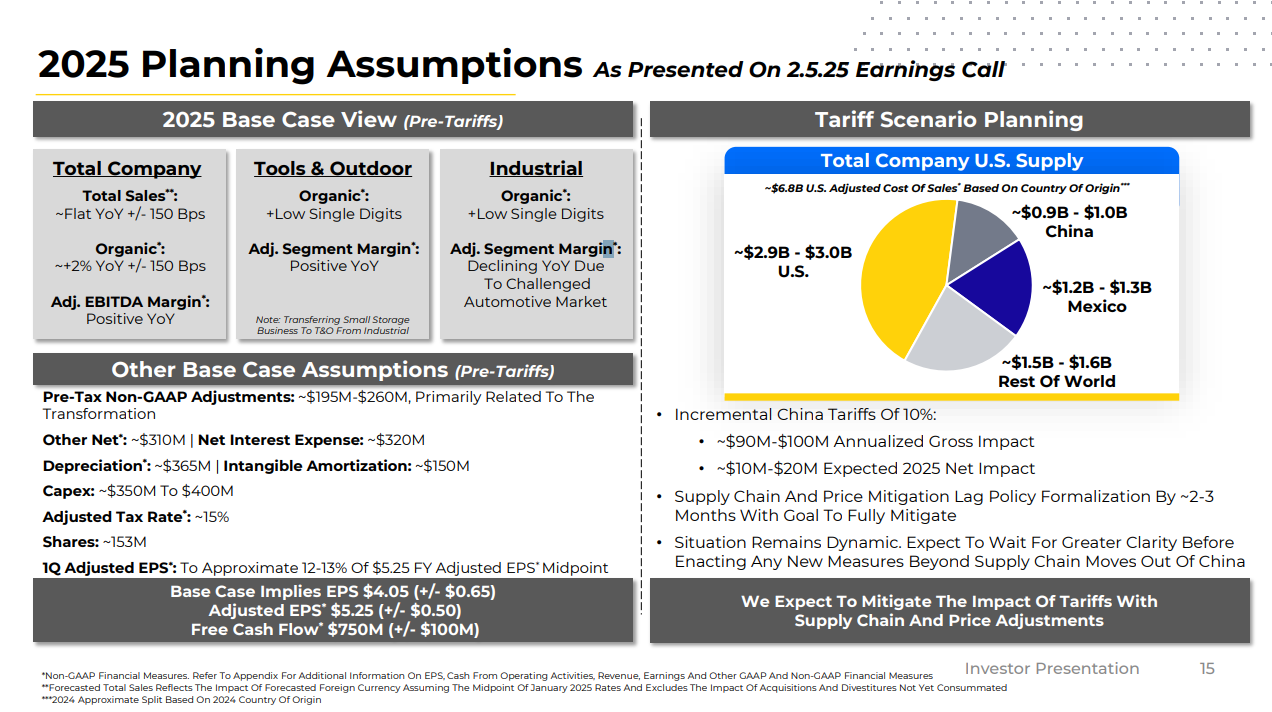

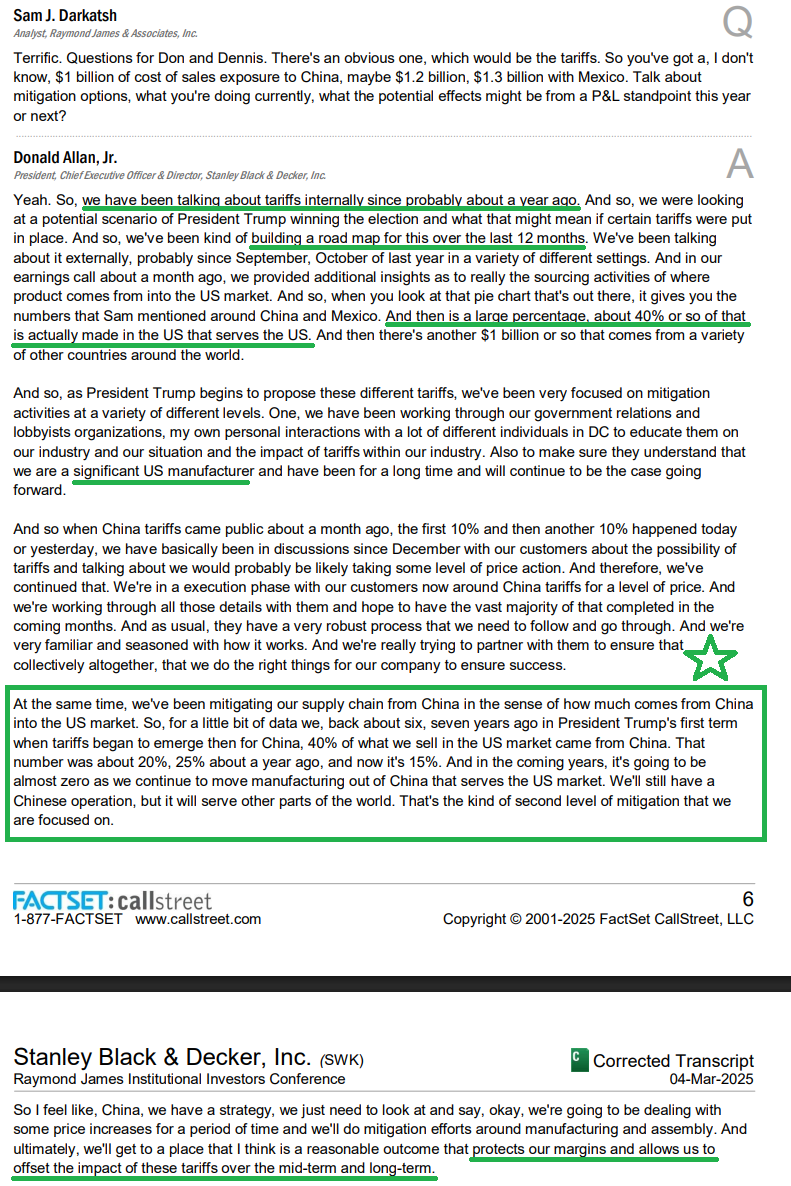

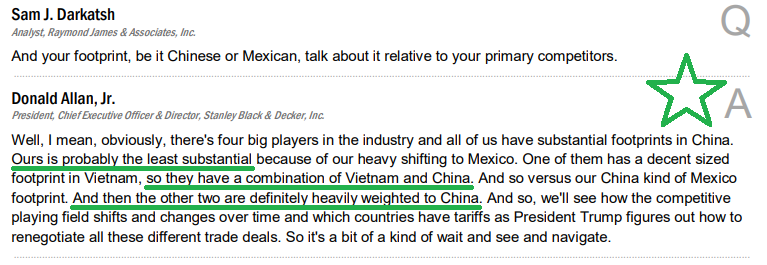

Reality: Unless you believe someone is going to suddenly build a factory in the middle of Ohio and pose a legitimate competitive threat in the tool industry, this is nothing more than a one-off price increase. There are four major players, and Stanley Black & Decker has the LEAST EXPOSURE TO CHINA (~18%) and one of the largest domestic footprints, manufacturing >40% of its sales in the US. For nearly a decade, SWK has been shifting AWAY from China and has been building its tariff playbook over the past 12 months.

