With yesterday’s weakness into the close, we chose AC/DC’s, “Thunderstruck” as the song to embody current stock market sentiment. The end of day sell off was precipitated by the NYC Mayor’s decision to close all schools.

This decision comes in the face of an arbitrary 3% positivity ratio and ZERO student deaths. Now 1M students will have nowhere to go tomorrow, and it will impair their parents’ ability to work, earn money and contribute to the economy.

Thunder, thunder, thunder, thunder

I was caught

In the middle of a railroad track

I looked round

And I knew there was no turning back

My mind raced

And I thought what could I do

And I knew

There was no help, no help from you…

The problem with this arbitrary decision is that the data shows it disproportionately hurts students of lower socioeconomic status – as they may not have the proper equipment, internet connection or support system to keep up with their school work remotely. It becomes a disadvantage in their development years that will haunt them throughout their lives.

The underlying subtext is “we don’t have the money to properly keep schools open” so if you’ll just pass a $3T stimulus package we can re-open properly. The problem is that the leverage is gone.

The House of Representatives had great leverage before the Election to get a larger package than was justified (based on the legitimate COVID related costs – testing, schools, stimulus checks, extended unemployment, PPP, hospitals, airlines, etc). All of the core COVID related costs came out to ~$500B, and with a bunch of extras thrown in you could go as high as $1T, but that’s with quite a bit of pork in it.

The Senate was at $500B-$1T. The House wanted $2-3T. Because of House Leadership’s pre-election leverage, the Senate and Administration blinked and offered $1.8B – effectively conceding everything House Leadership demanded. BUT THEY COULDN’T TAKE “YES” FOR AN ANSWER! The House held out for $2.2T after getting the Senate up 80% and winning 81% of EVERYTHING they asked for.

The miscalculation is that House Leadership was confident they would gain control of the Senate after the election and get 100% of their ask versus 81%. As it stands, that looks like a colossal error because now they will be lucky to get 50% of their ask – if any at all.

Now, the great hope for House Leadership is whether they can win the GA runoff on January 5. Odds are against them and if they make an election gamble once again, it is likely there will be NO stimulus package as there is expected to be enough vaccine available for 40M people by the end of the year (between PFE and MRNA supplies). Furthermore, there will be enough for 100% of the US population in Q2 2021.

What further compounds the problem is that we will hit a fiscal cliff PRIOR to the January 5 runoff (end of December). Two federal unemployment-insurance programs serving ~12M people will expire. Student-loan payment deferrals, mortgage forbearance, and eviction moratoriums have a year-end deadline as well.

Additionally, two key lending programs are set to expire at the end of the year including the Main Street Lending Program (for small businesses) and the Municipal Liquidity Facility – which plays a key role in backstopping the debt market for state and local governments.

Congress fiddles while the people get burned…

So given the November election miscalculation by House Leadership, what leverage do they have left? Shutdowns. As we covered on Friday’s VideoCast/Podcast, the only thing that could derail an end of year “chase for performance” rally would be “stupid political decisions/regional shutdowns.” You can review it here:

The basis of the $2-3T House “ask” was excess funds to shore up the finances of cities that were in distress PRIOR to the onset of COVID. The Senate wanted to limit the aid package to those in need and costs related to resolving COVID only, while the House wanted to do a larger package to remedy pre-existing regional budget/pension/economic shortfalls. House Leadership got 81% of what they asked when they had the leverage (before the election). Now that leverage is gone.

The Senate would do a $500B package tomorrow – which addresses stimulus checks, unemployment, small business, hospitals, testing, and anything else related to COVID. House Leadership will never go for that ($500B) now since they came SO CLOSE to getting everything they asked for in October – and missed the opportunity of a lifetime to take it.

How do they get their leverage back? There are only two ways:

- Win back the Senate (low odds).

- Shut down the cities and hold the economy hostage until they get the Senate to buckle for a $2T package.

The problem with this strategy is that the election is over. If the regions that need the money the most shut down until the vaccine is widespread and they no longer have any justification for staying closed, they will only be hurting themselves while the rest of the country thrives. They will create an unnecessary long-term financial burden that they will never be able to recover from.

In other words, they will play “Chicken” and lose big time as the leverage they had in October is now gone for good. If the shutdown strategy continues, they are on a path to cut off their nose to spite their face – inflicting unnecessary self harm to their cities and more importantly their constituents.

Hopefully they will realize this in short order, but if not, here’s the list of regions that will be next to shut down (rated in order of greatest PRE-COVID economic distress). These are the states have huge taxpayer burdens – defined as each taxpayer’s share of state bills after the state’s assets have been tapped:

According to the Detroit News, “Illinois finished second worst with a taxpayer burden of $52,600. The state has requested a bailout package of $41.6 billion with no strings attached so Illinois leaders could theoretically use a healthy part of the money to help shore up its $100 billion-plus pension shortfall that is unrelated to the pandemic.”

