The song we chose to embody this week’s stock market sentiment is Diana Ross’, “Upside Down”:

Upside down

Boy, you turn me inside out

And ’round and ’round

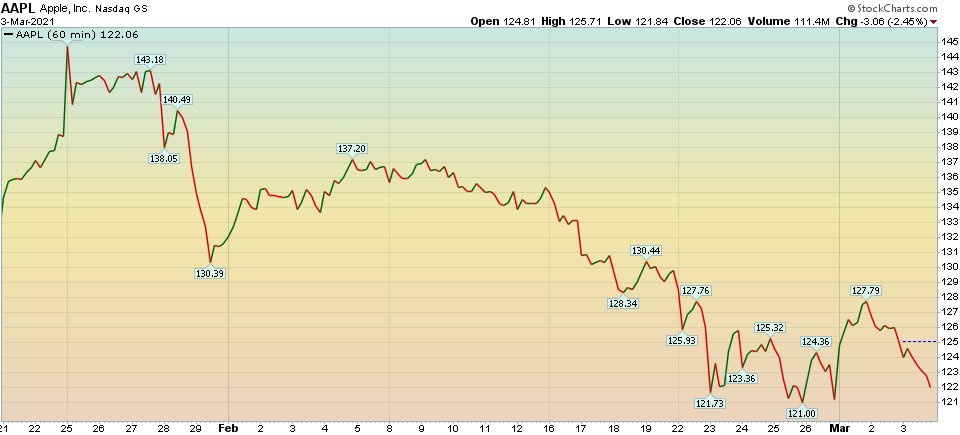

In our recent weeks’ podcasts/videocasts we have continually emphasized that we were watching AAPL as the key to the market. Our view was that the unwinding of several Hedge Funds from the GameStop debacle would take weeks (not days) – and would lead to the use of AAPL and FAANGM as a “source of funds” to meet redemptions (and in some cases – complete fund wind downs). A classic case of selling winners to pay for losers…

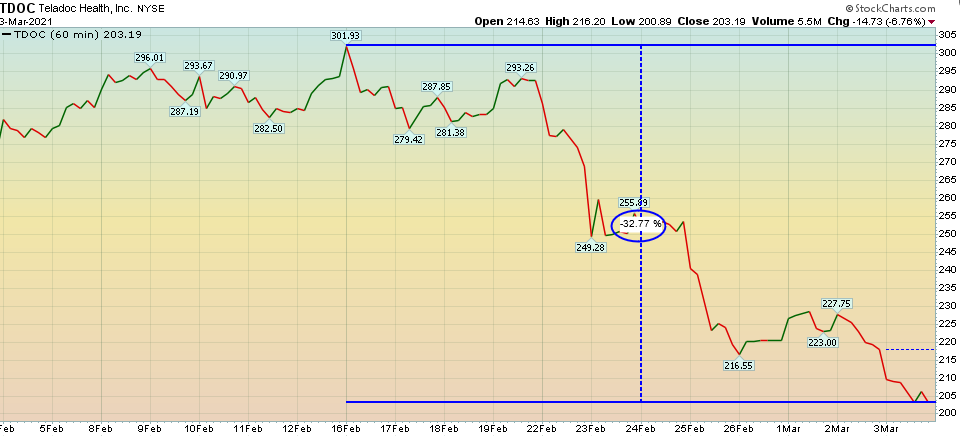

Here’s what that has looked like:

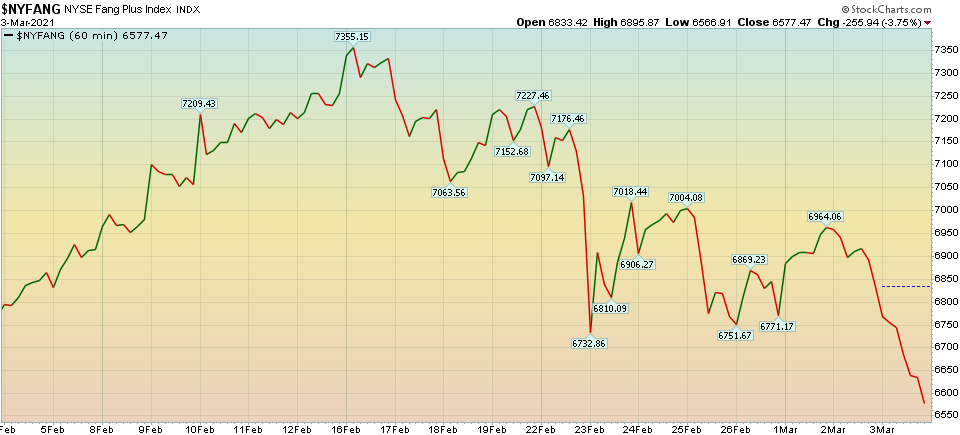

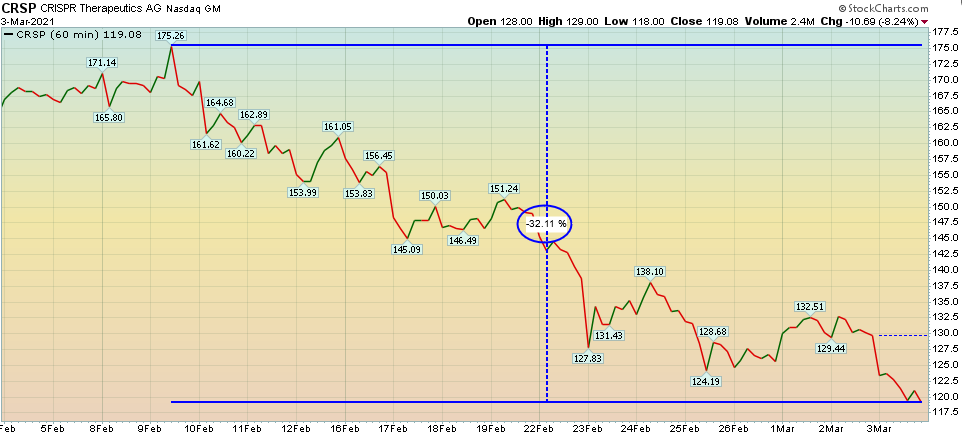

You’ve also seen a slaughter of (high-multiple, low profit) growth stocks:

Yesterday’s Stats:

Just 5 companies (AAPL, MSFT, AMZN, TSLA, GOOGL) accounted for almost half of the S&P 500’s 1.3% drop today pic.twitter.com/NwFWJXs7ZA

— Sarah Ponczek (@SarahPonczek) March 3, 2021

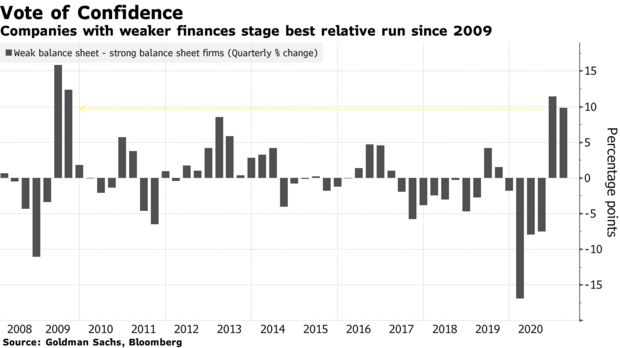

At the same time, here’s what is working:

Source: John Authers – Bloomberg

As is the case in all new business cycles, the leveraged balance sheet plays outperform – due to their economic sensitivity. When GDP grows fast – off of a low base – these are the groups that outperform:

Source: Sarah Ponczek – Bloomberg

Value has continued to outperform growth since late Summer of 2020.

While we’ve covered what has and has not worked, the key question now is, “what could work NEXT?“

On Fox Business last week we talked about the “rate of change” – for the rate rise – potentially moderating in ensuing weeks. It appears there is an attempt to make a stand here:

If these levels can hold or reverse for a bit, we could see a significant reversal in defensive (higher yielding) stocks like Consumer Staples, Big Pharma, and Utilities – as their yields would become attractive once again.

