When our eldest daughter Mimi (Madeline) was 2 (she’s now 8), she would go into uncontrollable crying fits when we would drive around in the car…

There was no solution to this persistent problem until one day, I randomly had the car radio on “scan” jumping from station to station – until it came up with the song, “Build Me Up Buttercup” by The Foundations.

There was no rhyme or reason to it, but all of a sudden, she would stop crying, sit there, smile and start bopping along to the lyrics:

Why do you build me up (build me up) buttercup, baby

Just to let me down (let me down) and mess me around?

And then worst of all (worst of all) you never call, baby

When you say you will (say you will) but I love you still

I need you (I need you) more than anyone, darlin’

You know that I have from the start

So build me up (build me up) buttercup, don’t break my heart…

Only press “play” if you want to smile today:

On Tuesday, I had a great conversation with Brad Smith at Cheddar about the cyclical stocks finally outperforming in September. Thanks to Francesca Conti for inviting me on the show.

Financials, Industrials, Materials and Transports ALL outperformed Tech for the month. We also covered which sectors are likely to outperform in 2021 and why. Watch here to take advantage:

On Wednesday, I was on Yahoo! Finance with Kristin Myers. Thanks to Sarah Smith for inviting me on the show. Kristin and I discussed the “on again, off again” stimulus talks. I explained a little discussed option – that could ultimately wind up solving the short term needs of millions of Americans who have not yet regained the jobs they lost due to COVID.

We also discussed a breakthrough COVID treatment and expectations for Friday’s NFP report. You’ll be pretty surprised with what might be coming down the pike. Listen to my chat with Kristin here:

On a daily basis we have fought back and forth between Growth and Cyclicals. In the month of September, Cyclicals finally outperformed – implying the “re-opening trade” is starting.

In September; Industrials, Materials, Transports and Financials have all outperformed Technology.

This remains consistent with 2021 Earnings Estimates for the S&P 500. Most Cyclical sectors will grow earnings at a FASTER pace than the S&P 500, while Tech will grow earnings at HALF the pace of the S&P 500:

Sectors that will grow 2021 earnings FASTER than S&P 500 (26%): Energy, Industrials (87.4%), Consumer Disc. (74.4%), Financials (30.8%), Materials (29.9%).

Sectors that will grow 2021 earnings SLOWER than S&P 500 (26%): Comm. Services (20%), Tech (13.7%), Health Care (13.6), Real Estate (7%), Cons. Staples (6.8%), Utilities (5.9%).

Here’s a summary of the difference:

| Re-Opening Trade | Stay at Home Trade |

| Cyclicals/Value Outperform | Growth/Tech Outperform |

| Managers have ABUNDANCE of choice to buy EARNINGS GROWTH. They can pay lower multiples for same growth rate. | Managers have SCARCITY of choice to buy EARNINGS GROWTH. They have to pay higher multiples for same growth rate. |

| VACCINE = Catalyst | Shut Downs/Lock Downs = Catalyst |

| Perform in HIGH economic growth environment (Early Cycle) > 5% GDP Growth environment (which we will have in 2021) | Perform in LOW economic growth environment (Late Cycle) < 2% GDP Growth environment |

| Examples: Financials, Industrials, Materials, Energy, Transports, etc. | Examples: Tech, Healthcare, Biotech, etc. |