With the LEAST exposure to China industry-wide, we could actually see a scenario where SWK GAINS MARKET SHARE through competitive pricing.

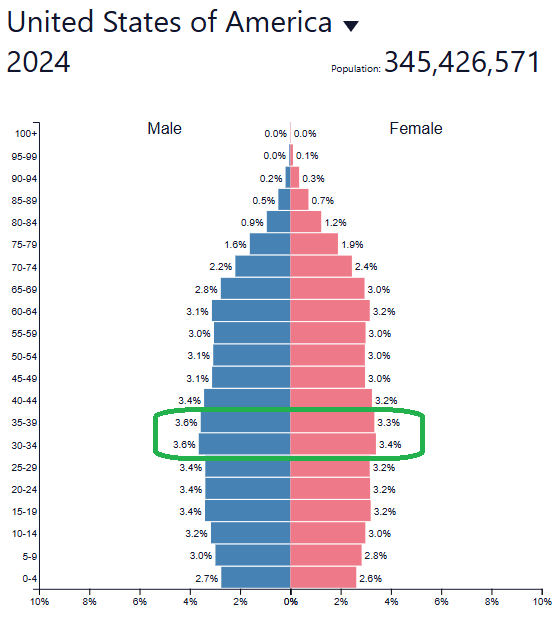

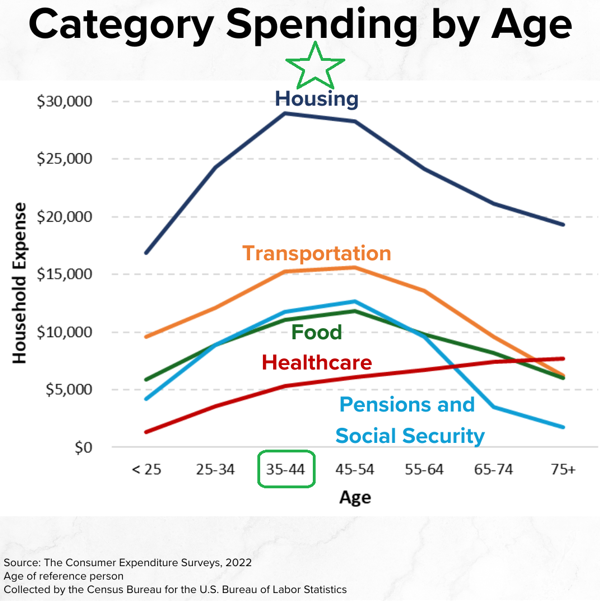

At the end of the day, this is a leveraged arms dealer play on the housing market recovery. Tariffs don’t change the fact that the US is short nearly 4 million housing units. They don’t change the peak 30-39 US demographics. And they certainly don’t change the fact that DeWalt, Craftsman, Stanley, and Black + Decker are industry-leading tool companies that have been trusted for generations.

