Fox Business

On Tuesday, I joined Cheryl Casone on Fox Business the “Claman Countdown” to discuss the biggest surprises coming in 2025 and a couple of our holdings. Thanks to Cheryl, Kathryn Meyers, Jake Mack and Liz Claman for having me on:

Watch in HD Directly on Fox Business

We didn’t have time to go into VF Corp in the segment but clients will soon be reminded of what a great job Bracken Darrell is doing with the turnaround!

MoneyShow

Over the weekend I had the privilege to speak at the legendary 4 decade+ MoneyShow “Investment Masters Symposium” (for Accredited Investors) in Sarasota, FL. Thanks to Kim Githler, Debbie Osborne, Mike Larson and Aaron West for inviting me to speak.

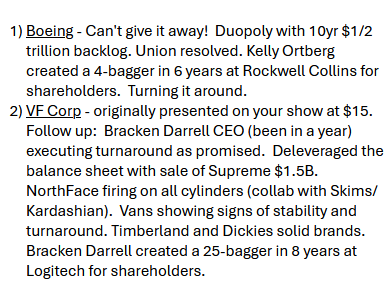

In this presentation I discussed “Turnaround Tom’s Top Picks for 2025.” The problem with the presentation is it’s like asking “which is your favorite child?” There is no answer as you love them all equally.

The reason I chose these four is because I didn’t cover them last year. Last year I talked Alibaba, PayPal and Disney. PayPal and Disney have taken off. Alibaba tried in September, but will likely see the move of a lifetime in 2025-2026. I did not cover it in the formal presentation because I covered it last year and there is no change in outlook. It is still my favorite child, just taking longer to develop than the others which are popping now.

However, stay tuned for the Q&A at the end of the presentation. You’ll never believe what came up! And then once again on the Panel, SHOCKINGLY, I had something to say about Alibaba! In the meantime, enjoy the 4 picks I covered in detail here – along with some commentary about high-flyers.

