The Hawks were out this week, trying to walk-back the “data dependent” pivot from Chairman Powell last week. With a technical recession now booked in the rear view mirror (2 quarters of negative GDP growth in 1H), DON’T BUY IT!

Last week’s move by the Fed could potentially be the last move in this tightening cycle. To say this is a minority view is an understatement. If this plays out, it would leave the Fed Funds rate at 2.25-2.50%. This is the same level the Fed stopped and reversed in July of 2019.

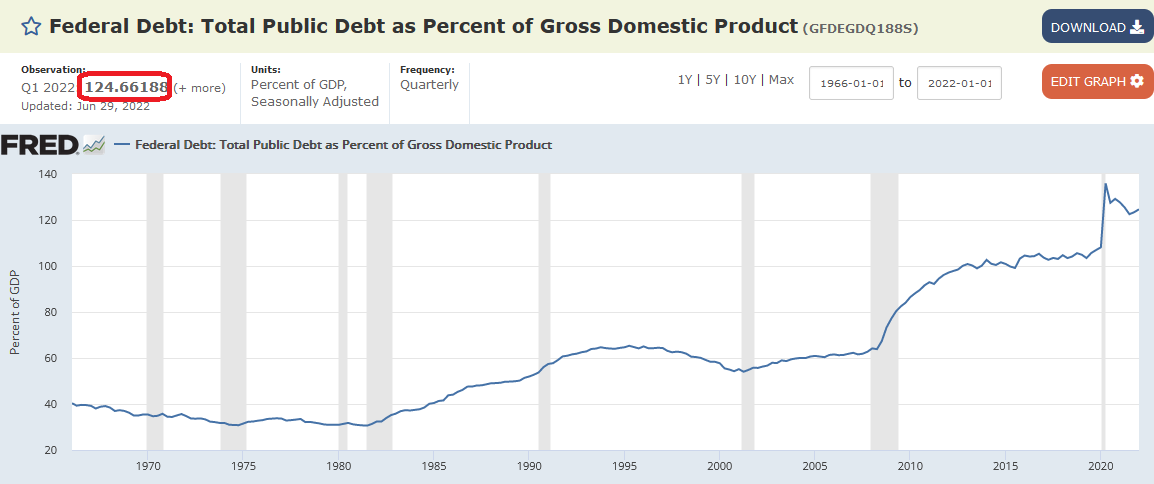

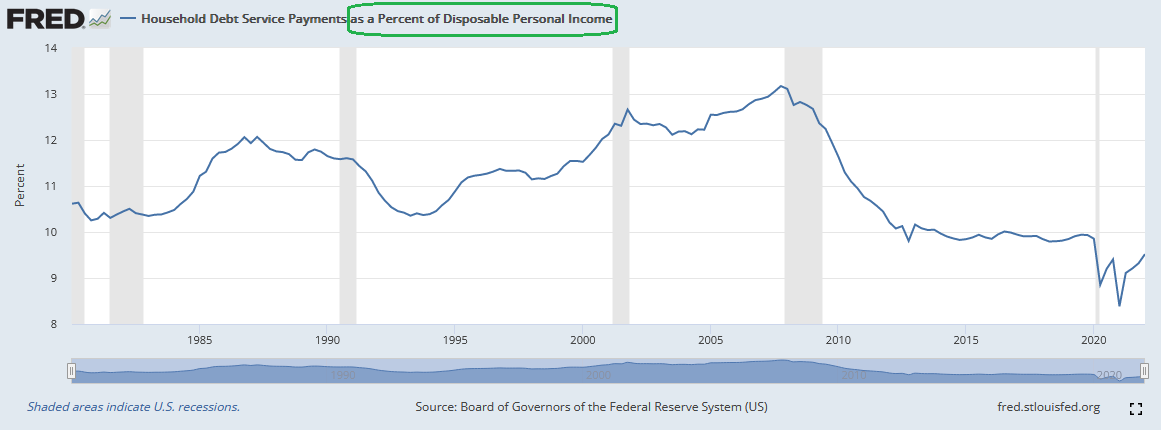

The Fed has no desire to exacerbate the domestic debt servicing burden. Higher US rates is a magnet for capital from around the world flooding into the U.S. dollar (already happened). This makes us less competitive on a global basis.

-The Fed does want to “reduce demand” but they don’t want to DESTROY the economy. They promised $47.5B in Quantitative Tightening in June. They only did $7.5B (and were net buyers of Treasuries). GOAL: Jawbone TOUGH on inflation, but raise rates as little as possible to bide time until the commodity price rollover shows up at the cash register for consumers.

Here’s a sampling of Jawboning from the last two days:

FED’S KASHKARI: WE STILL NEED TO GET INFLATION DOWN TO 2% IN A SUPPLY-CONSTRAINED WORLD.

FED’S DALY: A 50 BPS HIKE WOULD BE REASONABLE IN SEPTEMBER.

FED’S DALY: HOWEVER, IF WE SEE INFLATION GALLOPING AHEAD UNABATED, 75 BPS HIKE MAY BE MORE SUITABLE.

