I chose this song “Hot Hot Hot,” by Buster Poindexter, to embody the sentiment of this week’s stock market. After breaking 30,000 on the DOW, my mom is now calling me to ask if she should buy Pfizer. “Must be a top,” say the contrarians. But are they right?

Me mind on fire,

Me soul on fire

Feelin’ Hot Hot Hot!

All da people,

All around me

Feelin Hot Hot Hot!

Yesterday I was on the “Mike Simone Show” with legendary TV personality Larry Mendte (he has 4 Emmy Awards and 80 regional Emmy Awards) – an all around great guy and I enjoy going on both Radio and TV when he asks. This was a great segment to listen to because Larry asks all the questions that “Main Street” wants to know – and what’s coming next. Listen here:

Tom Hayes – Mark Simone Show Appearance with Larry Mendte on 710 WOR – 11/25/2020

In our October 22nd article, when everyone was buying insurance and calling a top, we were suggesting that folks “Calm Down” like Taylor Swift, as the time to buy insurance is when the VIX is BELOW 20 or 15, not above. We also made 2 critical cases for what to expect moving forward:

- Equal Weighted indices would begin to outperform Cap Weighted indices as cyclicals began to outperform in the new business cycle. Just a week later the shift began in earnest.

- Everyone was calling the market a bubble, and I laid out over 100 stocks that looked nothing like a bubble. The stocks in that list are the ones that have had the most dramatic out-performance in the past few weeks. Here’s a list of what stocks have performed best this month – from Mike Santoli (CNBC):

The rally led by laggards.

S&P 500 month-to-date top performers are down an average of 40% this year (that’s after rising between 47% and 84% the past few weeks). pic.twitter.com/xZ09iBZEBs

— Michael Santoli (@michaelsantoli) November 25, 2020

Compare it to the list I laid out on October 22. You can also review the charts I posted showing “equal weight” performance eclipsing “cap-weighted” performance at the beginning of the last business cycle:

The Taylor Swift “You Need To Calm Down” Stock Market (and Sentiment Results)…

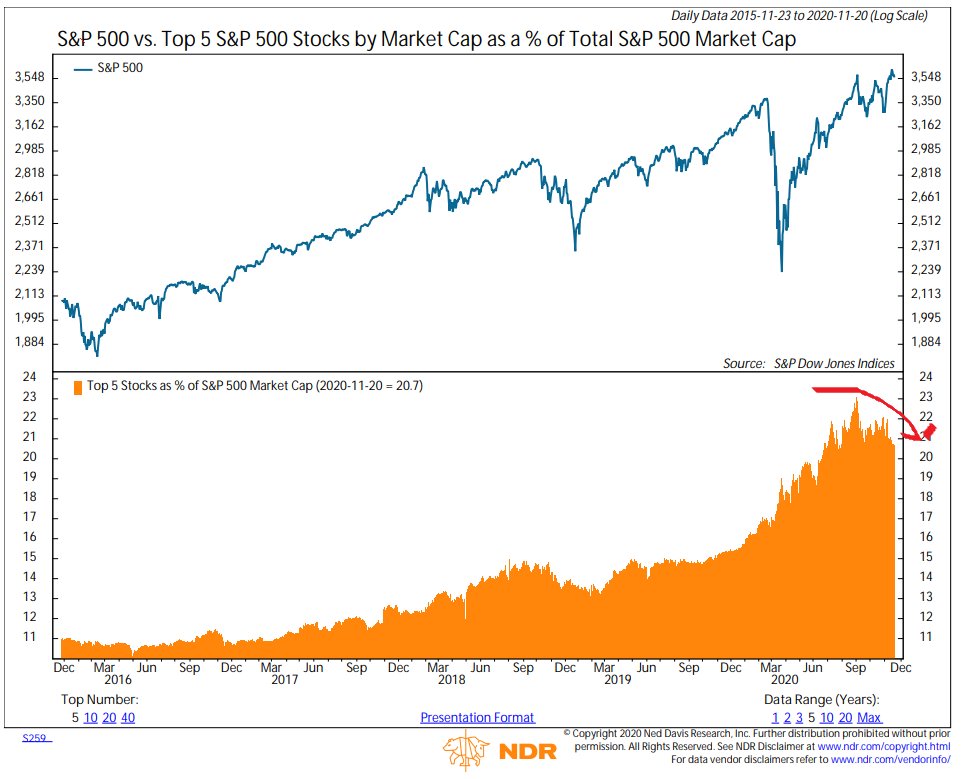

This chart below from Ned Davis Research (by way of @BullandBaird) points to the weakening of the “Top 5” weighted stocks (FAANGM) that made up 25% of the S&P 500, now starting to moderate (in line with our thesis from late-summer):

The Stevie Wonder, “Faith” Stock Market (and Sentiment Results)…

The market rising and the heaviest weights weakening is a sign of strength – as managers now have many more pockets of the market that they can purchase earnings growth – as we begin the high economic growth phase of the new business cycle.

Those stocks that were “bid up” in an effort to find earnings growth in a weakening economy (during covid) can no longer command the same premiums they once did as managers’ options to buy earnings growth have now multiplied.

