In 1984 Prince released “When Doves Cry” on his Purple Rain album. It was his first Billboard 100 hit and held the #1 spot for five weeks. We thought we would refer to some of his famous lyrics to wrap our arms around the Federal Reserve decision this week:

This is what it sounds like

When doves cry

When doves cry (doves cry, doves cry)

When doves cry (doves cry, doves cry)

On Tuesday, I was on Fox Business with Ashley Webster on the Claman Countdown. Thanks to Ellie Terrett, Ash Webster and Liz Claman for having me on. I was asked to speak on my expectations regarding Fed action on Wednesday (in the face of hot PPI and CPI inflation numbers):

Our expectation (show notes) proved to be accurate:

“The Fed has a dual mandate of price stability and maximum sustainable employment.

Looking back to Feb 2020 (pre-pandemic): The unemployment rate was 3.5% (with 5.7M unemployed)

Today: The unemployment rate is 5.8% (with 9.3M unemployed)

Chair Powell has repeatedly stated that he is willing to let the economy/inflation run hot in order to avoid the long-term structural unemployment we faced following the great financial crisis in 2008.

While recent PPI and CPI numbers have come in hot, I do not believe this will deter Chair Powell from staying the course and delaying tapering (from Q4 2020 consensus) to at least Q1 2021 (after his re-appointment).

The recent 2 jobs report misses, lighter retail sales than expected, and copper/lumber/grains all softening in recent weeks (despite Oil remaining elevated), give them cover to keep rates at 0% until 2023 and defer tapering (reducing $120B/mo. of asset purchases) until 2022.

This means that the yield sensitive groups – which fell on inflation (and tightening fears) earlier this year – Tech, Utilities, Staples, Healthcare could begin to outperform the groups that led in the beginning of the year (Energy/Financials).

For the market to power to new highs, Big Tech (over 20% of the S&P 500) will have to participate this summer – which is probable considering the Fed is likely to remain dovish. Always be cautious of responding to the first move after the announcement.

After grinding sideways for 1 year, we like AMZN for US tech. AMZN AWS grew 32% yoy, but their “Other”business (which is mostly advertising), grew 77%. It is now 2.4x bigger than SNAP, TWTR PINS, ROKU advertising businesses COMBINED!

We also like the “Chinese Amazon” Alibaba because you can buy it at 2018 prices despite the fact the business has doubled (Revenue, Cashflow, and Earnings per share).

We think these groups (Tech, Utilities, HC, Staples) will do better in coming months. The “reflation trade” Energy, Financials, Cyclicals should come back strong again toward the end of the year as tapering becomes more imminent in 2022.”

When Doves Cry

While the Fed remained on hold with even “talking about tapering” and Chair Powell stated that you could view this as the meeting that they were talking about talking about tapering at some point in the future, nothing changed in his commitment to keep the pedal to the metal until full employment is achieved.

His colleagues however started to blink (Crying Doves). As you can see in the Dot Plot below, it showed 13 of 18 officials favored at least one rate increase by the end of 2023, versus 7 in March:

Chair Powell largely referred to this projection as unimportant during his Q&A. “The dots should be taken with a big grain of salt,” Powell said, referring to the interest-rate forecasts. He cautioned that discussions about raising rates would be “highly premature.” The FOMC raised its projections for economic growth. GDP was seen expanding 7% this year, up from a prior projection of 6.5%. The Fed maintained the 2022 expansion forecast at 3.3% and raised the 2023 estimate to 2.4% from March’s 2.2%. (Chart and Quote Source: Bloomberg)

The market responded with dollar up, rates up, equities and commodities softer. But as I alluded to in the “show notes” on Tuesday, the first move is not always the correct move. The Fed effectively took itself out of the market until 2022. It will take a few days to digest, but our sector views for the Summer have not changed. Part of this is due to sentiment and positioning among institutional managers:

Bank of America Fund Managers Survey Summary

~207 Managers overseeing ~$645B AUM responded to this month’s BofA survey (June 4-10). Here was the biggest takeaway in my view:

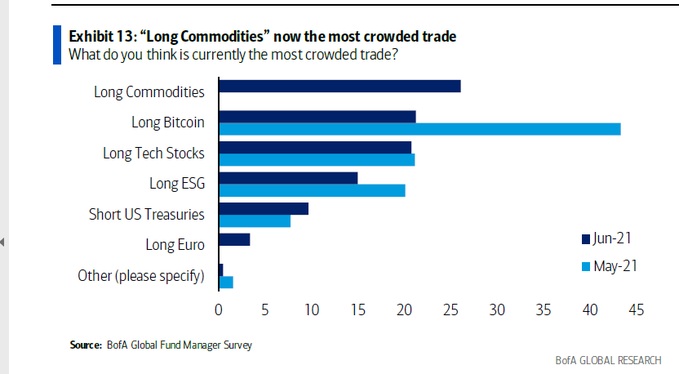

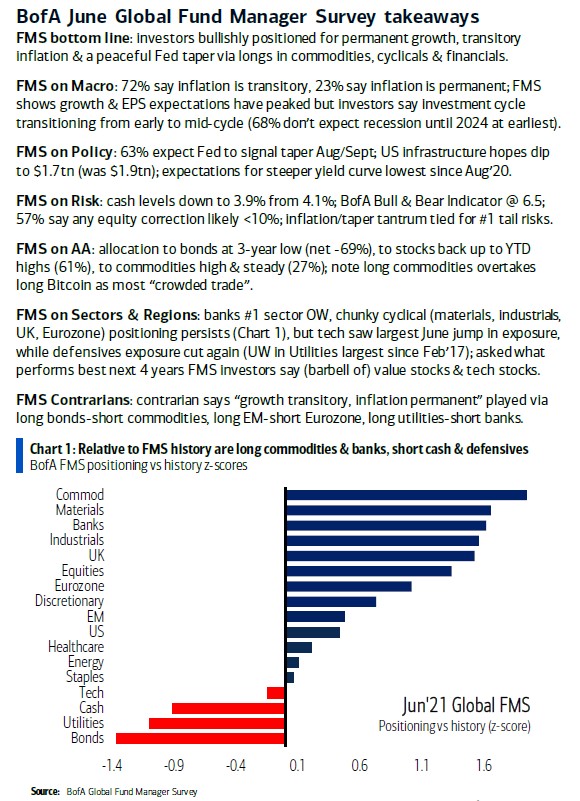

When we were aggressively touting cyclicals in the Summer and Fall of last year (when no one wanted them), everyone wanted Big Tech (which has done nothing for 12 months).

Now that institutional managers have reluctantly “capitulated” into cyclicals (after 100%+ moves) AND dropped exposure to Tech, we know everything we need to know for our next step (we’ve been talking about adding selective pockets of Tech for the past few weeks).

Fund managers are now overweight cyclicals, with a net 30% overweight banks, a net 11% overweight energy and a net 23% overweight materials.

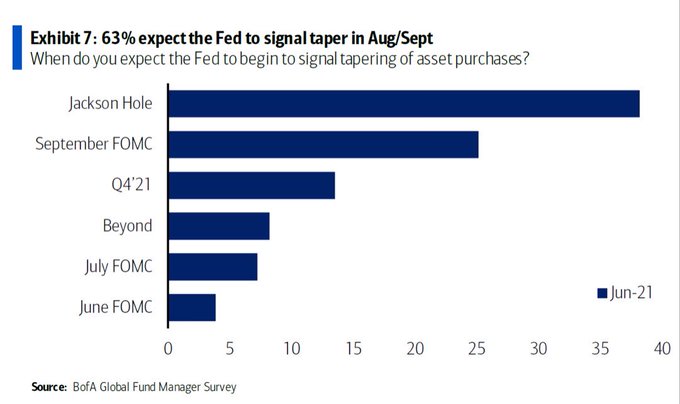

Another key takeaway from the Survey was that 63% expect the Fed to signal taper in Aug/Sept:

While they may “talk about” tapering in Jackson Hole, the tenor of Powell’s commentary on Wednesday signals to me that he’s in no rush to taper until 9.3M unemployed Americans are able to get jobs.

Myles Udland of Yahoo! Finance made a key point on Twitter:

“The key chart from BofA’s latest fund manager survey — the last time growth expectations flipped from early-cycle to mid-cycle, the economy grew for 9 more years:”