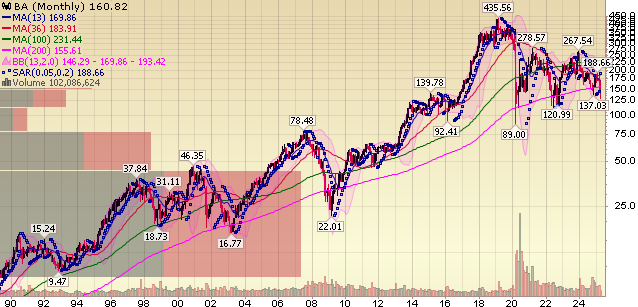

Boeing ($BA)

Perception: The business will do terrible due to tariffs.

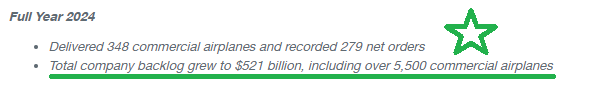

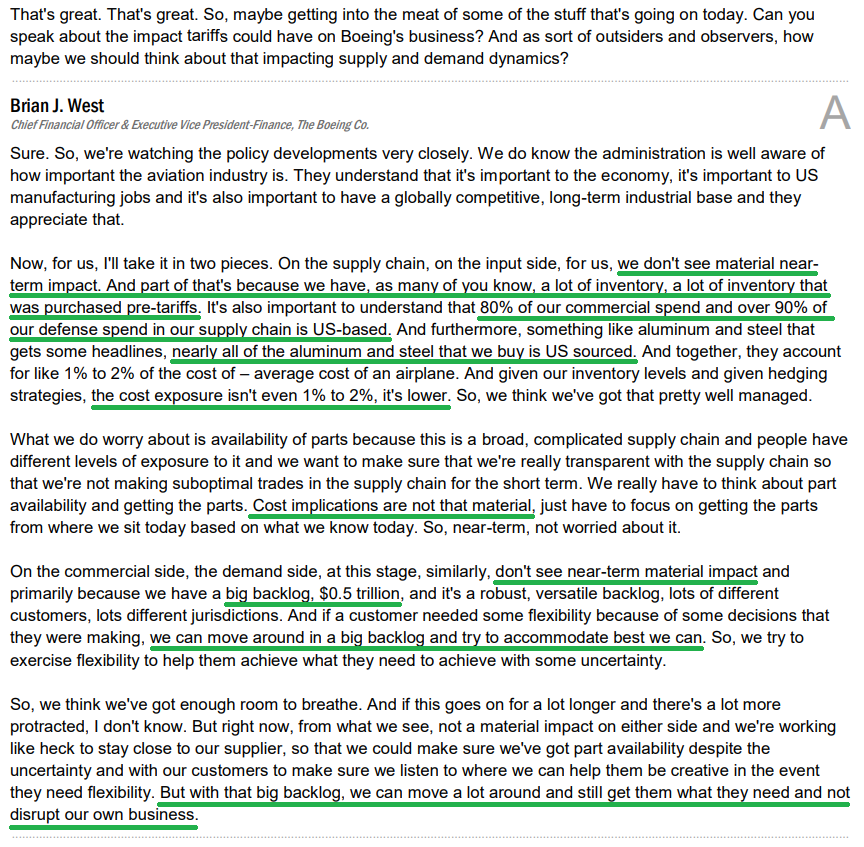

Reality: On the supply side, overall cost exposure is just 1-2% of the value of a finished plane. Nearly all of the aluminum and steel is sourced from the US, with 80% of commercial and over 90% of defense spending based domestically.

On the demand side, management sees no near-term material impact, thanks to a ~$0.5 trillion backlog and the flexibility to deliver more planes in North America and adjust deliveries to sidestep tariff exposure.

At the end of the day, this is a GROWING GLOBAL DUOPOLY. Tariffs won’t change the fact that Boeing has a $521B backlog. All you need to do is ask yourself: Will people be flying more or less in the next 10 years? This is a “second bite at the apple” opportunity to purchase what we see as a proxy of US manufacturing – set to benefit from the incoming record $1 trillion defense budget – and WE’RE TAKING FULL ADVANTAGE.

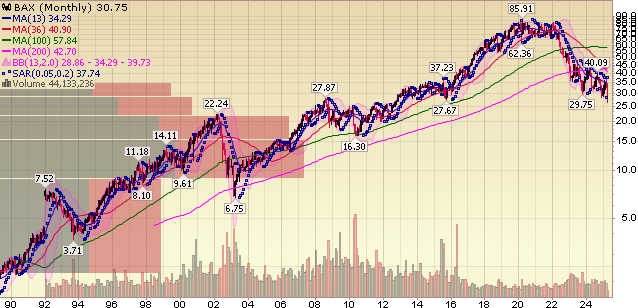

Baxter ($BAX)

Perception: The business will do terrible due to tariffs.

