In recent weeks we commented to stop worrying about a “September Swoon” as most pullbacks would be likely be contained to ~3-5%. So far this has held true on a closing basis…

In contrast, we suggested shifting focus from the general indices and buying quality that was on sale and had already experienced a “Summer Swoon.” When I saw the lyrics to Jordan Davis and Luke Bryant’s country hit “Buy Dirt” I could empathize with the strategy:

A few days before he turned 80

He was sittin’ out back in a rocker

He said, “What you been up to lately?”

I told him, “Chasing a dollar”

And in between sips of coffee

He poured this wisdom out

Said, “If you want my two cents on making a dollar count

Buy dirt…

‘Cause the truth about it is

It all goes by real quick

You can’t buy happiness

But you can buy dirt

The literal meaning of this suggestion is to buy land, build a house and a life around it. As it relates to the stock market, I view it as buying value with immense raw intrinsic value (when on sale), and waiting for that inherent value to be realized by the market over time.

This week we saw a very interesting public filing from Warren Buffett’s partner Charlie Munger. Charlie and Warren did not become Billionaires buying fully priced “shiny skyscrapers” when everyone wanted them, they got rich “buying dirt” and seeing the intrinsic value in a high quality company when no one else did (wanted it).

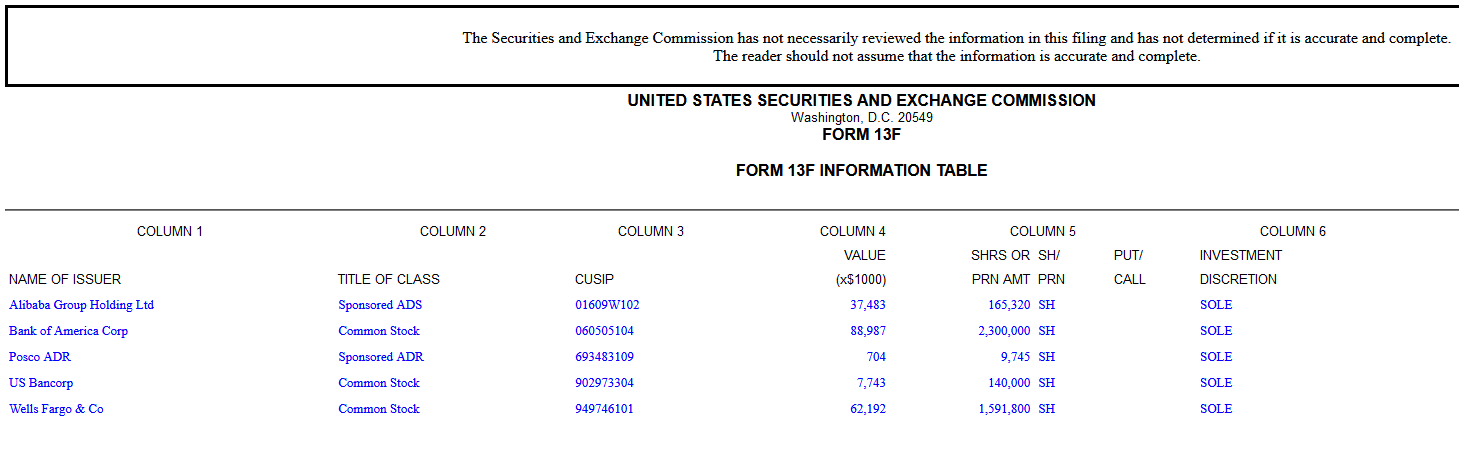

Earlier this year, Munger (through his investment vehicle – Daily Journal), bought Alibaba (BABA). His first purchase was in Q1 2021 (reported on April 5, 2021):

This means his initial purchase of BABA was priced between ~$220-$274. My guess is it was closer to the low end of the range as he would have been buying the panic selling off the $319 high in Q4 2020.

