(source: WSJ)

(source: WSJ)

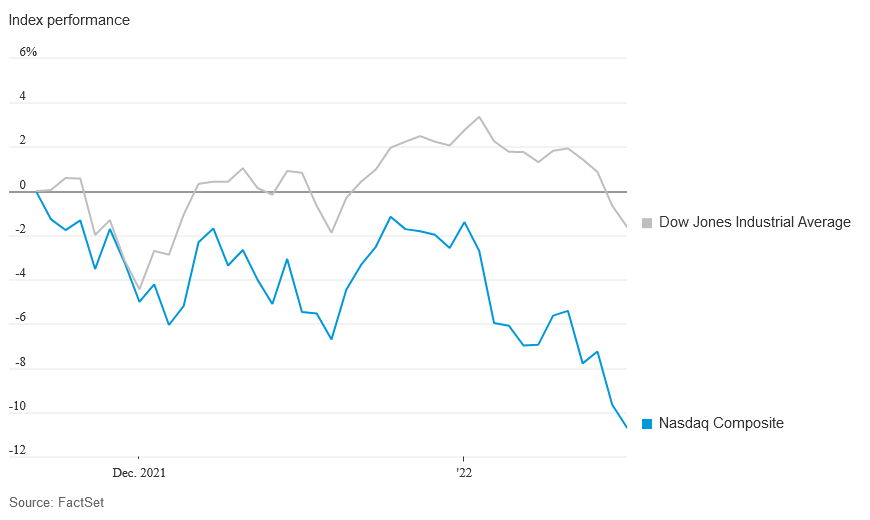

The Nasdaq Composite has officially fallen into correction territory – down 10.7% from its November high on Wednesday’s close.

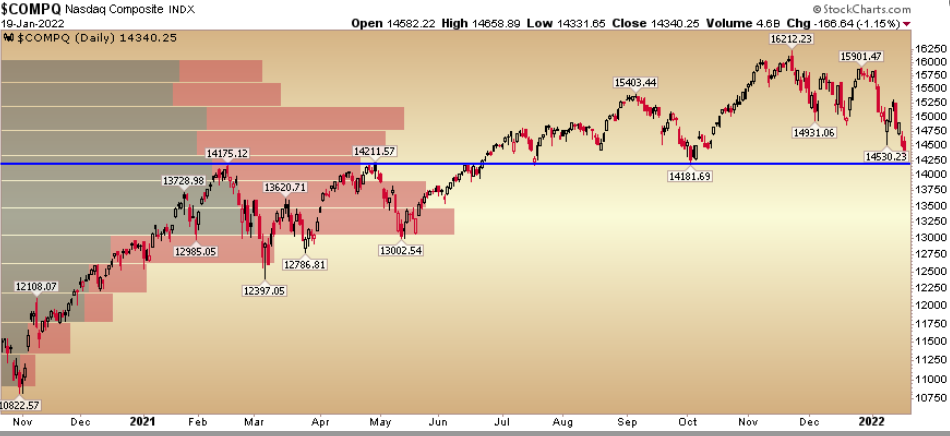

This (growth and tech laden) index seems to have hit a critical level at this point:

Part of this move is attributable to Hawkish moves by the Fed and climbing 10yr yields:

As the discount rate rises, the value of futures cash flows declines in the present. Tech is especially vulnerable in this environment. Value/Cyclicals are currently outperforming:

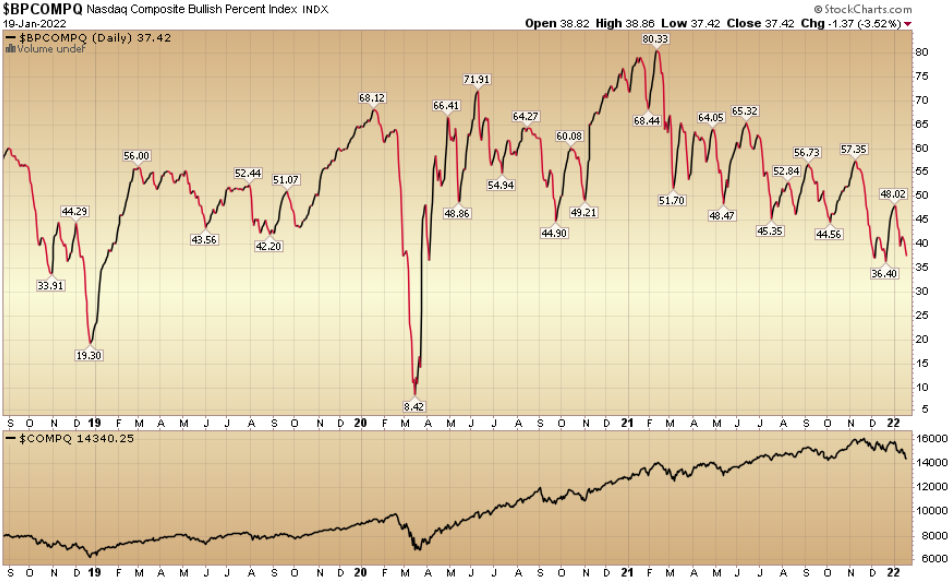

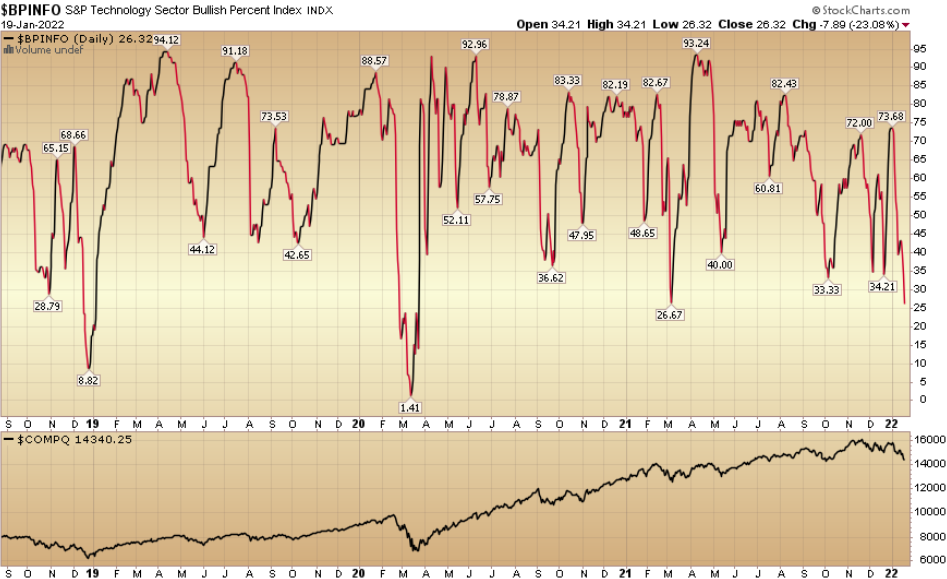

While some of the indicators are nearing extreme levels (for tech), the companies that are big on promises and small on profits continue to get hit — and likely will for some time.

The funny thing about money is that when it’s free, it goes to all kinds of seedy places (i.e. malinvestment). Once it begins to have a cost, managers demand earnings, cash flow and reasonable multiples so that capital is returned to them in a greater quantity than their cost of cash.

