On Tuesday morning I joined Stuart Varney on Fox Business to discuss the implications of a Republican Sweep Election on markets. Thanks to Stuart and Christian Dagger for having me on:

Watch in HD Directly on Fox Business

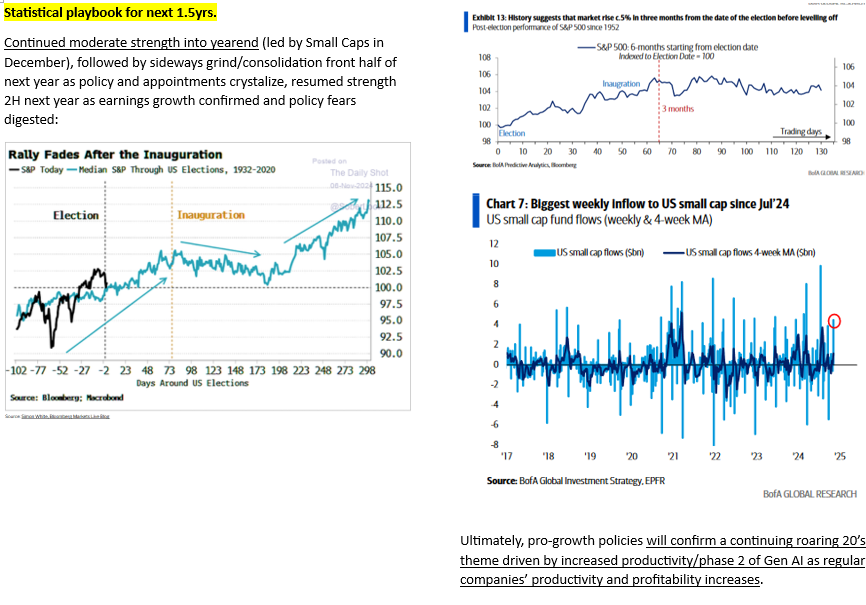

Here were my notes ahead of the segment:

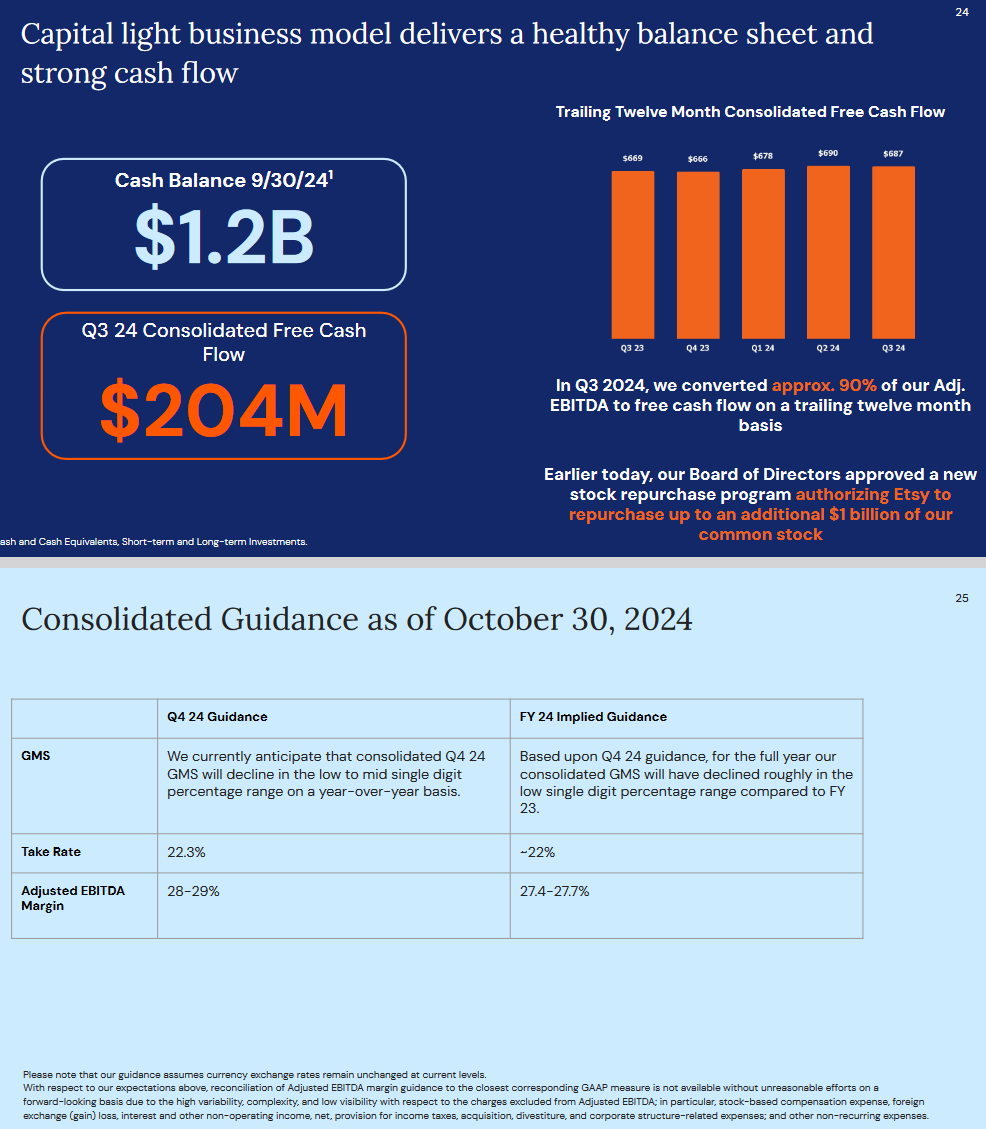

During earnings season I try to cover 1-2 stocks that we have discussed on our podcast|videocast(s) and/or hold in client portfolios/personally/beneficially:

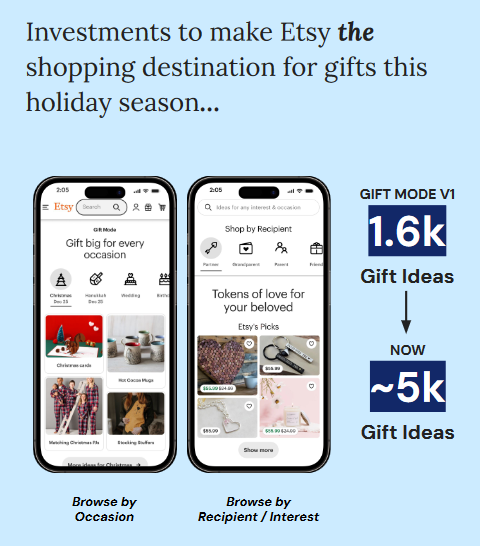

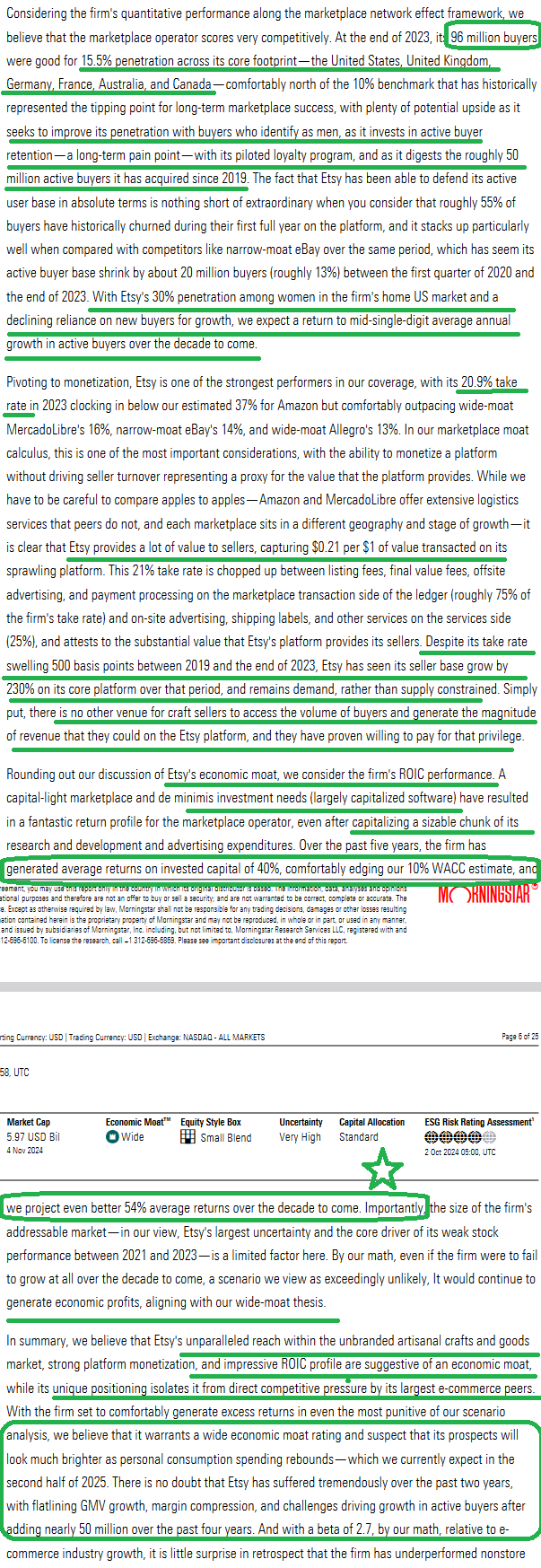

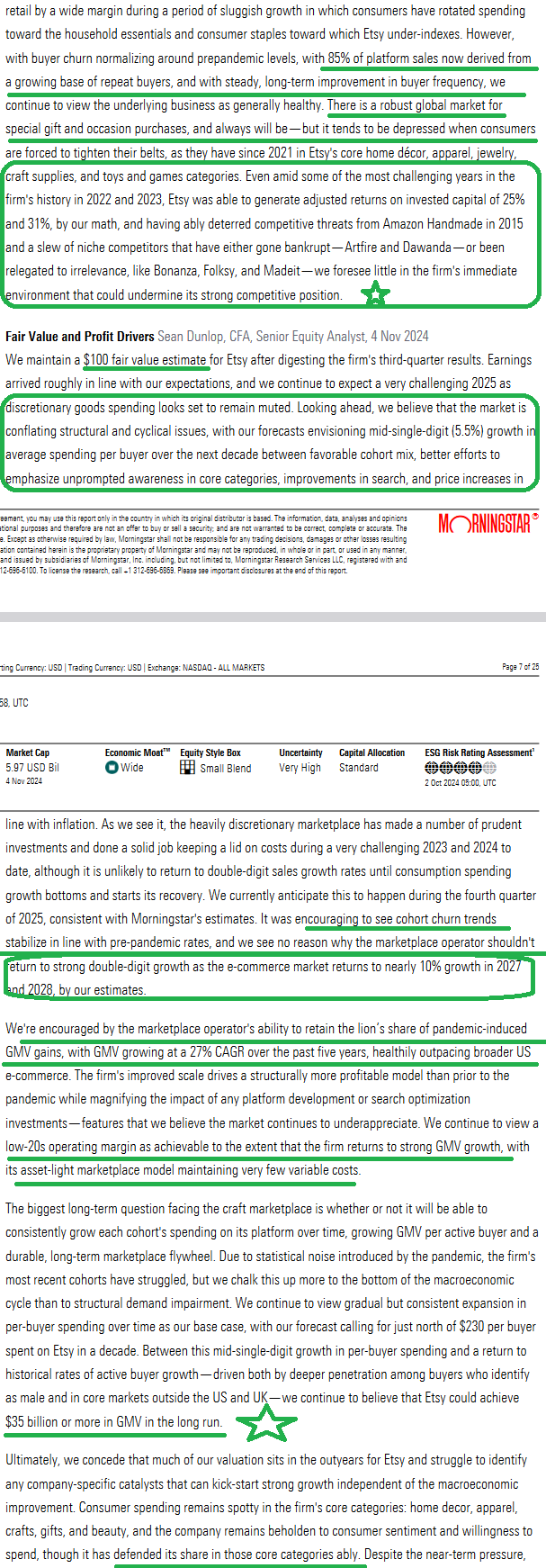