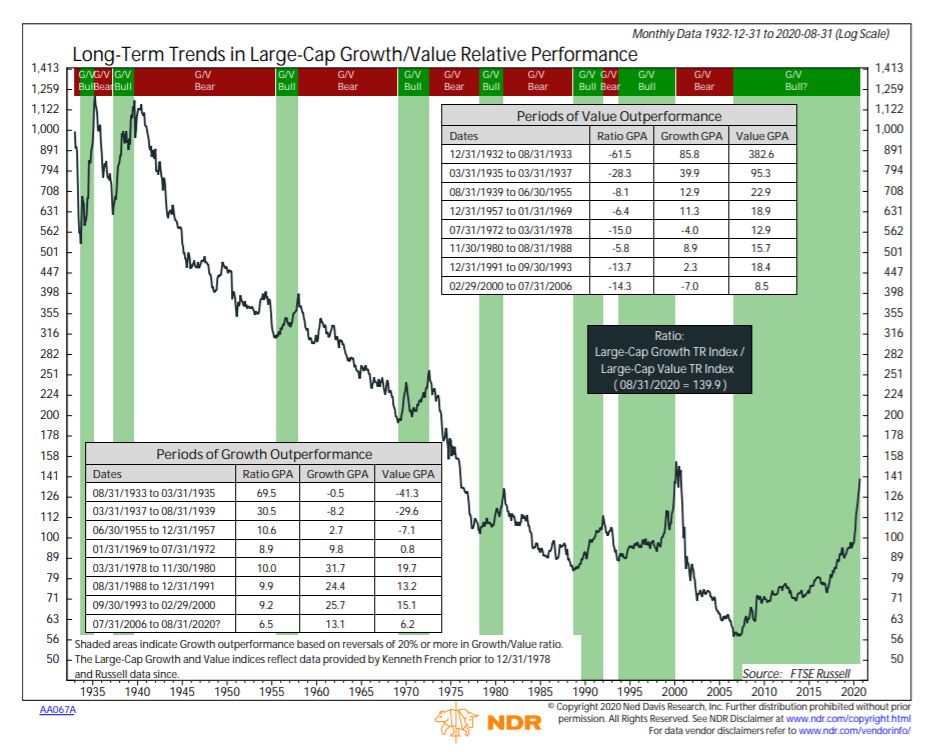

Looking at the chart above, from Ned David Research, you can see that Growth has had more than a decade of out-performance over value. The last time that growth out-performed over this duration was the 90’s.

Dimensional, which was one of the first asset managers to focus solely on academic factors like value and growth, recounts times in investing history when some value managers have thrown in the towel on the strategy (Source: Institutional Investor):

“On March 31, 2000, growth stocks had outperformed value stocks in the US over the prior year, prior five years, prior 10 years, and prior 15 years. As of March 31, 2001 — one year and one market swing later — value stocks had regained the advantage over every one of those periods,” the paper’s authors wrote.

