This week’s Stock Market theme song is Morgan Wallen’s “Chasin’ You.” Managers who were dramatically underweight equities – and missed the rally – were reluctantly forced to succumb to Morgan’s lyrics this week. They scrambled to gain equity exposure and chased the stock market rally:

Chasing you like a shot of whiskey

Burning going down, burning going down…

In our March 19th article we stated, “We are selectively and slowly adding to those stocks/sectors which are nearing valuation levels that we would define as ‘pricing in at/near the worst case scenario.’” You can see a list of some of the stocks in the article here:

The Spanish Flu – Coo coo ca choo – Stock Market (and sentiment results)…

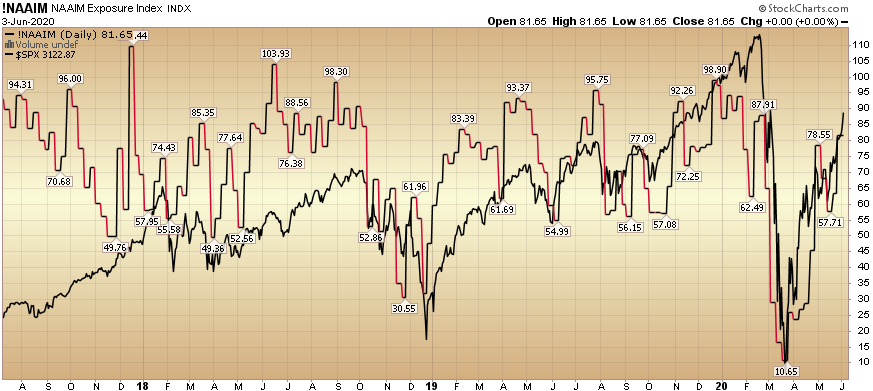

The following week (on March 26th) we pointed out that, “Active managers will have to regain exposure in coming weeks as the worst of the news starts to move into the rear view mirror” when they were at just 10.65% equity exposure. You can review that note here:

The Luke Combs, “Beer Never Broke My Heart” Stock Market (and Sentiment Results)…

Since the crash ~10 weeks ago, we have been making an aggressive case to buy the “laggard cyclical/value stocks” as they historically outperform coming out of recessions. Since Q1 and Q2 are negative for GDP growth, it will be deemed a “Recession” despite the fact that it was a voluntary health choice to protect the most vulnerable from coronavirus.

