On Friday I joined Brian Sozzi and Julie Hyman on Yahoo! Finance to discuss market shifts, outlook, bonds, emerging markets, US Dollar, stock picks and more. Thanks to Justin Oliver, Cheyenne Reid, Julie and Brian for having me on. And to all of you who asked, NO, that is NOT a virtual background!!!

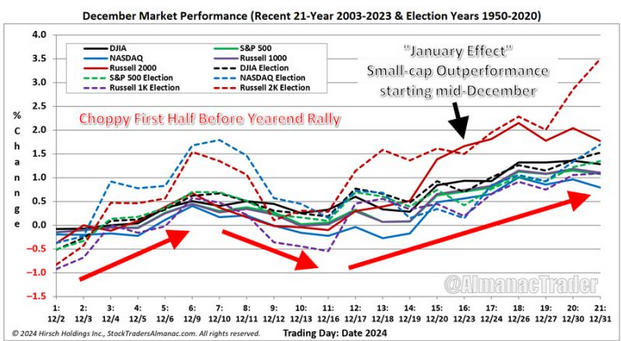

Something to keep in mind from Jeff Hirsch over at the Stock Trader’s almanac:

During earnings season I try to cover 1-2 stocks that we have discussed in our podcast|videocast(s) and/or hold in client portfolios/personally/beneficially.

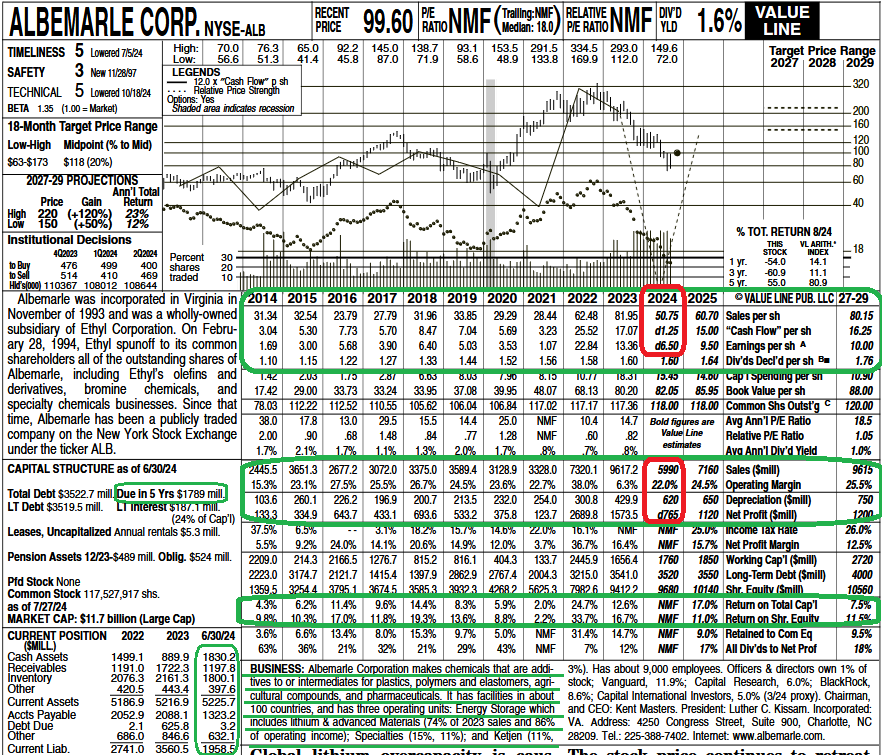

Albemarle Corp. (ALB)

Several months ago we discussed a new position in Albemarle Corp. (basis ~$93.22). It is not a large position yet because at the time of initiation there was limited excess (un-invested) capital to put to work. As new capital came in, price ran away from us. We don’t “buy up.” We do think we will get additional opportunities to size this position up as more data comes in, but if not, we’re okay with what we have.

