On both Friday and Monday I was on Fox Business – The Claman Countdown – with Liz Claman. Thanks to Ellie Terrett and Liz for having me on. In both of these segments we discussed the seasonal period of choppy markets that historically occurs in August and September.

In the face of these headwinds, on Friday we pointed to three stocks in the Healthcare space that should weather any chop through this period:

Pick 1 – Cigna. We bought the recent 15% pullback in this name. We think it can push up to new highs in coming months.

- Trading at 9.8x 2022 EPS vs. Avg. historic multiple of 12x EPS.

- Evernorth (Pharmacy Services) were up 13% last quarter.

- US Health Insurance was up 5% on premium increases.

- 1.7% dividend yield (far greater than 10yr yield).

- Reports tomorrow. We will top up if weak on print.

Pick 2 – Novartis. We originally suggested this name on the show in the mid-80s. We think it can work well beyond $100 in coming months.

- Trading at 13.9x 2022 EPS vs. Avg. historic multiple of 22x EPS.

- Strong Earnings: EPS up 22% year on year. Revenues up 14% yoy.

- Beat Top Line, Bottom Line and Raised Guidance.

- Innovative medicines up 15%: Cosentyx (psoriasis/arthritis drug) Entresto – Hearth Failure drug.

- 3.4% dividend yield.

Pick 3 – Pfizer. We originally suggested this name on the show in the mid-30s. We think it wan work well beyond $50 in coming months.

- Trading at 12.5x 2022 EPS vs. Avg. historic multiple of 15x EPS.

- Crushed Earnings: EPS up 72% year on year. Revenues up 92% yoy.

- 1/2 revs from vaccines. Boosters coming this Fall + annually moving forward. Management expects this to be a durable/annual revenue stream similar to a flu shot.

- Non-Vaccine business up 10% yoy.

- 3.37% dividend yield.

In Monday’s segment, I suggested using any weakness to buy high-quality names that have pulled back in recent weeks. We suggested 3 more picks that we believe can outperform into year-end:

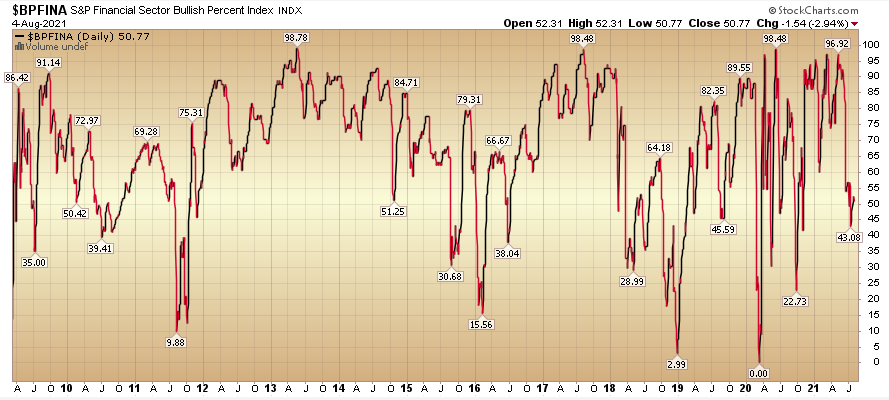

Pick 1 – Citigroup.

- Trading at .87x Tangible Book vs. 1-2x under normalized conditions.

- Trading at 8.5x 2022 EPS vs. Avg. historic multiple of 12x EPS.

- Turnaround Story: New CEO Jane Fraser took efficiency ratio down from 64% to 52.9% by cutting costs. Anything below 50% is good.

- More Credit Reserve reversals coming.

- Commercial loan demand will pick up in 2H 2021 and 1H 2022.

- 3% dividend yield.

Pick 2 – Dollar Tree.

- Trading at 14.5x 2022 EPS vs. Avg. historic multiple of 18x EPS.

