This week, we chose Louis Armstrong’s, “What a Wonderful World” as the theme song to capture market sentiment.

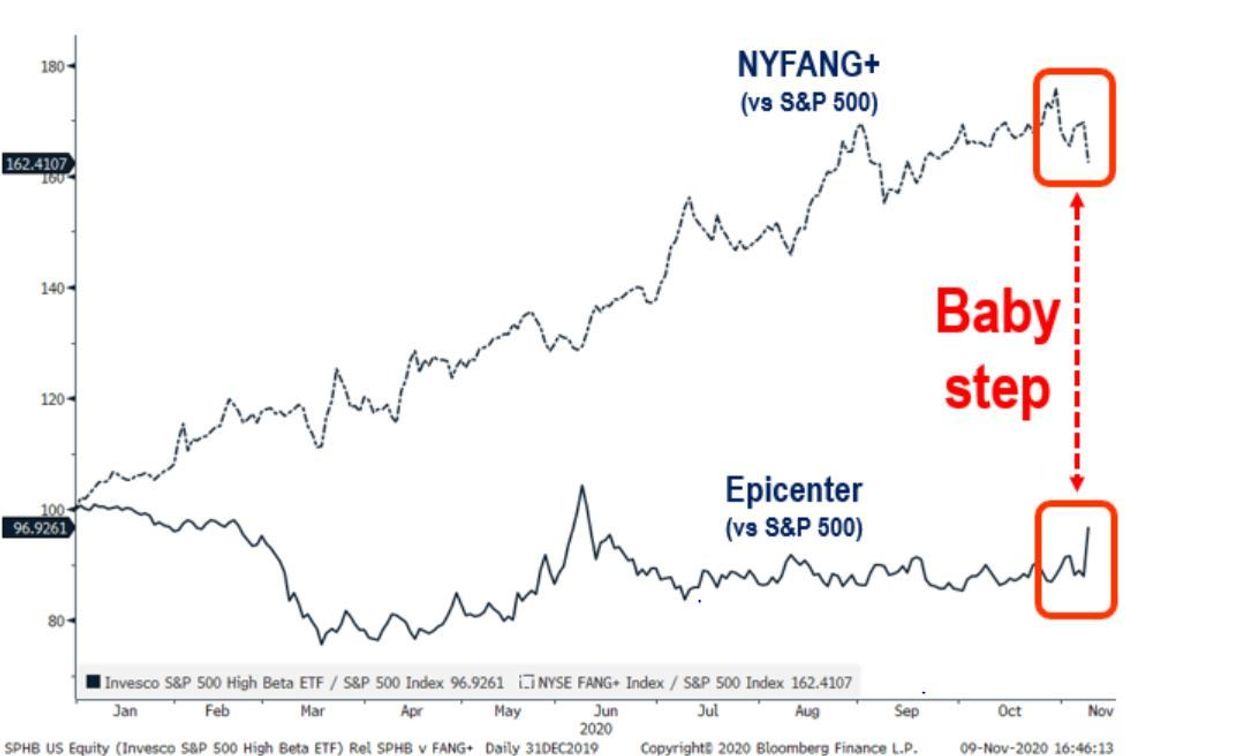

Following the Phase 3 results from Pfizer/BioNTech on Monday (showing 90% efficacy), the switch was finally flipped (from the “Tech Market” to the “Cyclicals/Everything Market”). Market breadth broadened and this is a sign of great health for the market and the economy moving forward:

It’s a wonderful world

I’m just walking on air

Talk of heaven on earth

I’ve got more than my share…

While this doesn’t mean it’s time to throw caution to the wind, it does mean that the economically sensitive stocks are finally back in play…

Yesterday I was on Fox Business, “The Claman Countdown.” Thanks to Ellie Terrett and Liz Claman for inviting me on the show.

We discussed Goldman Sach’s upside revision to their end of year price target on the S&P 500 (PT 3,700). They are also calling for 4,300 by the end of 2021, and 4,600 by the end of 2022. Here are the key components that I believe will make their thesis play out (also watch until the end for a fun stock pick):

On Tuesday I was on CGTN Global Business discussing China CPI and PPI (inflation) and the implications on their recovery. Thanks to Rachelle Akuffo and Stephanie Savage for inviting me on the show.

