Last week we spoke about opportunities starting to present themselves in selective Chinese Stocks and “Broken SPACs/SPAC warrants.”

On Friday, I joined Liz Claman on Fox Business, “The Claman Countdown.” In this segment, I discussed two new positions – for the Summer – to take advantage of the recent dislocation in SAAS (Software as a Service) and Chinese Stocks. Thanks to Liz and Ellie Terrett for having me on:

Over the past week we have been selectively, but aggressively digging into a basket of Chinese Stocks, SPACs/Warrants, and Selective Tech/SAAS stocks that we feel are getting overdone and should rebound nicely over the Summer.

It wasn’t until today that I realized; a number of the stocks I was adding happened to overlap with the same stocks that Archegos and the prime brokerages/banks were forced to liquidate in recent weeks – as the fund went bankrupt due to excessive leverage.

The natural sector/stock corrections were compounded by forced sellers – who sold billions of notional value in the following stocks that were used to hedge (the total return swaps) and now had to liquidate – as Bill Hwang’s family office unwound. In other words, the bargains are steeper than they would have been due to the structural mechanics. It seemed coincident until it clicked.

So what names got overdone from the unwind (Bloomberg)? Chinese: IQ, HUYA, BABA, GOTU (GSX), BIDU, TME, VIPS. Other: VIAC, DISCA, FTCH.

These are especially interesting, not only because they are all trading at meaningful discounts relative to their 3-5 year outlooks, but also because they were top holdings of a guy who quietly turned $200M into a $20B personal fortune in less than a decade – largely betting on Asian stocks (peak wealth was $30B) (Bloomberg).

It worked until it didn’t. Apparently, Archegos (the name of Bill Hwang’s Family Office), is a Greek word used in the New Testament to refer to Jesus. Hwang should have known from his devout Christian studies that Jesus not only had to pay taxes, but apparently he had to pay margin calls as well…

The moral of the story is that Hwang’s picks will likely prove to be very valuable (as he was one of the best pickers of Asian stocks in the business), however the key is not to leverage up $5B into $100B notional – no matter how high your level of conviction is.

The opportunity is to take the good that the market correction is serving up, with the “edge” of Bill Hwang (a peerless picker of Asian stocks) and take advantage of the rare dislocation opportunity currently available.

Here is a sampling of Chinese stocks that are down ~30-75% in the last few months (most of which were owned/impacted by the liquidation of Archegos):

Charting Source: FinViz

Charting Source: FinViz

As I love to say, “Wall Street is the only place on earth that when they hold a clearance sale, no one shows up!” We’re loading our basket now, and plan to return the inventory when prices go back up to MSRP!

