Rudyard Kipling, “If you can keep your head when all about you are losing theirs… Yours is the Earth and everything that’s in it, And—which is more—you’ll be a Man, my son!”

What you read below will probably not make sense until we look back on it a month or so from now, but here it goes…

The vast majority of this article was written on Wednesday evening. Since that time, Russia has reportedly invaded/struck non-separatist regions in Ukraine. As of this addendum on Thursday morning, NATO and the US have done nothing to deter Russia, beyond a few modest sanctions.

For context, the last instance of Russia aggression was when President Biden was then Vice President under President Obama. While not a perfect comparison, it can give us some insight as to how things could play out. History doesn’t repeat, but it does have a tendency to rhyme…

According to Wikipedia’s account:

“In February and March 2014, Russia invaded and subsequently annexed the Crimean Peninsula from Ukraine. This event took place in the aftermath of the Revolution of Dignity and is part of the wider Russo-Ukrainian conflict.

On 22–23 February 2014, Russian President Vladimir Putin convened an all-night meeting with security service chiefs to discuss the extrication of the deposed Ukrainian president, Viktor Yanukovych. At the end of the meeting, Putin remarked that “we must start working on returning Crimea to Russia”. On 23 February, pro-Russian demonstrations were held in the Crimean city of Sevastopol. On 27 February, masked Russian troops without insignia took over the Supreme Council (parliament) of Crimea and captured strategic sites across Crimea, which led to the installation of the pro-Russian Sergey Aksyonov government in Crimea, the conducting of the Crimean status referendum and the declaration of Crimea’s independence on 16 March 2014. Russia formally incorporated Crimea as two Russian federal subjects—the Republic of Crimea and the federal city of Sevastopol on 18 March 2014. Following the annexation, Russia escalated military presence on the peninsula and leveraged nuclear threats to solidify the new status quo on the ground.”

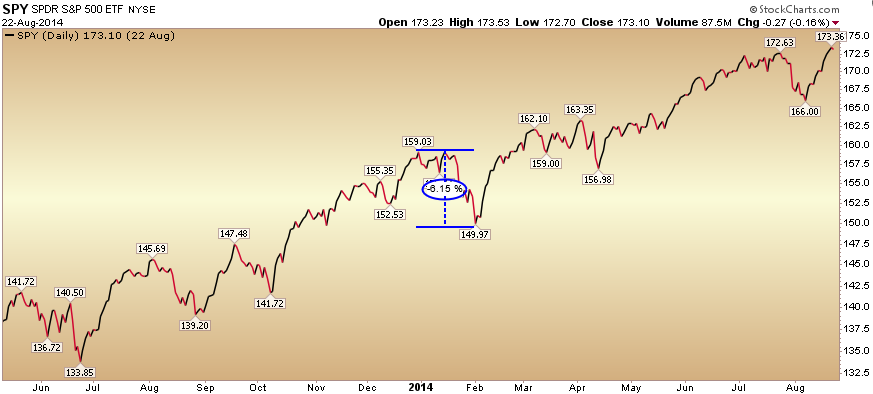

Here’s what happened to the S&P 500 and to WTI Crude Oil prices during this period – February/March 2014 (S&P down ~6%, WTI Crude up ~15%):

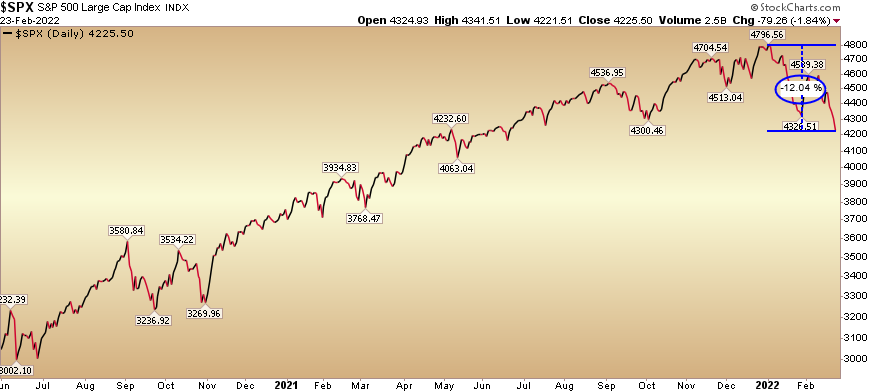

The Russia/Ukraine risk has been in the markets for some time now and here is what has happened so far (S&P down ~12%, WTI Crude up ~47%):