“Connecticut — which was third worst with a taxpayer burden of $51,800. A bailout would do nothing to fix Connecticut’s pre-existing unfunded liability problem.”

“New York has a taxpayer burden of $20,500, ninth worst in the United States, fueled largely by retirement benefits promised to workers of those public-sector jobs.”

“New Jersey topped the list as the most poorly managed state, with a taxpayer burden of $65,100.”

With all of the recent talk about “pre-existing” conditions, we thought is was related to preserving protections in our health insurance plans, not curing “pre-existing” economic conditions (budget/pension shortfalls) with outsized stimulus packages…

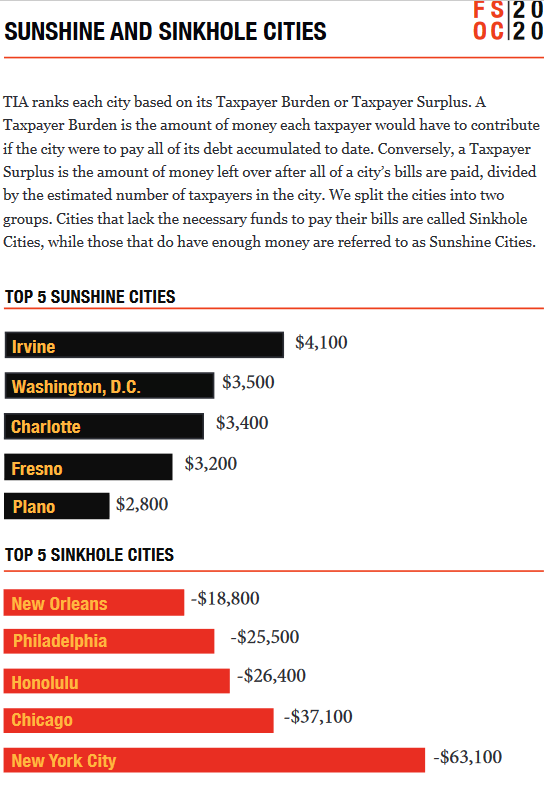

We will see in coming weeks if the NYC school shutdown is a “one-off” that reverses their shutdown decision quickly, or if it’s the beginning of a cascade. If it is a cascade, it will be easy to tell which cities will shut down first in order to ATTEMPT to hold the economy hostage – trying to force a big bailout package:

Source: TruthInAccounting.org

So let’s see, Chicago shut down on Tuesday, New York on Wednesday. Perhaps we will see Honolulu, Philadelphia and New Orleans by next week? Just a wild guess…

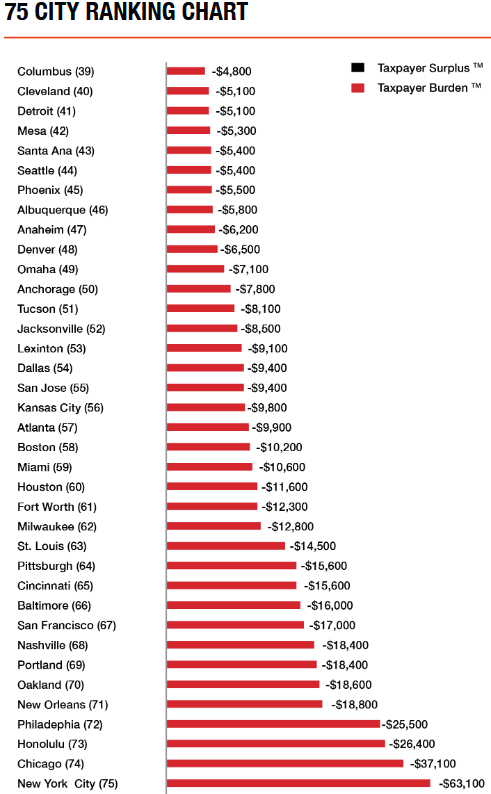

Then here’s the list of potential shutdowns for the following week – if no Stimulus Package has been passed. Start with the biggest red bars first:

If this continues, we’ll see Oakland, Portland, San Francisco, Baltimore and Pittsburgh close before Thanksgiving. It will all be an effort to force the Senate’s hand, but unfortunately it will only hurt their cities irreparably in the long term – as all leverage is lost.

My Suggestion: Do a $500B-$1T package right away to help those most in need. If the House Leadership’s calculation is correct this time and they take back GA, well then – “to the victor goes the spoils” and you can pass another $2T on top of the $500B- $1T you get done now. But holding the economy hostage in the short term will only cause massive capital and human flight from the weakest of cities – turning once vibrant economies into insolvent ghost towns. You don’t have to think too long to guess which “business/tax friendly” States will be the biggest beneficiaries of an ill-conceived extortion attempt.