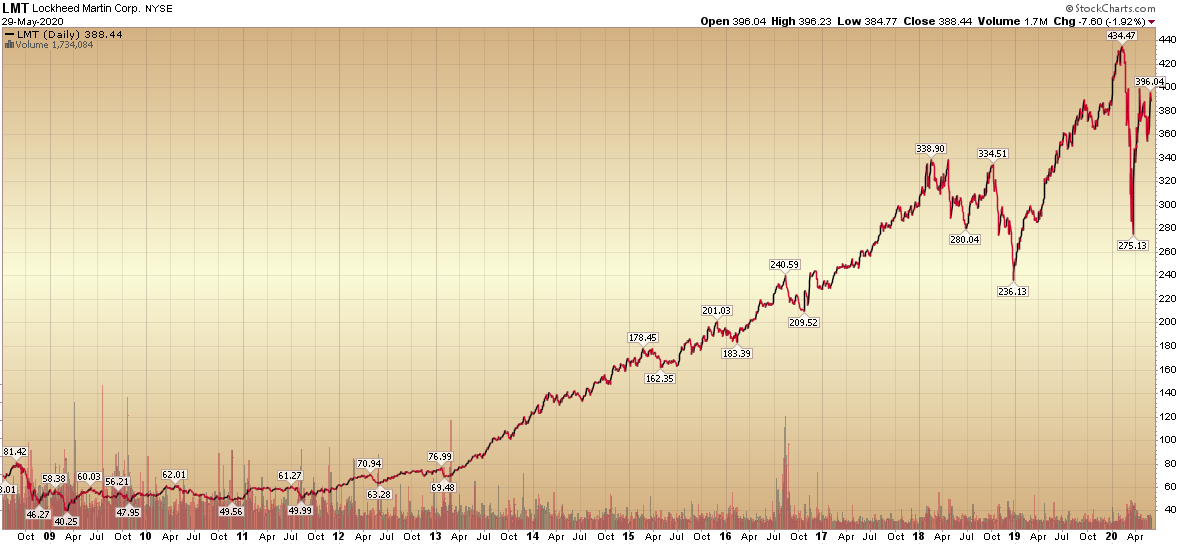

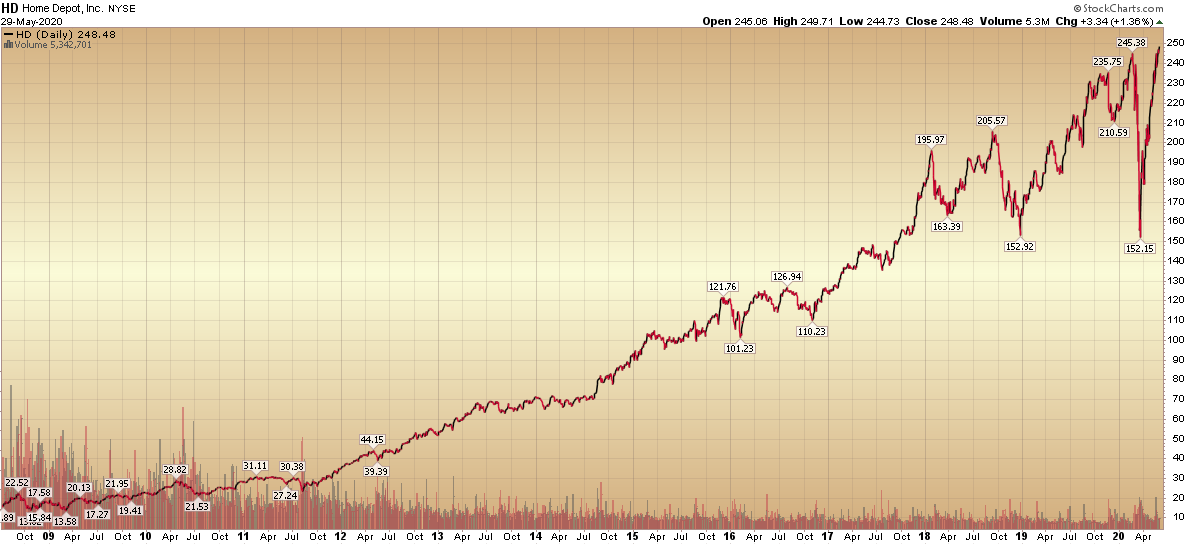

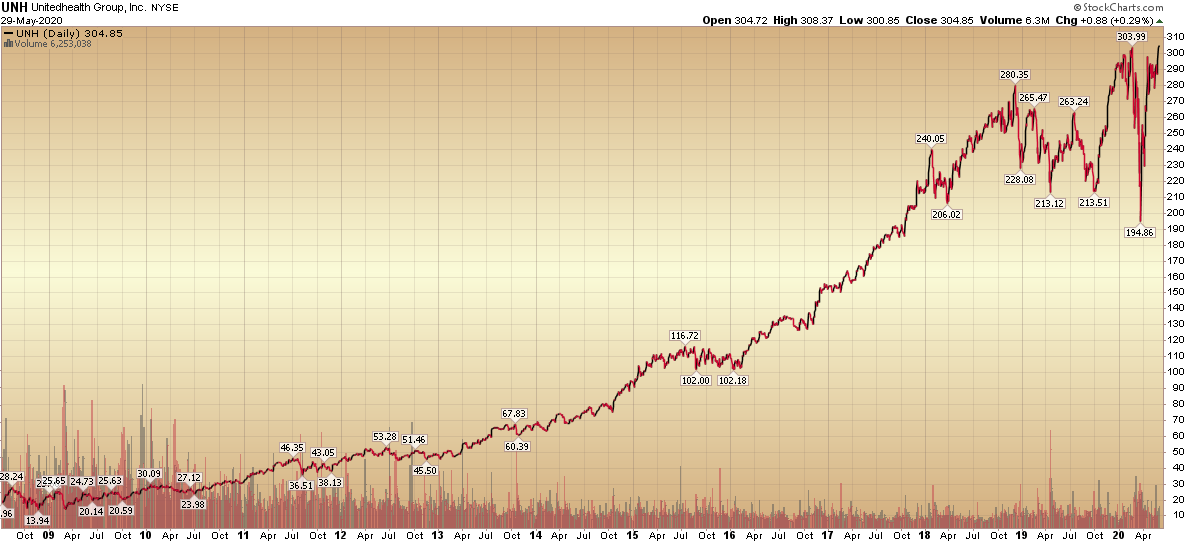

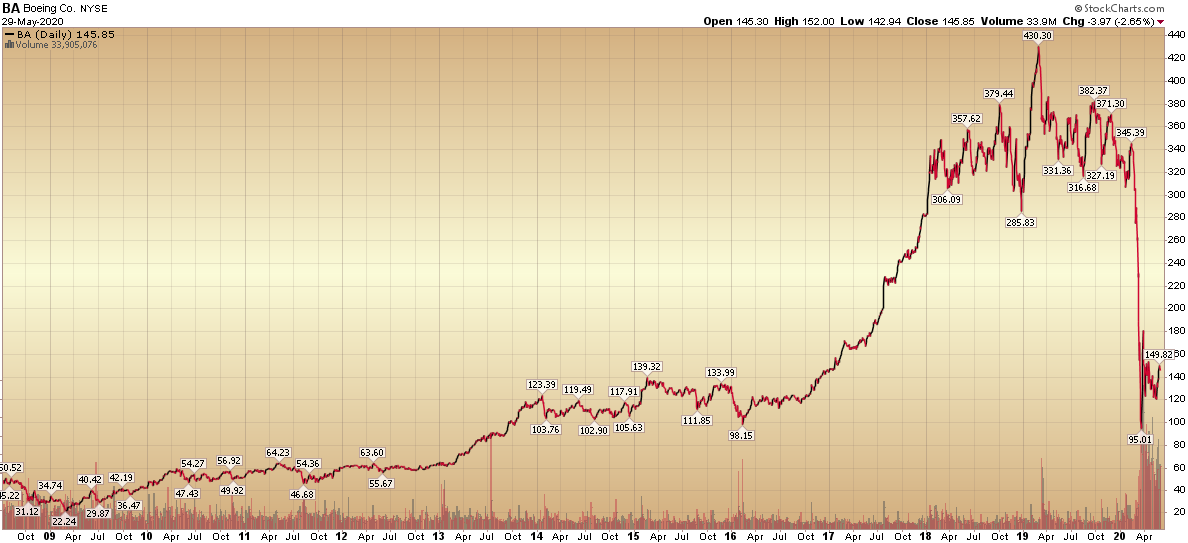

On Monday I was on Fox Business for the “Claman Countdown” show. Thanks to Liz Claman and Ellie Terrett for having me on. In this segment, I re-emphasized this theme – pointing out that some of the best performers since the last recession were “left for dead” value stocks coming out of the last recession in 2008-2009.

All 5 stocks I named appreciated at least 10x (900% or greater) in this cycle. No one wanted to touch them coming out of the recession as they were “boring” value stocks.

So it is not a question of value versus growth, but rather, “what works best empirically coming out of recessions?”

Among the sectors/cyclicals I have been emphasizing in recent weeks are Banks, Defense Stocks, Home Builders, Small Caps and Energy. As we covered last week, they have all outperformed since the March 23rd lows. The relative out-performance for these cyclicals expanded even further this week:

The Dua Lipa “Did a full 180” Stock Market (and Sentiment Results)…

With all of these groups up huge in the last month or so, the last remaining group that still offers some significant value (even after the rally) is banks. There are two core catalysts:

- The yield curve is steepening – which will help net interest margin.

- CCAR “Stress Test” results will be out in coming weeks and likely show that banks are better capitalized than anticipated (see previous notes for explanation).

