On Friday I was on Fox Business – The Claman Countdown – with Liz Claman discussing which sector (+company) and which asset class (+company) we are focused on for 2022. Thanks to Ellie Terrett and Liz for having me on:

Watch in HD directly in Fox Business

Here were my notes for the segment:

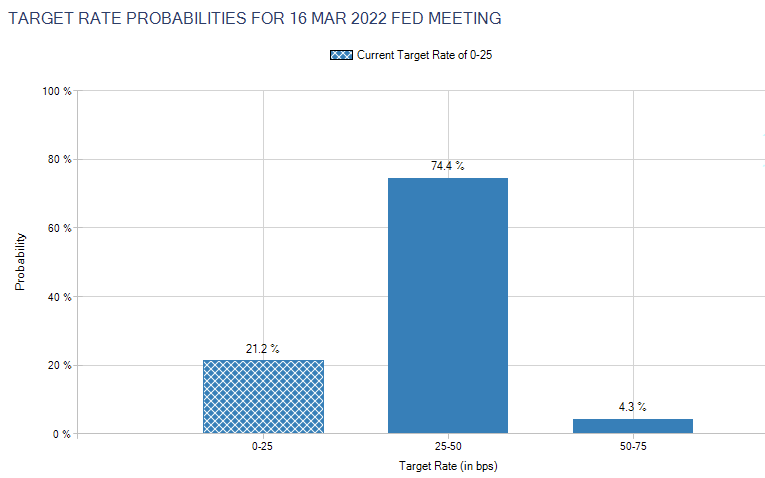

Fed RATE HIKE Liftoff now likely in March for 3 reasons:

- Unemployment Rate 3.9% (3.5% pre-pandemic)

- Avg. Hourly Earnings +4.7% v. 4.2% expectations

- Laborforce Participation Rate ticked up to 61.9%

Where to Invest:

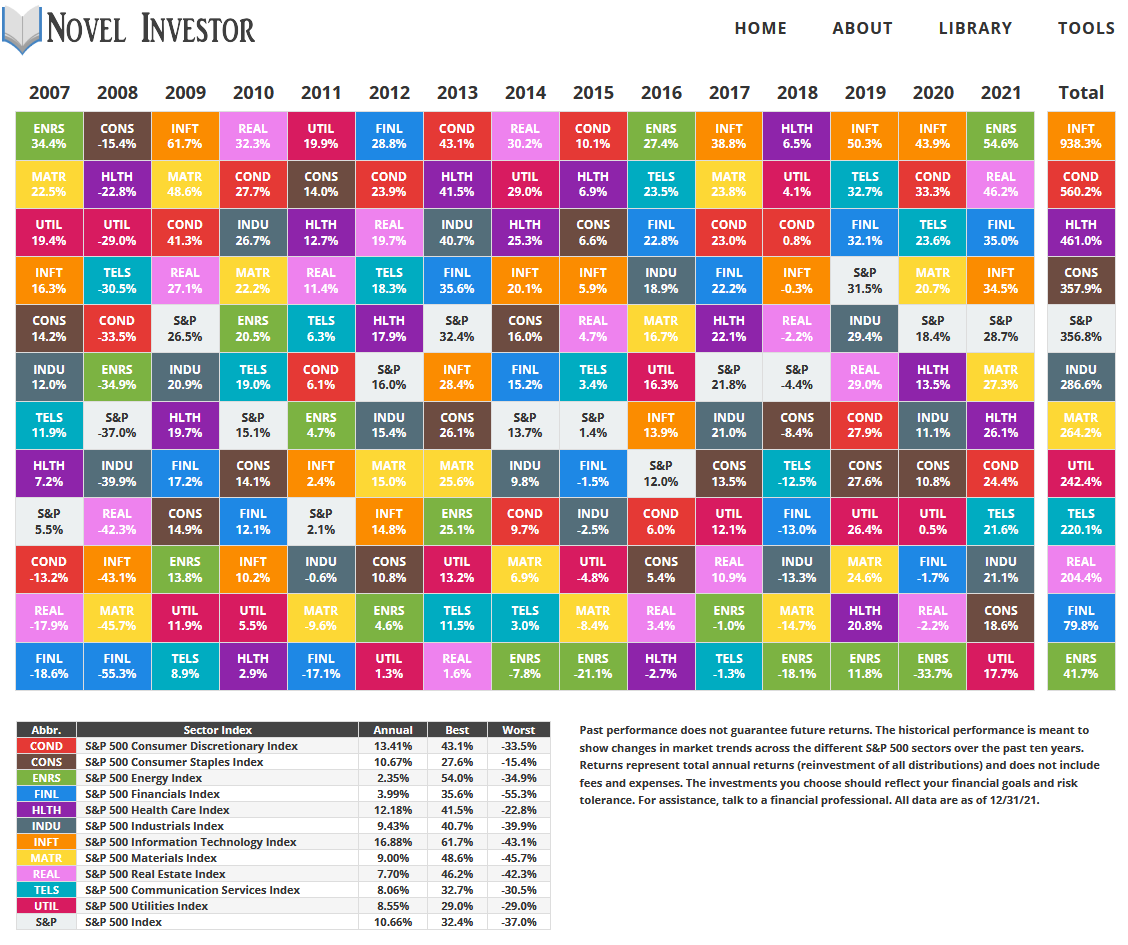

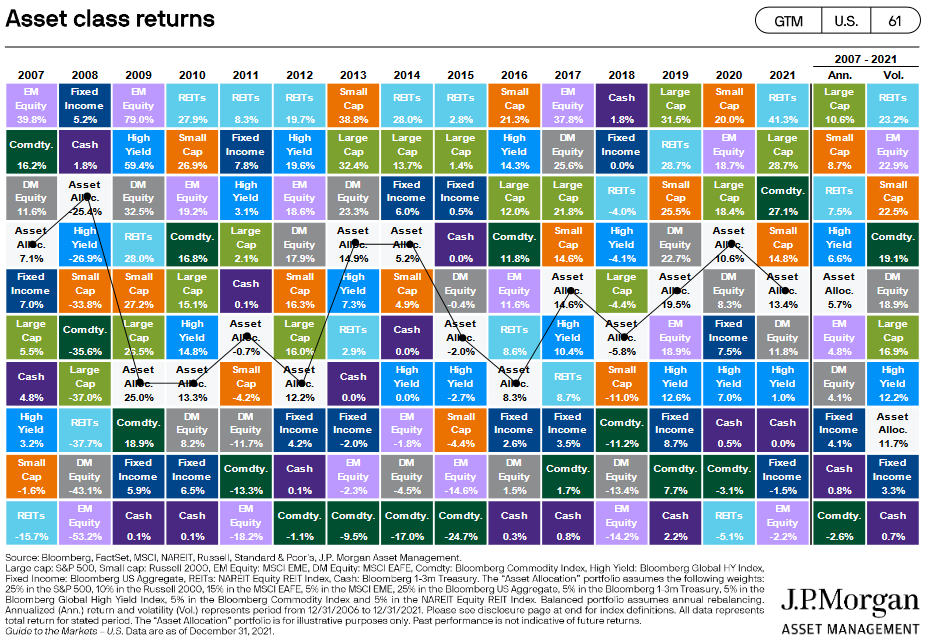

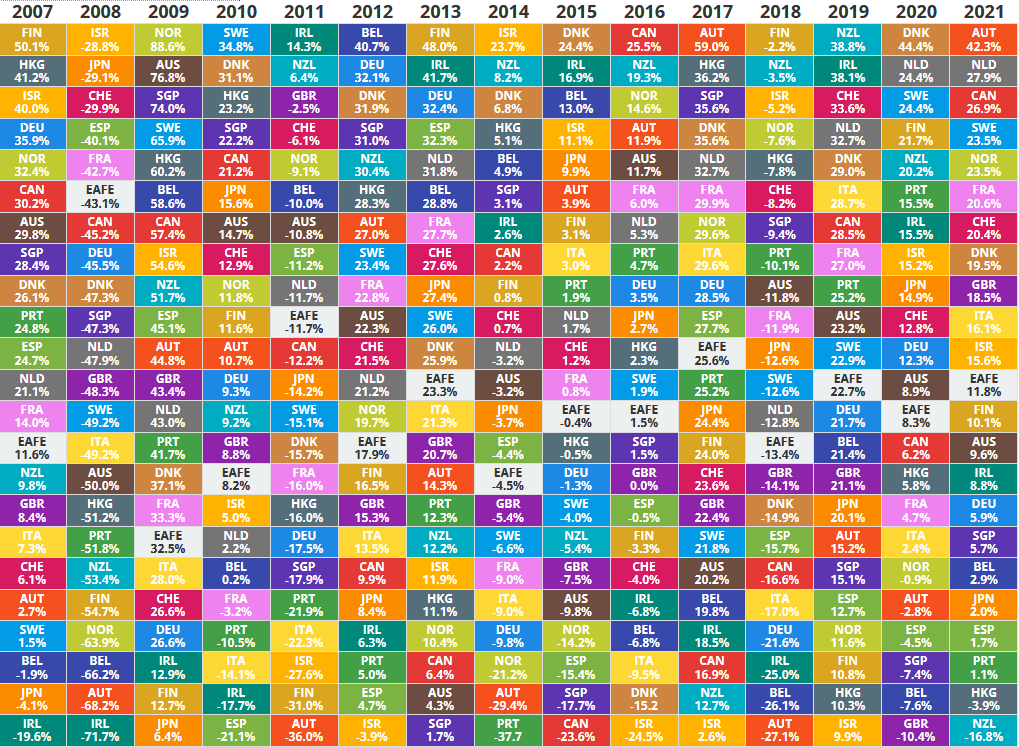

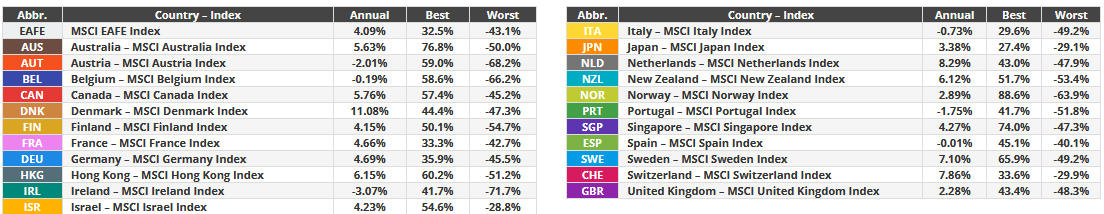

If you look at sector performance and asset class performance by year over the last two decades, a clear pattern emerges: Laggards become leaders and Leaders fall from grace every 1-2 years.

“The Last Shall Be First”