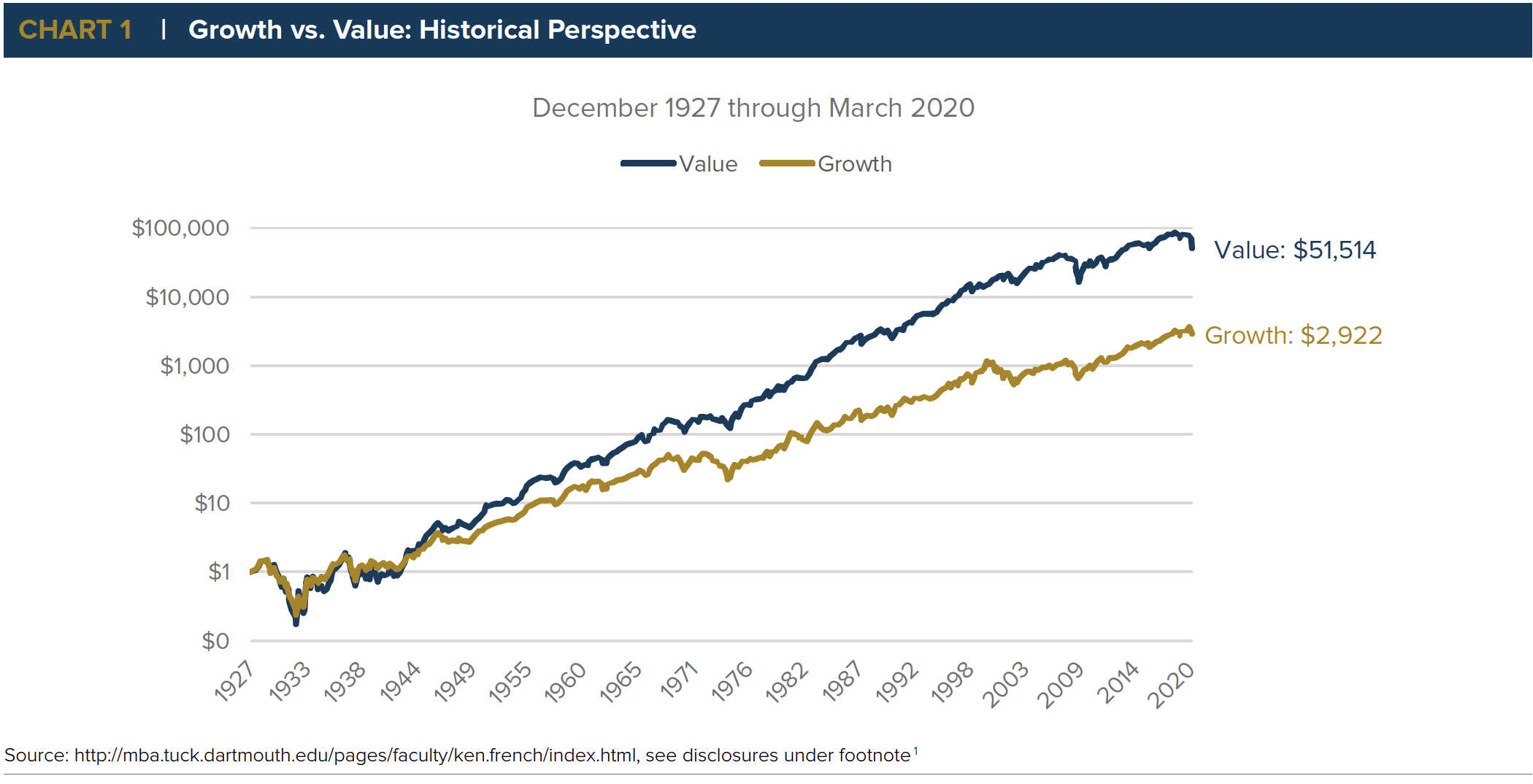

If you had invested $1 in value and $1 in growth stocks in December 1927, today the value investment would be worth nearly 18 times the growth investment. (See Chart Below)

Growth’s annualized compound return of 16.3 percent over the ten-year period ending June 2019 (time Dimensional wrote paper) was much higher than its 9.7 percent return since July 1926.

“On the other hand, value performance over the past decade has been more or less in line with its historical average: 12.9 percent versus 12.7 percent. We can see value has performed similarly to how it has historically behaved,” noted in Dimensional’s report, entitled “Value Judgments: Viewing the Premium’s Performance Through History’s Lens.”

12.7% CAGR is not only orders of magnitude greater than the Growth Factor over the long-term, it is orders of magnitude greater than the general market S&P 500:

The average annualized total return for the S&P 500 index over the past 90 years is 9.8% (LPL Financial Data).

Champagne for my real friends, and real pain for my sham friends…

I first heard this quote from Edward Norton’s character in the 2002 Spike Lee drama, “25th Hour.” He was making a toast when he uttered the chiastic quote during a night club scene.

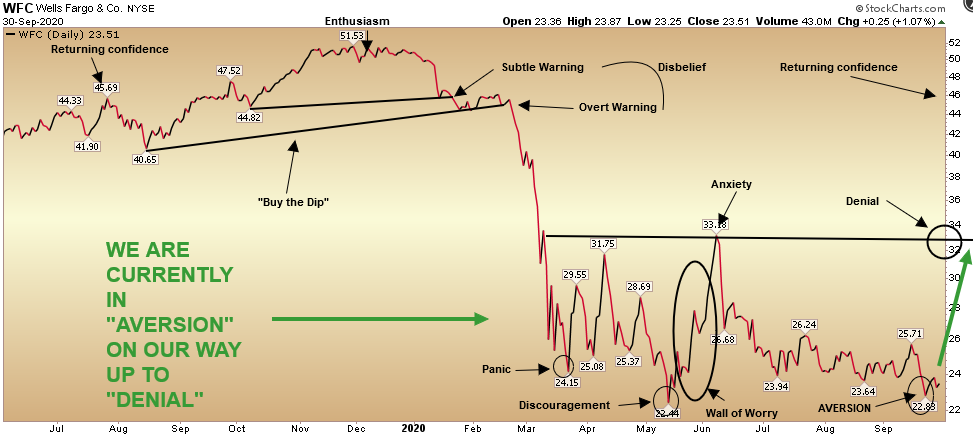

I think when we take a look at the “Most Hated” stock in the S&P 500 – Wells Fargo (see here for previous note’s context), no words will prove to be more accurate than Edward Norton’s pithy toast. Here’s why:

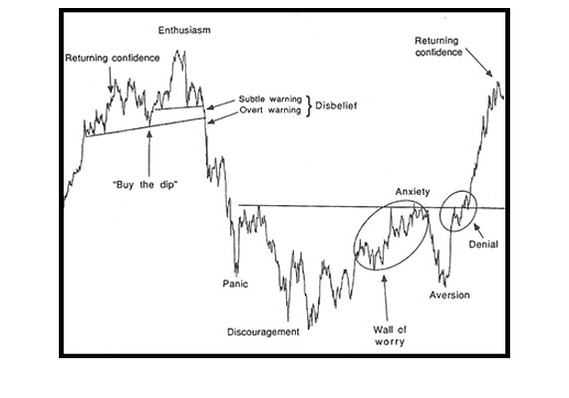

This sentiment chart (above) has been circulating around for many years. It illustrates the normal sentiment cycle of the market, a sector or a single stock…

Every few years I pull it up and it never fails to fit the puzzle. WFC (Wells Fargo) is a metaphor for value/re-opening trade/new cycle/housing led recovery, etc.