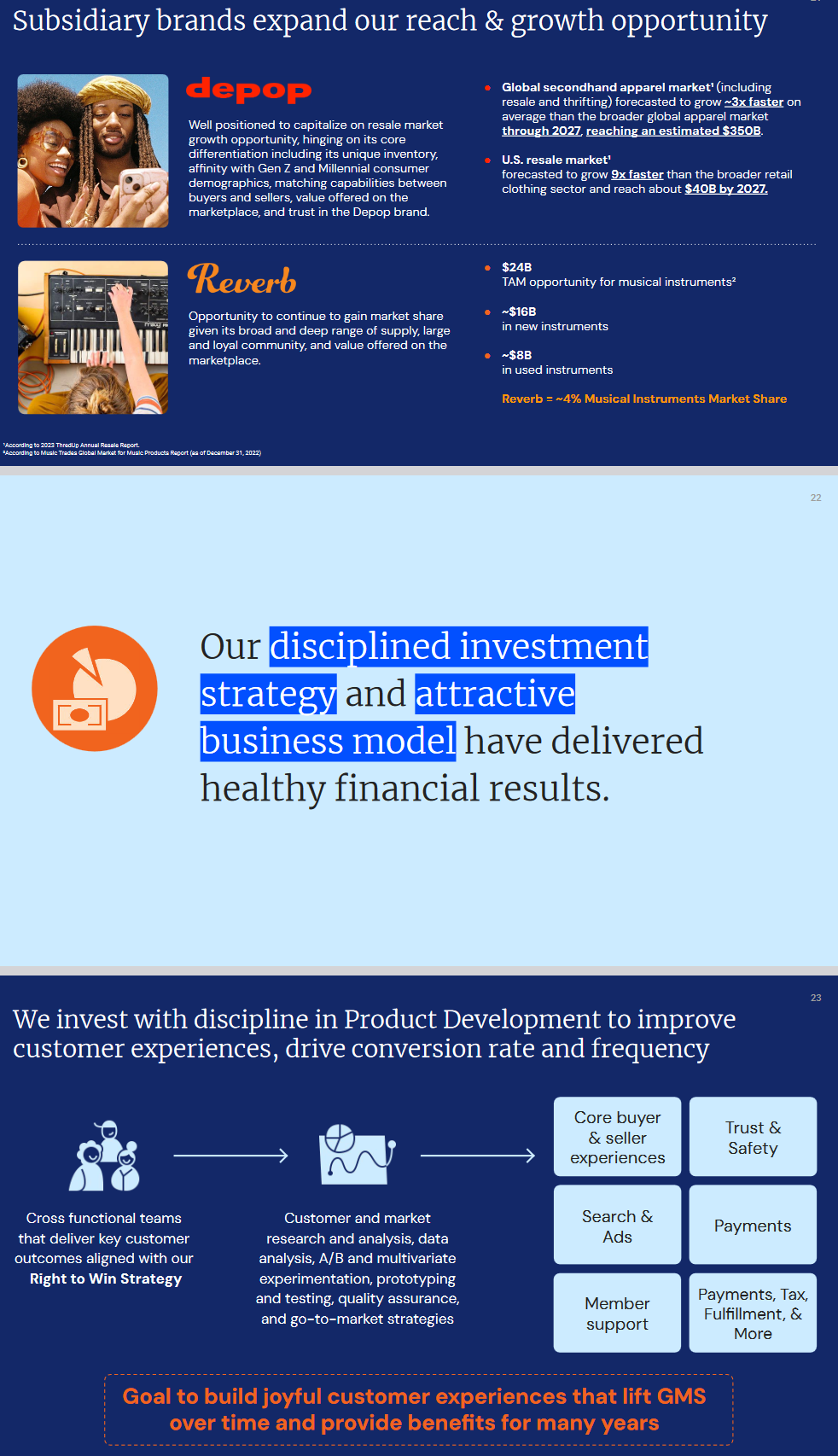

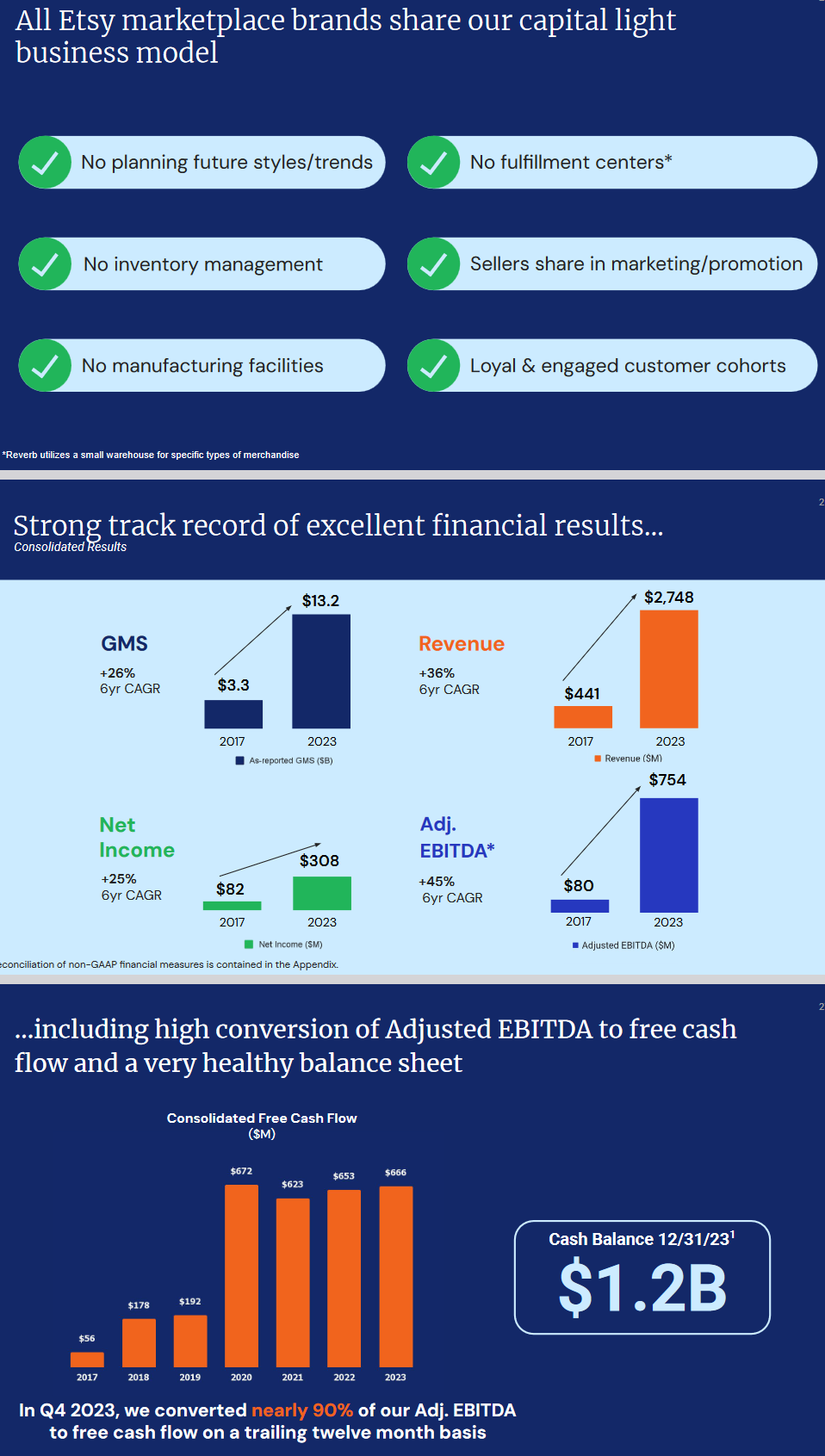

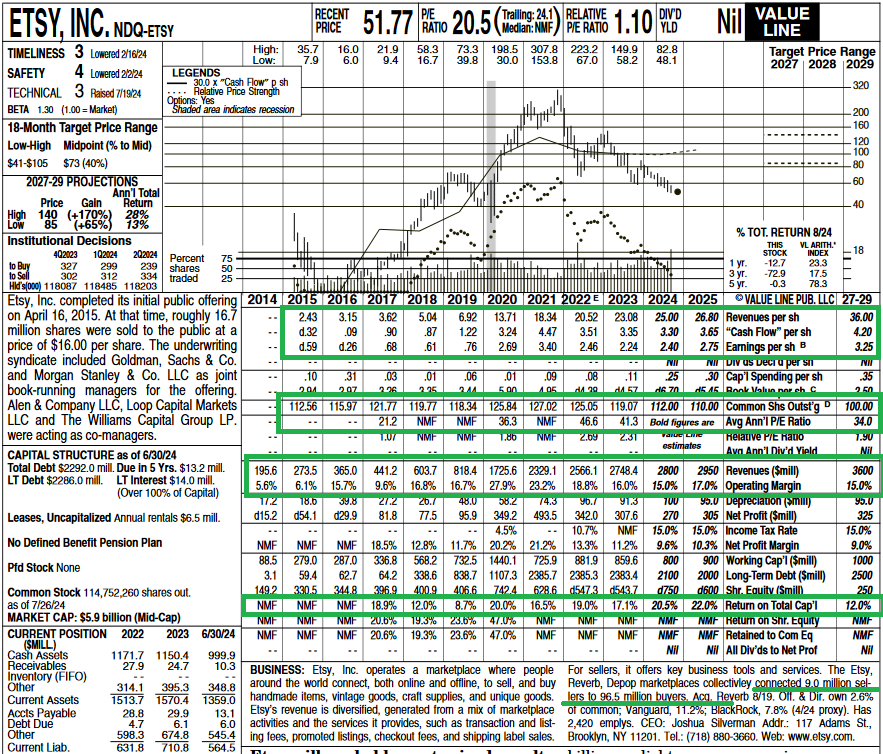

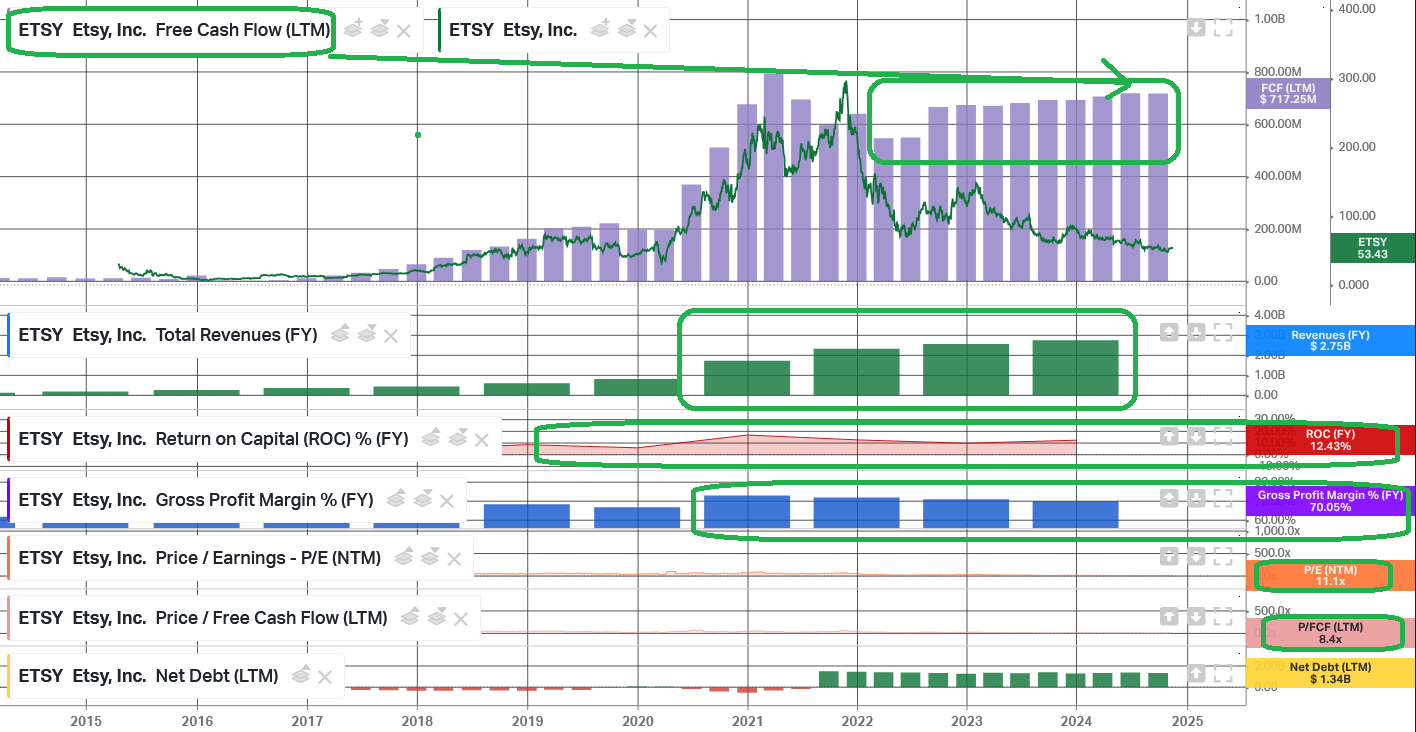