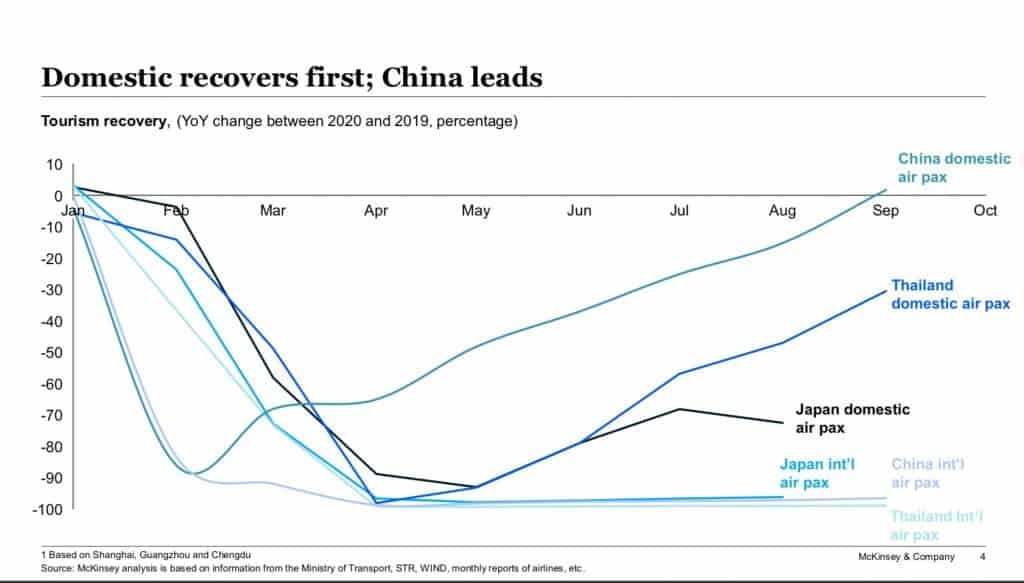

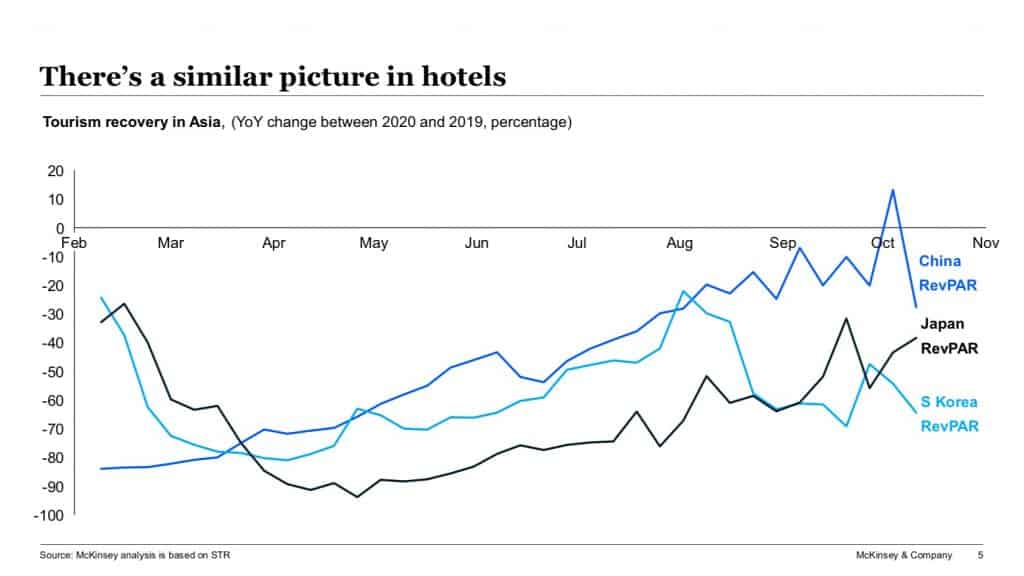

The reason China data is so important is because on every metric, they have led the U.S. by 2-3 months. Looking at the positive results they are seeing domestically with regard to air travel, hotel bookings, and movie box office ticket sales – shows us that we have a lot to look forward to. Keep in mind these numbers are BEFORE a vaccine:

Source: McKinsey & Company

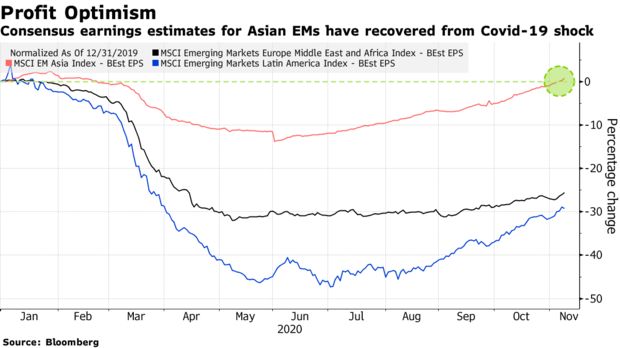

China/Asia Earnings Leading Emerging Markets Recovery.

We have been making the case for many weeks that the catalyst for money to flow into the cylcicals/economically sensitive names would be a vaccine and repeated over and over, “don’t bet against science.”

Last week I closed out our weekly note with this suggestion, “this is not the time to give up on the cyclical trade.” You can review it here:

What a difference a week makes:

Source: Tom Lee – Fundstrat

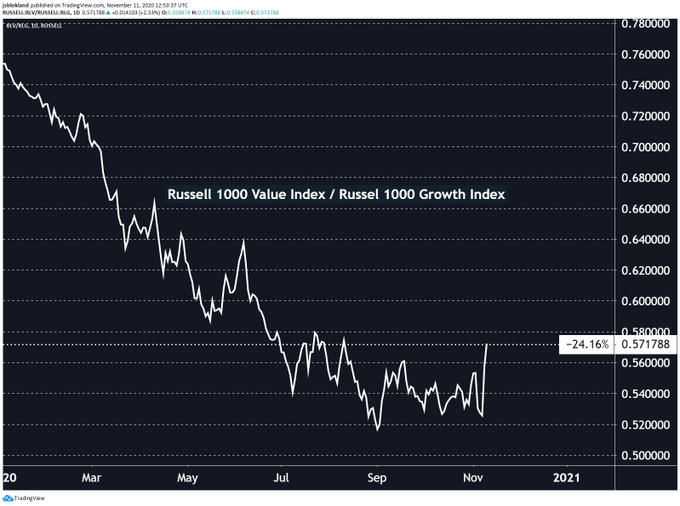

US Value has outperformed US Growth by a jaw-dropping 9% since last Friday:

