On Friday, I joined Charles Payne on Fox Business (live from LA studio) to discuss past picks and current stock picks. Thanks to Charles, Nicholas Palazzo and Ally Thompson for having me on:

On Tuesday I had a short hit on CBS News ahead of the inflation report. Thanks to Camille Smith for having me on:

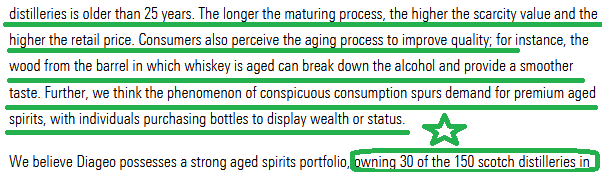

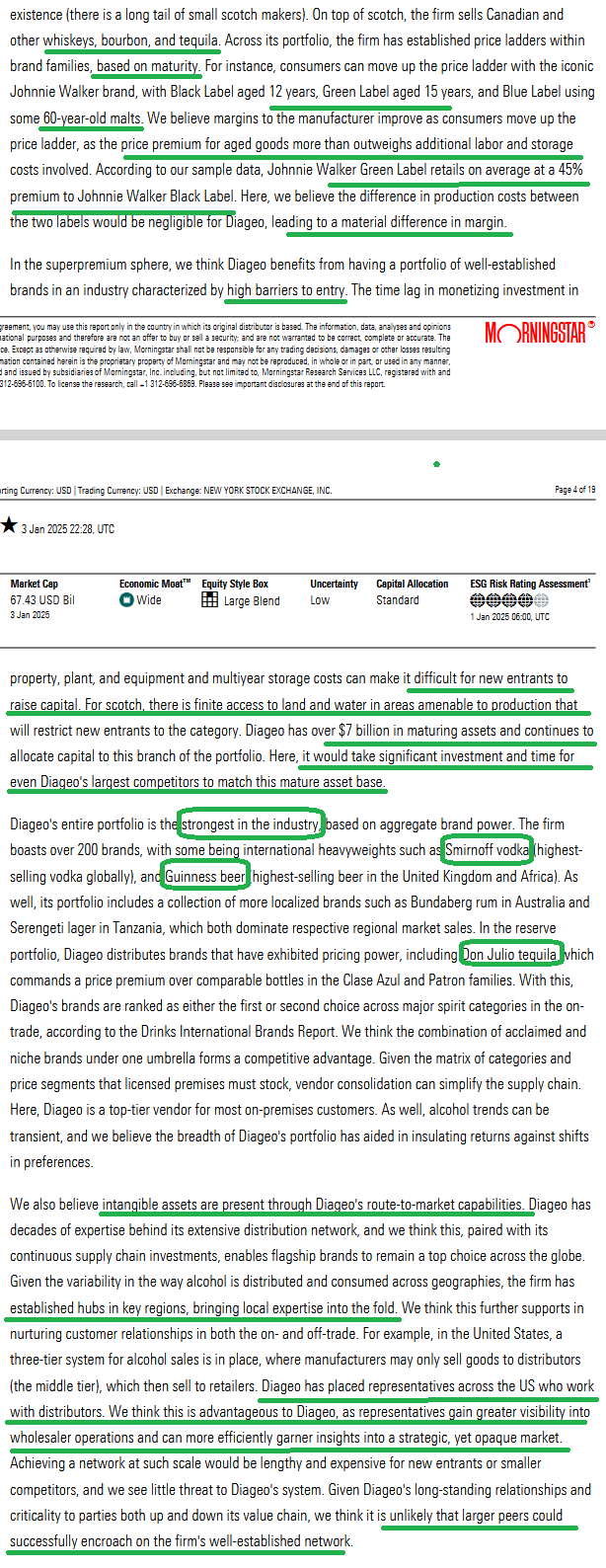

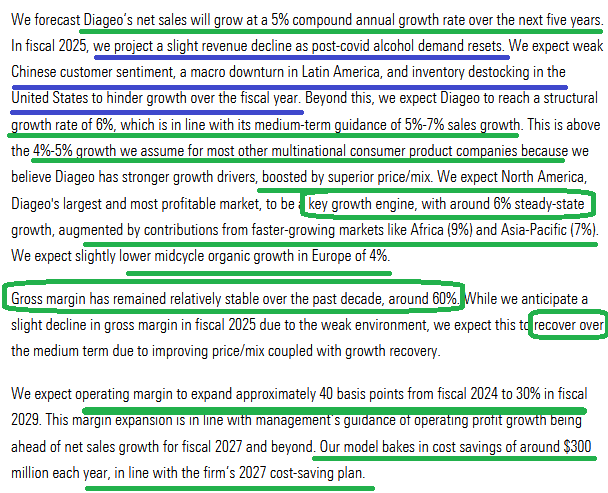

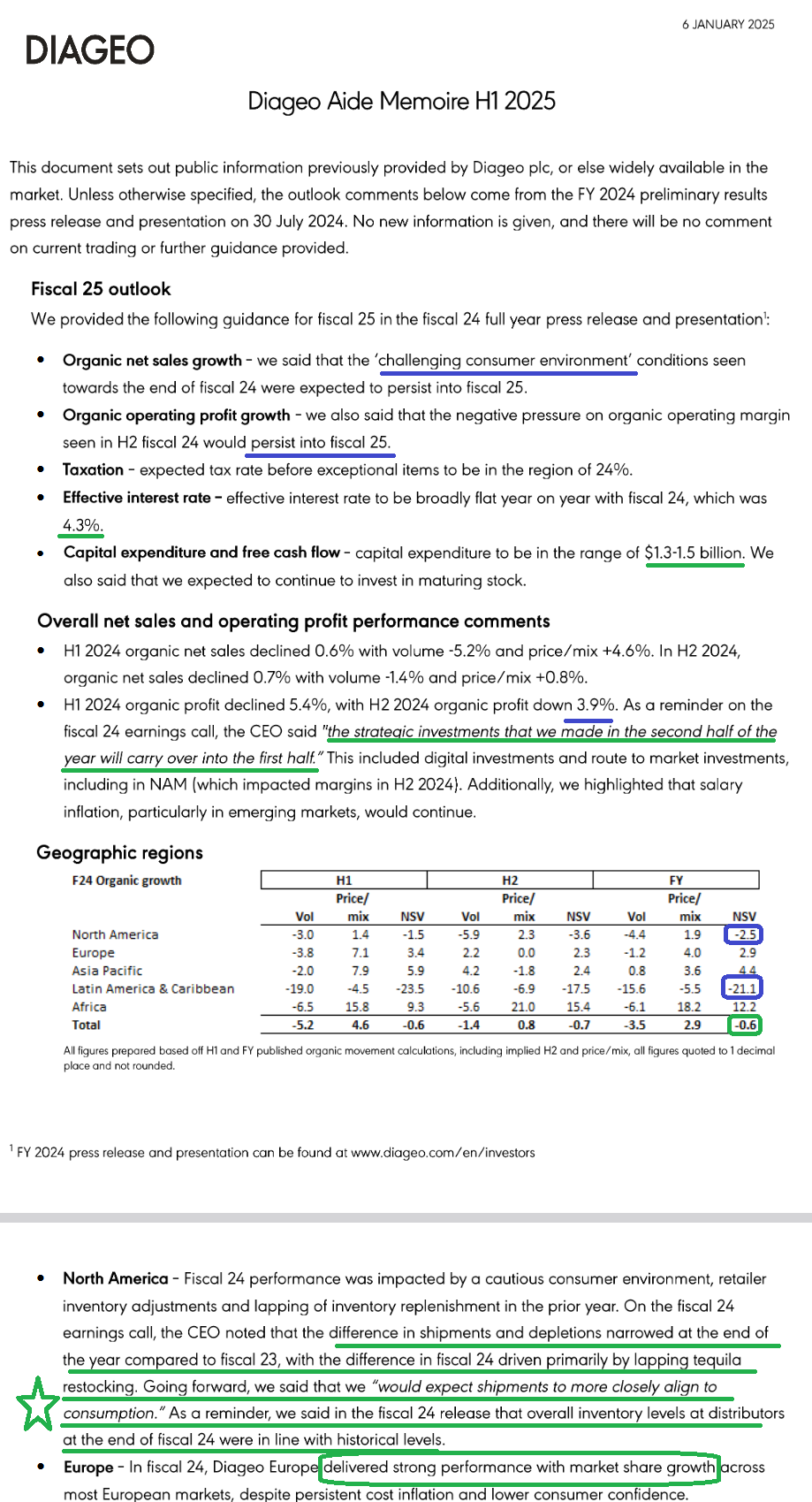

