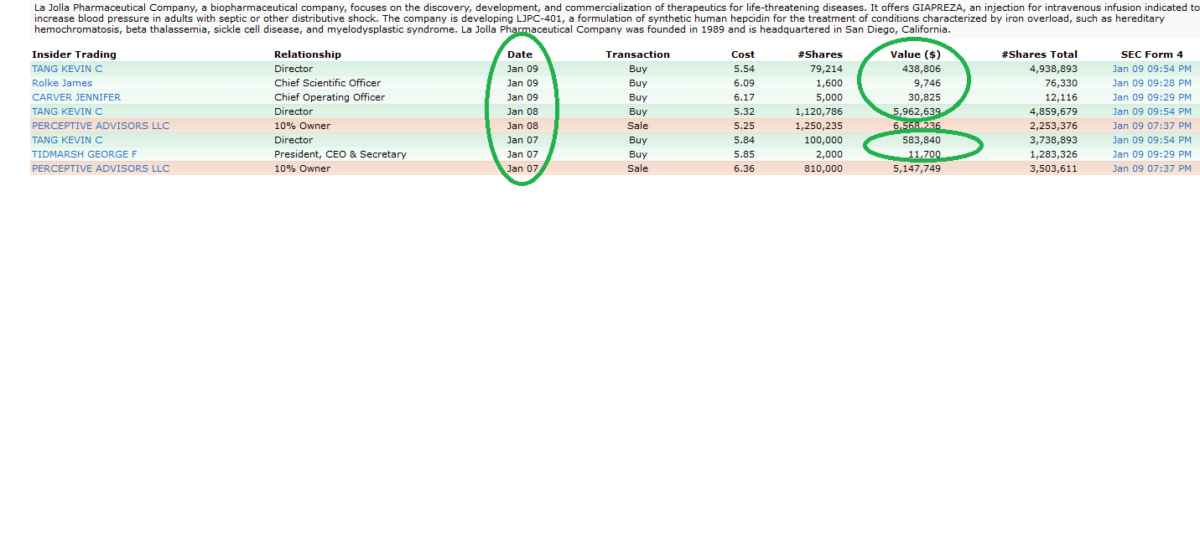

Insiders seemed unfazed by the additional ~47.7% drop in $LJPC La Jolla Pharmaceutical Company on Jan 7 – as they have been in the market scooping up shares since the company announced preliminary operating Continue reading “Insider Buying”

What I’m reading today…

- These 6 stocks rose after downgrades. That’s a good sign: (Barron’s)

- Stock Markets Could Get a Lift From These 3 Things: (Barron’s)

- Computer Models to Investors: Short Everything: (Wall Street Journal)

- Should You Fear the Yield Curve? (Wall Street Journal)

- Fed Ready to Pause on Interest Rate Increases (New York Times)

- PayPal Quietly Took Over the Checkout Button (Bloomberg)

- Beijing says latest US-China trade talks made progress on forced tech transfers (CNBC)

- Twitter named a 2019 best Internet idea at JPMorgan: (The Fly)

- Legendary Hedge fund manager Jeffrey Vinik believes the current bull market could last another 10 years (CNBC)