Reality: Overall, management has called the tariff impact “not highly material,” with manufacturing exposure to China and Canada being very small and posing minimal risk. While BAX does have several international manufacturing sites, the VAST MAJORITY of products are sold in the same country in which they are made, including Mexico, the EU, and of course, the US. For example, 95% of its IV fluids business for the US market is manufactured domestically across six IV plants.

To us, “not highly material” doesn’t exactly scream worthy of a ~22% drawdown. But we’ll happily oblige. Even if the costs of medical devices or IV bags rise, these aren’t exactly discretionary items you can afford to skip.

VF Corp ($VFC)

Perception: The business will do terrible due to tariffs.

Reality: VFC briefly made new lows, even dropping below the Q4 2024 $12 levels. Here’s the difference: During Q4 2024, VFC reported -27% growth at Vans, -5% at North Face, -14% at Timberland, -15% at Dickies, and a -13% total revenue decline, all while struggling with an over-leveraged balance sheet and negative operating margins.

Here’s what VF delivered in its latest quarter: North Face grew +5%, Vans improved to -9% with an expected inflection this back-to-school season, Timberland was up +11%, and Dickies improved to -10%, resulting in total revenues up 2% YoY. Solvency risk has been taken off the table with the $1.5B Supreme sale, and adjusted operating margins were 11.4%.

That’s not to say VF doesn’t face some real tariff risk — they are certainly exposed. But in nearly every dimension, these fears are way overblown.

Take Levi Strauss, for example. They have similar exposure to VFC, with ~40% US sales versus VF’s 53%. Levi’s just reported a solid quarter this week, and most importantly, MAINTAINED THEIR ANNUAL FORECAST, thanks to already having products for both SPRING and SUMMER. This isn’t just a Levi’s-specific phenomenon. Retailers carry months of inventory. VF had ~140 days of inventory as of Q3. Expect many retailers to pause and delay orders in the coming months and work through existing inventories while deals get sorted out with tariff-exposed countries.

We expect these deals to happen quickly because many of the countries VFC is most exposed to have a HIGH INCENTIVE to reach a deal. High, as in ~30% of Vietnam’s GDP tied to exports to the US. Cambodia’s is over 32%, and Bangladesh’s is 12%. Deals will get done.

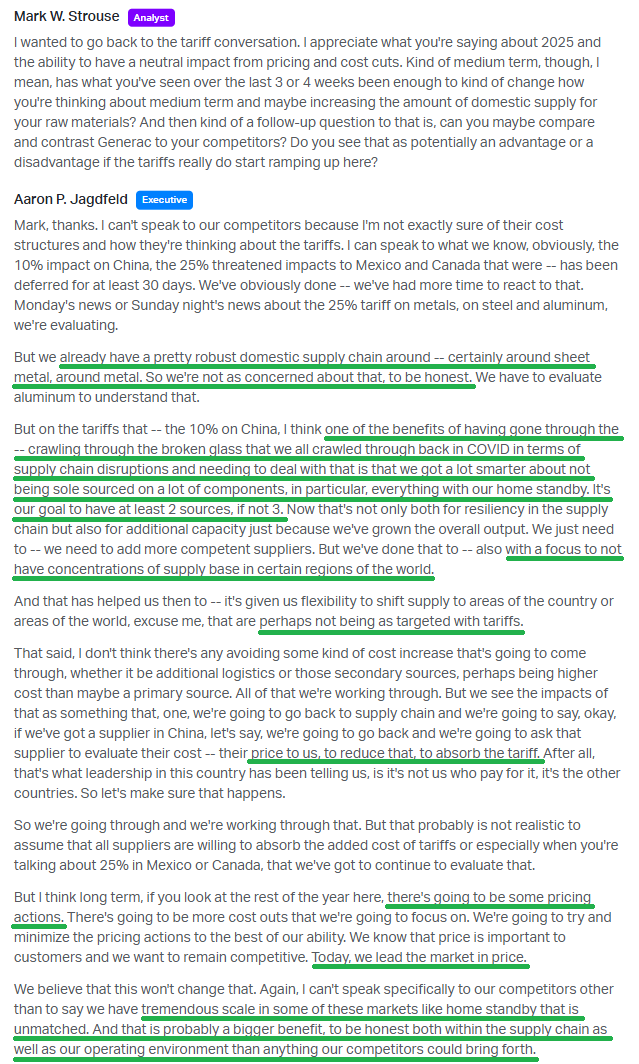

Generac ($GNRC)

Perception: The business will do terrible due to tariffs.

Reality: Generac has already shifted much of its supply chain domestically, with 5 sites in Wisconsin alone, largely done to address Covid-related inventory and supply chain disruptions. For every component needed, they have 2-3 sources. Management has already spoken about their strong domestic supply chain – particularly in metals. Management expects any cost increases to be offset by a mix of cost reductions and price hikes, resulting in a neutral impact on EBITDA margins for the year.