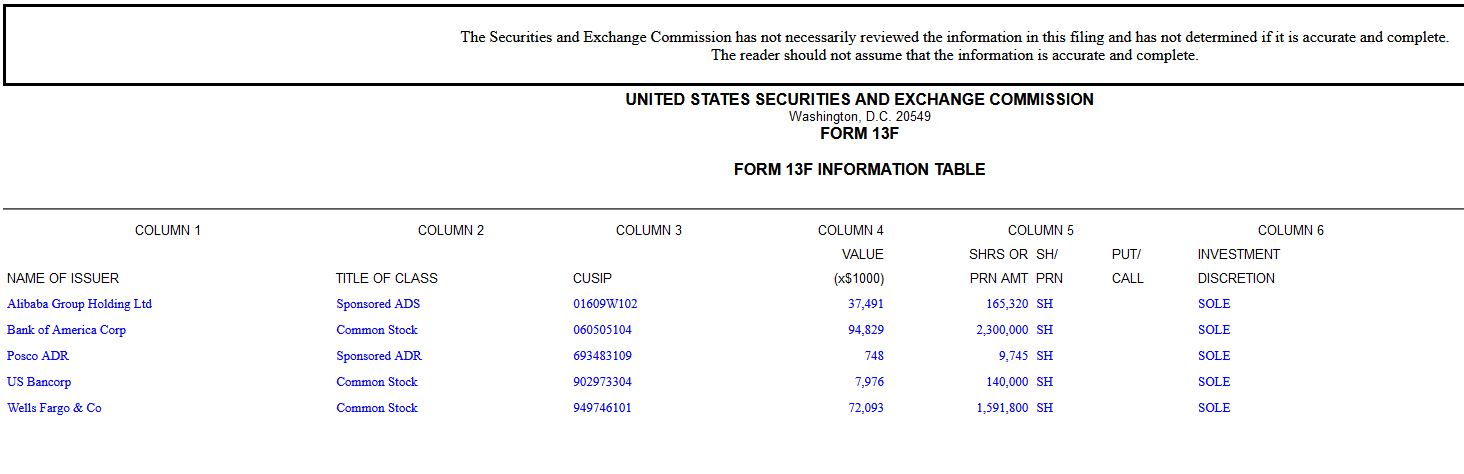

In Q2 2021, BABA fell as the regulatory crackdown ensued and Alibaba paid a $2.8B fine for “monopolistic” practices. BABA traded between ~$204-$245. Munger did not add on the further weakness in Q2:

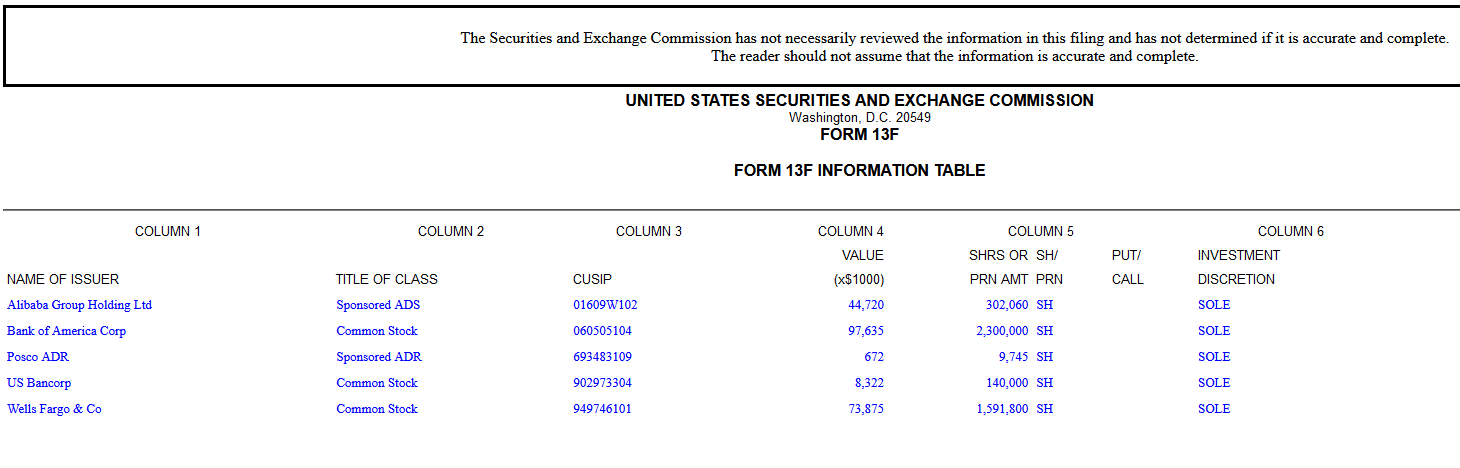

In Q3 2021, the Chinese Communist Government started aggressive crackdowns on Education Providers, Online Gaming companies, Real Estate Companies, and any other target they could think of. Foreign investors fled the arbitrary and capricious government actions by voting with their dollars and exiting stage left.

With one exception, Charlie Munger decided to nearly DOUBLE DOWN on his position in Alibaba (BABA) taking his shares from 165,320 to 302,060. BABA traded between $228-$146 during Q3. This aggressive purchase likely took Munger’s basis down to the $180-200 range and now represents 17.59% of his portfolio. Our stock position basis is now materially below this range – as we started our position much later than Munger and have added nicely on recent weakness. To raise funds, we simply shaved a bit from each of the gainers in the portfolio that no longer have the same ~60-90% upside potential – over the next 9-18 months – that we believe BABA has from these levels. It was simply an analysis of “best use” of capital.

So why was Munger nearly DOUBLING his position while everyone else was puking theirs out? For starters, successful people do what unsuccessful people won’t. He’s willing to take some short term pain for long term gain. Not on the basis of wishing or hoping, but on the basis of facts and data.

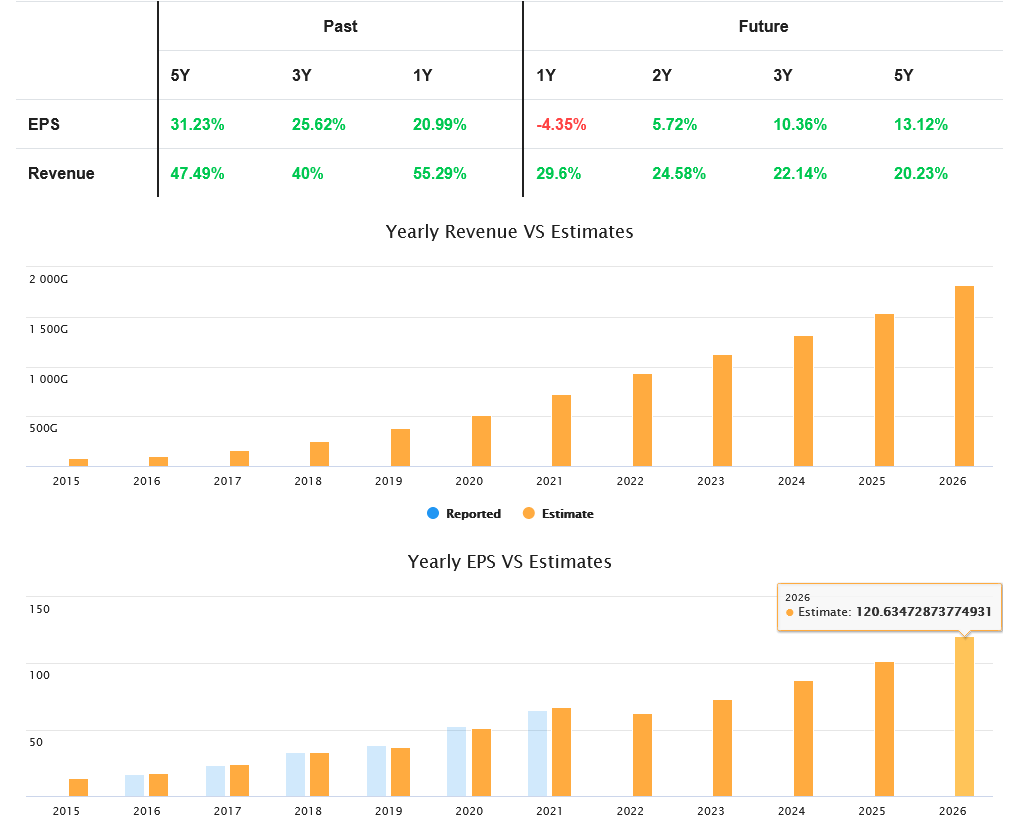

The fact is he realized he could buy a business that has more than tripled in the last 4 years for less than it cost before the growth, and on top of that the business is expected to double again in the next few years.

