While most people brag about their winners and hide their losers, we spend ~80% of our time on the positions that have not yet moved and ~20% on the ones that are working. We will not cover recent successful earnings results from BAX, C, BAC, EL, GOOS or CCI this week. DIS was a nice beat as well, so we will not spend much time on it either.

VF Corp Update

We came out with VF Corp publicly on Fox Business “The Claman Countdown” on November 7:

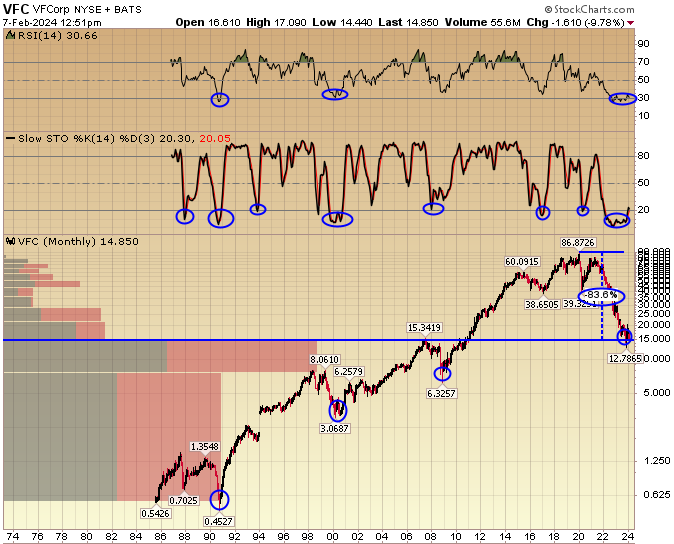

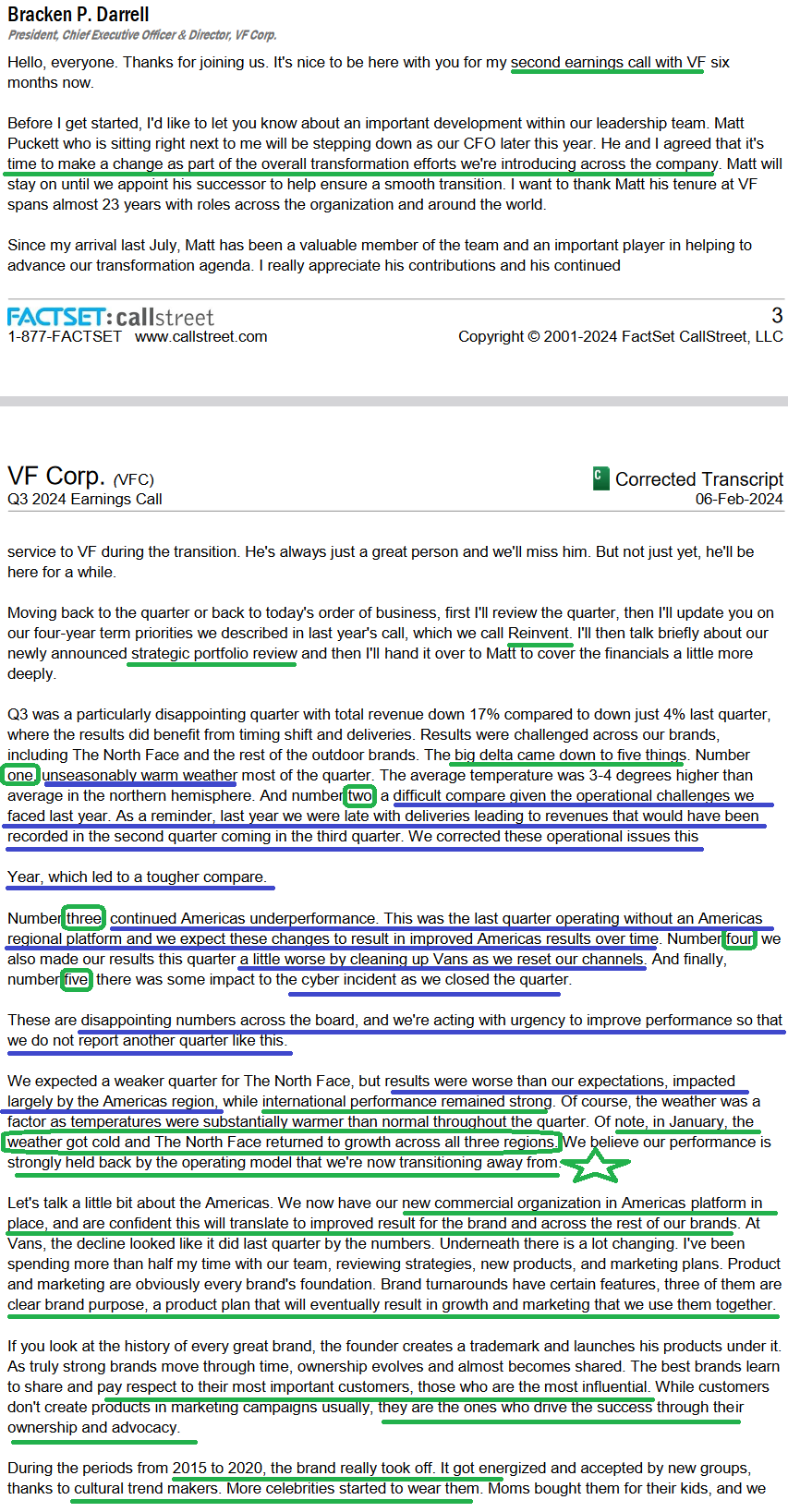

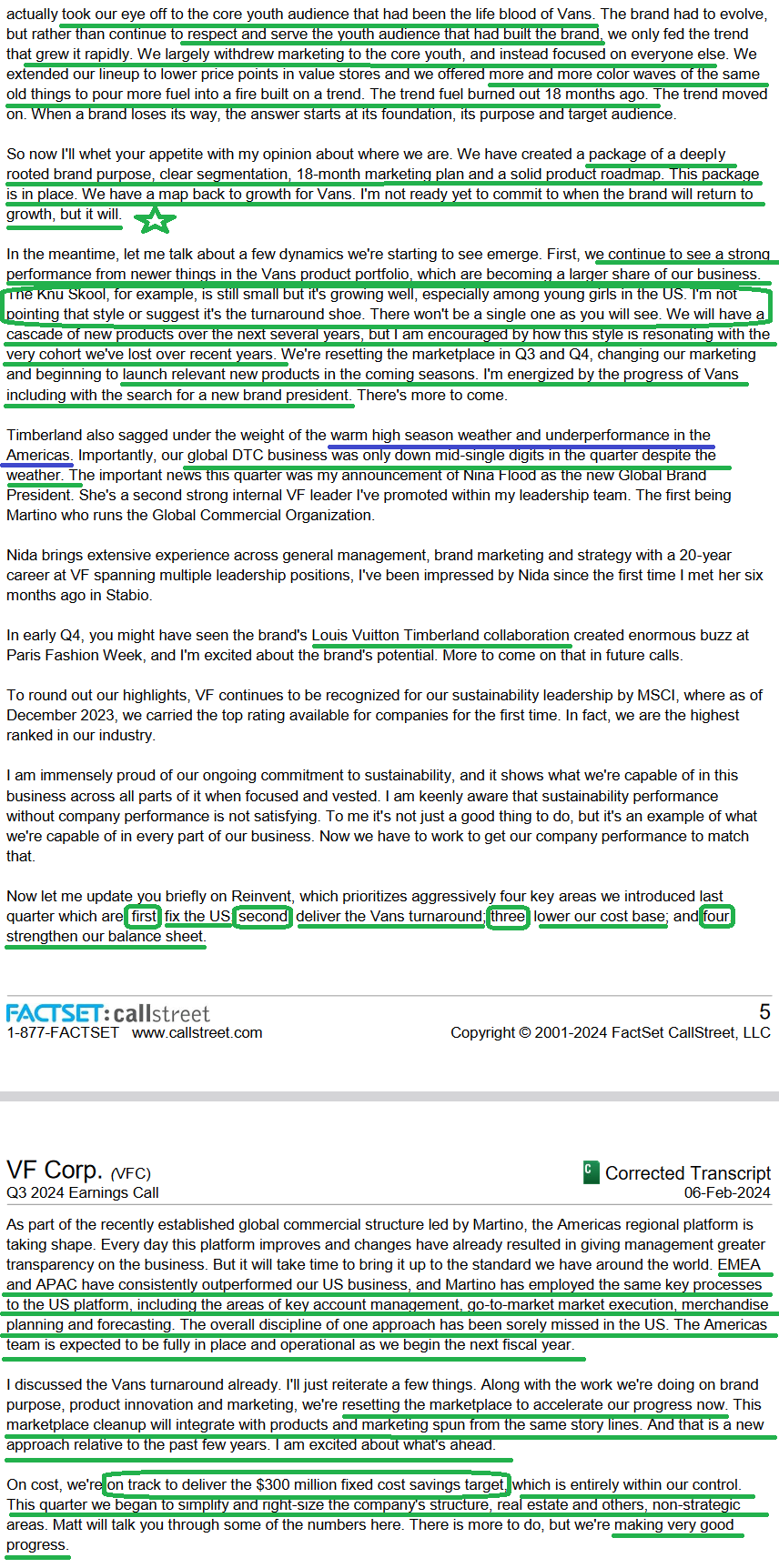

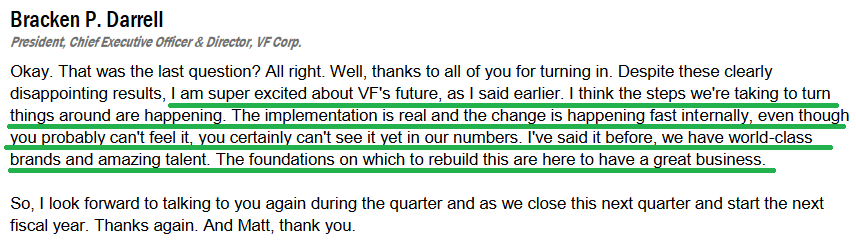

While it is unequivocal that VF Corp is under pressure [i.e. eyes wide open as we purchased it ~83% off its all-time high (and added more after earnings)], there is still a core base for Bracken Darrell (the new CEO) to turn around – just like he did at Logitech.