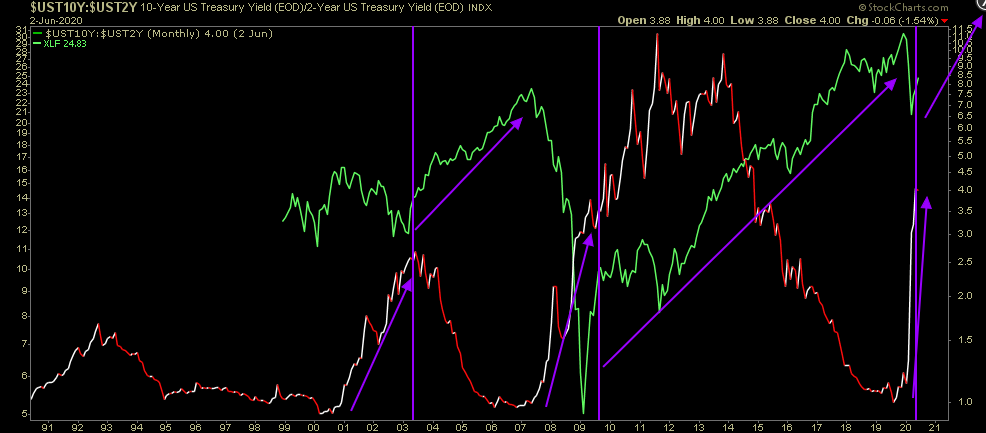

This chart helps us understand what has happened to financials following a quick steepening of the yield curve (after it has inverted):

The chart above is the 10yr yield to the 2yr yield (red and white line). When it gets below 1 it is inverted. That happened last summer. Historically, that presages a recession 6-18 months out. We got one (Q1 and Q2 will be negative GDP – so a technical recession). The recovery may come just as quickly due to the global fiscal and monetary stimulus that we have covered in recent notes and media spots.

If you look after the last few inversions, when the yield curve 10:2 yield ratio rose from inversion at 1 to the 3-4 range, the Financials sector took off (Green line). You can see this denoted by looking at the purple vertical lines above and see what happened to the green line (XLF: Financials Sector) after these levels were hit. This level of yield curve steepening preceded multi-year rallies for banks/financials. This is also consistent with the data that supports cyclicals’ out-performance coming out of recessions. You can see our case for cyclicals from mid-April here:

The Kanye West, “Drive Slow” Stock Market (and Sentiment Results)…

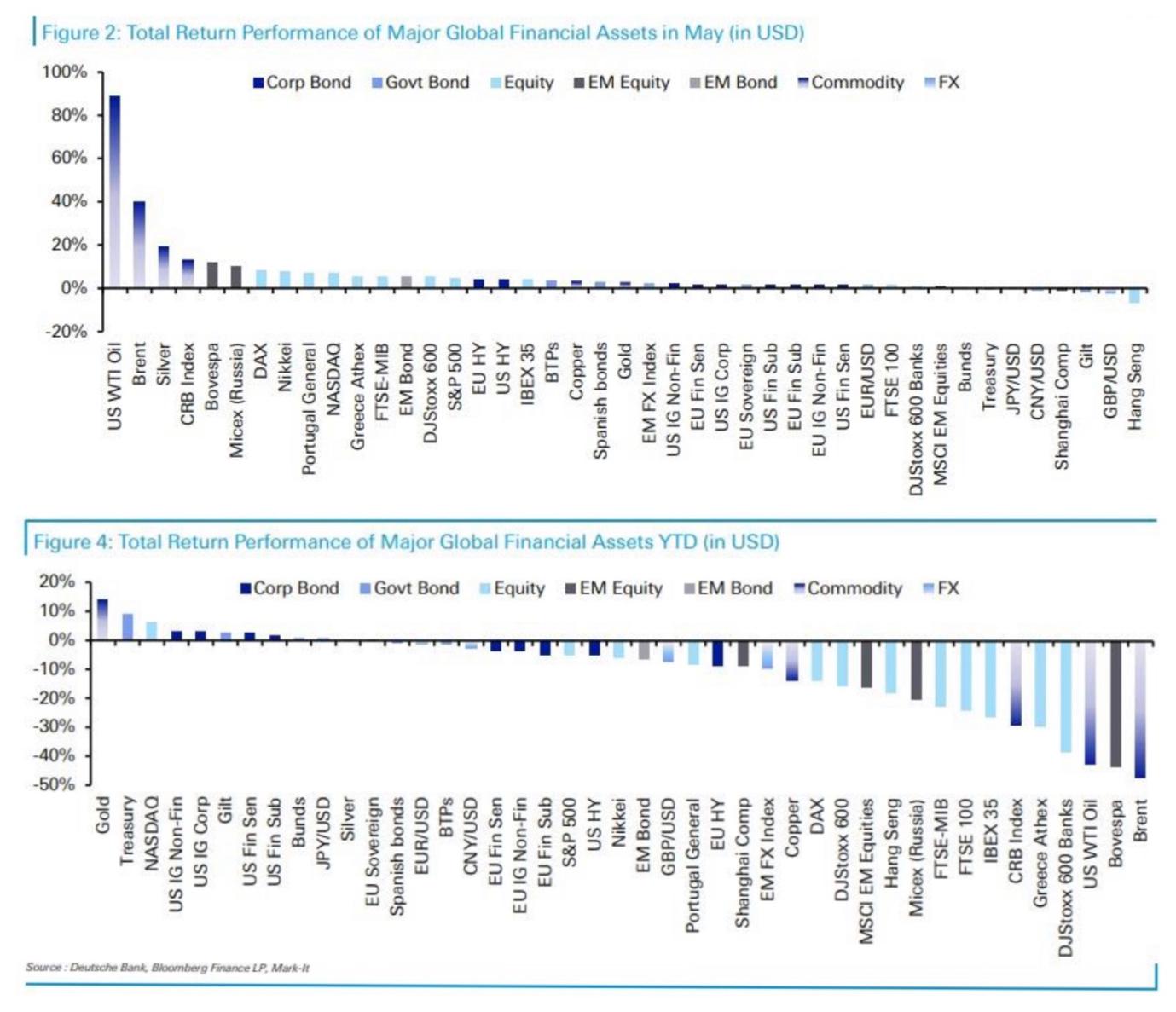

Below you can review the asset performance for global assets in May and Year-to Date (Source: Bloomberg/DB):

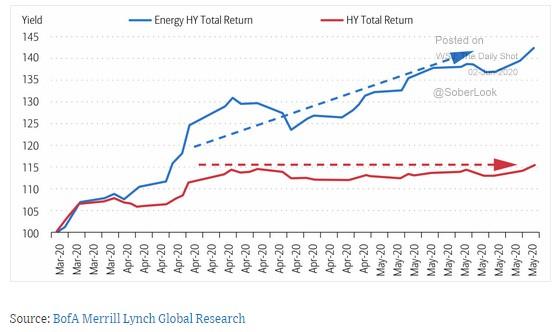

Of note – which is also in line with our cyclicals thesis – is the fact that High Yield Energy Credit has outperformed the High Yield Credit Index (as a whole) since the market low (source: BofA via WSJ Daily Shot). In our early April notes we discussed our focus on HY credit during that period. You can review all past notes here (Weekly Research Note Archive).

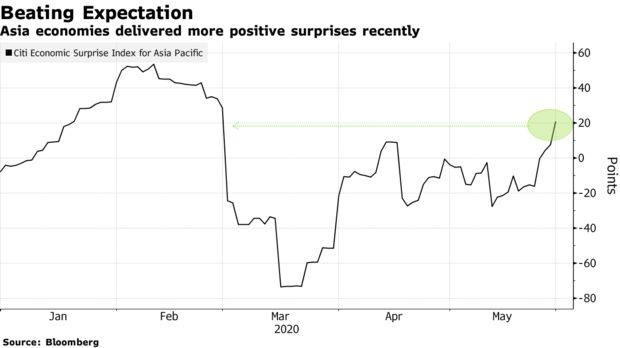

The Citi Global Economic Surprise Index (for Asia) beat expectations this week. This is consistent with the subsequent news that China’s manufacturing activity unexpectedly expanded in May (CNBC):

We also believe the US/China tensions are likely to stay contained and constructive in coming months. Thank you to Mariko Oi and Derek Cai for having me on BBC News (World) to discuss this subject last night. You can view it here:

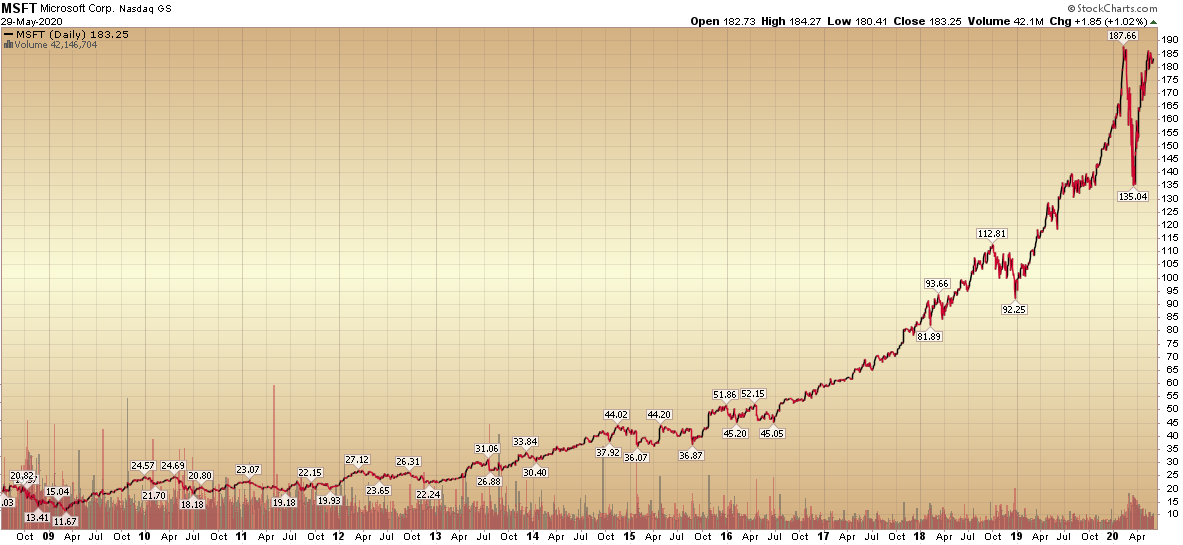

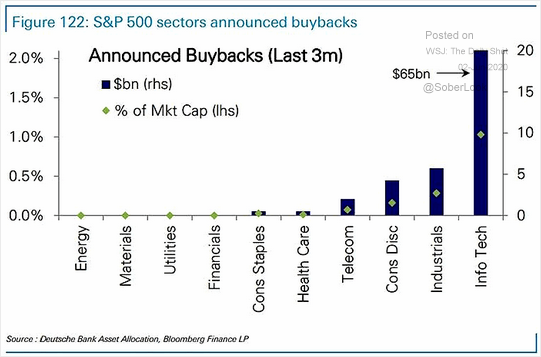

The Tech Sector remains on a buyback binge despite trading at historic valuation levels. Where were the buybacks in 2009?

(Source: Bloomberg via WSJ Daily Shot)

