This week we chose Luke Combs Billboard hit “Forever After All” to capture the current sentiment of the stock market. The lyrics that stood out were:

They say nothing lasts forever

But they ain’t seen us together

Nervous Nellies

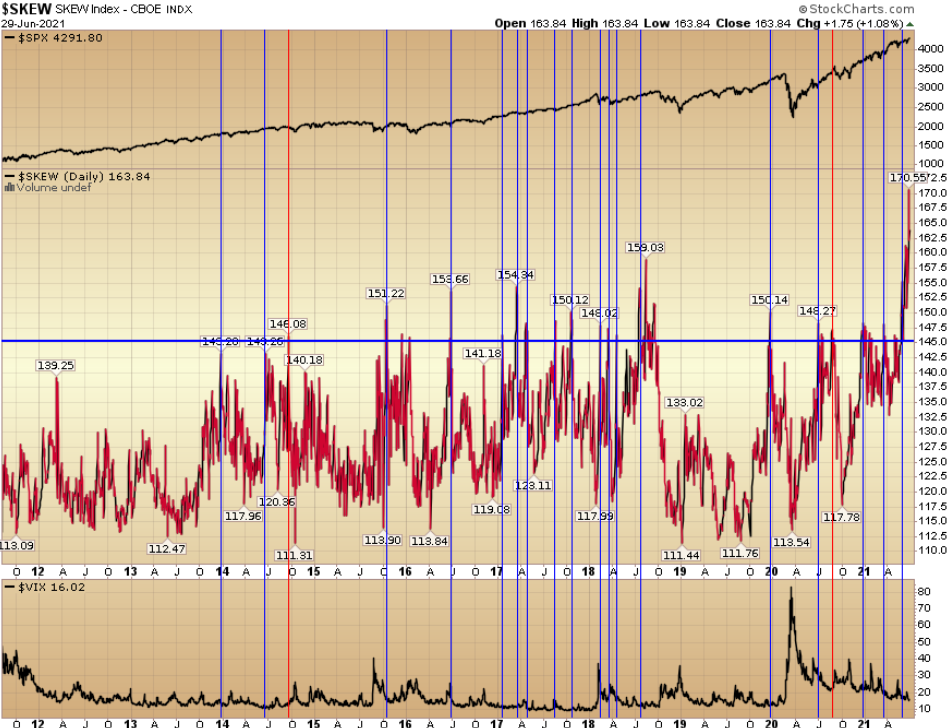

We have seen this chronic “wall of worry” climb for about 16 months – and since the day the Fed decided to backstop the corporate credit market, naysayers have been singing “nothing lasts forever” and buying “catastrophe insurance” (deep out of the money S&P puts) that never paid out. They are doing the same thing again (and will eventually be right – if they can stay solvent in the meantime):

As a refresher for those who are new to our weekly notes and podcasts|videocasts, I refer to option skew on a regular basis.

As a refresher for those who are new to our weekly notes and podcasts|videocasts, I refer to option skew on a regular basis.

In simple terms, VIX measures the cost/demand (implied volatility) of insurance (S&P puts) AT THE MONEY, while SKEW measures the cost/demand (implied volatility) of “tail risk” insurance (S&P puts) OUT OF THE MONEY (2+ Standard Deviations from the mean). While this is not a comprehensive definition, it is an easy way to think about it to get the general idea.

Right now, the demand for “tail risk” insurance is high. That is concerning, but also a sign that many players do not believe this rally. The “wall of worry” continues to be climbed, but if I were a betting man – I’d be on the lookout for a scenario where the market BREATHES but does NOT pay off the “tail risk” buyers – simply because there are too many of them.

For the sports gamblers, this is the equivalent of a situation where your team wins but you lose the bet because the spread was too wide. In this case the sellers of the premium in demand (tail risk insurance) are the bookies. They love nothing more than when you’re right (the market pulls back) and you still lose (the pullback is shallow and they keep your money).

As you can see in chart above, out of the last 20 times there have been aggressive bets placed on a market “catastrophe” they only paid out 2 times (10% success rate).

So while the buyers of premium continue to pay through the nose while singing “nothing lasts forever,” the dealers happily take their money singing an entirely different lyric “but they ain’t seen us together!”

Sooner or later the nervous nellies will be right and get paid for the 3rd time (out of >20 attempts) in 10 years.