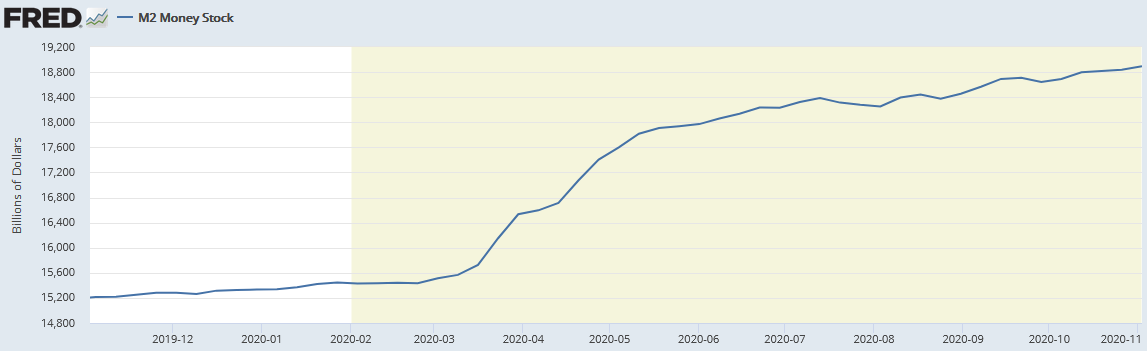

The fact is, the economy and the stock market do not need any further stimulus to thrive over the next 12-18 months. Already $12T of global fiscal stimulus and $7.5T of global monetary liquidity has been applied to solve a $3.6T (problem) -4.4% Global GDP contraction. There is always a 6-9 Month LAG TIME until the full effect of stimulus/easing is felt on main street. When you add the timing delay of the stimulus effect, global pent-up demand, and the vaccination timeline beginning within weeks – we are going to see growth levels that we have not seen in decades >6% GDP in 2021. M2 money supply is now up a whopping ~25% YoY. So the cities can play games with regional shut downs, but they will not collapse what has already been set in place, they will only collapse their own finances – and more sadly, the most vulnerable people in their communities.

So the cities can play games with regional shut downs, but they will not collapse what has already been set in place, they will only collapse their own finances – and more sadly, the most vulnerable people in their communities.

The Answer? Take what you can get now, and go back to the trough later. $500B is more than enough for unemployment, stimulus checks, PPP, shcools and Covid. Win Georgia and you can have another $2T for whatever you want (i.e. Green Deal). Lose GA and you still got something in the meantime. Lose GA without a small package beforehand and you may get nothing at all because by then, the vaccines will be rolling to the tune of 40M doses and the bank vault shuts. Don’t be little piggies, take what you can get…

What will they do when the top 5-10 worst managed cities shut down their children’s learning and the rest of the country’s economy continues to flourish? They will be left behind permanently from a financial and intellectual capital deficit that will haunt them for decades – all over an arbitrary decision based on “an abundance of caution.”

Onto the Stock Market…

Each regional shutdown (and you have the roadmap of which cities will close down next), will cause headline noise as it relates to the stock market. However, the stock market is a discounting mechanism – and with the imminence of the vaccine and $20T global fiscal/monetary wave just beginning to kick in, the Stock Market will continue to thrive (in the intermediate term) regardless of any further “stupid political decisions.” Short term, we may hit a few air pockets, but not enough worth pulling down the oxygen mask (or changing your plan).

On Monday morning I was on Cheddar TV with Kristen Scholer. Thanks to Kristen and Francesca Conti for inviting me on. This was a very detailed segment that covered WHICH SECTORS will do the best over the next 12-18 months. You can watch it here:

Click here to Watch Directly on Cheddar.com

The Rotation is Real

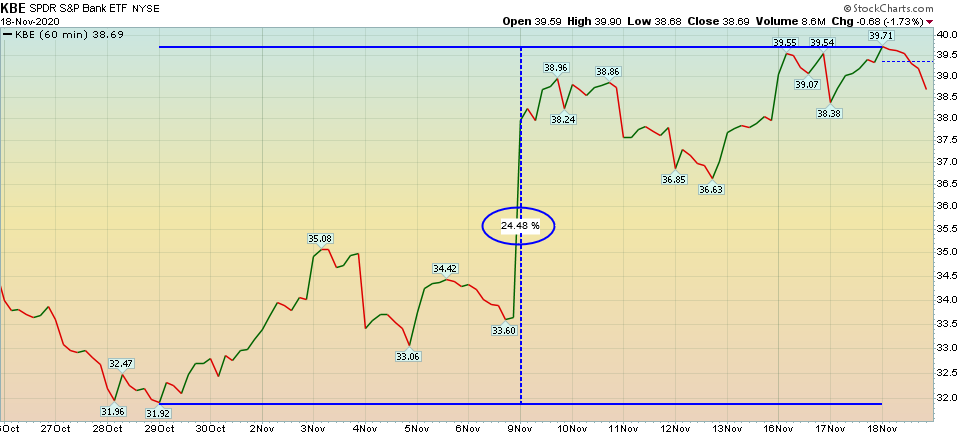

Energy up 34.5% since October 29, 2020.

Banks up 24.5% since October 29, 2020.

