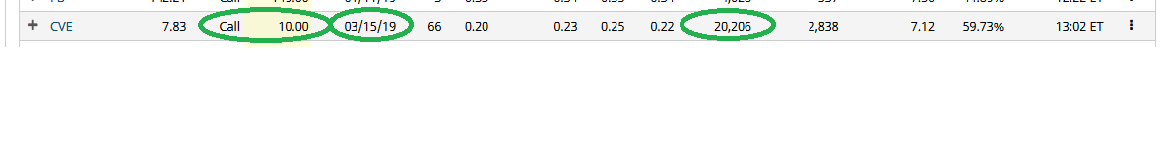

Today some institution/fund purchased 20,205 contracts of March $10 strike calls (or the right to purchase 2,020,500 shares of Cenovus Energy at $10). This is an abnormally sized bet for this stock and contract as the open interest was just 2838 prior to this purchase. We’re seeing more and more paper come into the Energy sector as WTI approaches $50/bbl and credit risk comes off the table.

Unusual Option Activity