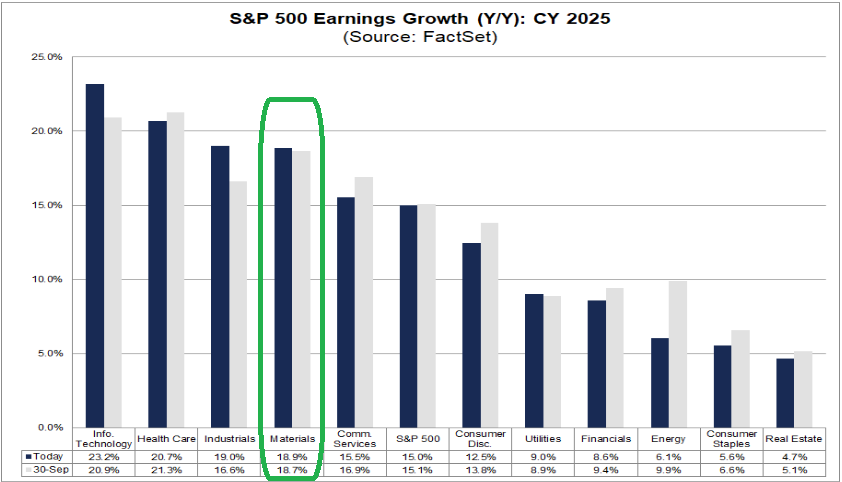

ALB is in keeping with our theme to find more “Materials” exposure in 2025 – as the sector has been decimated and earnings growth is expected to recover handsomely:

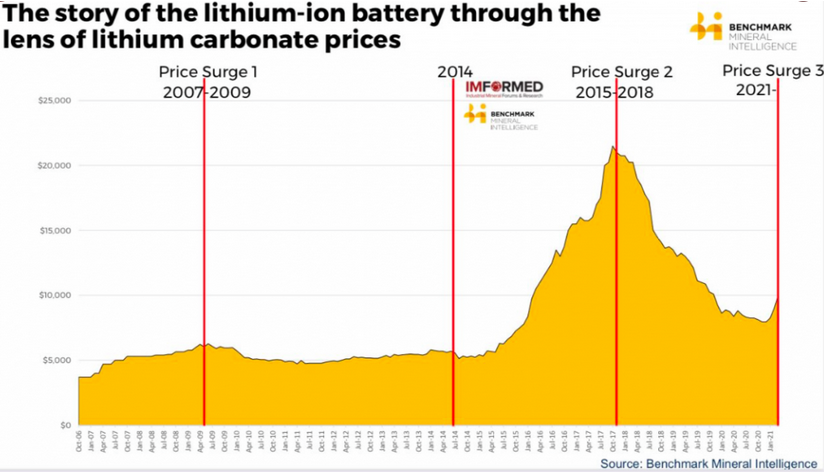

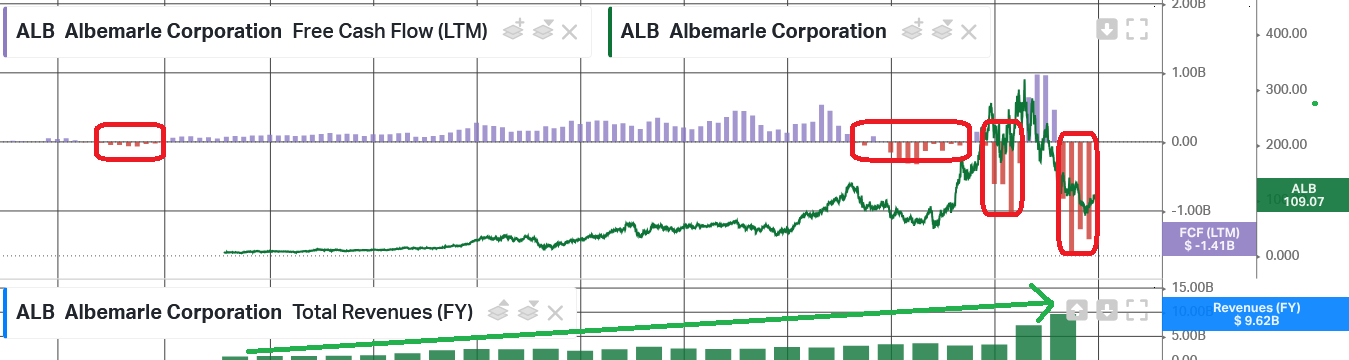

Albemarle’s primary business is Lithium production. We can see below the stock’s most recent spike and collapse in price (from 2021-2024) correlates with the spike and drop in price of Lithium Carbonate:

I generally avoid “commodity” stocks for this very reason (with the exception of Oil and Nat Gas stocks when I can buy the commodity cheaper on the NYSE than in the fields). I learned that tactic from J. Paul Getty in his legendary book “How To Be Rich.”