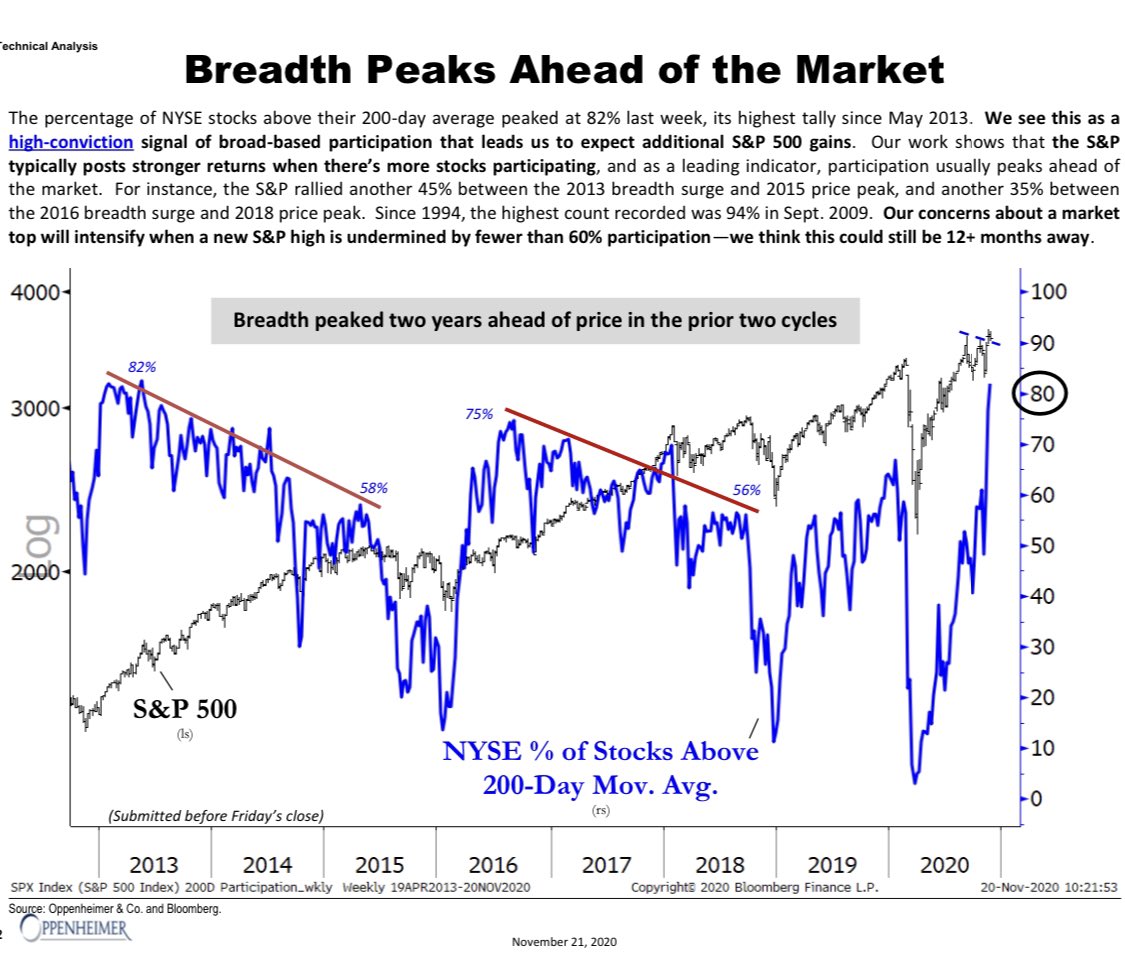

This “extreme high” in market “Breadth” – off of multi-decade lows this past March – is not the sigh of a top, but rather a confirmation of a new uptrend:

The implication of this study by Ari Ward at Oppenheimer (by way of J.C. Parets) is that we are closer to the beginning of a new uptrend, than the end. That doesn’t preclude pullbacks, but is potentially a sign that it will be more costly to be on the sidelines than most expect in coming years. That $4.4T of cash on the sidelines will be forced back in – kicking and screaming…

This is due to:

1) The market discounting a full re-opening (and potential vaccination “herd immunity” as soon as May 2021).

2) The lagged effect of ~$20T of Global stimulus, aid and liquidity hitting the economy (it usually takes 6-9 months to feel the effect). $12T of Fiscal Stimulus and ~$7.5T of Monetary Liquidity has been applied globally to more than displace a $3.66T GDP contraction in 2020.

What is strange about this “extreme in sentiment” – and other normal measures – is the fact that everyone knows it and they are all calling for a top for the same reasons once again.

With ~$4.4T of cash on the sidelines this could be one of those instances where, “when everyone is expecting a major correction, you might not get one.” In effect, many professionals are begging for a pullback because they were flat-footed into the election (or overweight FAANGM) and they have no chance in hell of catching their benchmark without said pullback occurring. Hence, the “pain trade” may very well be UP – and everyone calling it euphoric (while right in theory), may be deadly wrong in performance.

When we look at the SKEW index (watch this short video to learn how it works) to see how people are betting on tail risk, we see the elevation in August – before the pullbacks. We are not trading near worrisome levels at present:

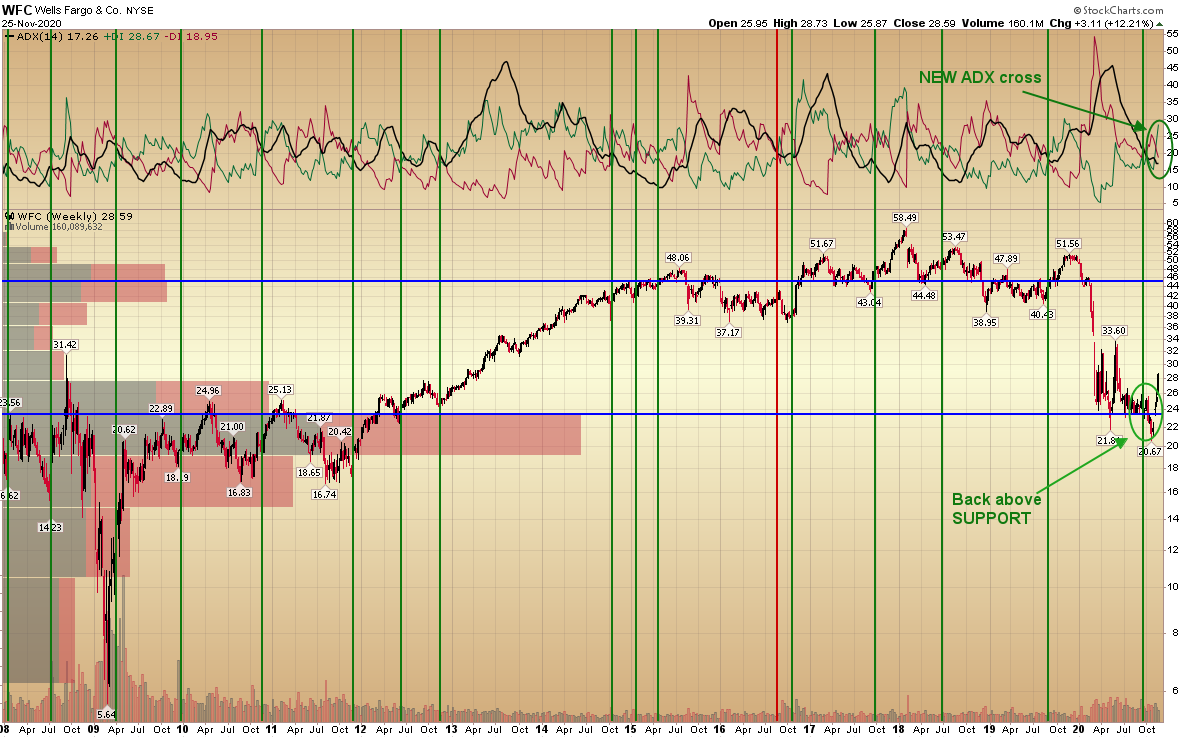

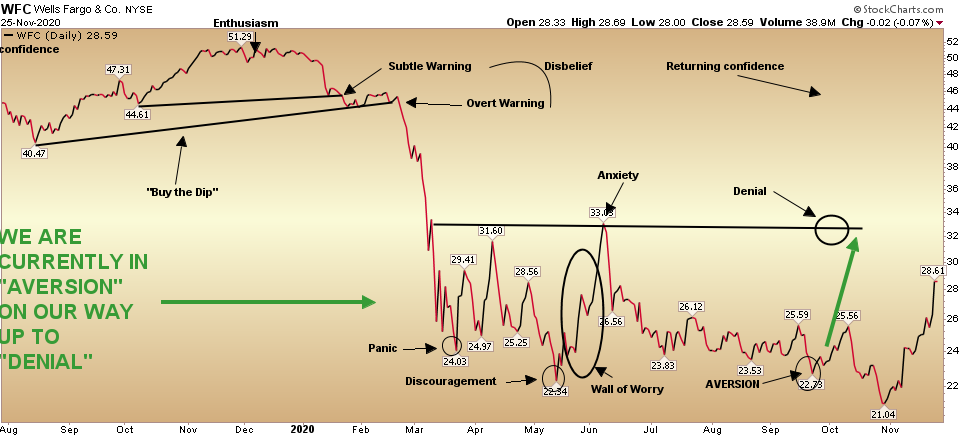

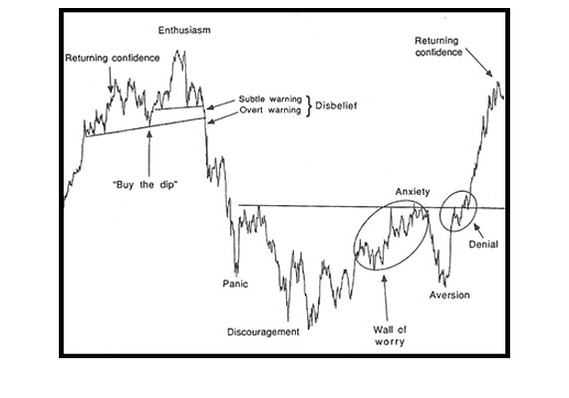

On the COT reports (click here to watch short video on COT) – while not a perfect indicator – commercials are usually ahead of the big moves and right now they are net buyers of the DOW (which we are focused on only because of the retail/media attention regarding DOW 30k). Update on Wells Fargo:

Update on Wells Fargo:

In short, so far it’s working as laid out in recent notes.

