This week I chose Chuck Berry’s classic song “No Particular Place to Go” to describe current market sentiment. As you can see below, watching the markets for the past ~2 weeks has been like watching paint dry:

Chuck Berry put it best:

Crusin’ and playin’ the radio

With no particular place to go…

So far we have seen Bank earnings and Big Tech earnings. Both blew the doors off. The question moving forward is, “how much was priced in?”

On Wednesday afternoon, I joined Nicole Petallides on TD Ameritrade Network to discuss “Big Tech” earnings results and expectations. Thanks to Nicole and Declan Murphy for having me on:

At the beginning of the year, we laid out the case for a mid-teens UP year for the S&P 500, and that it was unlikely we would see any major pullbacks greater than 3-5% (similar to 2013 and 2017). As such, the prescription was to ignore the general indices and look for the “rallies under the surface.”

We’ve been successful with that strategy – having rode Energy and Financials early in the year – followed by Utilities, Staples and Big Pharma in the past two months. So now what?

In the video above we covered Microsoft and Alphabet. After the bell, Facebook beat big as anticipated. Apple also beat expectations, but lowered guidance by $3-4B in Q2 due to the chip shortage. The last time AAPL reported “perfect” earnings was January 27, 2021. This was the headline from their press release:

“Revenue up 21 percent and EPS up 35 percent to new all-time records. iPhone, Wearables, and Services set new revenue records”

Here’s what happened next: Here’s the headline from Wednesday night’s earnings:

Here’s the headline from Wednesday night’s earnings:

“Revenue up 54 percent to new March quarter record

Services and Mac revenue reach new all-time high”

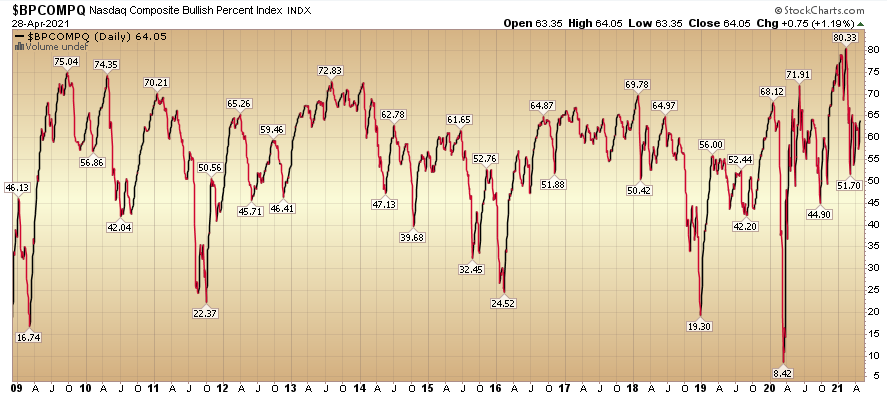

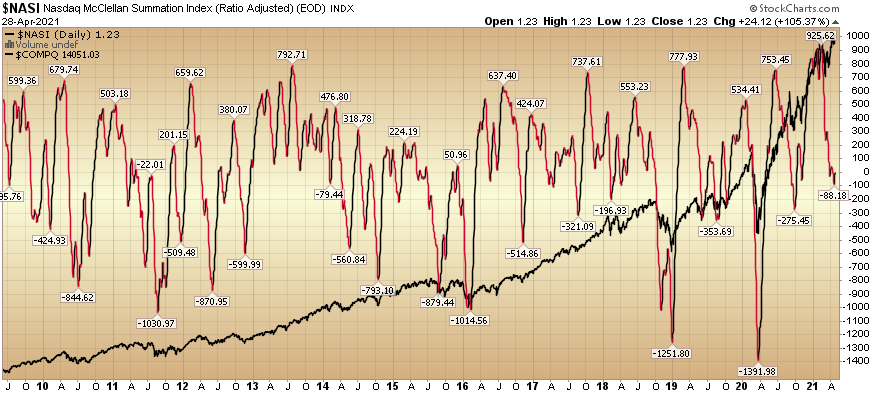

What will happen next? It’s hard to say for AAPL, but for the Nasdaq, with FB, GOOGL, MSFT – all showing secular strength – there may be some gas in the tank – whether AAPL participates or not:

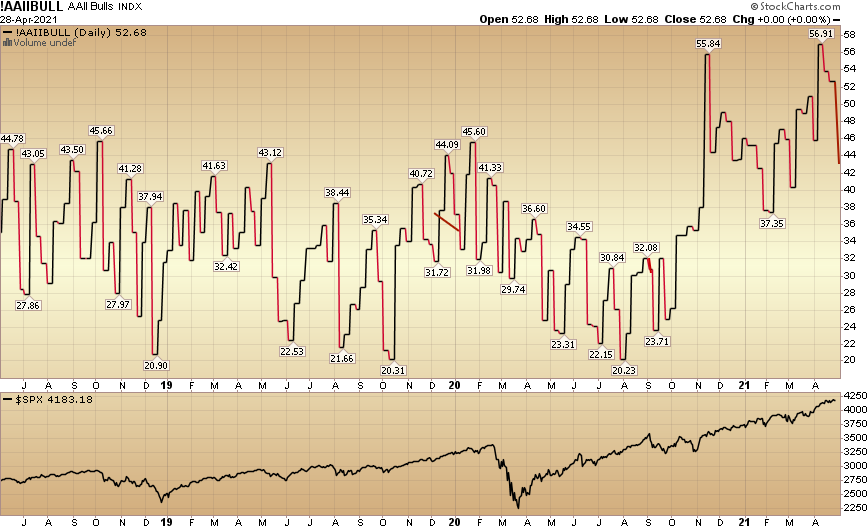

Despite the general indices feeling “frothy,” neither of these Nasdaq centered indicators scream “overheated” at the moment. That could change soon, but it hasn’t changed yet.

We took our own advice on April 8, and added some selected Tech in recent days and weeks. Here’s what we said in that note:

“We will look for very selective opportunities in Tech/SAAS – particularly in stocks that have fallen 20-40% in the past few weeks – and will be less impacted by tough comps for Q1 and Q2. This is NOT a wholesale call on tech – as we believe certain pockets will continue to face headwinds.”

We also said in the April 8 note,

“We built up selective positions in Utilities, Consumer Staples, and Big Pharma since we first mentioned it at the end of February. We think the rebound in this group should continue in coming months (even if we have a few fits and starts – after a very big jump in the past five weeks).

We continue to hold our banks, energy and defense/aerospace stocks from much lower levels last year and would not be surprised if they continue to take a breather – before resuming their uptrend/new highs later this year.”

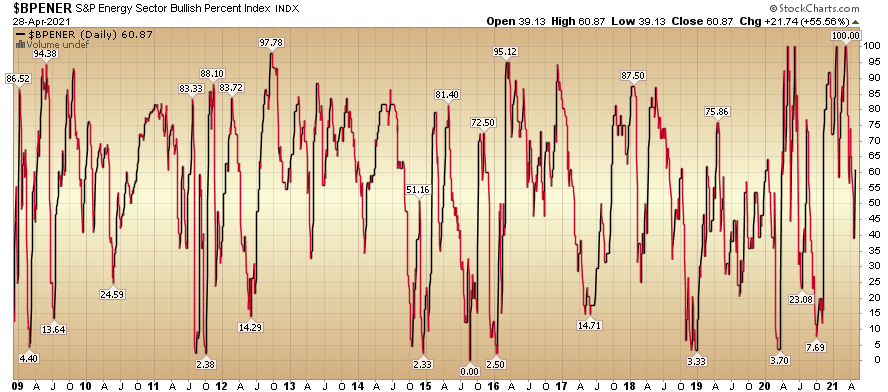

Banks and Energy took a breather in the subsequent weeks, and now as we leg into Energy earnings, it looks like they may resume their uptrend as we anticipated:

Utilities, Staples and Big Pharma had a hiccup in the past week or so. We took the opportunity to “top up” some Staples and Pharma on the breather (after a huge move since late February/early March – when we initiated).

There have been many public calls in the last few days and weeks for a 10-20% correction. On Wednesday, Ryan Detrick posted the “worst six months” statistics – which point to seasonal weakness in the next six months.

Get ready to hear this a lot, the worst six months of the year are right around the corner. pic.twitter.com/AwJtrn6m3P

— Ryan Detrick, CMT (@RyanDetrick) April 28, 2021

This is part of the reason we got ahead of the curve with Staples, Utilities and Big Pharma weeks ago (they are defensive groups where institutional money goes to hide during volatility). However, I do not anticipate a “major correction” that seems to be recent consensus. There are 2 reasons for my more moderate view:

- Earnings estimates are still too low (and coming up weekly).