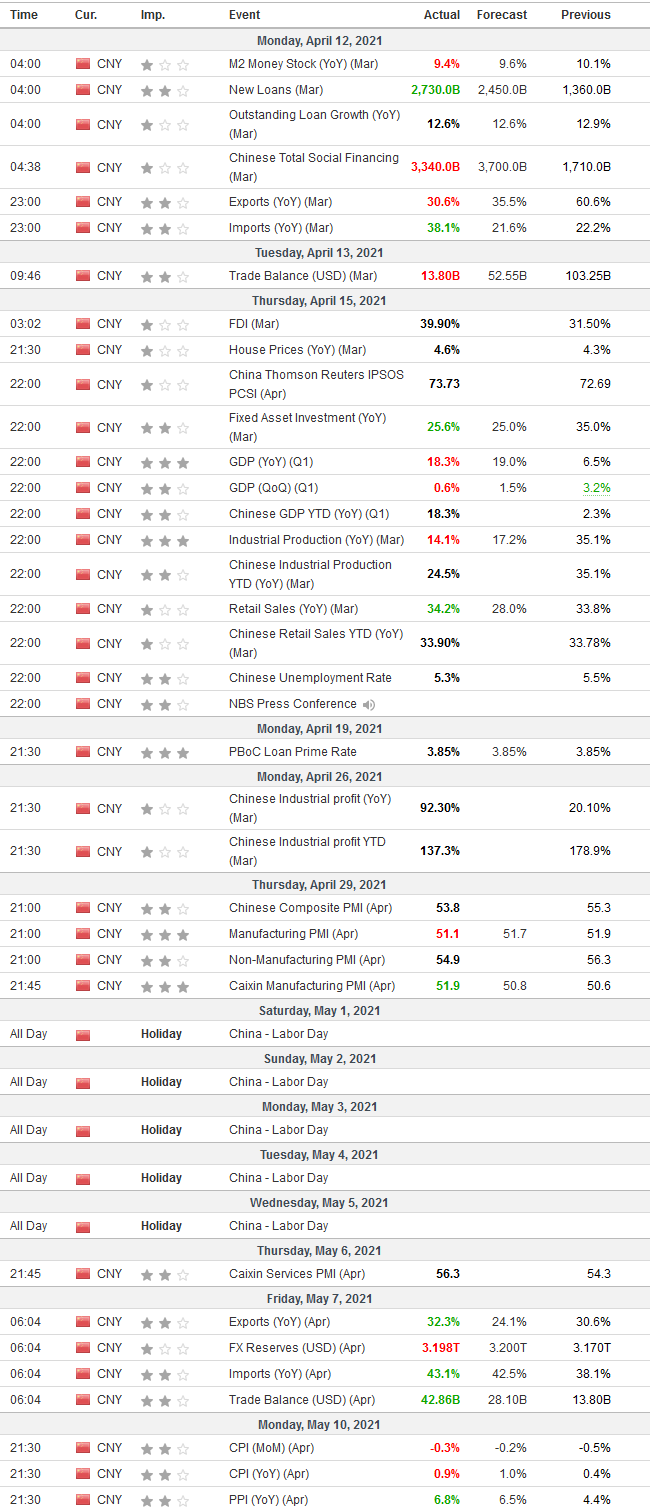

Nothing has changed materially in the Chinese economy to warrant the magnitude of these corrections. This is largely a structural deleveraging coupled with some short-term seasonal weakness and Government “anti-trust” winds/fines that are known and likely priced in. The short-term inflation noise is expected (and currently lower than estimates in China):

Data Source: Investing.com

What about the General Market?