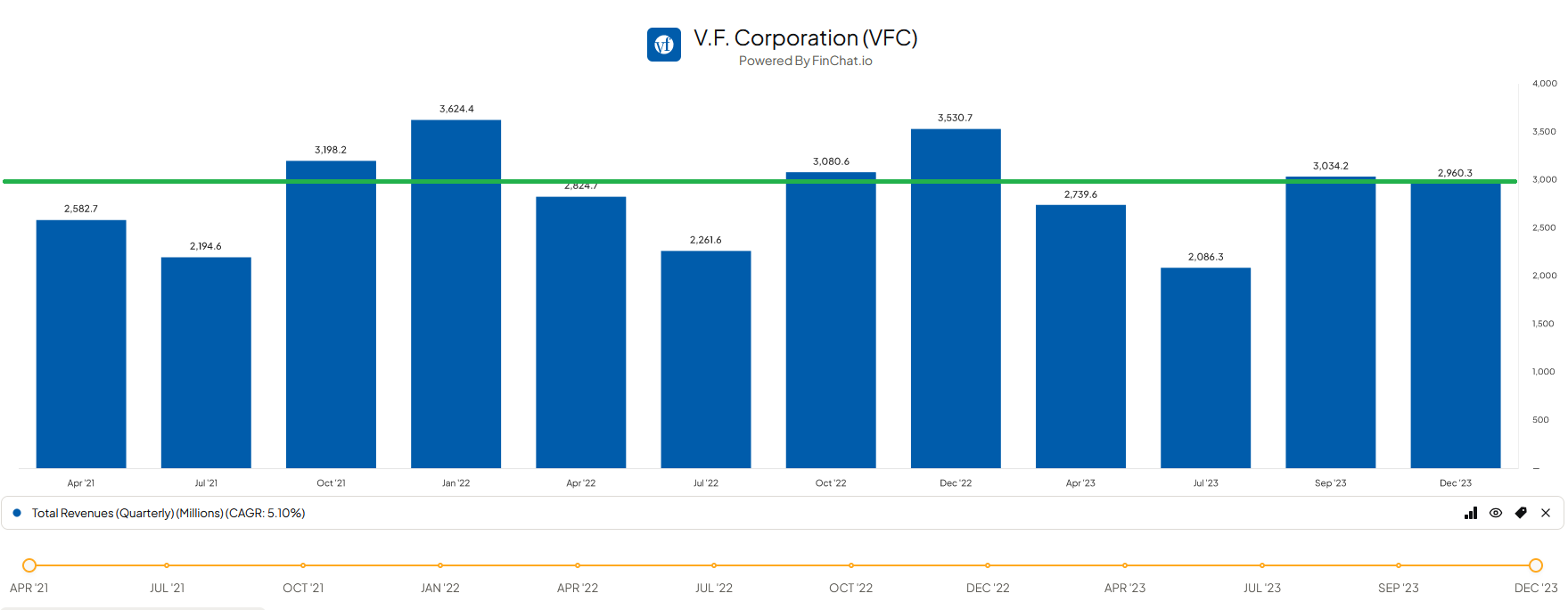

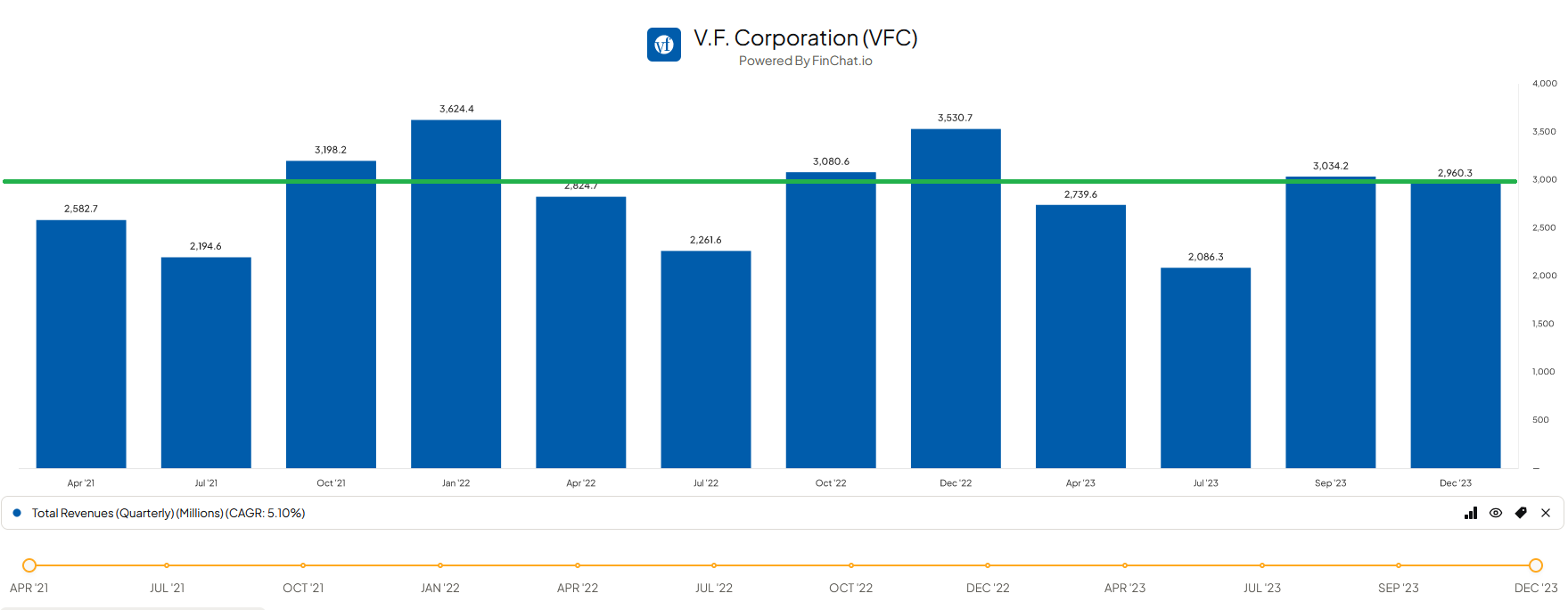

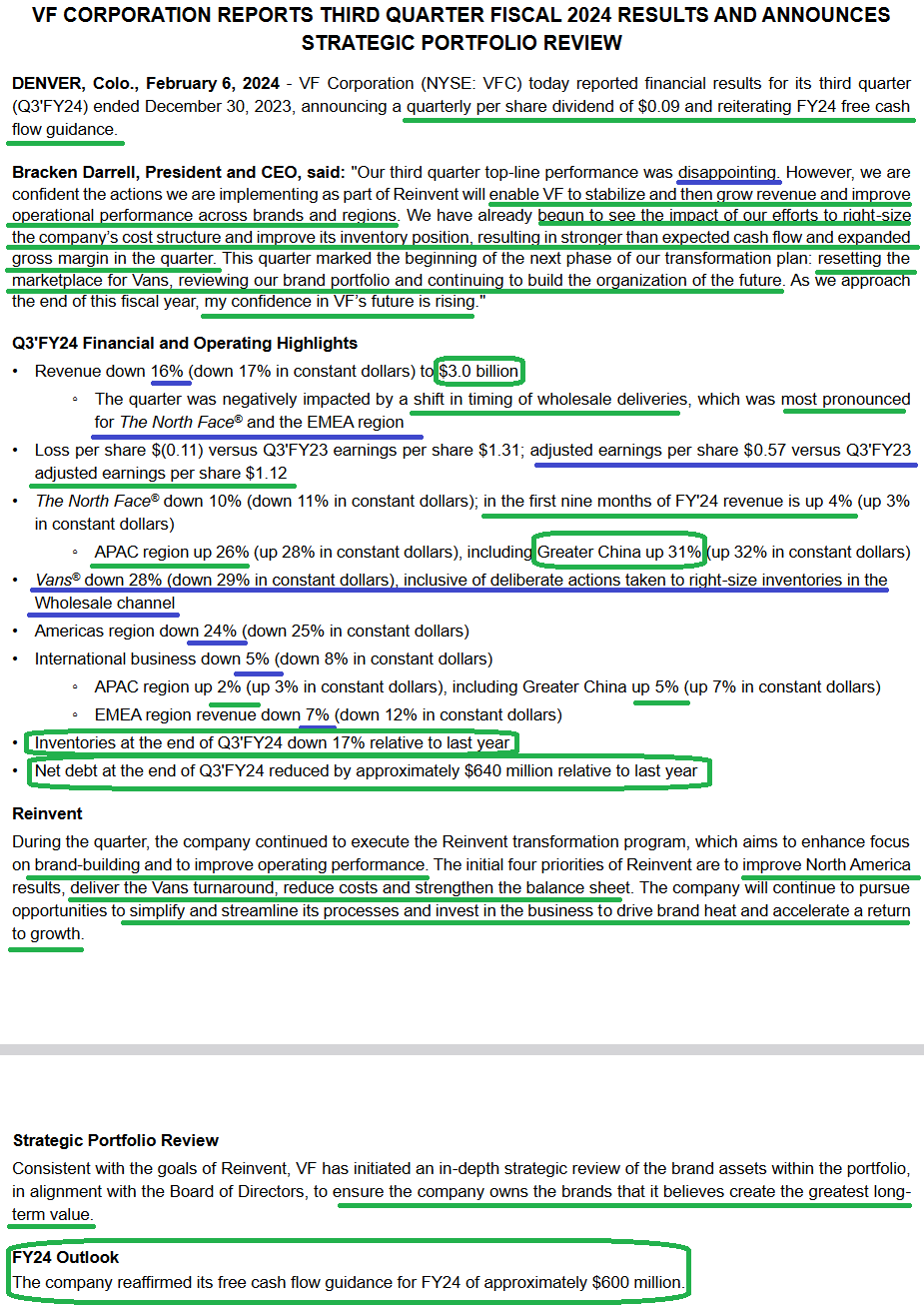

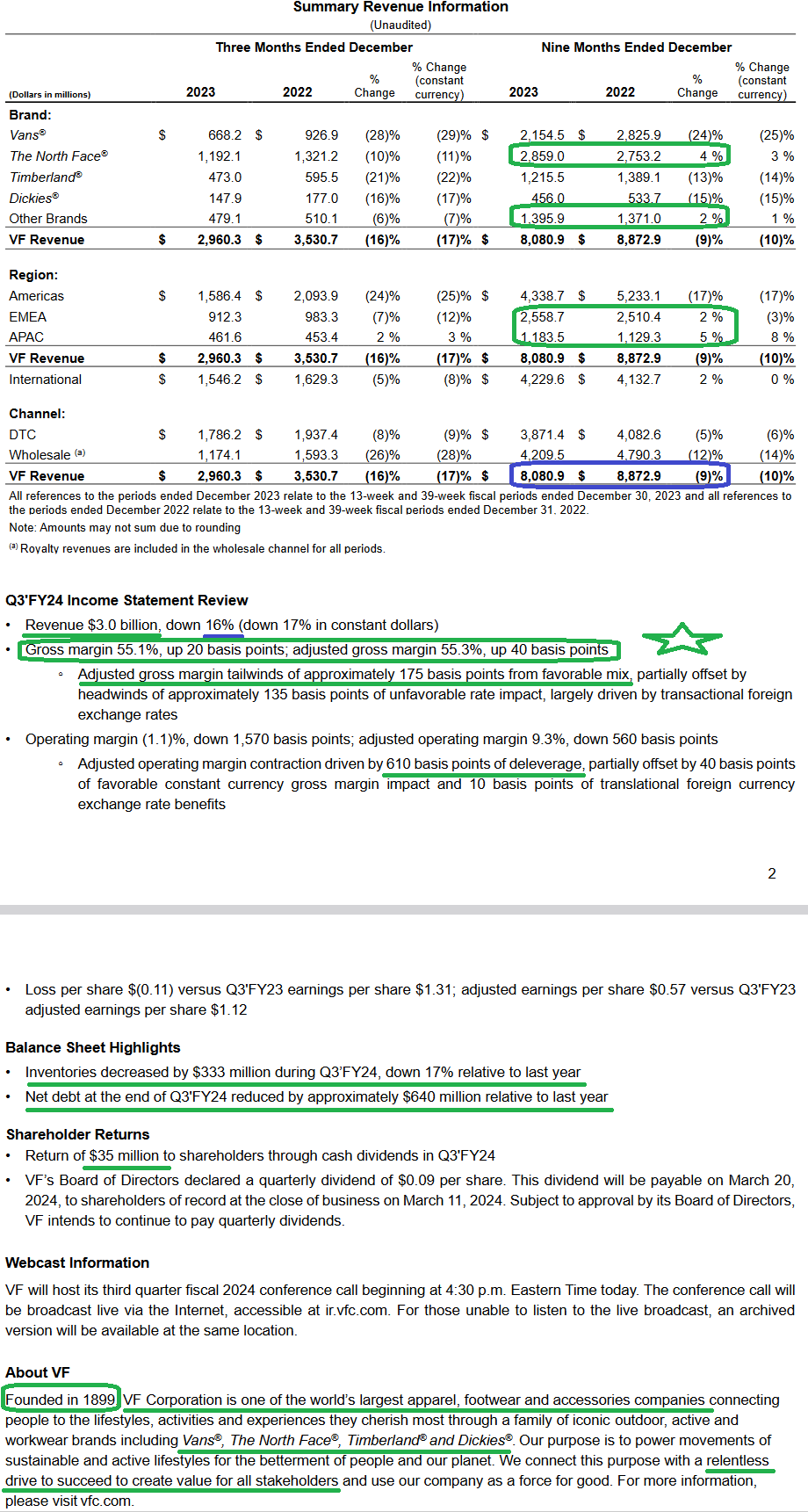

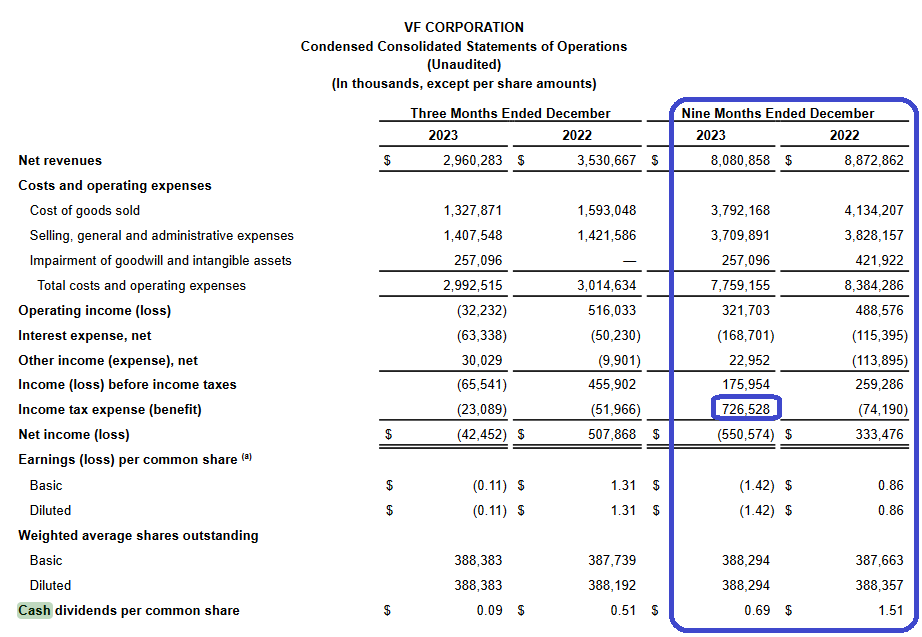

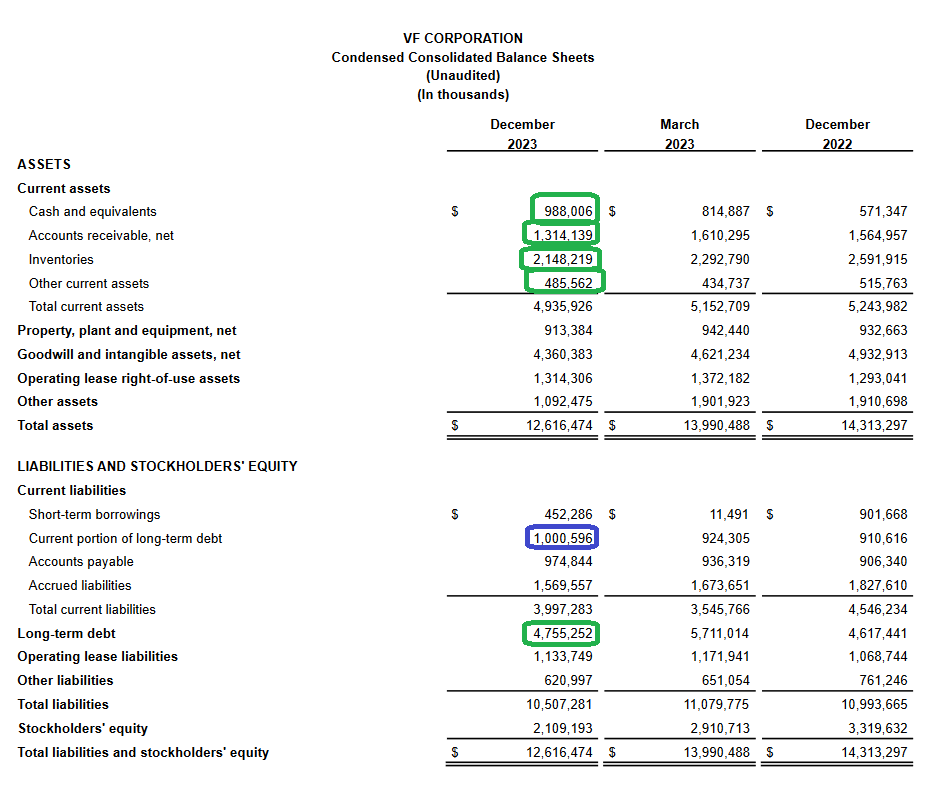

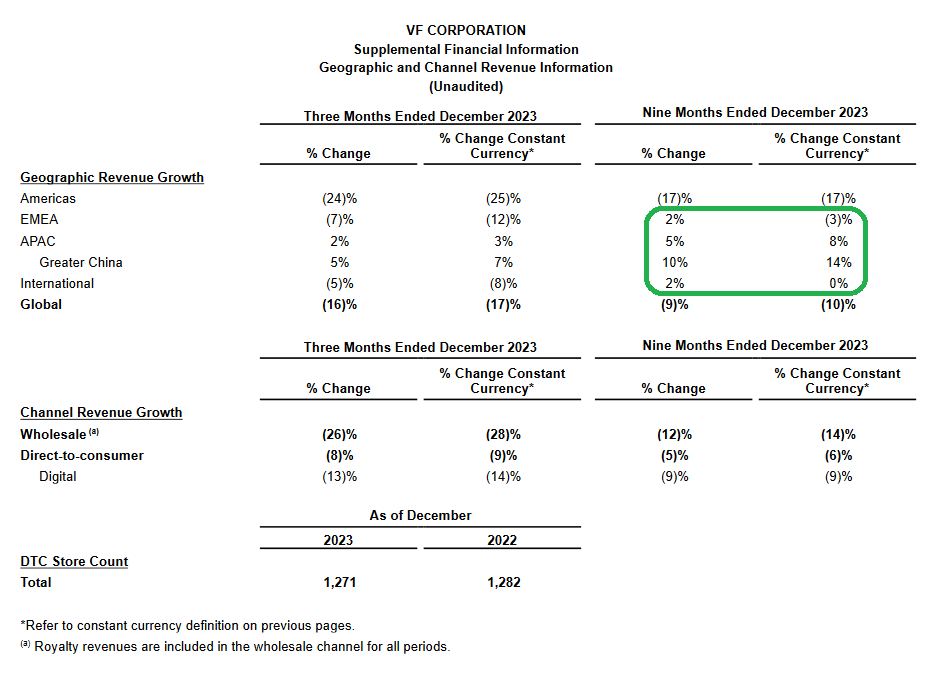

In the table above, I have listed the quarterly revenues for the last 3 years. What you essentially have is a steady-state (flattish) business that does ~$3B revenues per quarter. The EXCEPTIONS (2 of 12 quarters) were Q4 2022 and