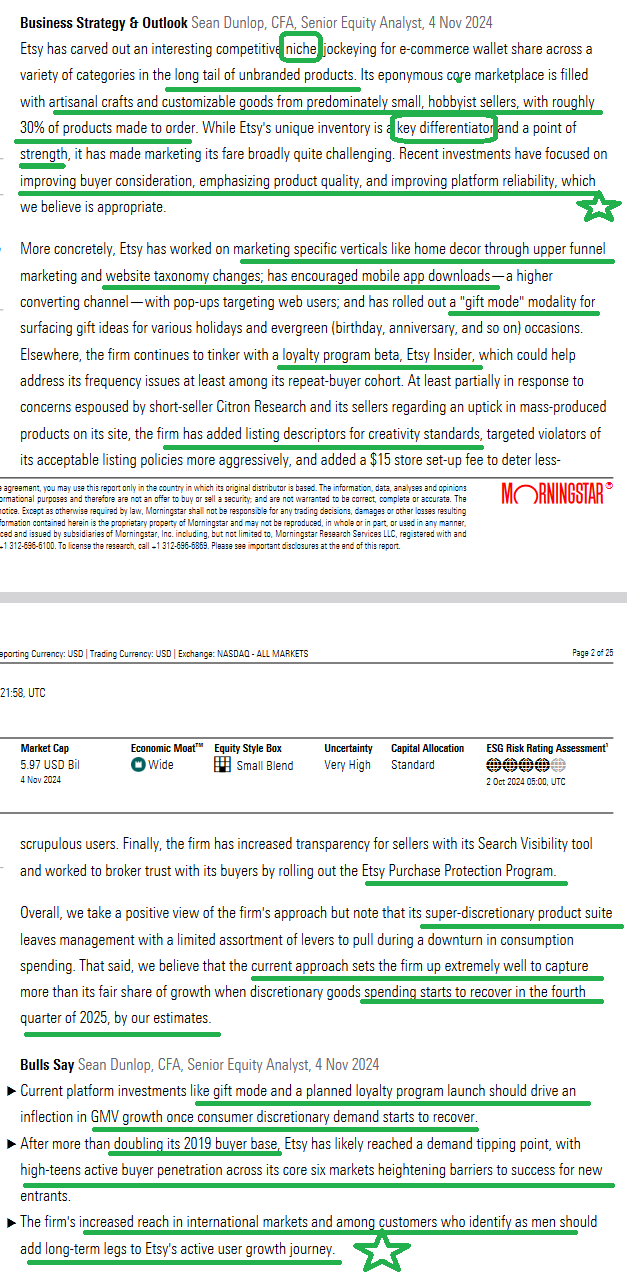

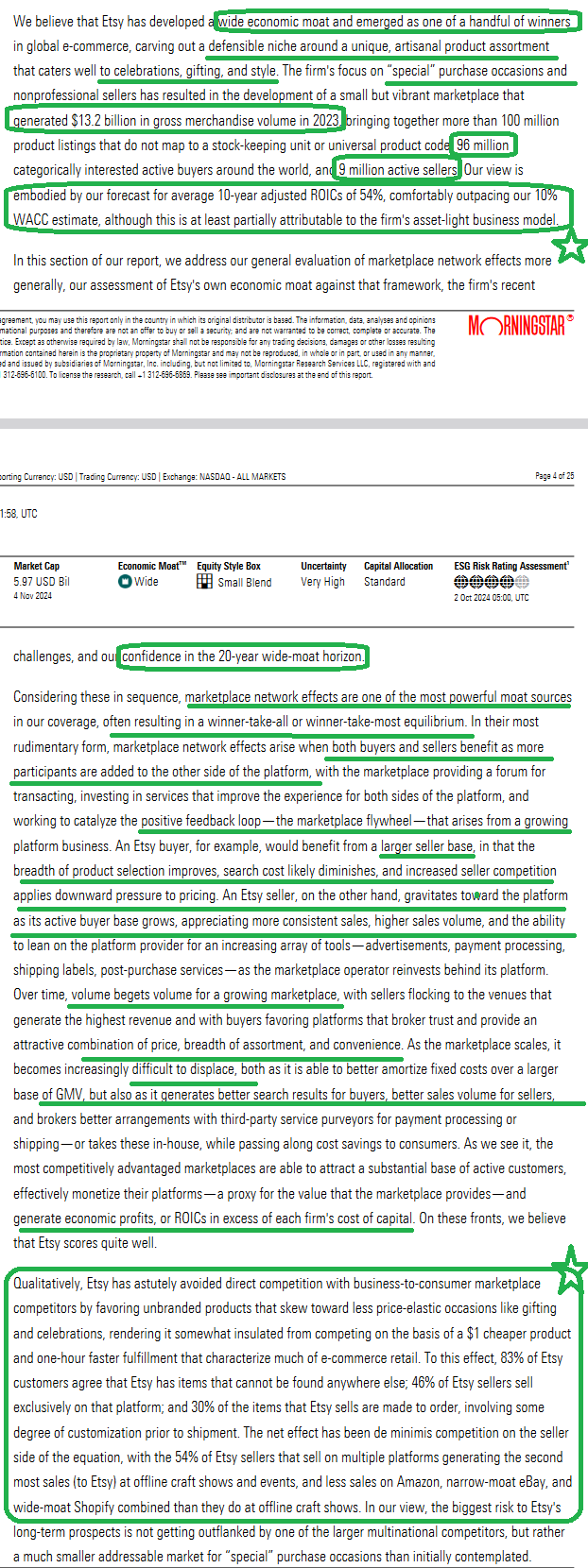

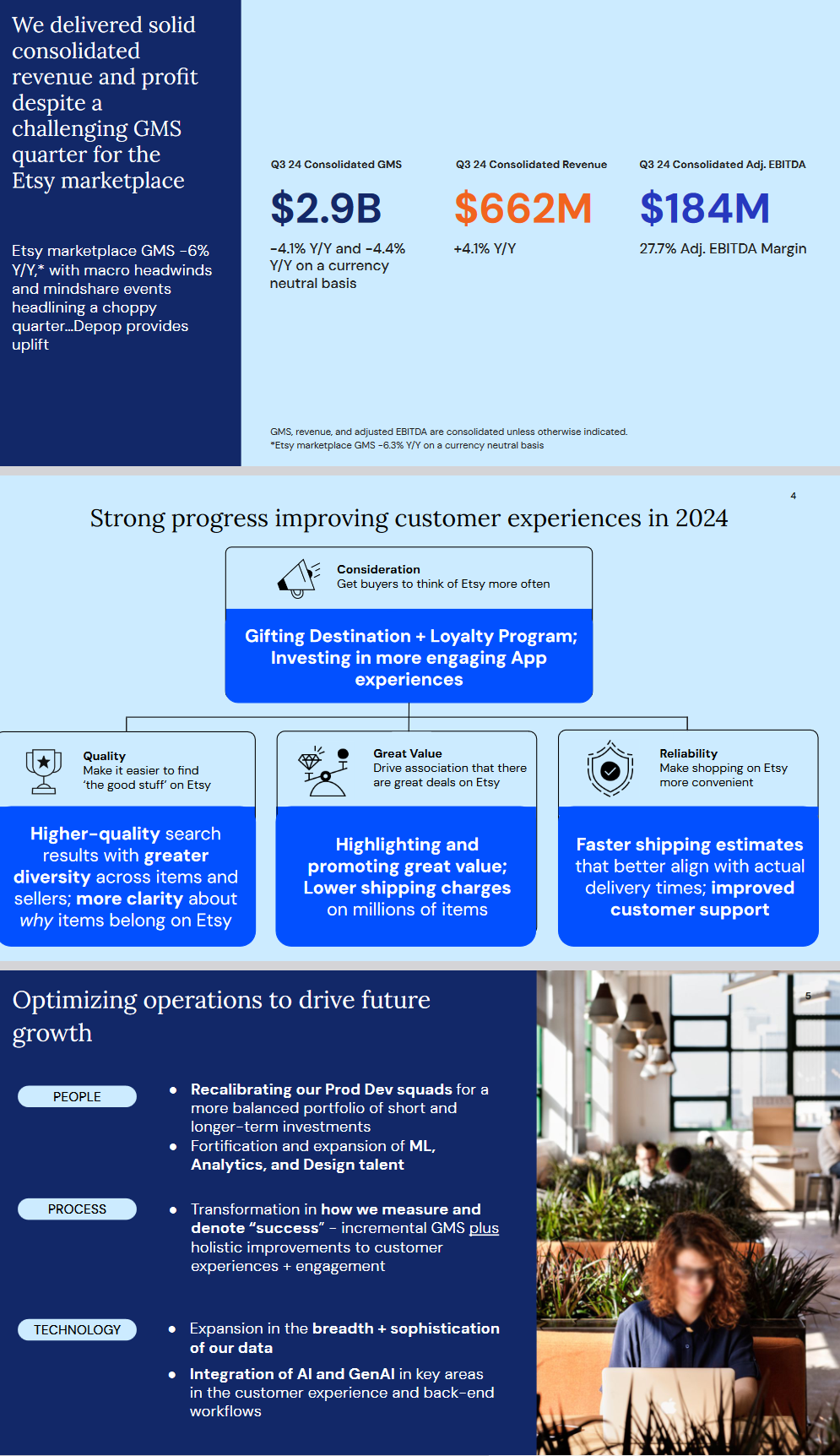