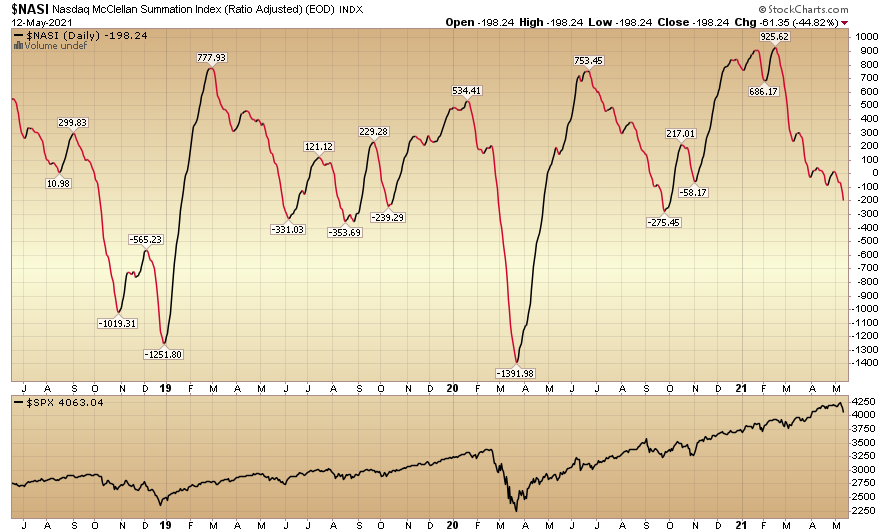

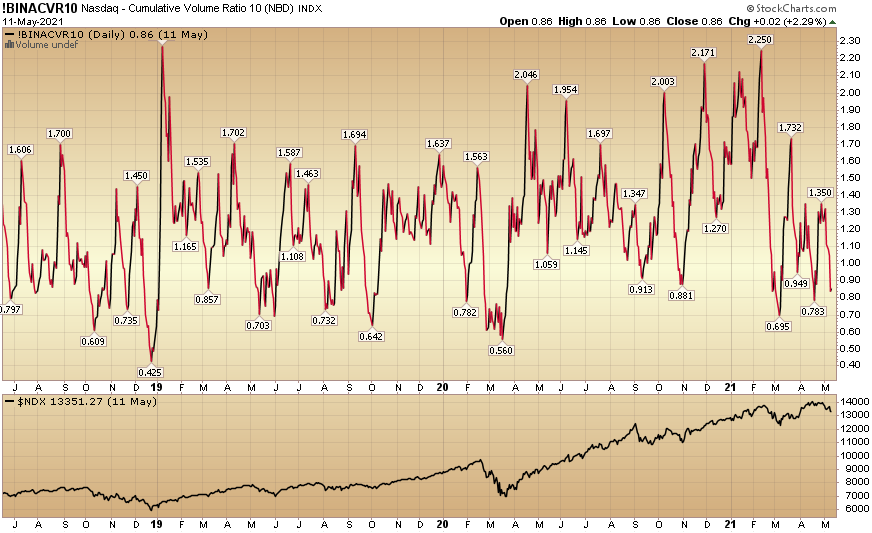

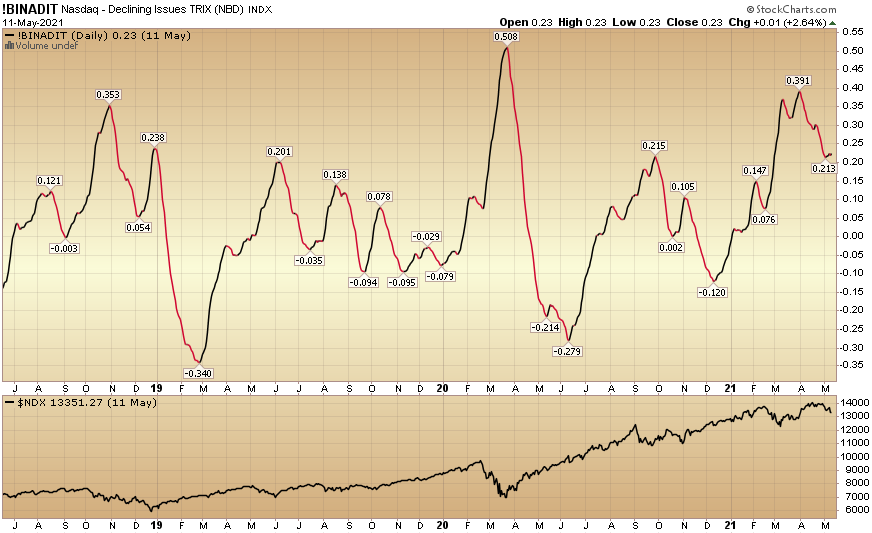

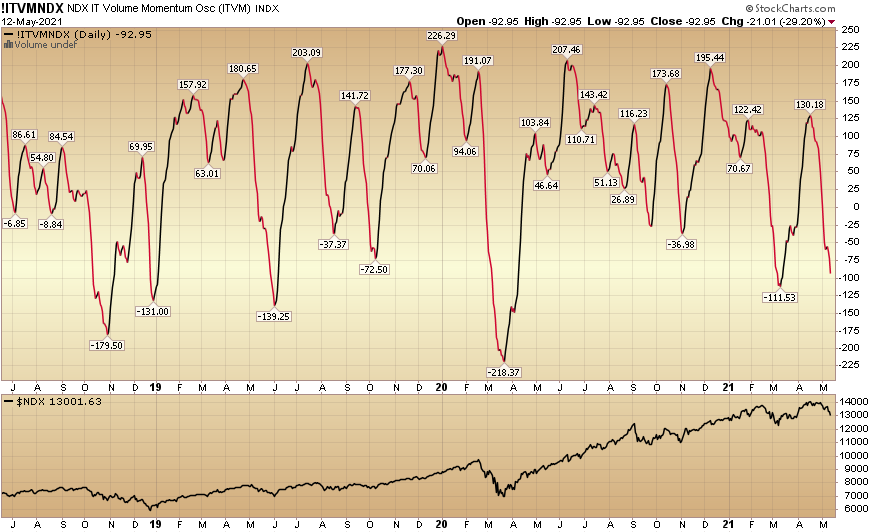

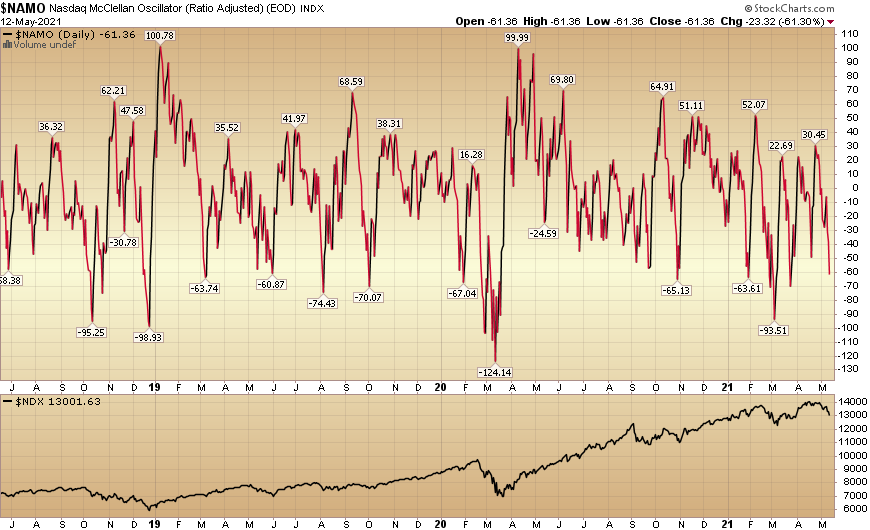

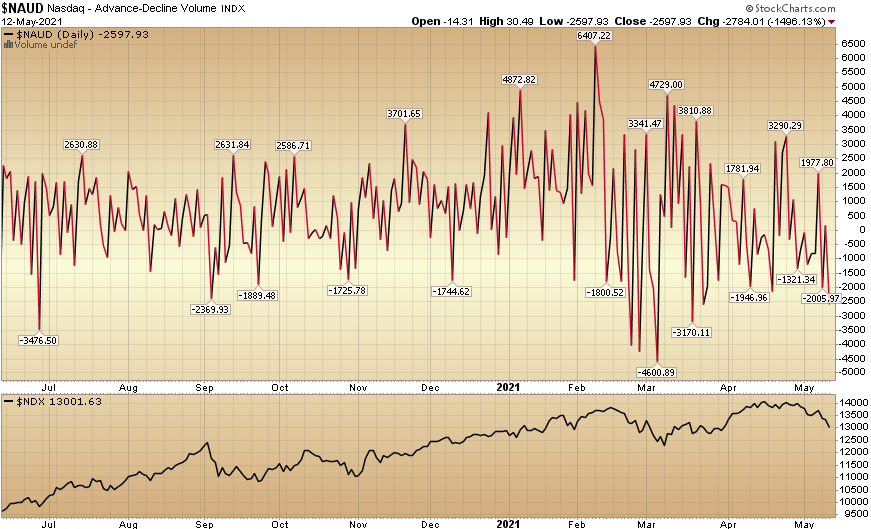

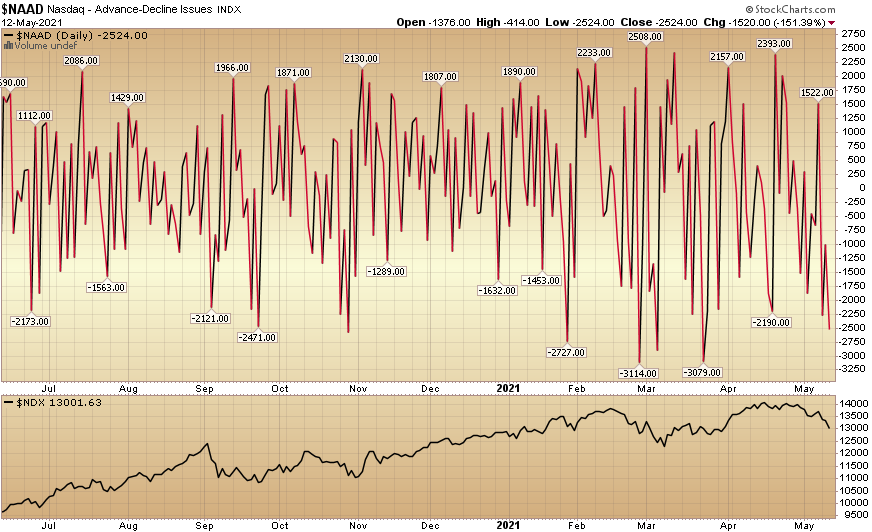

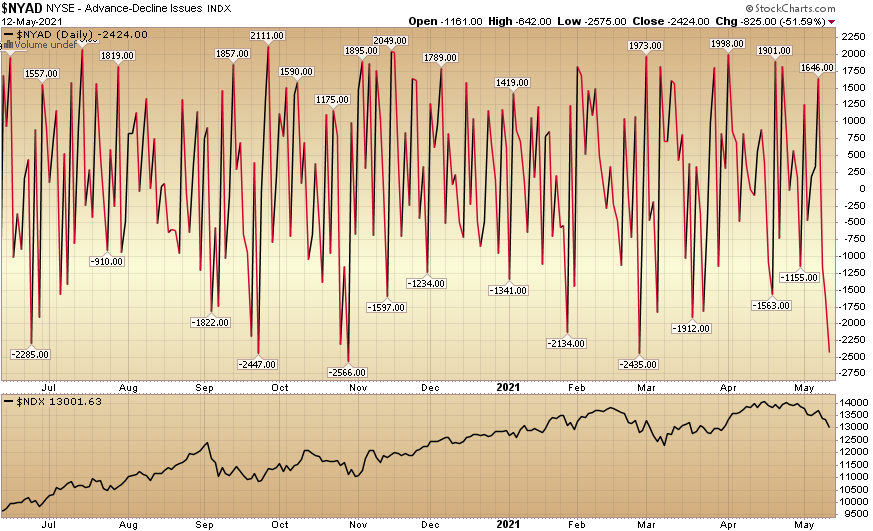