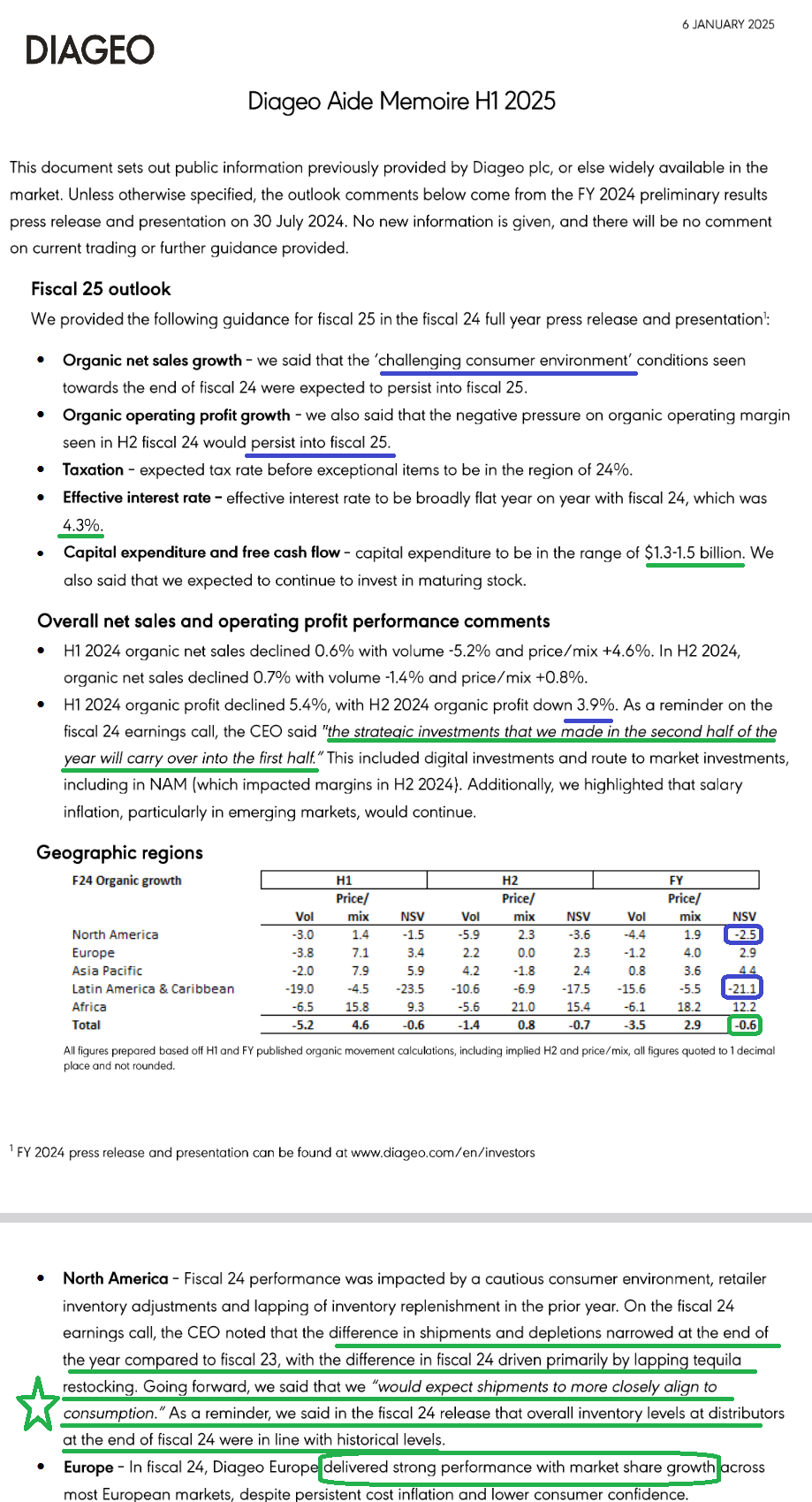

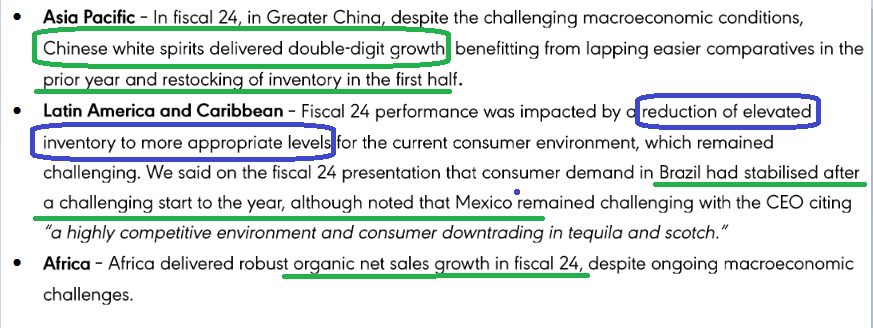

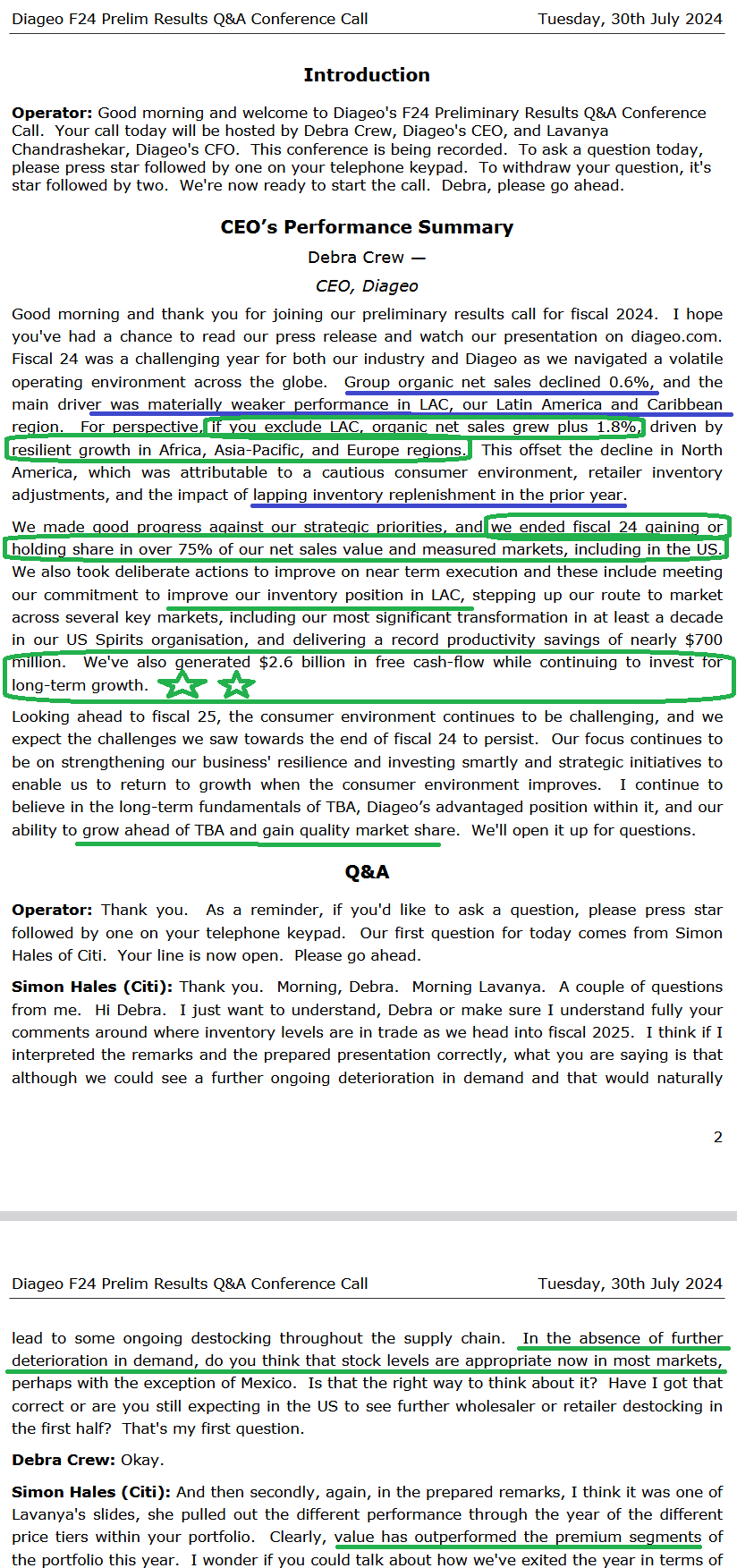

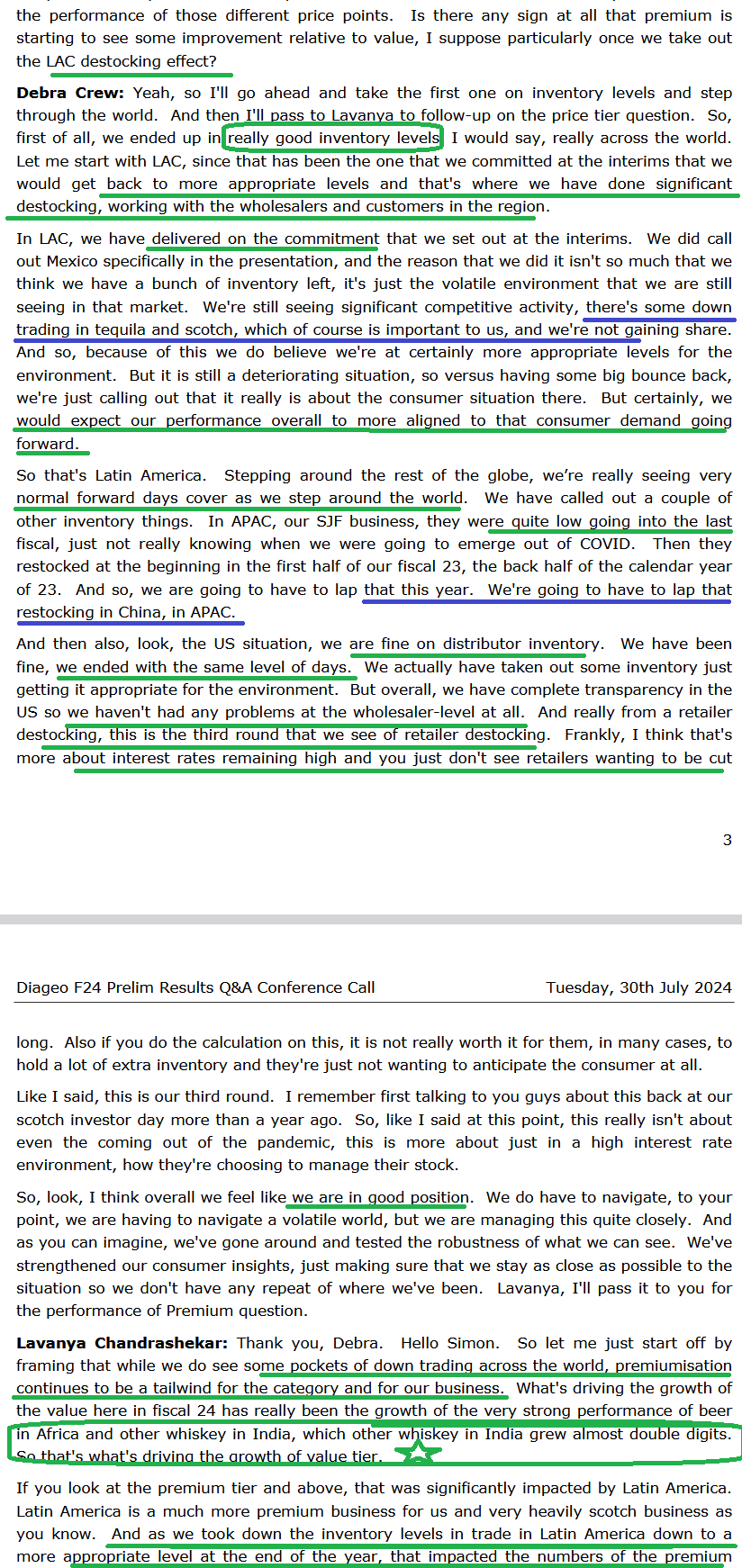