- Online sales slowing (AMZN). People getting out and about. DLTR beneficiary.

- Avg. Ticket up 9.5% last quarter.

- Best same store sales comps since 2017 (up 4.7%).

- Guidance light due to short term spike in shipping and freight costs. This will mitigate in coming quarters and has created the opportunity to step in ~20% off its recent highs.

Pick 2 – Intel.

- Trading at 11.8x 2022 EPS vs. Avg. historic multiple of 15x EPS.

- Lions share of PC and Server Processor markets.

- Server processors will be the main driver of growth in the short term.

- 2.5% dividend yield. Long-term dividend grower.

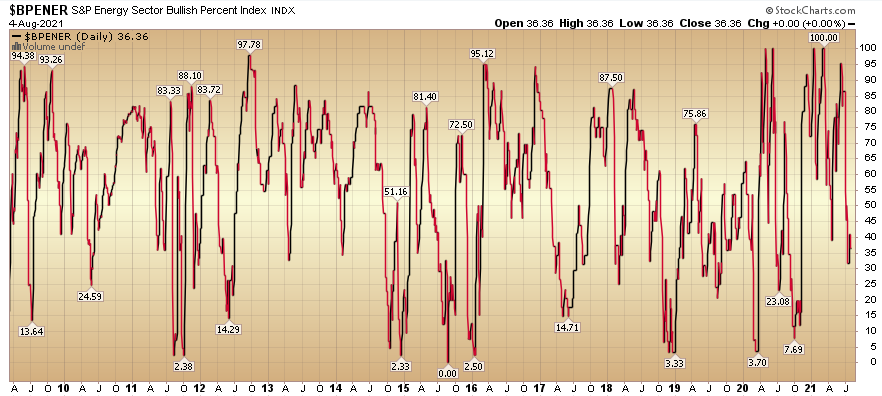

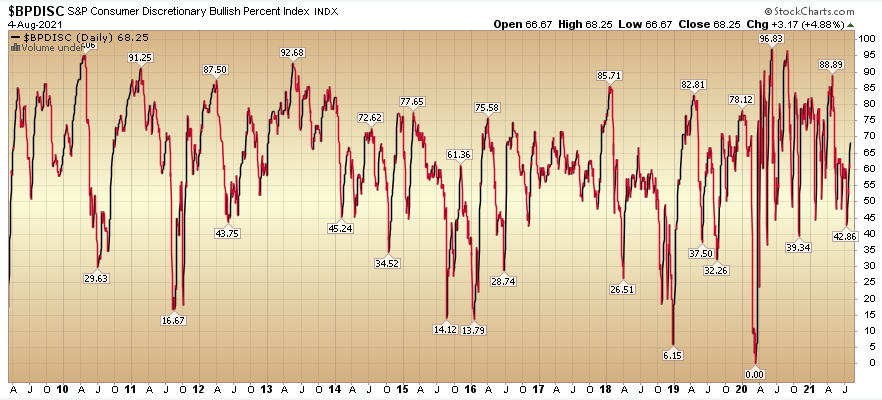

Bullish Percent

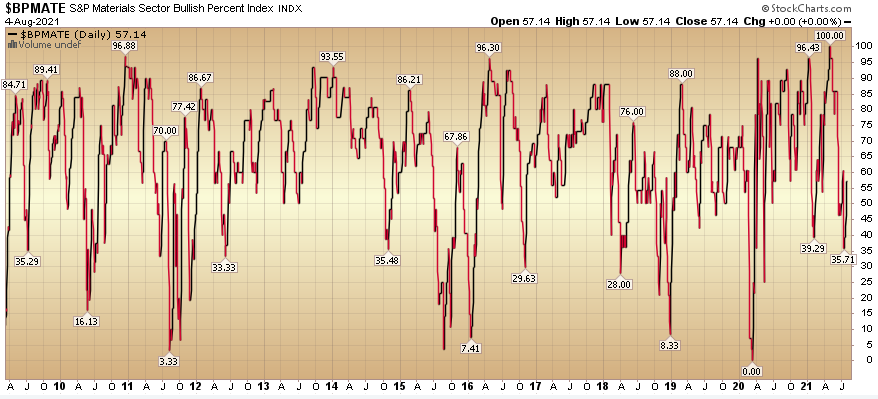

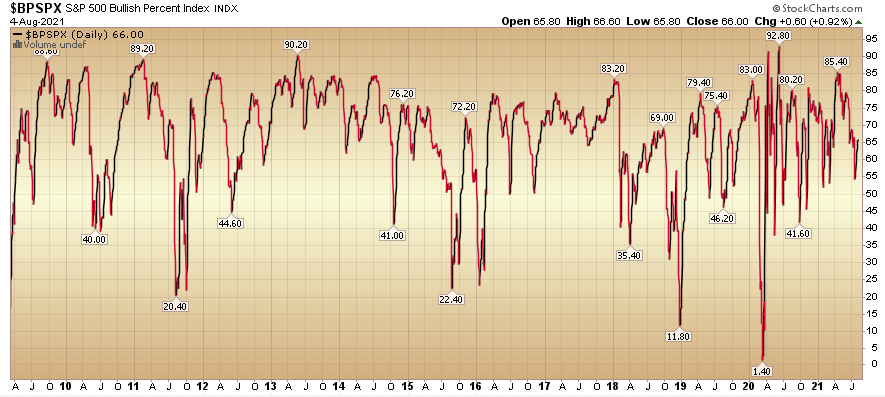

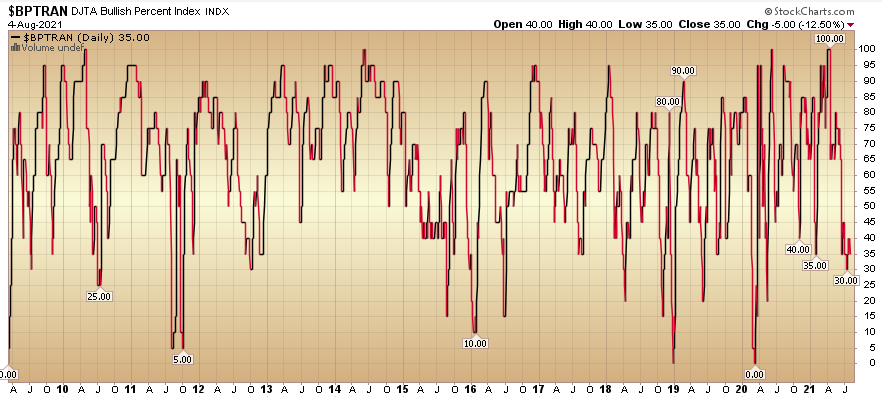

One of the multitude of indicators I look at on a regular basis is “Bullish Percent.” I do this across all sectors to give me a sense of where the opportunities lie. This indicator measures the percentage of stocks in a particular group or sector that are on “point and figure” buy signals. I do not utilize point and figure charting, but I do find this barometer useful when it comes to finding the next sectors I am going to focus on.

So while it may feel like the market is “due for a crash,” there have been many mini-crashes going on “under the surface” all summer and creating opportunities to pick up stock on the cheap. Looking sector by sector, here are some groups that are closer to probabilistic buy areas versus sell areas:

So if the market feels a bit heavy or your portfolio has plateaued in recent weeks, now you know why. We’ve had ongoing rolling corrections under the surface setting up to take advantage into year end. You just have to know where to look…

So if the market feels a bit heavy or your portfolio has plateaued in recent weeks, now you know why. We’ve had ongoing rolling corrections under the surface setting up to take advantage into year end. You just have to know where to look…