Q4 2023. The RULE is closer to what we saw this quarter. You could argue that this quarter was a Holiday quarter and should have been another exception. I generally agree, but the point I’m making is that there is a STRONG BASE for Bracken to turn around and it is not “falling off a cliff” as the percentage drop – related to abnormally high comps – suggests to the uncritical eye.

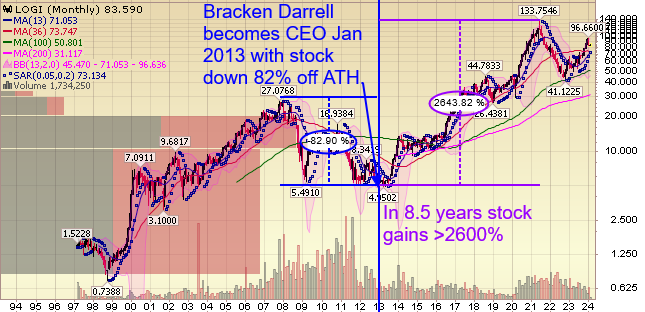

As a refresher, Bracken entered a fading brand “commodity” business (LOGI) in January 2013. The stock was ALSO down ~82%! Over the next 8.5 YEARS (not minutes, not weeks, not months, not even quarters), the stock was up >2600% (i.e. $1M became $26M). Oh, and by the way, the stock went DOWN for a little while AFTER he took the helm BEFORE it started turning around:

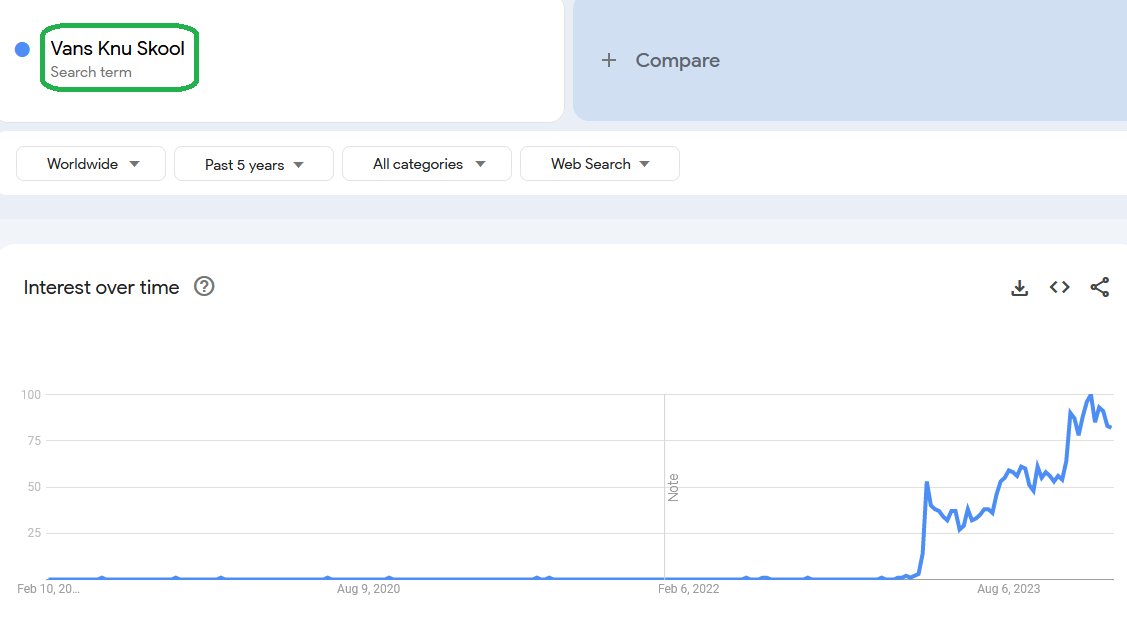

As you can see in our header photo, the company is refocusing on young consumers and their “Knu Skool” shoe has been a huge hit among children. They look like the classics, but the side trademark is puffed out:

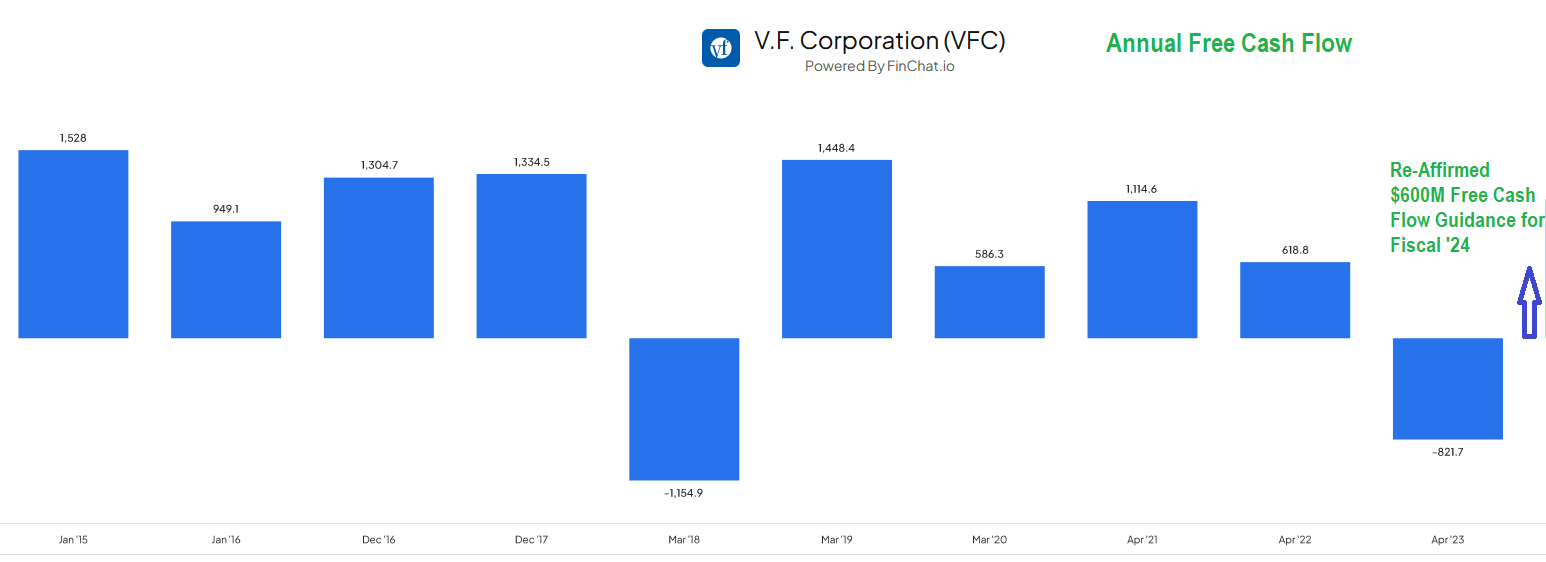

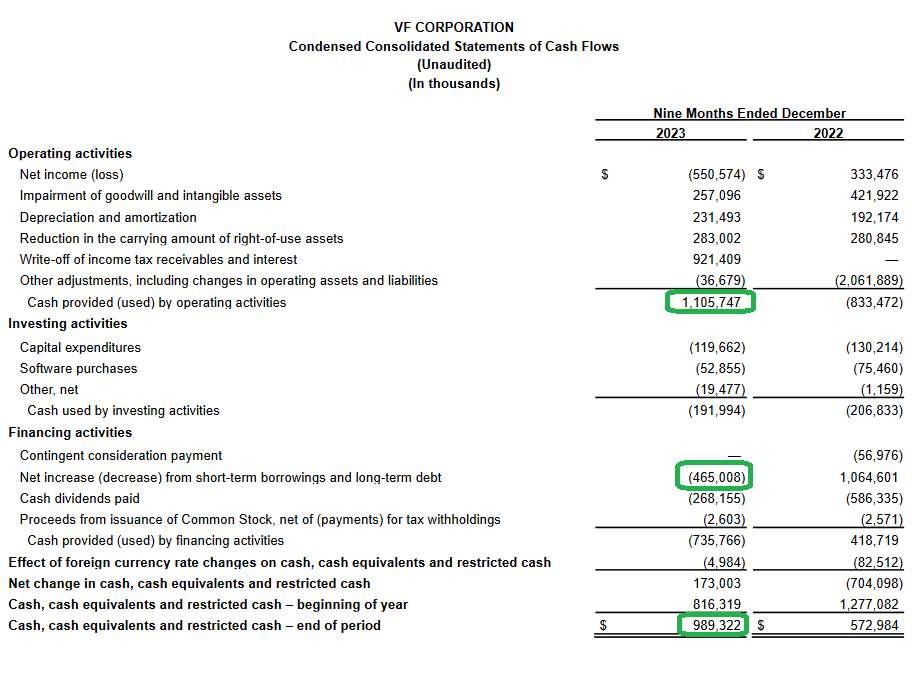

The number one analysis you do when entering a major turnaround situation is SOLVENCY risk. So long as they are generating sufficient Free Cash Flow to buy them enough time to turn the corner, you are simply playing the “time arbitrage” game (so long as you have a good jockey). VF Corp re-affirmed its Free Cash Flow guidance at $600M for fiscal 2024 on the call:

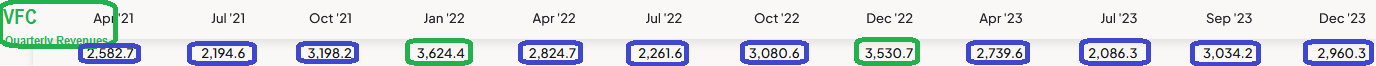

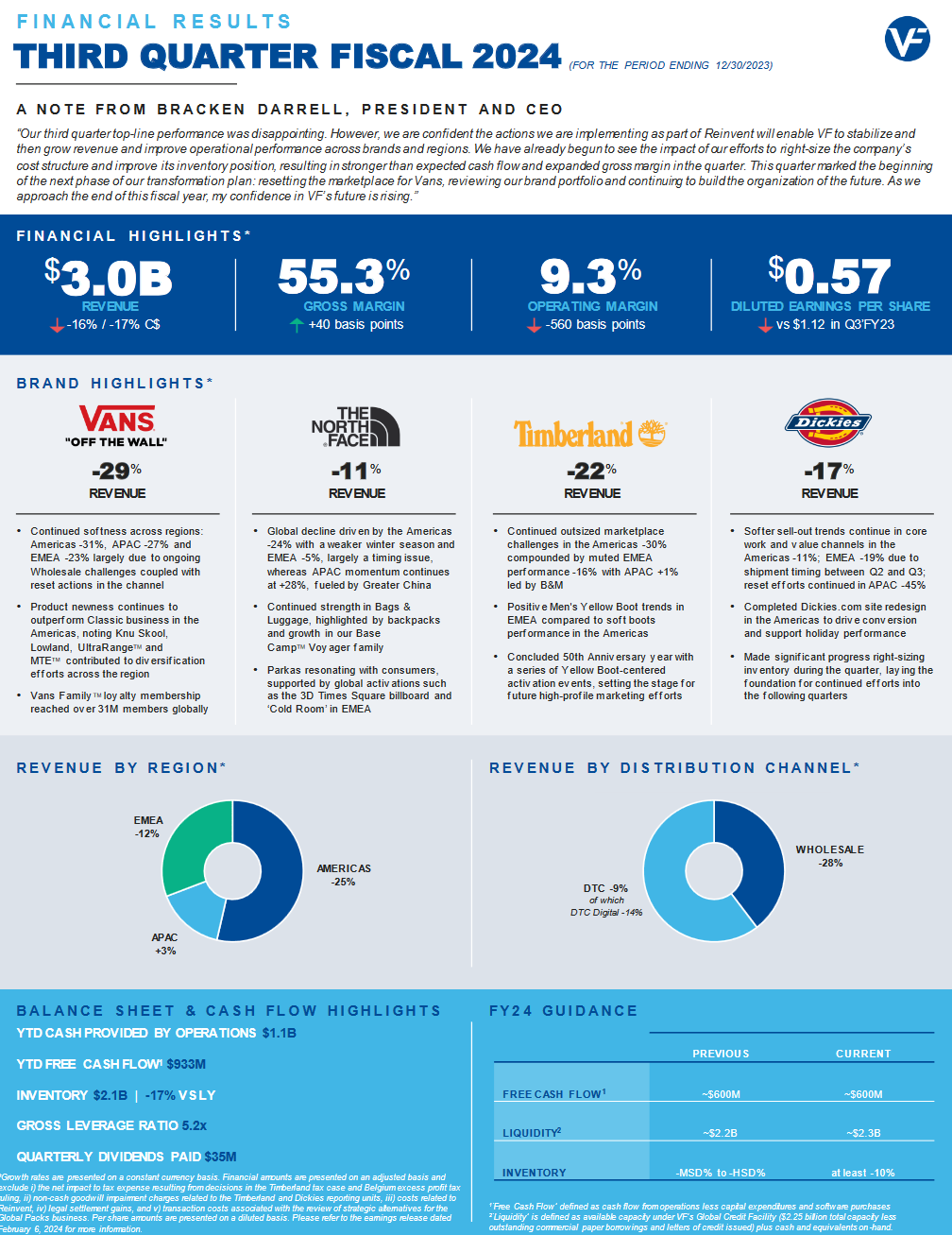

As we get into the results and earnings call you will see 1) why people puked out the stock (knee-jerk reaction) because the revenue decline looked like they are going out of business! However, you will see that the Q4 2022 comp was an aberration both from normal run rate AND by the fact that a lot of Q3 2022 got pushed into Q4 2022 making the comp that much higher. So when you see a “16% decline in revenues yoy” you DON’T SEE the sequential revenue run rate basically flat. In other words, the headline (without proper analysis/understanding) is much worse than it seems:

Again, look at the “SCARY” revenue numbers:

Now look at the reality:

1) It’s fixable.

2) Buying it down 82% off it’s ATH more than compensates us for the waiting we will do to get a full recovery and beyond…

3) As I always say, “they don’t give away mult-baggers for free.” If you can’t stand the heat, get out of the kitchen.

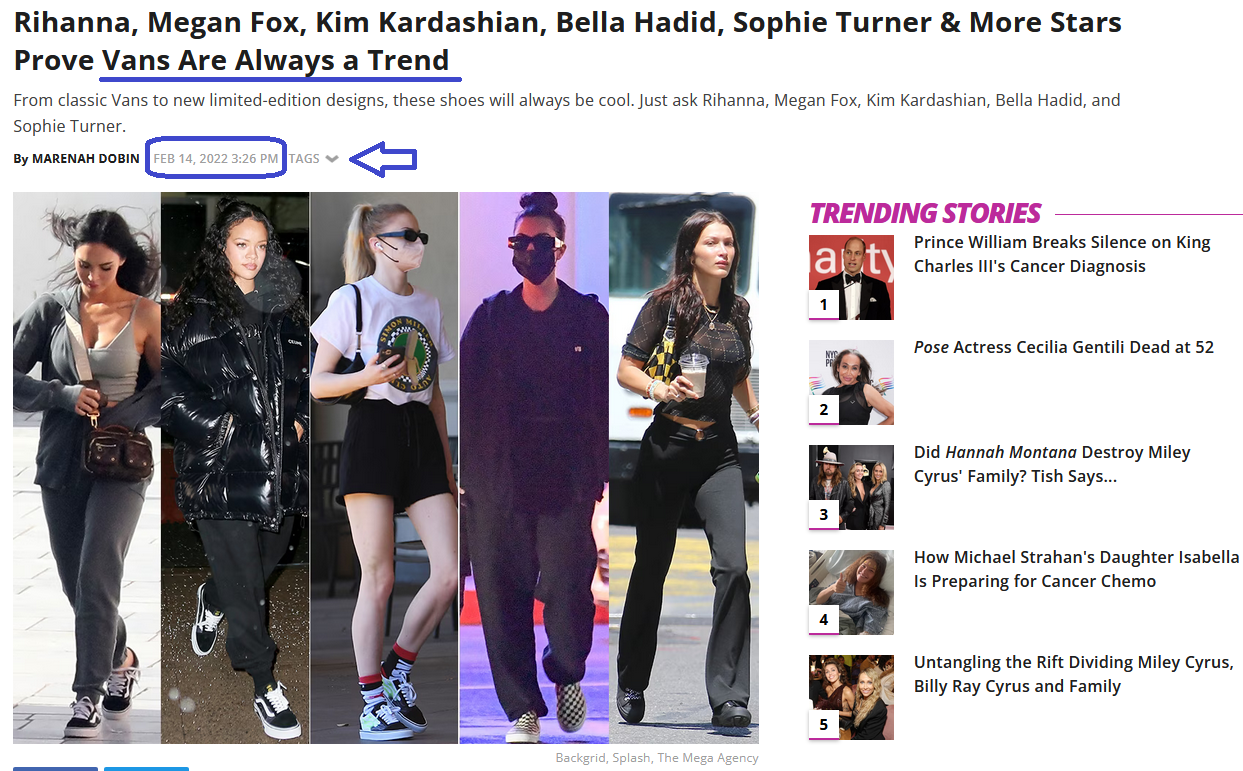

Unlike Allbirds, Vans have been around long enough that they always come back. This is from just 2 years ago (their most recent peak):

