Country Star, Kenny Chesney wrote a hit song last year entitled, “Everything’s Gonna Be Alright.” With everyone now focused on the rear view mirror data – it hardly seems like an appropriate theme…

Let’s look at both sides of the data – starting with the bear case:

- 3 consecutive quarters of negative earnings growth (3 Quarters of Negative Earnings. Bad News?)

- GDP NOW estimates below 2%

- Global Manufacturing Slowing

- China Slowing

- Trade Wars/Tariff Concerns (China, Europe)

- Impeachment

- Brexit

Why would it make sense to have a sanguine outlook with all of these clouds? Here are the facts:

- S&P 500 2020 EPS estimates (growth) > 10.4%

- Q3 Earnings coming in better than expected (Earnings: Better Than Expected…)

- Fund Managers still underweight equities (BAML Global Fund Manager Survey: Slippery When Wet)

- Laggard Sectors Starting to get Bid (Biotech) (Biotech EPS UP 8.58%, Price DOWN 9.52% (in last 2 months))

- Laggard Sectors Starting to get Bid (Energy) (Energy Earnings Estimates/Revisions: Rainbows follow the Storm…)

- The Fed has gone from Tightening to Easing (50bps cut so far – 25bps more to come before year end)

- 10 year+ expansions are normal, not exceptional (No one is writing about this: Perspective… )

- If 75% of 2020 EPS estimates come to pass, we have fuel for late-cycle re-rating and multiple expansion (high teens/low 20’s P/E).

- The 7 points of rear view concern above are required bricks in the “wall of worry” to climb higher and force off-sides managers aggressively back into equities before year-end.

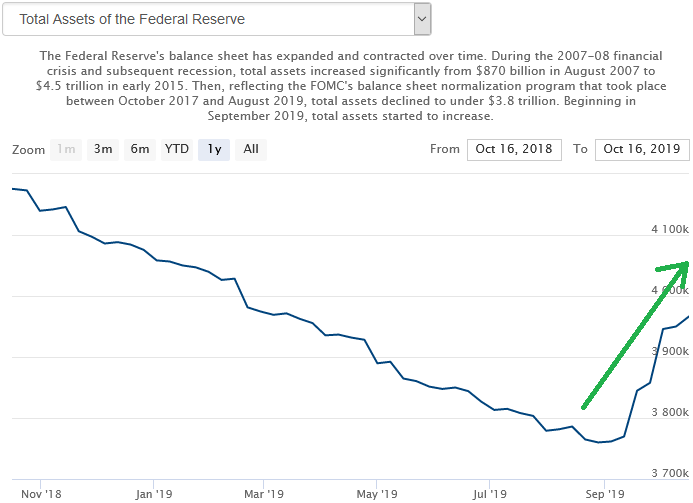

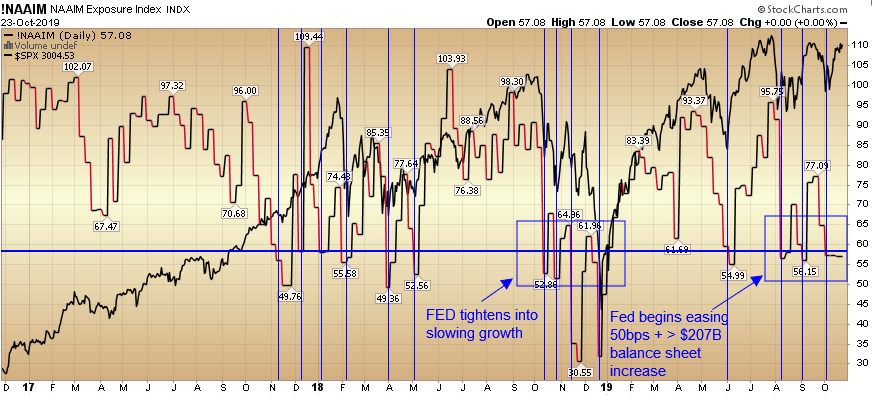

- Fed is adding liquidity back to the system ($207B in balance sheet expansion since August 28 – see chart below) (Your Rich Uncle is Back From Vacation…)

- ECB restarts QE next week.

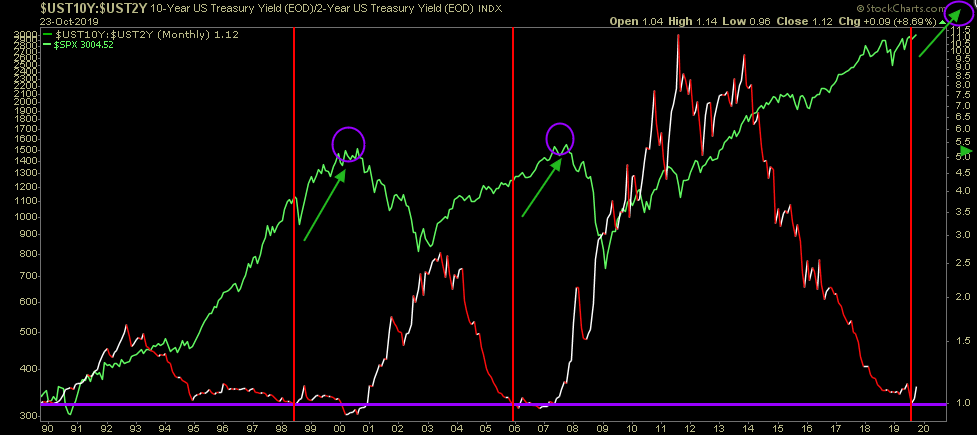

- Market peaks have averaged ~18 months AFTER 2/10 inversion and mid-30% gain before peak. We only inverted briefly in August (see 2nd chart below – red vertical line is inversion, purple circle is market peak)