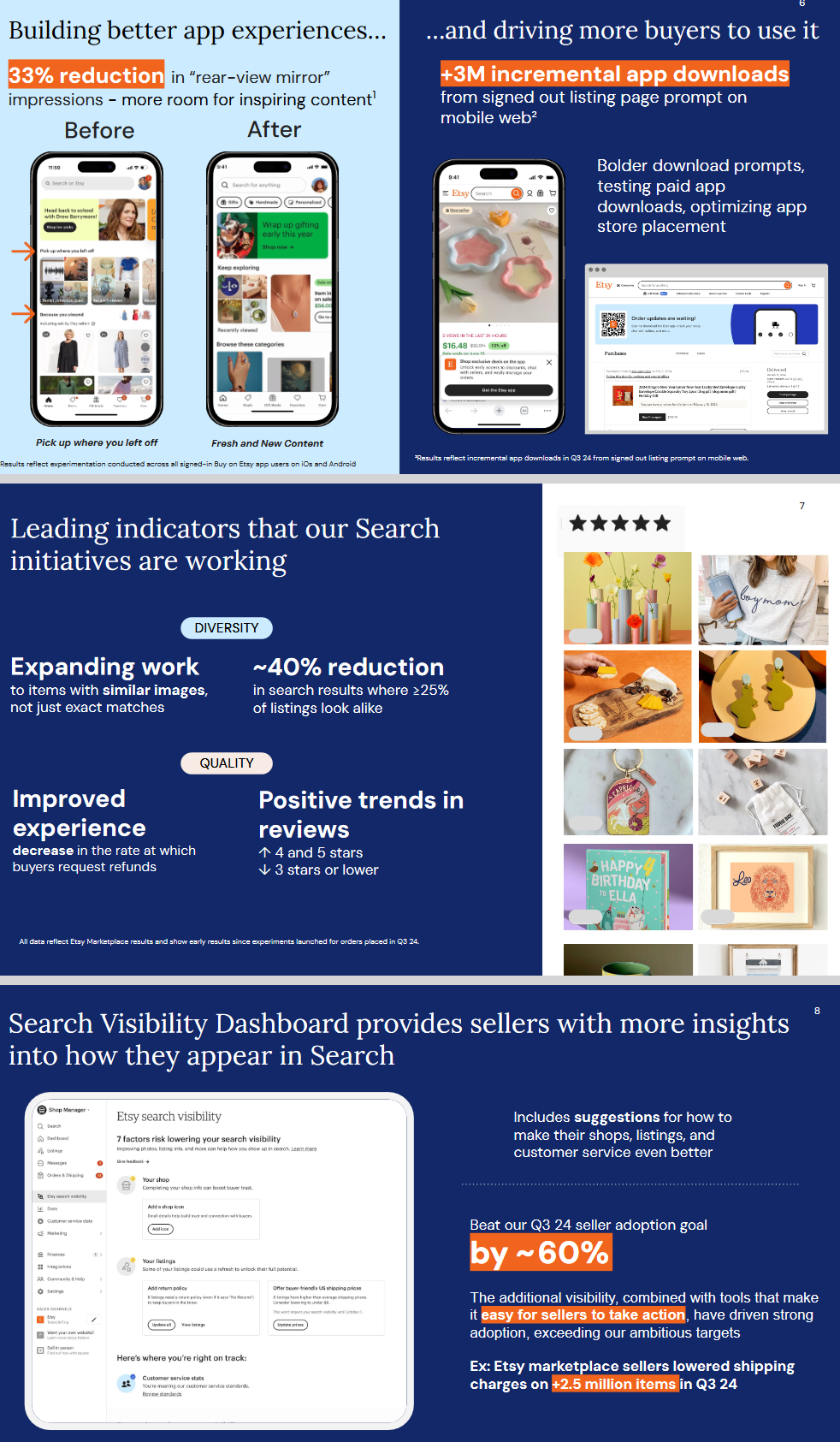

Etsy

We announced this new holding on our podcast|videocast several weeks ago (current blended basis ~$49.36).