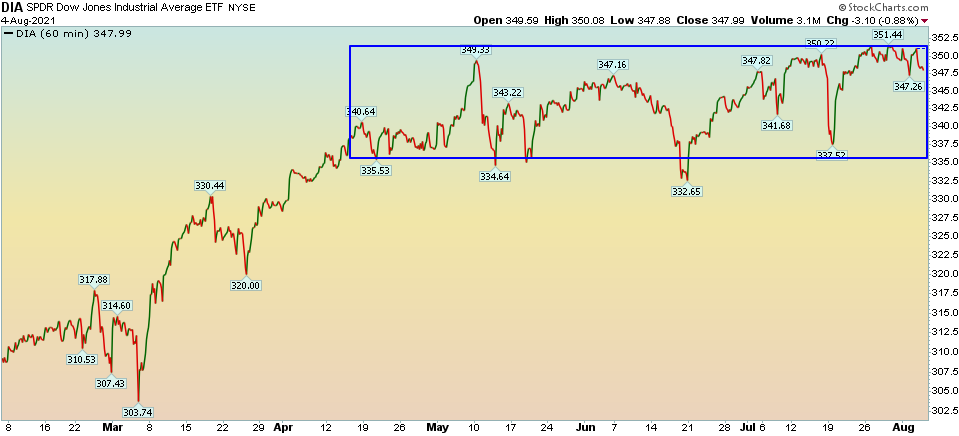

Small caps have done nothing in a half a year:

The Dow has behaved similarly:

Now onto the shorter term view for the General Market:

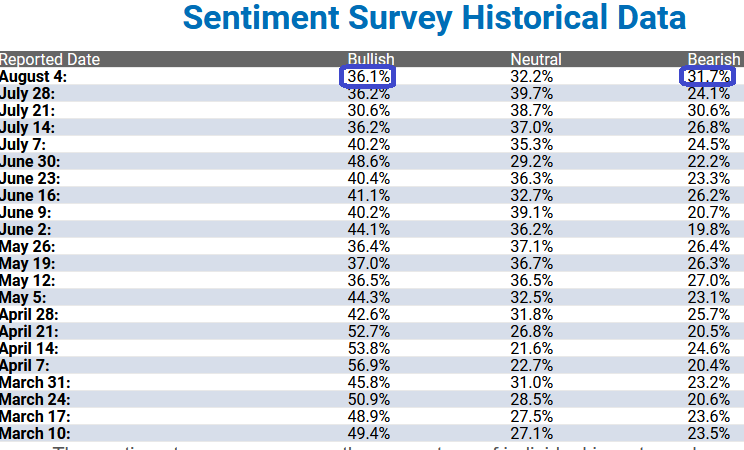

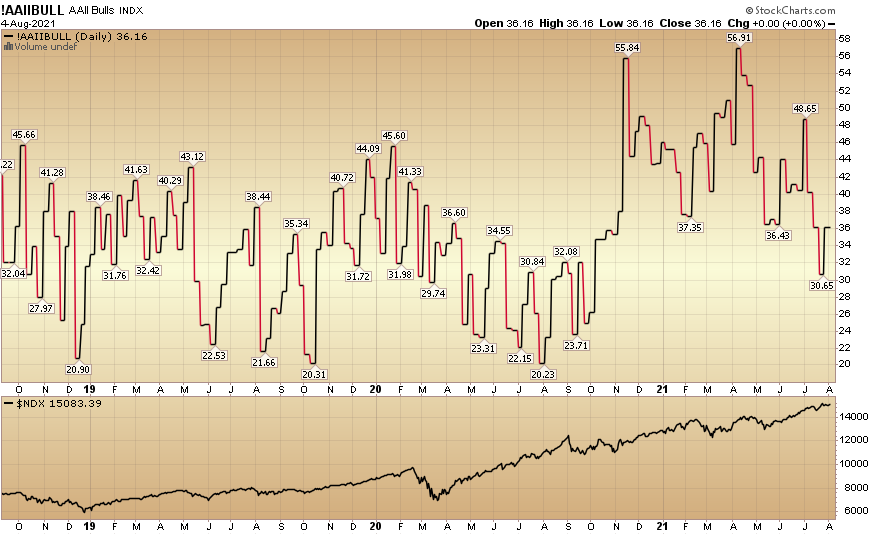

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) flat-lined at 36.1% from 36.2% last week. Bearish Percent jumped to 31.7% from 24.1% last week.