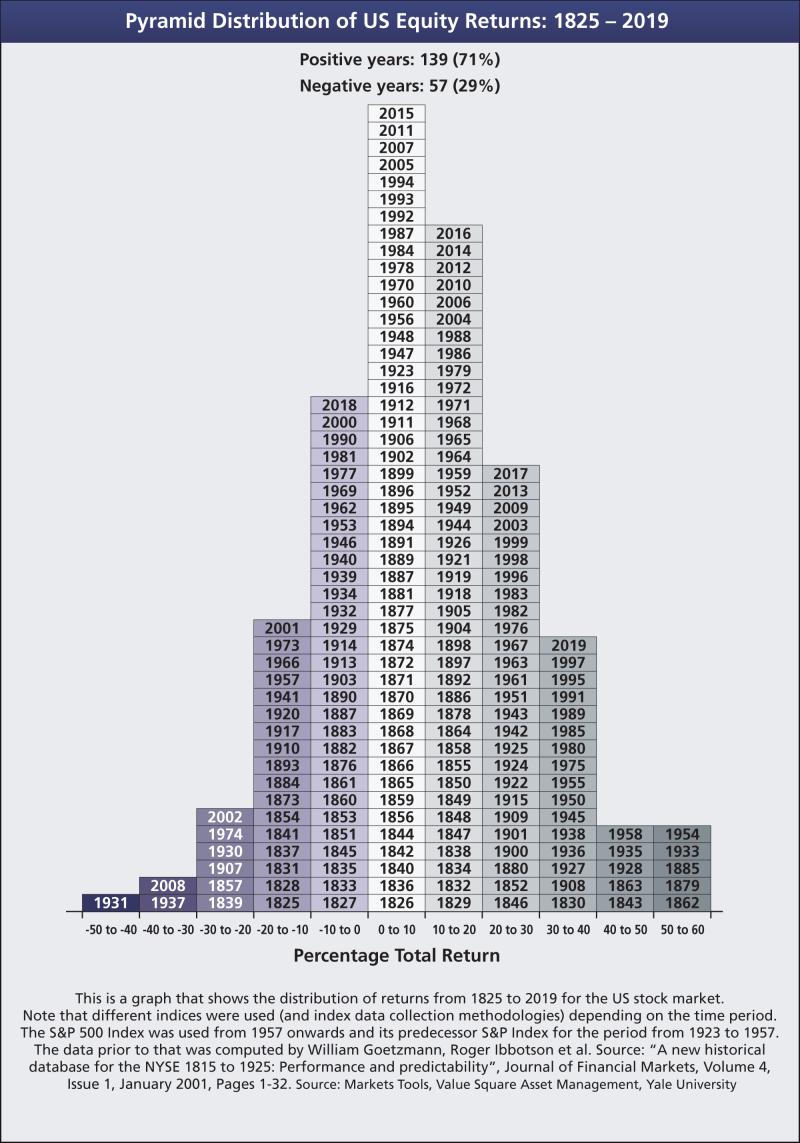

And finally, you can see where this year’s performance is lining up in the historic distribution (source listed in picture):

Now onto the shorter term view for the General Market:

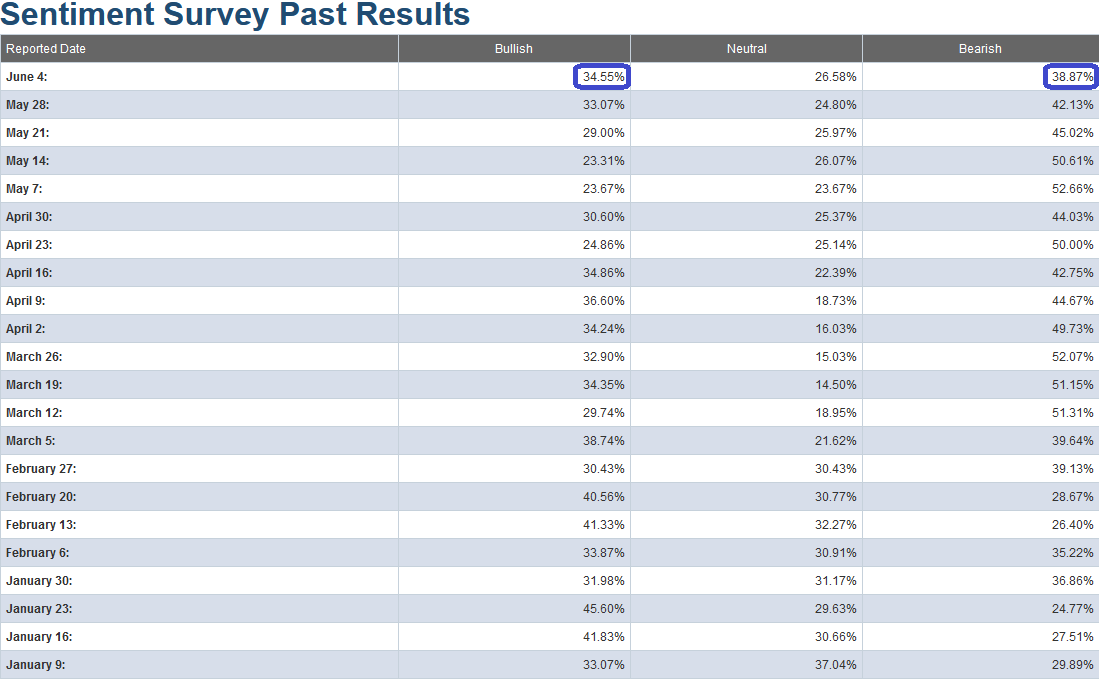

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) rose to 34.55% from 33.07% last week. Bearish Percent came down to 38.87% from 42.13% last week. Fear is thawing for individual investors, but there are no signs of euphoria in these numbers at present.