Part 1 – Presentation

Click HERE to follow along with Slide Show

Part 2 – Panel

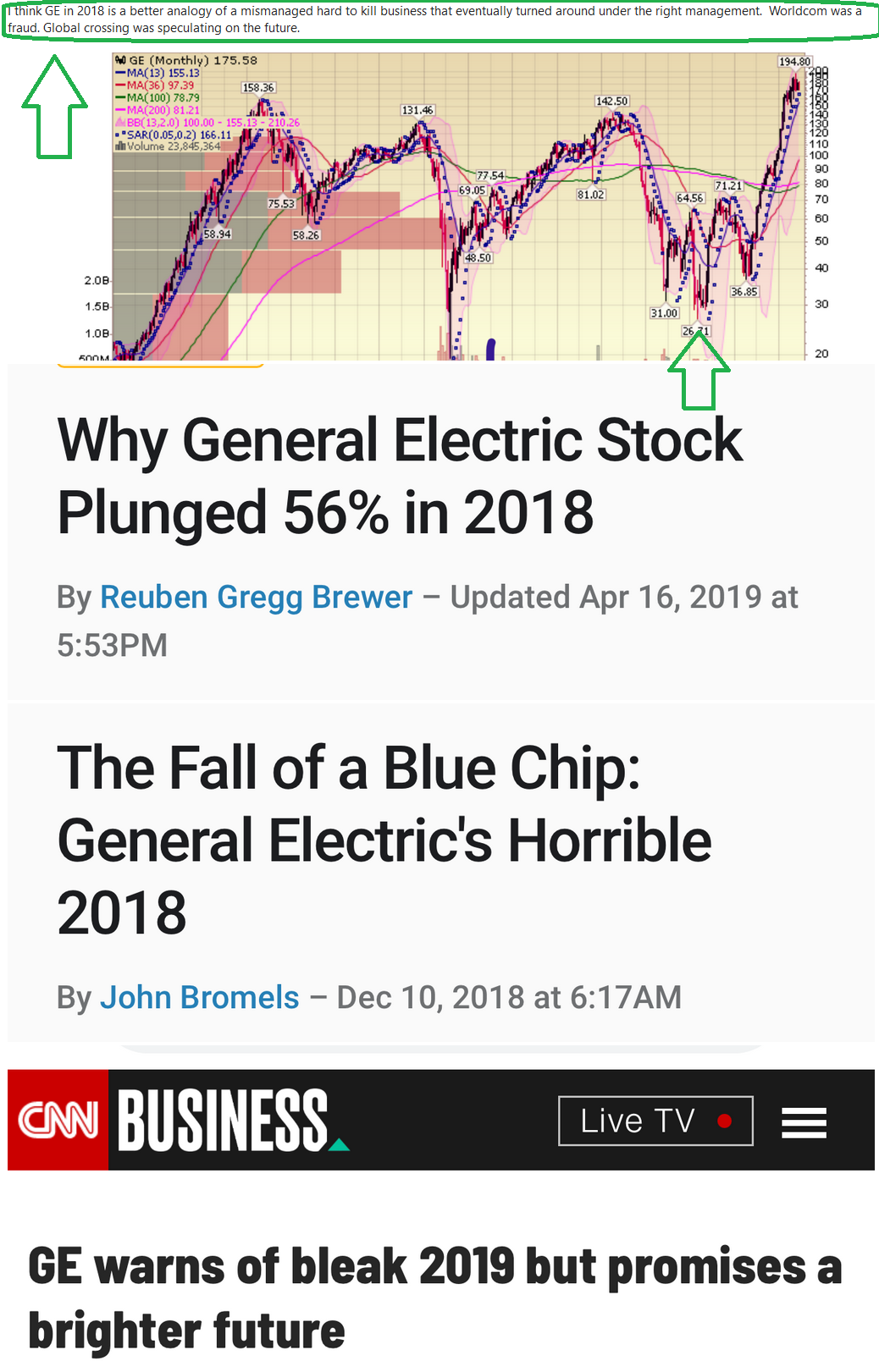

Intel

A friend emailed me with some negative headlines on Intel this week. He said, “It’s been a long time since I’ve seen this kind of coverage of a single dog. It reminds me a bit of Global Crossing or WorldCom.” I totally understand his view and I’m sure a lot of people out there feel the same way. Here’s what I had to say in response – which I think some of you will find helpful:

GE rebounded ~8x after these type of headlines – and if you don’t think GE was as hairy as Intel, think again. It was more opaque and had many more possible time-bombs than Intel. The tide turned when Larry Culp was hired.

Intel needs a great turnaround CEO and it will be off to the races. Very hard to kill a business with $50B+ of revenues. Time will tell if it’s GE or Worldcom. I’m betting on the former…