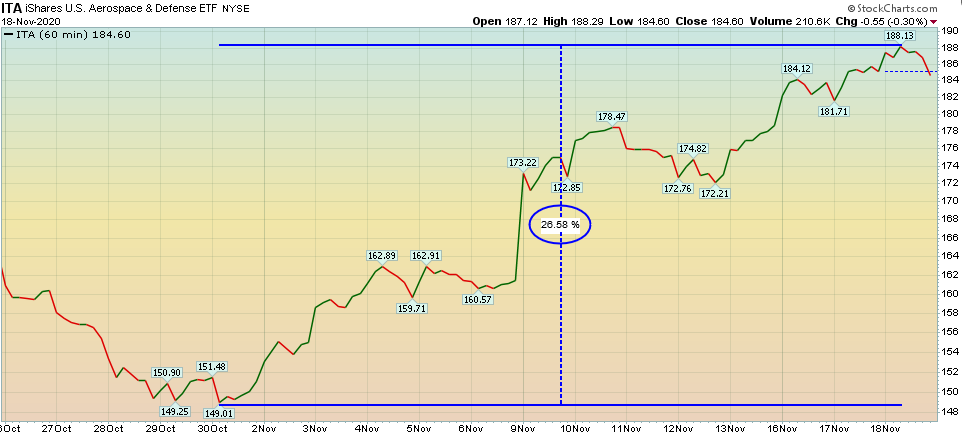

Defense Stocks up 26.5% since October 30, 2020.

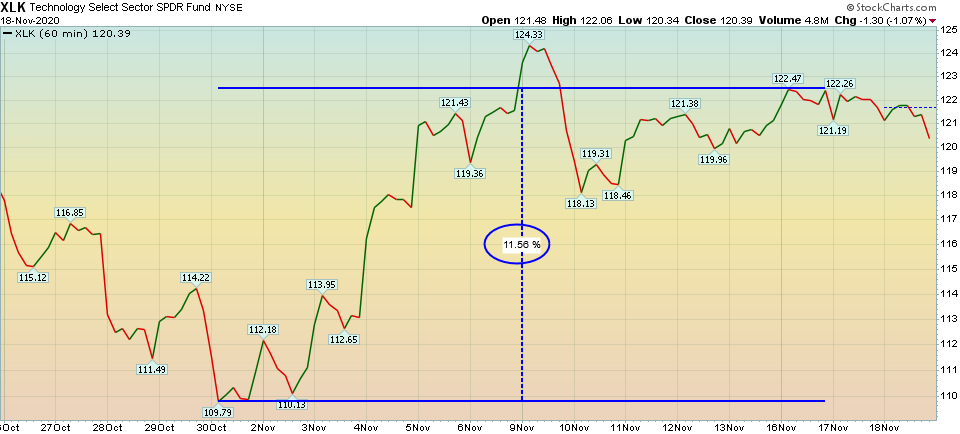

COMPARE THAT TO TECH WHICH IS UP LESS THAN HALF AS MUCH:

Tech Stocks up 11.5% since October 30, 2020.

The announcement of the Pfizer/BioNtech/Moderna vaccine data last week and this week was a game changer. Cyclicals took the lead with Energy having its best week EVER, and Value out-performing growth by its widest margin since 2001.

Banks came in hot and will be a major contributor to UPWARD EARNINGS REVISIONS in 2021 as the big 4 money-center banks are over-reserved by >$20B – which will come back as earnings in future quarters. There are now $110B of reserves for the banking sector that were taken in Q1/Q2 (due to COVID). It is likely that ~half will come back as earnings power – that is not priced in at present. These reserves were taken in Q1/Q2 when people were expecting 20% unemployment. We are now at 6.9%.