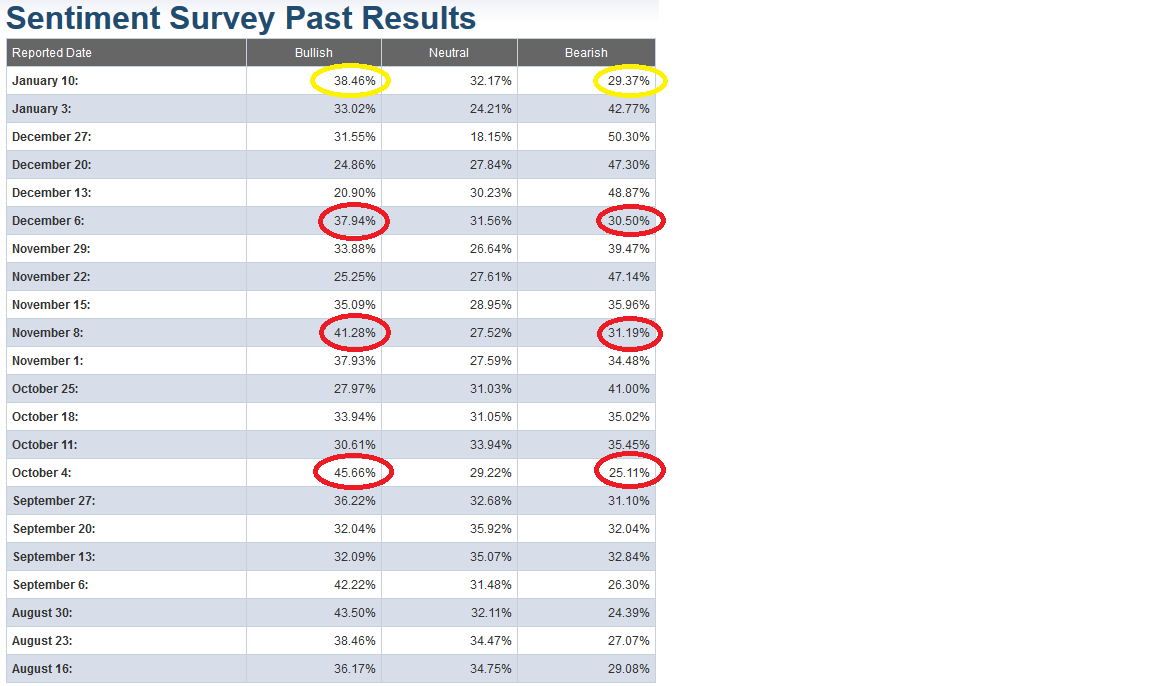

AAII Sentiment indicator

AAII sentiment results are out this morning. The implication is the markets may need a few days/week rest before resuming higher. The last instances that Bullish sentiment/Bearish sentiment were in these ranges were Dec 6, Continue reading “AAII Sentiment indicator”

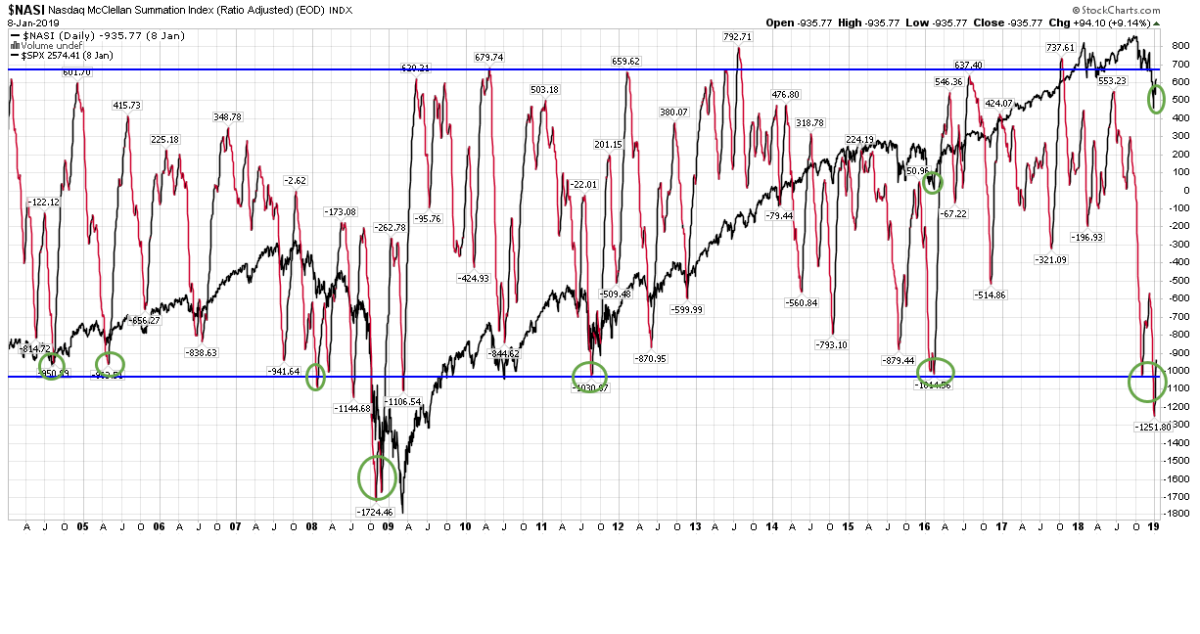

NASI indicator

I’ve always used the Nasdaq McClellan Summation Index as a barometer for risk in the market. The McClellan Summation Index is a breadth indicator derived from the McClellan Oscillator, which is a breadth indicator based on Continue reading “NASI indicator”

Quote of the day…

What I’m reading today…

- Disney CEO Bob Iger Says Spending Billions on Theme Parks Is a No-Brainer (Barron’s)

- Best Income Investments for 2019 (Barron’s)