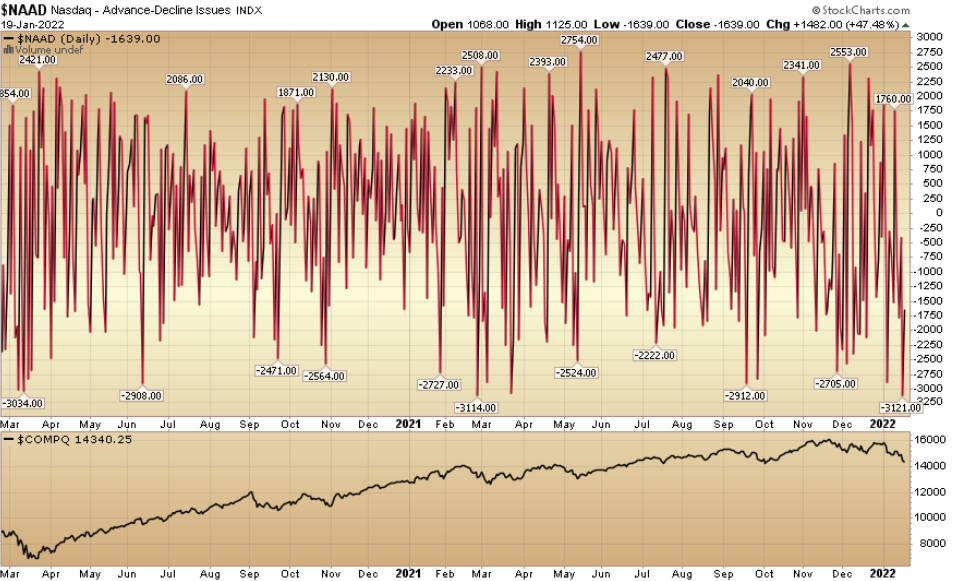

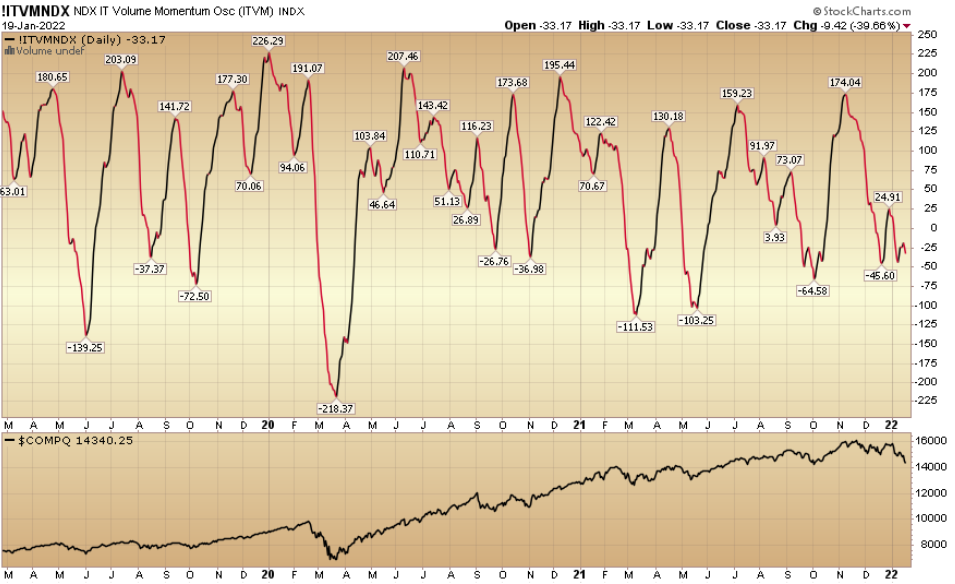

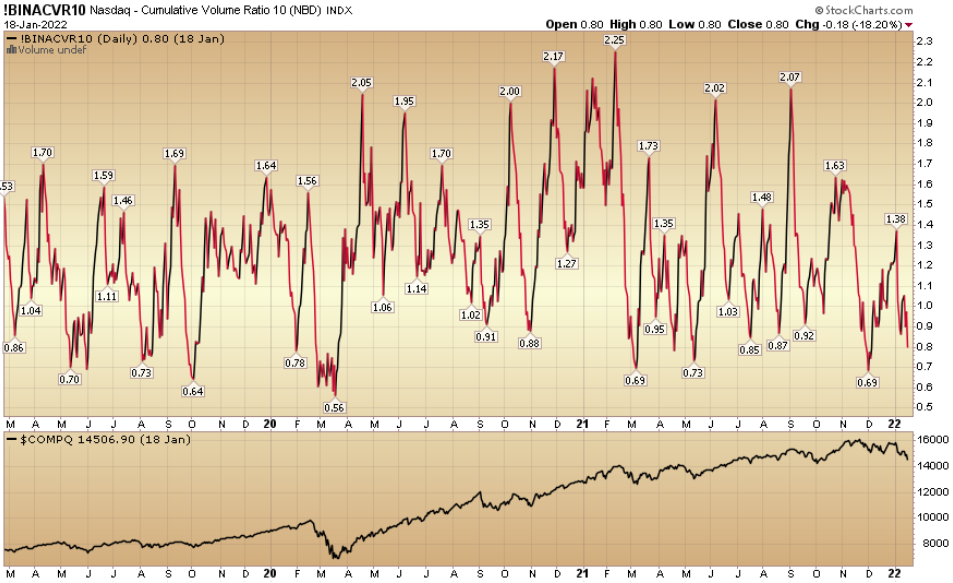

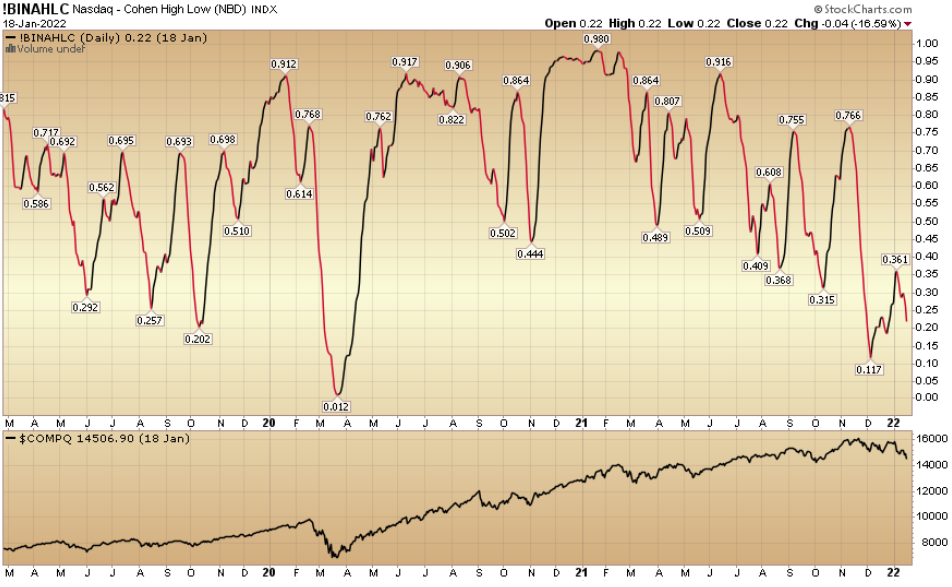

Here are some broad indicators we look at that imply it may be time to start digging in very selectively on a name by name basis. On last week’s podcast|videocast, we starting discussing the opportunities in Biotech. We have been active in the market over the past few sessions. We will continue to add selectively on weakness in coming days and weeks. We tend to leg into major positions over tranches and out of positions in tranches as well.

