For those of you who have followed us for some time, you know we have been putting out bullish notes since the August 2019 lows. You can review each weekly note under the “Sentiment” category of the site. We called for the end of year “melt-up” just a few weeks after the 2/10 yield curve inverted in early August 2019.

Last week we were on Yahoo! Finance making the case that while there was still some upside left, the risk:reward ratio was changing. This was predicated on the fact that – while we are bullish for full year 2020 – it is likely we would start to see companies coming out in coming weeks saying Q1 was a bit soft (due to coronavirus). This week, AAPL was the first company to do so.

While we recognize that the market will look through this blip in the intermediate term, now that we are trading at over 19x forward earnings, it is likely the market will use this “softness” as an excuse to digest some of the 42%+ gains we have enjoyed off of the December 2018 lows and ~20% gains since August (S&P 500).

So while there could be as much as another 2-3% upside in coming weeks, a normal healthy pullback/correction of 7-10% at some point in the next few months is well within the realm of possibility. So the max upside of ~3% relative to the likely max downside of ~10% is where we are at for the next few months – in our view. This only matters if you are trading, not long term investing.

In the intermediate term, we are constructive for the year and expect the “softness” of Q1 to be offset in the back half by the recovery of Boeing (737 MAX coming back on line) and recovering its earnings power. In other words, I would expect new highs in the back half of the year consistent with the overall earnings growth that will manifest upon the resurgence of Boeing.

The set-up (Dec 2018 lows after ~20% correction until now – up ~42%) looks very similar to the (October 2011 lows after 20% correction to April/May 2012 – up ~32%) before you had a ~10% correction to work off the 32% rally – then going on to make new highs in the back half of the year.

The reason I bring up this analog is not because of squiggly lines on a chart, but rather market behavior which now parallels the “chasing” behavior seen in both periods and explained in my commentary below. The last time that the notional value of options as a percent of the notional value of shares hit an all-time high was Spring 2012. I explain the positioning, behavior and conditions that led to the same type of “chasing” here:

Finally, this week we put out a summary of the monthly “Bank of America Global Fund Manager Survey.” The data point that stood out to me was the “most crowded trade” being Long US Tech and Growth. As was the case in Spring 2012 and August 2018 (when tech was also the most crowded trade), this most crowded group will likely have the bigger short term pullback/correction before recovering in the back half. See the summary here:

February Bank of America Global Fund Manager Survey Results (Summary)

Now onto the shorter term view for the General Market:

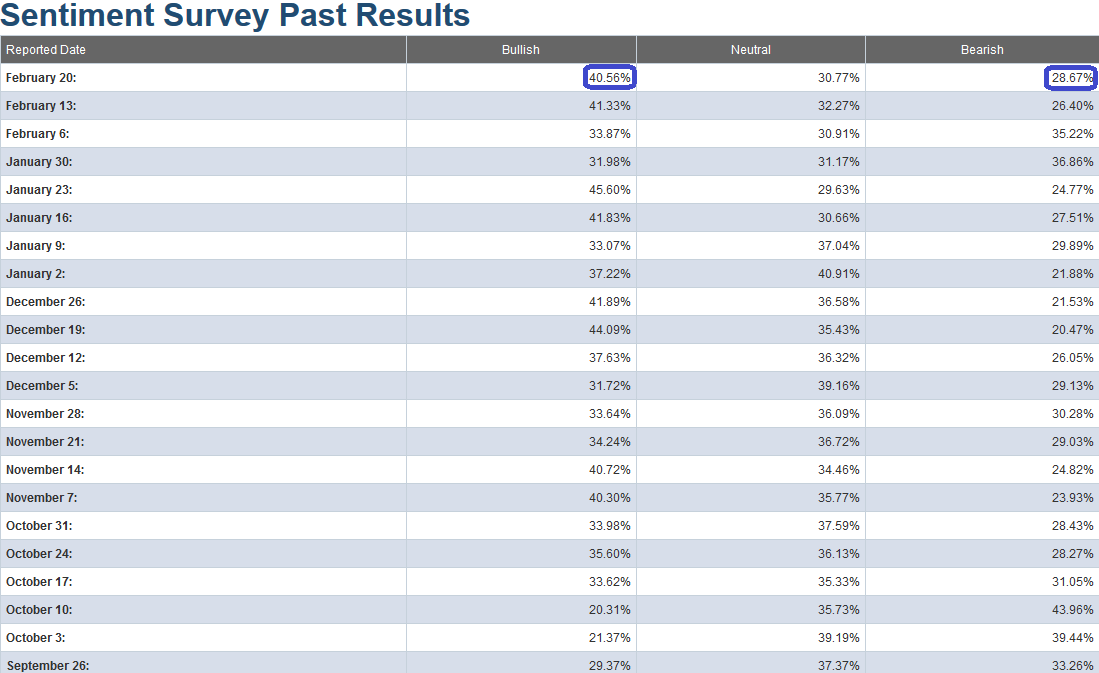

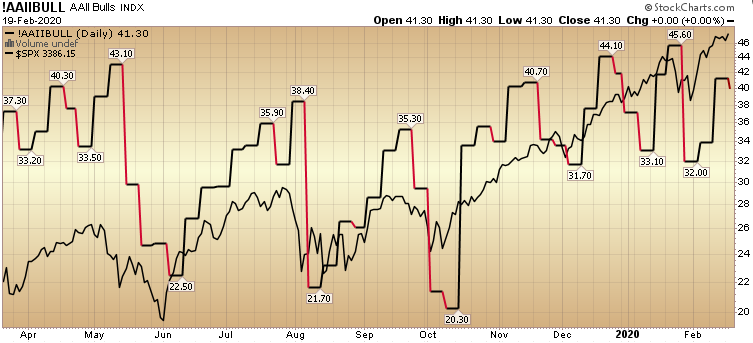

This week’s AAII Sentiment Survey result (Video Explanation) Bullish Percent fell modestly to 40.56% from 41.33% last week. Bearish Percent rose to 28.67% from 26.40% last week.

The CNN “Fear and Greed” dropped from 60 last week to 53 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation Here) jumped from 62.49% equity exposure last week, to 86.08% this week. We said last week, “Managers will have to play ‘catch-up’ once again if we get follow-through on this week’s move.” They have started this process:

Our message for this week is similar to the last few weeks:

While we remain bullish in the intermediate term (for 2020), for the short term we are getting more conservative. As we have stated in our recent notes, we have trimmed some names that have had huge runs off of the August/September lows, and had re-allocated some profits into sectors/stocks that had just begun to participate.

We have been building a long-term position in the Exploration and Production sub-sector. We are in good company in this contrarian view – “Billionaire Leon Cooperman says the market has become too pessimistic on energy stocks, too euphoric on Tesla (CNBC).” Warren Buffett more than doubled his equity investment in Occidental Petroleum from 7.4M shares to 18.9M shares in Q4 2019 (Barron’s). Here’s our thesis:

The end of oil, or just the beginning? (and Sentiment Results)

We also recently added a few selective shorts. The short positions are not due to excessive bearishness per se, but rather “special situations” that we believe will work even in a sideways to up market and outperform in the event of a pullback.

You can review our previous notes under the category “Sentiment” on the right side of the site.