So while the noise scared most people out, the business continued to grow top-line aggressively and cash-flow will more than double in the next few years – yet you pay less than most folks did 4 years ago when the business was less than a third of the size.

Will BABA face competition moving forward? You bet. Can its ~1 Billion users be replicated? Unlikely. And that’s why Buffett and Munger are the best investors around:

Of further note, Munger is good friends with a well regarded “on the ground” Chinese money manager named Li Lu. Lu manages some of Munger’s personal money and is well connected and knowledgeable about policy and business outlook in his local market.

So if I can buy a business that is expected to DOUBLE in the next few years and pay the same price as someone who bought it four years ago when it was producing ~1/3 of what it is today, what could go wrong (why is it so under-priced)?

- The market is concerned that the Chinese Communist Government will continue to regulate it to a point that its future earnings power is permanently impaired. We believe this fear is overblown because it would destroy China’s global competitiveness, discourage citizens from having children in an economy with less opportunity, and lead to significant unemployment and social unrest.

- The market is concerned that all Chinese stocks will be de-listed from the US exchanges. Chinese ADRs have been in existence for ~2 decades and their future is questioned every 3-4 years when the Chinese indices correct 30-40% due to regulatory crackdowns. The SEC intends to de-list roughly 270 Chinese companies listed on U.S. exchanges by early 2024 unless they allow their auditors to be inspected. We don’t believe this will become an issue for Chinese listings that have major global “big four” auditors. In the case of BABA, their auditor is PwC (PricewaterhouseCoopers) and the review of such audit should be straightforward if/when required over the next few years.

WSJ: Alibaba Group Holding Ltd. Chief Financial Officer Maggie Wu said the company is closely monitoring the U.S. bill that aims to de-list foreign companies from the country’s stock exchanges and anticipates that it will be able to comply with any new regulations.

Wu said the company “will endeavor to comply with any legislation whose aim is to protect and bring transparency to investors who buy securities on U.S. stock exchanges.”

October Outlook and Summer Swoon Picks

On Friday I was on Fox Business – The Claman Countdown – with Cheryl Casone. Thanks to Ellie Terrett, Cheryl and Liz for having me on:

In this segment I gave my general outlook for October as well as identified 2 new picks that has “Summer Swoons” and may represent good value moving forward:

OCTOBER OUTLOOK: Tends to be volatile BUT, here are some stats:

-Over the past 20 years, October was the 4th best month of the year (since WW2 it’s the 7th best month).

-After a 7 month win streak ends (as it did in Sept.), Avg. returns (since WW2) are solid: 1mo. 1.2% 3mo. 4.1% 6mo. 7.9% 12mo. 9.5%

-Q4 quarter is best time of year averaging 3.8% returns since WW2.

With the Merck pill (tamaflu for COVID – reducing hospitalizations by 50%), Global Covid Cases declining, and the Fed signaling taper, the re-opening (value, cyclicals) should regain the leadership position it had in Q1. Long-duration earnings (tech/growth) become less valuable in the short term when rates are rising.

WYNN:

-Macau recorded gross gaming revenue of US$733 million in September, up 32.4% compared to August. Government (licensing/concession) fears are overblown as WYNN has local partners who own 28% of WYNN Macau.

-US Wynn Las Vegas and Encore leisure bookings trends are stronger into year-end. Exposure to digital gaming and sports betting has a big runway in US.

LMT :

-Lockheed Martin fell ~15% off its summer highs as Industrials/Aerospace fell out of favor. With the re-opening trade back in play we believe this stock can work back up to new highs over the next 6-9 months.