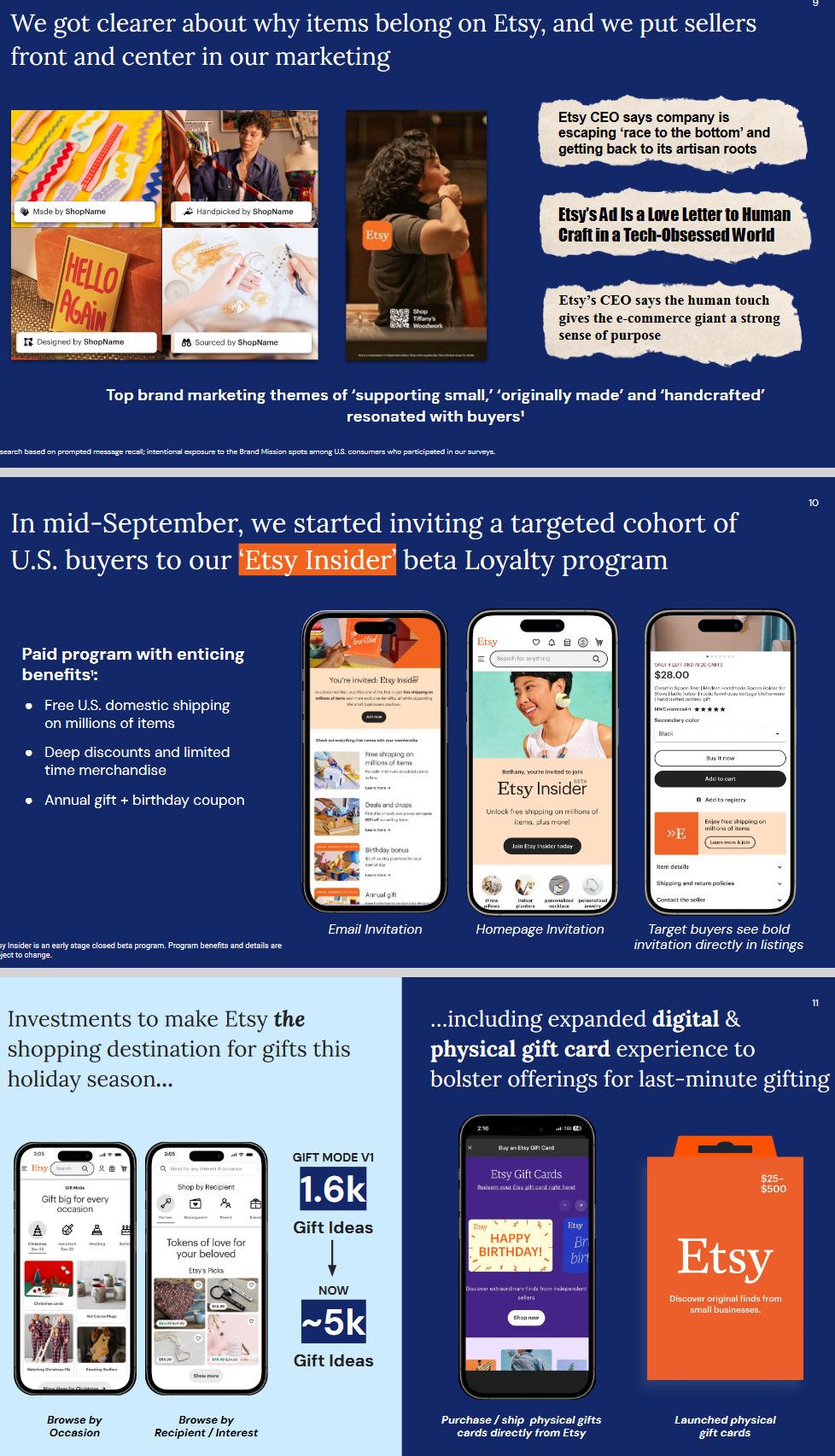

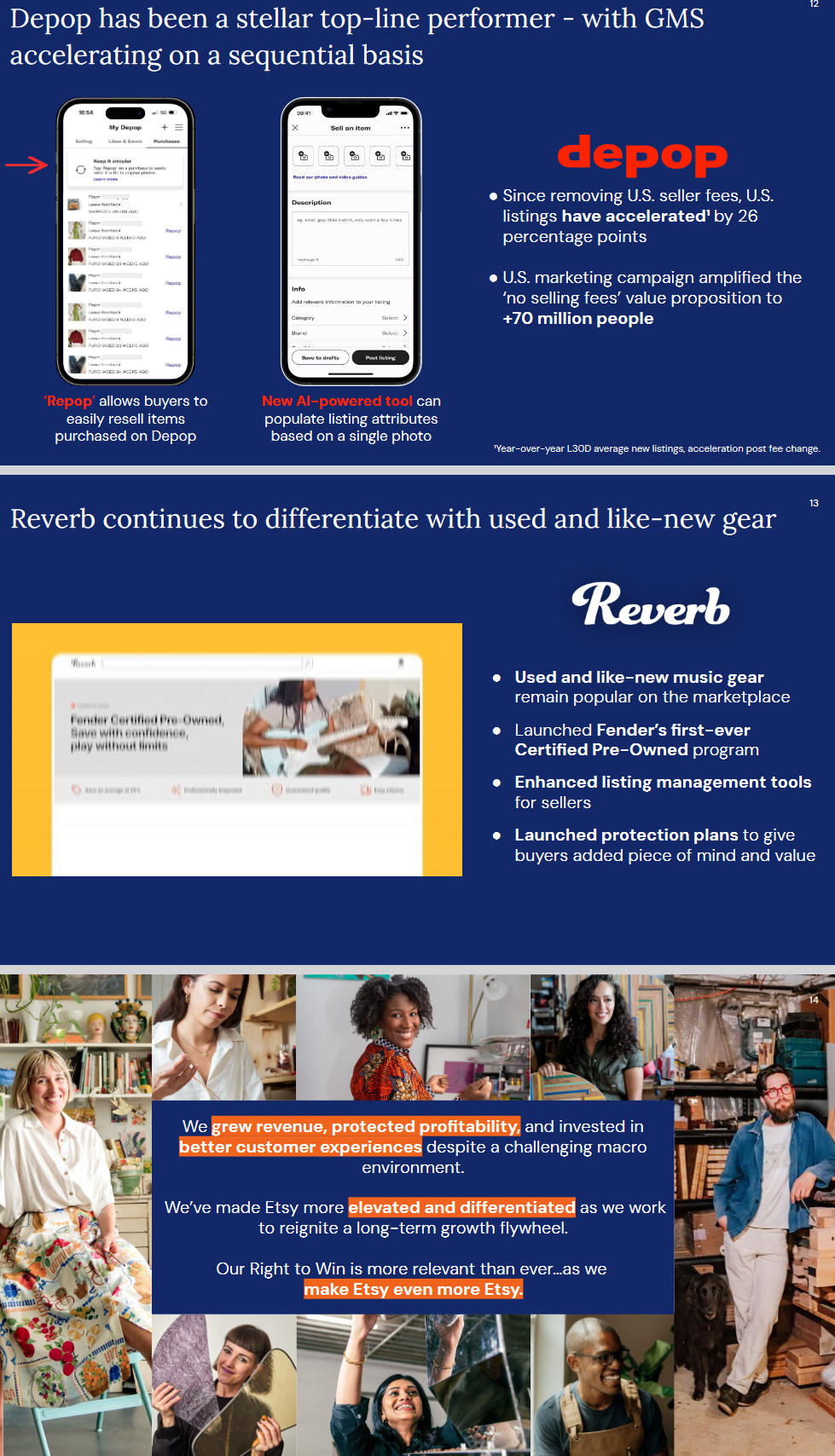

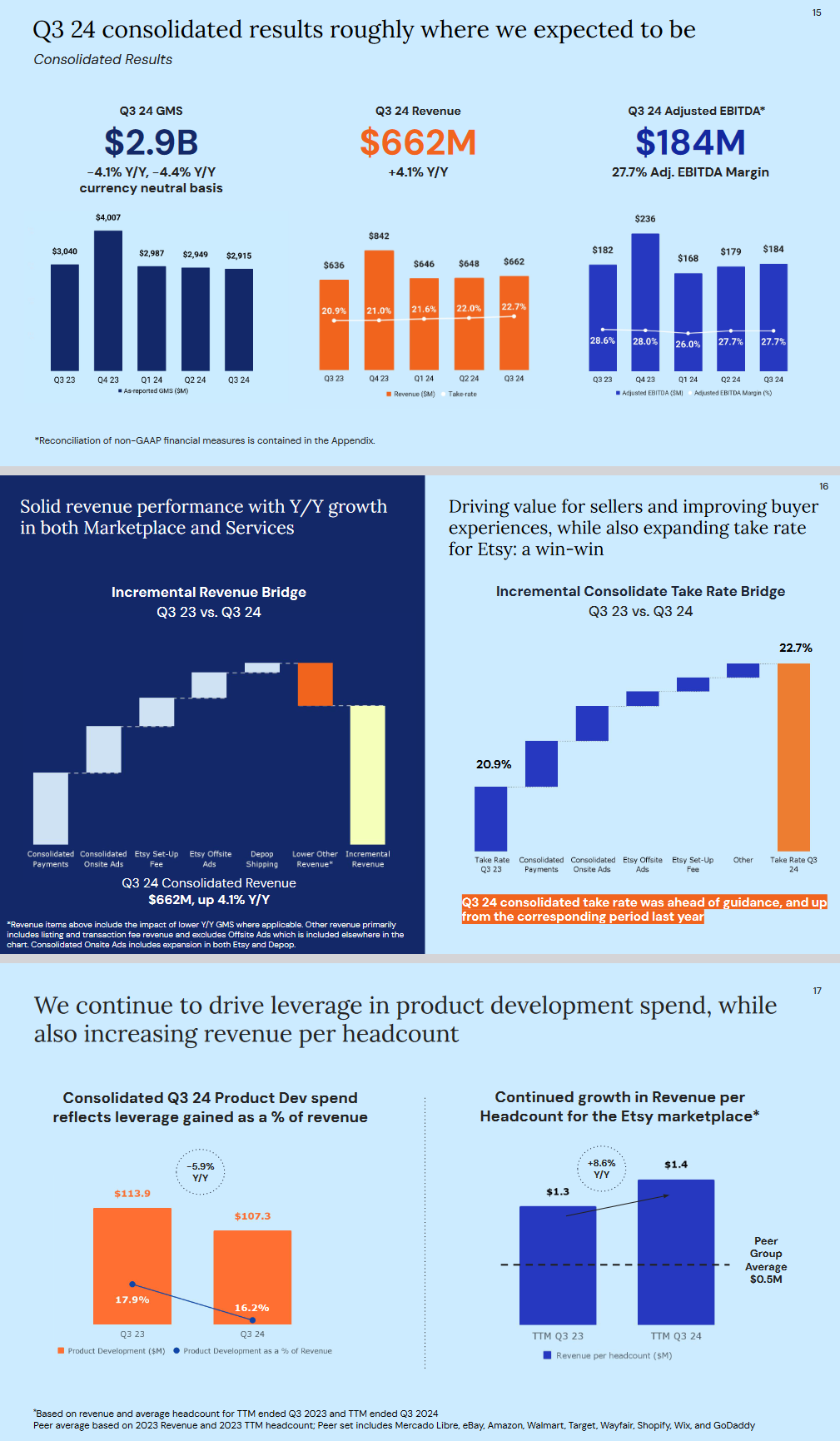

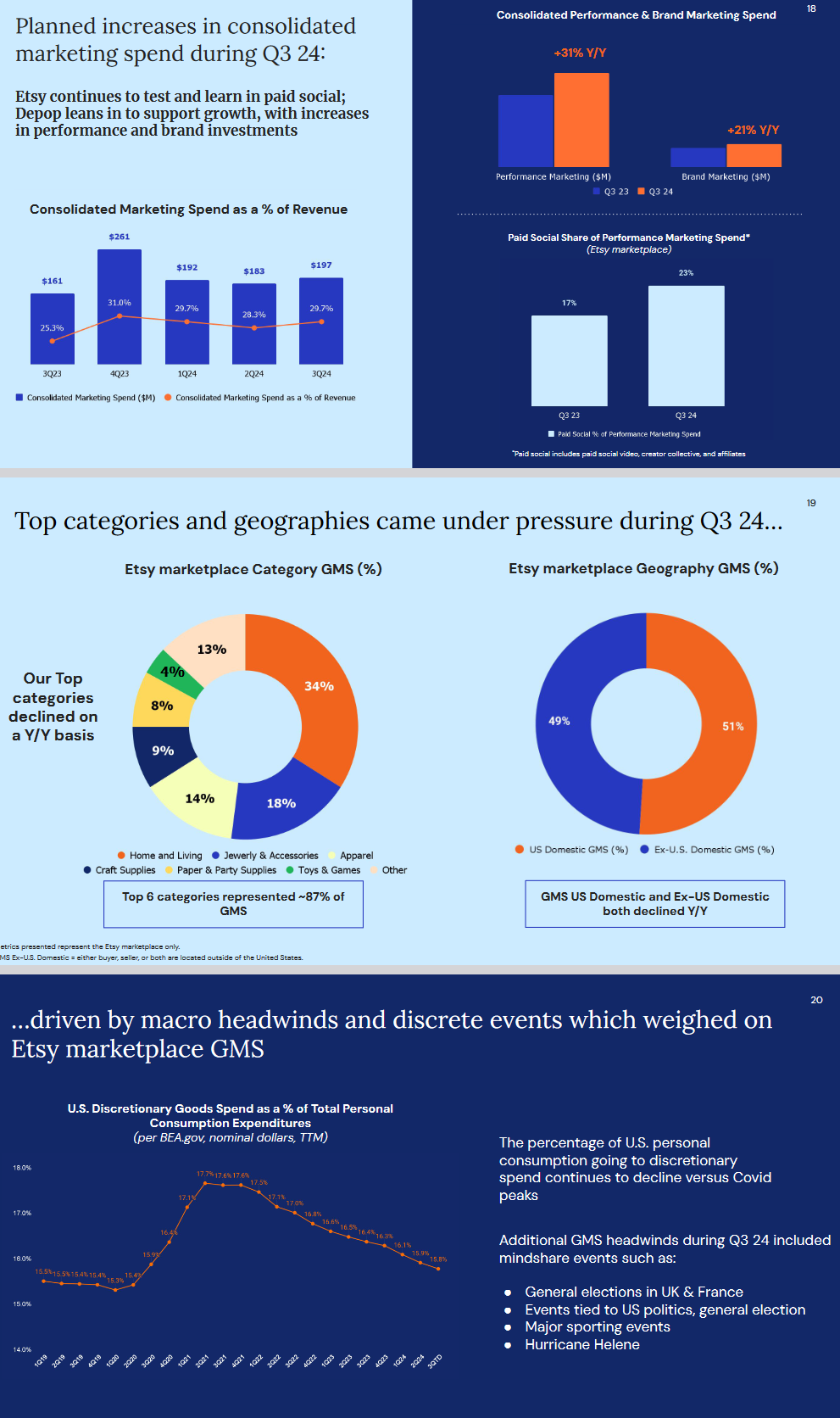

Q3 results:

Bank of America Fund Manager Survey Update

Bank of America Fund Manager Survey Update