We took a short detour but are well back on track – up 38.58% since the October 28 “discouragement” lows:

Now onto the shorter term view for the General Market:

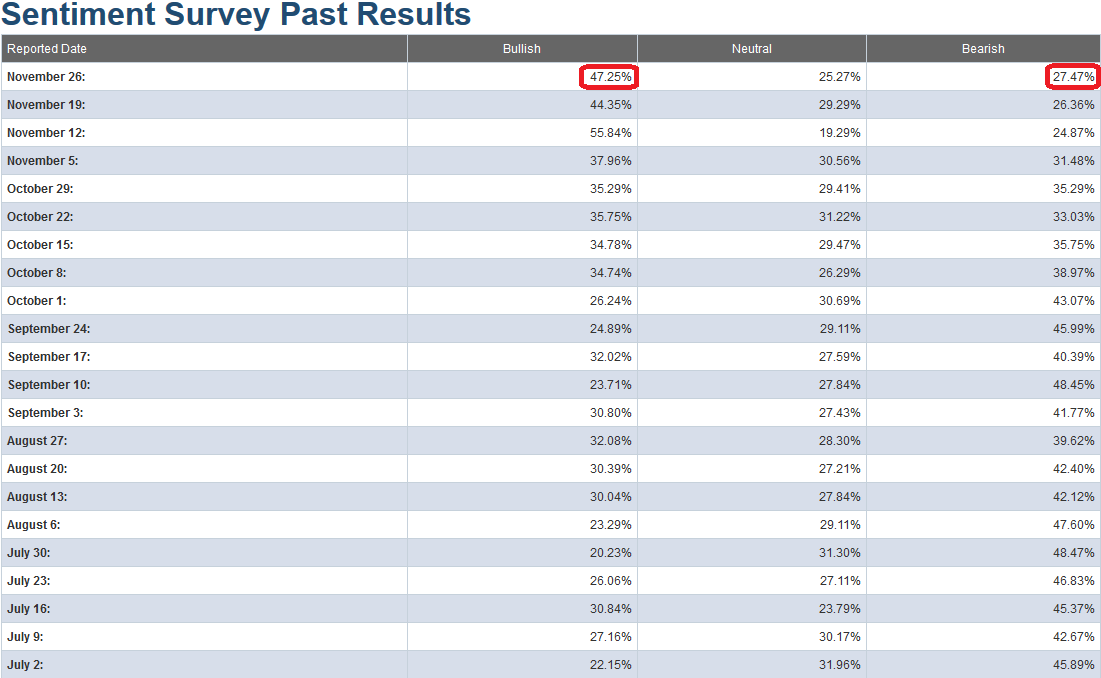

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) rose to 47.25% from 44.35% last week. Bearish Percent also rose to 27.47% from 26.36% last week. We are still at an extreme in sentiment for retail investors.