FED’S DALY: A SLIGHT INCREASE IN THE UNEMPLOYMENT RATE IS A TOLERABLE PIECE FOR ME TO BRING INFLATION DOWN.

FED’S BULLARD: TO GET INFLATION COMING DOWN IN A CONVINCING WAY, WE’LL HAVE TO BE HIGHER FOR LONGER.

FED’S BULLARD: BETTER BET IS IT WILL TAKE A WHILE FOR INFLATION TO COME DOWN TO 2%.

FED’S BULLARD: IF WE CAN TAKE ROBUST ACTION AND GET BACK TO 2%, WE’LL AVOID A STOP GO STORY.

FED’S BULLARD: I STILL WANT TO GET TO 3.75 TO 4% THIS YEAR, I PREFER THIS TYPE OF FRONTLOADING.

FED’S BULLARD: US JOBS MARKET IS SO STRONG.

FED’S BULLARD: I STILL THINK WE’LL GET POSITIVE GDP GROWTH IN THE SECOND HALF OF THIS YEAR – CNBC.

FED’S BULLARD: WITH THE JOB GROWTH IN THE FIRST HALF, IT’S HARD TO SAY THAT THERE’S A RECESSION.

FED’S BULLARD: IT APPEARS THAT BOTH THE FED AND THE ECB WILL BE ABLE TO CUT INFLATION IN AN ORDERLY MANNER, ACHIEVING A PRETTY SOFT LANDING.

FED’S MESTER: WE HAVE A NARROW WINDOW TO AVOID A LARGE INCREASE IN LAYOFFS.

FED’S MESTER: I BELIEVE UNEMPLOYMENT WILL RISE AS WE PROGRESS THROUGH THIS CYCLE, BUT WE NEED TO HAVE THAT HAPPEN TO MAKE SURE WE GET BACK TO PRICE STABILITY.

FED’S MESTER: I HAVEN’T SEEN ANY EVIDENCE THAT INFLATION HAS EVEN BEGUN TO LEVEL OFF.

FED’S MESTER: WE MUST WATCH OUT FOR ENTRENCHED HIGHER INFLATION EXPECTATIONS.

FED’S MESTER: SINCE THE INFLATION HAS NOT CHANGED, WE STILL HAVE WORK TO DO.

FED’S MESTER: INFLATION HAS NOT DECREASED AT ALL.

FED’S EVANS: WE HAVE TO BE MINDFUL THAT INFLATIONARY PRESSURES MAY BE BROADENING OUT.

FED’S EVANS: BY THE END OF THE NEXT YEAR, I PREDICT THAT THE POLICY RATE WILL BE BETWEEN 3.75% AND 4%.

FED’S EVANS: I AM STILL HOPEFUL THAT WE CAN DO A 50 BPS HIKE IN SEPTEMBER AND THEN CONTINUE WITH 25 BPS RATE HIKES UNTIL BEGINNING OF SECOND QUARTER OF 2023.

FED’S EVANS: A 50 BPS RATE HIKE IS A REASONABLE ASSESSMENT FOR THE SEPTEMBER MEETING IF INFLATION DOES NOT IMPROVE. A 75 BPS INCREASE IS ALSO OKAY; I DOUBT 100 BPS HIKE IS CALLED FOR.

FED’S DALY: MY MODAL OUTLOOK IS WE RAISE INTEREST RATES AND HOLD THEM THERE FOR A WHILE.

FED’S DALY: IT WOULD BE A MISTAKE TO GET OVERCONFIDENT THAT WE HAVE ALREADY FOUND THE SOLUTION.

FED’S DALY: THE JOB ON INFLATION IS FAR FROM FINISHED.

Here’s what is actually happening:

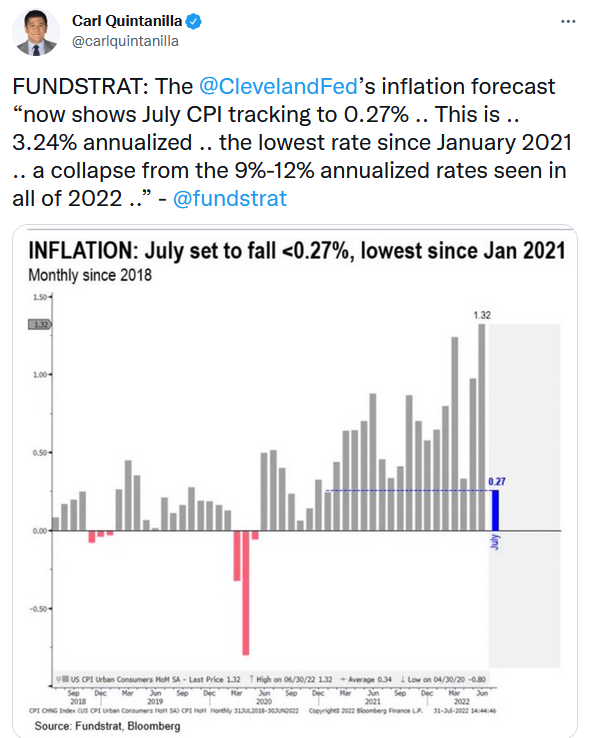

- Inflation is coming down:

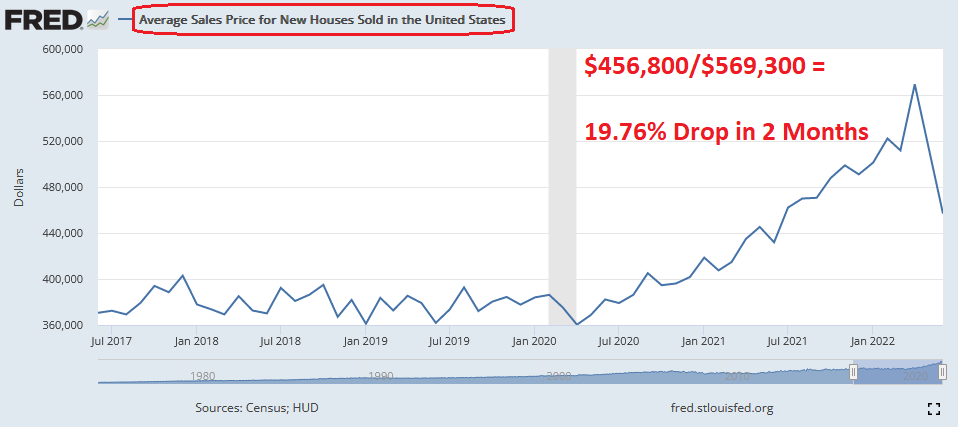

- Home Prices are coming down:

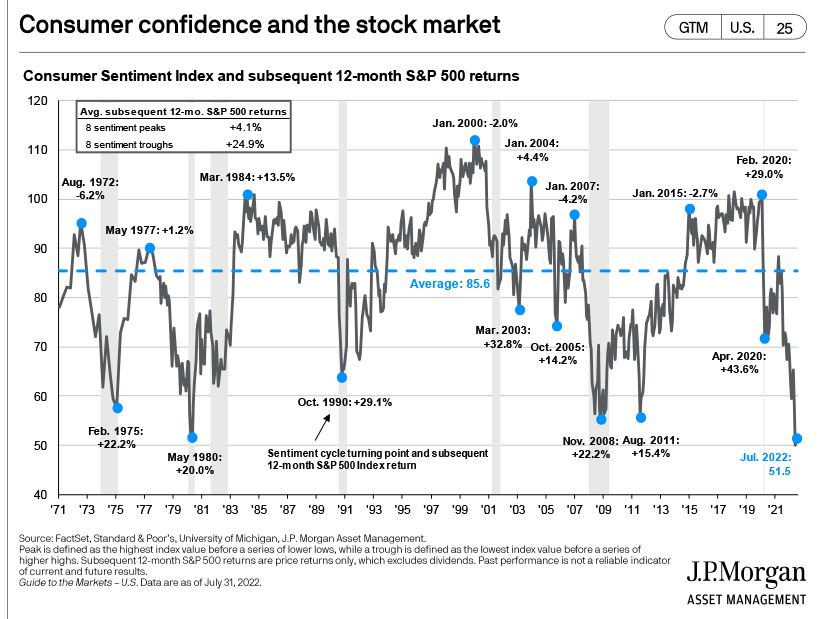

- Consumer confidence (lack thereof) has bottomed. Expected returns for equity markets moving forward are positive:

- Household balance sheet is strong (debt service as a percent of disposable income):

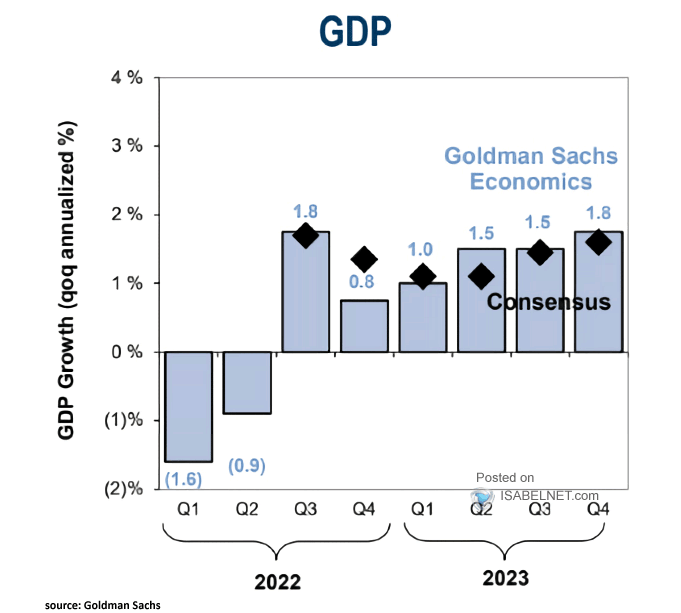

- 2H US GDP estimates imply recovery after Q2 China Lockdown (Goldman Sachs):