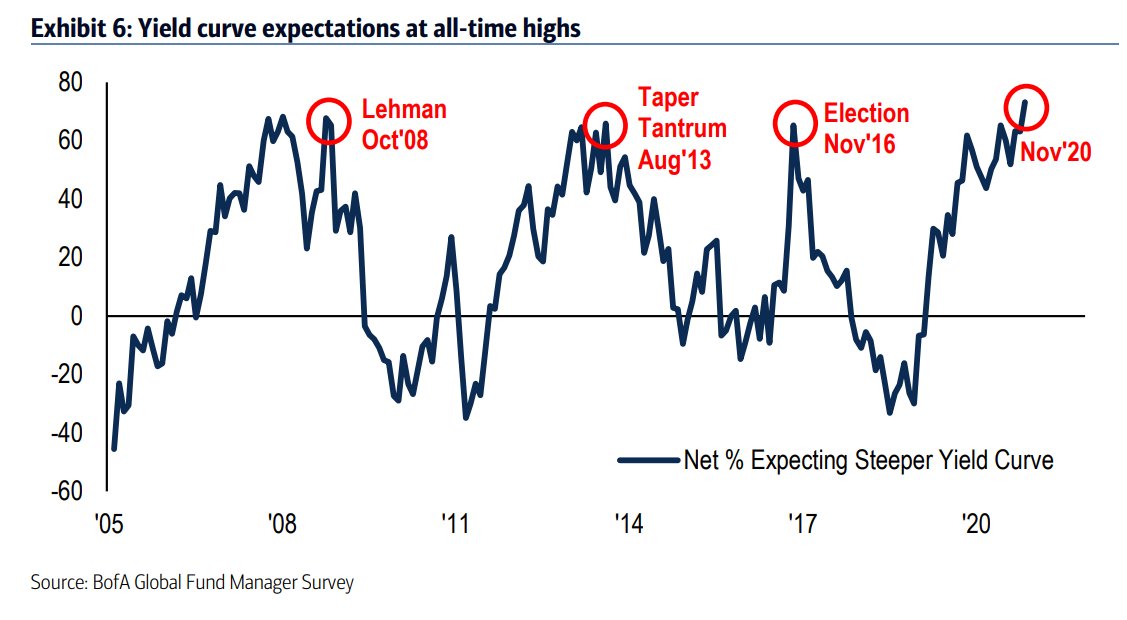

The other factor that will help banks is the yield curve steepening – helping NIM (net interest margin):

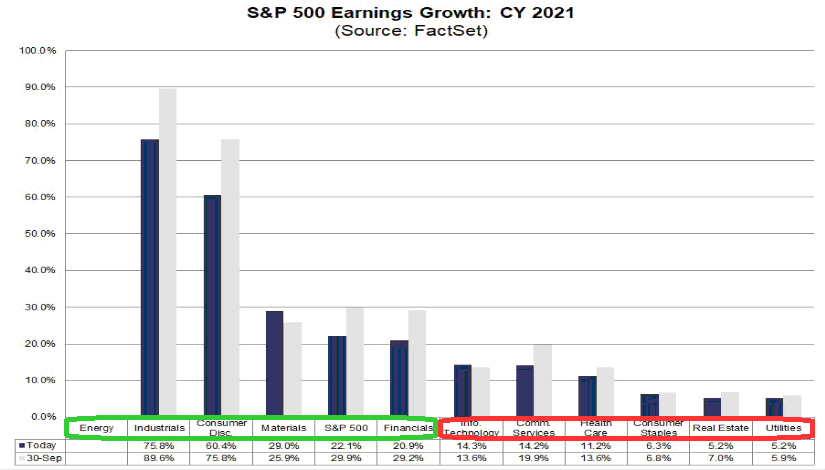

The move into cyclicals is consistent with 2021 Earnings Estimates. Cyclical sectors (Energy, Industrials, Materials, Financials) will have the highest earnings growth off of low bases, whereas, tech/communication services pulled forward meaningful earnings in 2020 and will lag the S&P earnings growth rate in 2021:

2 Additional Tailwinds for Cyclical Stocks:

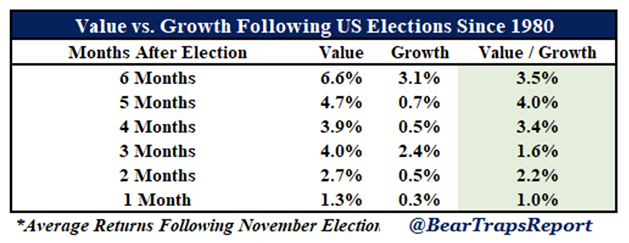

- Value historically outperforms Growth in first 6 months after Presidential Election.

- Cyclicals historically outperform in first ~8 Quarters of new business cycle (which we just started in Q3 after 2 quarters of negative GDP growth – Q1/Q2). You can review the analysis here:

The Taylor Swift “You Need To Calm Down” Stock Market (and Sentiment Results)…

Earnings:

-With 92% of the S&P having reported Q3 results, 84% beat EPS (highest % in over a decade). 78% beat on revenues.

-2021 EPS estimates continue to revise UPWARD with consensus now at $168.38 (as of Friday).

This may be too low for 3 reasons:

- Increasing NIM/Reserve Releases for Banks.

- Un-grounding of Boeing 737Max (coupled with increase air travel demand due to vaccine) could have a material impact on earnings. China domestic air travel exceeded the previous year for October 2020. They are 2-3 months ahead of us in recovery. Review China data from last week’s note here:

The Louis Armstrong, “What a Wonderful World” Stock Market (and Sentiment Results)…

3. Getting a vaccine this quickly was not priced into estimates. There is global pent-up demand that will be realized once people feel safe.