However, when you look at Albemarle’s long-term price chart, the correlation unravels. Albemarle historically has a moat around its business which – when executing at proper levels – can mint money irrespective of the price of the underlying commodity:

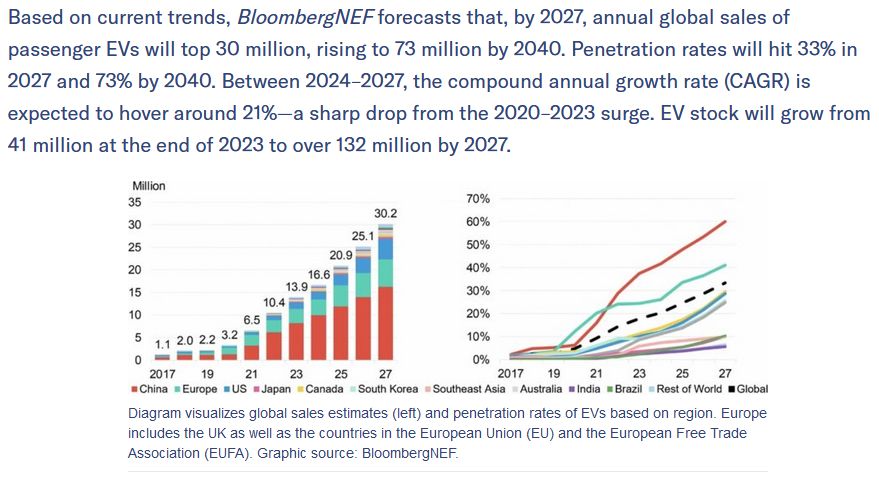

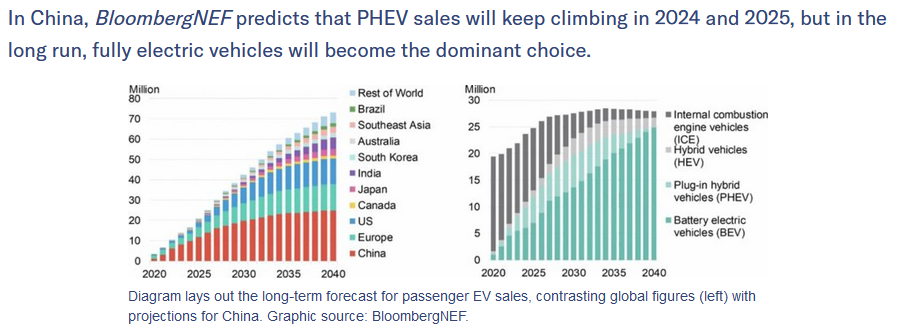

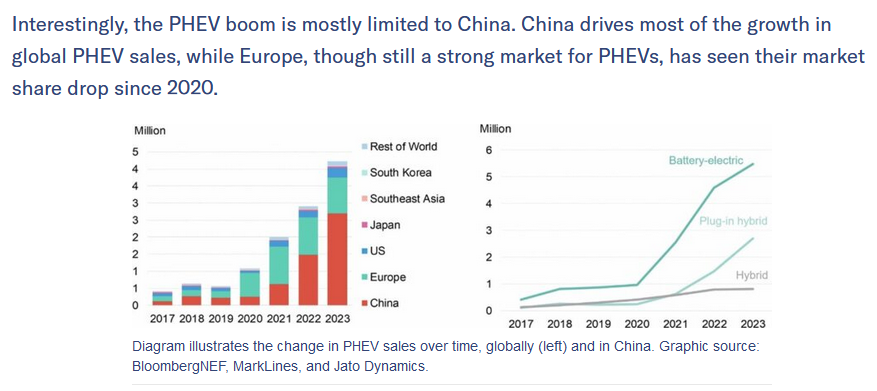

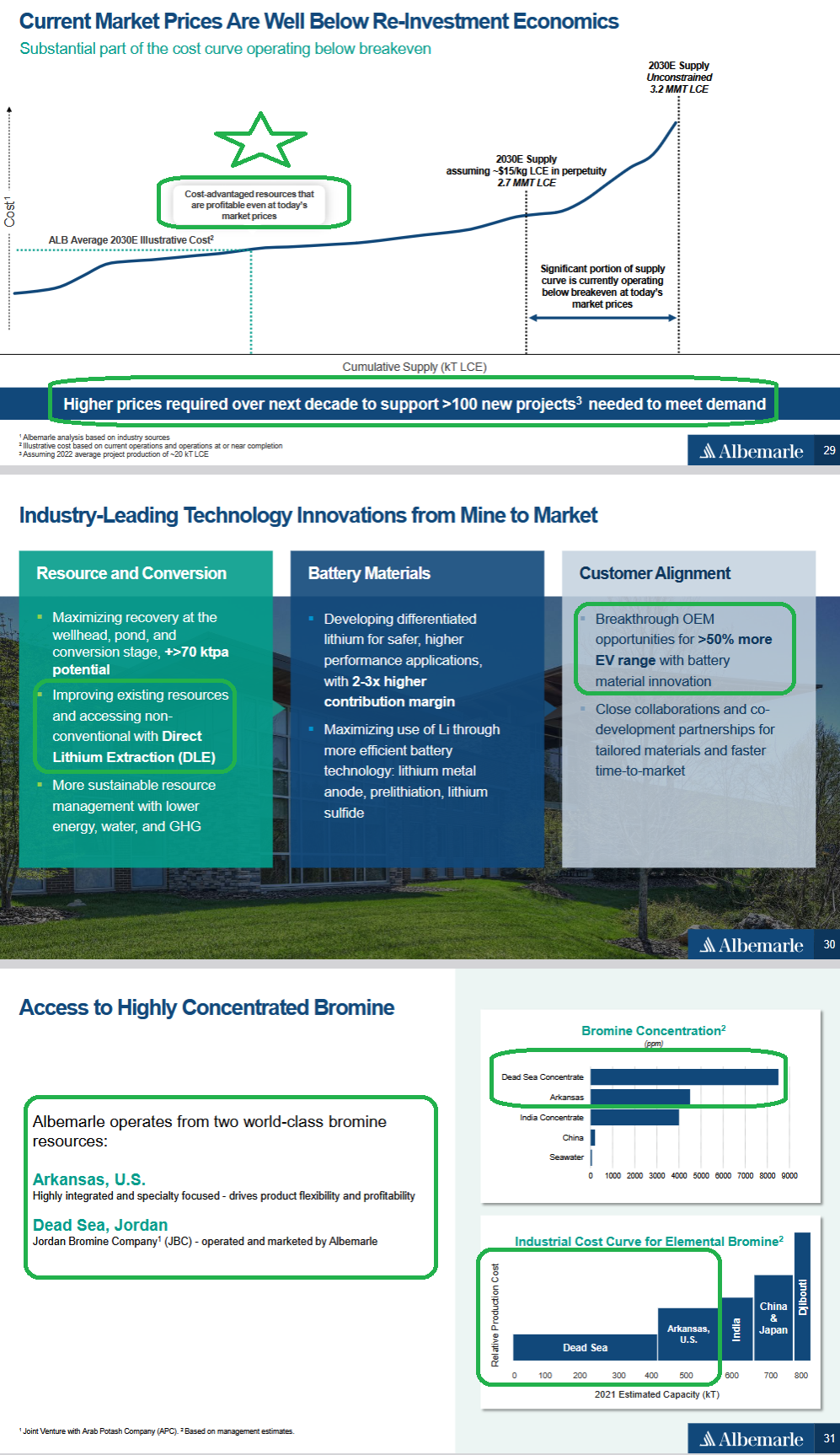

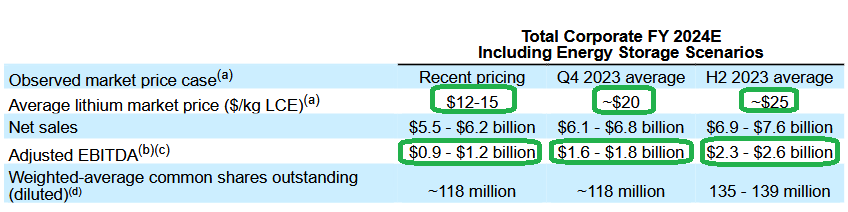

China’s appetite for EVs shows no signs of abating – even if N.A. sales have softened of late. If these estimates prove to be 25% true, ALB will not be able to handle all of the demand required in coming years:

2024 was an aberration due to short term global lithium overcapacity.

2024 was an aberration due to short term global lithium overcapacity.