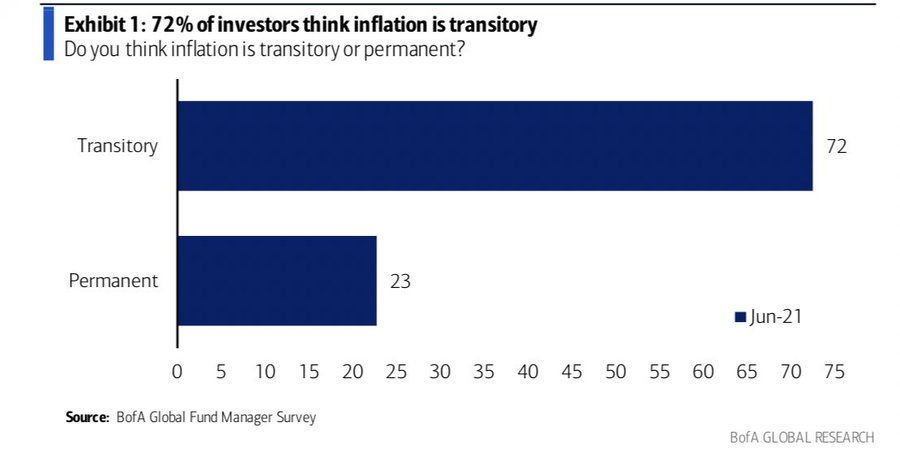

What is conflicted is that managers have crowded into cyclicals and commodities – while at the same time viewing inflation as transitory:

MANAGERS’ OUTLOOK:

-72% say inflation is transitory, 23% say inflation is permanent.

-A net 75% expect a stronger economy, down 9 percentage points from the previous monthly survey.

-41% of respondents expect the global economy to get “a lot stronger,” down 8 percentage points from last month.

-A net 67% expect global profits to improve over the next 12 months, down 11 percentage points month-over-month.

-A net 64% of respondents said they expect higher inflation in the next 12 months, down 19 percentage points from last month.

-A net 59% of fund managers are expecting higher short-term rates, down 4 percentage points from May.

-A net 59% of respondents now expect a steeper yield curve, the lowest since August.

-57% say any equity correction likely less than 10%.

-A record net 76% of global fund managers expect above-trend growth and above-trend inflation for the global economy over the next 12 months, up 7 percentage points from last month.

-Only 13% say it’s a bubble.

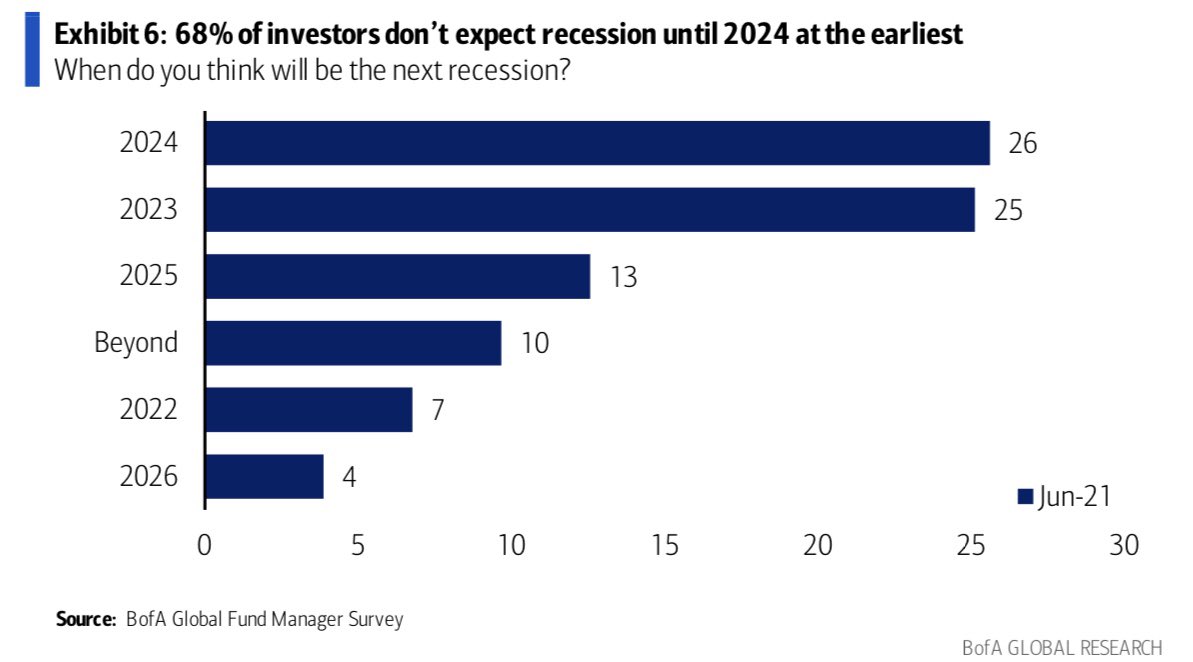

-68% of fund managers don’t expect recession until 2024 at the earliest, while 26% think a recession will occur in 2024 and 25% in 2023.