Diageo

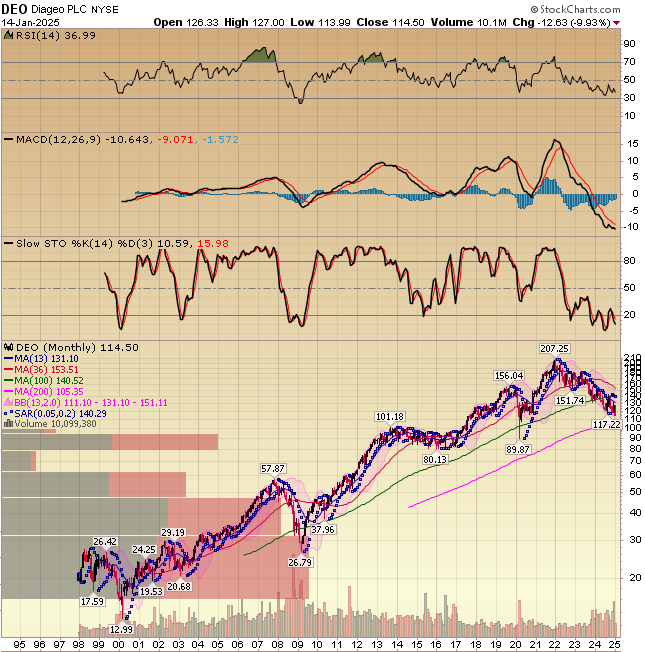

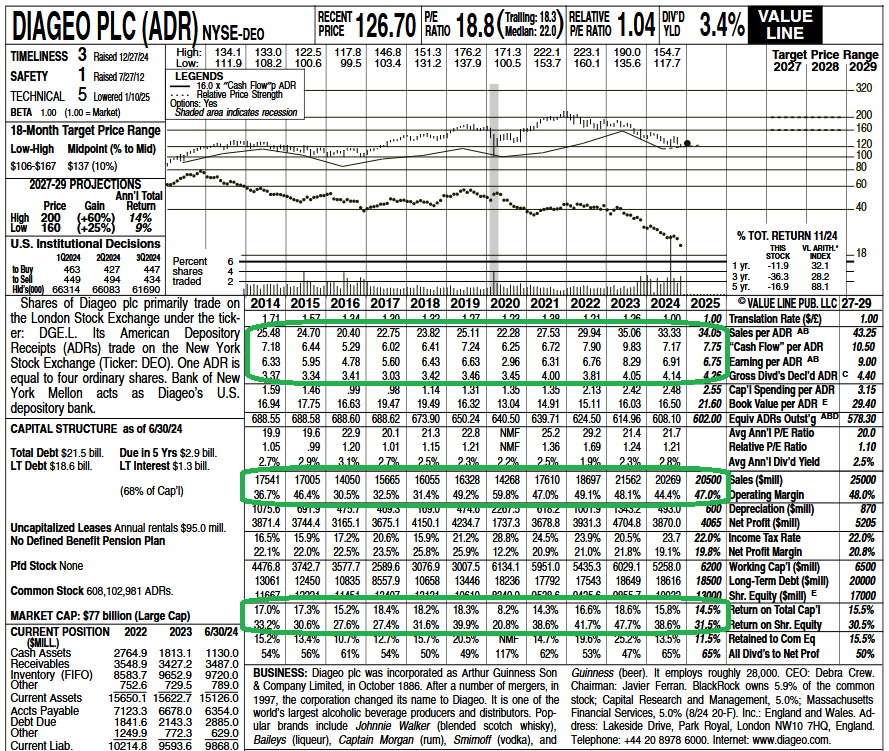

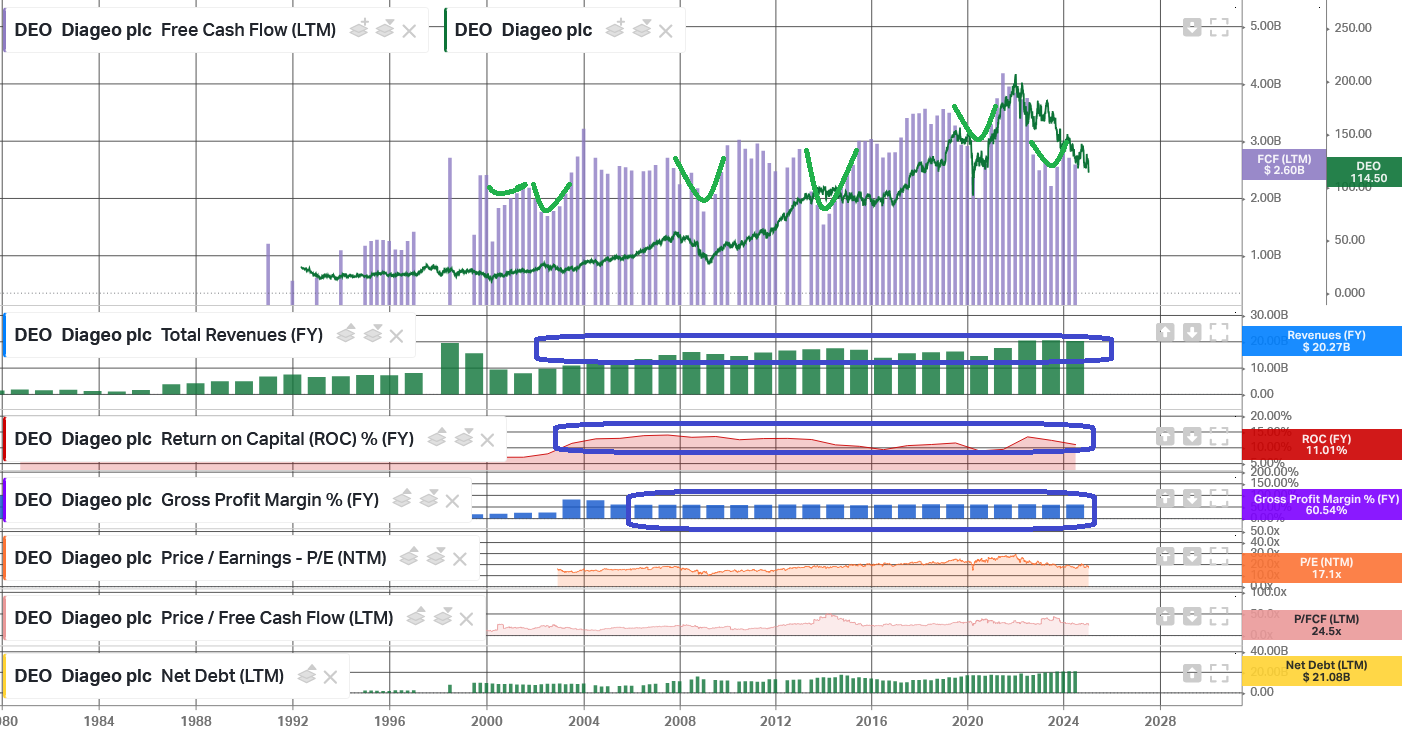

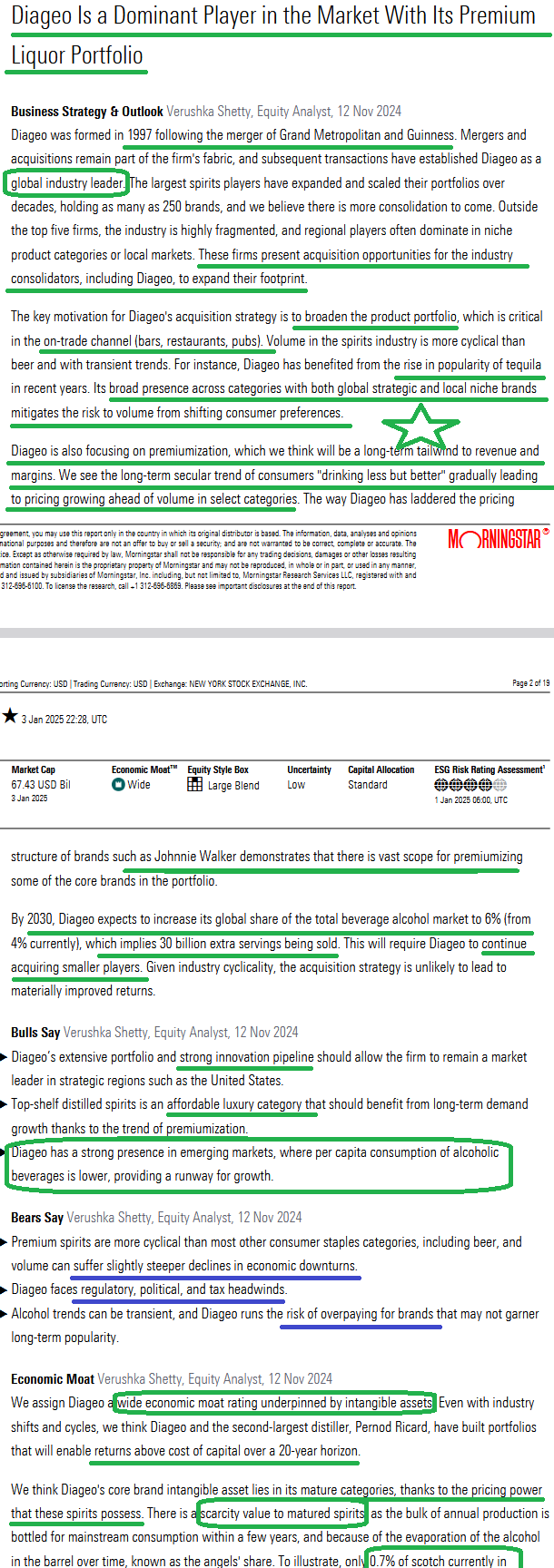

As you can see, Diageo is a story of cyclical downturns in the context of a long-term secular uptrend. Free Cash Flow dips and recovers every cycle. The one thing that has been consistent through the years is a high return on invested capital and a continued shrinking of the share count through buybacks.