Since the Nasdaq is taking the brunt of the pain, I’m going to post a number of Nasdaq indicators I look at to get a feel for when we should be adding stocks and when we should be lightening up.

SUMMARY: We’re adding because most of these indicators are nearing points that it paid to be a buyer versus a seller. We ALWAYS scale in and out of positions. Very rarely are we an ALL or NOTHING player, but I can say we have been a more aggressive buyer than normal in the last 48 hours (in the groups I mentioned above):

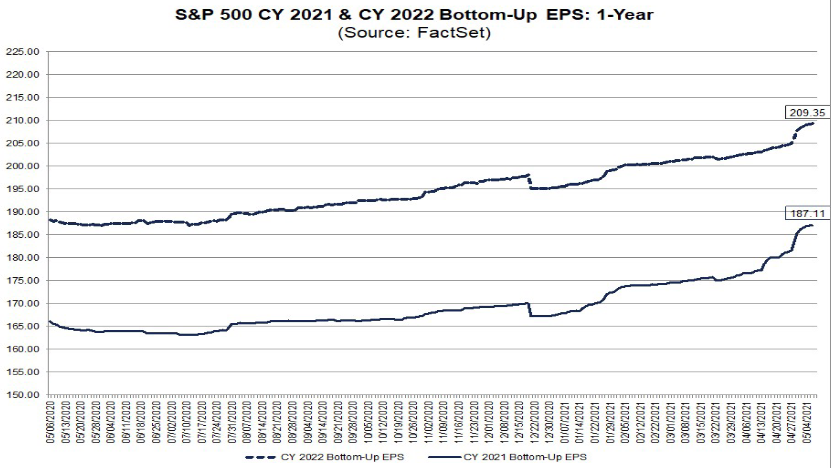

Did I mention Earnings Estimates for 2021 and 2022 jumped up AGAIN this week?

