Image Source: RobinReport

There have been a few themes we’ve been pressing on in recent weeks’ article|podcast|videocast:

- Bond Shorts were crowded and it would reverse.

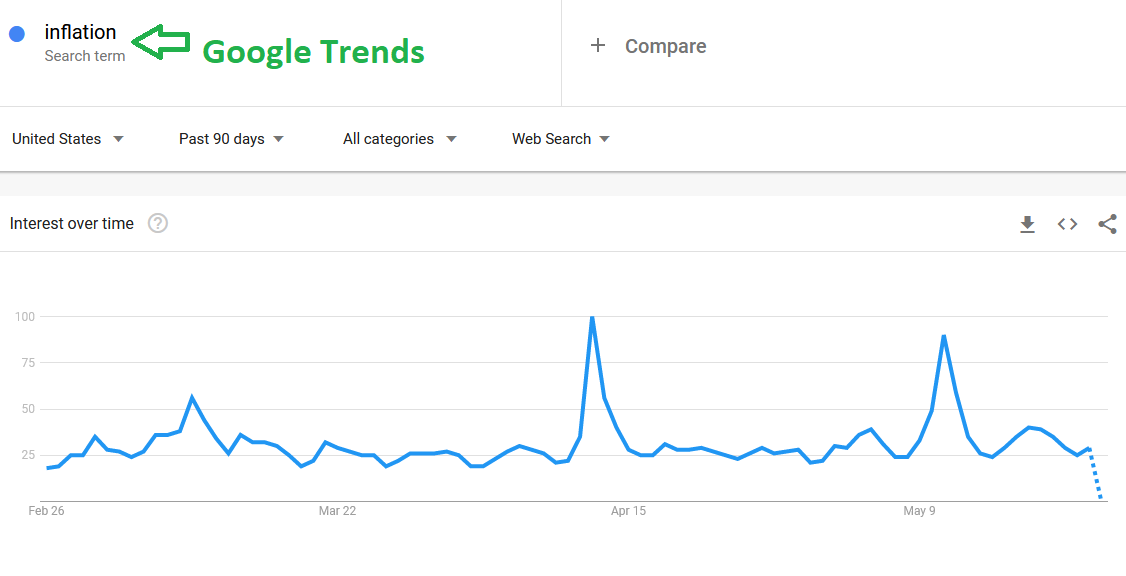

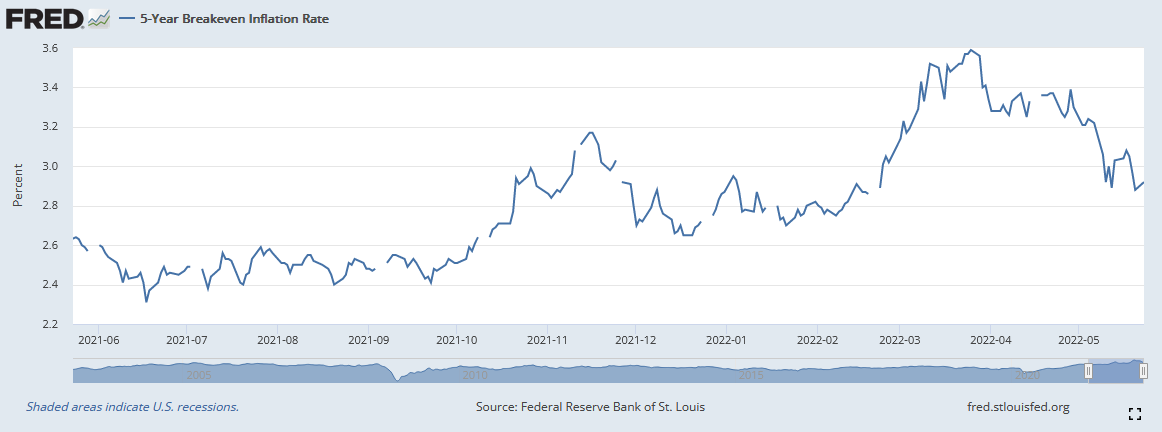

- Inflation expectations would get better.