It is behaving EXACTLY as it should causing, “REAL PAIN TO ITS SHAM FRIENDS,” and soon to bring, “CHAMPAGNE TO ITS REAL FRIENDS.” The “sham friends” are those who bail when the going gets tough, while the “real friends” are those who stick out the tough times to ultimately enjoy a celebration:

Here is an update of the short term (Cobra Kai “Leg Sweep” Chart) from last week’s note:

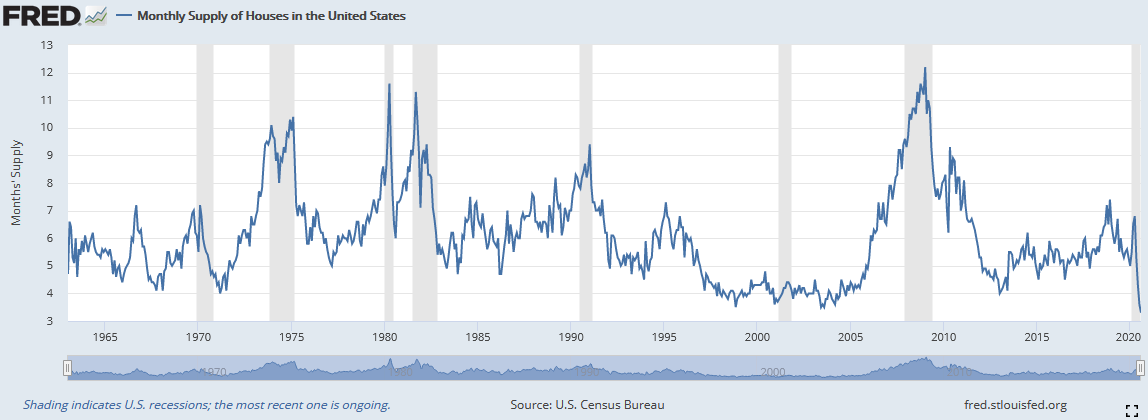

With the exception of 2008-2009, every other recession has always been led out by a HOUSING RECOVERY. We have already seen it in housing stocks – which we were talking about in March and April. Now Materials and Industrials are following, and the LENDERS will not be far behind. Wells Fargo is one of the largest…

Here’s an update on the yield curve steepening and how it impacts Financials in a new cycle:

This housing recovery is due to 3 factors:

- 85M Millenials with an average age of ~30 – starting housing/family formation.

- Record Low mortgage rates.

- Urban Exodus accelerated by COVID.

It is JUST BEGINNING AND WILL NOT END ANYTIME SOON. See 1982 for reference – when 80M Baby Boomers were starting the same phase of their lives…

Housing Inventories have not been this low in 2 decades:

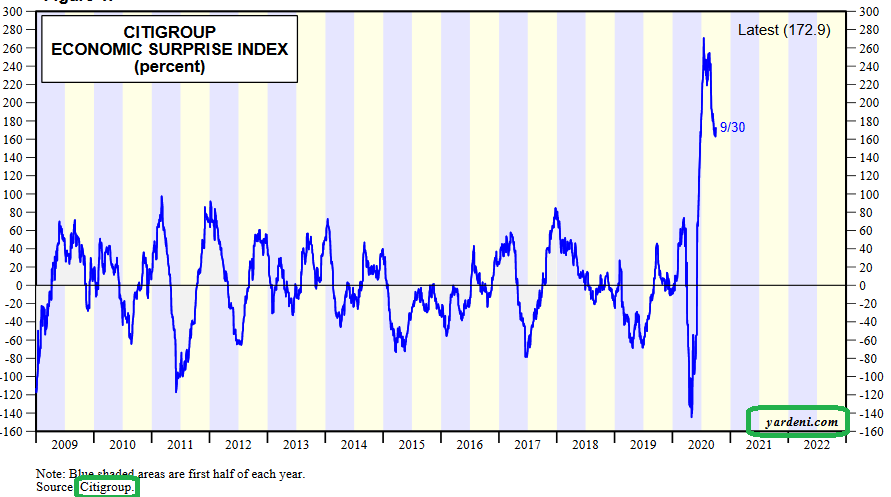

I was planning on going through all of the data beating consensus this week – like existing home sales up 8.8%, ADP payrolls +749K (130k new manufacturing jobs), Chicago PMI (62.4 vs. 52 est.), but instead you can simply sum it all up with the phrase “RECORD BEAT RATE:”