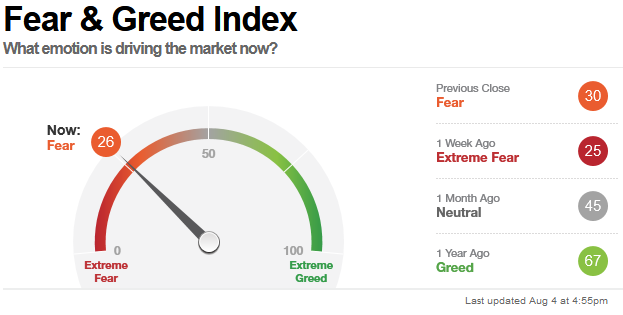

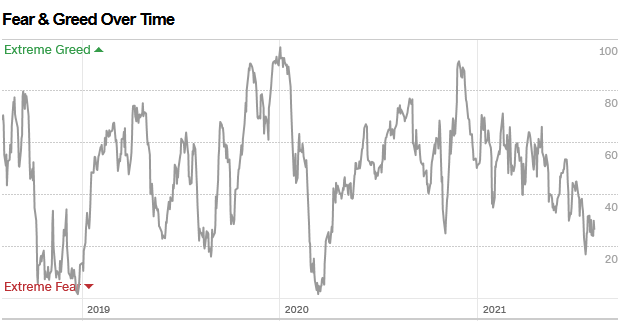

The CNN “Fear and Greed” Index flat-lined from 25 last week to 26 this week. Fear is still present in the market. You can learn how this indicator is calculated and how it works here: (Video Explanation)

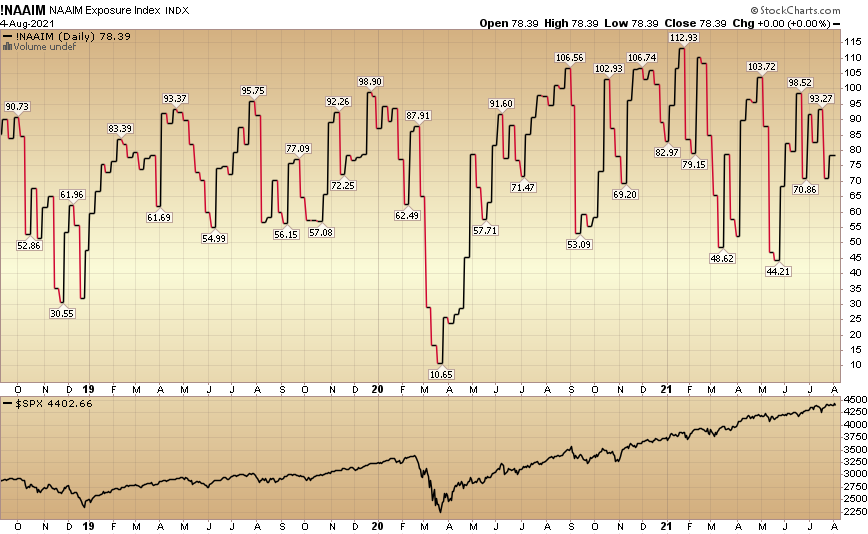

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose to 78.39% this week from 71.04% equity exposure last week.

Our message for this week

Don’t wait for a “big storm” to conclude before you cast your net. 1) It might not come, and 2) There have been many rolling “flash storms” already taking place over the past weeks and months – and if you wait too long to put some lines in the water, you may find all of the best fish are gone.