- Food/Commodity prices would start to come down.

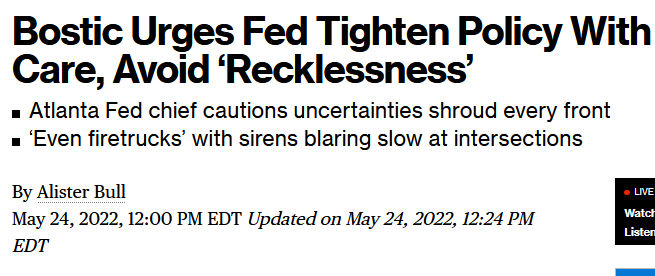

- The Fed would begin laying groundwork for a “dovish pivot.”

- USD would start to weaken. This will help earnings in 2H.

All 5 are happening:

1.

Source: Finviz

2.

5 year inflation breakevens coming down dramatically.

3.

4.

4.

5.

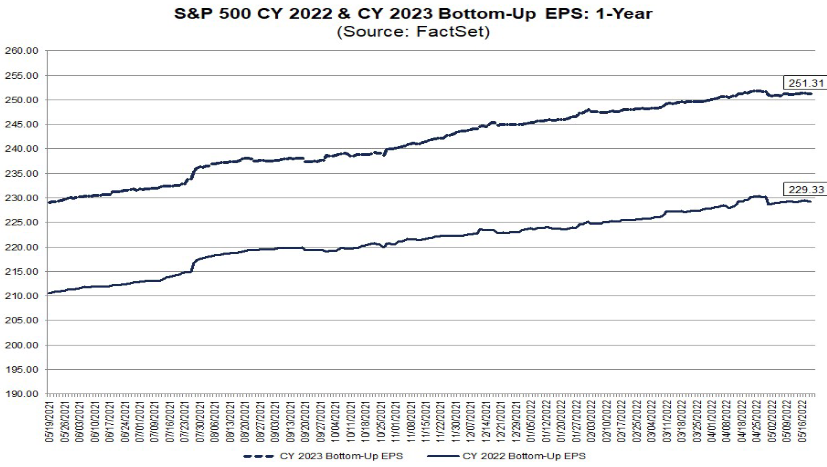

In the Fed Minutes today we saw that the key emphasis of the Fed is to “Anchor Longer-Term” expectations about inflation. By the chart I posted above (5yr breakeven), we can see that they are getting closer than anyone is focused on:

“Monetary policy is 98% talk.” – Ben Bernanke, former Fed Chair (this week)

The Lonely Bull

The above-mentioned developments are why I could be relatively bullish when I joined Alicia Nieves on Cheddar News Monday to discuss the Markets. Thanks to Ally Thompson, Alicia and Rebecca Mezistrano for having me on:

View in HD directly on Cheddar

Show notes from Monday:

Time to buy high quality companies and sectors trading at deep discounts due to rates and tightening fears.

SENTIMENT: BofA Global Fund Manager Survey

-Managers have the highest cash balances since 9/11 in 2001

–Most Underweight stocks since May 2020

-Too Crowded: Biggest tech “short” since August 2006 (Rallied 42% next 1.5yrs)

–Most Crowded Trades: Long Oil/Commodities (28%), Short 10y Tsy (25%)

EARNINGS/MULTIPLES

-The 5yr average multiple on the S&P 500 (WHICH INCLUDES THE LAST TIGHTENING CYCLE) is 18.6x. We are currently trading at 17x 2022 EPS and 15.5x 2023 consensus EPS. Could multiples go lower? YES, but rates would have to go much higher to justify that magnitude of multiple contraction. Rates (10yr yield) were 6.82% in 2000 BIG DIFFERENCE.

-While we did spike up to ~3.20% on the 10yr for a few minutes last week, it is consistent with the peaks in October 2018 of 3.25% and Jan 2014 at 3.03% – before receding aggressively.