Potential Short-Term Headwinds/Chop:

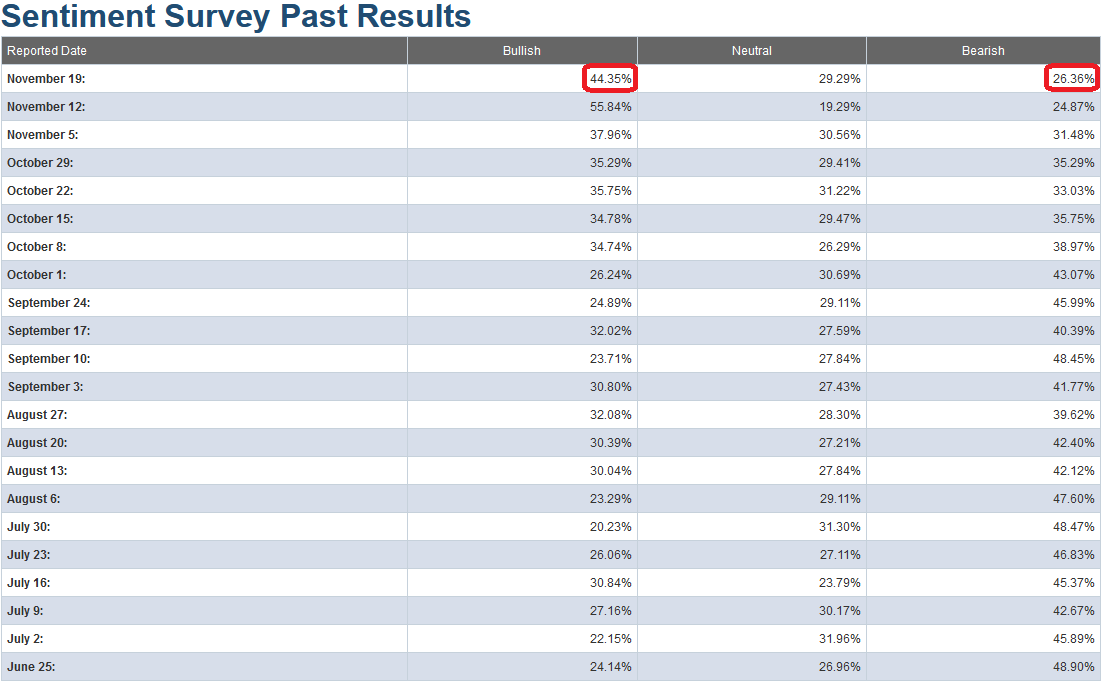

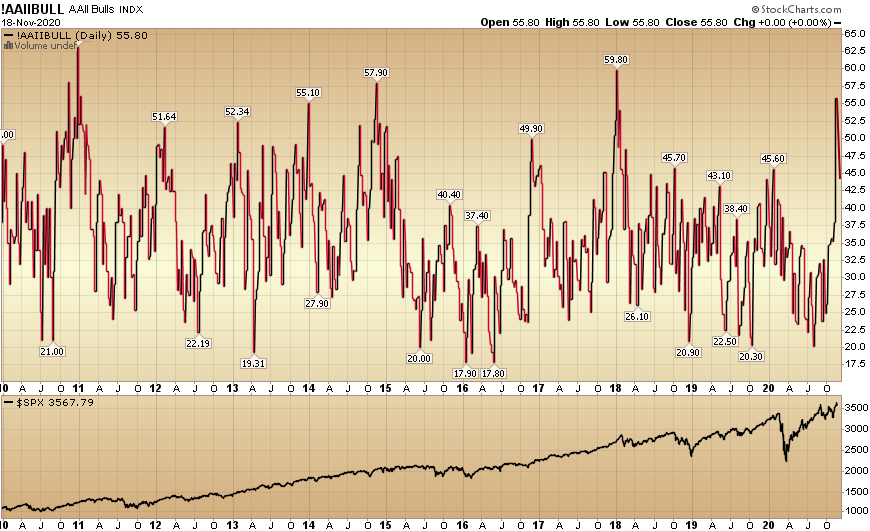

1) Retail Investor Sentiment is running a bit hot in the short term – as we discussed in last week’s note above. Institutional sentiment is getting somewhat aggressive as well (we will discuss below).

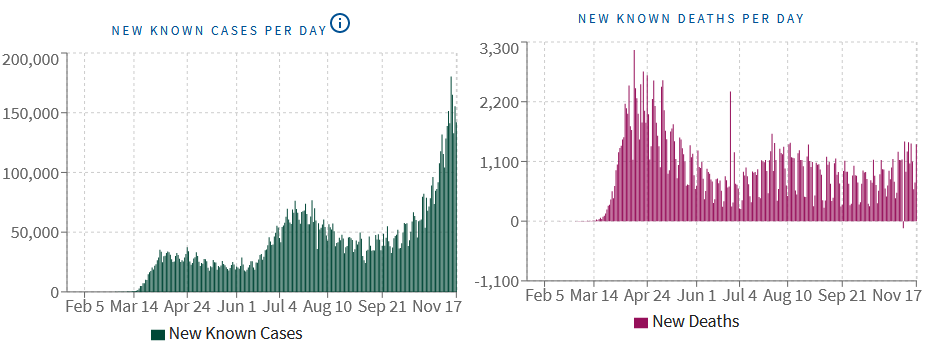

2) Cases are elevated and vaccinations will not start for weeks. This may lead to regional restrictions and shutdowns – which would impair growth in the short term (although they seem to be peaking – just as schools are deciding to shut down):

Source: usafacts.org

The key question is whether market will look through this…

Intermediate Term Outlook Positive:

While the “easy money” has been made in the general indices (since the March lows) – in the short term, I think the “easy money” is just getting started in “left for dead” sectors/stocks (Cyclicals/Value). We believe Banks, Defense Stocks and pockets of Energy will be as good – if not “orders of magnitude” better – than buying the general market in late March.