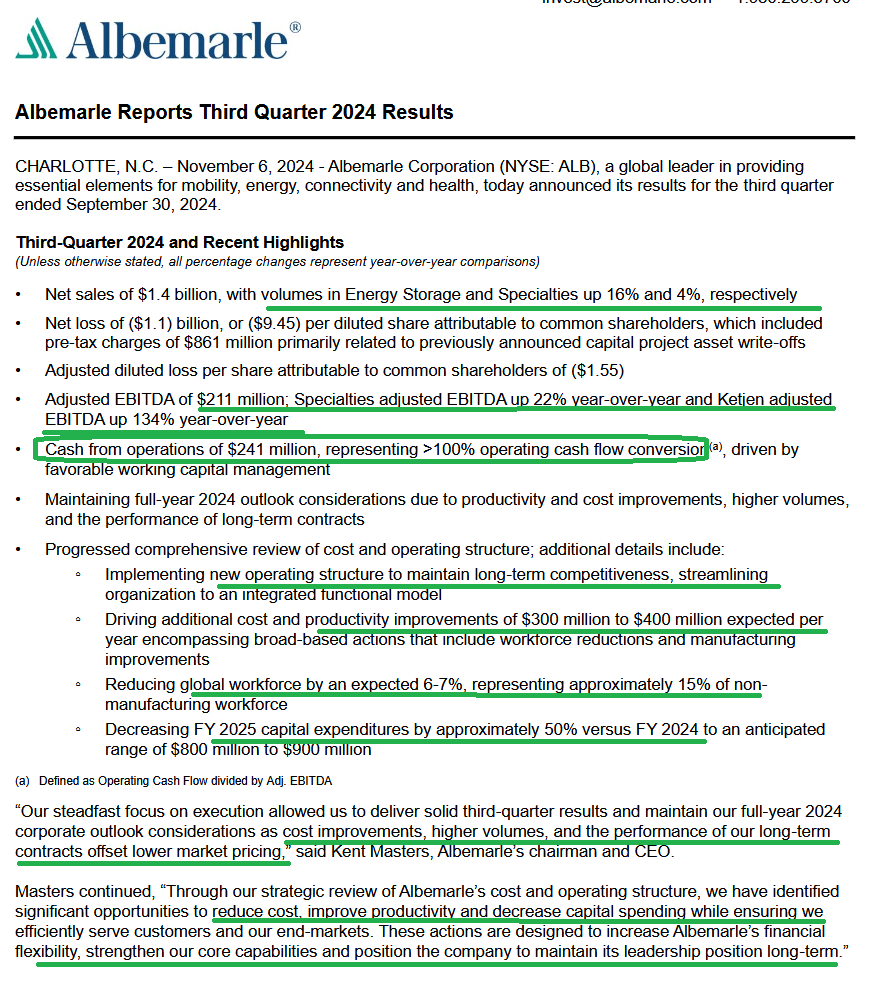

Turnaround Tactics:

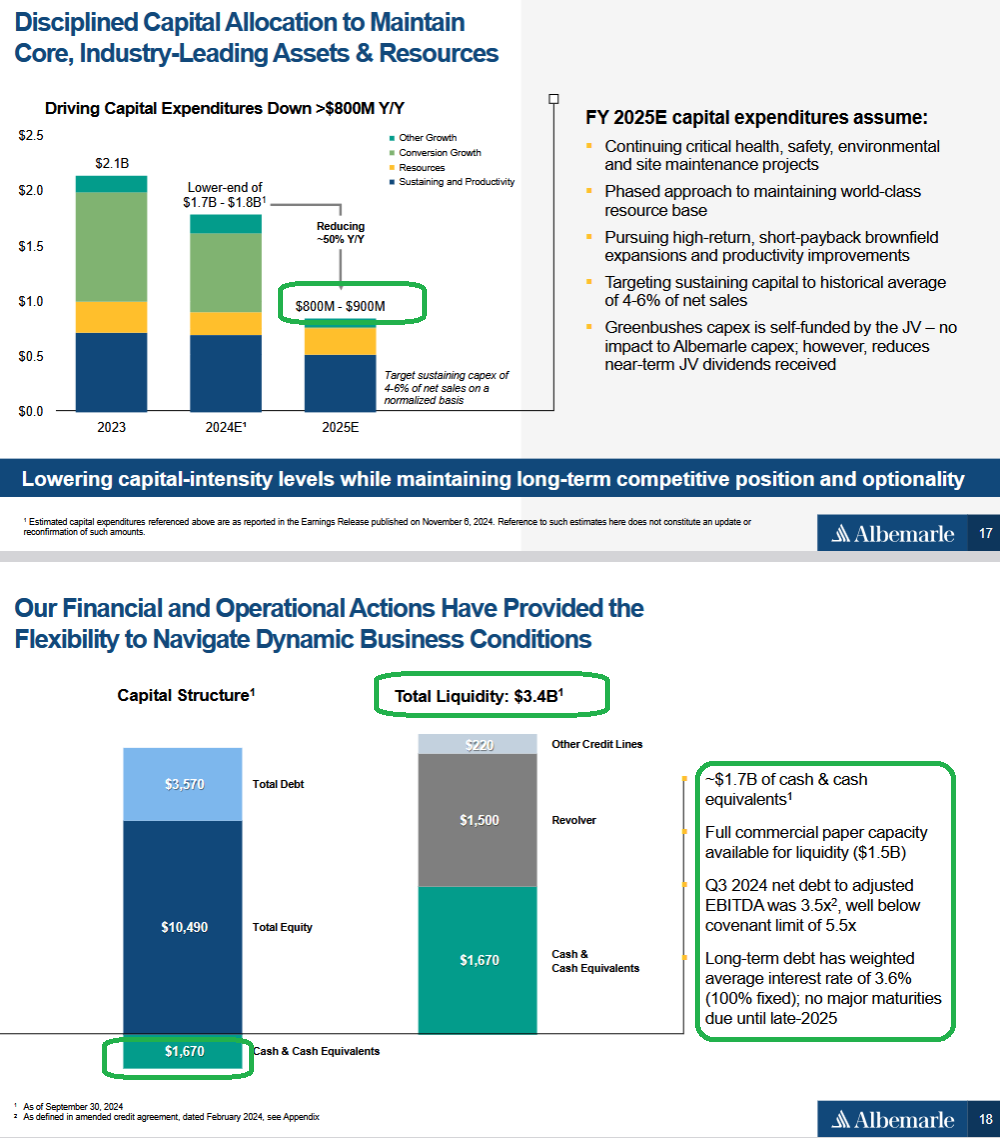

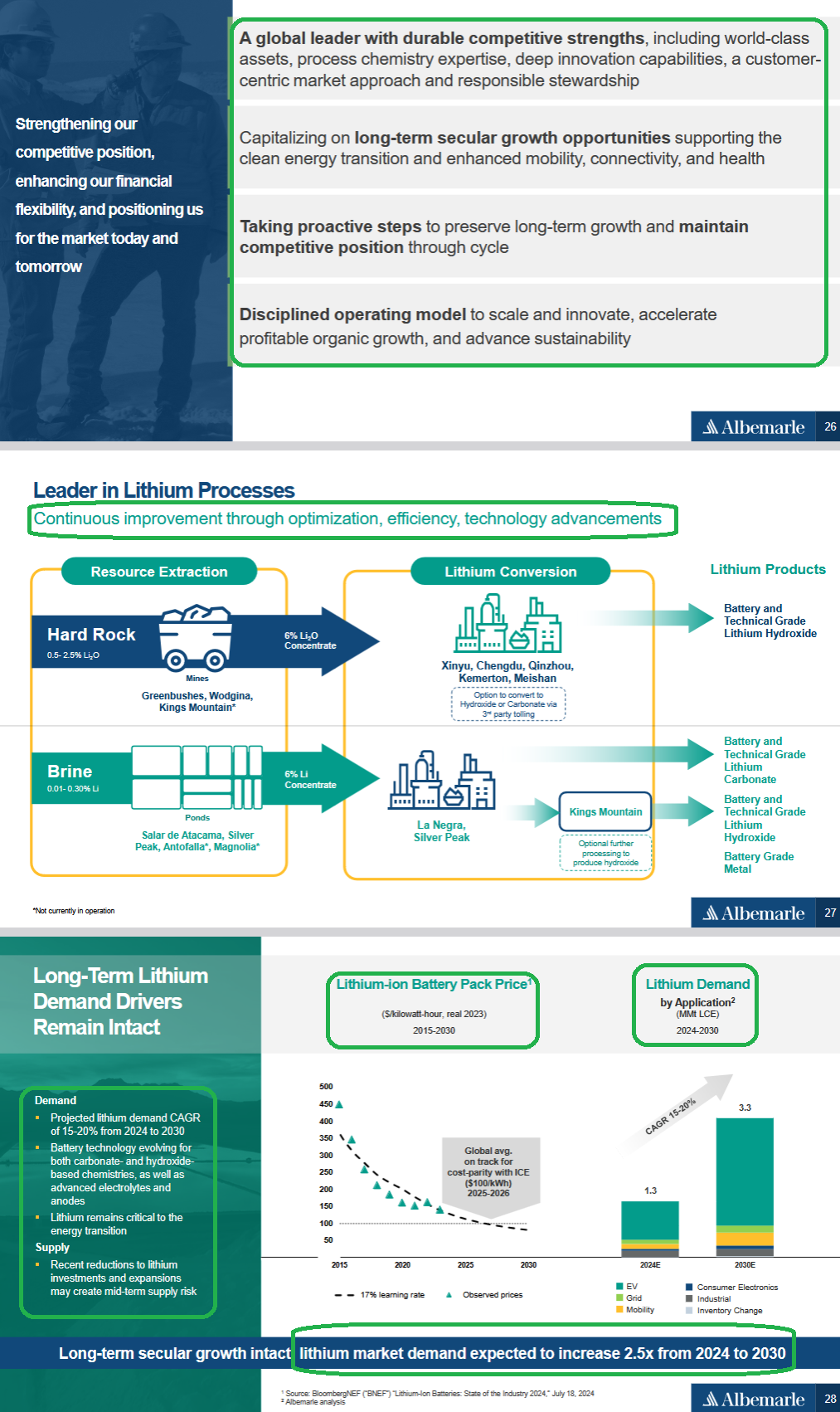

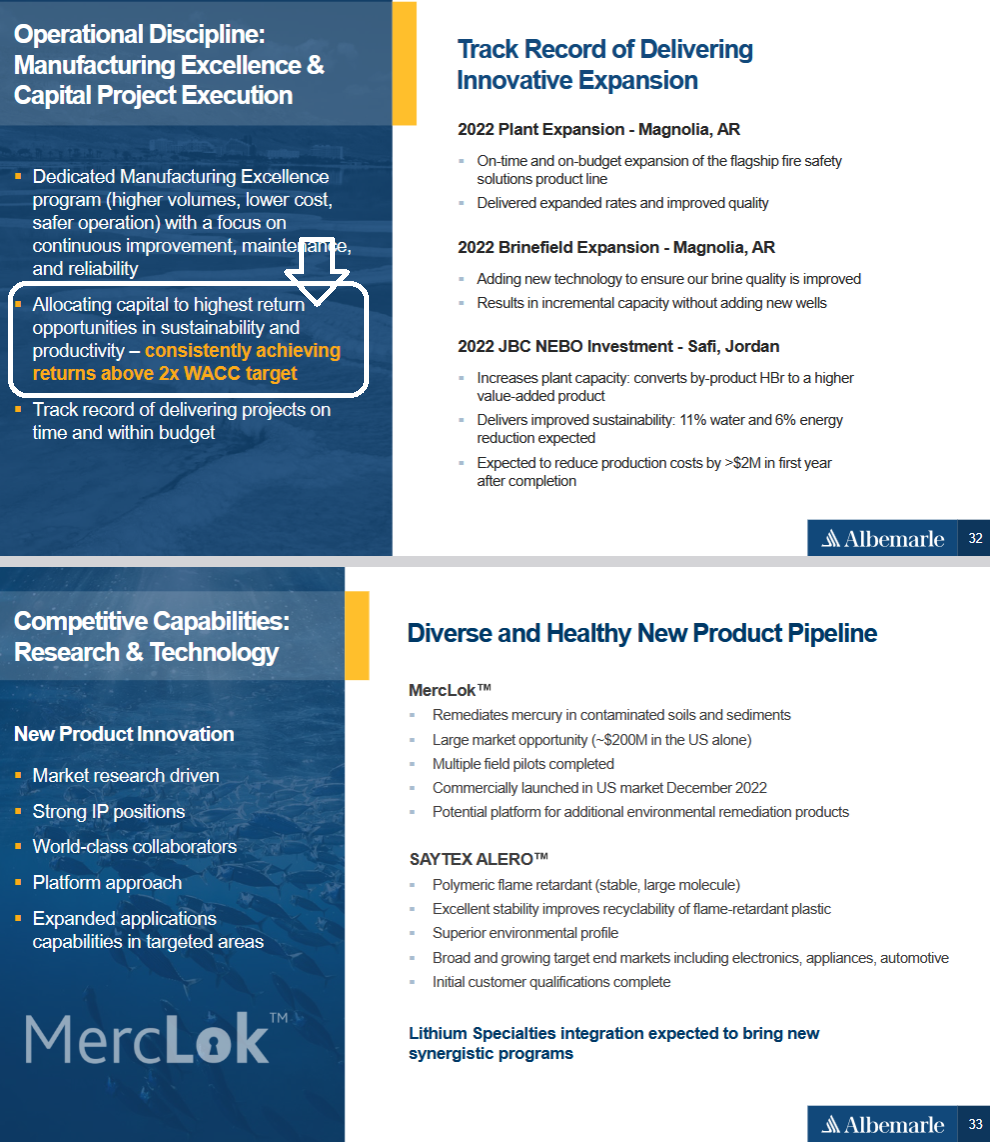

1. Management’s plan to reduce both operating costs and capital expenditures in response to cyclically low lithium prices.