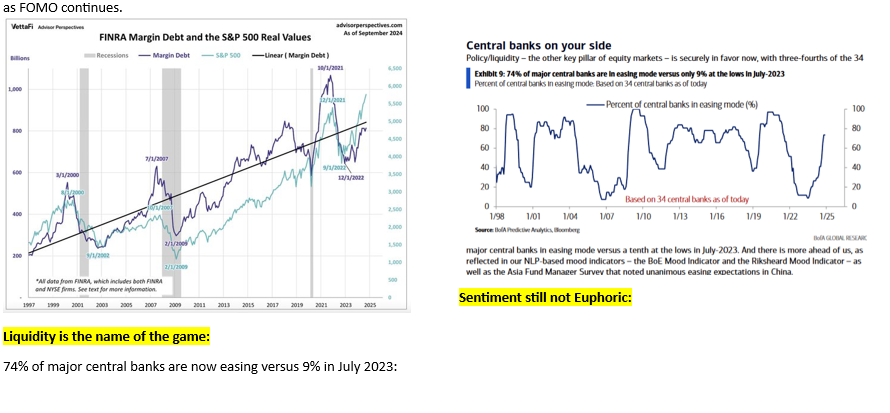

On Tuesday, we put out a summary of the monthly Bank of America “Global Fund Manager Survey.” This month they surveyed institutional managers with ~$503B AUM:

November 2024 Bank of America Global Fund Manager Survey Results (Summary)