FEAR OF TIGHTENING IS WORSE THAT TIGHTENING ITSELF (2 examples):

-2015-early 2016: 2 sectors were DECIMATED in ANTICIPATION/FEAR OF THE TIGHTENING CYCLE that started in 2016: China Tech and Biotech.

-Alibaba (BABA) sold off 53%, and Biotech (XBI) sold off 52% in the 12 months ahead of the hikes (2015).

-After the first rate hike in December 2015, both Biotech and BABA found their bottoms in early 2016. The Fed raised 8 more times over the next 2 years. Biotech was up 140% and Alibaba was up 258% in this 2 year period of tightening (8 hikes).

Moral of the Story: The fear of tightening can be WORSE than the actual tightening itself. We’ve been early on these two but adding into weakness regularly as we see a longer-term major inflection starting. They are simply too cheap at these levels.

RELIEF MAY BE IN SIGHT

-Much of the selling in recent weeks was “forced selling” unnatural margin calls and fund redemptions from people who had too much leverage.

-Melvin Capital’s letter to investors that he was closing down last Wednesday may have marked the bottom. Between his $7.8B fund and Tiger Global losing $17B on its tech holdings, much of the pain may now be in the rearview mirror.

-If you were wondering why Amazon, Expedia and Uber were selling off like they were going out of business – now you know.

NO SELLERS LEFT?

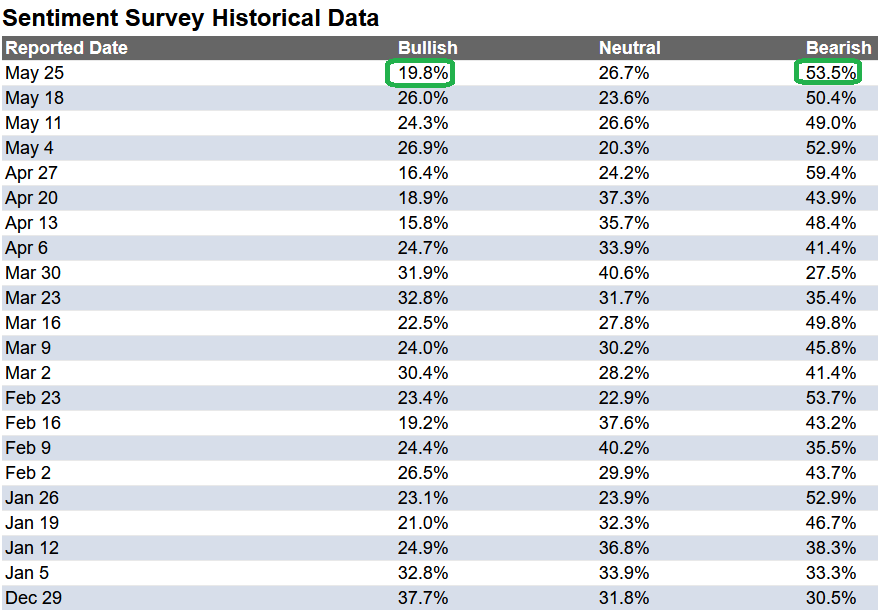

AAII Sentiment Survey – 50.4% bearish (pandemic lows was ~52.6%)

CNN Fear and Greed is at 11 (Extreme Fear)