Here are the 7 key catalysts:

- Vaccine (PFE)/Treatments (LLY/REGN/GILD) are finally here or nearly here.

- Political Gridlock is good. Corporate tax rate stays at 21%.

- Uncertainty with policy/trade should diminish in coming months.

- 5-6%+ GDP growth in 2021 – lagged effect of ~25% M2 money supply growth yoy.

- Upward Earnings Revisions: Banks (NIM [net interest margin]/Reserve Releases)

- Accomodative Fed. Short end will stay pinned at 0-25bps. Long end will expand – steepening the curve (good for banks/credit expansion).

- Stimulus: $500B-$2T within the next few months.

With economic growth coming back (>5-6% GDP in 2021), managers will have many options where they can find earnings growth (economically sensitive/cyclical stocks). This contrasts to 2020 where managers loaded into a narrow group of stocks that could provide earnings growth in a slow economy – thereby bidding up the multiples.

Earnings multiples on 2020’s “stay at home”/Tech/SAAS stocks will start to moderate as money flows into economically sensitive sectors that will resume growth in 2021.

Institutional Sentiment

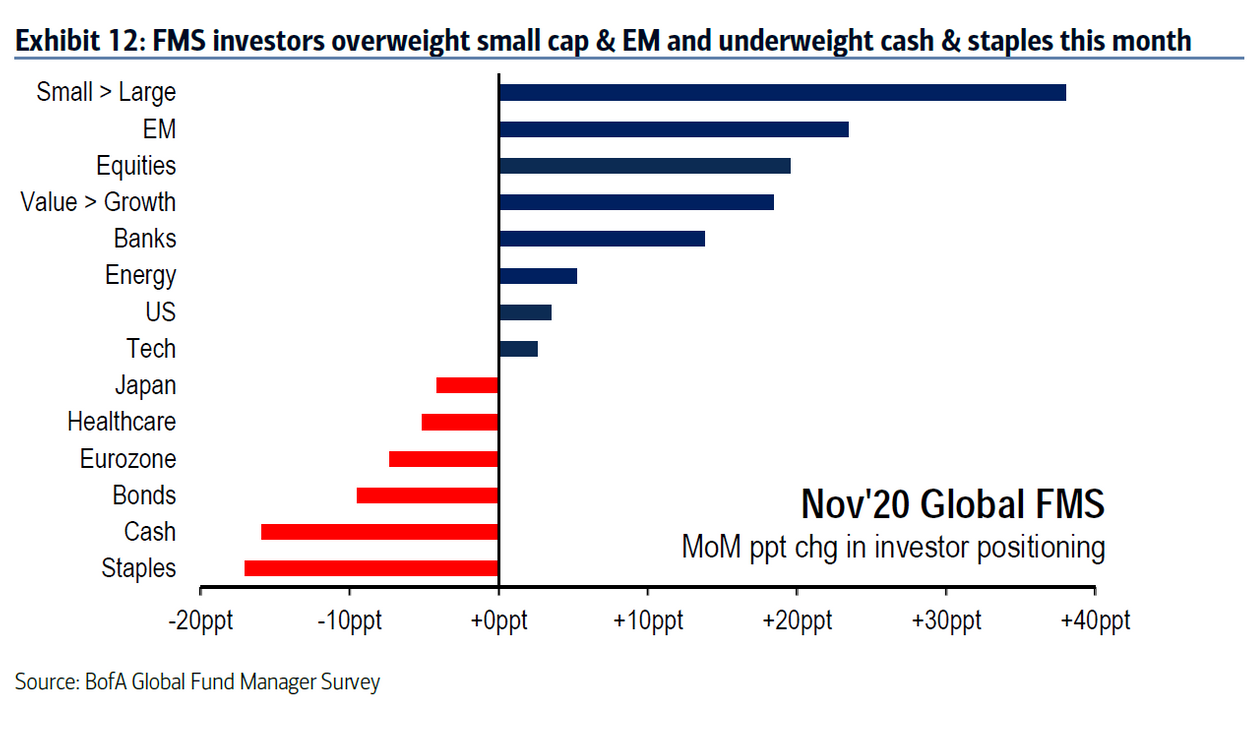

This week, Bank of America published its monthly “Global Fund Manager Survey.” We put out a summary of the key points which you can review here:

November Bank of America Global Fund Manager Survey Results (Summary)

The key takeaway is that managers went from flatfooted before the election, to near exuberant as of last week. So we have to balance the fact that most managers still have to chase year end performance – while at the same time recognizing that many indicators are nearing extremes.