- Money supply growth and stimulus is nearing 50% of GDP.

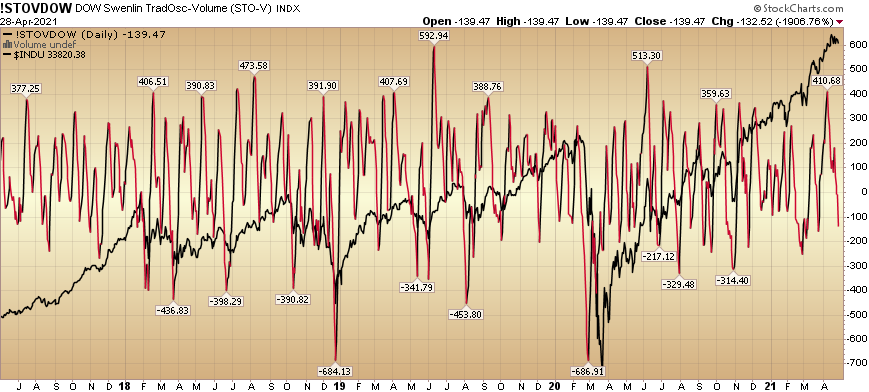

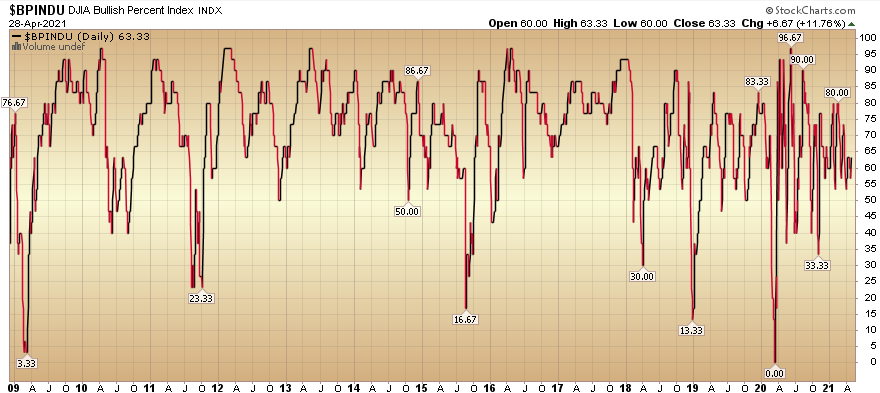

When you look at the DOW in particular, a few indicators I look at are not pointing to an extreme overbought situation (at present). I can certainly point out stocks that are overdone, but there may be some gas in the tank before a moderation:

Now onto the shorter term view for the General Market:

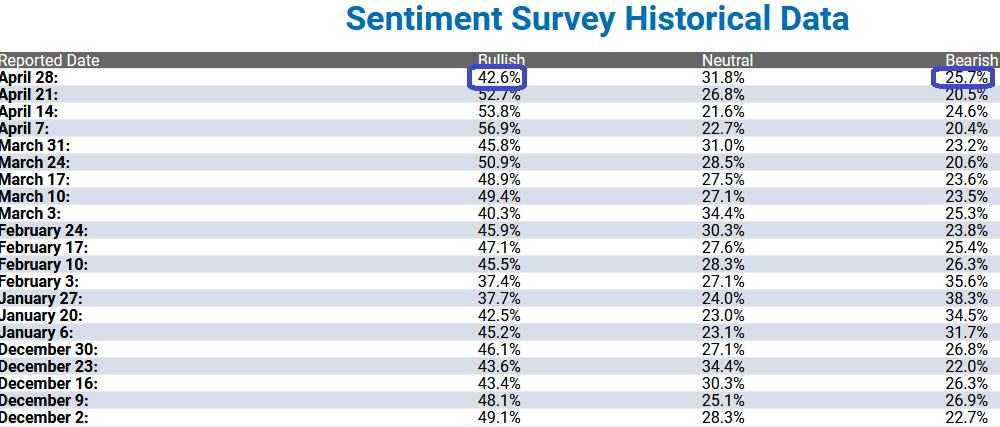

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) dropped to 42.6% from 52.7% last week. Bearish Percent rose to 25.7% from 20.5% last week. Retail investors are becoming more cautious.