Our focus for putting new money to work in the last few weeks has been:

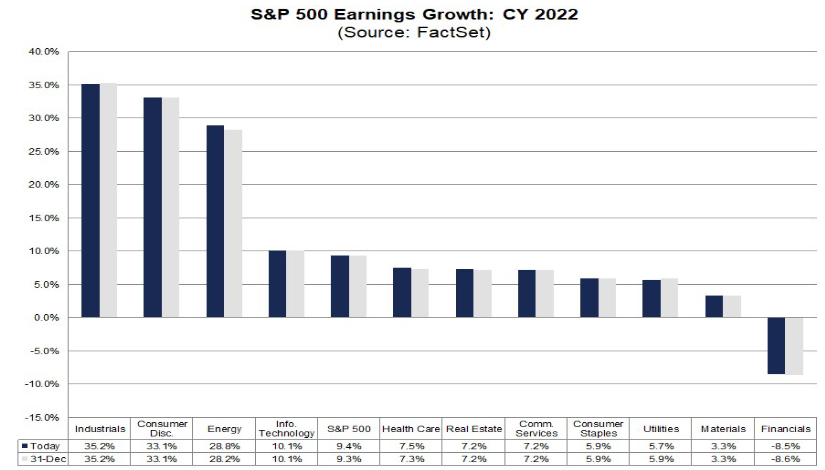

Sector: Industrials – was 3rd worst performer in 2021 – points to a move up in 2022. 35% earnings growth est. in 2022 vs. 9% S&P. Rising rate environment favors Value/Cyclicals and Industrials (current earnings) will benefit over growth/momentum (future earnings).