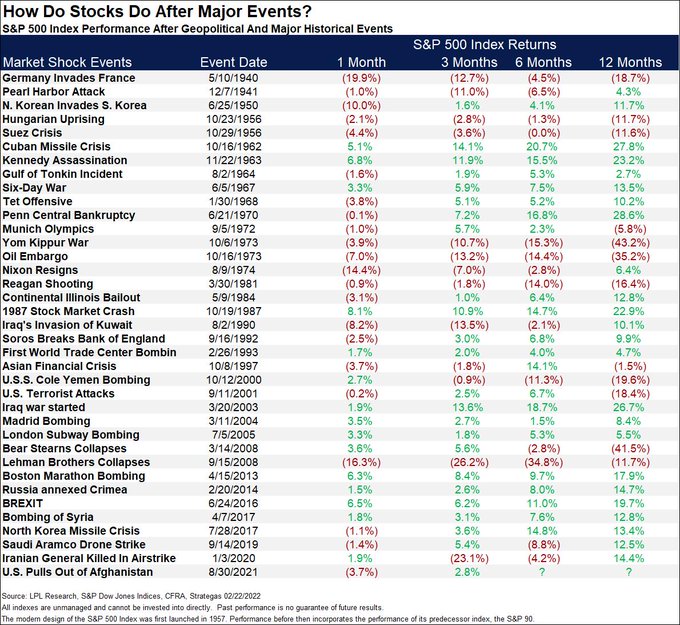

Looking back at all of the geopolitical events since 1940, the data supports our view that the disruptions should be relatively short-lived. Data per Ryan Detrick/LPL Financial:

As such, we will use any further strength in Oil to harvest profits in Energy stocks (predominantly Exploration and Production names). Oil servicers should benefit from a consistent rig count increase in coming months as more supply comes onto the market. We will redeploy that capital into pockets of Biotech and Chinese/US tech that are reasonably valued – but selling off indiscriminately due to general fear in the market.

For example, do you think Russia’s invasion of the Ukraine will impact how many drug prescriptions are written in the next few months? How about number or Doctor visits, screenings, tests – or whether people take their medicine each morning? Will it impact how many people log onto Facebook to see pictures of their friends and family? We don’t. It may temporarily impact the price of the stocks (incrementally more than it already has), but the underlying business fundamentals will be unimpaired.

Wall Street is the only place on earth that when they throw a “clearance sale”, no one shows up…

Now onto our original article from Wednesday evening:

Wednesday afternoon I joined Karina Mitchell on Yahoo! Finance to discuss the relentless selling in the stock market since ~January 5. Thanks to Karina, Taylor Clothier and Sara Dramer for having me on. Watch here to get my full thinking on the market, sectors and what we are buying versus selling

Watch in HD directly on Yahoo! Finance

My starting headline was that, “the biggest risk to the market in coming weeks is to the UPSIDE at these levels.” I proceeded to lay out the relevant facts to make my case.

The market is scared of the Fed, Inflation and Putin, however, much of it is already priced in:

- 7 rate hikes are now priced into the short end of the curve.

- The biggest fear (Putin would invade Ukraine) has already happened.

- ~200 of the 500 S&P 500 components are currently down 20% or more.

What does this mean? It means that the market has spent ~7 weeks “selling the rumor” and it is now nearing the point to “buy the news.”