-It will earn 27% more in 2022 than it did pre-pandemic (2019) and yet is trading at an ~18% discount to its pre-pandemic highs.

-Trades at 12.4x next year’s earnings and pays 3.25% dividend while you wait.

-F-35 fighter pilot (largest weapon program in history) will fuel earnings for decades to come.

Now onto the shorter term view for the General Market:

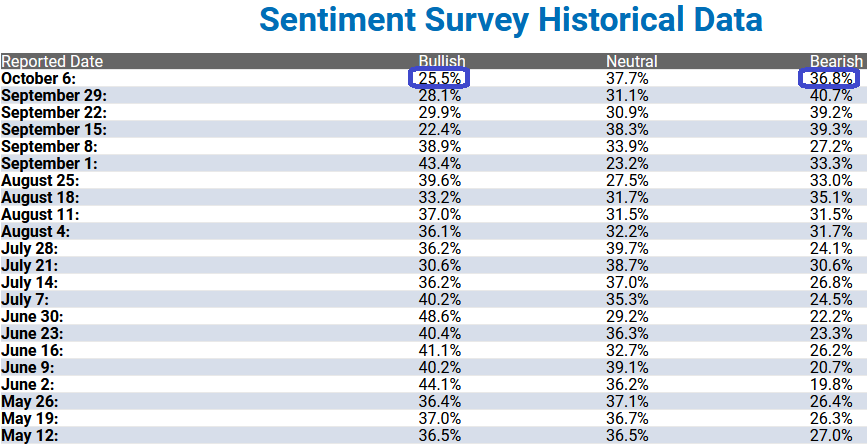

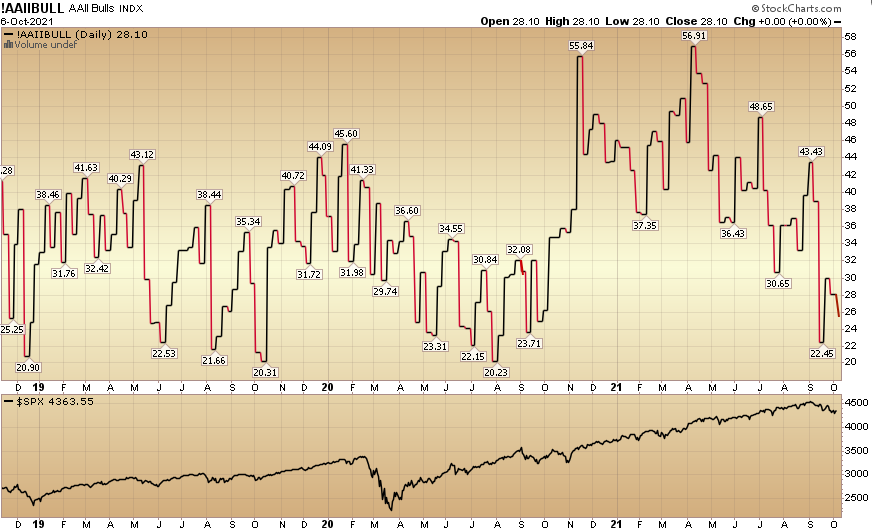

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked down to 25.5% this week from 28.1% last week. Bearish Percent ticked down to 36.8% from 40.7% last week. Fear is still present at the retail level.