Pick: Boeing – got 2 new orders this week 19 – 777 freighters from Atlas Air and 50 737MAX from Allegiant (was Airbus customer exclusively). China recertification should be completed in coming weeks which will be huge catalyst. They received plan from Chinese Gov’t in Dec. Still trading down over 50% from pre-pandemic highs.

Asset Class: Emerging Markets was the worst performer in 2021. The heaviest weight is China. We think the regulatory crackdown is now priced in at these levels and stocks move up the most on “less bad” news. While the rest of the world is tightening policy in 2022, China has started easing in recent weeks to offset the effect of their crackdown and tightening in early 2021.

Pick: Alibaba is a controversial stock but is now up >20% off its lows in recent weeks. Charlie Munger just DOUBLED DOWN on his DOUBLE DOWN position. (i.e. in Q3 he doubled his Q1 purchase. In Q4 he doubled his total (Q3+Q1) position). You can buy cheaper than one of the best value investors in the world – with a company that grew top line by 29% last quarter (despite the crackdown and headline noise). Earnings and cash flow are up >500%+ since IPO in 2014 and you could buy at 2014 prices in the past few weeks. Both Charlie and I were in the market scooping up more!

So what’s happened so far this year?

Alibaba is up ~24% in the past 14 days.

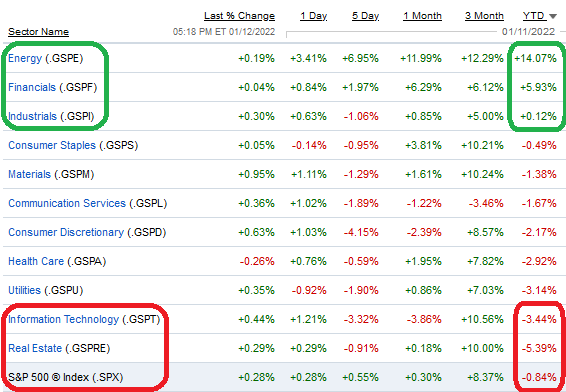

Energy, Financials and Industrials are the top 3 performing sectors ytd. Tech and Real Estate are the worst performers:

We can see below that not only do sectors and asset classes rotate on a year to year basis (per above), but country performance does as well:

Source: Novel Investor

The Hong Kong Hang Seng Index is up ~+4.47% ytd.

The S&P 500 is down ~-.38% ytd.

The Nasdaq is down ~-2.98% ytd.

Emerging Markets performance relative to the S&P 500 just broke its downtrend in the past week:

General Market

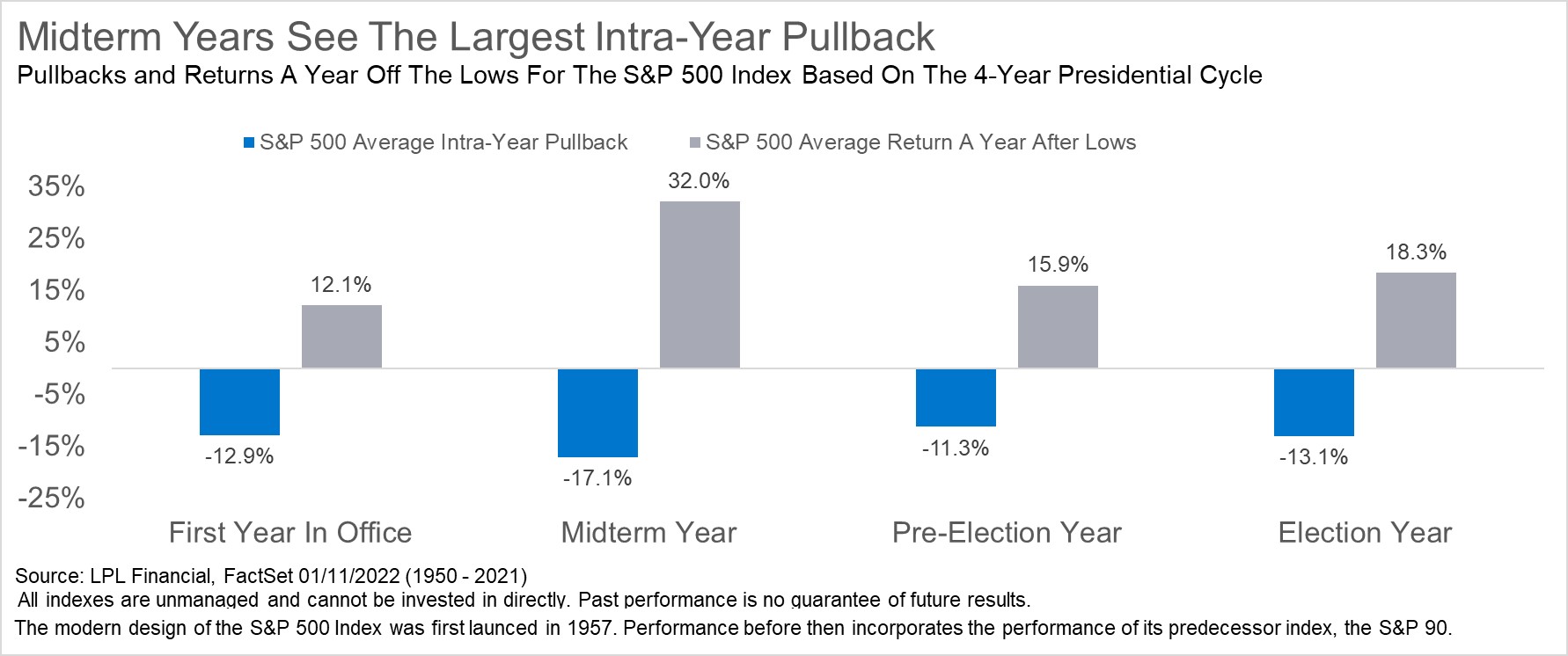

We’ve been consistent in calling for a high single digit/low double digit return for the S&P 500 this year – coupled with a lot more volatility than last year (i.e. 3-5% pullbacks of last year will become 8-10%+ mini-corrections in 2022).