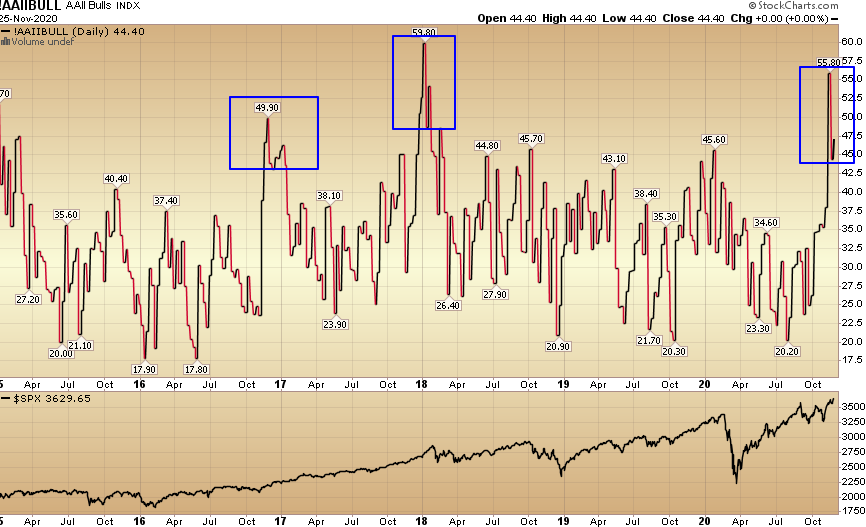

While this is still an extreme in short-term sentiment – and should be heeded in the short-term – it is important to note in the chart below, that while similar levels presaged a short term top in early 2018, they occurred near the beginning of a longer term uptrend at the end of 2016-2017 (right after the last Presidential election).

We noted the similarities between the pre-election stock-market in 2016 versus 2020 in our October 29, 2020 note. It has played exactly according to script ever since, which is why I am inclined to give this extreme level in sentiment the same “benefit of the doubt” as late 2016 – as just like then – most managers were off-sides and flat-footed going into the election and had to panic into the market to play “catch up.” You can review the October 29 note here:

The “Back to the Future” Stock Market (and Sentiment Results)…

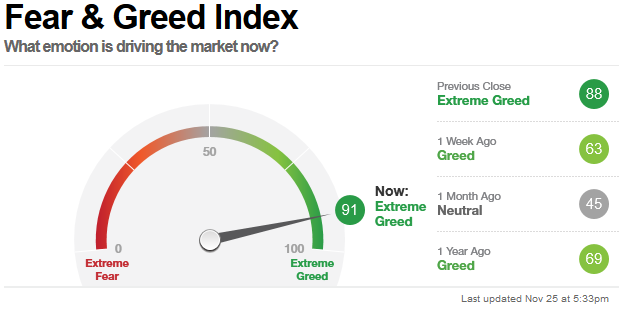

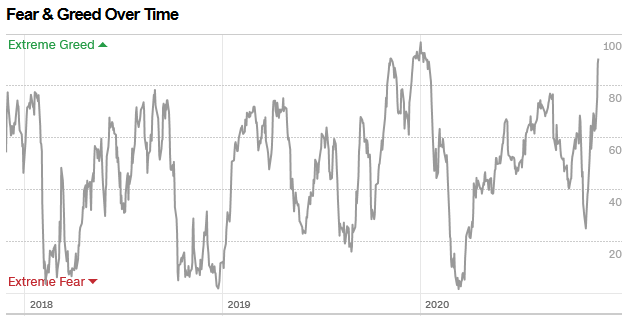

The CNN “Fear and Greed” Index jumped from 61 last week to 91 this week. This is a euphoric read. This is not where you want to be adding risk to as it relates to the general indices. It can run hot for a while, but the odds start to stack against you if you are not selective at these levels. You can learn how this indicator is calculated and how it works here: (Video Explanation)

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) jumped to 106.41% this week from 96.30% equity exposure last week. As we said before the election, managers would have to chase into year end – and they are now doing just that. As you can see over the past five years, this level of extreme warrants caution but is not always indicative of a top.

Our message for this week has not changed:

While the (short-term) “easy money” has been made in the general indices (since the March lows), I think the easy money is just getting started in “left for dead” sectors/stocks. I believe Banks, Defense Stocks and pockets of Energy will be as good – if not “orders of magnitude” better (in coming quarters) – than buying the general market in late March.

In the meantime, you will see a parade of “top callers” praying for a buy-able pullback to catch their benchmarks. Even if they are right in the short term and we get a minor pullback, they will be wrong over the intermediate term as the new business cycle has just begun…

In case you are wondering what I told my Mom, I said she could buy Pfizer here with a long-term view and that the purchase should have nothing to do with short-term vaccine approval. She will own a long-term durable franchise in a secular uptrend (due to demographics) and get paid a handsome (increasing dividend) of 4.15% – in the mean time – while she waits.

All da people,

All around me

Feelin Hot Hot Hot!