At the same time, Generac continues to LEAD THE MARKET in pricing and holds ~75% share of the home standby generator market. That should give Generac, AKA the Kleenex of generators, plenty of additional breathing room (compared to competitors) and the ability to lean into their scale and pricing power to offset tariff risks.

Here’s what actually matters: tariffs don’t change the reality of worsening grid reliability, increasingly severe weather events, and the massive under-penetration of the market (~6.5% penetration).

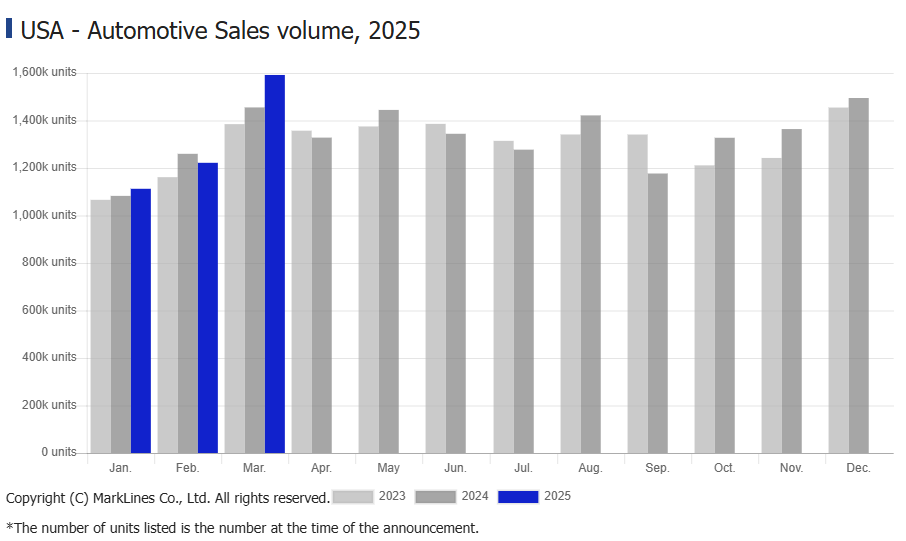

Advance Auto Parts ($AAP)

Perception: The business will do terrible due to tariffs.

Reality: AAP, along with the rest of the aftermarket auto parts sector, may actually emerge as a major BENEFICIARY of tariffs. The logic is pretty straightforward. A 25% tariff on a new $50,000 vehicle is far harder to absorb than, say, a $30 windshield wiper. For context, AutoZone has an average ticket size of around $30, and assuming AAP’s is similar, if prices were fully passed along, we’d see an average ticket of about $37.50. That’s far more manageable than the $12,500 price increase on a new vehicle.

At the same time, the average age of vehicles on the road has reached a record high of ~13 years. If people aren’t replacing their vehicles, they’re repairing them. And AAP’s business is largely non-discretionary. Whether in a downturn or not, people need to drive to work. As AutoZone CFO Jamere Jackson mentioned on the last earnings call, “THE LION’S SHARE OF OUR BUSINESS IS RELATIVELY INELASTIC.”

As for actual tariff exposure, AAP had “teen % levels” of inventory sourced from China back in Q4 2019. Since then, they’ve continued to diversify overall sourcing, leading us to believe this percentage is even LOWER today.

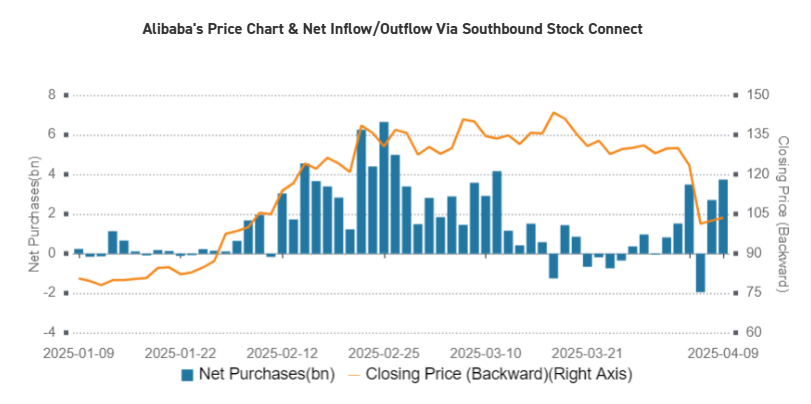

Alibaba ($BABA)

Perception: The business will do terrible due to tariffs.

Reality: Here are the facts: Alibaba essentially has 0% U.S. revenue exposure. Less than 3% of China’s GDP comes from exports to the U.S. In fact, Alibaba could end up being a MAJOR BENEFICIARY of these tariffs if China unleashes the bazooka stimulus that many have speculated on to offset weakness in exports through INCREASED DOMESTIC CONSUMPTION. Alibaba is the TOLL-TAKER of the Chinese middle class, holding ~40% market share in Chinese e-commerce. If tariffs are the catalyst to front-load stimulus and monetary easing, BABA will be the biggest winner, no question about it. Until then, BABA will keep its foot on the buyback pedal, all while the National Team and Mainland investors keep piling in (STRONGEST DAY EVER FOR SOUTHBOUND STOCK CONNECT INFLOWS YESTERDAY).