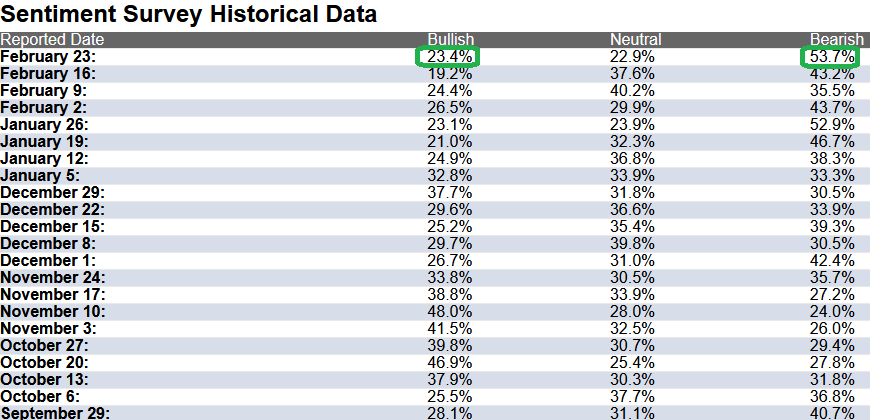

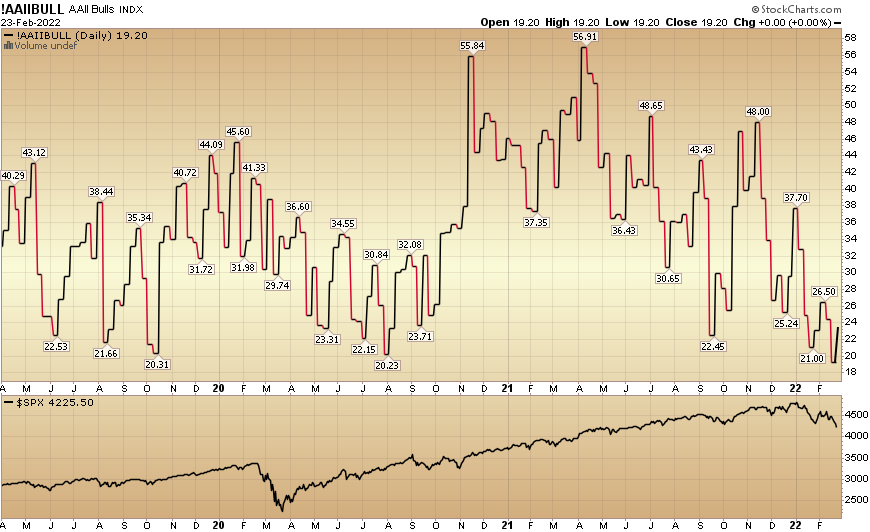

SENTIMENT: Sentiment is washed Out:

- AAII Sentiment Survey: Retail Bullish Percent down to 19.20 last week – historically found near lows.

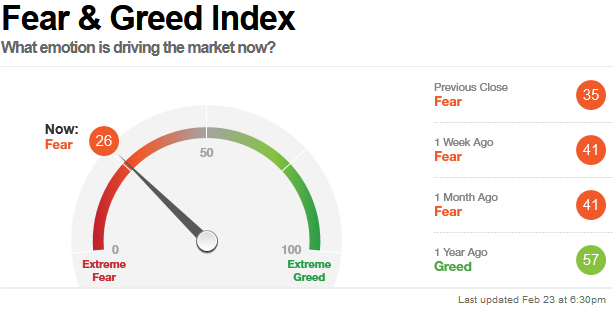

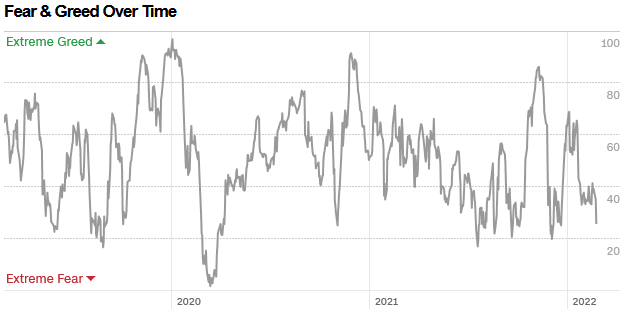

- CNN Fear & Greed Index: 26 = Fear

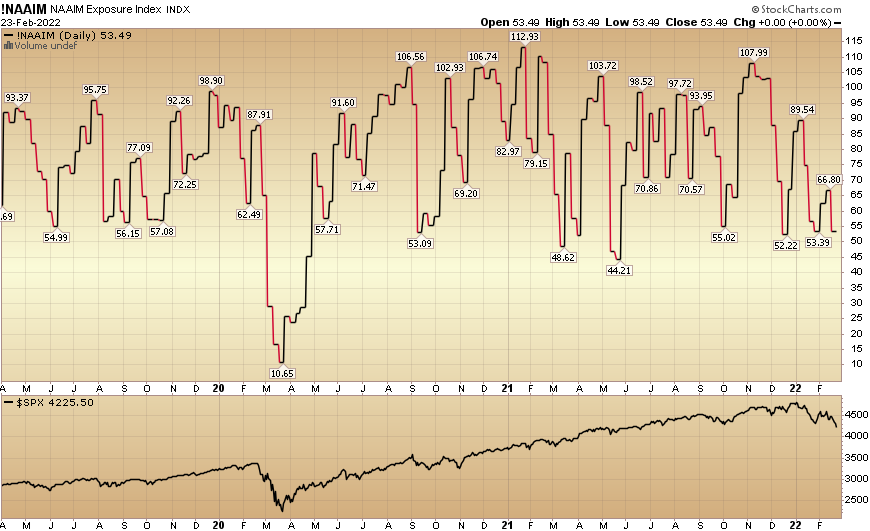

- National Association of Active Investment Managers: Equity exposure at just 53.49% found near bounces and bottoms.