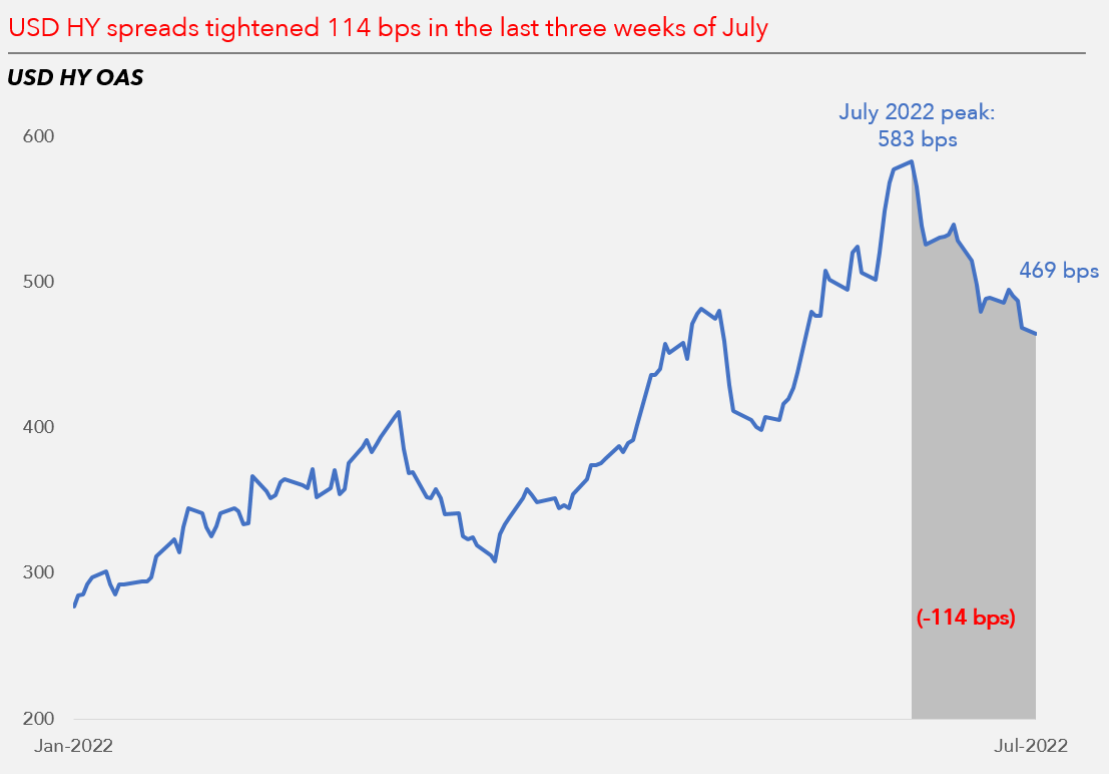

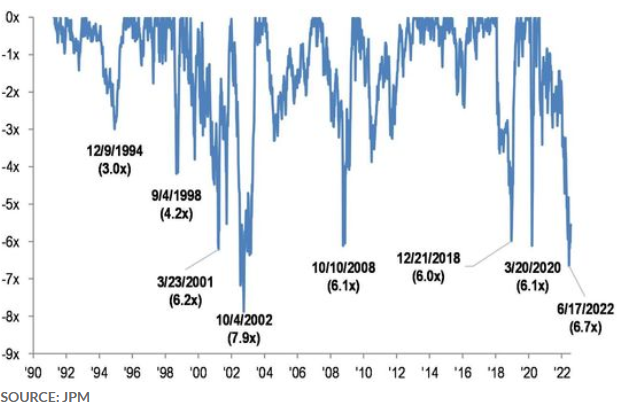

- Credit Markets (credit spreads) are now thawing (114bps last 3 weeks). This is THE MOST IMPORTANT CHART to watch moving forward. Expect deals and financing to return this Fall h/t MUFG:

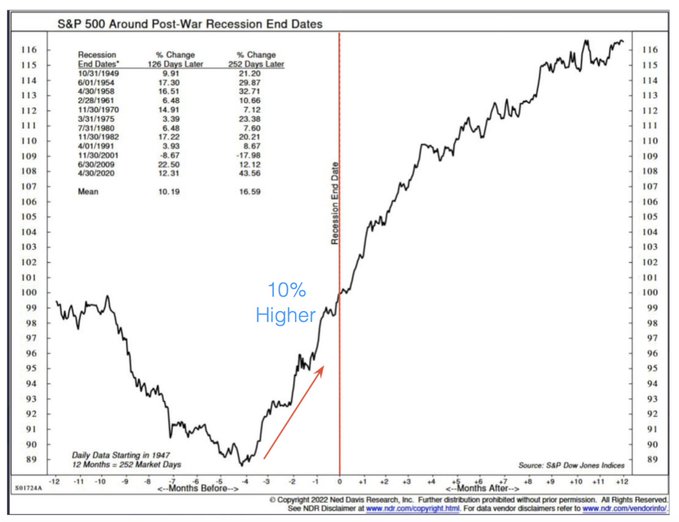

- Stock Market rebounds before recession is over (technical recession began Q1 2022) h/t Ned Davis:

- Multiples have contracted in accordance with previous recessions and are beginning to recover h/t JP Morgan:

Earnings Season Takeaway

The big takeaway is that earnings season was “better than feared.” Revenues were up over 14% yoy and earnings up 6%. Not bad considering China was locked down for the first half of the quarter. Managers came into earnings season hidden under bunkers (highest cash levels since 9/11 and the GFC) and when their fears were proven unfounded, a “panic chase” ensued with the Nasdaq up ~18% off its June lows and the S&P 500 up ~14% over the same period.

