During earnings season we try to cover 1-2 companies we have discussed in previous podcast|videocast(s).

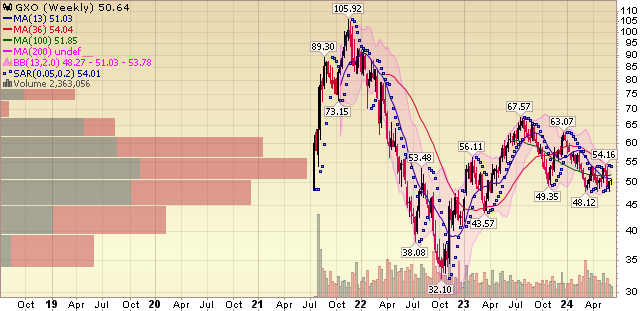

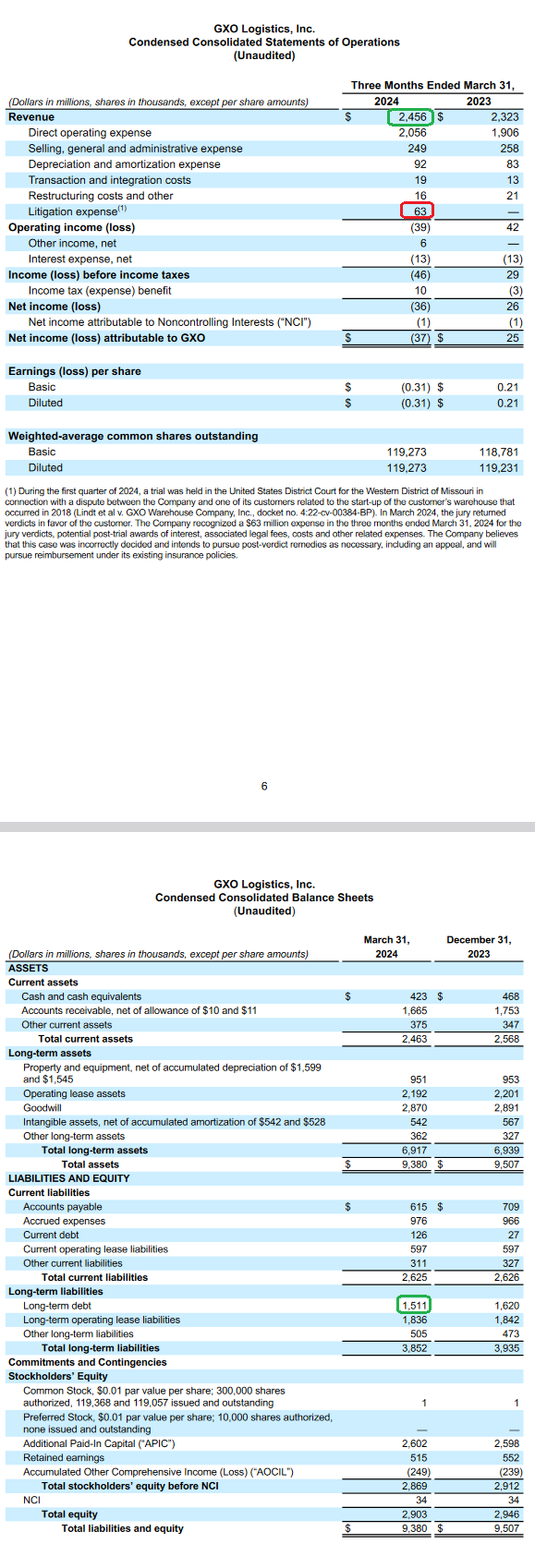

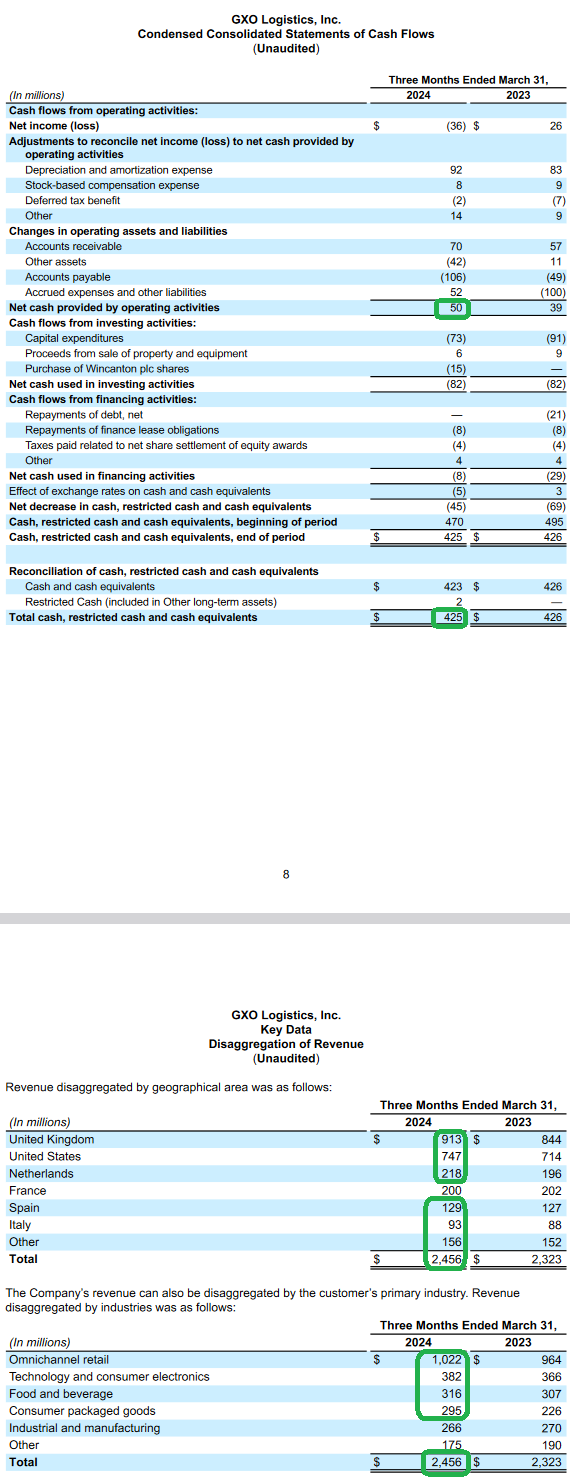

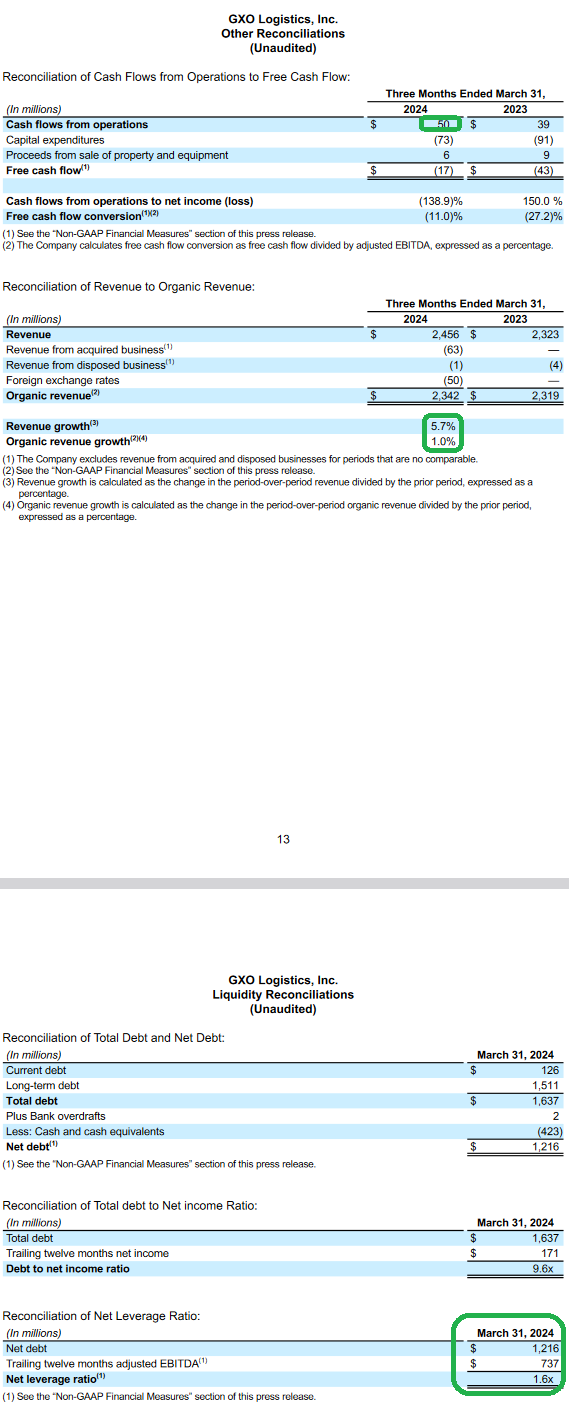

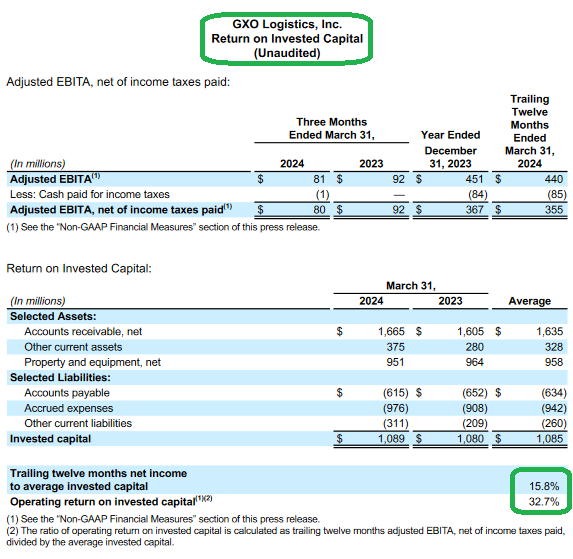

GXO Logistics

To see our original note about GXO click here. Cyclicals are ready for their turn at the plate. The Fed will be the catalyst:

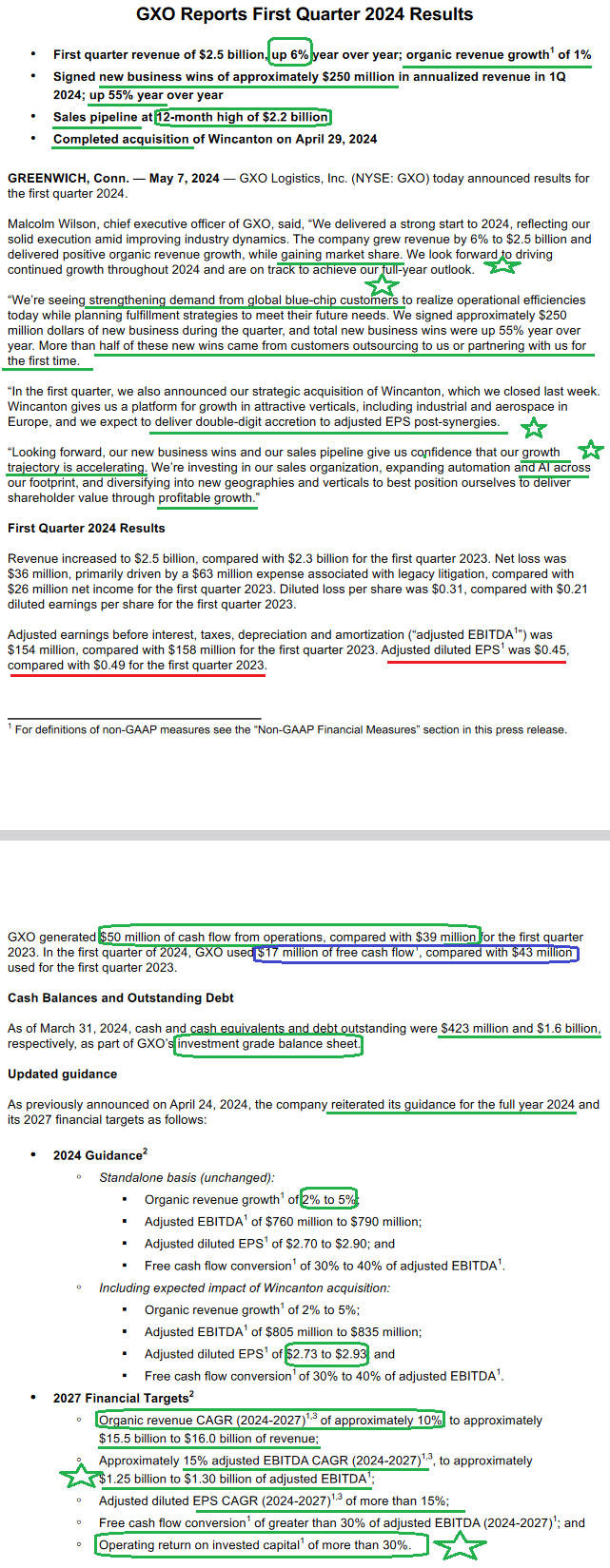

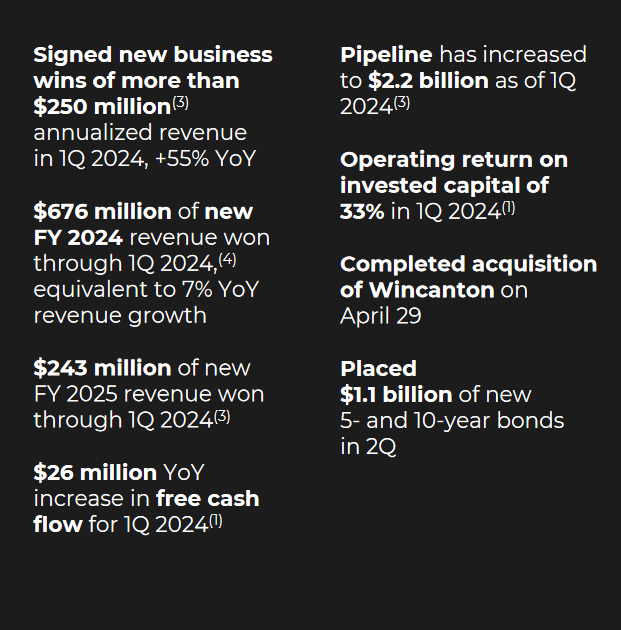

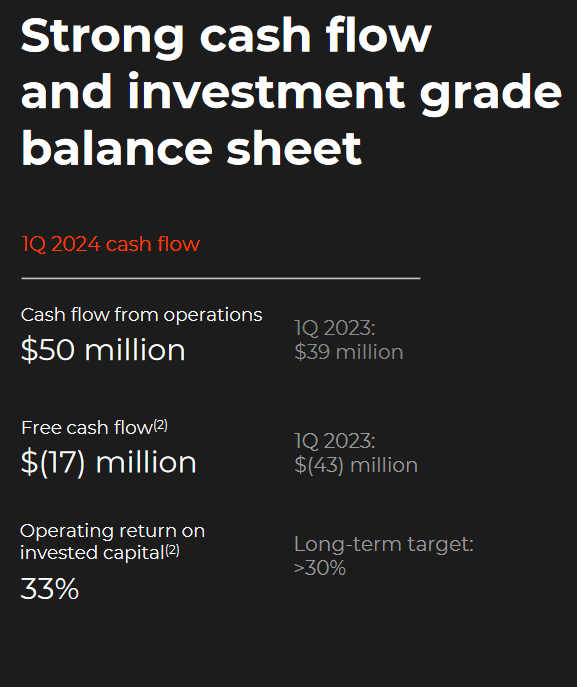

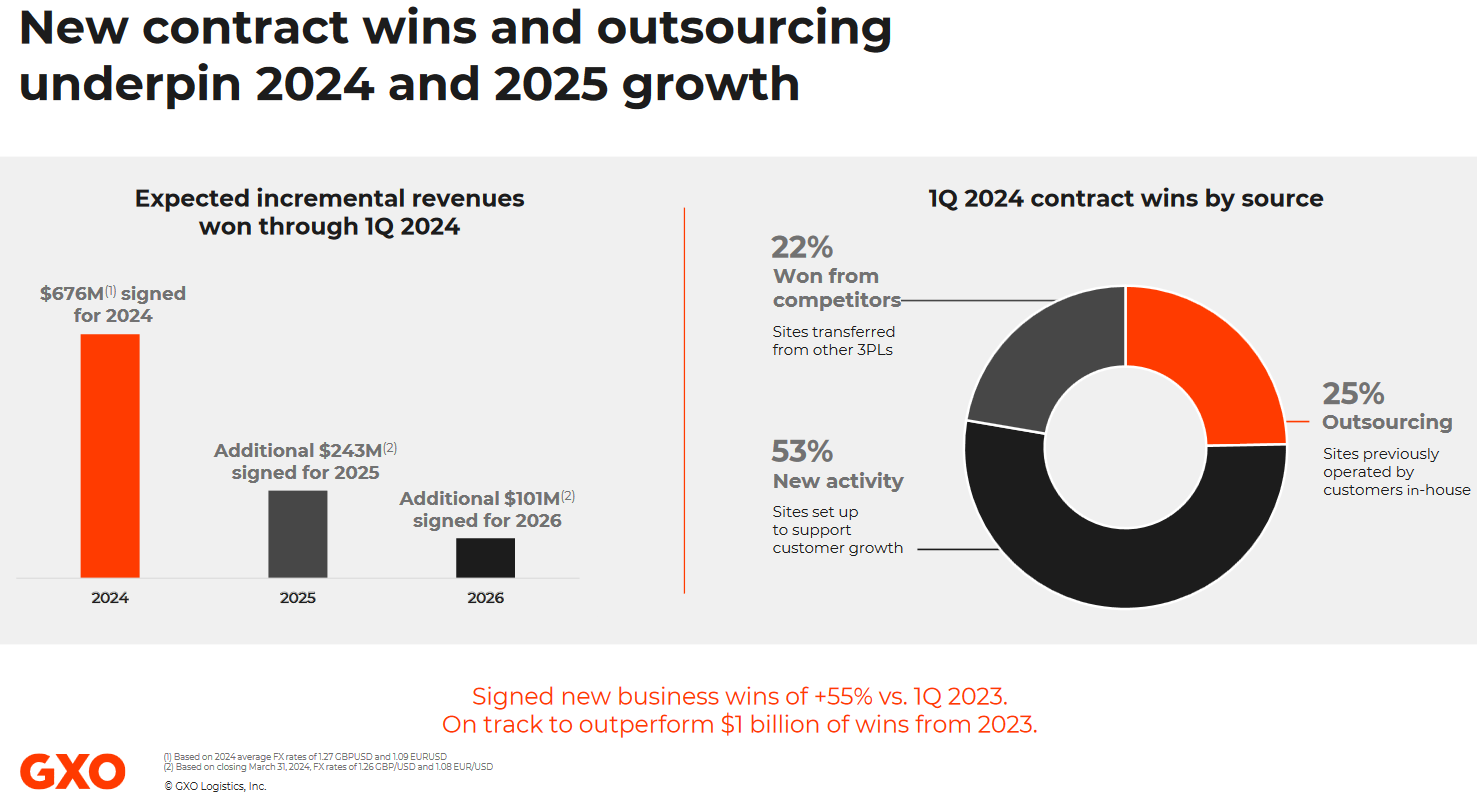

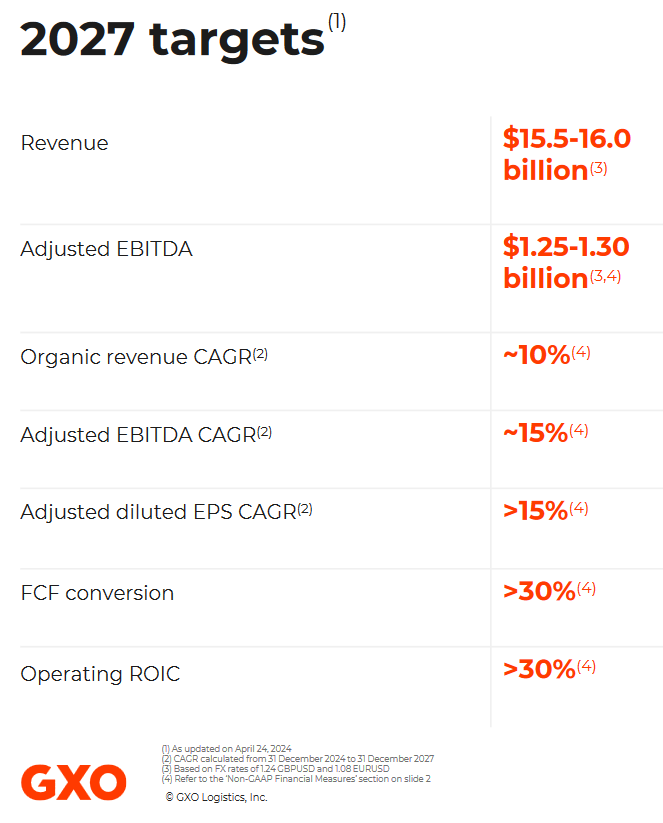

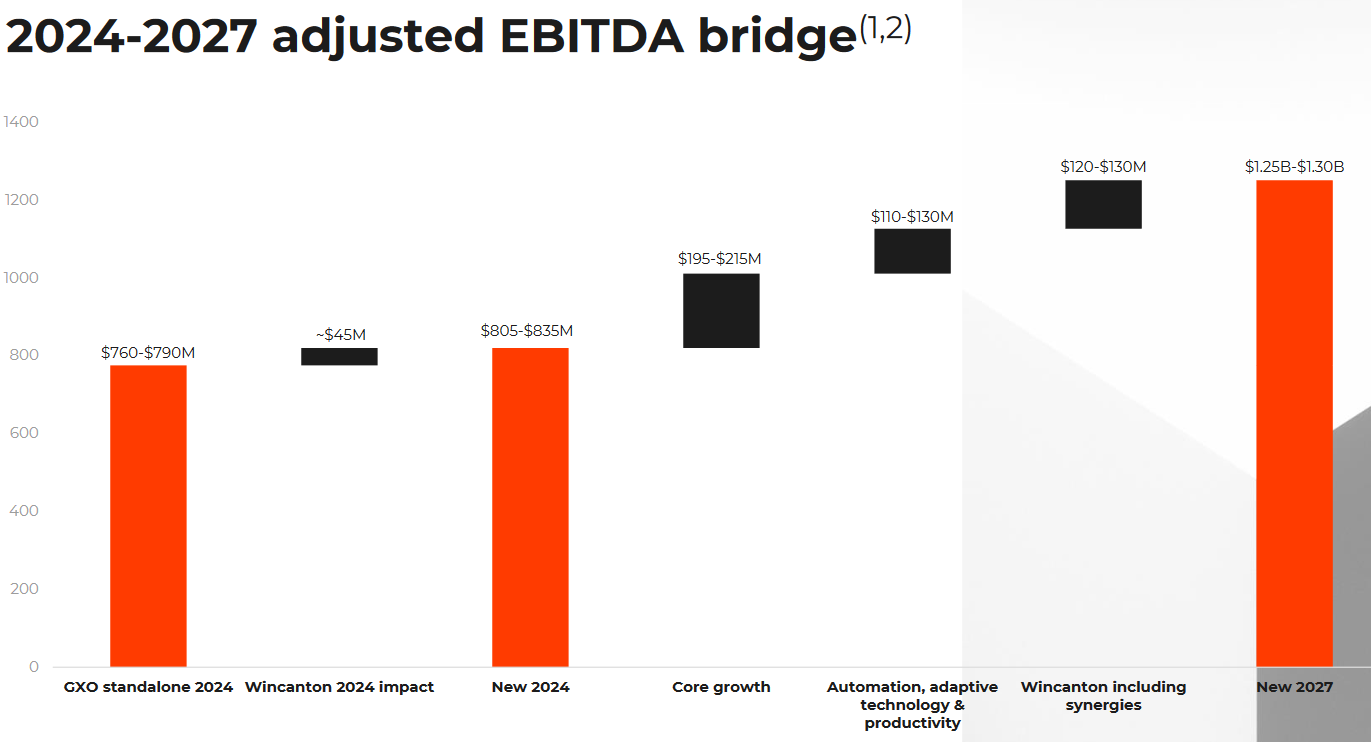

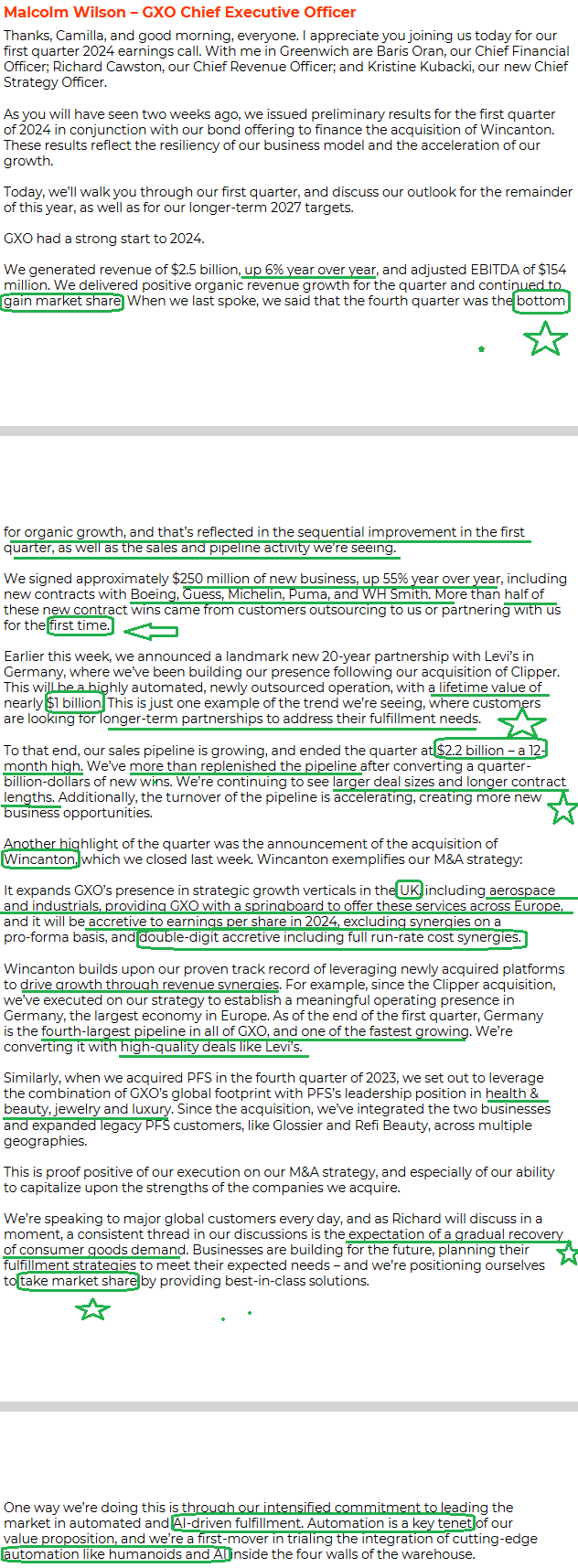