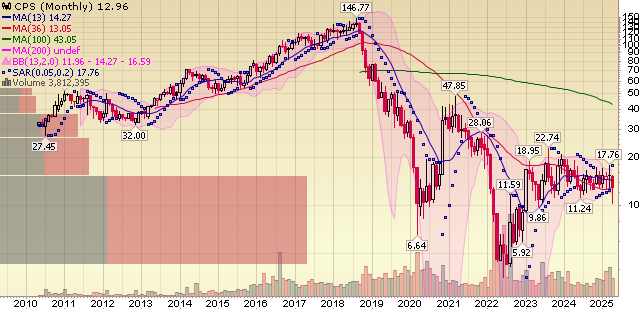

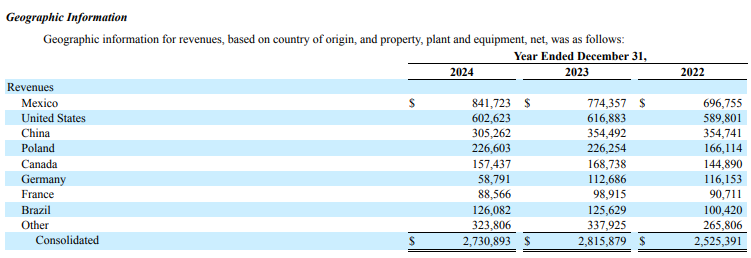

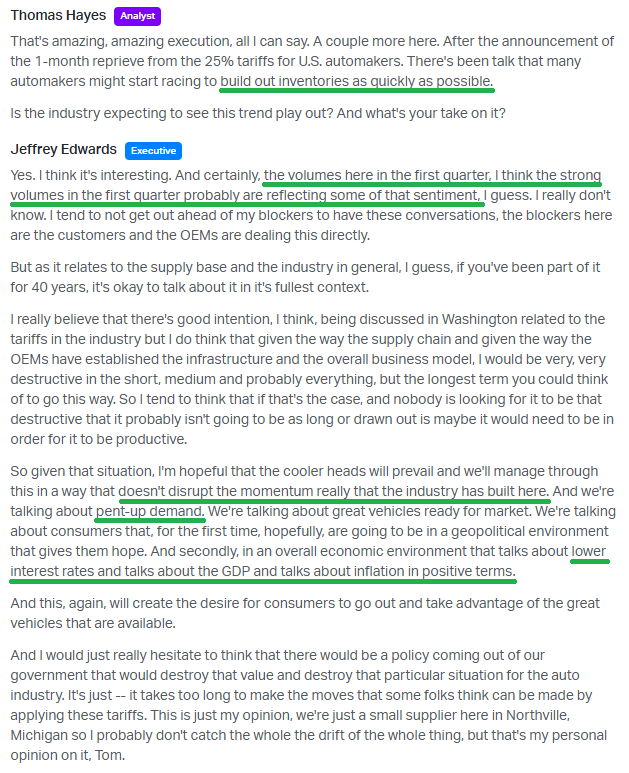

Cooper Standard ($CPS)

Perception: The business will do terrible due to tariffs.

Reality: Everything you need to know about CPS can be found below in the interview with CEO Jeff Edwards. As the late Charlie Munger would say, “Nothing to add.” CPS will be just fine.

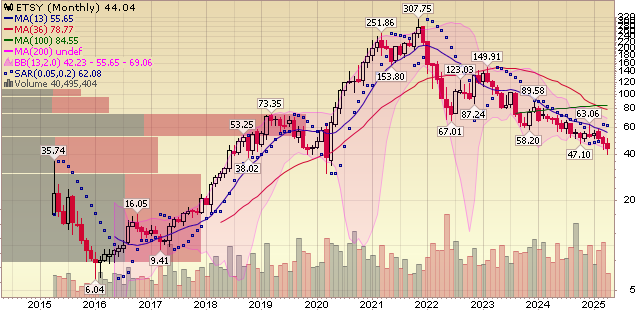

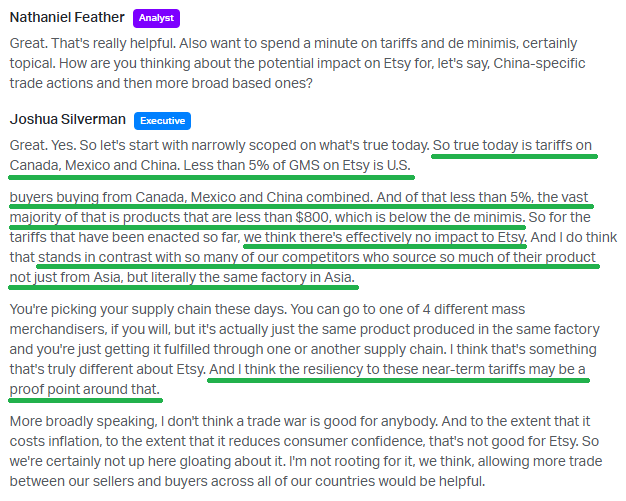

Etsy ($ETSY)

Perception: The business will do terrible due to tariffs.