Now onto the shorter term view for the General Market:

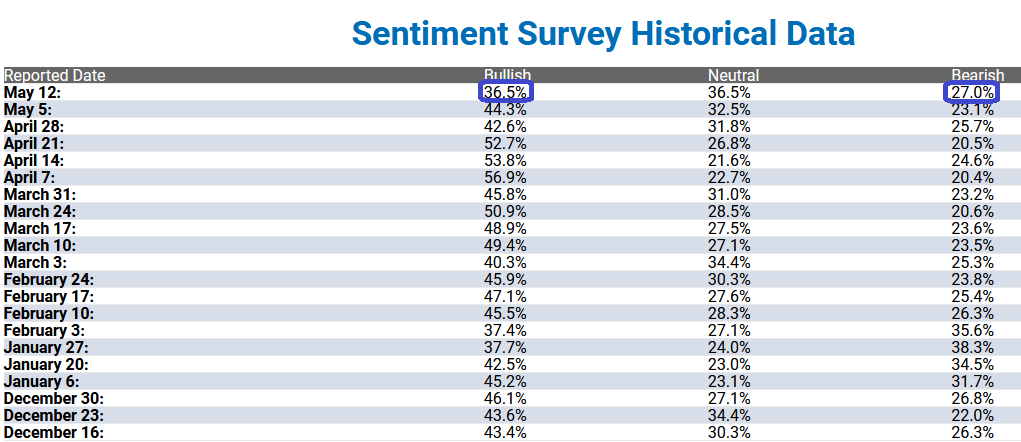

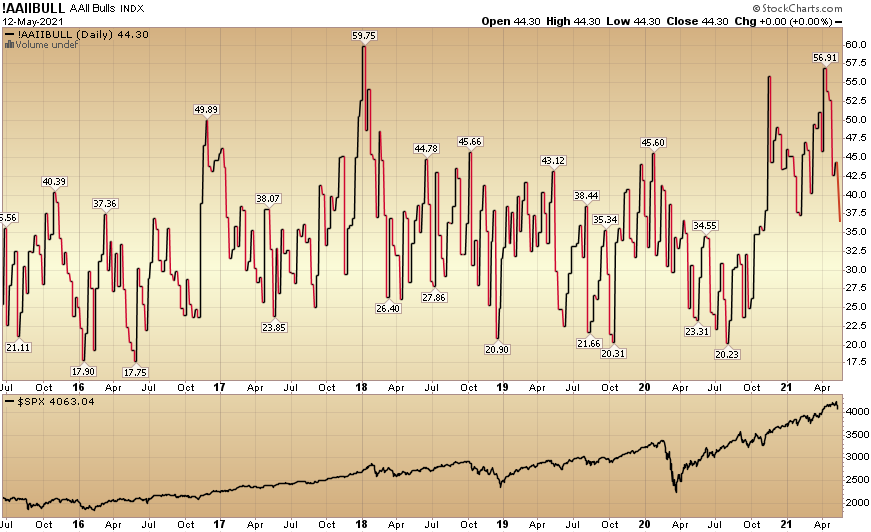

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) dropped to 36.5% from 44.3% last week. Bearish Percent rose to 27% from 23.1% last week. Fear is returning for retail investors.