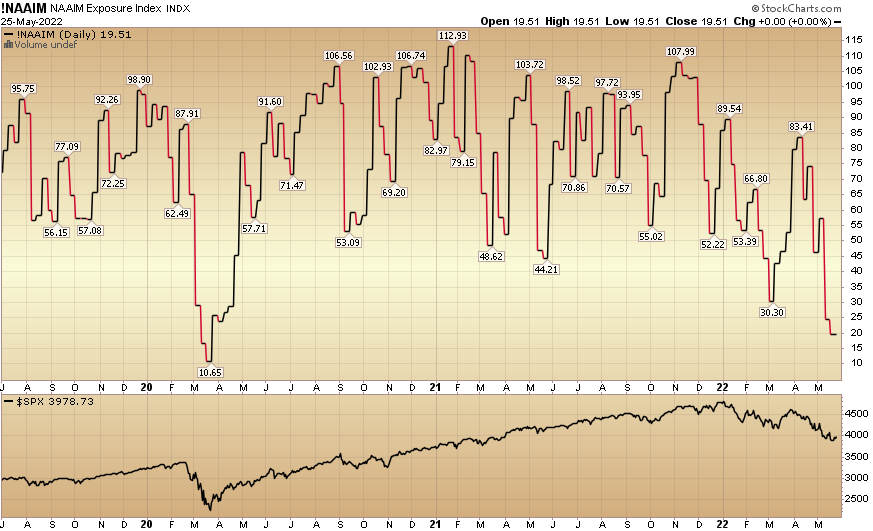

NAAIM: Equity exposure lowest since Pandemic lows – 20%

Follow Warren Buffett:

Warren Buffett put ~1/3 of his cash hoard (approximately ~$50B) to work since the beginning of the year. While others were puking, Warren was shopping.

The Twitter Saga (420)

Filing After Bell: Musk committed an additional $6.25B in equity financing. Increased to $33.5 billion.

There is no way this deal gets done at $54.20/$44B.

Musk has the company boxed:

-Musk stated that estimated that at least 20% of Twitter’s 229M accounts are spam bots (low end of his estimate).

-He will lowball the company with the leverage of fraudulent reporting in discovery.

-$TWTR won’t be able to prove <5% of followers are bots – which they have publicly asserted in their filings.

-Independent 3rd party will prove fraud in filings.

-CEO Parag Agrawal trying to get out ahead of it:

“Unfortunately, we don’t believe that this specific estimation can be performed externally, given the critical need to use both public and private information (which we can’t share).”

*COURT WILL FORCE external audit if it comes to it.

-The board/company will want to avoid lawsuit “discovery” at all costs and cut a cheaper deal.

Musk’s 20%+ fake estimate plays out like this:

$42.0/share is 22.5% less than $54.20 ($44B) = $32B.

NOTE he secured $33.5B in his filing today.

When shareholders complain he will say, “if I’m getting such a good deal, throw in your shares with me for the ride.”

Could see up to 30-40% of existing shareholders roll in their shares at $42 giving Musk control of the asset for ~$20B – which is lunch money for him.

Then as CEO he’ll grant himself a ton of new equity and incentive options like he did with Tesla.

The collapse of Snapchat this week following their cut in guidance gives Musk perfect timing for more leverage with the company and shareholders.

Likely Changes Coming:

“10% on hard right will hate it. 10% on hard left will hate it.”

- Free Speech.

- Open Algorithm. No favoritism/filtering.

- Edit Button.

- More Than 140 Characters.

- User Authentication: “Say what you want, but accountable for actions.” You can yell “Fire” in a crowded theater but you will pay consequences for your actions.

- Re-engagement of inactive celebrities.

- Trump may use it (go back on) to promote Truth Social.

Earnings Are The Name of the Game…

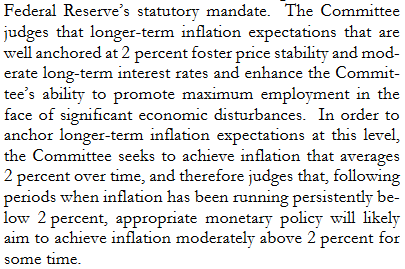

For all of the pessimism out there that we discussed on the Cheddar Segment with Alicia, the key factor we look to – EARNINGS – estimates were actually revised UP for the last 2 consecutive weeks. Unless/Until this materially changes, we remain constructive at these levels:

Now onto the shorter term view for the General Market:

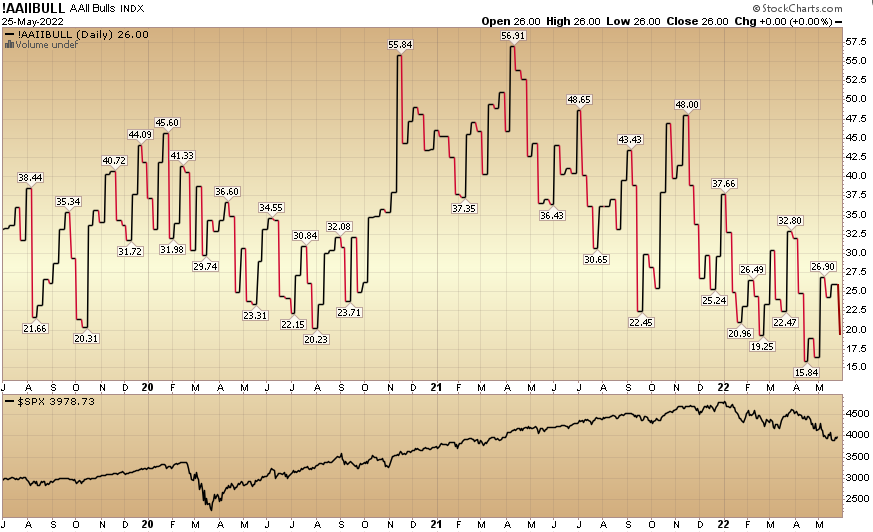

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) dropped to 19.8% this week from 26% last week. Bearish Percent rose to 53.5% from 50.4%. Retail fear is at extremes again.

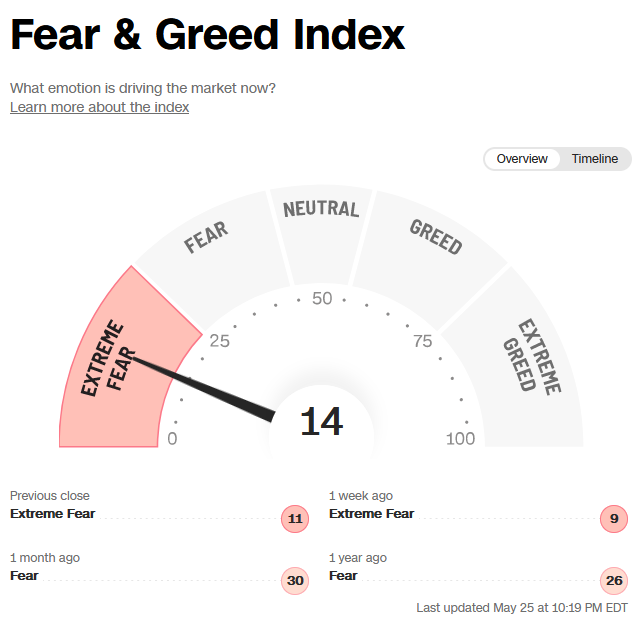

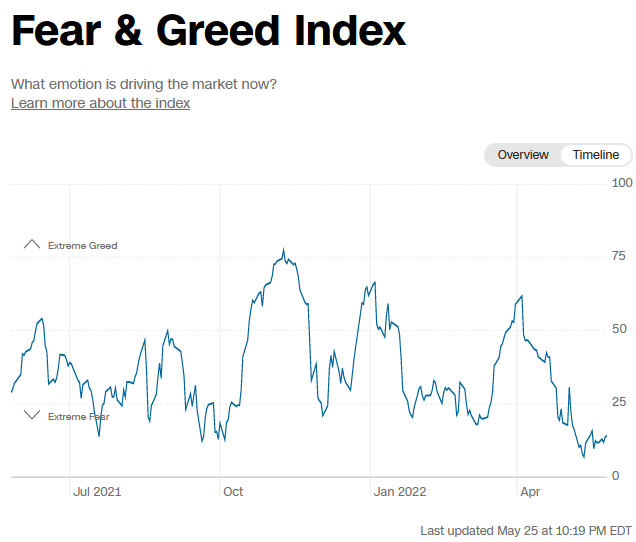

The CNN “Fear and Greed” ticked up from 9 last week to 14 this week. Sentiment is still at maximum fear in the market. You can learn how this indicator is calculated and how it works here: (Video Explanation)

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) fell to 19.51% this week from 24.31% equity exposure last week.

Our podcast|videocast will be out on Thursday or (likely) Friday this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.