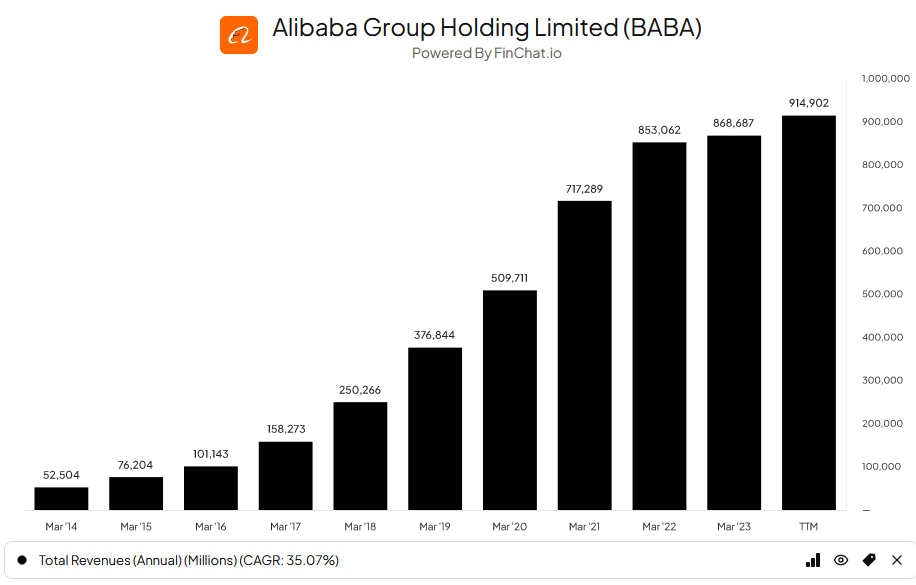

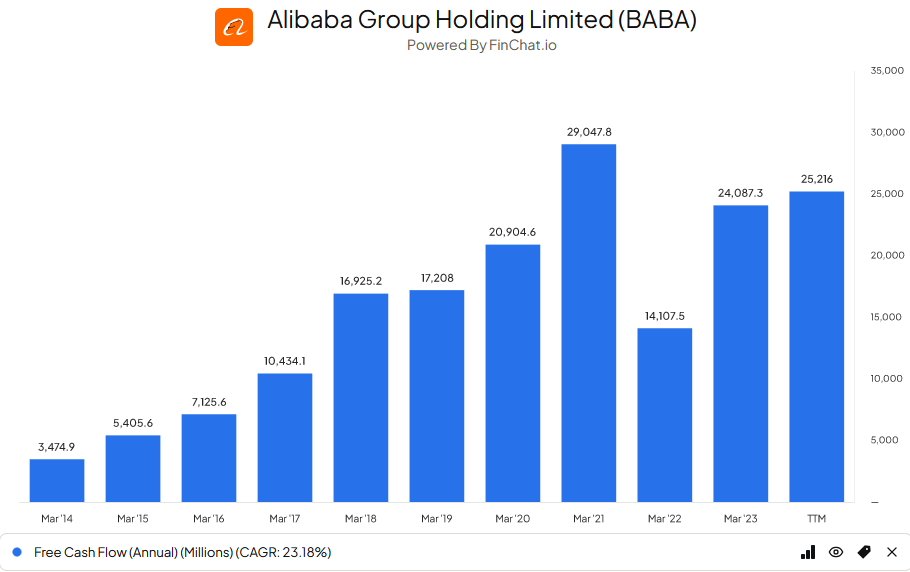

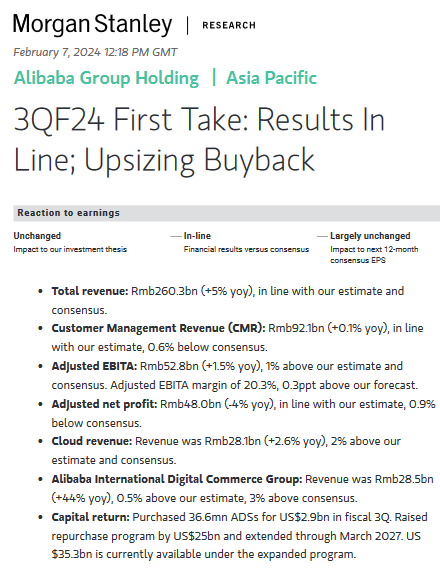

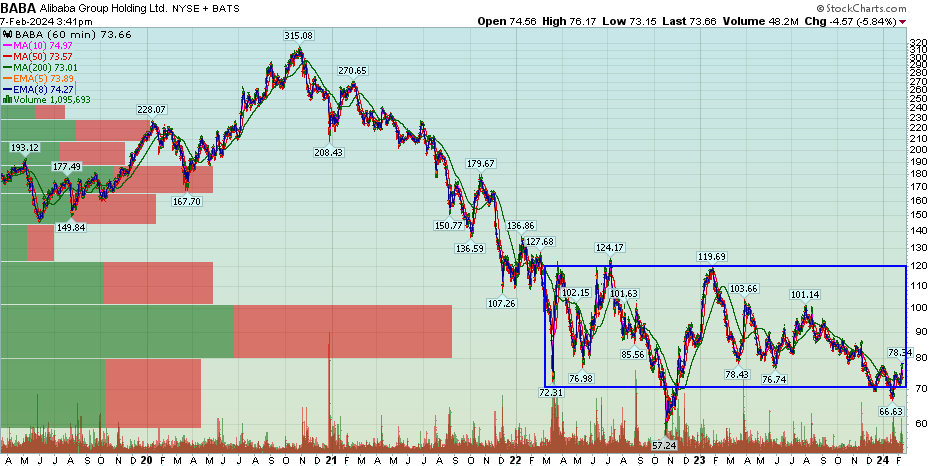