Either natural market forces will cause a pause in the rate rise, or we’ll begin to see Fed speakers start to “trial balloon” a repeat of 2011 “Operation Twist” (Fed selling of short dated bonds to buy more long-end). This temporarily flattens the yield curve and brings down/stabilizes long-end yields without increasing money supply.

The Fed Launched Operation Twist on September 21, 2011. Here’s what happened to the 2:10 year Treasuries yield ratio next:

The purple vertical line is beginning of operation twist. While that was the PEAK of yield curve steepening last cycle, it was just the beginning of the rally in Financials.

Consumer Staples, Big Pharma, and Utilities took off from their September 2011 lows as well:

This Monday I was on Fox Business – The Claman Countdown. The segment covered Warren Buffett’s massive investment commitment to utilities as well as a discussion about Bitcoin – particularly as it relates to public companies buying $BTC with their cash (and why that is a mistake).

Thanks to Ellie Terrett and Liz Claman for having me on:

Now onto the shorter term view for the General Market:

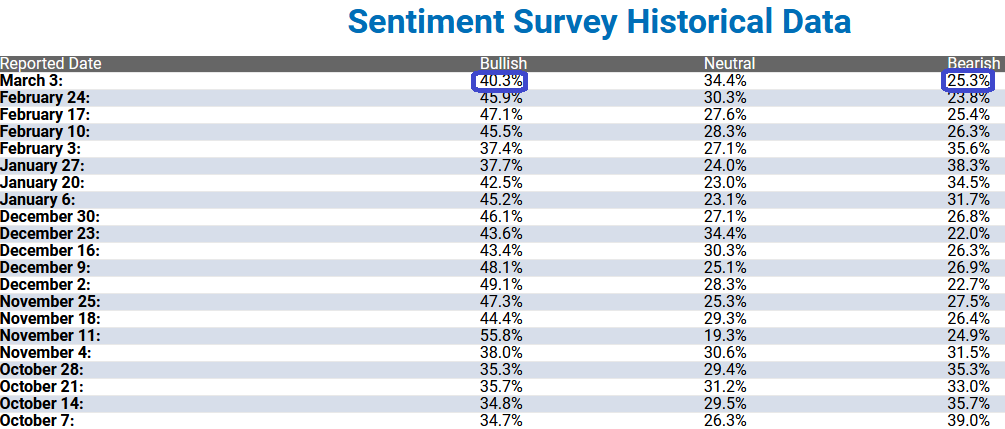

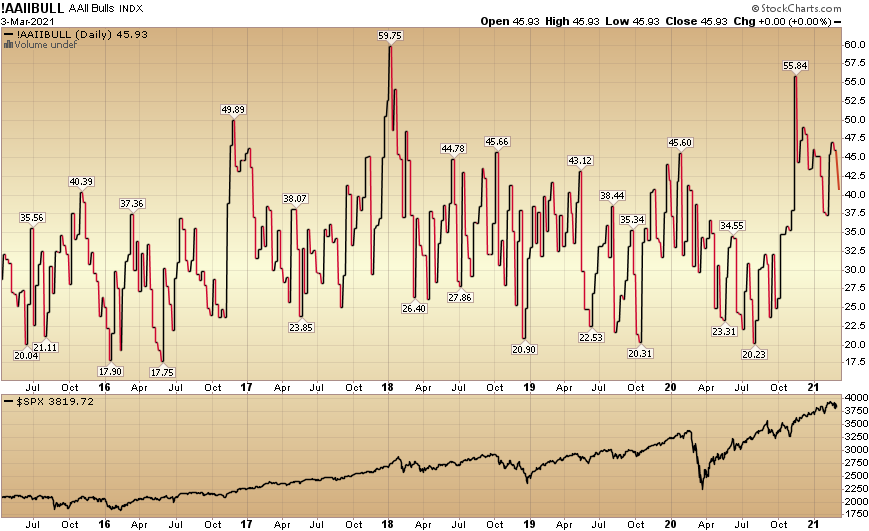

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) dropped to 40.3% from 45.9% last week. Bearish Percent rose to 25.3% from 23.8% last week. Retail exuberance is beginning to be tested.