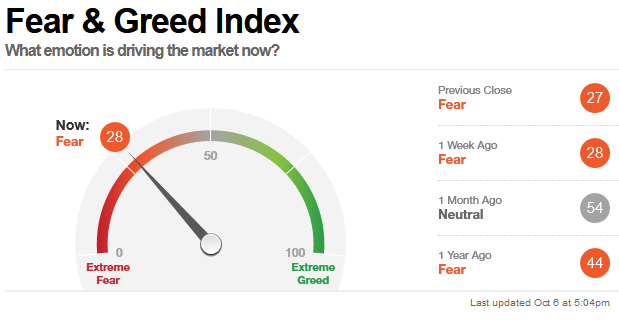

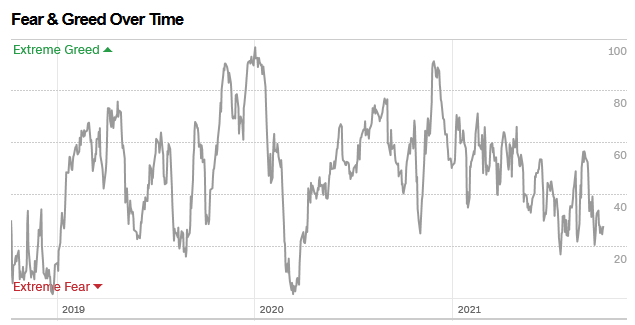

The CNN “Fear and Greed” Index flat-lined from 28 last week to 28 this week. Fear is at/near an extreme. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The CNN “Fear and Greed” Index flat-lined from 28 last week to 28 this week. Fear is at/near an extreme. You can learn how this indicator is calculated and how it works here: (Video Explanation)

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 55.02% this week from 77.7% equity exposure last week. Managers will have to chase into year end – as they are underweight if the market bounces.

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 55.02% this week from 77.7% equity exposure last week. Managers will have to chase into year end – as they are underweight if the market bounces.

As we said in previous notes, while everyone debated whether we were going to have a “September Swoon” or not, we took a step back and looked for sectors/stocks that have already had a “Summer Swoon” and bought (or added to) the quality stocks that were on sale. We will discuss the progress on this week’s podcast|videocast.