Source: Jeroen Blokland – Robeco

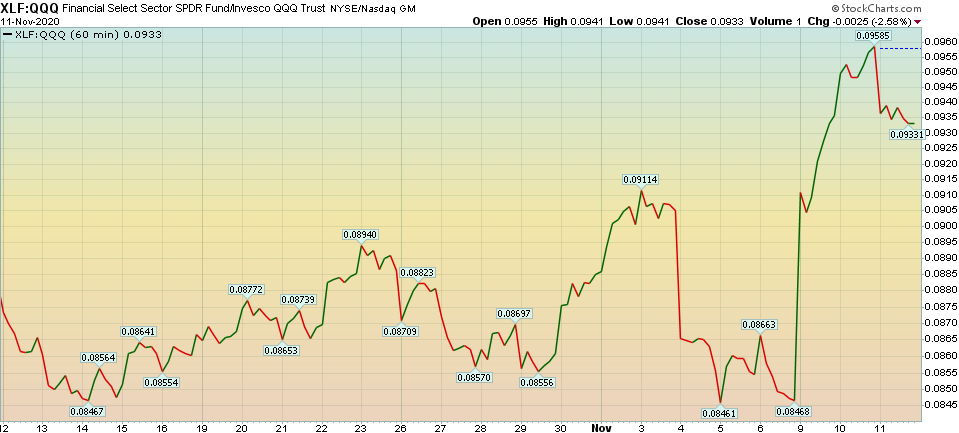

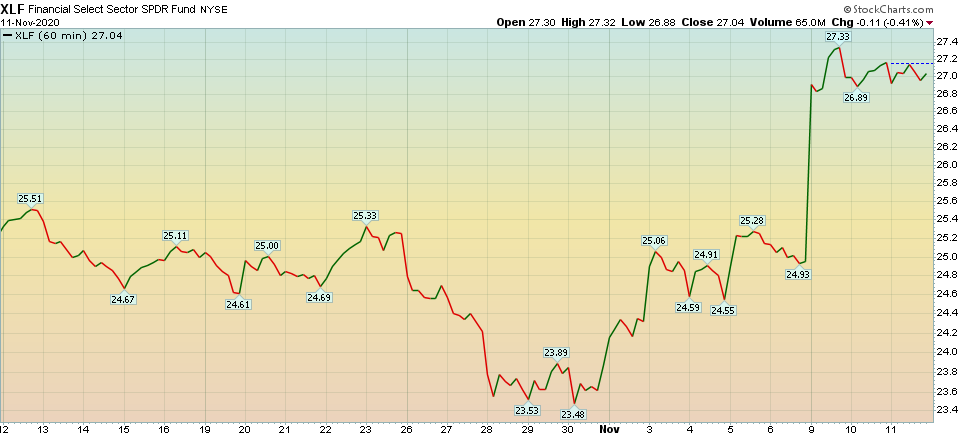

Financials Relative to Nasdaq

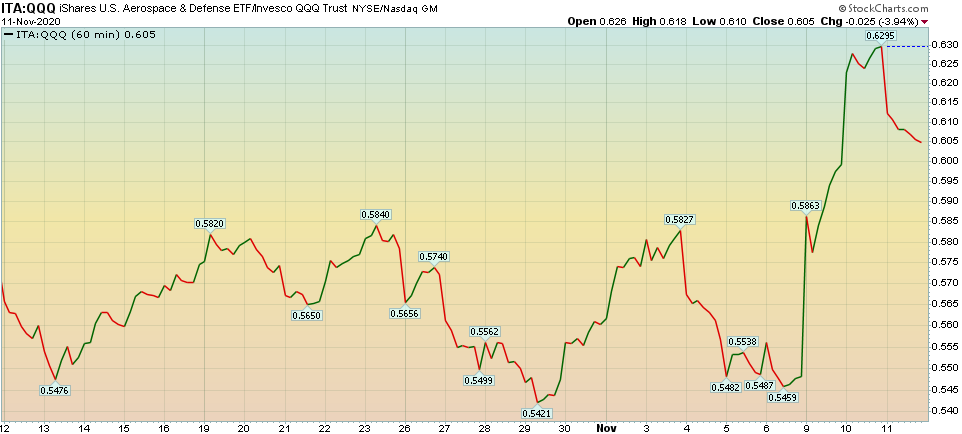

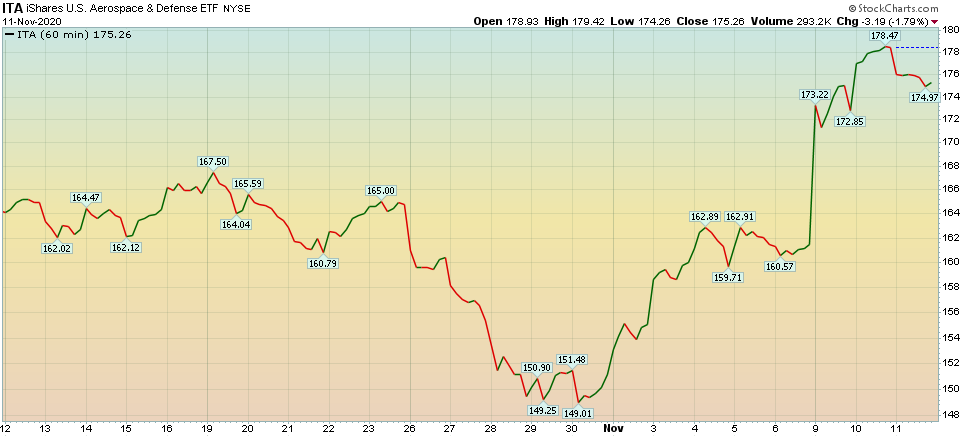

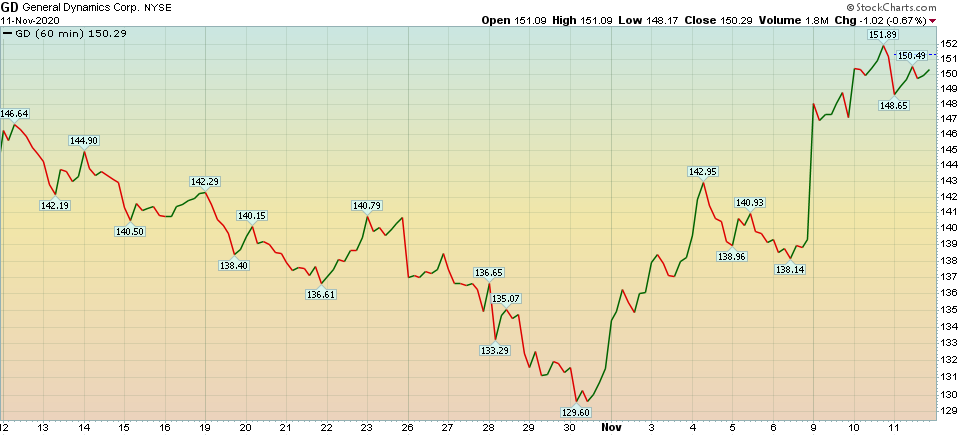

Defense Stocks Relative to Nasdaq

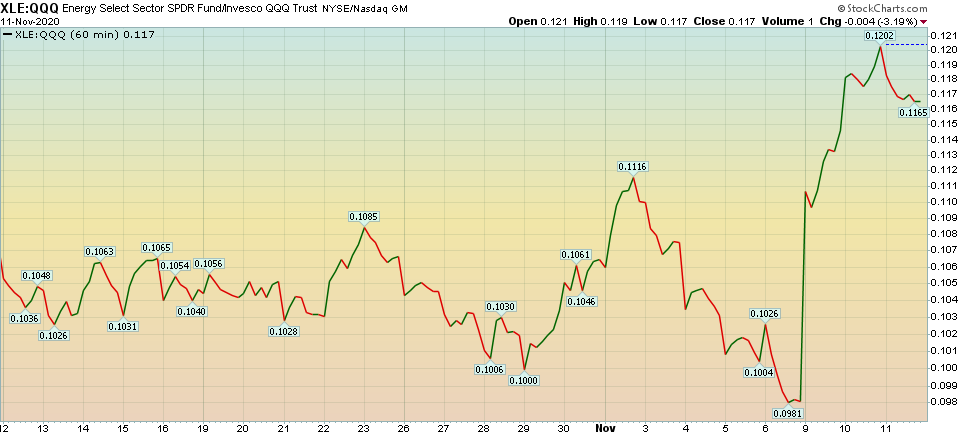

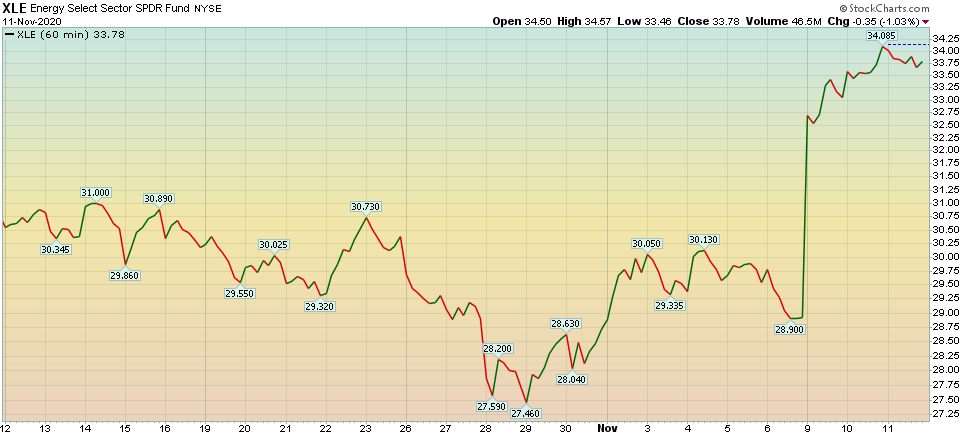