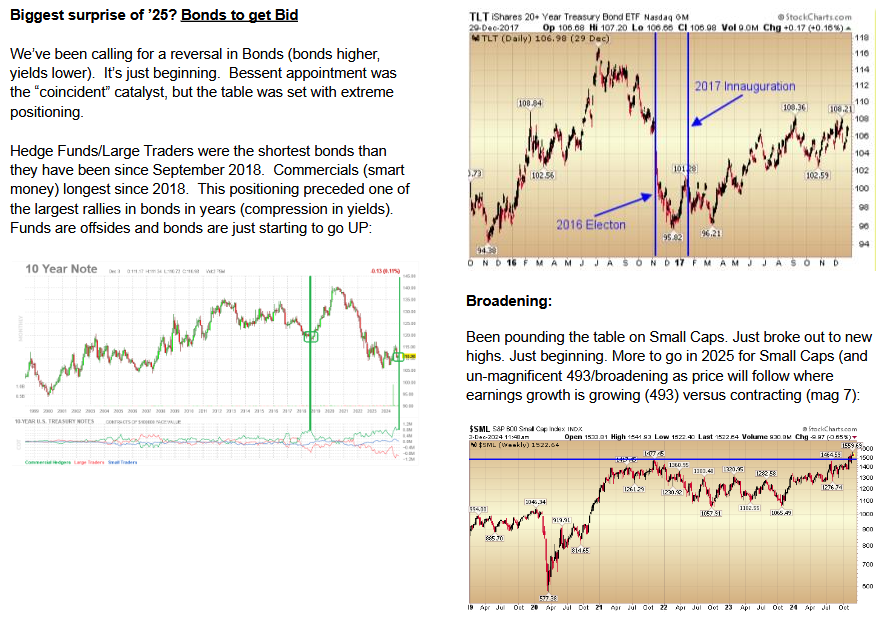

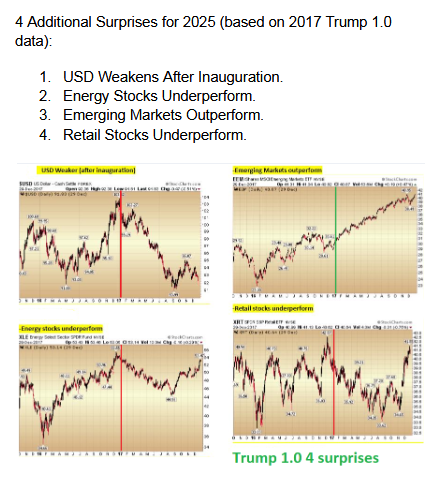

General Market

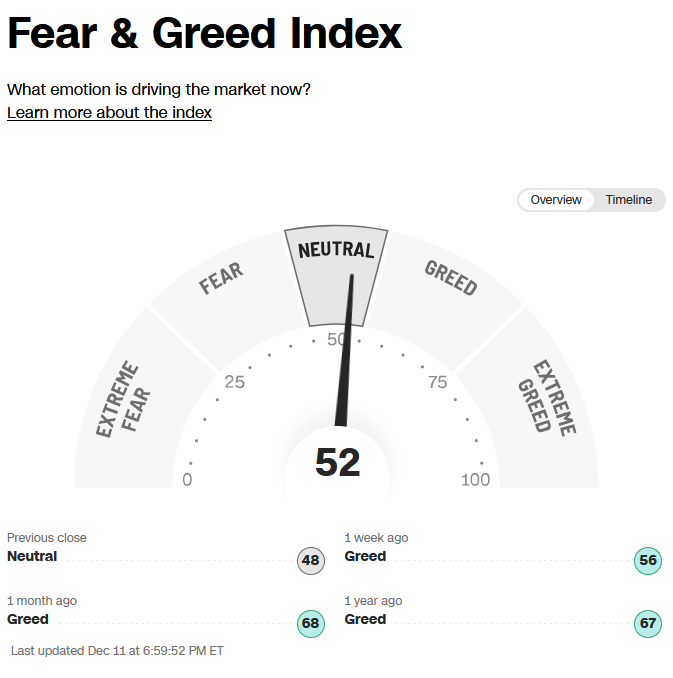

The CNN “Fear and Greed” dropped from 62 last week to 52 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

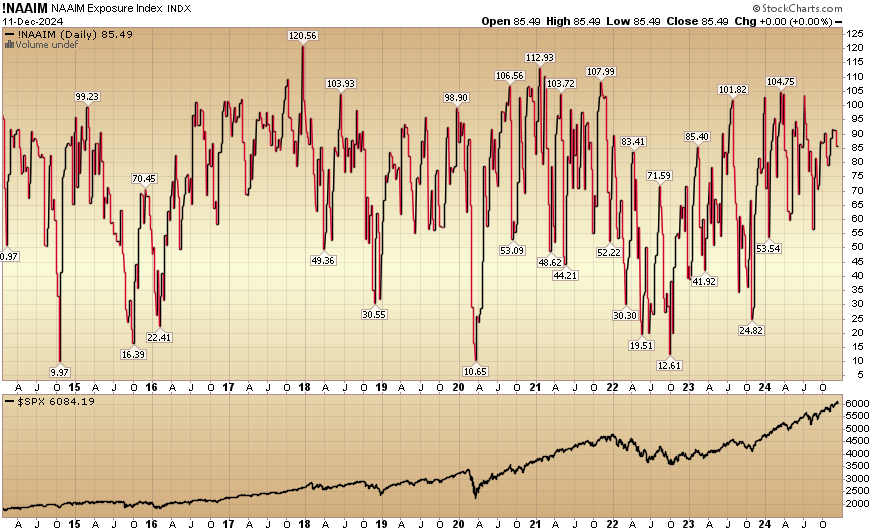

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked down to 85.49% this week from 91.33% equity exposure last week.

Our podcast|videocast will be out sometime today. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here

*Opinion, Not Advice. See Terms