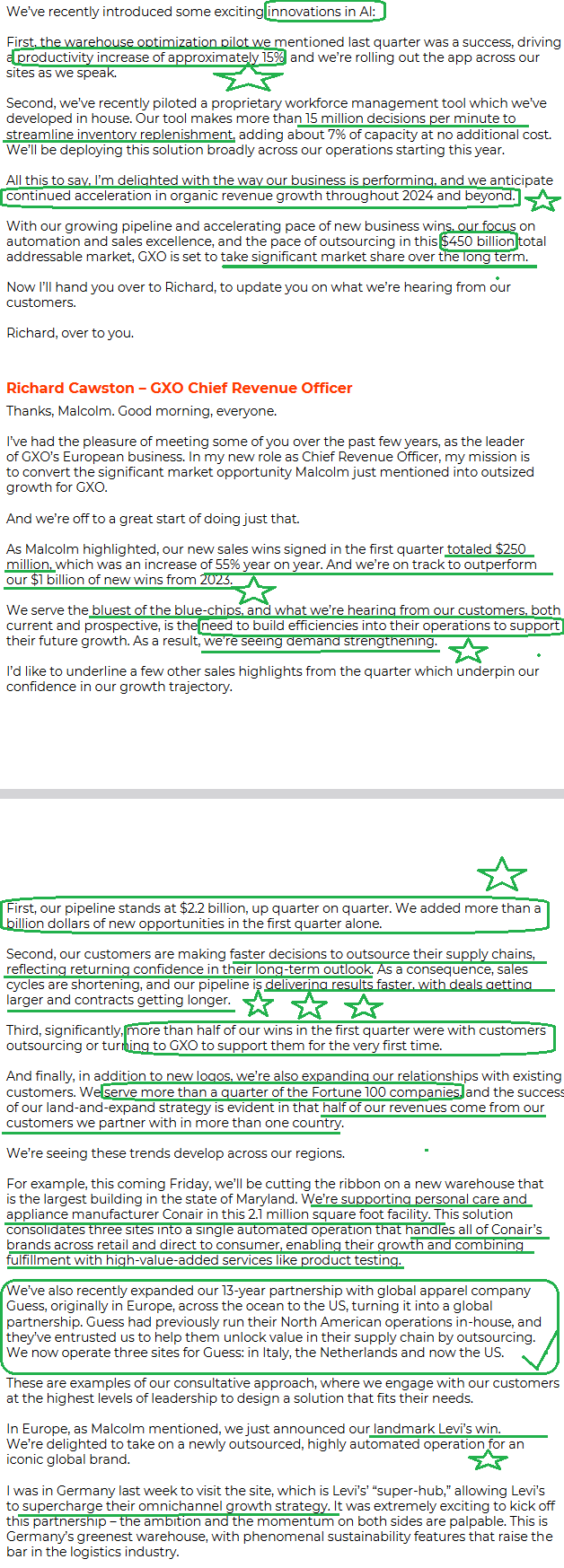

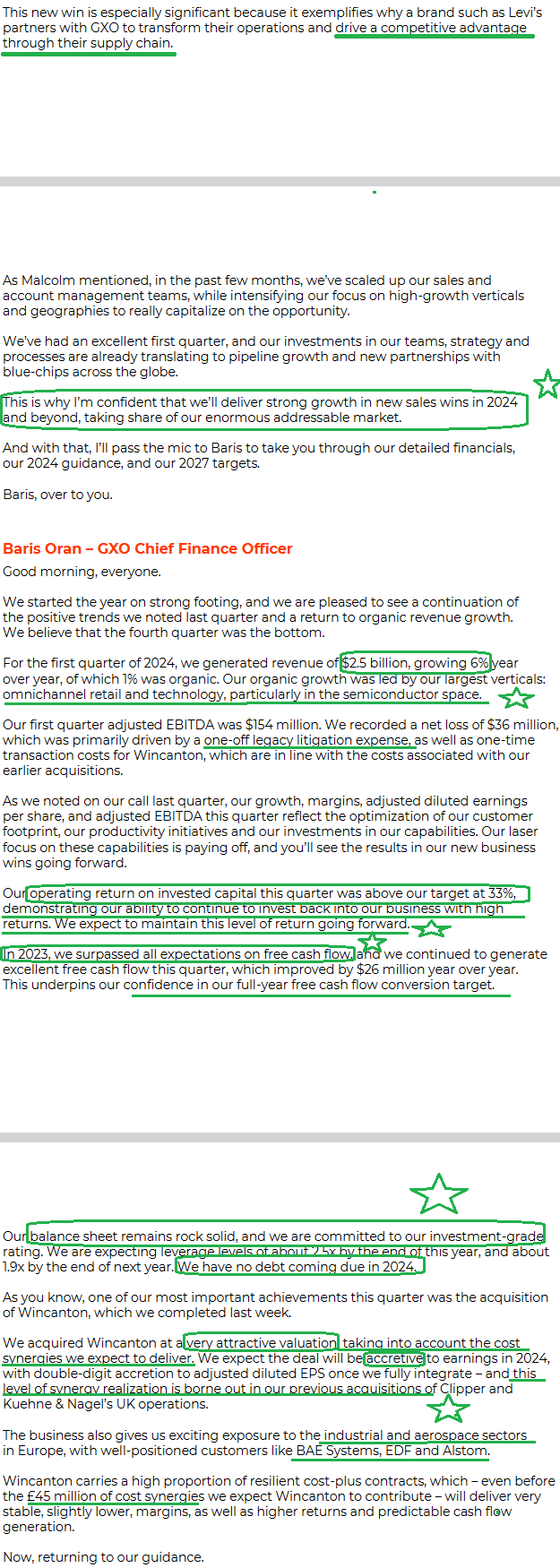

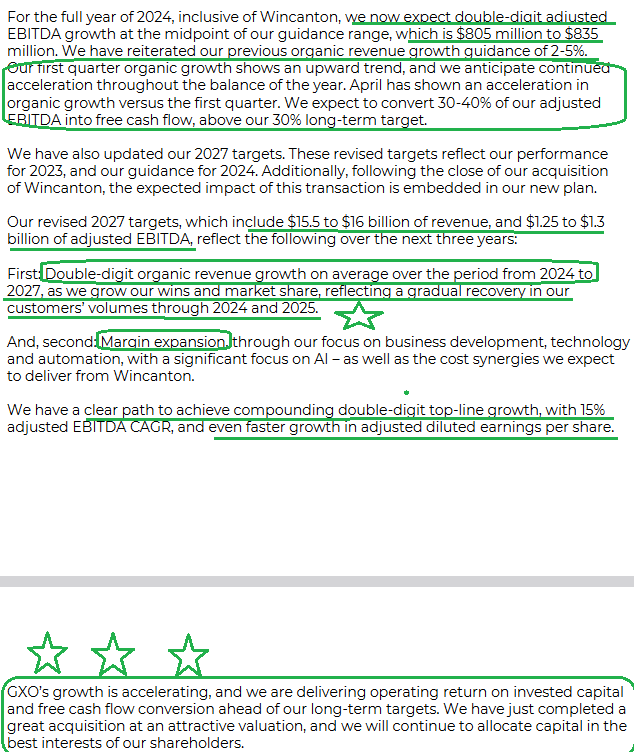

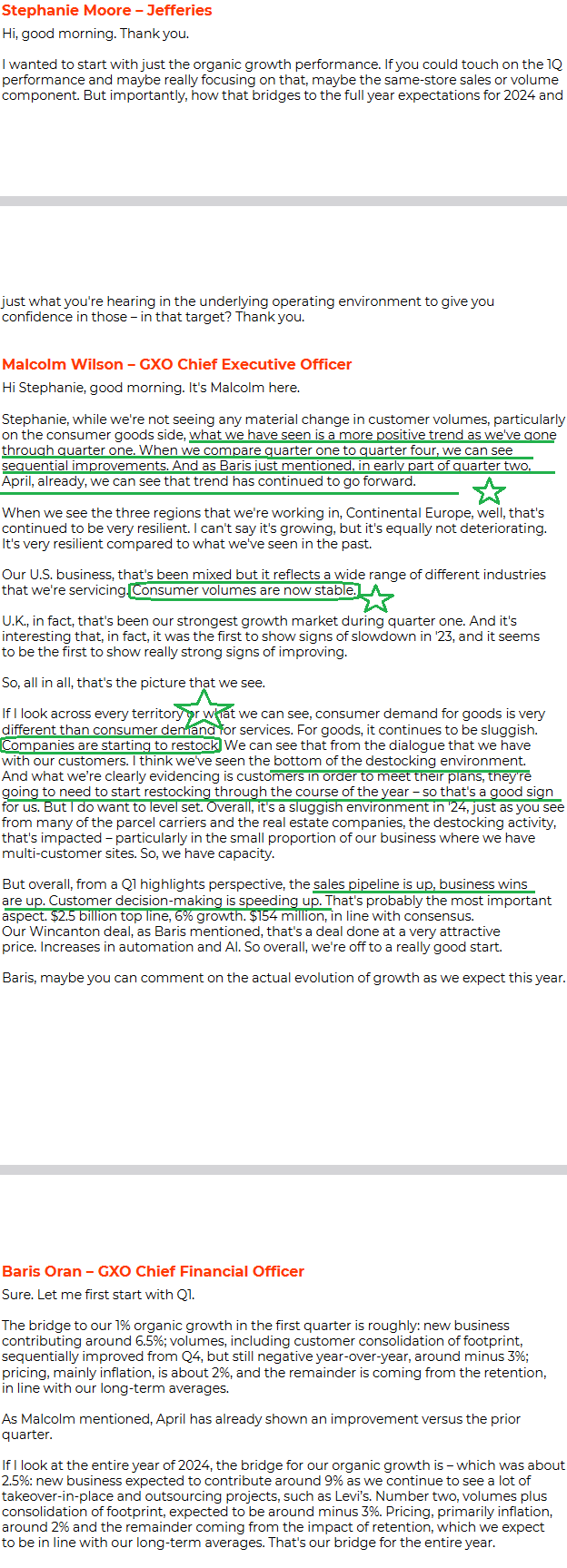

The most important section of this release is the 2027 targets – which imply the business will nearly double adjusted EBITDA by 2027. The implication is not only a potential doubling of the stock, but with double digit top-line and bottom-line CAGRs, we expect to see a re-rating from trough multiples to more normalized multiples consistent with a double digit grower – cash machine. As a point of comparison, its parent (XPO Logistics – another Brad Jacobs company) has an avg. annual p/e of 25x. We also think guidance may be conservative as all Jacobs companies have tendencies to find new accretive acquisitions that are not yet baked into guidance.