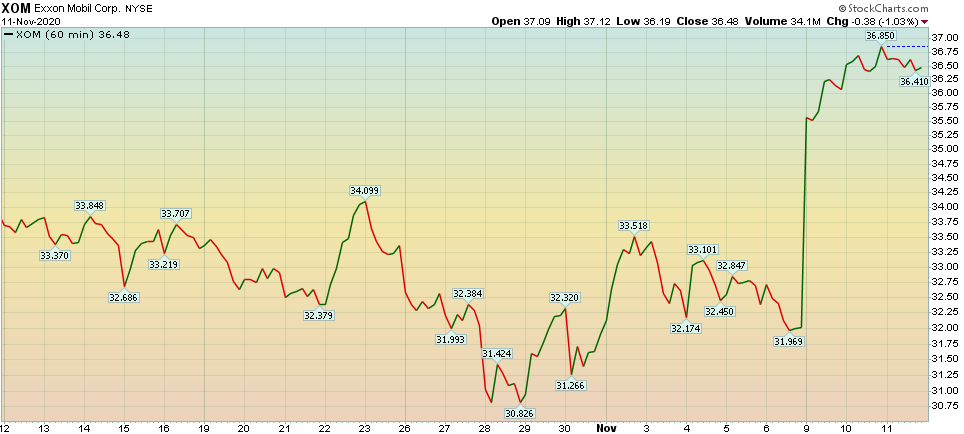

Energy Stocks Relative to Nasdaq

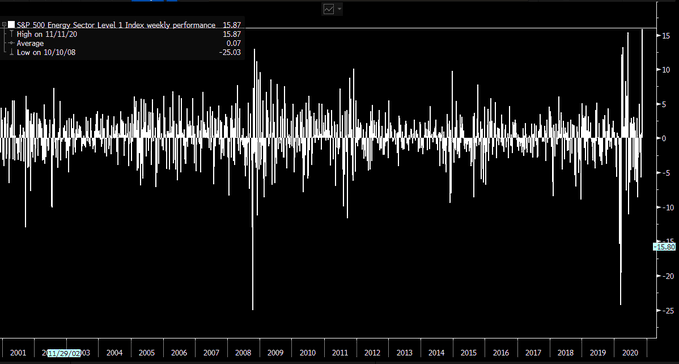

Despite yesterday’s dip, energy stocks in the S&P remain on track for their best week ever. Source: Elena Popina – Bloomberg

We have been seeing crude draws pretty much every week since we put out this Rystad Energy data on June 18:

The Drake “Toosie Slide” Stock Market (and Sentiment Results)…

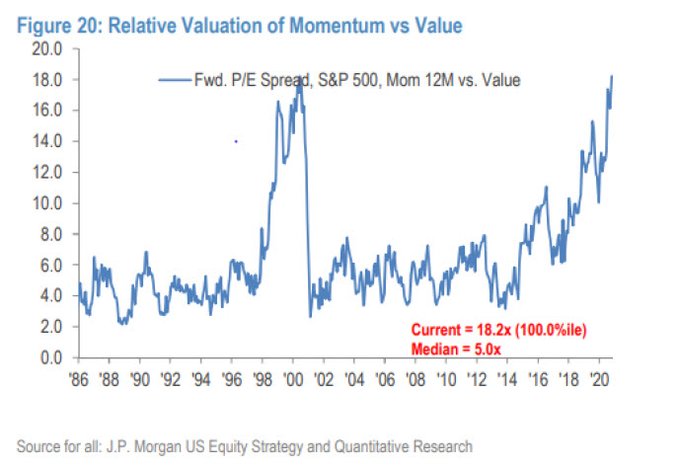

What is taking place now is an unwinding of excesses caused by unusual – once in a century – circumstances:

As I have stated repeatedly, I do not think the performance (Value/Cyclicals) is going to come at the “zero-sum” expense of Growth/Momentum/Tech stocks, but I do think we will see material relative out-performance.

Historically, cyclicals not only outperform in the first 8-12 quarters of a new business cycle (which began this quarter), but also in the 6 months following a Presidential Election. We have both tailwinds behind us. The vaccine (and to a lesser extent the Lily/Regeneron/Gilead treatments) was the catalyst.

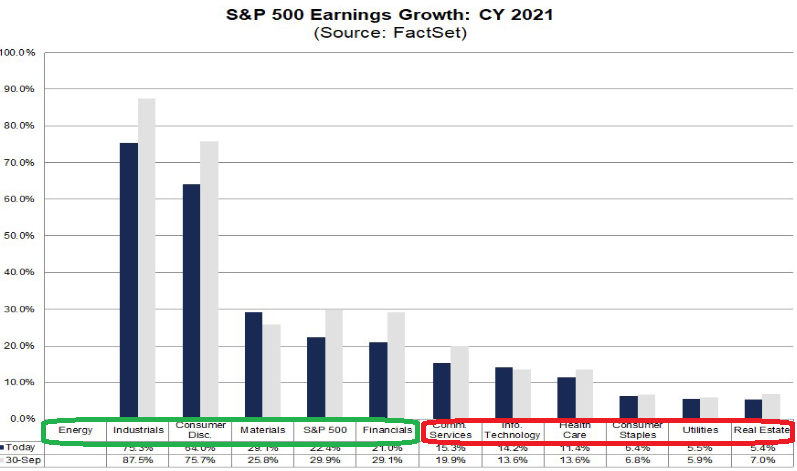

Earnings

This thesis is also supported by earnings. The green sectors are going to grow earnings the fastest in 2021. The red sectors will grow the slowest:

Post Election Behavior

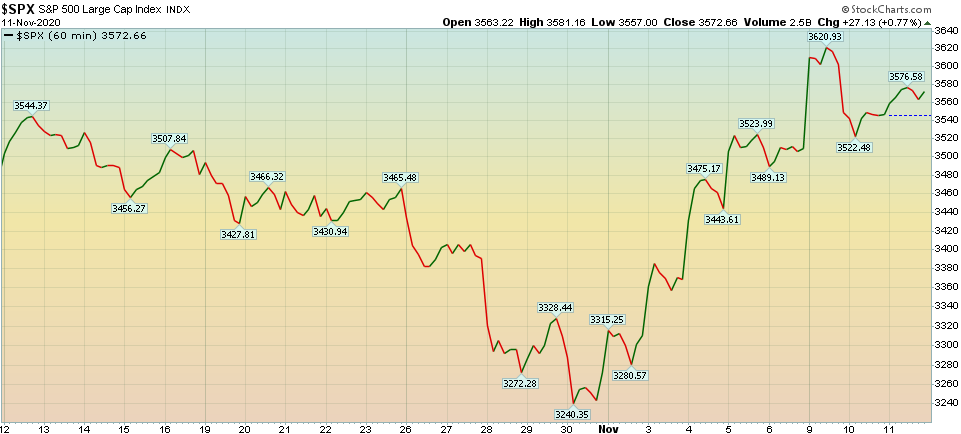

Two weeks ago we laid out the case that the market was setting up very similarly to how it was setting up going into the 2016 election. Because the results were delayed until the weekend after the election, we did not see the hard turn until Monday.

The key was not the Presidency, but rather the divided government outcome that keeps the corporate tax rate at 21%. Here’s the note to review, followed by each covered stocks’ performance since the Networks’ proclamation:

The “Back to the Future” Stock Market (and Sentiment Results)…

S&P 500

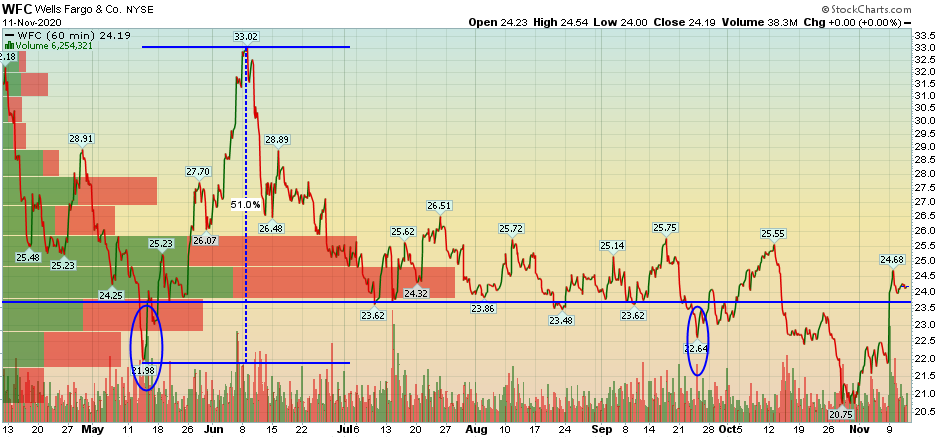

Financials

10 Year Treasury Yield

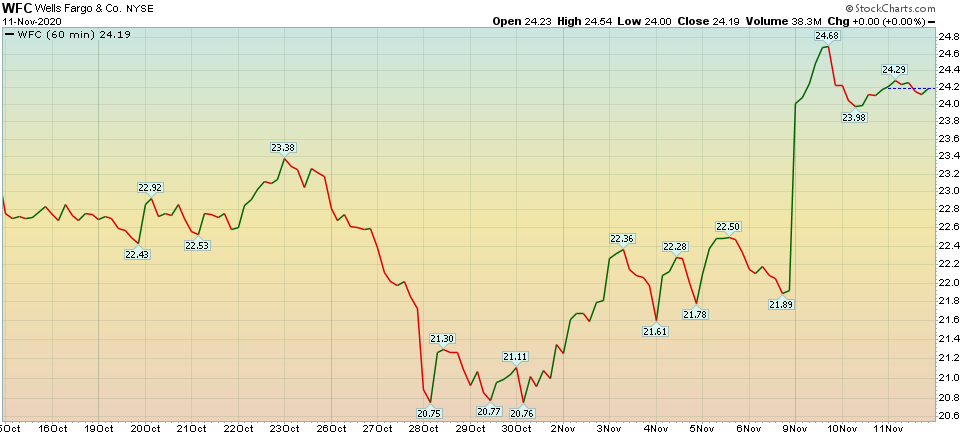

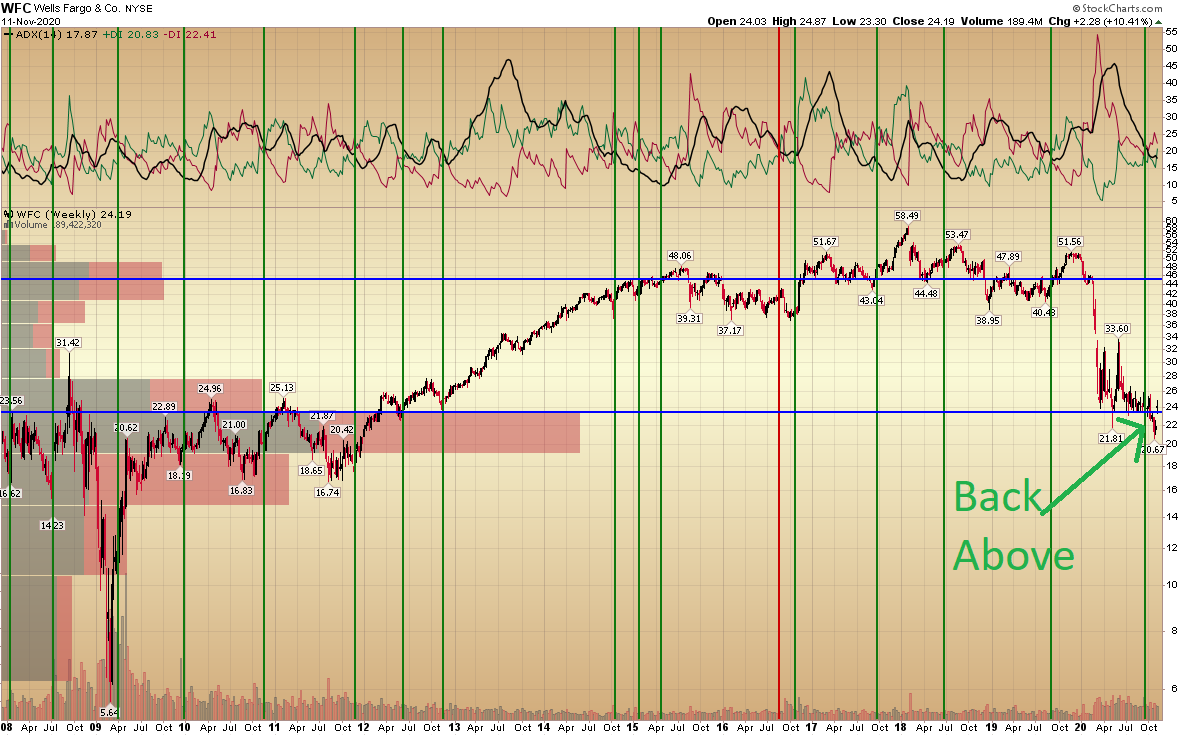

Wells Fargo (WFC)

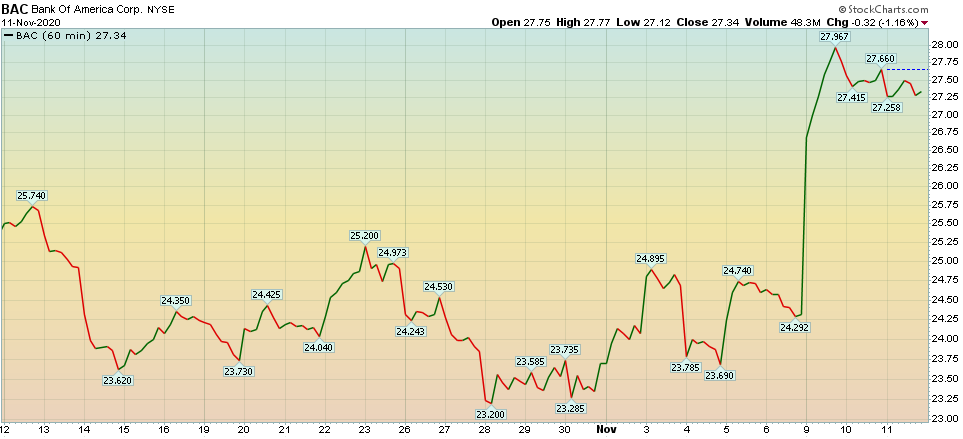

Bank of America (BAC)