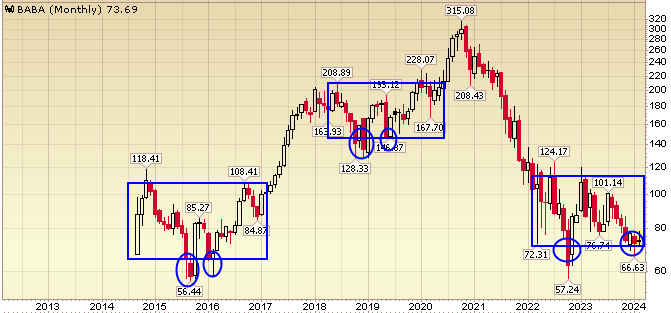

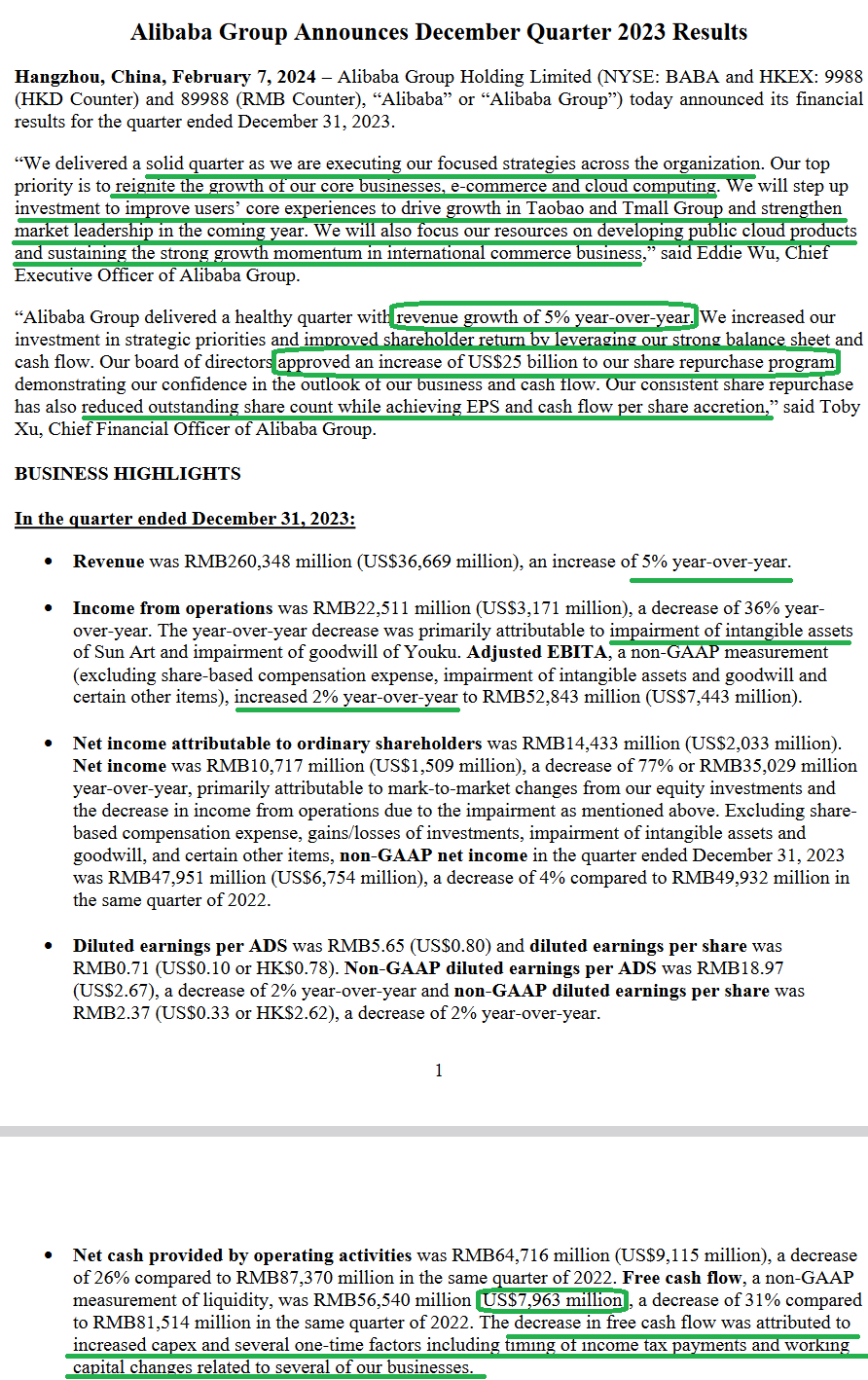

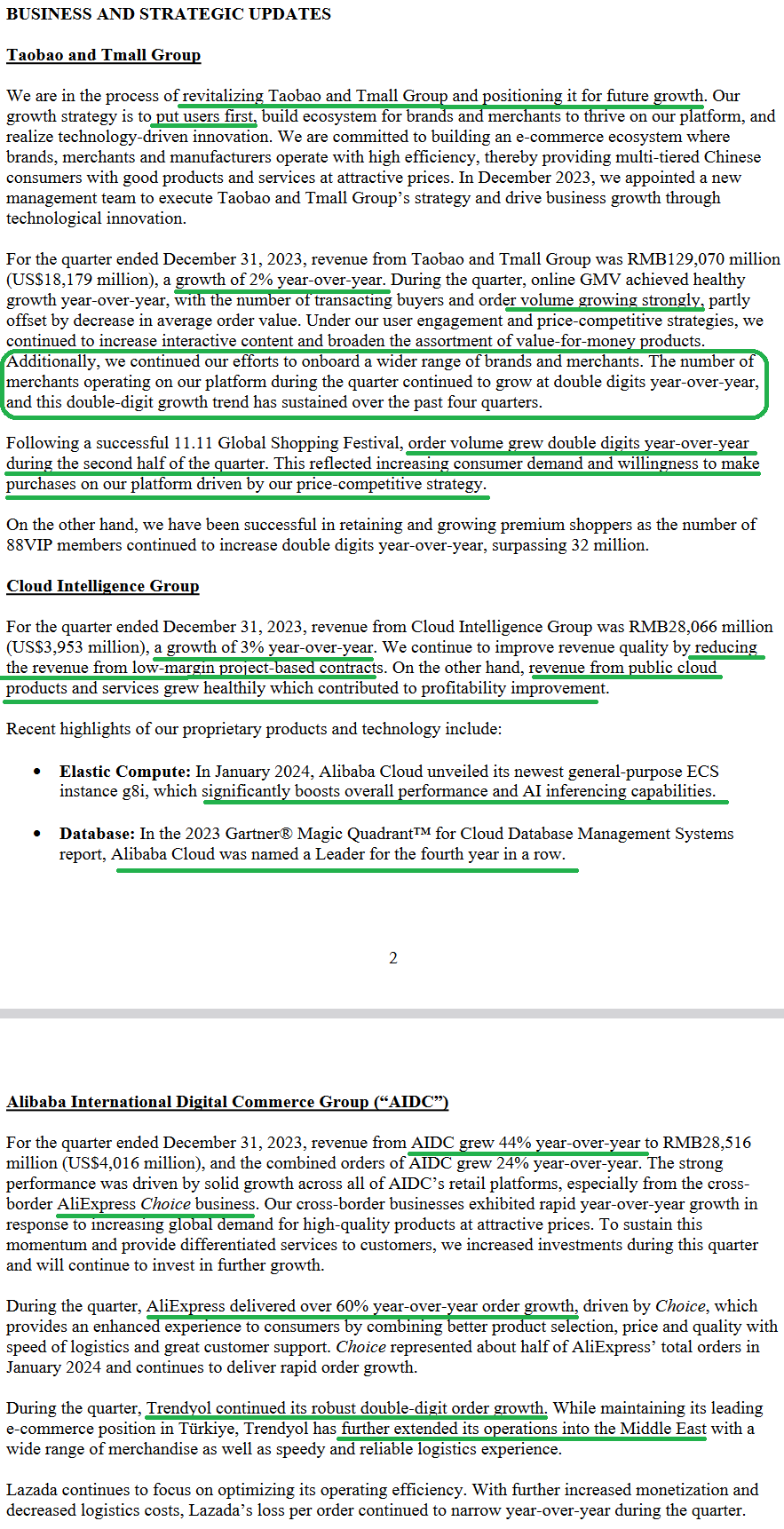

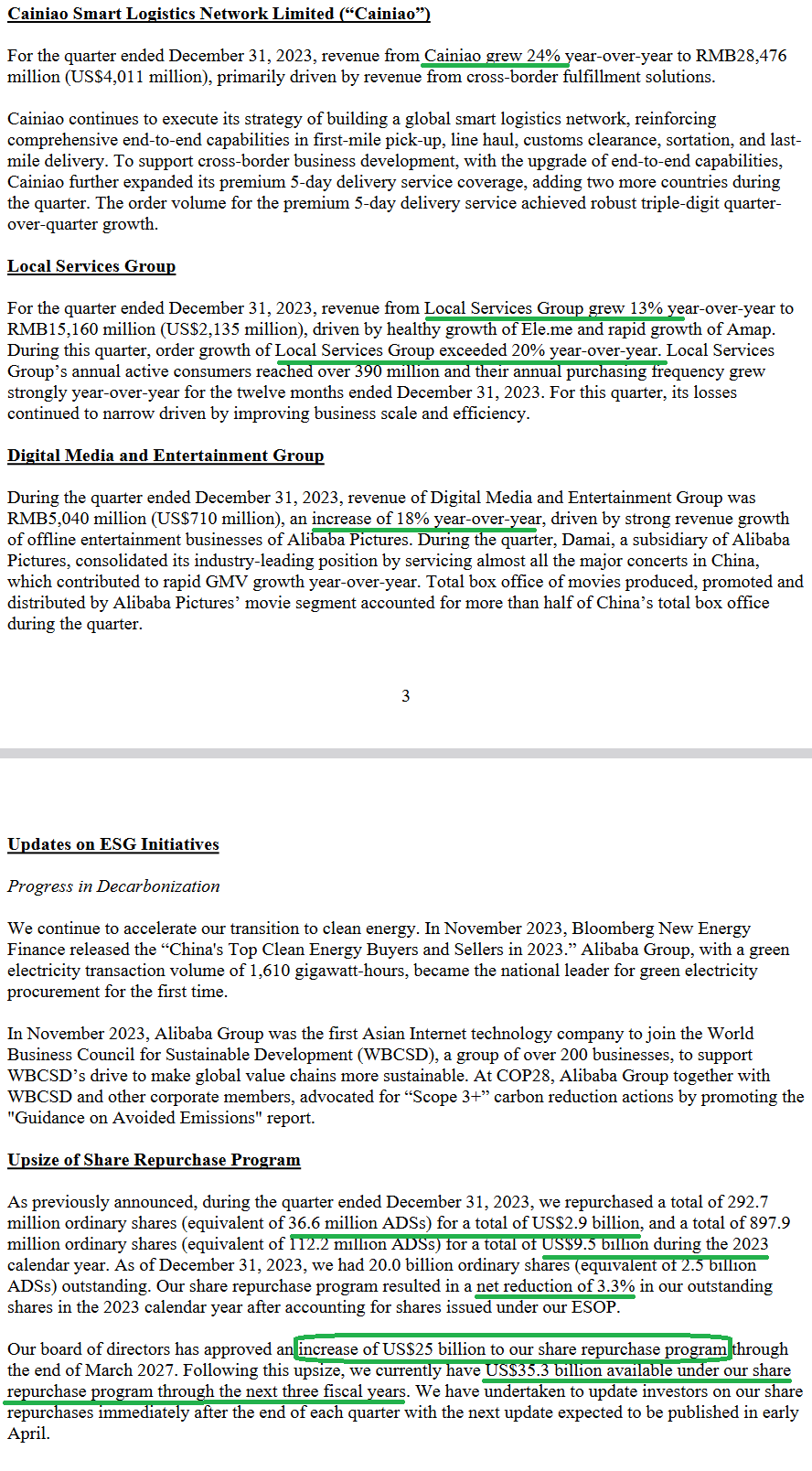

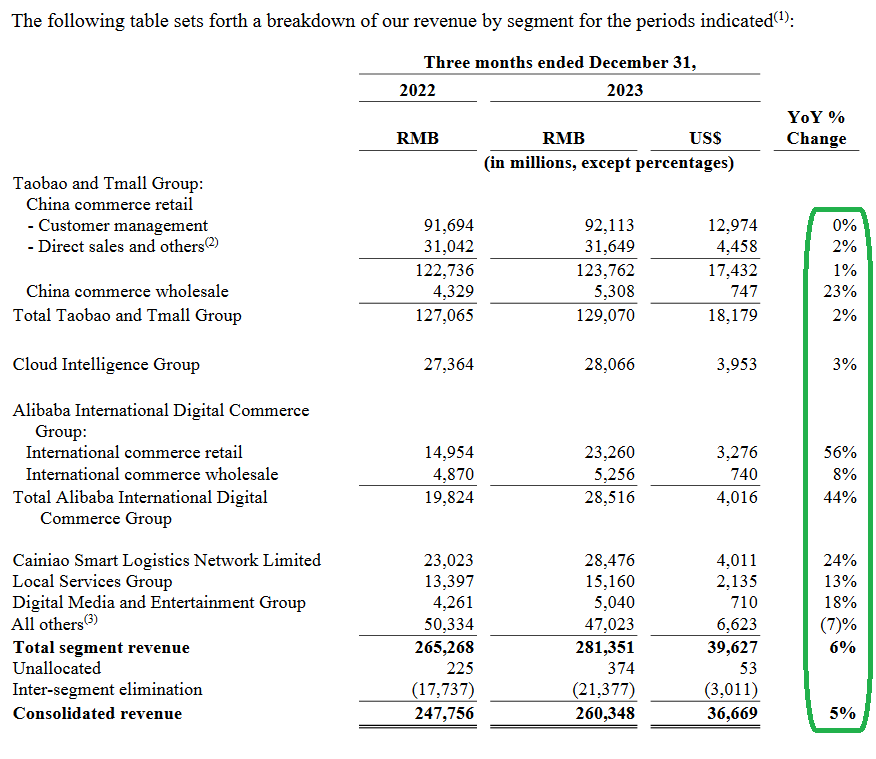