Now onto the shorter term view for the General Market:

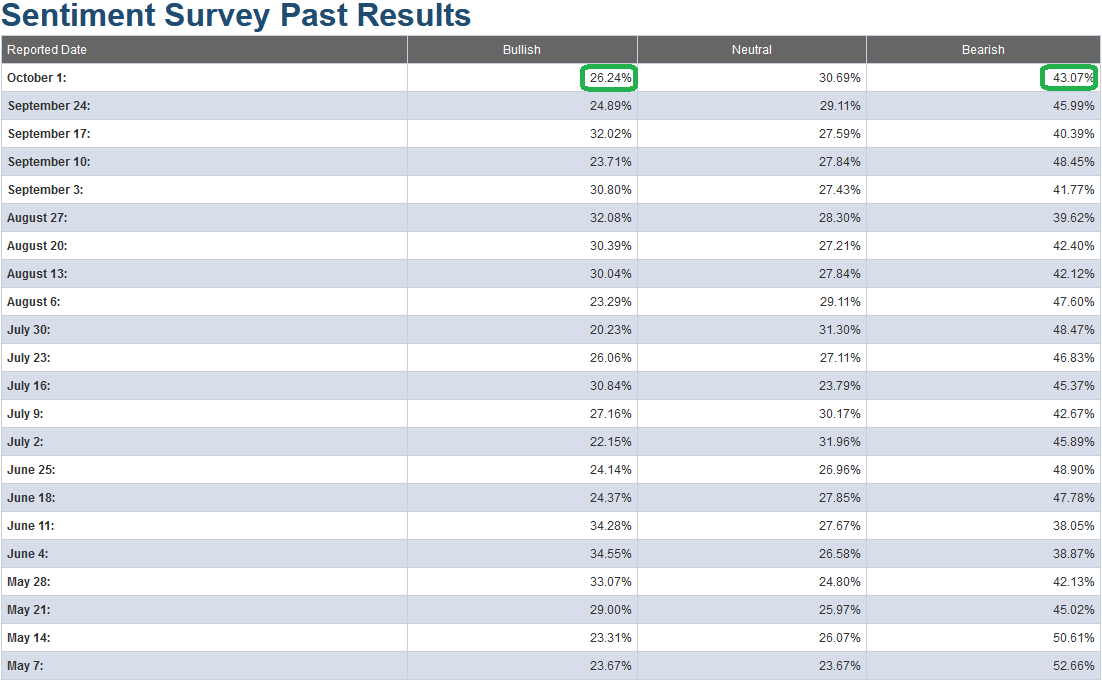

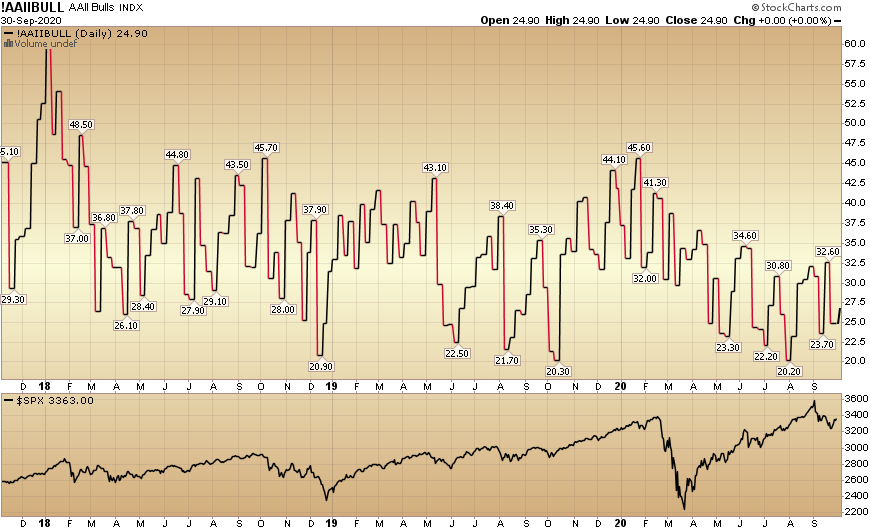

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) climbed to 26.24% from 24.89% last week. Bearish Percent moderated to 43.07% from 45.99% last week. We are starting to bounce off an extreme level.