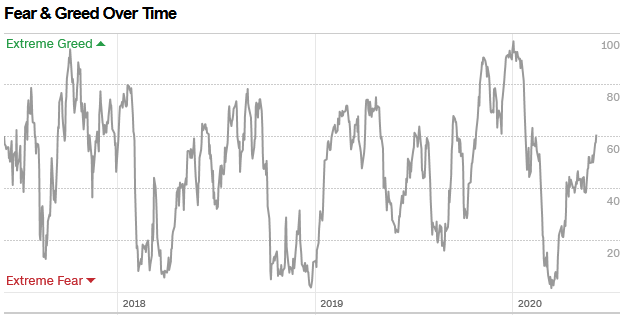

The CNN “Fear and Greed” Index ticked up from 54 last week to 61 this week. The fear continues to thaw and will move in fits and starts in coming weeks. You can learn how this indicator is calculated and how it works here: (Video Explanation)

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose from 63.22% equity exposure last week, to 81.65% this week. Managers are chasing at these levels in a late effort to catch their benchmarks.

Our message for this week:

We have had a monster run in the last ~10 weeks. For this rally to continue (already up ~40% off the lows) we will need to see this trend of broadening participation and partial rotation (from leaders to laggards that we discussed in previous weeks’ notes) PERSIST…

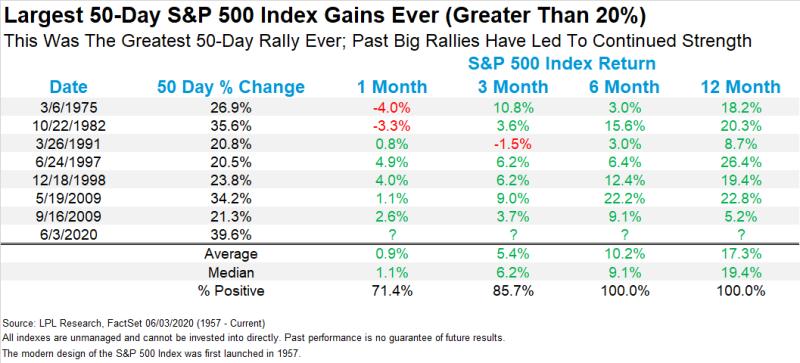

Ryan Detrick of LPL Financial put out a useful table today that shows what performance looks like after a 50 day rally of this speed and magnitude:

While the strength historically persists, it tends to be subdued in the short term (0.9% return avg. for the subsequent 30 days)…

Of further note, some short term indicators are getting near extremes. For example, the 10 Day moving average of the Put/Call Ratio has now fallen to near the .50 level. As you can see below – by looking at the blue vertical lines – it does not mean that you get a pullback every single time, but it usually does at least slow the pace in the short term.

In the last couple of sessions we added a few shorts – in frothy pockets of the market – to hedge part of our equity exposure from mid-March to early April purchases (which we are holding for the long term). These names should perform even in the event of continued strength in the general indices.

We also topped up a few selective cyclicals long (in the past week) that were still trading at historically subdued valuations and levels. We believe these names can continue to perform and play “catch up” even if the general indices slow/pause or take a breather in the coming weeks.

In case we forgot to mention it REPEATEDLY for the last eight to ten weeks: We still like Banks (as noted in the featured image for this article)!

We also like and own pockets of Defense Stocks, Home Builders, Energy, and Small Caps. It will not be a straight line up, but over the next 6-18 months we believe we will see relative strength in these groups. This will happen as demand kicks in (people continue to return to work) and the (what will be) >$10T of stimulus/aid/liquidity starts to circulate in the economy (velocity picks up).

We may see growth levels by 1H 2021 that would not be possible if not for COVID-19 – as we would never have this level of global FISCAL (and monetary) policy at play.

Retail investors are still cautious – not yet at euphoric levels, but active managers tripped over each other to “panic buy” the rally this week – which is why we added the small short term hedge in a few frothy names. We remain constructive in the intermediate term and will take advantage of any additional buying opportunities in laggard/cyclical names – should they arise in coming weeks.