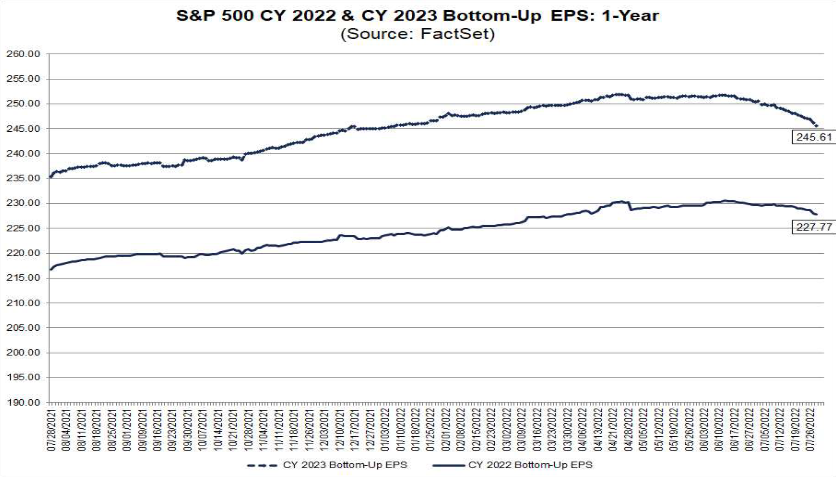

Pessimistic analysts and spectators were calling for a 20% markdown in earnings estimates. They were wrong and we got a modest 2% decline. While we booked a “technical recession” (two consecutive quarters of negative GDP) in the first half, the market is sniffing out the road to recovery as inflation comes down (see Cleveland Fed’s inflation forecast of .27% for July (3.24% annualized)), and the likelihood the Fed slows (or pauses) its pace of tightening in the face of this mild slowdown.

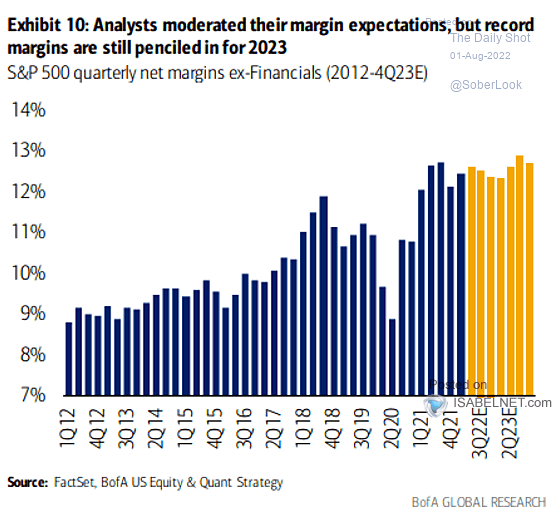

- Margins have held up:

The Long View

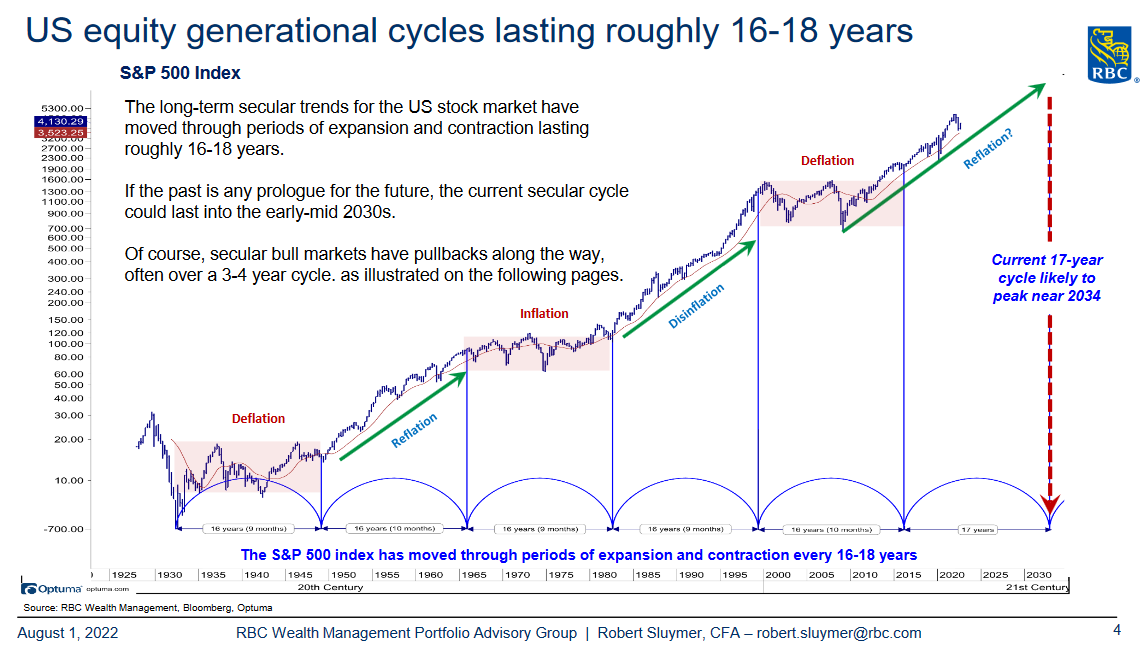

- We are halfway through the secular bull (driven by age demographics/Millennial housing and family formation) h/t RBC:

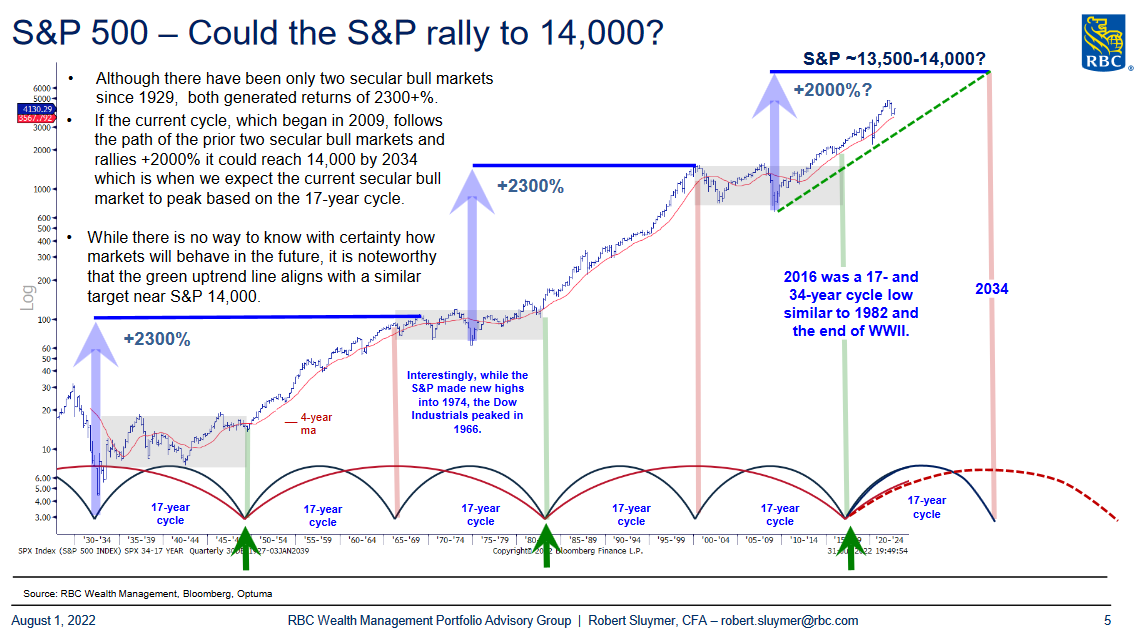

- More room to run:

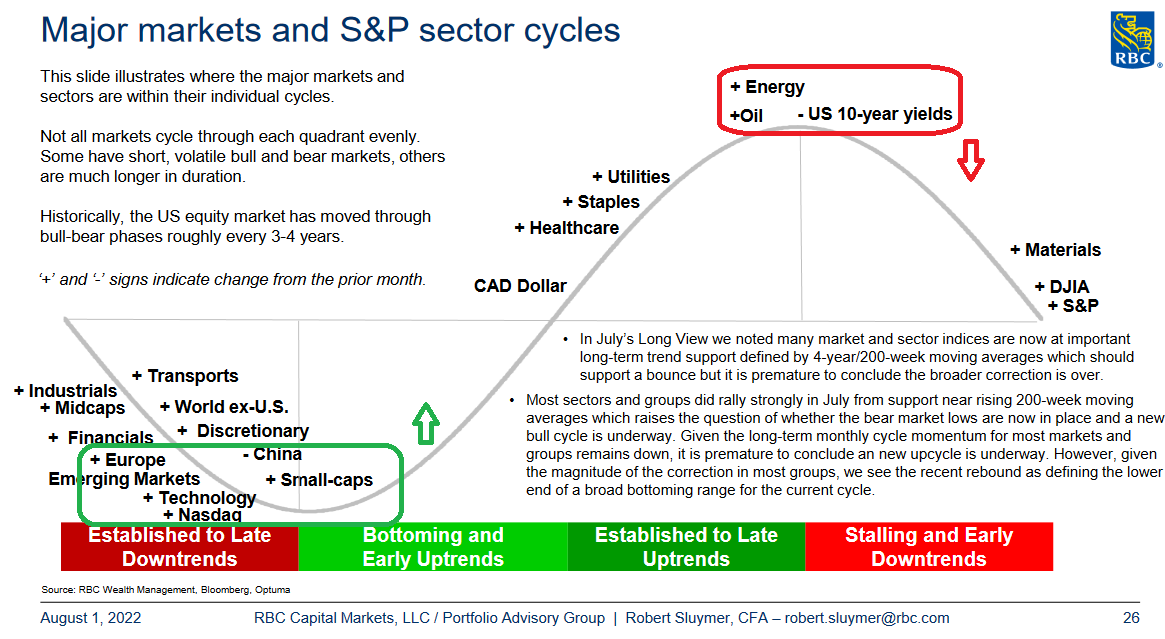

- China and Tech ready to run, Energy ready to rest:

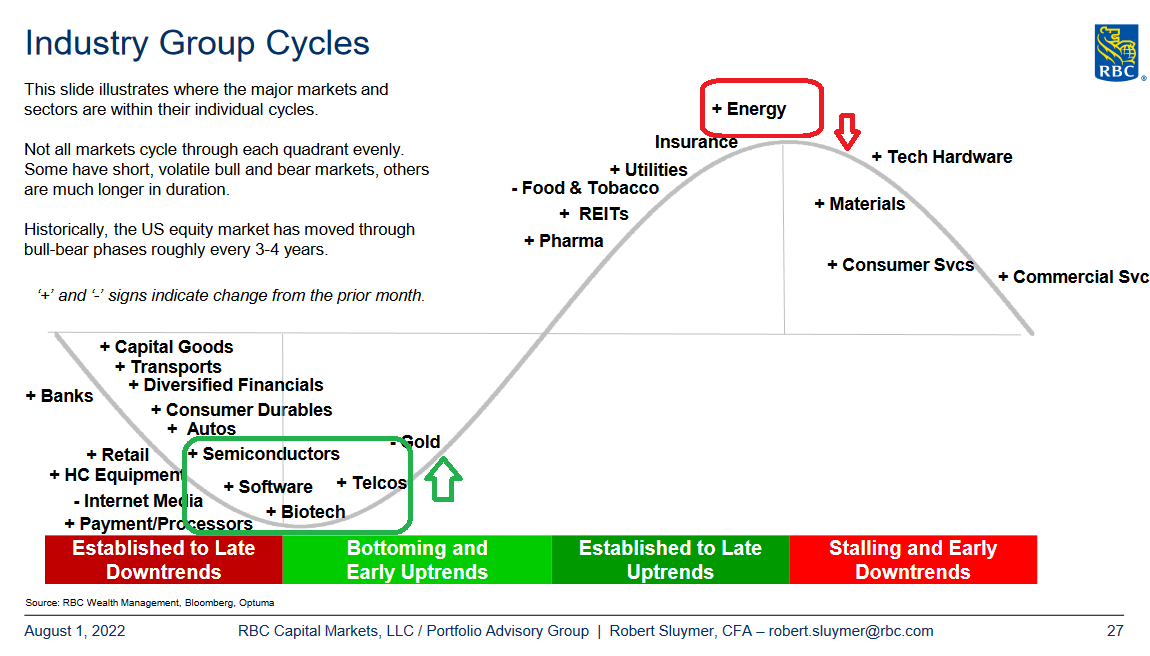

- Biotech and Software ready to run, Energy ready to rest:

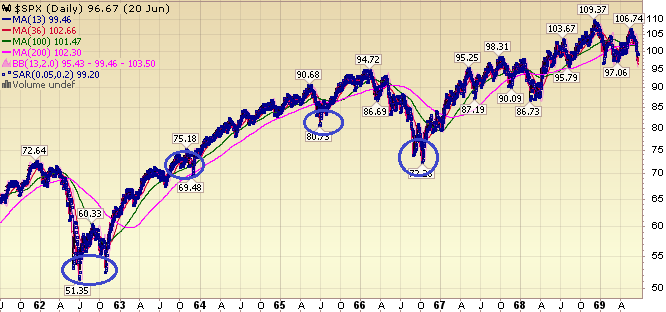

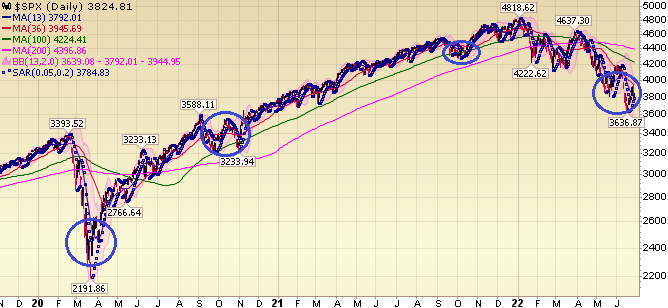

- In June we put out the following analog (comparing 1966 to 2022) on our podcast|videocast. The S&P 500 is up ~9% since that time:

Now onto the shorter term view for the General Market:

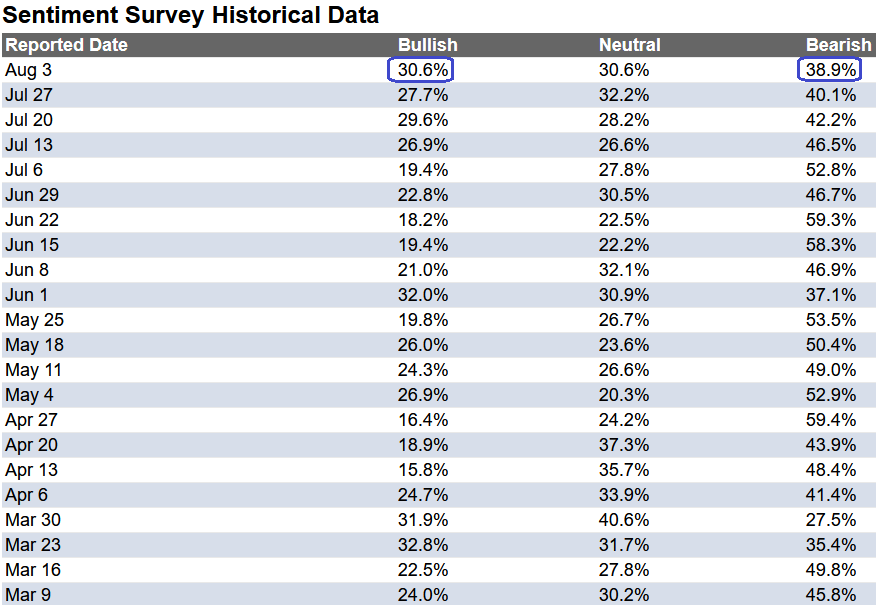

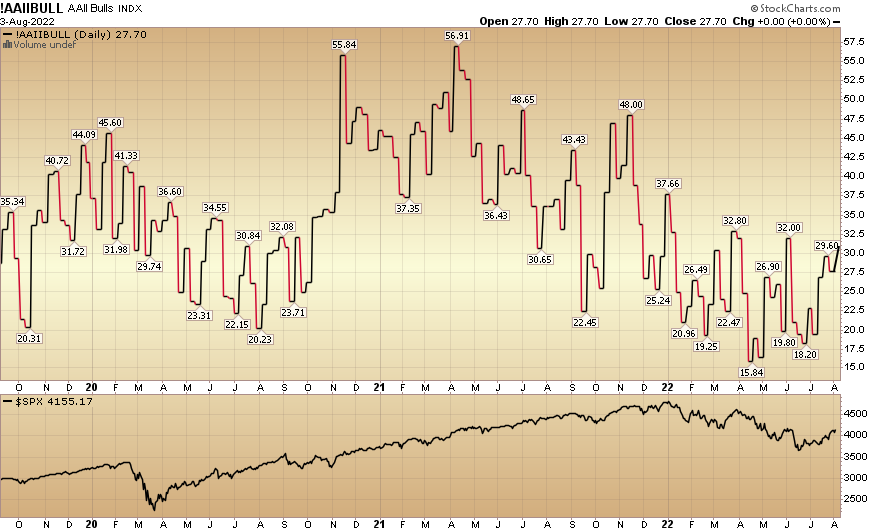

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked up to 30.6% this week from 27.7% last week. Bearish Percent dropped to 38.9% from 40.1%. Retail investors’ fear is thawing.

The CNN “Fear and Greed” ticked up from 38 last week to 46 this week. Fear is easing. You can learn how this indicator is calculated and how it works here: (Video Explanation)

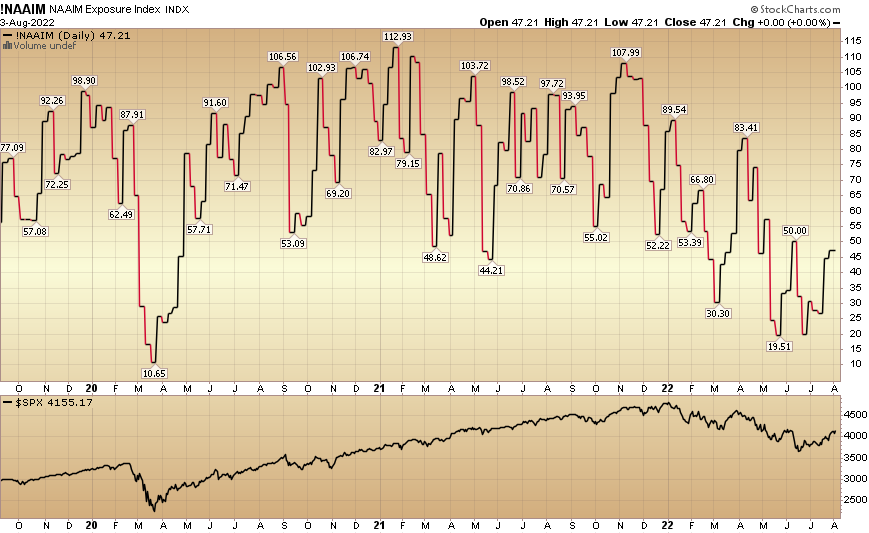

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose to 47.21% this week from 44.48% equity exposure last week. Active managers are still underweight equities. Any unexpected further positive news will continue to force them back into the market aggressively.

Our podcast|videocast will be out today or tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.