This week, nearly every headline was, “TikTok is too Chinese” or “TikTok is not Chinese enough” so I had to take a second to find out what the heck is TikTok?

Turns out the U.S. Government is worried that the Chinese Government is using the social media app to get into US computers/phones/data. My take: if you see articles about a start up Chinese Hedge Fund outperforming with spreads on US Large Cap stocks, I’ll know they breached my site through TikTok!

So I downloaded the app and set up a profile @OfficialHedgeFundTips so I could see what all of the commotion was, and why I was one of the few people in the developed world who hadn’t yet downloaded TikTok (over 1.5 Billion Downloads globally).

My takeaway? America has retained its hegemonic hold on global dancing power, while simultaneously bartering to retain its economic supremacy. I have no idea how to use TikTok, but it’s unlikely you’ll see me join the ranks of prolific dancers on the app anytime soon. But never say never…it looks like fun!

In the context of the barter (trade negotiations), the market “gits up” and “gits down” on a regular basis – or in the lyrics of one of the most popular dance themes on TikTok, Blanco Brown’s “Git Up”, the market vacillates on each new trade headline:

Take it down now, take it, take it down now

Take it down now, take it, take it down now

Bring it up now, bring it, bring it up now

Bring it up now, bring it, bring it up now

Listen to Blanco Brown’s – Git Up Here

If you don’t believe that millions of people are dancing to this song in front of their cell phones (from ages 10-80), just ask your 13 year old. It’s ubiquitous.

So how do these lyrics apply to this week’s stock market commentary?

In last week’s note and video (below), The Lil Nas X – “Old Town Road” Stock Market, we discussed that short term “overbought” conditions could warrant a mini-shakeout to scare the “late money” that has come into the market in recent days and weeks, but that due to market structure and most active managers coming into the end of the year underweight equities and behind their benchmarks – it would likely be short-lived.

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 3

Yesterday, we saw a taste of the “on again, off again” nature of the negotiations. First we were down on the Reuters report that Phase 1 might not get signed until 2020. Then we recovered a bit following the Fed Notes – which discussed the possibility of a “standing repo” to stabilize the overnight funding rates.

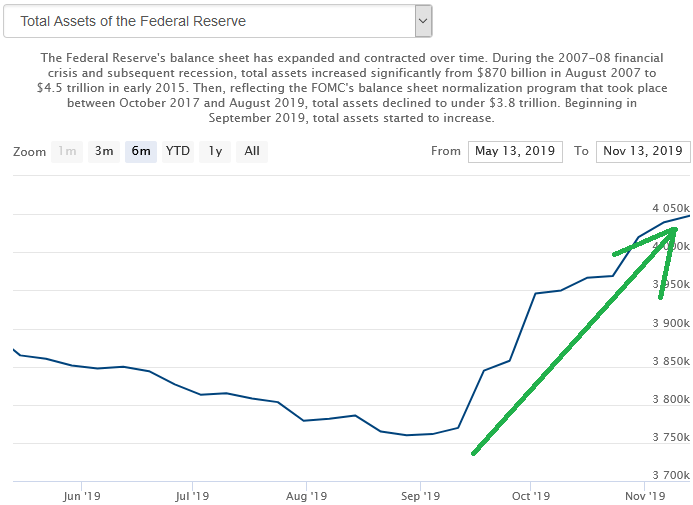

For the Chinese watching through my TikTok app, “standing repo” is Fed Speak for unlimited liquidity injection (a.k.a balance sheet expansion)! Simply put, it means that it is in your interest to cut a Phase 1 deal (buy some pork, gas, oil and beans that you need and use anyway) because Jay’s got our side covered regardless of what happens (and you don’t want to fight the richest guy in the world – don’t bring a knife to a gun fight):

If the past couple of months are any indication, we should be able to unwind the $745 Billion of Quantitative Tightening that took place from 2017-2019 over the next 4-5 months.

The Fed has added $288 Billion of liquidity since August 28 (~2.5 months), so at a pace of ~$115B/month moving forward, all of the tightening in 2017-2019 – that caused the slowdown – would be unwound by Springtime.

I’m sure Chair Powell didn’t meet President Trump for breakfast this week empty handed. His mama taught him to always bring a gift when someone invites you to their home for a meal. President Trump and Chairman Powell’s goals of continued growth are aligned. Their methods are divergent, but they will get to the objective nonetheless.

Last week we laid out the 7 conditions that supported continued strength for equities in the intermediate term (6-9 months) despite any short-term pullbacks or bumps we might have to weather. You can find the list and explanations here:

The Lil Nas X – “Old Town Road” Stock Market (and Sentiment Results)