- Cancer Deaths Decline 27% Over 25 Years (Wall Street Journal)

- Small-Cap Stocks Take On New Shine as Markets Slump (Wall Street Journal)

- S., China Negotiators Narrow Differences on Trade (Walll Street Journal)

- Big hedge funds make gains, most slump in 2018 returns (New York Post)

- This Activist Investor Should’ve Believed More in His Plan (Bloomberg)

- Trump Wants Trade Deal With China to Boost Stocks (Bloomberg)

- Trump is probably going to get his way with the Federal Reserve this year (CNBC)

- Hedge fund managers are betting big against these 12 stocks, Bank of America says (Business Insider)

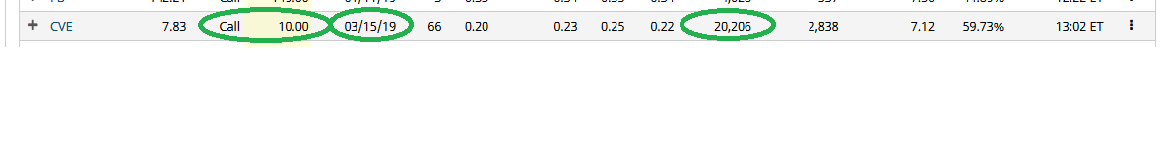

Unusual Option Activity

Today some institution/fund purchased 20,205 contracts of March $10 strike calls (or the right to purchase 2,020,500 shares of Cenovus Energy at $10). This is an abnormally sized bet for this stock and contract as the open Continue reading “Unusual Option Activity”

What I’m reading today…

- Stocks Climb as Investors Look to China-U.S. Trade Talks (New York Times)

- Annual Tech Show To Tout 5G Wireless (Investor’s Business Daily)

- Larry Ellison invest $1Billion in Tesla (Bloomberg)

- Saudis Plan New Export Cuts in Hopes of Lifting Oil to $80 a Barrel (Wall Street Journal)

- Investors Are Counting on the ‘January Effect’ to Revive the Bull Market (Barron’s)

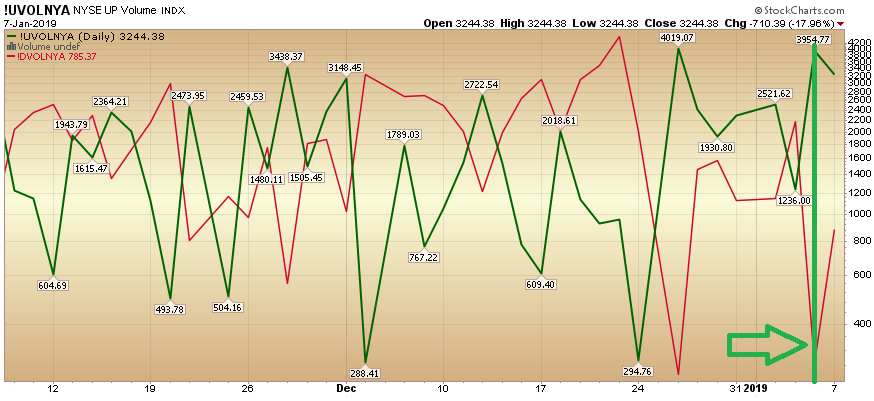

Zweig up/down bottoming indicator triggered

In his book “Winning on Wall Street,” the legendary Marty Zweig explained the value of volume ratios. A ratio of 9:1 or greater of up/down volume is considered to be very bullish and 9:1 down/up volume is considered to be very bearish. Continue reading “Zweig up/down bottoming indicator triggered”

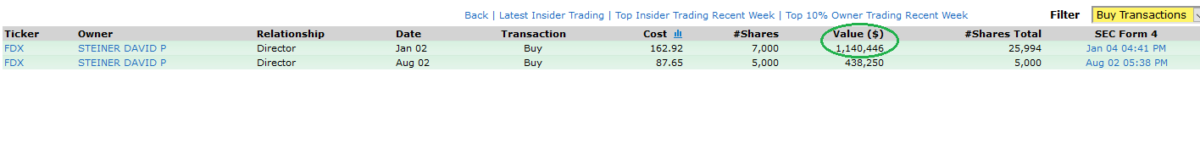

Insider Buying

David Steiner, a Director of FedEx (FDX) did some bargain shopping last week – picking up 7000 shares of FedEx in the bargain bin. Wall Street is one of the few places that when they hold a big sale, no one shows up! David Steiner did and bet $1,140,446 of his own money that the future is a lot brighter than the street thought in December.