Reality: Etsy may end up being a NET BENEFICIARY from tariffs and certainly from the elimination of de minimis loopholes (~1.4B packages annually). Less than 5% of GMS on Etsy comes from U.S. shoppers buying from Canada, Mexico, and China combined.

This compares to peers who, oftentimes, are ordering from the EXACT SAME ASIAN factories and selling the same cheap, junk products. This is where Etsy stands out, and in the end, it could serve as a key catalyst for re-accelerating GMS.

Albemarle ($ALB)

Perception: The business will do terrible due to tariffs.

Reality: The name of the game with Albemarle is Chinese EVs and plug-in hybrids, which are expected to account for over 60% of EVs sold in 2024. The US, in comparison, only accounted for 10%. Just last month, sales of Chinese EVs and plug-in hybrids jumped 38%, making up 50.4% of overall sales in China. Expect that trend to continue. Overall, management expects VERY LITTLE direct impact from tariffs.

GXO Logistics ($GXO)

Perception: The business will do terrible due to tariffs.

Reality: ~74% of revenues are ex-US. Two of GXO’s biggest opportunities are increased supply chain complexity and US re-shoring. If tariffs aren’t a catalyst for both of those trends, I don’t know what is. GXO has no exposure to the de minimis exemption and is already working with customers looking to shift supply chains domestically, which could very well end up being GOOD NEWS. The CMA deadline is coming up at the end of April, which will be the next big catalyst. Until then, European stimulus, particularly German defense spending (which is one of Wincanton’s biggest verticals and now GXO’s fastest-growing market) along with a weaker dollar will continue to benefit GXO.

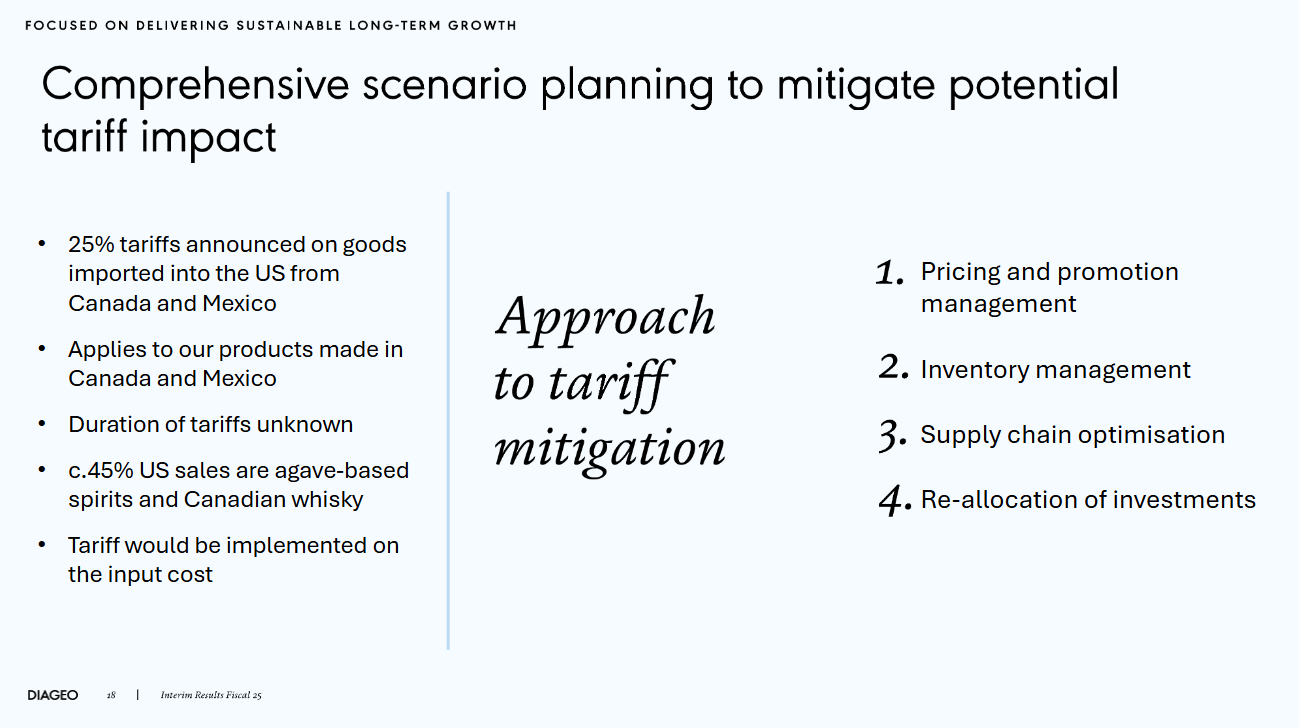

Diageo ($DEO)

Perception: The business will do terrible due to tariffs.