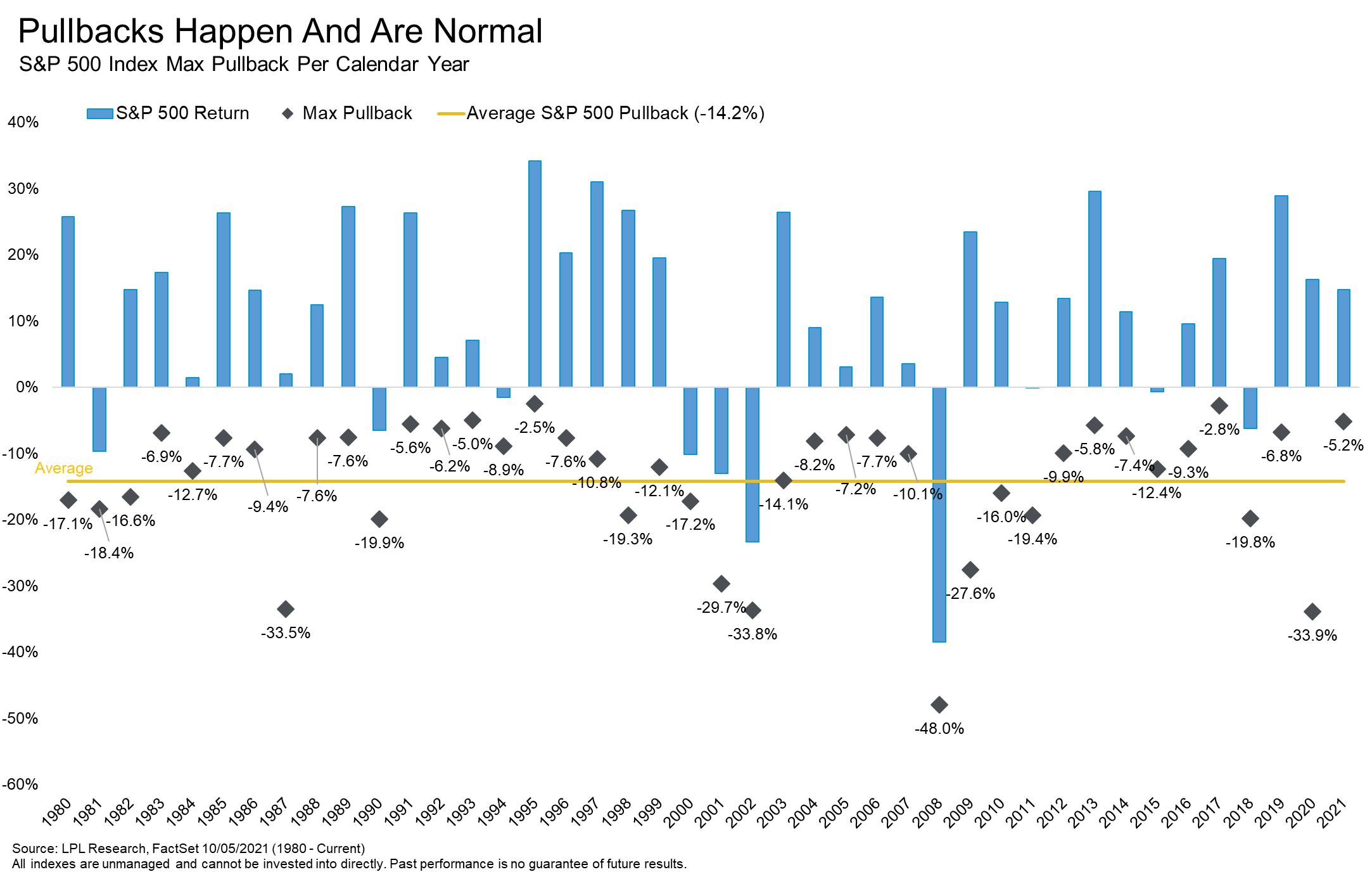

While 10% corrections are normal, they should not be a forgone conclusion – just because we haven’t seen one in a while. This chart shows the last 41 years of market pullbacks. In 21 of the last 41 years HAVE NOT HAD a 10% correction.

(source: LPL)

(source: LPL)

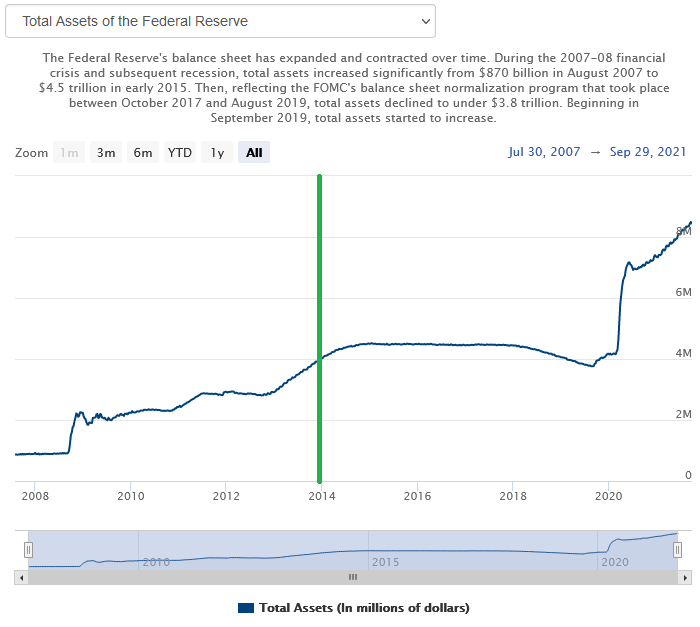

If we hit any further turbulence in October – while the politicians go through their normal shenanigans – keep in mind that the “richest man in the world” – Jay Powell – still has your back:

The Fed signaled taper in May 2013 and started in December 2013. As you can see from the green line, when taper started, the balance sheet/liquidity still grew for many months with asset purchases and reinvestment.

If the Fed tapers $15B/mo. starting in early 2022, over the 8 month period the Fed will add another ~$660B to its balance sheet. The S&P 500 gained 32.59% in 2013 (anticipating taper), and another 13.69% in 2014 (digesting taper).

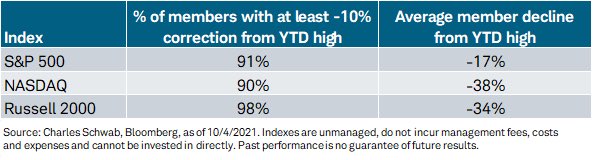

Don’t buy the “finished product” that’s fully valued and everyone wants. Buy the quality “dirt” and the skyscraper will come. There is plenty of “dirt” still available right now:

You just have to know where to look…

You just have to know where to look…