- Put:Call Ratio hit 1.12 on Tuesday. Found near bottoms.

POSITIONING:

- High Cash: Institutional Managers 38% overweight cash.

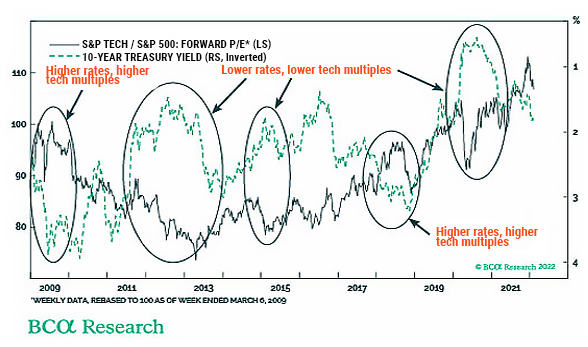

- BofA Global Fund Managers Survey shows managers have fled Tech. Now –9% underweight tech (lowest since December 2008) due to RATE HIKE FEARS.

- They now have their highest overweight to cyclicals in history. Problem is, the time to buy cyclicals was 2020. As GDP moves from 6% last year to 4% this year and back to long-term trend next year – money will flow back into sectors that can grow in a slowing environment.

- The last 3x managers were this overweight Cyclicals (banks + energy + materials), marked short term tops for the group in Jan 2018, Jan 2011, and mid 2006.

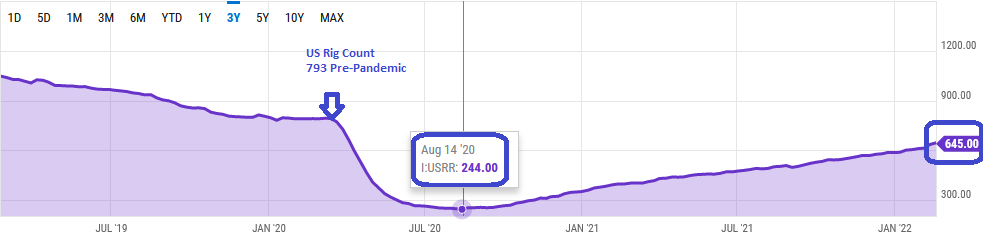

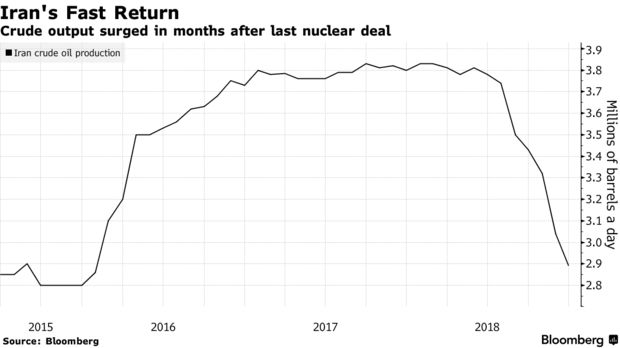

- Energy may run a bit more until Russia is resolved, but when you look out a couple of months you may find the trap has door opened and let out all of the “Johnny Come Latelies.” Iran deal is imminent (1-1.8M bbl/day by eoy). US Rig Count is now up 164% off the pandemic lows (and growing):

source: ycharts

source: ycharts - Buying reasonably valued (not high P/S) Tech/Biotech. For the Biotech sector, just to get back to their average multiples since 1986 the group would have to appreciate:

~24% – to get back to average Price to Book multiple.

~155% – to get back to average Price to Operating Cash Flow multiple.

~112% – to get back to average Forward P/E multiple.

Remember: recovery rallies never stop at their “average.” Just as they overshoot in pessimism on the downside, they overextend in euphoria on the upside.

