In 1980, Martin Scorsese released a film called “Raging Bull.” It starred Robert De Niro, and although the film received mixed reviews upon its release, after its release, Raging Bull went on to garner high critical acclaim. It is now often considered Scorsese’s magnum opus and one of the greatest films ever made.

One of the memorable quotes of the film was, “If you win, you win. If you lose, you still win.” — Joey La Motta

That philosophy has been our guiding light behind suggesting “high yielding stocks with dividend growth.” In last week’s note we concluded with this statement:

“We are building up selective positions in Consumer Staples, Utilities and Big Pharma. We have added aggressively all week.”

Here’s what has happened to all 3 groups since (most names are up 5-10%+):

UTILITIES:

STAPLES:

BIG PHARMA:

On Tuesday I was on Fox Business with Liz Claman. Thanks to Liz and Ellie Terrett for having me on.

In the segment, I clarify the key catalyst to the move into these groups and identify several names we are focused on at present:

The key is Rates:

We were on Liz’s show a week prior suggesting that the “rate of change (in rates) should slow” and to start looking at Utilities, Consumer Staples, and Big Pharma (yield plays/safety).

Friday was the catalyst – as BOJ’s Kuroda shocked markets when he decided against widening the band (effectively capping their 10yr JGB yield at zero).

While Japan has been a net seller of Treasuries for the last 5 years, this move (from Kuroda) makes it economic to start buying again as they can make ~100bps spread (after currency hedging costs).

With that, the ten year yield is coming in and those sectors that have sold off due to the rapid rise in yields are now starting to bounce.

While some parts of Tech will benefit as yields stabilize/cool, the “slow growth” economic environment that propelled them in 2020 is no longer present. GDP is projected to grow between 7-9% in 2021. Couple that with tougher “comps” starting in Q2 – as Tech pulled forward a ton of growth last year (with everyone stuck at home).

Since managers no longer have to “pay up” to find earnings growth (as growth opportunities are now plentiful in cyclicals/value), we think the way to play the short term normalization of rates is “yield plays” like:

Utilities (AEP, D), Pharma (PFE, MRK – possible COVID anti-virals coming later in year), and Staples (K, CPB). This trend should persist in coming months. All six of these names yield 2x that of the 10 year treasury. That current yield excludes future dividend increases.

In the case of Utilities, the sector was down ~12.25% in the past few months, while 2021 earnings estimates for the top 27 weights were down only -.88%:

This was clearly a case of, “If you win, you win. If you lose, you still win.” Even if rates had not stabilized and we “lost” (because the dividend would be less valuable in a higher rate environment), we would still win because the earnings power remained stable (in spite of the market’s overreaction to rising rates). Furthermore, we also win if the market adds volatility – since all three groups are defensive sectors and will hold up better in a choppy environment.

Our favorite two names were down ~20% each (despite EPS estimates holding firm) at the time we posted the article and suggested the group on Fox Business. The are now up ~9% each in just over a week.

“In the short term the market is a voting machine. In the long term it is a weighing machine.” (Ben Graham) The unusual circumstance in this case was the rapid rise in rates over the first two months of the year. The 20% drop was a “mis-appraisal” that created an opportunity for us to step in.

The unusual circumstance in this case was the rapid rise in rates over the first two months of the year. The 20% drop was a “mis-appraisal” that created an opportunity for us to step in.

If we were wrong about the rate rise slowing, we’d still win as the underlying earning power of the business was unimpaired.

Last night I was on CGTN America with Rachelle Akuffo discussing China Relations, the US/Hong Kong IPO markets and outlook for US/China relations moving forward. Thanks to Rachelle and Stephanie Savage for having me on:

Now onto the shorter term view for the General Market:

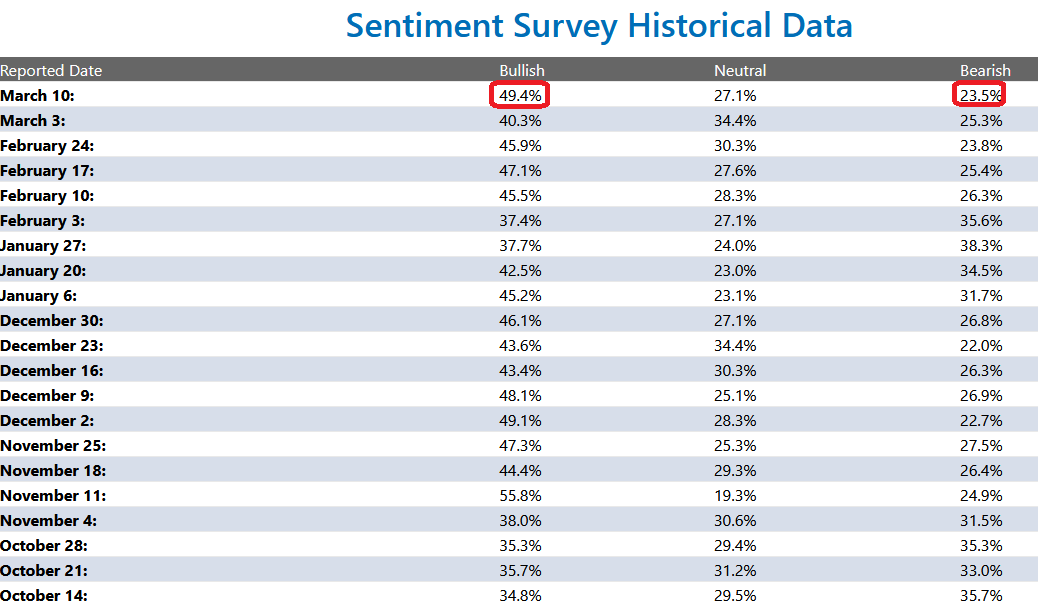

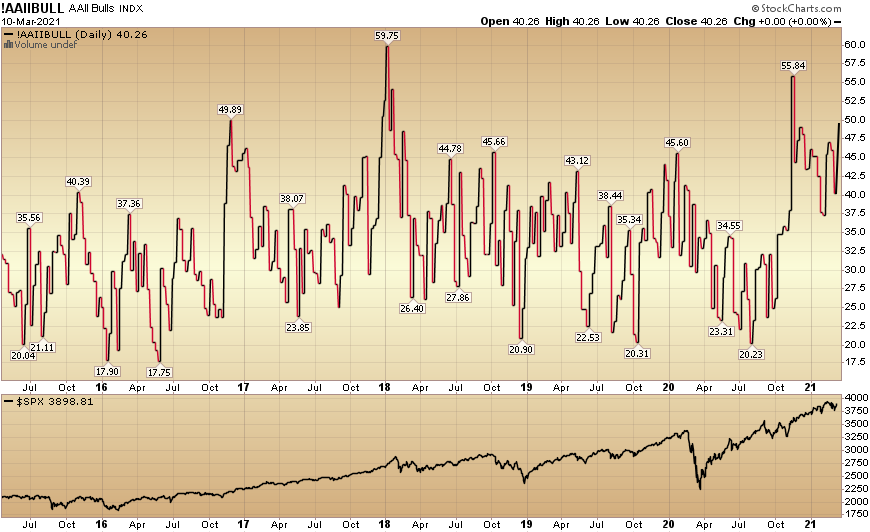

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) jumped to 49.4% from 40.3% last week. Bearish Percent fell to 23.5% from 25.3% last week. Retail exuberance is persisting.

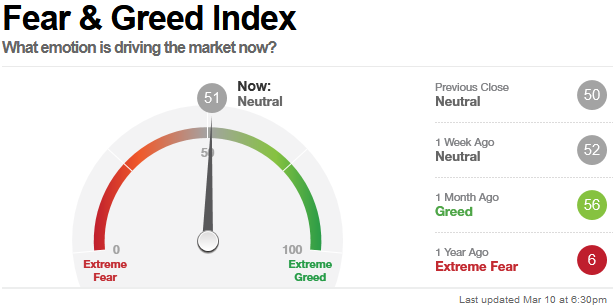

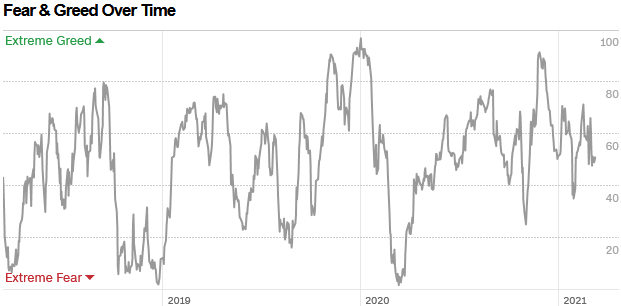

The CNN “Fear and Greed” Index flat-lined from 52 last week to 51 this week. This is a neutral reading. You can learn how this indicator is calculated and how it works here: (Video Explanation)

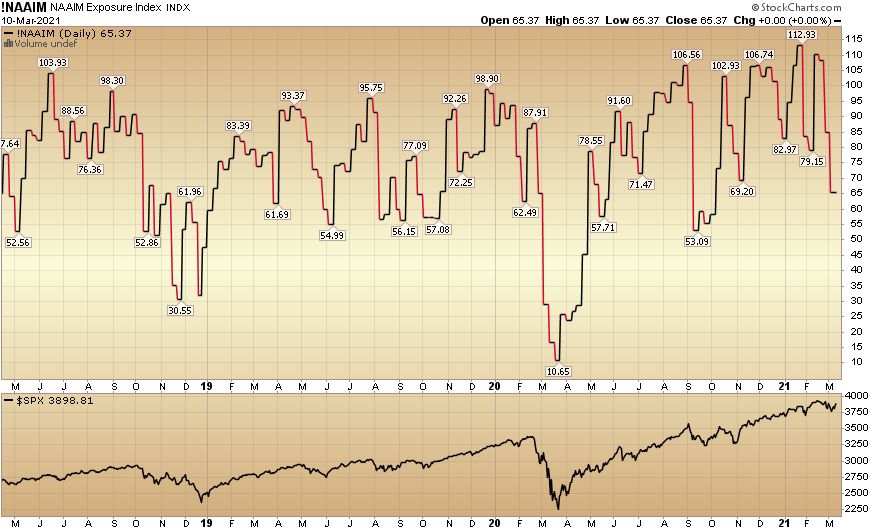

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) fell to 65.37% this week from 84.99% equity exposure last week.

Our message for this week:

We built up selective positions in Utilities, Consumer Staples, and Big Pharma. We think the rebound in this group should continue in coming months.

Reminder: Pay less attention to the general indices – as there are many crosswinds at present – and more attention to take advantage of the “rallies under the surface” through sector rotation.

And finally, remember to always look for situations where, “If you win, you win. If you lose, you still win.” When you buy right, a lot can go wrong and you still make a ton of money.

Last year we pounded the table on Banks, Energy and Defense & Aerospace. Those stocks have rocketed higher and may take a rest at some point – before resuming their new uptrend. There are still some opportunities left in Defense & Aerospace, but our NEW money moving forward will focus on the three groups covered in the last couple of weeks.