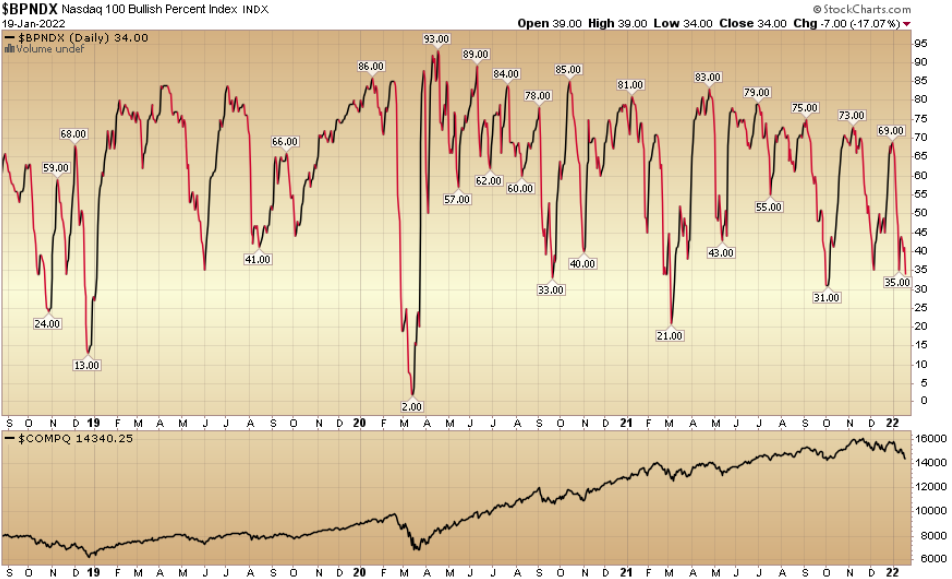

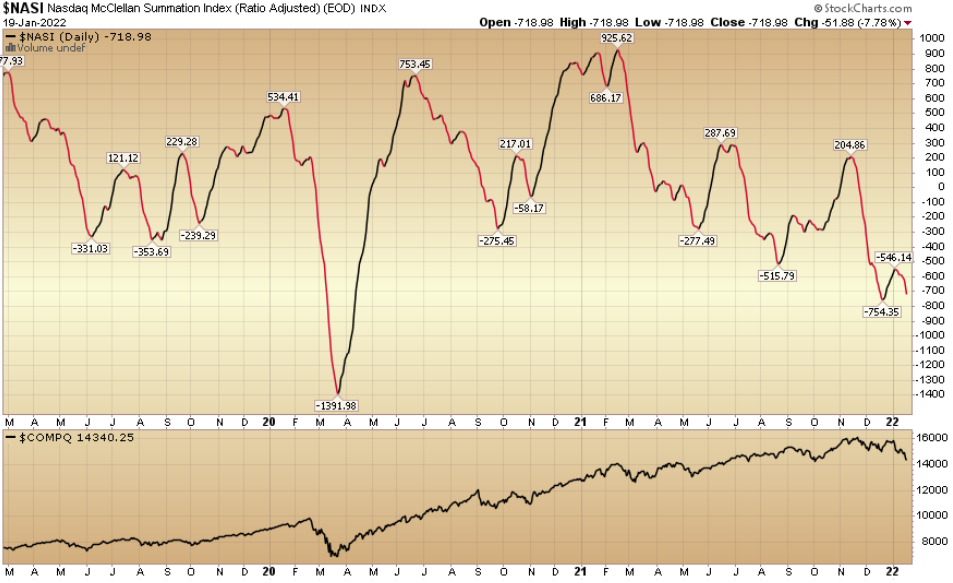

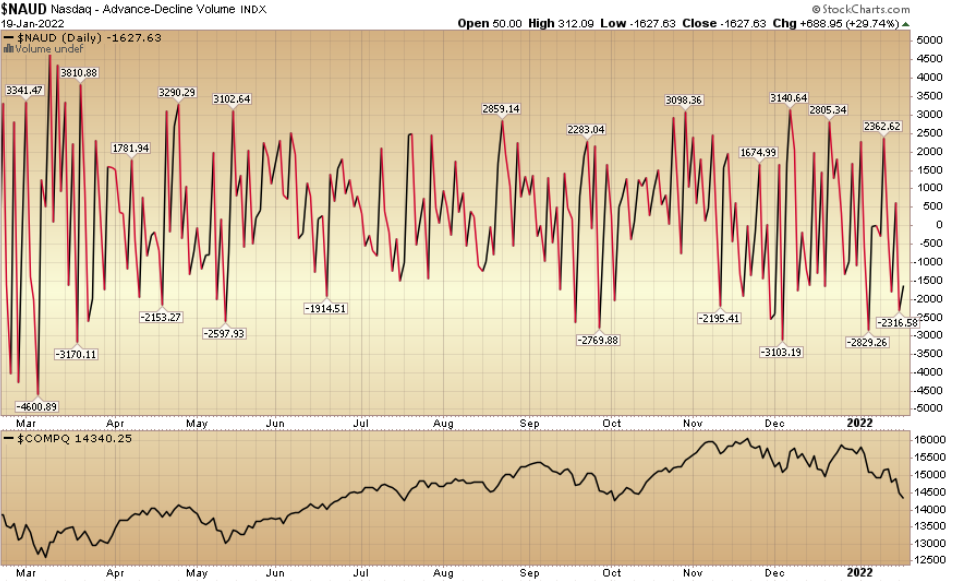

So what’s happening for beaten down tech/growth (compare the Nasdaq Composite in black at the bottom to the indicator at the top). Did it pay to be a buyer or seller at current levels in the past?

Fox Business

On Friday I was on Fox Business – The Claman Countdown – with Lauren Simonetti discussing the Retail Sales miss and a few stock picks. Thanks to Ellie Terrett, Lauren and Liz for having me on:

Watch in HD directly on Fox Business

Here were my notes for the segment:

Retail Sales: -1.9% vs. -.1% est.

Retail Sales (ex-Auto): -2.3% vs. +.3% est.

Consumer Sentiment: 68.8 vs. 70 est.

Biggest Hit: Online Retailers -8.7%, Home Furnishing -5.5%.

Short Term Headwinds:

1) Omicron – led to more uncertainty among consumers in December.

2) Inflation – CPI (Prices) up 7% yoy (highest since 1982). PPI up 9.7% (highest since 2010). Due to pandemic related huge demand for goods over services and supply-chain issues. Unprecedented levels of cash injections to the economy from both fiscal and monetary policy.

3) Pull forward in October/November due to supply chain fears.

Big Picture: The consumer’s balance sheet has never been in better shape: cash balances $2T, still spending 25% more than pre-pandemic, net worth is growing from RE and Stock gains, been paying down debt, debt service ratio lowest in over 50 years, plenty of jobs available, etc.

As omicron rolls over as we have seen in S.A. and now U.K., we expect spending to shift back to services (Travel and Leisure) from goods. This should alleviate some of the price pressure/supply chain issues.

One group that has been unloved is casinos (in part due to the uncertainly about licensing in Macau). We have owned LVS, WYNN and MLCO in anticipation of a resolution of these issues – which came today. The 6 licenses will remain (for 10 years).

Despite today’s surge LVS & WYNN are still ~37% off their 52wk highs. Plenty of room to run…

Cheddar News

On Tuesday morning I was on Cheddar News – Wake up With Cheddar – with Baker Machado discussing the stock market and a few stock picks. Thanks to Taylor Fleming, Andrew Balamaci and Baker for having me on:

Watch in HD directly on Cheddar

Here were my notes for the segment:

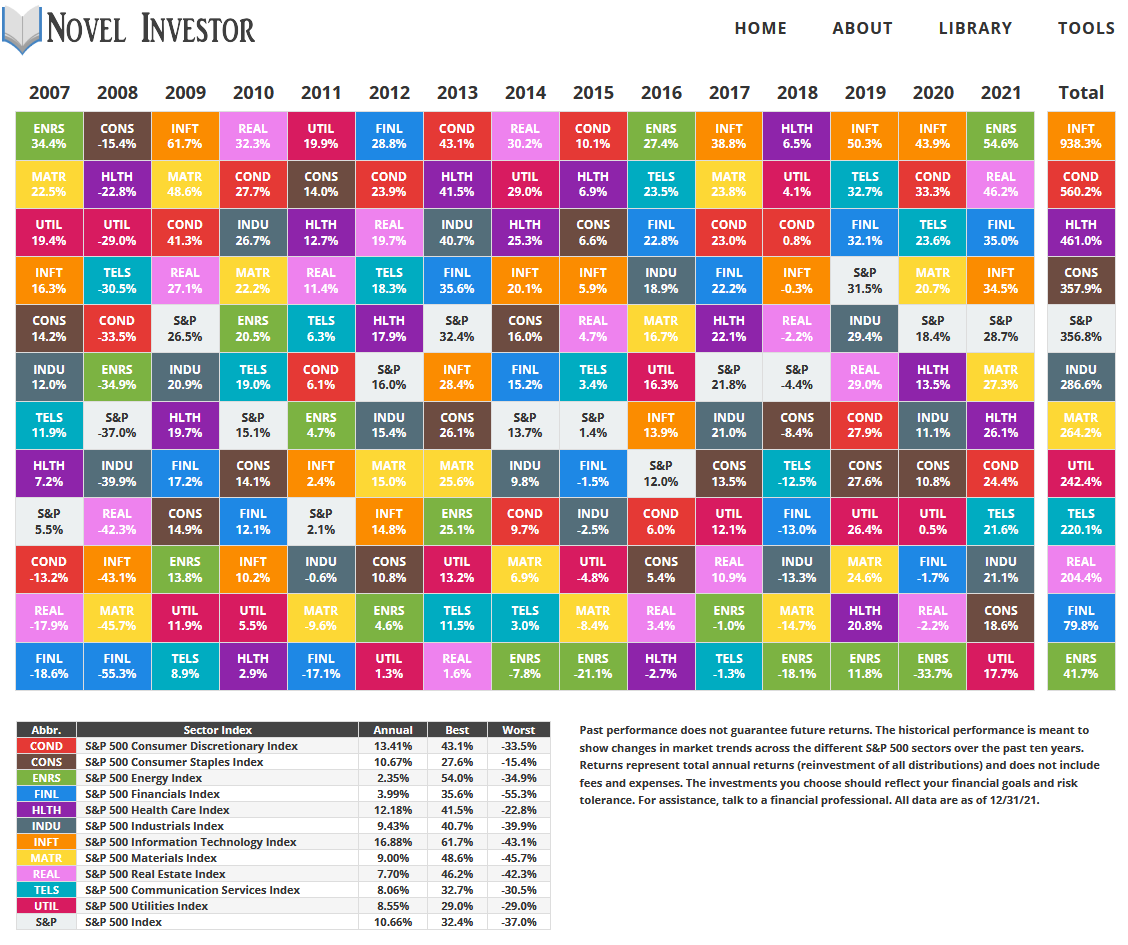

We are in a “Last Shall Be First” market environment:

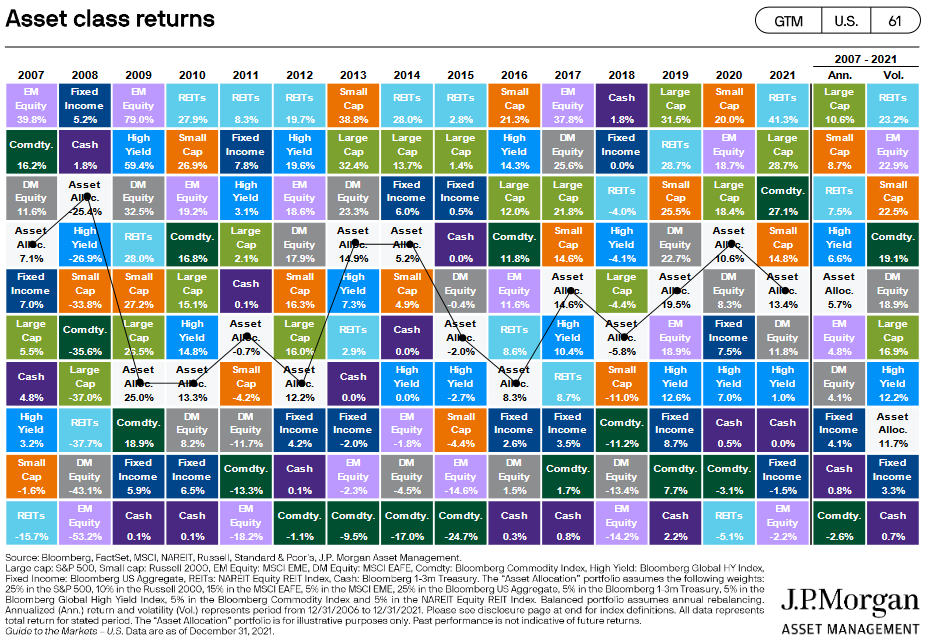

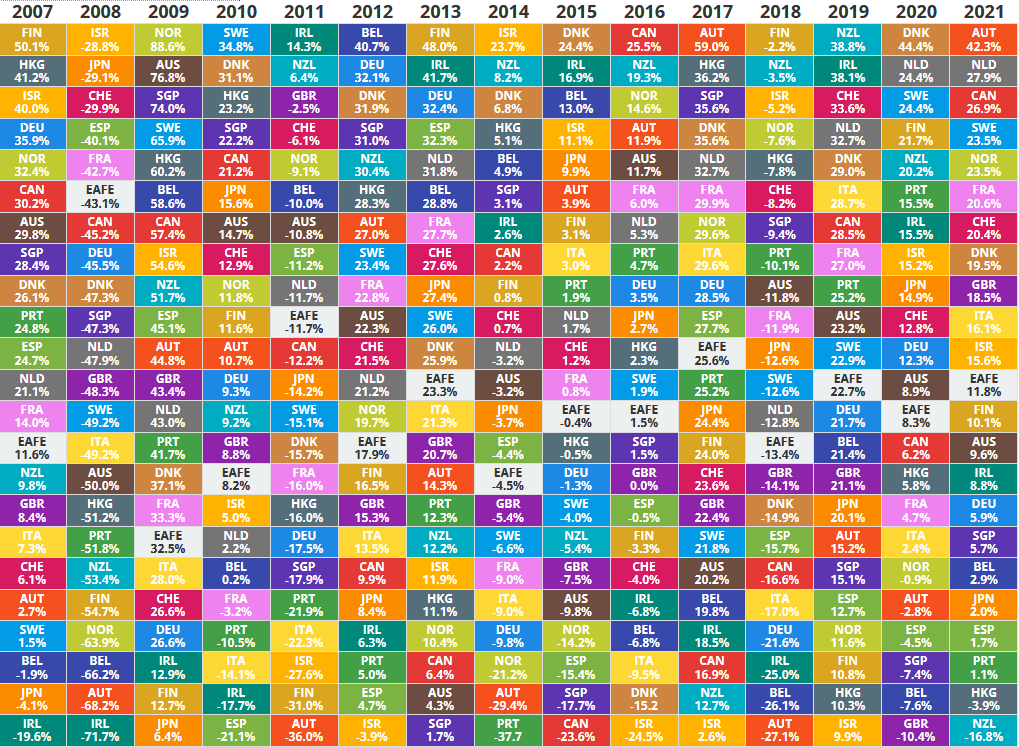

If you look at sector performance, asset class performance, and country performance by year over the last two decades, a clear pattern emerges: Laggards become leaders and Leaders fall from grace every 1-2 years.

(Image: Novel Investor)

Sector: Industrials were 3rd worst sector performer in 2021. We think they will continue to outperform this year after a strong start. Top picks are Boeing (expected to resume flights in China before end of January) – Still down ~50% off pre-pandemic highs. GE (sum of parts breakup into Aviation, Power, Healthcare will unlock value moving forward) Larry Culp going with aviation.

Biotech (healthcare sub-sector) was down –20.38% in 2021. We started building a position in the past few days as we believe this group has strong recovery potential over the next year. We will add more if it goes lower in coming weeks. Can gain broad (larger cap) exposure through IBB, small mid-cap (equal weighted) exposure through XBI. Overhang on drug pricing with BBB legislation (unlikely to pass) as well as reduced demand from lowered doctor and hospital visits during covid.

Asset Class: Emerging Markets were the worst performing asset class in 2021 at -2.2%. China is largest weight in index (~35%) and was burgeoned last year due to regulatory crackdown.

Hang Seng is up +4.05% ytd (after being the 2nd worst performer in 2021) while S&P 500 down -2.16% ytd. We believe this trend will continue as China is the only country starting to EASE monetary and fiscal policy – while rest of the the developed world is tightening policy aggressively.

Top Pick is Alibaba: Has grown earnings and cashflow per share by > 500% since IPO in 2014 and just a couple of weeks ago you could buy it at 2014 prices! Charlie Munger doubled his position in Q4. Despite regulatory crackdown, BABA grew revenues 29% last quarter and will continue to grow at 20%/year moving forward. Earnings should grow ~15% over the long term and you are buying at 14x forward earnings. This compares to its average multiple of 28x since going public.

Earnings: Earnings estimates continue to creep up for 2022 – now at $223 for the S&P 500 (up 9% for 2022). This is a tailwind for the market gaining high single digits to low double digits in 2022.

The key will be guidance moving forward. Can we keep the post-covid trend of analysts being too pessimistic and having to take estimates UP, or revert to a more normalized environment where analysts are consistently too optimistic?

Big Picture: The consumer’s balance sheet has never been in better shape: cash balances $2T, still spending 25% more than pre-pandemic, net worth is growing from RE and Stock gains, been paying down debt, debt service ratio lowest in over 50 years, plenty of jobs available, etc.

As omicron rolls over as we have seen in S.A. and now U.K., we expect spending to shift back to services (Travel and Leisure) from goods. This should alleviate some of the price pressure/supply chain issues.

Headwinds: Second year of the Presidential Cycle tends to be the weakest of the four. Market will start to discount the post taper removal of liquidity and we should see a much bumpier ride in 2022 than we did in 2021. Average returns for the year, but expect 10%+ pullbacks along the way. 4 hikes priced in. Quantitative Tightening is the wide card!

Don’t Fear the Reaper! S&P 500 gains on average 7% in the 12 months following the first rate hike.

Sentiment Survey – 3 Key Takeaways

On Tuesday I posted a summary or the Bank of America monthly Global Fund Manager Survey:

January 2022 Bank of America Global Fund Manager Survey Results (Summary)

In our view, the 3 key points are as follows:

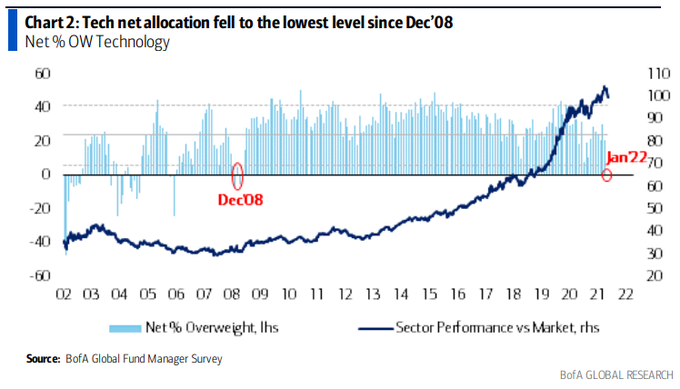

1. Net allocation to the tech sector fell 20% month-over-month to 1%, the lowest since December 2008. This may be nearing a short term extreme (even if this proves to be the general trend in a modestly rising rate environment):