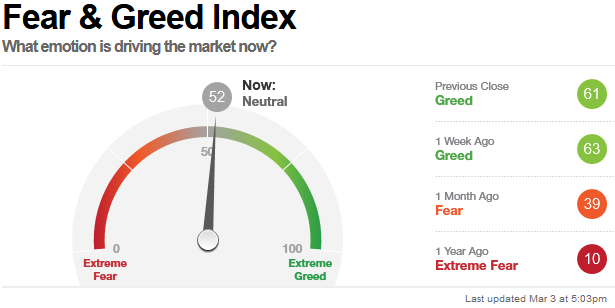

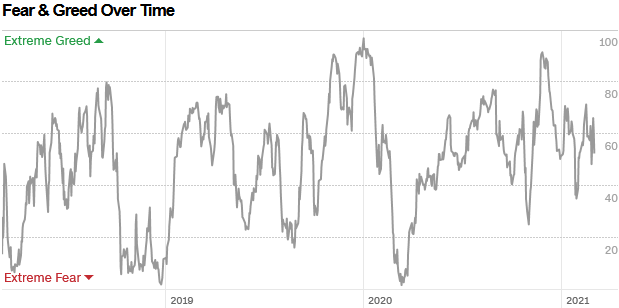

The CNN “Fear and Greed” Index moderated from 63 last week to 52 this week. This is a neutral reading. You can learn how this indicator is calculated and how it works here: (Video Explanation)

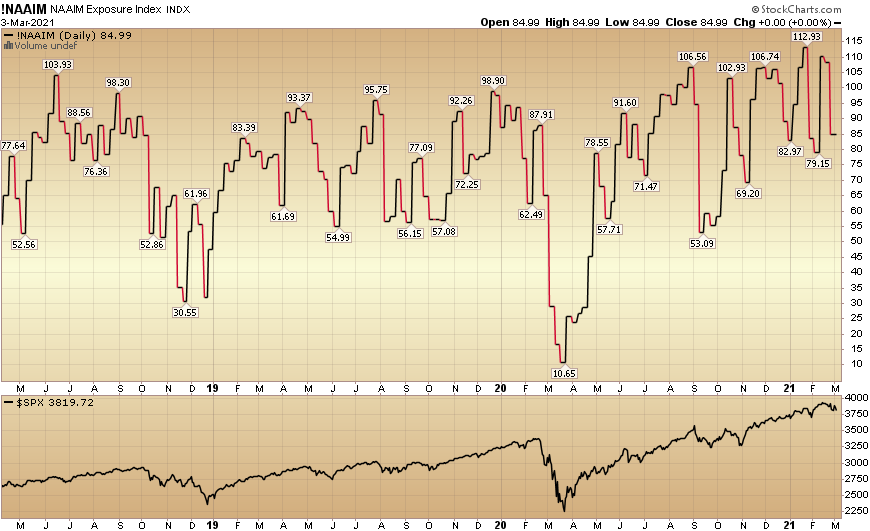

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) fell to 84.99% this week from 108.32% equity exposure last week.

Our message for this week:

We will continue to add to Defense & Aerospace on any weakness (on the 2H Commercial Aviation recovery thesis), and hold Banks and Energy – as we have a much lower basis in these groups.

New (last week): We are building up selective positions in Consumer Staples, Utilities and Big Pharma. We have added aggressively all week.

Remember: Pay less attention to the general indices – as there are many crosswinds at present – and more attention to take advantage of the “rallies under the surface” through sector rotation.

So while Diana Ross may have felt things were “upside down/round and round” we can see things are acting rationally for this part of the cycle. What was last in 2020 is now first in 2021…