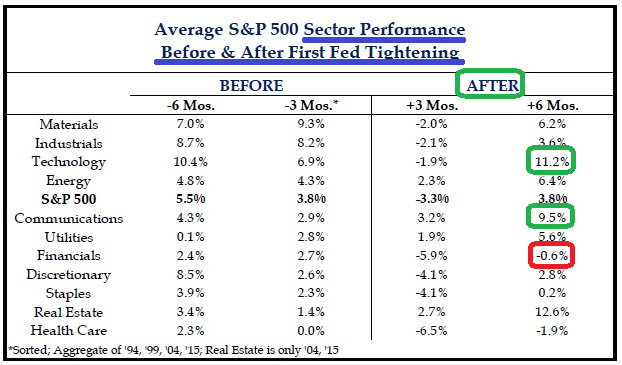

It has paid investors to maintain a cyclical bias leading up to the first hike. However, the performance in the three months following that hike has struggled.”

source: strategas

*This is not what the majority of market participants are expecting OR positioned for.

*This is not what the majority of market participants are expecting OR positioned for.

The time to buy insurance is BEFORE your house is on fire! We were buying banks and energy in fall 2020 in ANTICIPATION of rising growth, rates and inflation. Now, in anticipation of moderating growth (GDP ~6% 2021, ~4% 2022, back to trend in 2023), we are buying those sectors which can grow in the face of a slowing environment: Namely Biotech (Sector) and Chinese Tech – Alibaba.

PILLARS FOR THE MARKET:

- Buybacks: $1.234T authorized for 2022 so far (all-time record).

- Money Supply/Liquidity Still Growing (but slowing rate of change will help inflation moderation on a lagged basis). Growth rate peaked at 12% Feb 2021.

- Earnings are still RISING: $225.43 2022 est. $247.93 2023 est. Earnings Growth: For Q4 2021, the blended earnings growth rate for the S&P 500 is 30.9%. It will mark the fourth straight quarter of earnings growth above 30%.

- The 10-yr treasury yield: has been below 3% twenty percent of the time post WWII. In those periods, the market’s performance is 2x as good as when it is above 3%.

- Consumer Confidence has only been this low 3% of the time post WWII. Despite this fact, Retail Sales surged in January and JP Morgan Chase Credit Card data (up 8% and continuing in February) was the highest in a decade. As consumer sentiment and inflation are joined at the hip, we expect the consumer to improve even more as inflation begins to moderate in coming months.

_________________________________________________

Follow the Big Dogs…

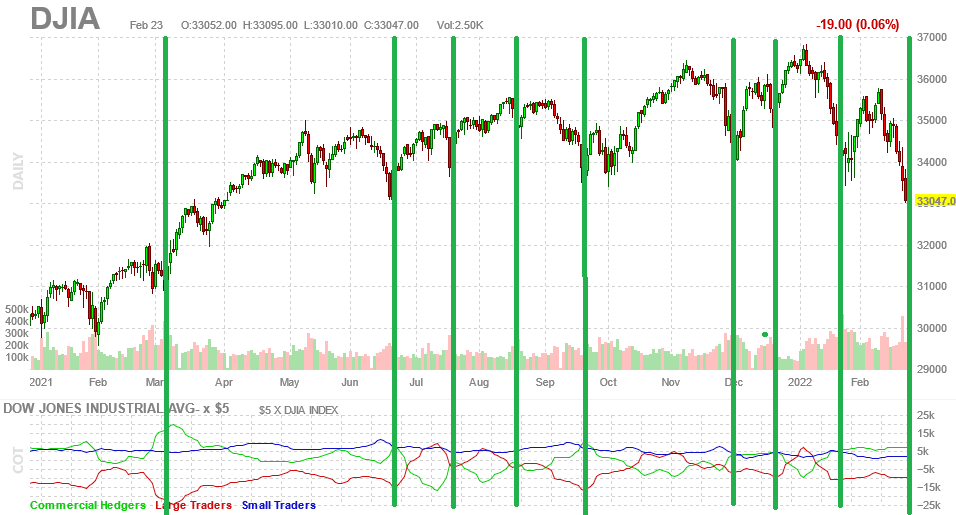

Each week we look at the Commitments of Traders report put out by the CFTC. We are most interested to see how the big players (COMMERCIALS – GREEN LINE AT BOTTOM) are positioning. In the two charts below (Nasdaq and Dow) I have drawn vertical lines showing when commercials were buying ahead of a big up move. You can see what happened next:

source: finviz (annotations by Tom Hayes)

Commercials have been buying aggressively and we are following suit (albeit in a targeted way – mostly adding to biotech and Chinese tech – which have a fundamental “margin of safety” embedded in their current low valuations). This contrasts with many of the “story stocks” that are down 50-80%+ and are still trading at >10-20x SALES – while aggressively and un-apologetically losing money every quarter (these are still “no touch”).