General Market

General Market

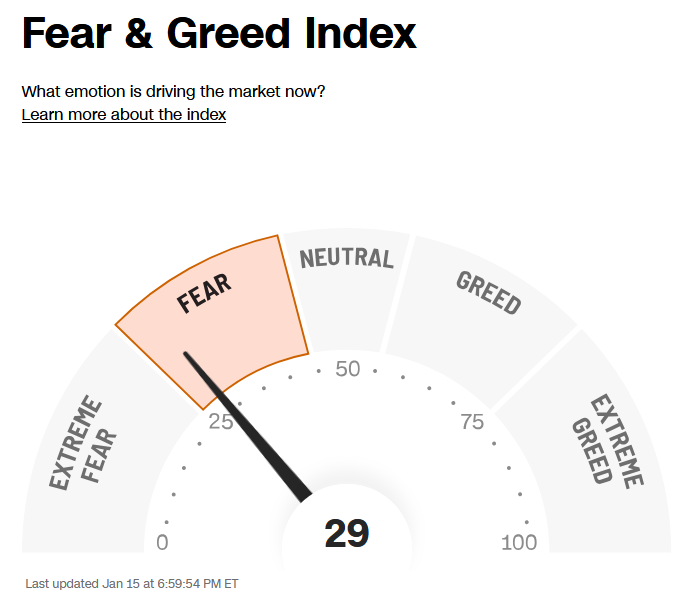

The CNN “Fear and Greed” ticked down from 32 last week to 29 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

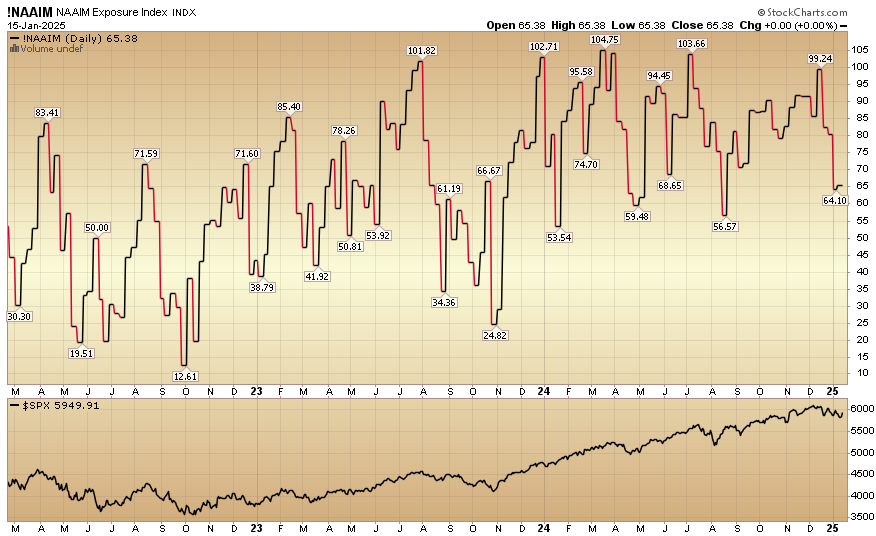

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) flat-lined to 65.38% this week from 64.10% equity exposure last week.

Our podcast|videocast will be out sometime on Thursday or Friday. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Congratulations to all of the new clients that came in during our 2024 raises and the first two weeks of our Q1 2025 opening. You could not be better positioned for what we believe will be a highly rewarding year in 2025. This view is based on much of the data we have shared in recent weeks on our podcast|videocast(s), as well as our proprietary methods of expressing and executing upon those views on your behalf.

*We re-opened to smaller accounts $1M+ again starting two weeks ago (because we want to be fully positioned as soon as possible before the inauguration – based on some of the data we have referenced on recent podcast|videocast episodes) and will remain open until the end of this week only (Sunday Evening).

Congratulations to all of you I had the pleasure of speaking with and on-boarding in the last two weeks – after we opened up. We have begun deploying capital on your behalf. If you are still in the process of application approval, it usually takes ~24-48 hours.

To see if you qualify and to take advantage of this opening click here. Larger accounts $5-10M+ can access bespoke service at their preference here.

*Opinion, Not Advice. See Terms