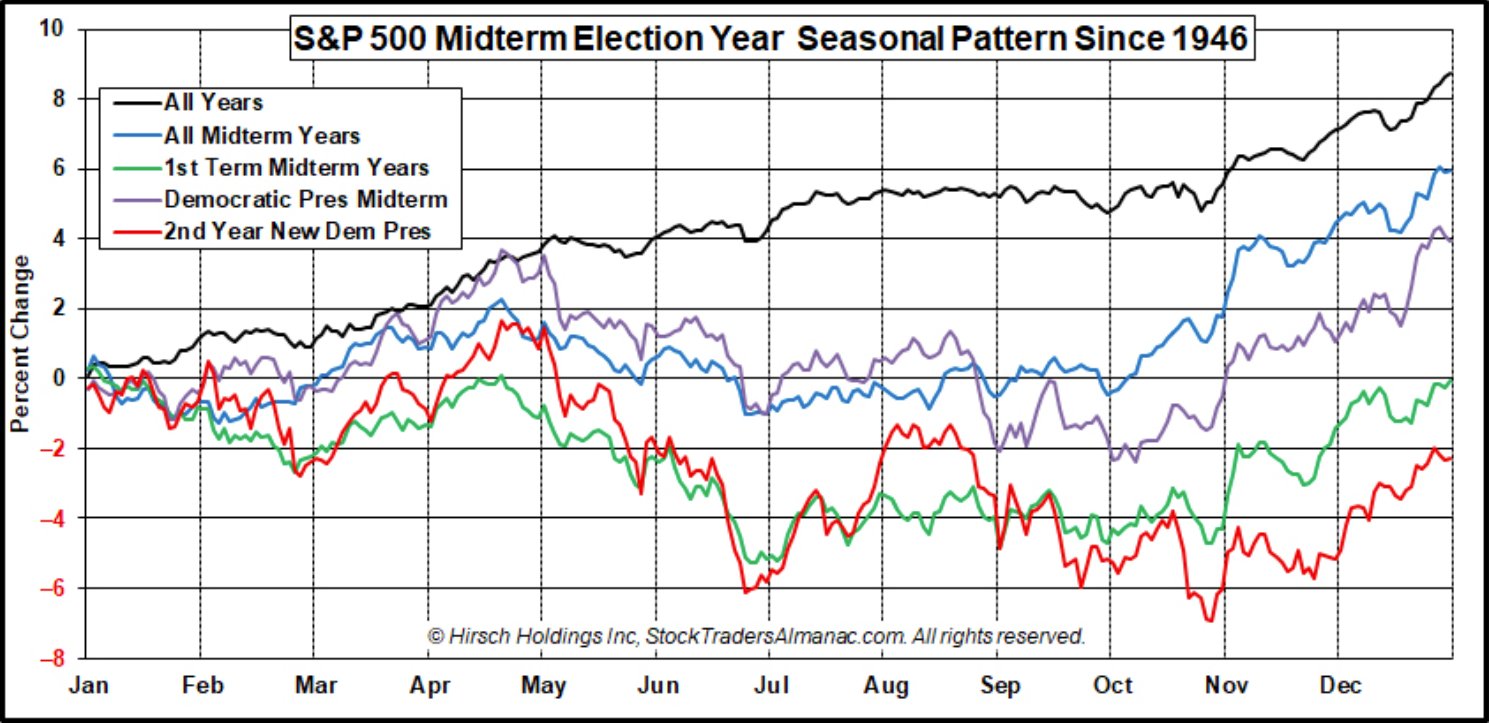

Ryan Detrick of LPL Financial posted some stats in the last few days that support this outlook (in the context of the Presidential Cycle):

I do believe both the average pullback (-17.1%) and average return a year after the lows (+32%) will be more muted this time (both downside and upside expectations), but the theme is correct.

This view is also confirmed by this table from the Stock Traders Almanac (see red line):

Earnings

Earnings are the name of the game…

We start in earnest on Friday with Wells Fargo, JP Morgan and Citigroup reporting for Q4. We got a flavor for what to expect from Jamie Dimon this week when he said the U.S. is headed for the best economic growth in decades. His confidence stems from the robust balance sheet of the American consumer.

The key will be guidance moving forward. Can we keep the post-covid trend of analysts being too pessimistic and having to take estimates UP, or revert to a more normalized environment where analysts are consistently too optimistic?

Right now, the bottom up consensus 12 month target price for the S&P 500 is 5,284 or 12.2% above today’s close. Analysts took 2022 estimates up a bit last week:

Now onto the shorter term view for the General Market:

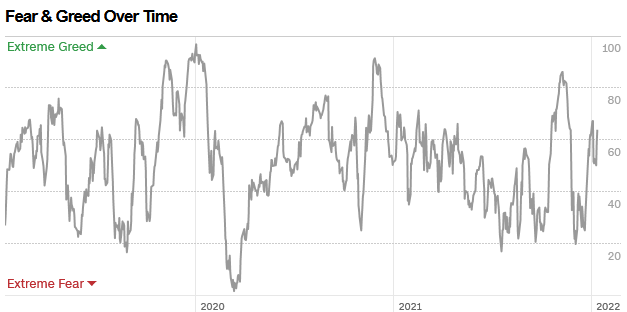

The CNN “Fear and Greed” Index moved up from 51 last week to 64 this week. This is still a relatively neutral reading. You can learn how this indicator is calculated and how it works here: (Video Explanation)

If “earnings are the name of the game,” interest rates are the arbiter of the score. It’s not only what companies produce and how they guide moving forward, but how much market participants will be willing to pay for those future cash flows. The higher rates go (discount rate), the less valuable those future cash flows are worth in the present. We are at a critical point here:

Our podcast|videocast will be on Friday this week. We will cover these points and more in further detail. See you then…