ENERGY SECTOR

EXXON MOBIL (XOM)

DEFENSE SECTOR

GENERAL DYNAMICS (GD)

Three weeks ago, I made the case that people needed to “Calm Down” like Taylor Swift because while most people were calling the stock market a “bubble” there were 100’s of stocks that looked NOTHING LIKE A BUBBLE. These are the same stocks that have rallied HUGE in the past week. See the list here:

The Taylor Swift “You Need To Calm Down” Stock Market (and Sentiment Results)…

The energy sector is now up ~10% since we made the case in this note a month ago:

The “I’m an Accountant” Stock Market (and Sentiment Results)…

Update on Wells Fargo and the Cobra Kai “Leg Sweep”

While we had to take a short detour after our “Cobra Kai” (Sweep the Leg) article:

The Cobra Kai “Sweep The Leg” Stock Market (and Sentiment Results)…

We are now right back on track – hopefully to the promised land:

Nothing has changed with the fundamental thesis. You can review it here:

The Stevie Wonder, “Faith” Stock Market (and Sentiment Results)…

The big 4 money center banks are likely over-reserved by ~$25B. As I said yesterday on Fox Business, these reserves were taken in Q2 when the assumption was that unemployment could go to 20%. We are now at 6.9%. Couple that with a steepening yield curve and you’re on the yellow brick road – only this time, the man behind the curtain has more cattle than hat (that’s for my Texas readers!).

The fundamentals have not changed and that’s why when you know what you own, you don’t get shaken out from an erratic “leg sweep” – you simply add more from the folks who puked. They will be back to buy it back from you in a number of months when it is “breaking out” to new highs – at which time we will gladly lay off a bit to the giddy converts.

And by the way, they (retail breakout/new high buyers) will make money too as the secular demand for housing/housing formation/mortgages for 85 million Millenials will not subside any time soon. There’s more than one way to the top of the mountain and plenty of opportunity to go around…

Election

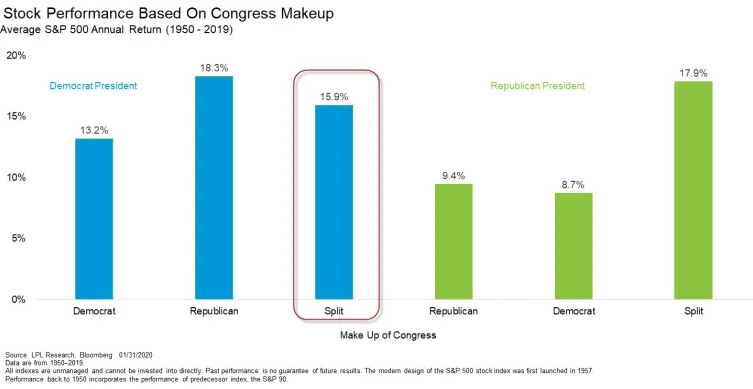

On August 13, we put out the note “Gridlock is Good.” That has proven to be true with this election:

The Gordon Gekko, “Gridlock is Good” Stock Market (and Sentiment Results)…

Based on the chart in that article, we have gotten the most bullish outcome based on ~90 years of data. LPL Research put out some similar data since 1950 this week:

Now onto the shorter term view for the General Market:

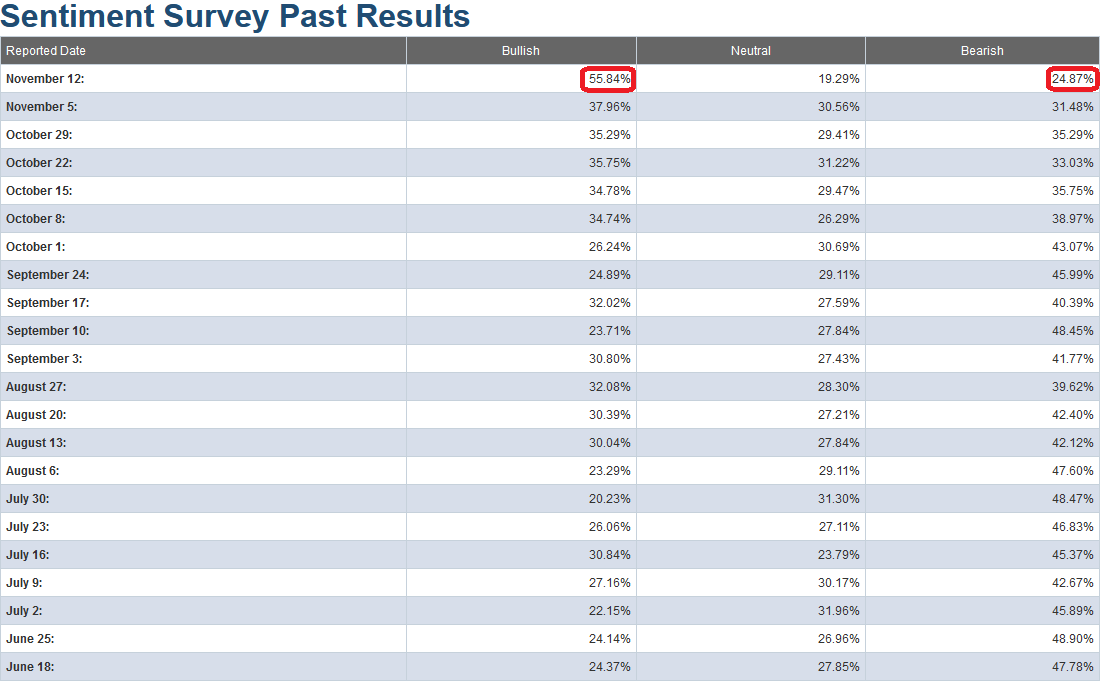

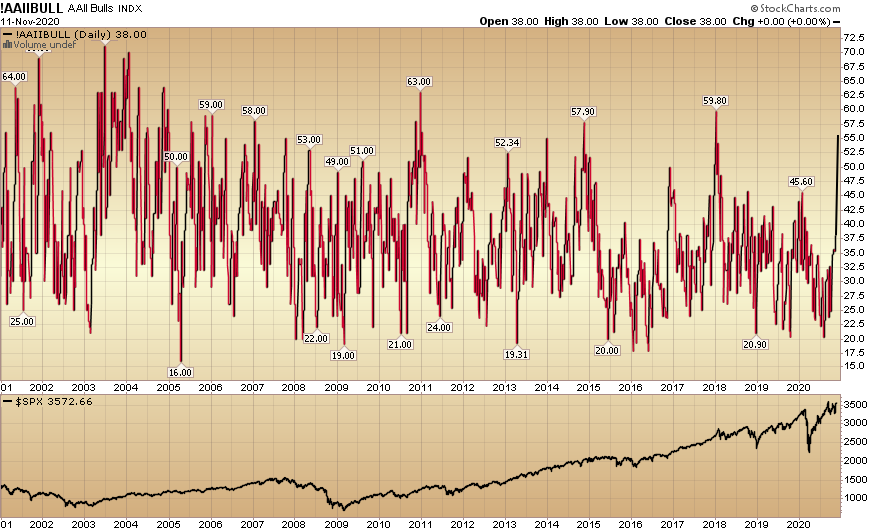

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) jumped to 55.84% from 24.87% last week. Bearish Percent fell to 24.87% from 31.48% last week. We are now at an extreme in sentiment for retail investors. This indicator has been behaving a bit strange in recent months, but a read this high must be noted and taken with short term caution (for the general market).

With the short-term restrictions/early restaurant closings, and case increases, it would make sense that we will see fits and starts until the first batch of vaccines is delivered before year-end. On bad covid news days, tech will bounce/outperform. But as we press forward to vaccination/resolution, the new phase of cyclical out-performance will lead the way.

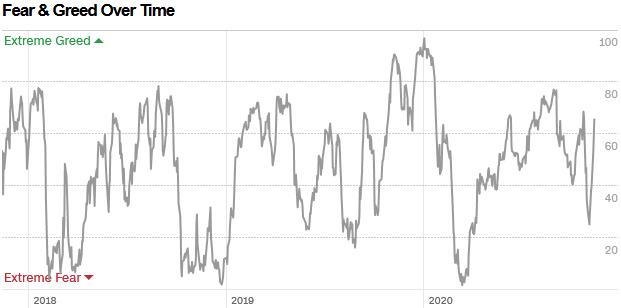

The CNN “Fear and Greed” Index jumped from 36 last week to 66 this week. We are seeing some renewed enthusiasm, but no euphoria (on this indicator) at present. You can learn how this indicator is calculated and how it works here: (Video Explanation)

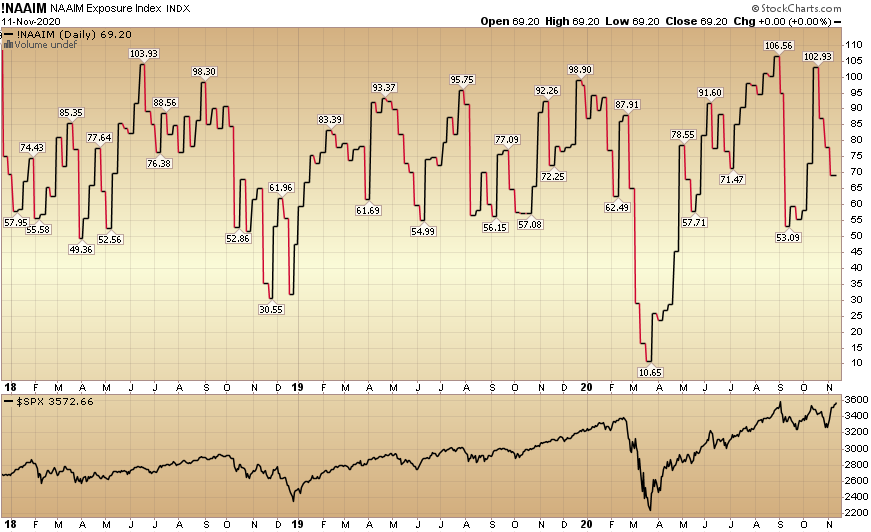

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) fell to 69.20% this week from 77.87% equity exposure last week. Fear has continued to persist among active managers, but they will have to chase up into year end.

2 out of 3 indicators are bullish this week. I would give more weight to the Fear & Greed than AAII due to the fact that it is a compilation of 7 indicators. That said, we do have to respect the extreme sentiment among retail traders in the AAII this week (despite the indicator’s recent quirkiness).

Our message for this week:

We have come a long way since we put out the “Spanish Flu” article on March 19 – anticipating a near term bottom (which came a few days later on the 23rd).

The Spanish Flu – Coo coo ca choo – Stock Market (and sentiment results)…

While the easy money has been made in the general indices, I think the easy money is just getting started in “left for dead” sectors/stocks. I believe Banks, Defense Stocks and pockets of Energy will be as good – if not “orders of magnitude” better – than buying the general market in late March.

Here are the key catalysts:

- Vaccine (PFE)/Treatments (LLY/REGN/GILD) are here or nearly here.

- Gridlock is good. Corporate tax rate stays at 21%.

- Uncertainty with policy/trade should diminish.

- 5-6%+ GDP growth in 2021 – lagged effect of ~25% M2 money supply growth yoy.

- Upward Earnings Revisions: Banks (NIM [net interest margin]/Reserve Releases)

- Accomodative Fed. Short end will stay pinned at 0-25bps. Long end will expand – steepening the curve (good for banks/credit expansion).

Time will tell, but in the mean time we will work hard, work smart, stay humble (no one has a perfect crystal ball) and be flexible – as opportunities abound in coming weeks and months…

What a wonderful world…