So Kenny has it right in his recent hit:

Everything’s gonna be alright

Everything’s gonna be alright

And nobody’s gotta worry ’bout nothing

Don’t go hittin’ that panic button

It ain’t worth spilling your drink

Everything’s gonna be alright

Alright, alright

Everything’s gonna be alright

And nobody’s gotta worry ’bout nothing

Don’t go hittin’ that panic button

It ain’t worth spilling your drink

Everything’s gonna be alright

Alright, alright

Last week we wrote about The Taylor Swift, “Shake It Off” Market. This week we’re focused on Kenny Chesney’s, “Everything’s Gonna Be Alright” Stock Market. Let’s look at the sentiment and positioning data:

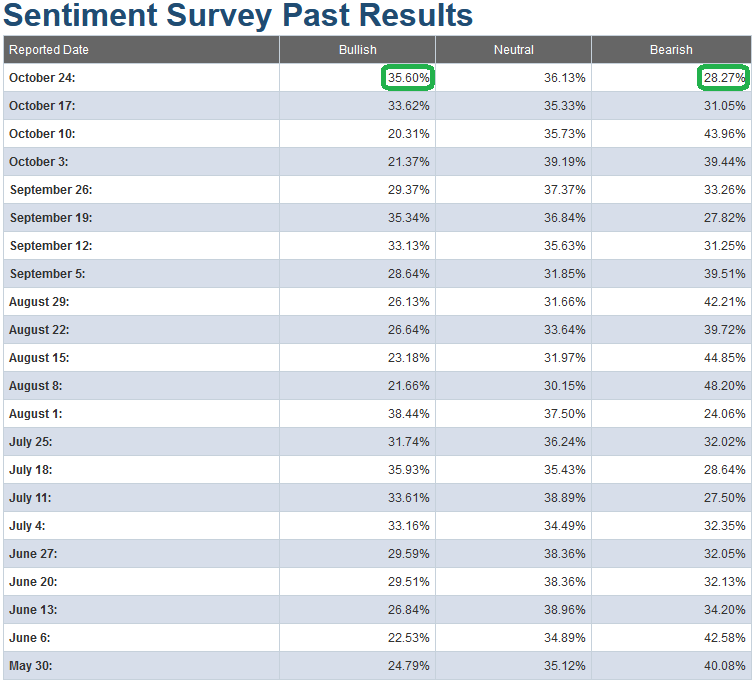

This week’s AAII Sentiment Survey result (Video Explanation) came in a bit higher than last week (35.60% Bullish Percent up from 33.62% last week). Bearish Percent dropped again down to 28.27% from 31.05%. The pessimism has thawed but we are not yet overheated or near euphoric levels by any measure. We would need to see well above 40-45% bullish to begin exploring caution. Bearish Percent in the low 20’s would also warrant a second look – but we are not there yet. See the chart below:

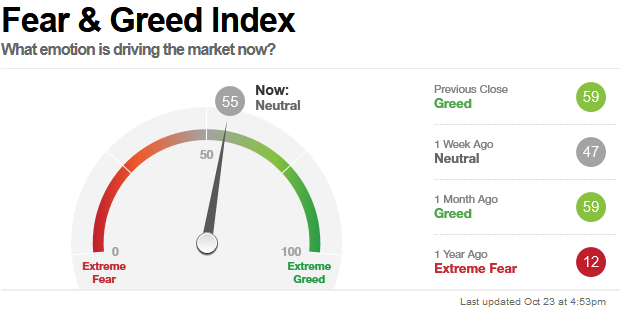

CNN’s Fear and Greed Index – which is a compilation of 7 different sentiment and positioning indicators also edged up 8 points week on week – from 47% to 55%. You can learn how this indicator is calculated and how it works here: (Video Explanation). We would start to get cautious above 75-80%+ on this metric – so again there is room to run:

As for the National Association of Active Investment Managers (NAAIM) Equity Exposure Index (Video Explanation Here) this week’s reading confirmed that active managers are still underweight equities (relative to bonds and cash) at just 57%. As we creep to new highs in coming weeks, managers will be forced out of defensive positioning and have to lever up to catch their benchmarks into year end – setting the stage for a possible “melt up” – which few are expecting.

As for the National Association of Active Investment Managers (NAAIM) Equity Exposure Index (Video Explanation Here) this week’s reading confirmed that active managers are still underweight equities (relative to bonds and cash) at just 57%. As we creep to new highs in coming weeks, managers will be forced out of defensive positioning and have to lever up to catch their benchmarks into year end – setting the stage for a possible “melt up” – which few are expecting.

While the bearish concerns are real and we could have bouts of short term volatility to digest on the way to new highs and beyond, the path of least resistance is higher. The richest three actors in the world are back in the market providing liquidity (ECB, BOJ, FED), 2020 forward estimates for the S&P 500 (US) and Stoxx 600 (Europe) are still holding at double digit growth for the first time since 2017, and there are enough bricks in the wall of worry to climb higher as sentiment and positioning reverses…

So take Kenny’s advice, and

Don’t go hittin’ that panic button…

Everything’s gonna be alright…