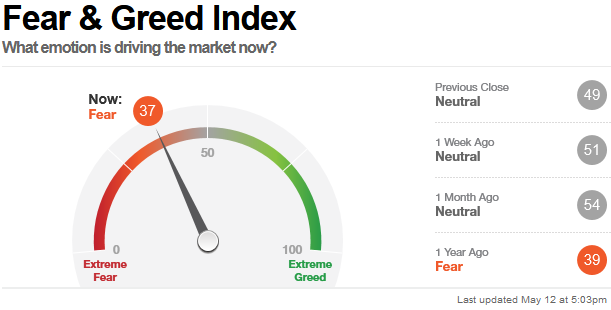

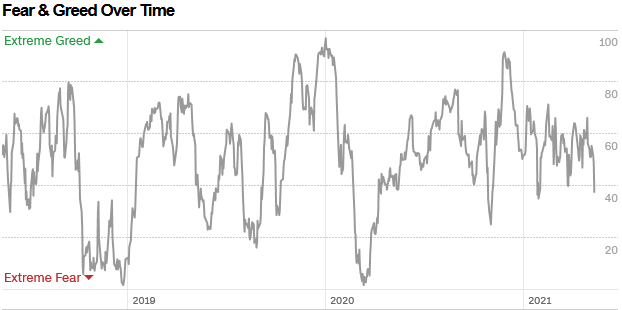

The CNN “Fear and Greed” Index fell from 51 last week to 37 this week. Fear is here. You can learn how this indicator is calculated and how it works here: (Video Explanation

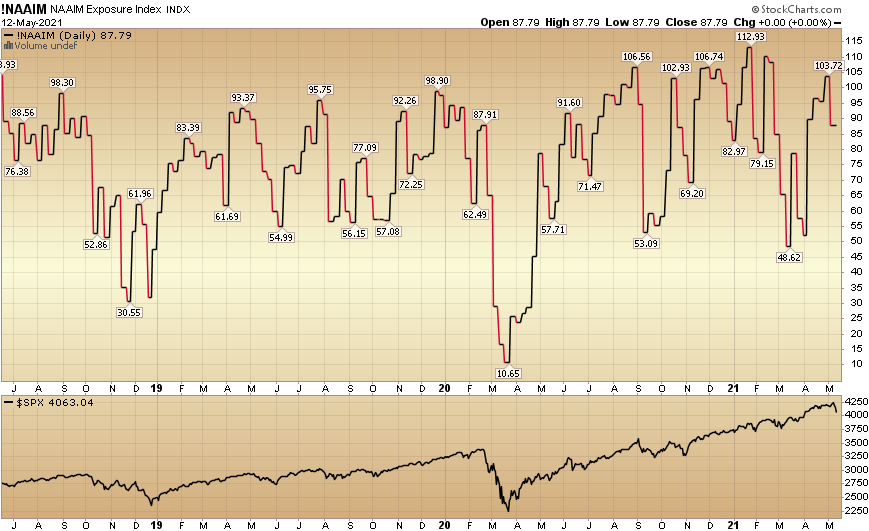

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 87.79% this week from 103.72% equity exposure last week.

Our message for this week:

Don’t get distracted by the general indices. They will do what they will do. Given the consensus has been looking for a 10-20% correction for the past few weeks (“Sell in May and Go Away” was their “edge”), odds are we don’t get anything close to that in the S&P 500.

More likely, there will be just enough turmoil for market makers to sell a ton of expensive insurance premium (that expires worthless) to the weak handed “late money” – who missed last year’s rally and chased at the wrong time this year.

Fear is not yet at an extreme, so we could see a bit more pain in the general indices before we find solid footing. That said, waiting too long to scale into individual bargains can be costly. As the old saying goes, “if you wait to hear the Robins sing, it’s already Spring” (and you missed it).

China Stocks and SPAC warrants were our primary focus in the last 48 hours as we used the fear to load up our shopping cart on hugely discounted merchandise. We expect to do a bit more shopping this week, but are pleased with the opportunities we’ve been able to take advantage of so far.

As for Bill Hwang, I wouldn’t bet against him. It may take longer than 3 days for his resurrection, but rise again he shall (albeit with a lot less leverage and capital)…