My sense is that because most market participants are now cognizant of the near euphoria – and missed the aggressive post-election bounce, the “pain trade” may still be up into year end. The caveat is to pick your spots. As we said to conclude last week’s note, we believe the easy money off the march lows has been made in the indices. However, the easy money may be JUST GETTING STARTED in the cyclical stocks/sectors we discussed in recent weeks.

Institutional money JUST started to move in our direction this month, but because they are steering tankers, it will be a long upward trend that takes time and lasts for many quarters. The change in this month’s survey was pronounced. Like we always say, “opinion follows trend.” Come on in, the water’s warm… what took you so long?

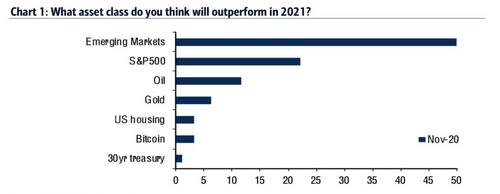

This month’s survey interviewed 190 Managers overseeing ~$526B AUM. Here are the key points:

- Net 24% of surveyed investors expect value stocks will outperform growth stocks, highest since February 2019.

- Assets that investors expect to outperform next year: emerging markets, S&P 500 and oil.

- Rotation to Emerging Markets, small cap, value, banks funded by lower allocation to cash bonds, staples.

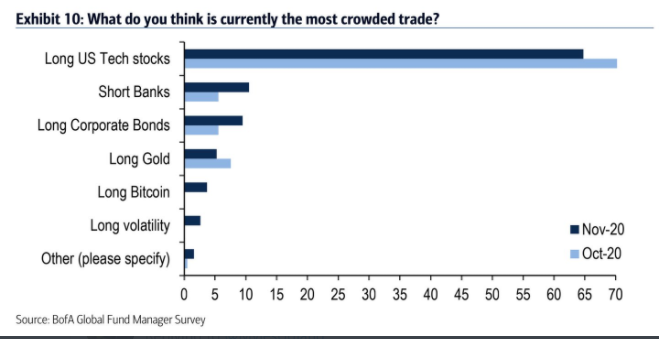

- The first “most crowded trade” is Long Tech

- The second “most crowded trade” is Short Banks

So while they have come around on “value” they are still too long Tech, and too short Banks. The contrarian trade is taking the other side of the unwinding of this lopsided exposure (i.e. lighter tech, heavier banks).

What is also ironic is that while “short banks” is the second most crowded trade, the managers just started warming up to the idea that the yield curve will steepen (after 8 weeks of steepening!):

Look at what happened to banks after each time yield curve expectations got this high:

Wells Fargo Update

Here’s an update on the Wells Fargo Cobra Kai “Leg Sweep” we reviewed in last week’s note (it has moved up 25% off the lows, with plenty more to come as this theme plays out):

On the long term chart, WFC has jumped back above support and also initiated a new ADX cross. This is a positive development 15 out of the last 16 times it has happened:

See Live Long-Term WFC Chart with annotations HERE

Now onto the shorter term view for the General Market:

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) fell to 44.35% from 55.84% last week. Bearish Percent fell to rose 26.36% from 24.87% last week. We are still at an extreme in sentiment for retail investors.

With the short-term restrictions/school closings, early restaurant closings, and case increases, it would make sense that we will see fits and starts until the first batch of vaccines is delivered before year-end. On bad Covid news days, tech will bounce/outperform. But as we press forward to vaccination/resolution, the new phase of cyclical out-performance will lead the way…

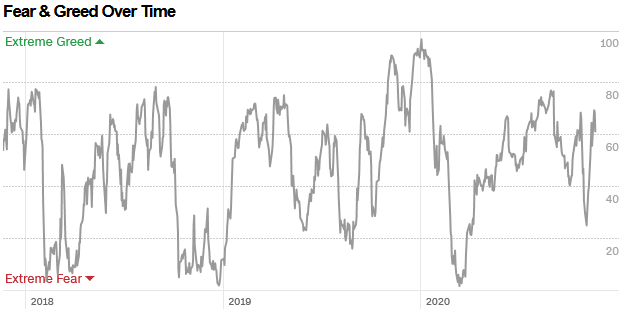

The CNN “Fear and Greed” Index moderated from 66 last week to 61 this week. We are seeing some renewed enthusiasm, but no euphoria (on this indicator) at present. You can learn how this indicator is calculated and how it works here: (Video Explanation)

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) jumped to 96.30% this week from 69.20% equity exposure last week. As we said last week, managers would have to chase into year end – and they finally started. It’s only natural to shake out the “weak sister” johnny-come-latelies…

Our message for this week has not changed:

While the easy money has been made in the general indices (since the March lows), I think the easy money is just getting started in “left for dead” sectors/stocks. I believe Banks, Defense Stocks and pockets of Energy will be as good – if not “orders of magnitude” better (in coming quarters) – than buying the general market in late March.

In the meantime, watch the “Thunder“, and don’t get shaken out of your plan or “struck” by the daily headlines and political noise…