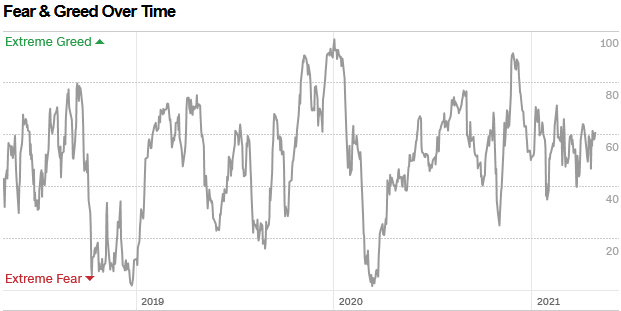

The CNN “Fear and Greed” Index ticked up from 58 last week to 61 this week. This is a neutral read. You can learn how this indicator is calculated and how it works here: (Video Explanation)

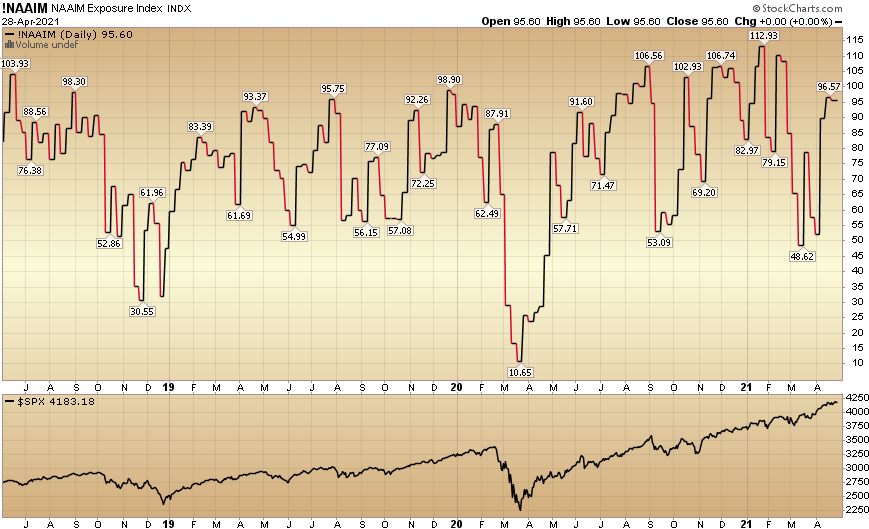

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked down to 95.60% this week from 96.57% equity exposure last week.

Our message for this week:

We built up selective positions in Utilities, Consumer Staples, and Big Pharma since we first mentioned it at the end of February. We think the rebound in this group should resume in coming weeks (even after the big move in the past 8 weeks).

We continue to hold our banks, energy and defense/aerospace stocks from much lower levels last year. We think the recent breather in the Energy sector may be concluding, and the uptrend should resume.

With the market up ~85% off the March 2020 lows, we are very selective where we put new new money to work. We added to selective Staples and Pharma that took a breather this week.

We also initiated very selective opportunities in Chinese Stocks, Green New Deal/Clean Energy Plays, and Busted SPACs as we said we would in last week’s note and podcast/videocast. Since we have lower confidence levels in these groups than we did in our Energy/Banks/Defense call last year or our Utilities/Pharma/Staples call in late February, we bought a basket.

On the Chinese exposure side we added names like BABA, LVS, MLCO, IQ, HUYA, DOYU. On the “busted SPAC warrant (and some clean energy)” side we added a large group that included UWMC, HPK, ERES, PAE, OUST, SNPR, FOA, NSH, ACIC, FTCV among others. We expect most of these warrants to fail, but in aggregate, both groups should be much higher a year from now than they are today (including failures). As we covered on the videocast, you can find information on SPACs and SPAC warrants here.

We will use any weakness moving forward to round out our new Chinese Exposure/Stock and “busted SPAC” warrant basket. We are not wholesale buyers of the general market, but still see pockets of great opportunity for intermediate term gains.

While the market seems to have “no particular place to go,” we have a clear path forward by shifting lanes as the opportunities present themselves.