Reality: Diageo, along with the rest of the alcohol industry, avoided the worst of the tariffs thanks to the USMCA trade deal, which exempts spirits like tequila and Canadian whiskey (~45% of DEO US sales). The rest of Diageo’s exposure includes a 10% UK tariff, a 20% EU tariff, and 10% from the rest of the world. Combined, these would lead to an estimated 2% hit to profits if the company absorbs all costs, according to UBS estimates (Now even LESS with 90-day pause and 10% baseline). No matter how you slice it, this is a buying opportunity – in our view.

General Market

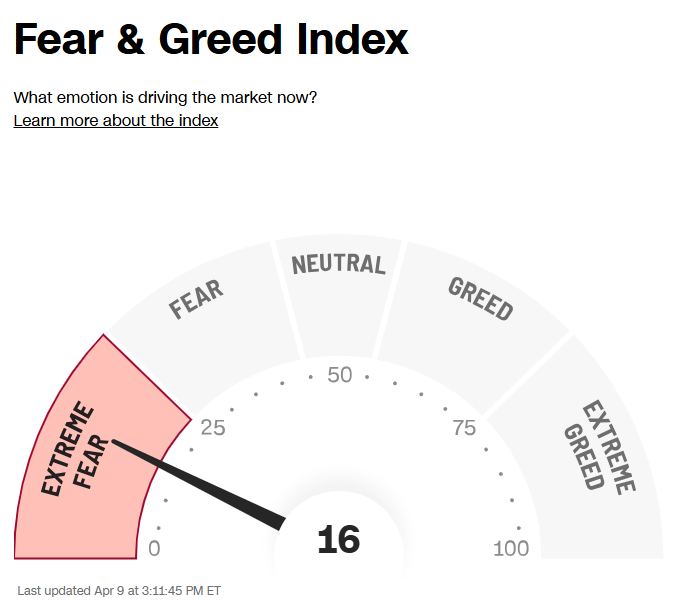

The CNN “Fear and Greed Index” ticked down from 17 last week to 16 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

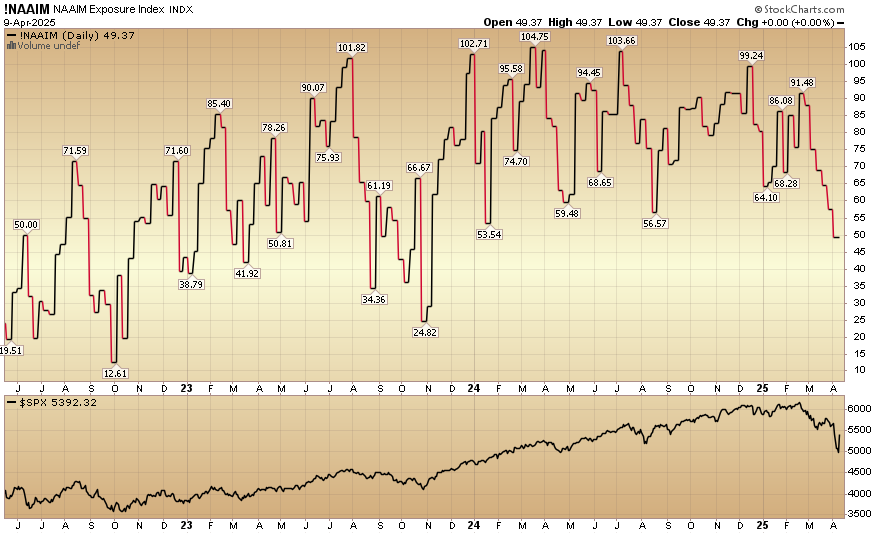

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked down to 49.37% this week from 57.55% equity exposure last week.

Our podcast|videocast will be out sometime on Thursday or Friday. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Congratulations to all of our existing clients who took advantage of our first ever private client webinar on Monday/Tuesday and wired in material amounts of money into your accounts to take advantage of the bargains this week. You showed real courage at the right time. When we stepped back, zoomed out and went through the specific detailed financials of each position for you – it was a complete no-brainer. Thanks for tuning in and stepping up.

For those of you who were not able to take advantage right after the webinar, it’s still not too late. Like all bottoming processes there will be fits and starts along the way – until a full recovery – and well beyond. A year from now you will look back and pat yourselves on the back. Be sure to email or call us when you are wiring funds so I can be immediately on top of deployment.

We recently announced our Q2 opening to new clients – for smaller accounts ($1M+). We will be closing our Q2 2025 opening on Saturday – April 12.

To see if you qualify and to take advantage of this opening click here. Larger accounts $5-10M+ can access bespoke service at their preference here.

*Opinion, Not Advice. See Terms

Not a solicitation.