Final Points

- The Pandemic is winding down. This week showed several TSA checkpoint prints that were higher than the equivalent day in 2019. This is largely ahead of the return of business travel.

- Immunity rates are now high due to omicron. Anticipate a roaring recovery into the summer season coupled with a hard shift from “demand for goods” to “demand for services/travel/leisure.” This will go a long way to alleviate pressure on the supply chain – and in turn – inflation.

- The average pandemic over the past century was ~2 years and 3-4 waves. Then nothing for a decade or two afterward. We are there following the omicron wind down.

- China’s aggressive fiscal and monetary easing – which started in November – will continue into the China National Congress meeting this November. This will help to offset the tightening stance in the West.

- China Tech and Biotech are among the most oversold groups globally (supported by below average valuation statistics). We continue to add on both fronts. Conversely, there are many groups which have sold down 50% or more, but are NOT supported by attractive valuations (continue to avoid).

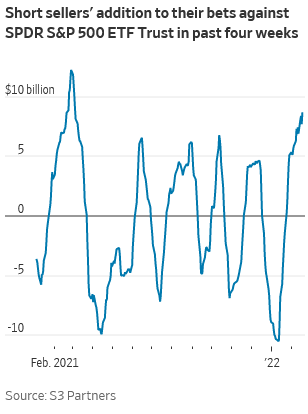

- Everyone’s getting short AFTER the worst is likely in the rear-view mirror. They did the same thing LAST February.(wsj)

- Expectations LOW for Alibaba’s Earnings report: Alibaba’s quarterly profit is expected to fall almost 60% year over year when the Chinese tech giant reports earnings on Thursday. Investors shouldn’t worry too much — it’s not as bad as it might seem on the surface. (barrons)

- An Iran Nuclear Deal is now imminent. This will add 1-1.8M bbl/day to the market. As was the case in 2015, Iran will be able to ramp up relatively quickly:

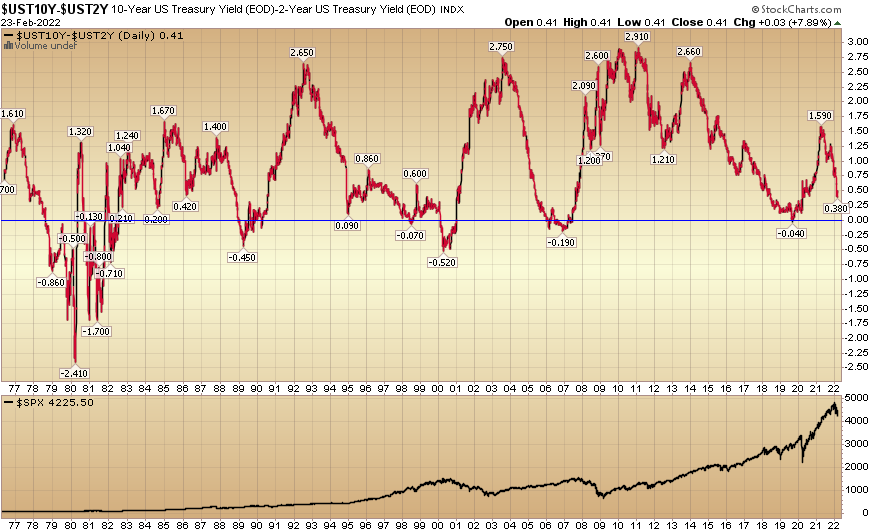

To get a bear market correction ~20%, you need a recession. To get a recession, you first need a yield curve inversion. While the yield curve is flattening, it is not yet near inverting:

Now onto the shorter term view for the General Market:

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked up to 23.4% this week from 19.2% last week. Bearish Percent rose to 53.7% from 43.2%. Retail trader/investor fear is at a level historically consistent at/near market lows.

The CNN “Fear and Greed” Index dropped from 41 last week to 26 this week. There is meaningful fear in the market. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The CNN “Fear and Greed” Index dropped from 41 last week to 26 this week. There is meaningful fear in the market. You can learn how this indicator is calculated and how it works here: (Video Explanation)

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 53.48% this week from 66.80% equity exposure last week. Managers will have to chase any strength in coming weeks.

Our podcast podcast|videocast will be out tonight or tomorrow. We have a segment each week called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form above.