Defensives

On February 24 and March 4 we made the case for Utilities (D, AEP), Big Pharma (PFE, NVS) and Staples (K, CPB). They immediately rocketed for couple of months – and have been consolidating for the past month or so. These are defensive groups that look like they are setting up again (for a second leg higher). While this setup is consistent with the “nervous nellies” buying “catastrophe insurance” we may see a similar situation where the market pulls back enough to scare money into defensives, but not enough to pay the out for the premium holders.

Let’s review what has happened:

As for CPB, it’s done a round trip. We have used the recent weakness to aggressively add. What is interesting about these three groups is that while their relative performance to the S&P 500 has faded in recent weeks, their relative strength has increased. This type of divergence often precedes reversals.

These three groups seem to be setting up in a similar fashion to Energy and Bank stocks when we were aggressively suggesting them before the election (see our October 15 note here). Below you will see “double bottom” type of patterns as it relates to each sector’s relative performance to the S&P 500 (right before taking off). These are the type of things we look at AFTER we have done our earnings analysis and fundamental work.

Just because the setup is similar, doesn’t mean it will work. Everything in this business is probabilities coupled with sizing/risk management, but see if you can spot the setup below. As an aside, Energy and Financials went on to become the top YTD performers for 2021 following this setup last Fall:

Tech

As for selected Tech, we started suggesting SPLK and BABA in our note on June 10. They are starting their ascent:

What I like most about our current setup is that if the “nervous nellies” are right, defensives will outperform. If they are wrong, all indications still point to it’s their (staples, utilities, pharma) turn to shine. It may simply be a reach for yield in the short-term, as people reach for dividend yield in periods of moderated bond yields:

Now onto the shorter term view for the General Market:

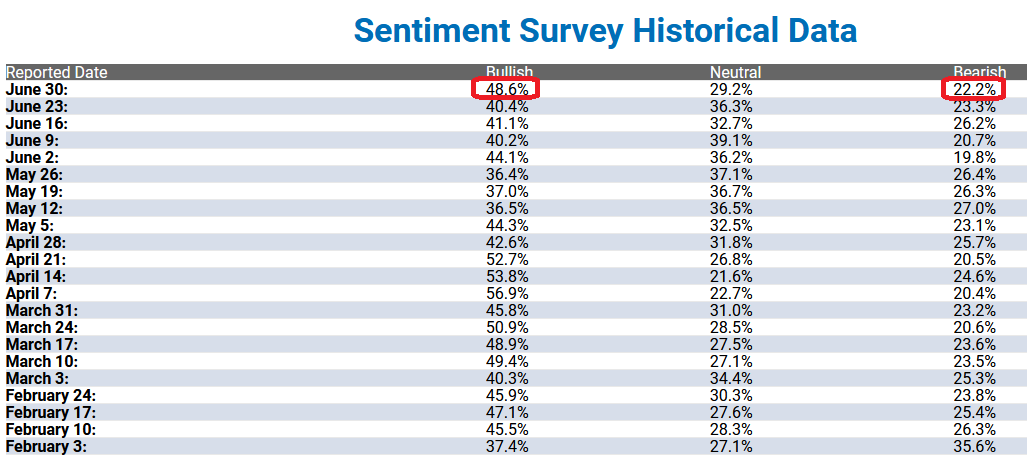

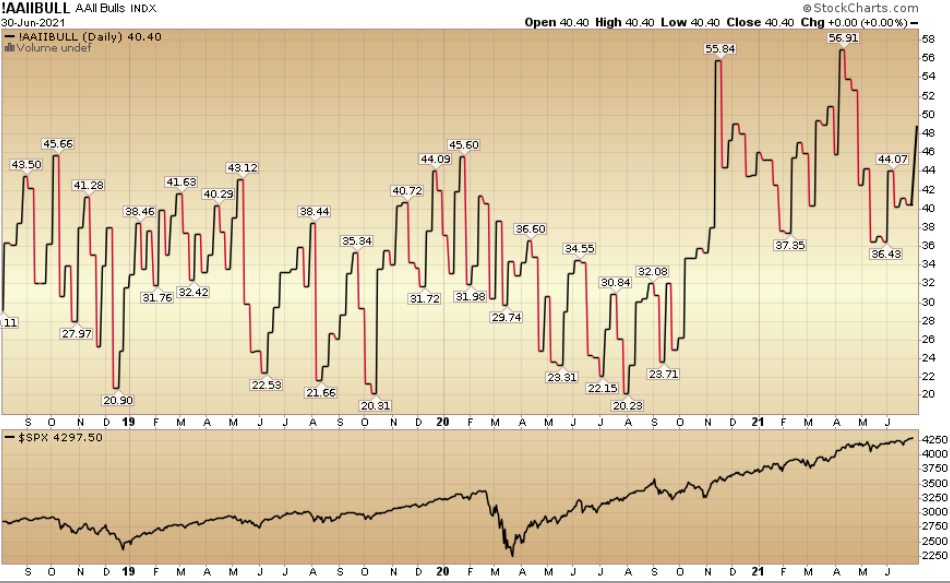

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) jumped to 48.6% from 40.4% last week. Bearish Percent decreased to 22.2% from 23.3% last week. Retail traders/investors are exuberant, but they only make up 10% of daily trading volume (down from 15% in September).

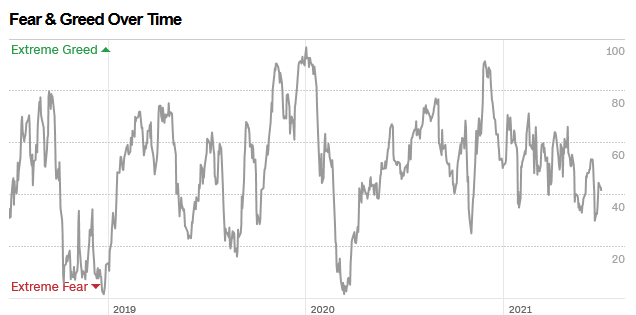

The CNN “Fear and Greed” Index increased from 35 last week to 43 this week. There is still a “wall of worry” present in the market. You can learn how this indicator is calculated and how it works here:(Video Explanation)

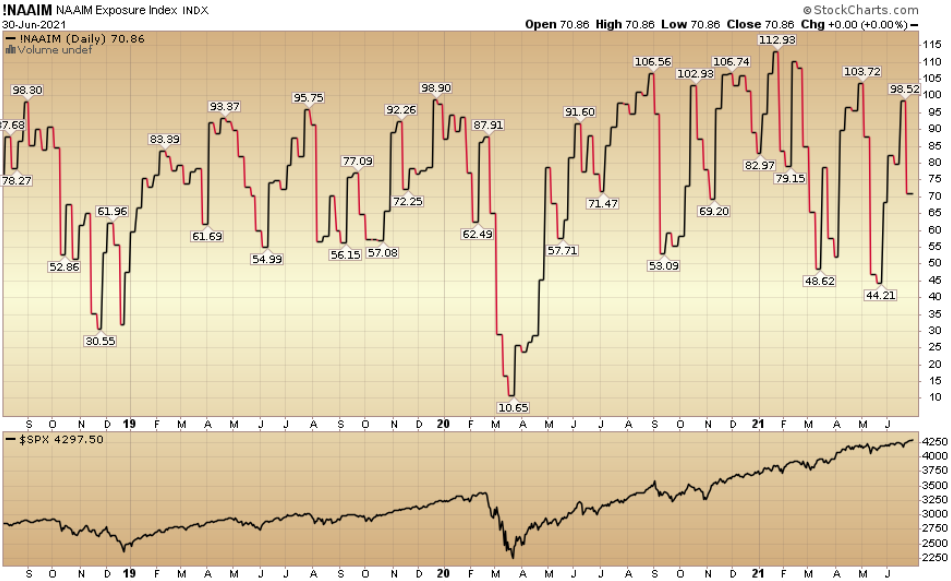

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 70.86% this week from 98.52% equity exposure last week.

Our message for this week:

With Q2 earnings season coming up in the next couple of weeks, expectations are high. Consensus is that S&P 500 grew earnings by 62.8% year on year. The good news is that number will likely be beaten and come in ~70%. The bad news is that you will start hearing “peak growth” every time you turn on the TV in coming weeks and months. That may keep rates subdued in the short term.

Selective Tech (see above) and Selective Defensives (Utilities, Staples and Pharma) is where we believe opportunity is right now (for Summer) as cyclicals will likely shake out some of the “late money” in coming months – before resuming their uptrend/new highs later in the year (we are still in the early stages of a new business cycle).

We have modestly trimmed (taken profits) on some of our cyclicals from last year over the past month (kept core positions) and will potentially add back to them in coming months on weakness.

They may say nothing lasts forever

But they ain’t seen us together (at least for now)…