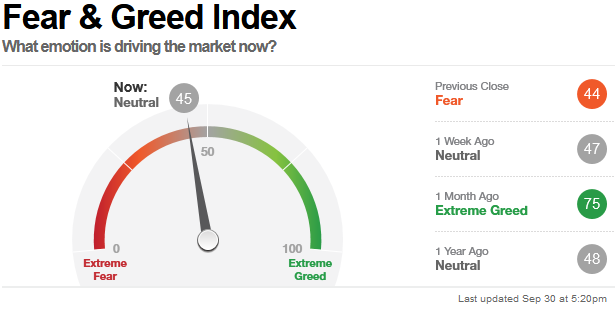

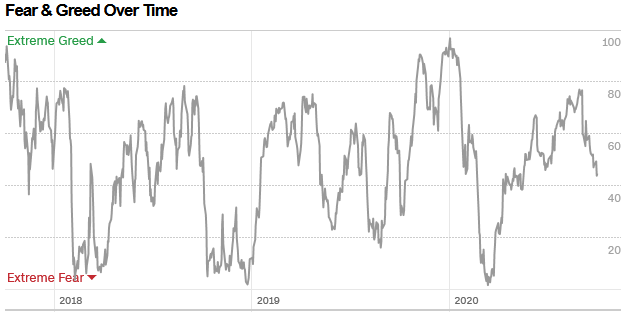

The CNN “Fear and Greed” Index flat-lined from 46 last week to 45 this week. Fear has crept in, but not at an extreme level. This indicator is in the middle of the range. You can learn how this indicator is calculated and how it works here: (Video Explanation)

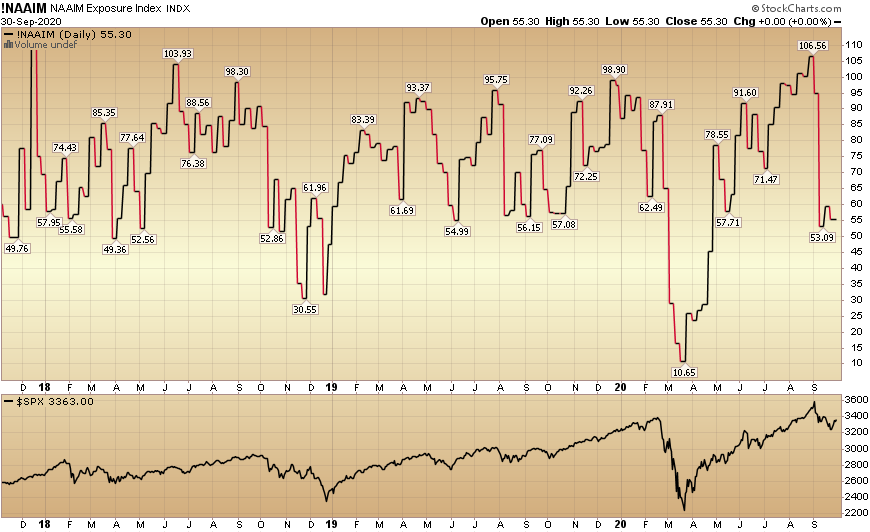

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) moderated from 59.30% equity exposure last week, to 55.3% this week.

Our message for this week:

As I have repeated for a few weeks, the catalyst for change (a continuation of the move into Cyclicals) will likely come from science at this point. Don’t bet against science. Not only do we have 4 vaccines in Phase 3, but we are seeing progress on treatments as well. The REGN drug we highlighted last week announced solid results yesterday (Read Here).

The market is starting to ease into the “re-opening” trade (Cyclicals) – in anticipation of the imminent vaccine approval. We saw this with Industrials, Materials, Transports and Financials all outperforming Tech in September.

Given the legacy overweight to tech, my sense is there is still some more to work out in the coming week(s) for some of the overvalued pockets of tech/saas, etc. That said, there’s enough money ($4.4T cash on the sidelines) that has yet to broaden their exposure and get positioned for the “re-opening” trade move into cyclicals/value.

These economically sensitive names outperform in the early/high economic growth stages of a new cycle – which we have started in Q3. We will continue to take advantage on any short-term weakness – as when the re-opening trade flips on in earnest – it will be abrupt and meaningful for those who were correctly positioned…

But for now, as we navigate through the Information Vacuum (I discussed on Yahoo! Finance with Kristin) in October,

Build me up (build me up) buttercup, don’t break my heart…