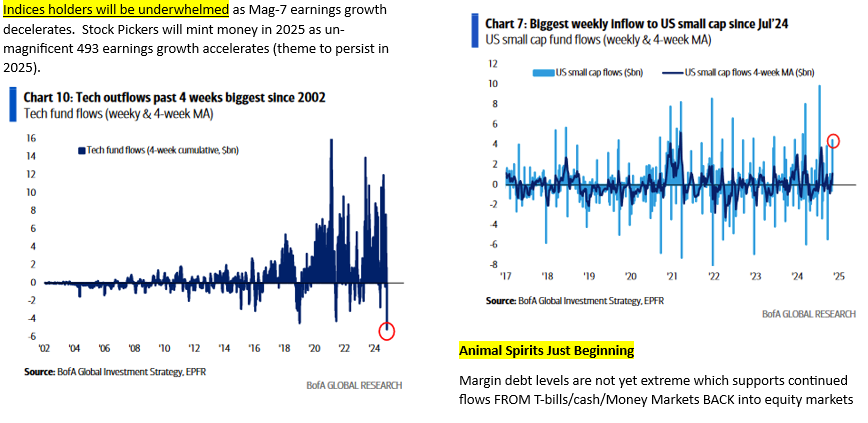

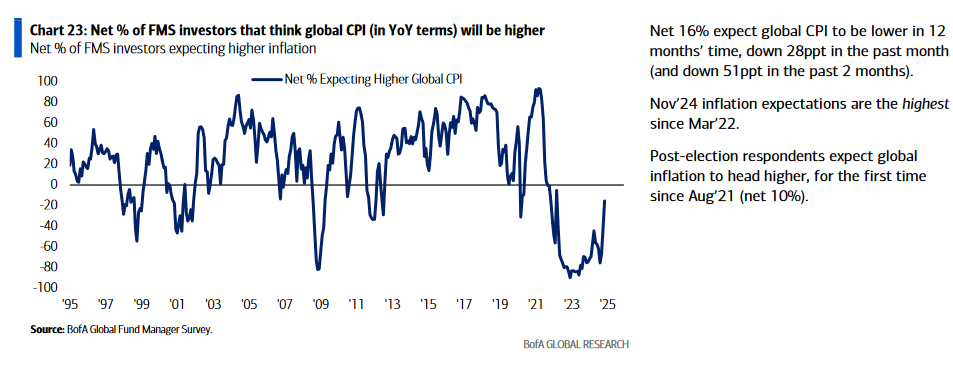

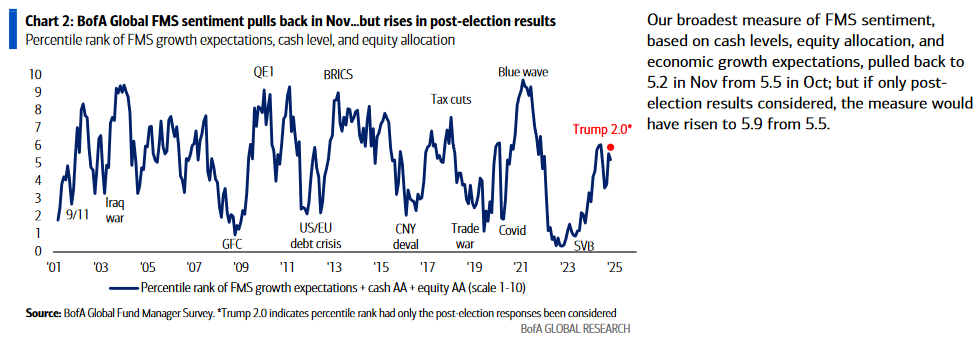

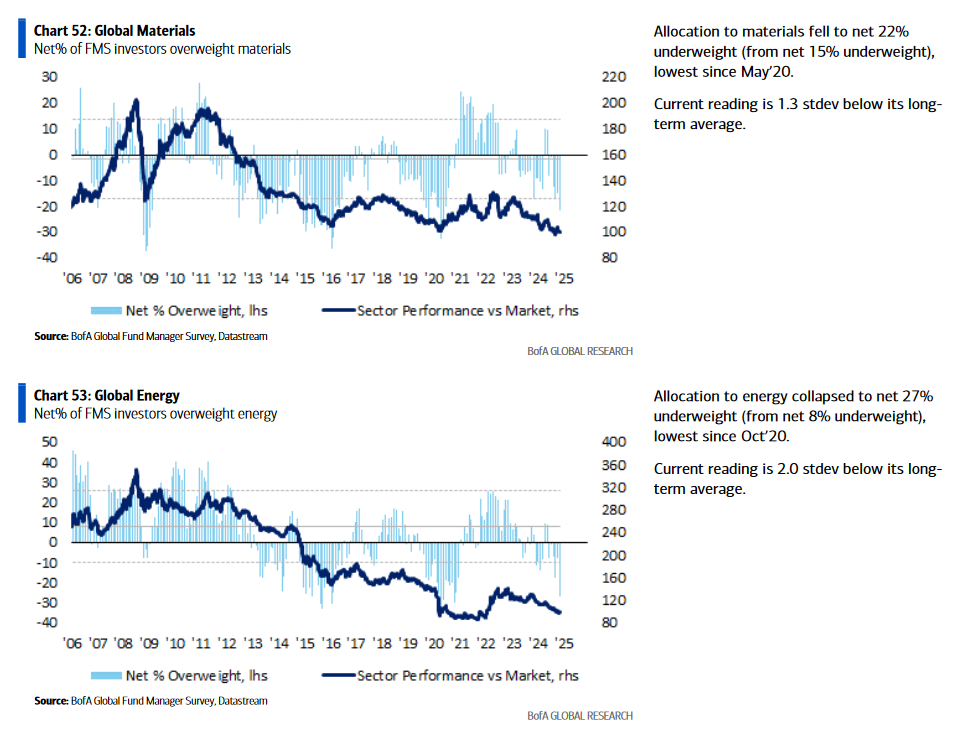

Here were the key points:

1. It is a positive (not a negative) that managers think CPI will be higher next year than this year. It is the same at each cycle trough – that precedes a growth recovery (2009, 2001, etc):

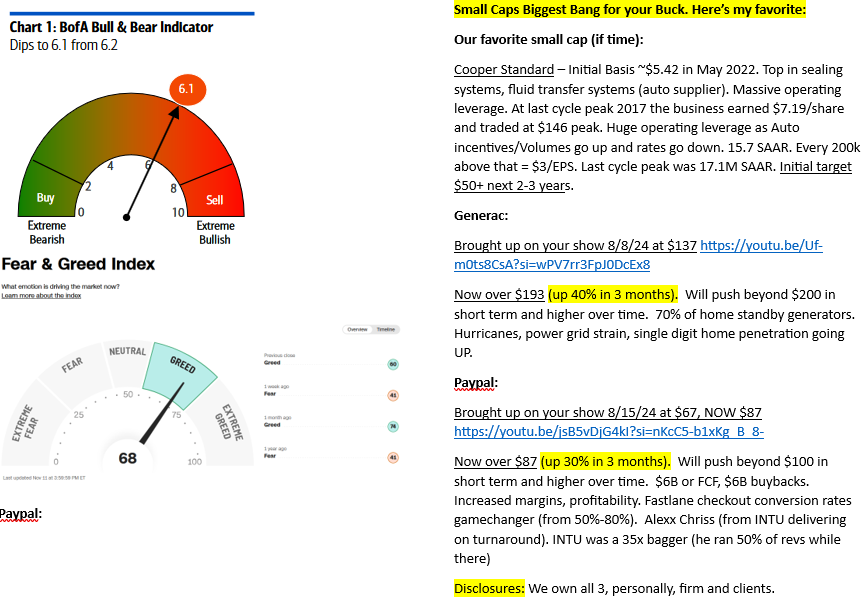

2. Sentiment is improving but not yet euphoric:

3. Managers dramatically underweight Materials and Energy:

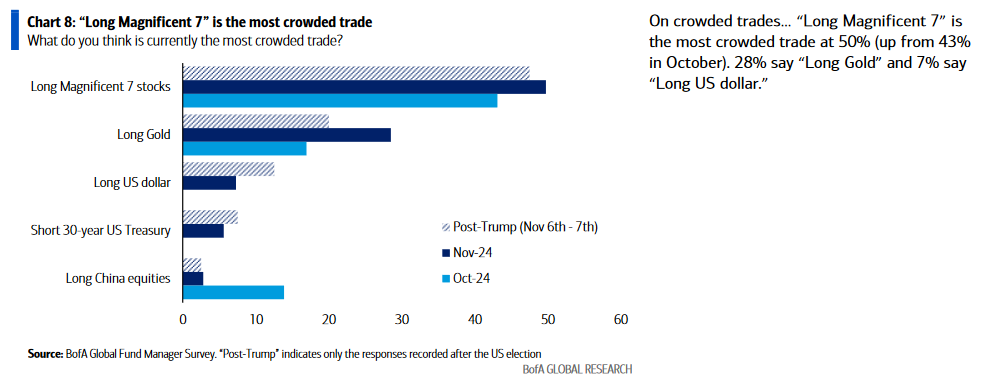

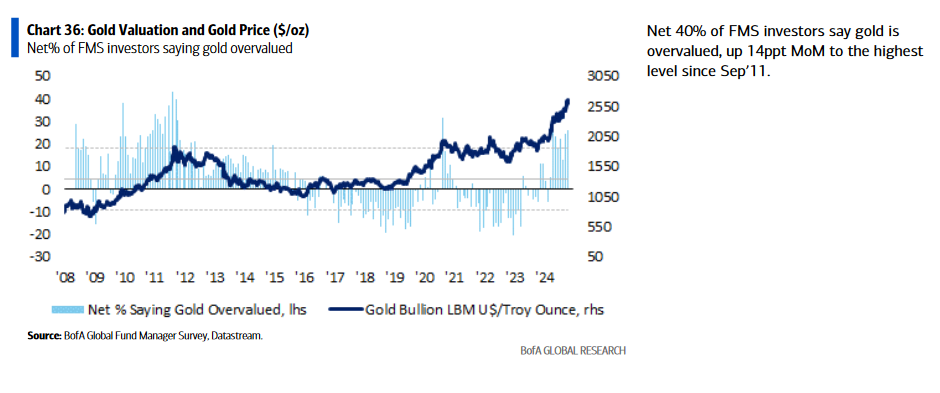

4. Long Gold is getting very crowded:

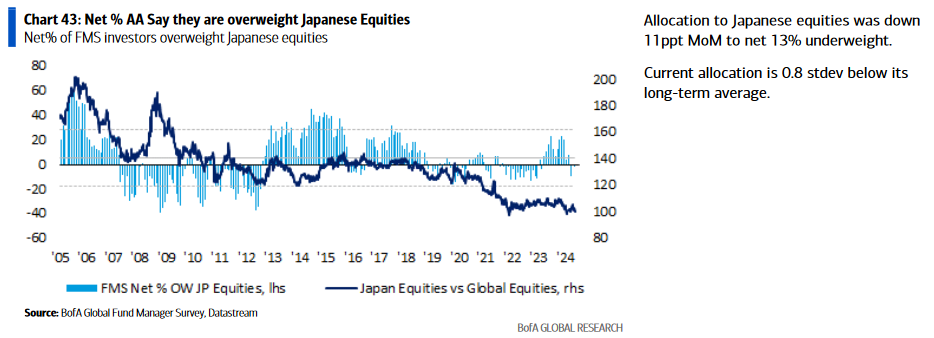

5. Managers starting to get out of Japanese equities:

General Market

The CNN “Fear and Greed” rose from 58 last week to 68 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose to 88.31% this week from 82.53% equity exposure last week.

Our podcast|videocast will be out tonight. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

*Opinion, Not Advice. See Terms