SENTIMENT:

-Bull & Bear Indicator at 6.5

-Any equity market correction in the next six months likely to be less than 10%, according to 57% of investors

POSITIONING:

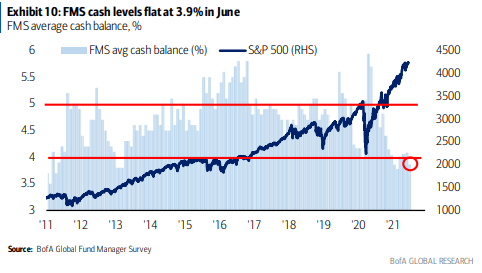

-Cash levels down to 3.9% from 4.1%.

-Cash levels at 8-year low.

-Equity & commodity allocations at highest since 2011.

-Investors remain close to an all-time high overweight in equities.

-Asset allocation to bonds is at a 3-year low at net -69%, while allocation to stocks is back up to year-to-date highs at net 61% overweight.

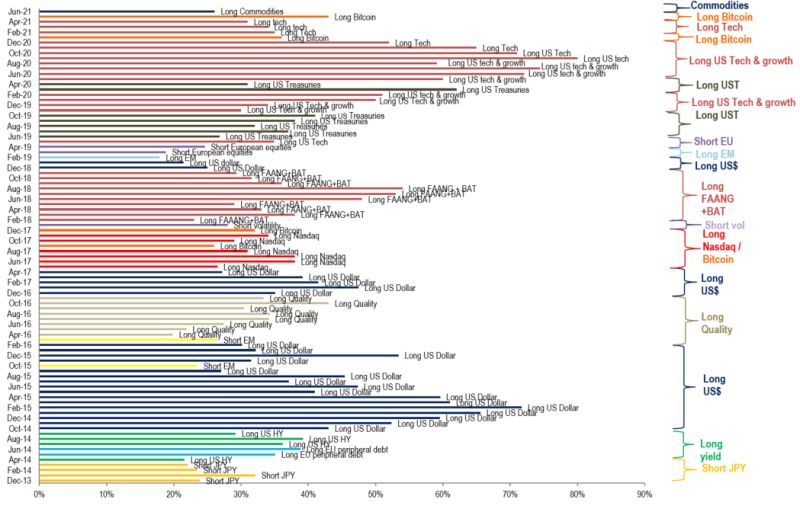

MOST CROWDED TRADES:

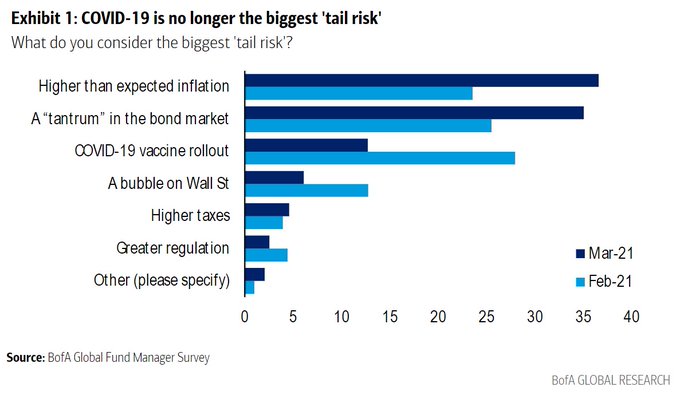

BIGGEST TAIL RISKS:

BANK OF AMERICA COMMENTARY:

Now onto the shorter term view for the General Market:

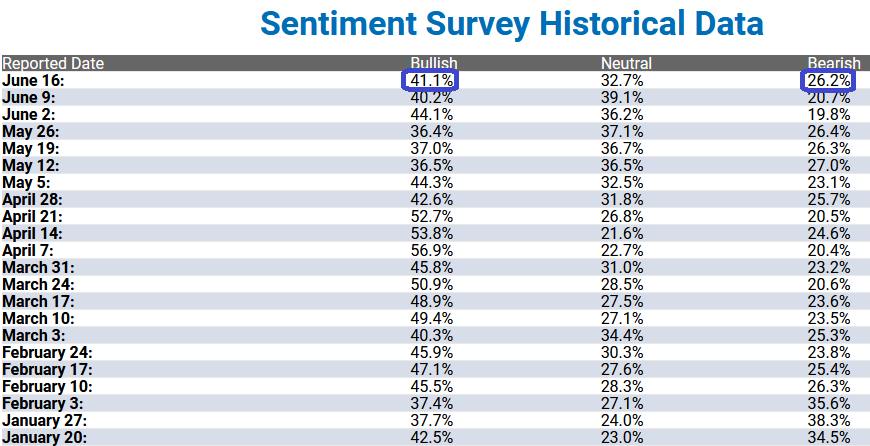

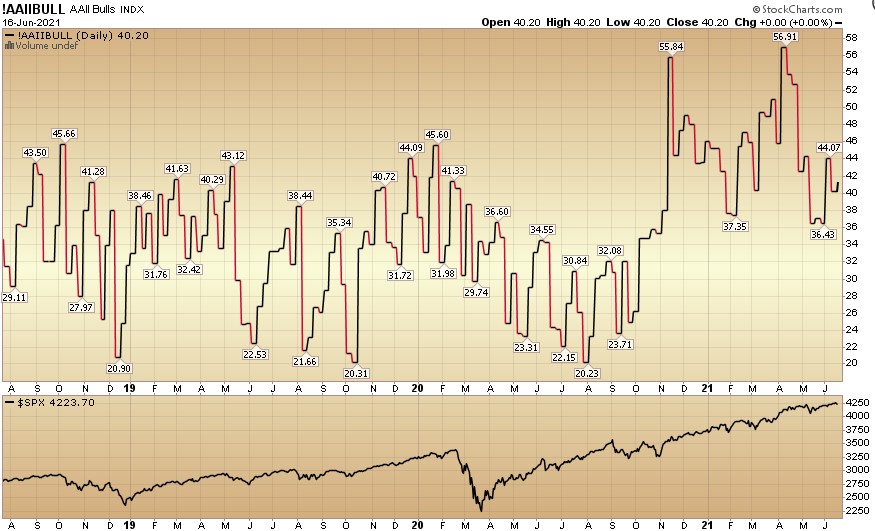

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) flat-lined to 41.1% from 40.2% last week. Bearish Percent increased to 26.2% from 20.7% last week.

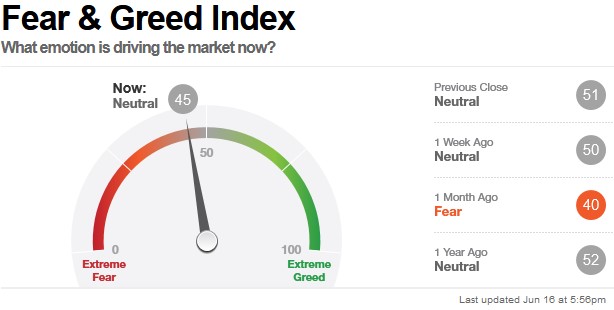

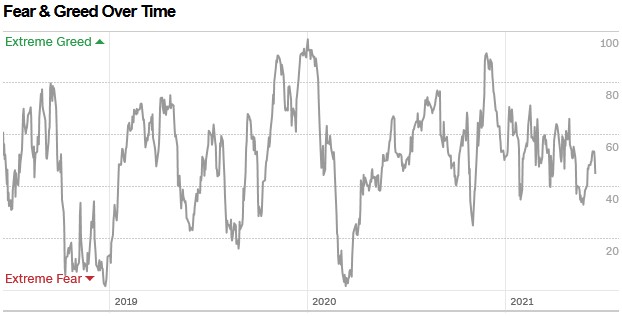

The CNN “Fear and Greed” Index declined from 50 last week to 45 this week. This is a neutral reading. You can learn how this indicator is calculated and how it works here: (Video Explanation)

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) moderated at 79.65% this week from 82.27% equity exposure last week.

Our message for this week:

There’s selective opportunity to be had in Tech. We’ve been talking about it for the past few weeks and building up our positions in BABA and SPLK. This week we added NFLX and added to our China (and SPAC warrant) exposure. You can see our thoughts on NFLX from Friday when we joined Ash Webster on the Claman Countdown (thanks Ellie Terrett):

This (selective Tech/Defensives) is where we believe opportunity is right now as cyclicals will likely shake out some of the “late money” in coming months – before resuming its uptrend/new highs later in the year (we are still in the early stages of a new business cycle).

In the mean time, ignore the crying doves as Chair Powell is still driving the bus…