2. Management announced 2025 capital expenditures will be reduced by 50% versus 2024 levels. Albemarle is also implementing overhead cost reductions that should largely offset lower sequential realized lithium prices during the fourth quarter, with the majority of cost savings to be implemented in 2025.

3. Capex and cost reductions could drive profit growth and positive free cash flow generation by 2026 if lithium prices remain lower for longer.

4. Lithium carbonate prices remain at multiyear lows, around $10,000 per metric ton on an index basis.

5. End market demand continues to grow. Global electric vehicle sales are set to grow in 2024, and utility-scale batteries used in energy storage systems are seeing strong demand growth, driving lithium demand higher.

6. In response to low prices, many producers, including Albemarle and its peers, are cutting supply. We expect the market will return to balance in 2025 from a current supply deficit.

Investor Highlights

Investor Highlights

Q3 Highlights

General Market

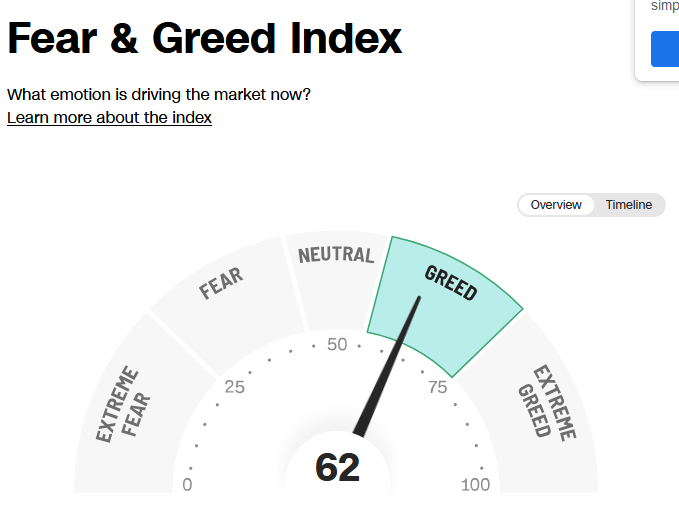

The CNN “Fear and Greed” flat-lined from 64 last week to 62 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

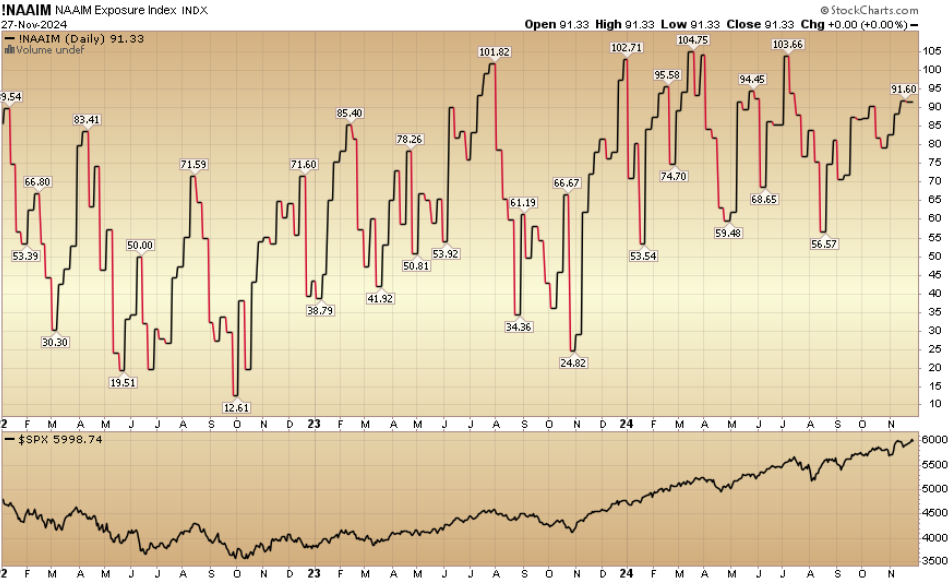

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) flat-lined at 91.33% this week from 91.60% equity exposure last week.

Announcements

1) I will be on Fox Business – The Claman Countdown – with the great Liz Claman today at 3pm. Tune in if you are free…

2) I will be speaking at the MoneyShow this weekend in Orlando and meeting existing/potential clients as requested in Tampa/Sarasota on Thursday and Friday afternoon. If you would like to request a meet up, reach out here.

3) Our podcast|videocast will be out today or tomorrow – depending upon my travel schedule. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here

*Opinion, Not Advice. See Terms