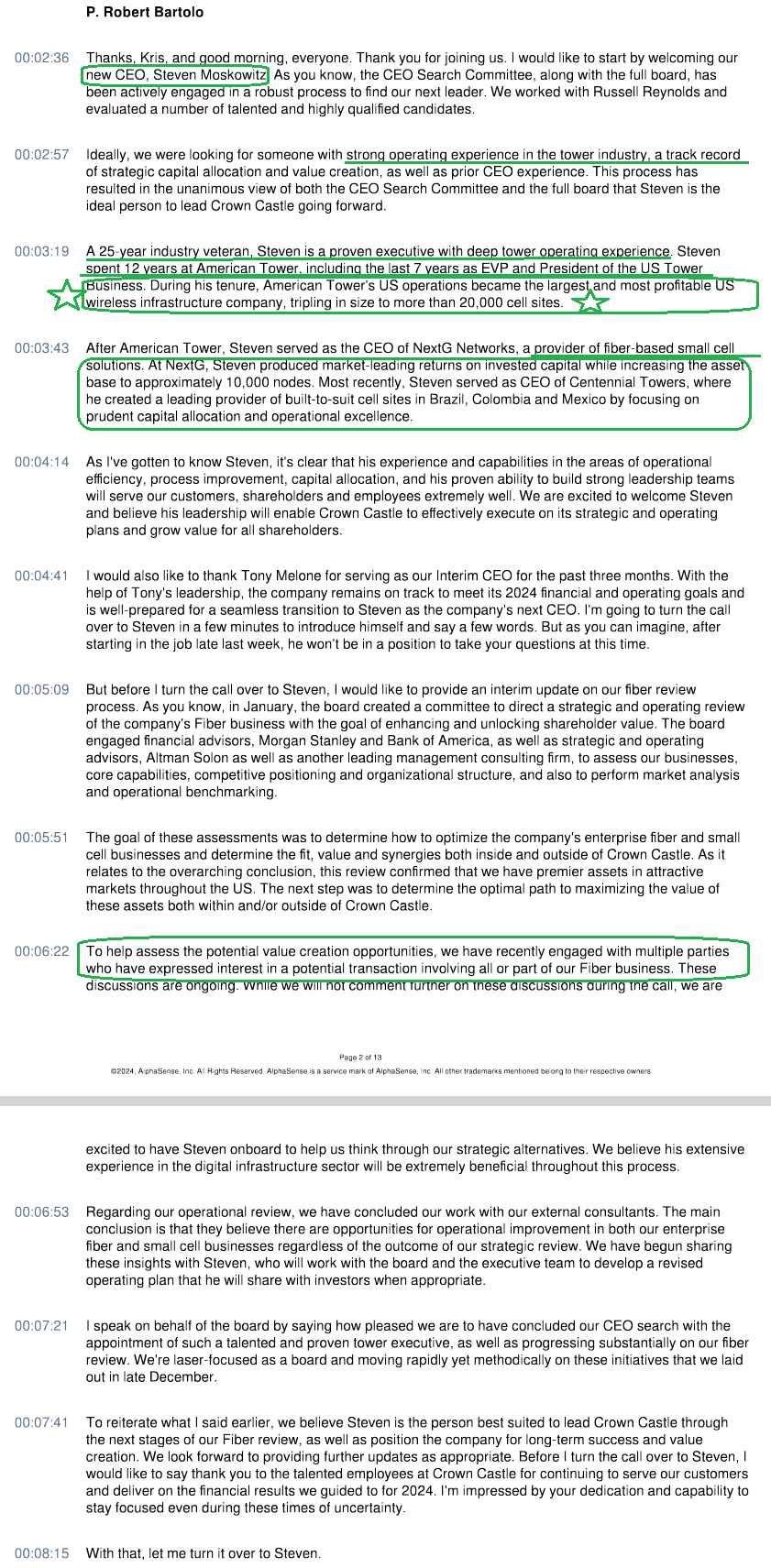

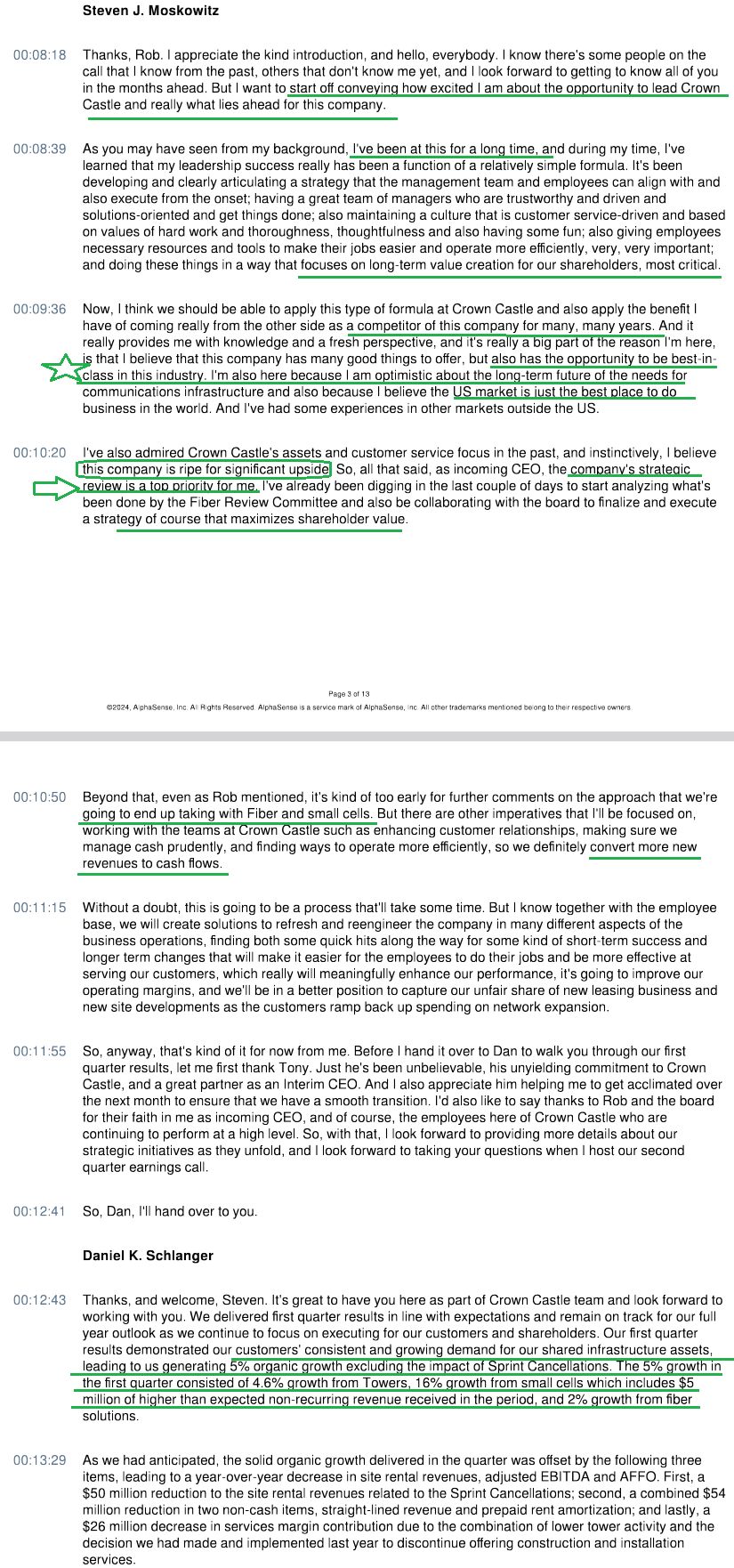

Crown Castle

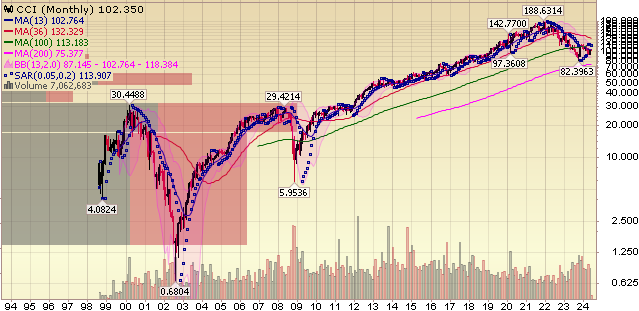

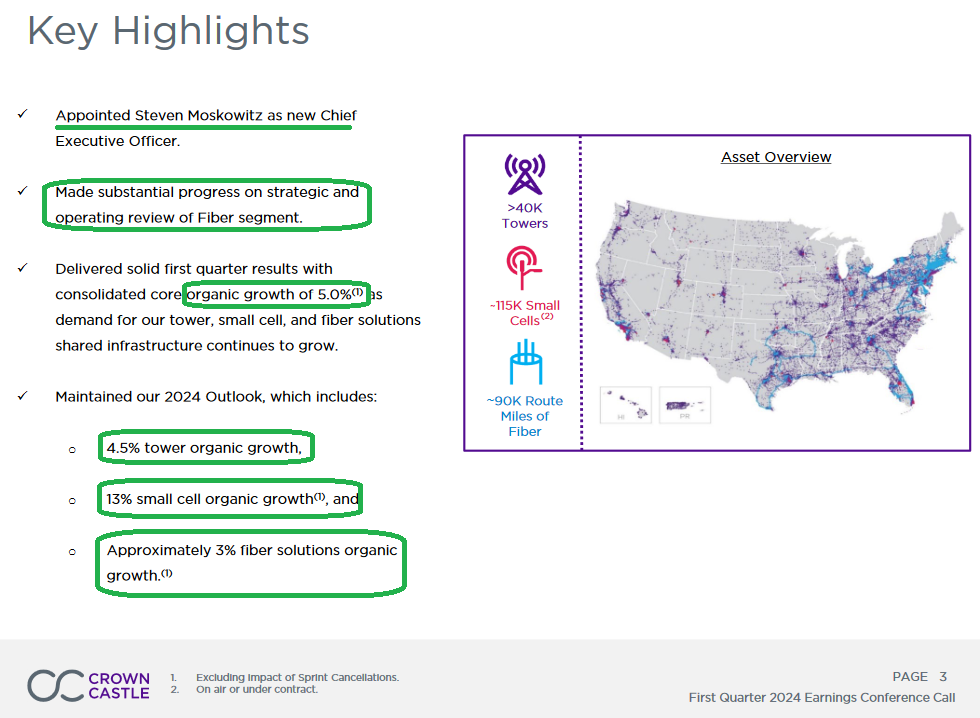

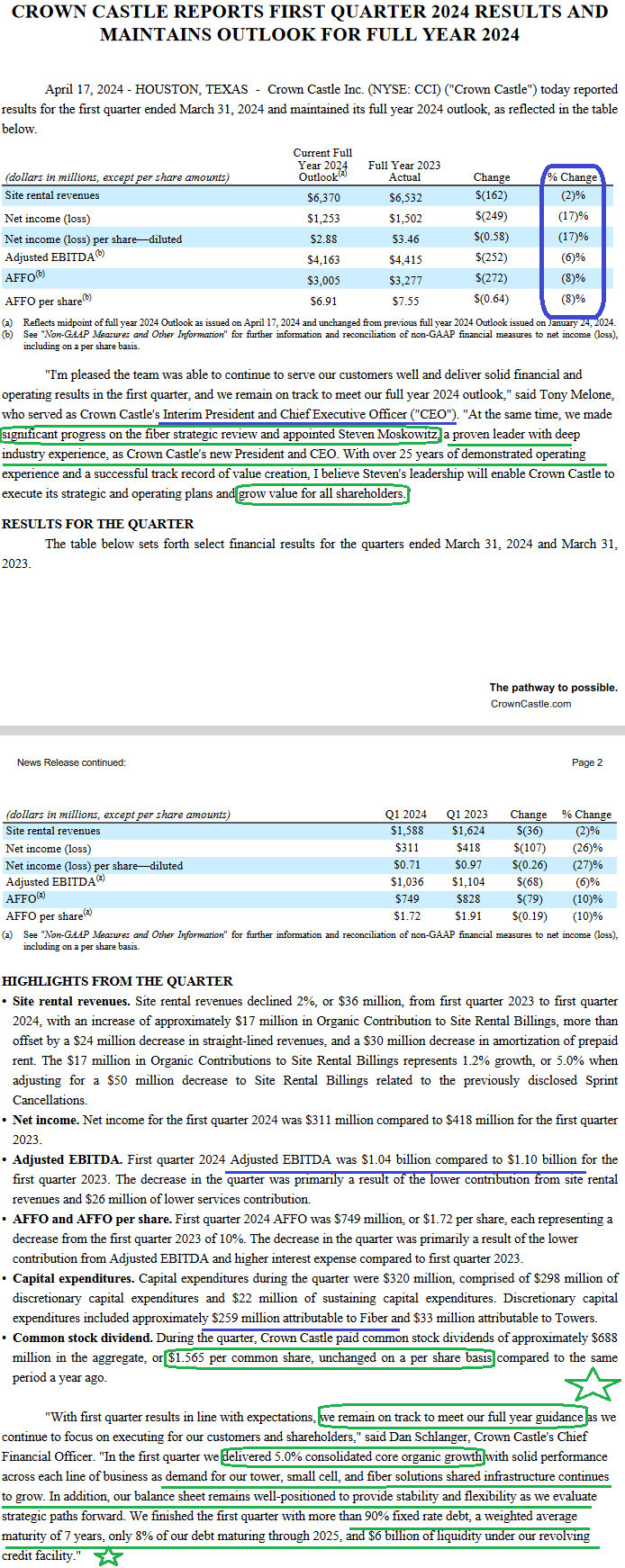

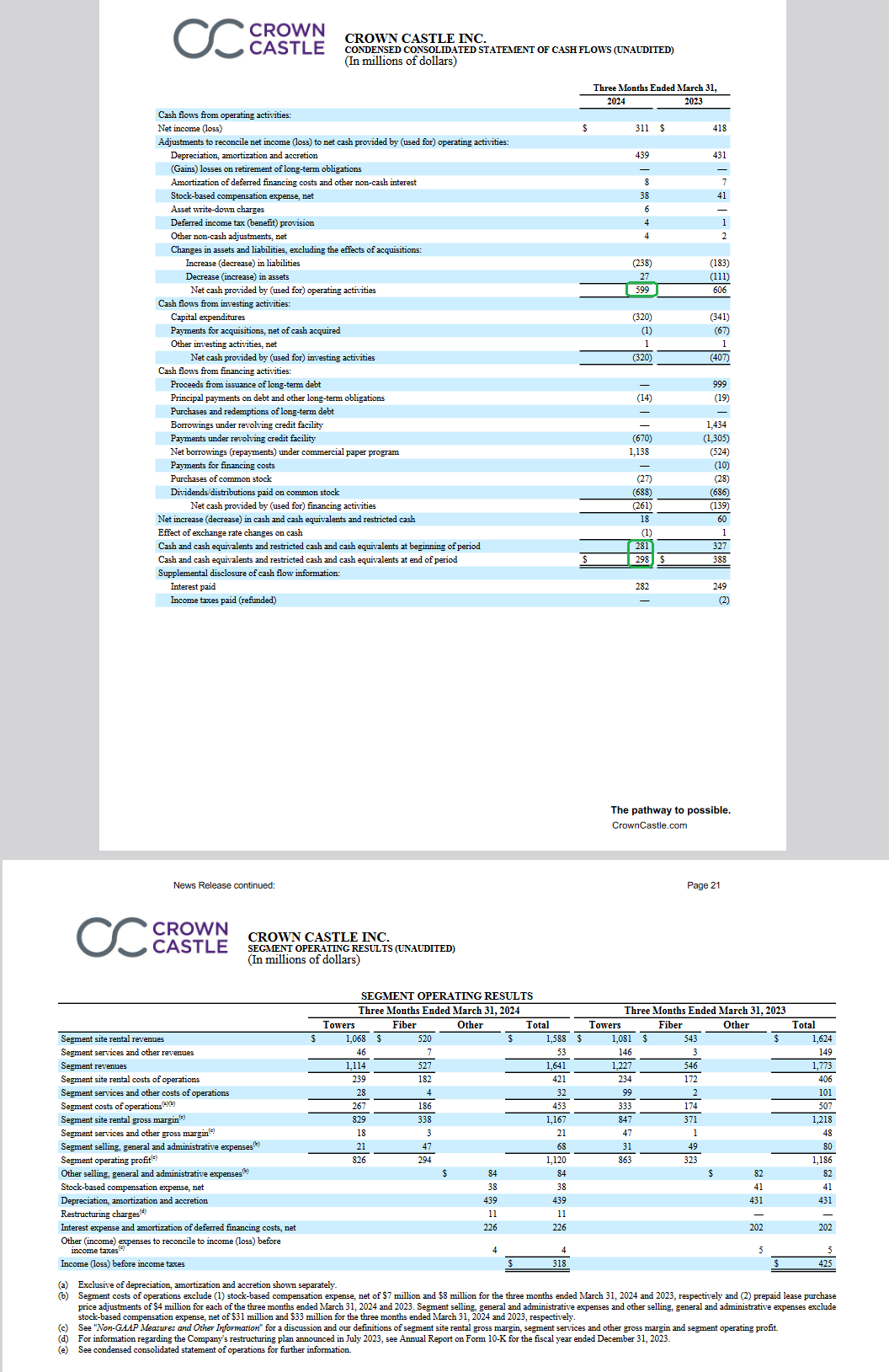

Crown Castle is a Cell Phone tower provider that generates cash to pay out to owners. Because it is a REIT and trades on yield – it will trade up (in price) as rates come down.

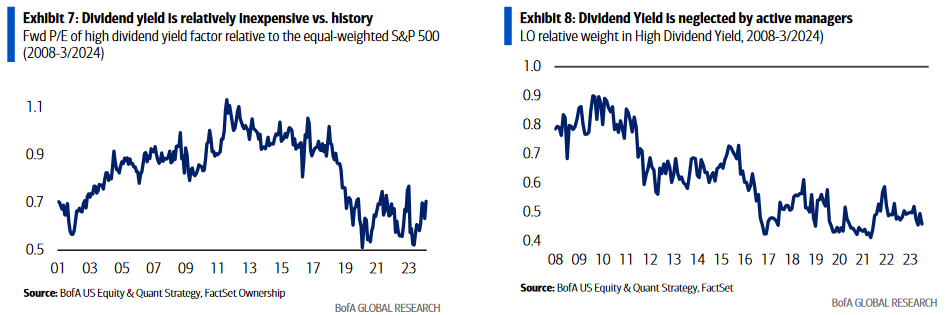

This position is core to our thesis that Dividend Yield is cheap and will be in high demand in short-order as first Fed cut is in sights:

Crown Castle currently has a 6.04% dividend yield. Here are some of the key catalysts, starting with the new CEO – Seth Moskowitz (who spend 12 years at American Tower – the biggest cell provider in the country):

Cooper Standard Update

Here is our previous update and thesis: Click Here

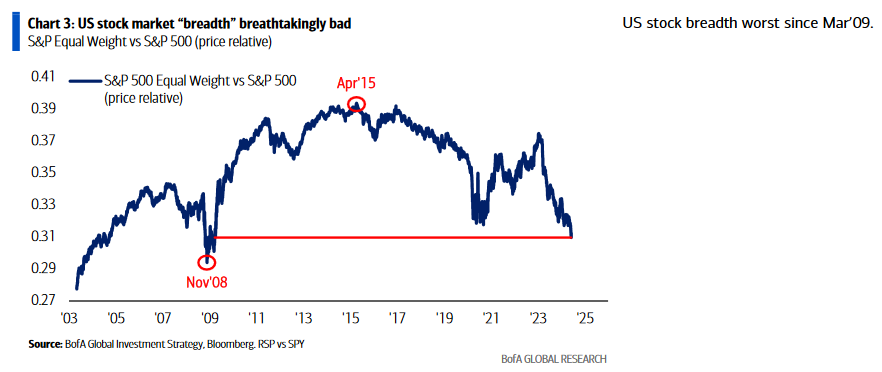

Now onto the shorter term view for the General Market:

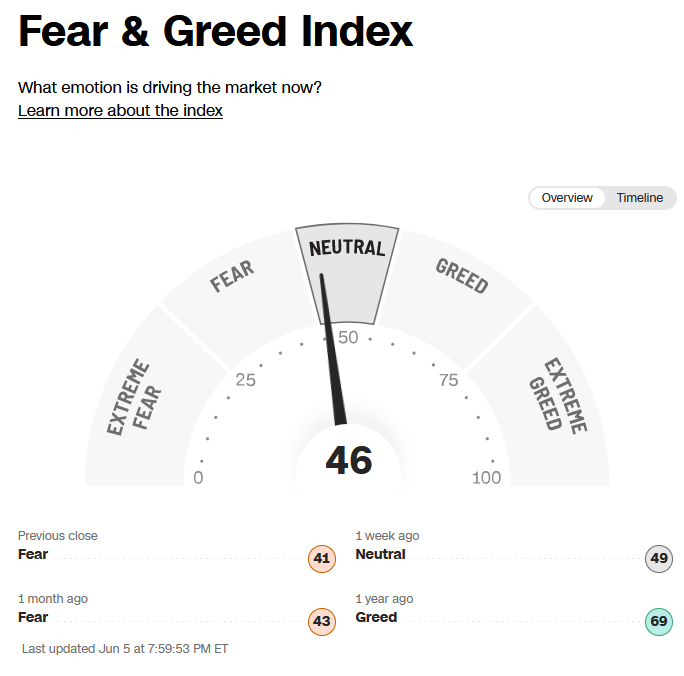

The CNN “Fear and Greed” flat-lined from 47 last week to 46 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

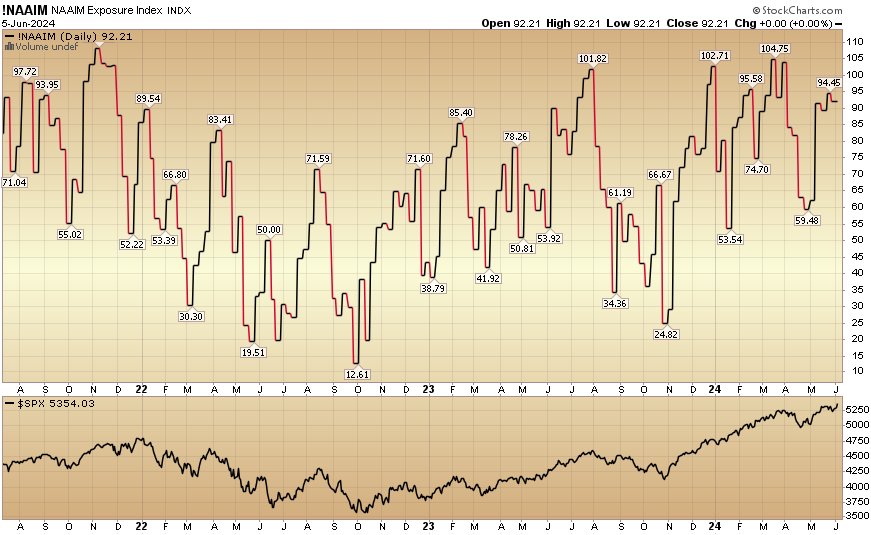

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked down to 92.21% this week from 94.45% equity exposure last week.

Our podcast|videocast will be out later today. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Congratulations to all of the new clients who came in so far this year during our Q1 and Q2 openings. We are now closed to smaller accounts ($1M+) again as of early this quarter and will remain closed to smaller accounts until sometime in Q3. Larger accounts $5-10M+ can access bespoke service at their preference here.

*Opinion, Not Advice. See Terms

Not a solicitation.