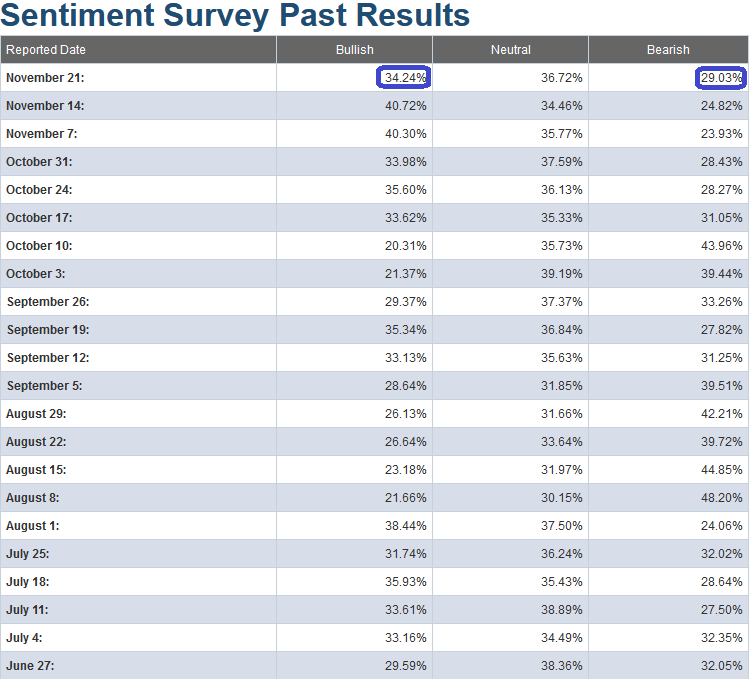

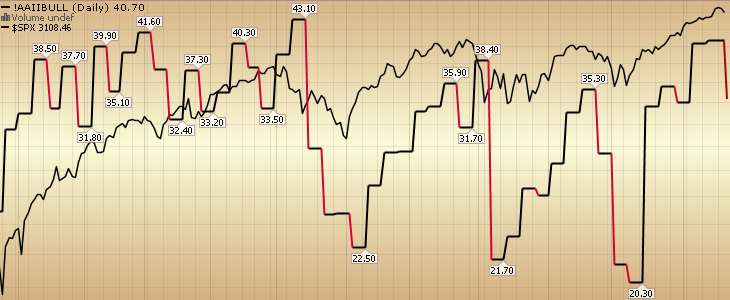

As for the short term, this week’s AAII Sentiment Survey result (Video Explanation) Bullish Percent came in at 34.24%, down from 40.72% last week. Bearish Percent lifted to 29.03% from 24.82% last week. Market participants curbed their short term enthusiasm somewhat over the past week.

This was confirmed by the CNN “Fear and Greed” Index – which came in 13 points (from 87 last week to 74 this week).

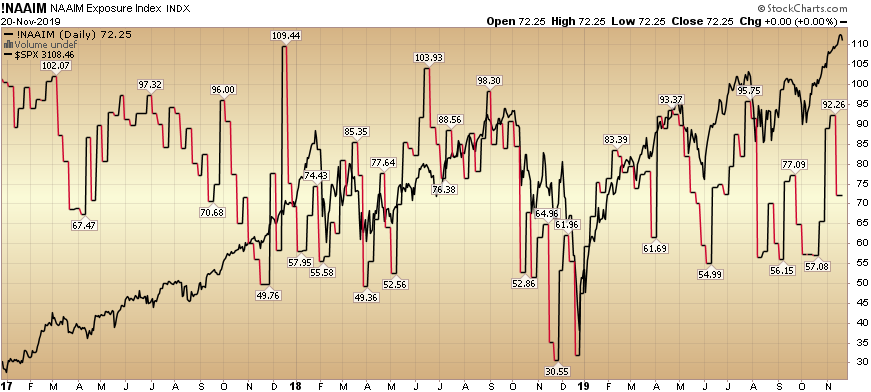

And finally, this week the NAAIM (National Association of Active Investment Managers Index) dropped from 92.26% equity exposure down to 72.25%. The implication here is that on the next positive “Phase 1” headline, managers will have to doubly scramble to get their exposure up into year-end.

At the end of the day, President Trump needs this deal for his 2020 re-election and to fend off the noise in the House about impeachment (despite having no risk in the Senate). The Chinese need this deal to recover growth and political stability (which is eroding by the minute). And Wall Street needs this deal to maintain their earnings estimates for 2020. The longer this drags on, the harder it will be for analysts to keep numbers up near double digit growth for 2020.

What no one is counting on is a Phase 1 deal getting inked and 2020 earnings estimates not only stabilizing at 9.7% growth, but starting to improve. The pressure apparently is not high enough yet for the Chinese to do what is in their interest, but as Hong Kong continues to devolve, the pressure will mount, a deal will get done, and then both sides can win.

In the mean time, we continue to use any short term turbulence to position for further intermediate term improvement. We followed our own advice and trimmed some runners. We also continue to add in those laggard sectors/stocks that are just beginning to have money rotate into them. You can see our September article on Biotech and our October article on the Exploration and Production sector here:

Snake OIL? How Portfolio Managers View Exploration & Production Stocks…

Biotech is already up 18.6% in the last 6 weeks after the article, but there are still pockets of opportunity. Exploration and Production is flat from our article a few weeks back. We recently discussed one of Warren Buffett’s picks in the sector – Occidental Petroleum – on Fox Business last week. You can review that commentary here:

So as Blanco Brown emphasizes in his catchy lyrics, we have just come off six weeks of a “Bring it up now” market.

Whether we get a few more days/week of a “Take it down now” market is to be determined, but I would not bet against the pressures on both the Chinese and the US to get Phase 1 tucked away, nor would I bet against the possibility of $100B of monthly liquidity from the Fed and $20B/month from the ECB.

Just as there was a lag to slow down growth from two years of tightening, there will be a short lag to realize increased growth – now that easing is back in place (having started this summer with 75bps of cuts and $288B of balance sheet expansion).

Don’t fight the Fed…