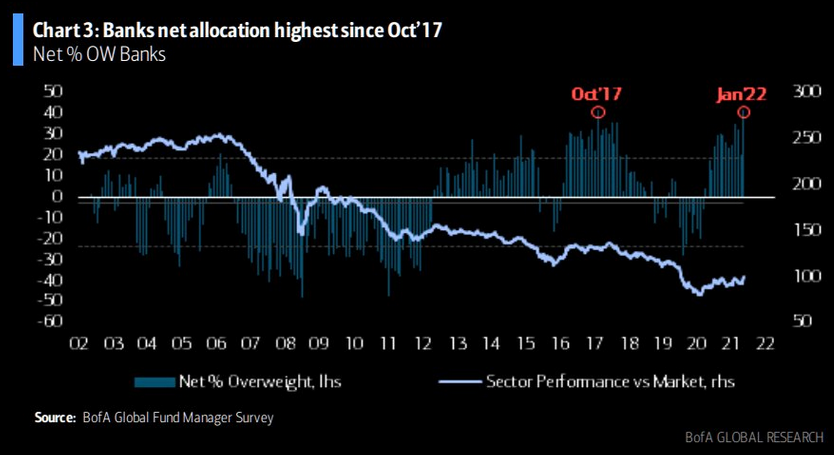

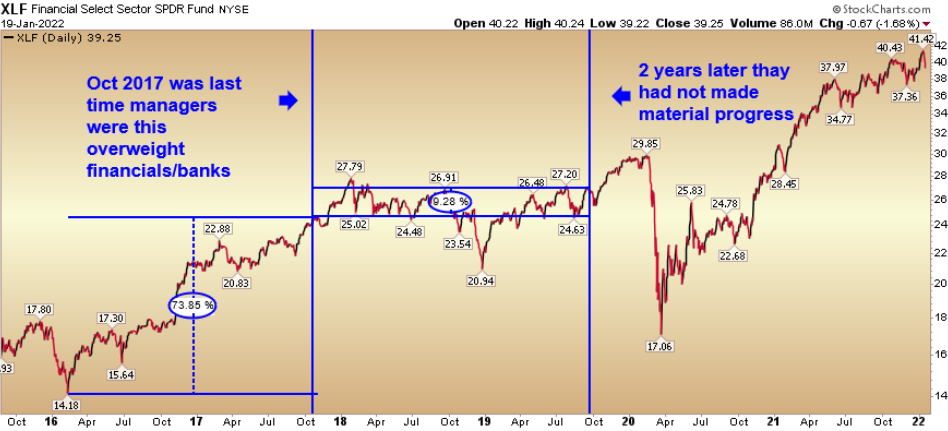

2. Overweight positions on bank stocks rose to 41% among BofA’s clients, closing in on a record set in October 2017.

While banks moved up a bit more following the same extreme in October 2017, 2 years later, they had made little additional progress. Everyone was already in off the February 2016 lows.

Managers can’t get enough banks and they can’t get out of their tech fast enough this month. While both trends can persist a bit longer, managers are LATE to the game in this positioning. The time to buy banks was Fall of 2020 when we were pounding the table:

The Cobra Kai “Sweep The Leg” Stock Market (and Sentiment Results)…

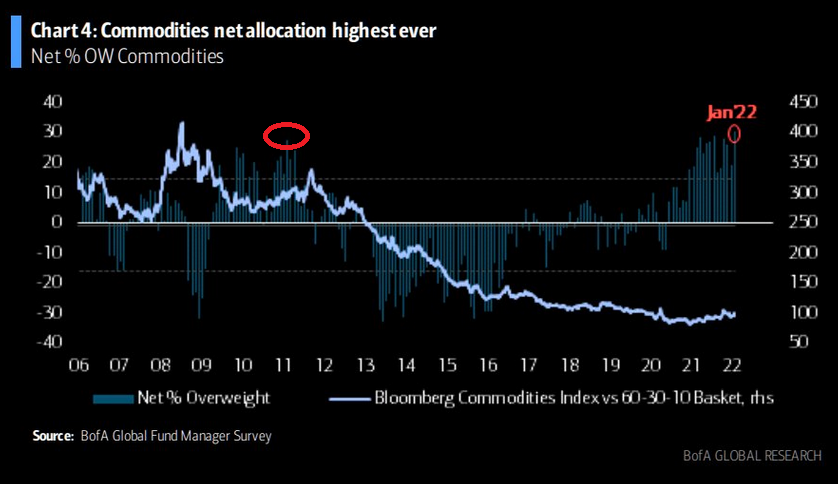

3. Net overweight positions in commodities rose to a historical high in January. The last time commodity euphoria was even close was 2011:

While the trend persisted for another few years (and we believe that will be the case this time too), there was a ton of CHOP (correction) when the euphoria initially got to these levels before resuming the trend that lasted another 3 years:

The time to buy commodities/energy stocks was when we were pounding the table in Fall 2020:

The “I’m an Accountant” Stock Market (and Sentiment Results)…

Now onto the shorter term view for the General Market:

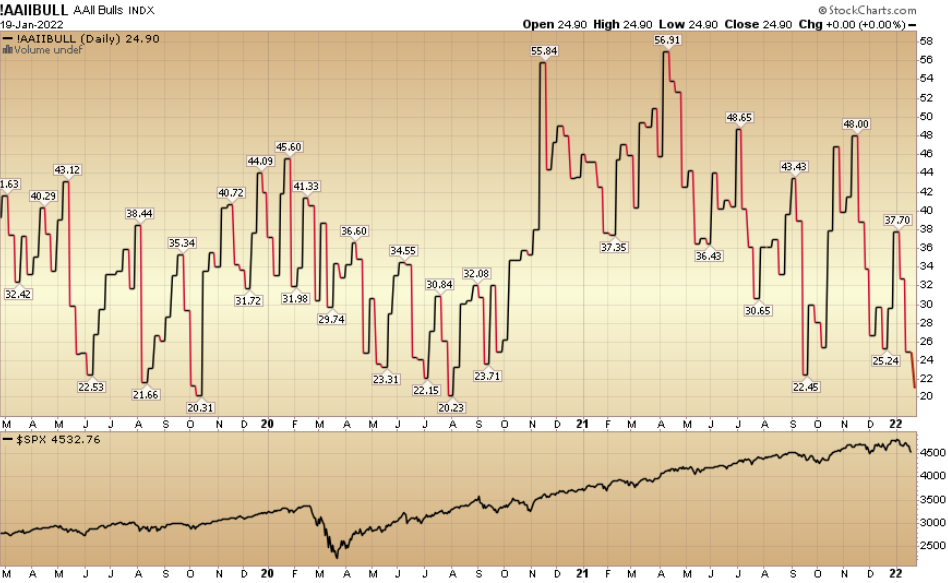

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) fell to 21% this week from 24.9% last week. Retail trader/investor optimism is flushed out. They are the most scared they have been since 2020. This usually occurs near inflection points:

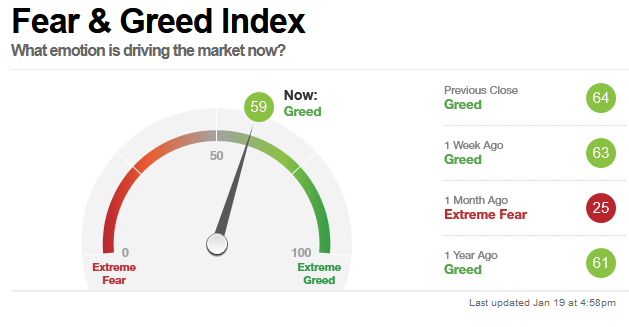

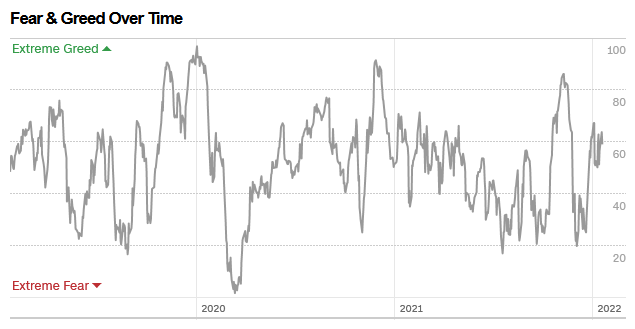

The CNN “Fear and Greed” Index ticked up from 51 last week to 59 this week. This is still a neutral reading. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The CNN “Fear and Greed” Index ticked up from 51 last week to 59 this week. This is still a neutral reading. You can learn how this indicator is calculated and how it works here: (Video Explanation)

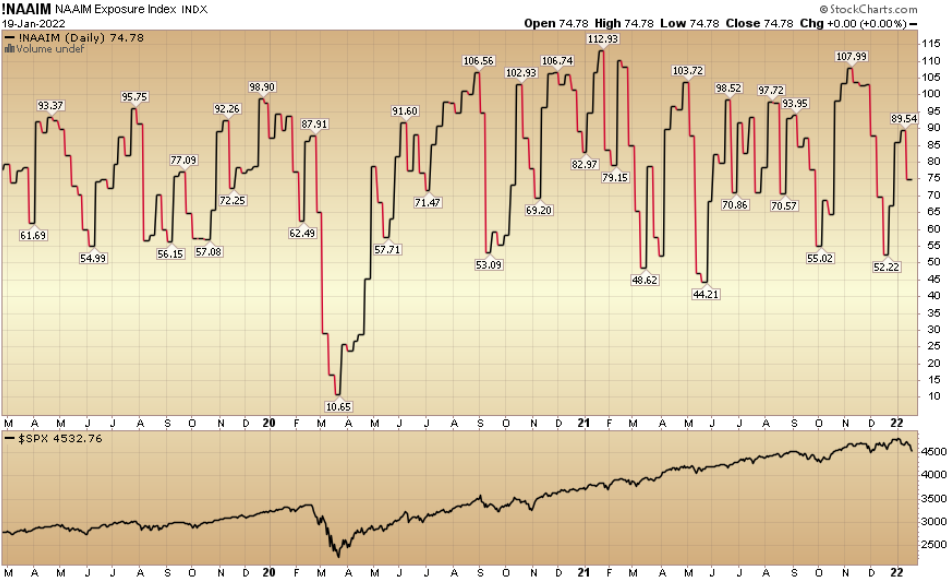

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) fell to 74.78% this week from 85.71% equity exposure last week.

This was my closing commentary from our January 6 note:

“The next Fed meeting is Jan 25-26. By then, the only data the Fed will have is likely a decent jobs report from this Friday – and limited evidence that inflation is rolling over. As I said in our podcast|videocast all last year – when people were looking for big crashes – we were not going to get one. We would be limited to a handful of 3-5% pullbacks given all of the liquidity.

This changes in 2022. I expect to see 8-10%+ mini-corrections moving forward. If we continue to gain strength in coming weeks, I’m inclined to harvest some profits and build a little cash going into the Fed meeting. Their recent hawkish pivot is not expected to change until inflation rolls over, and I think the earliest signs of that will be in March. February may create some great opportunities to go shopping for those who harvested a little cash. For the longer term investors, you’ll likely just hold on through the air pockets. They haven’t inverted the curve yet, so no recession is on the horizon in the near term – just a bit of turbulence…”

We have put a significant amount of capital (that we raised per above) back to work into the biotech sector in the past several sessions. We will continue to selectively add in coming weeks as/if opportunity presents itself.