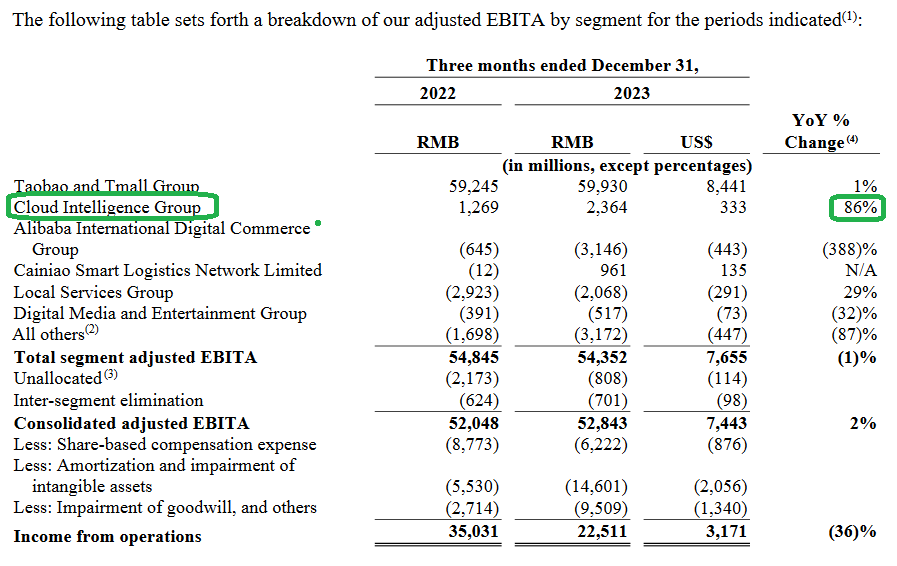

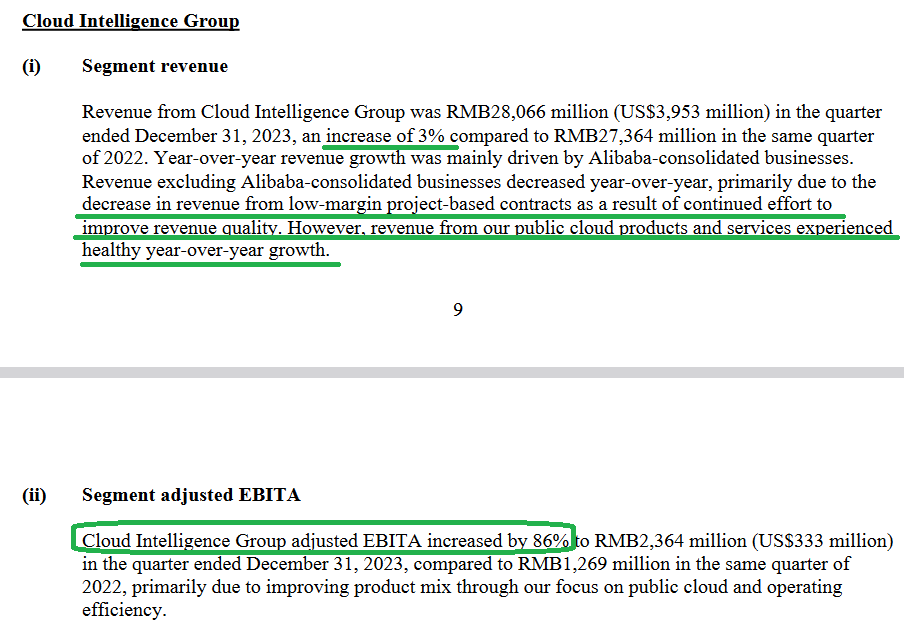

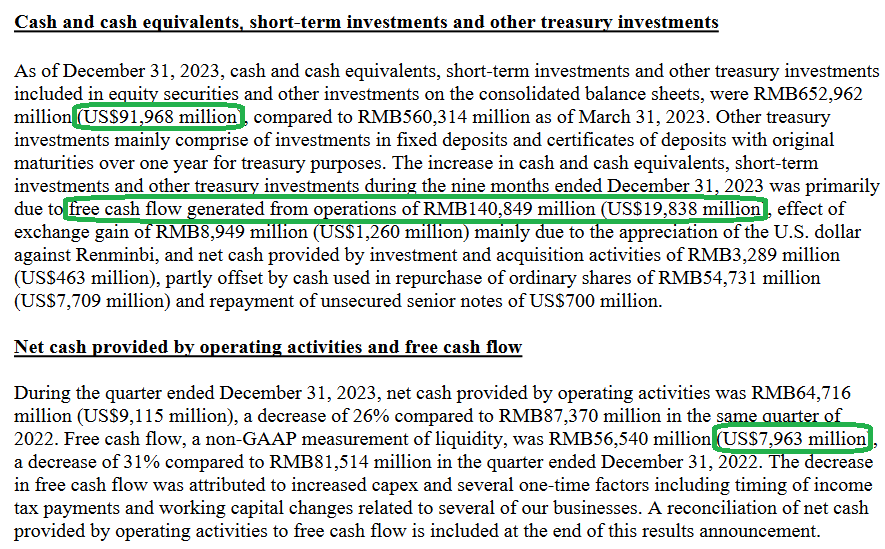

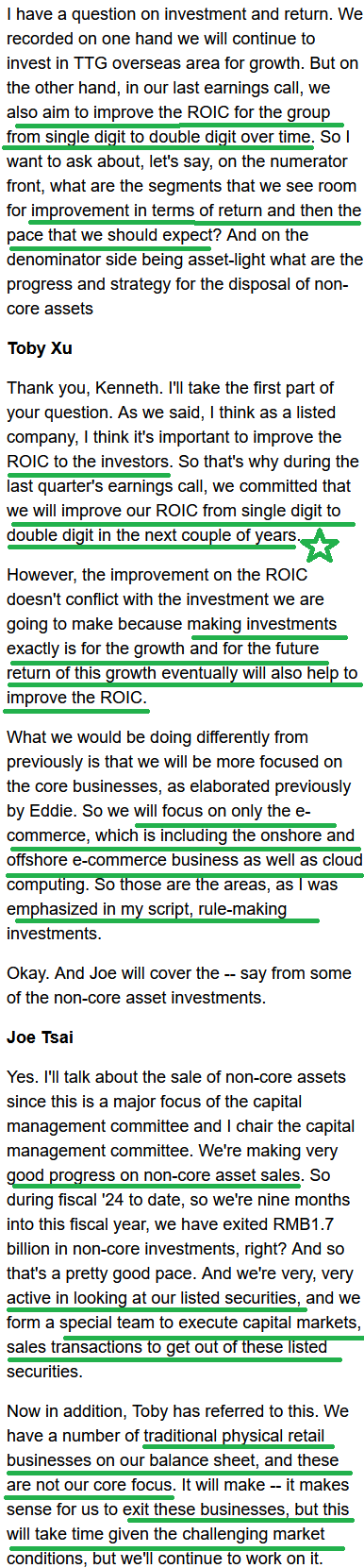

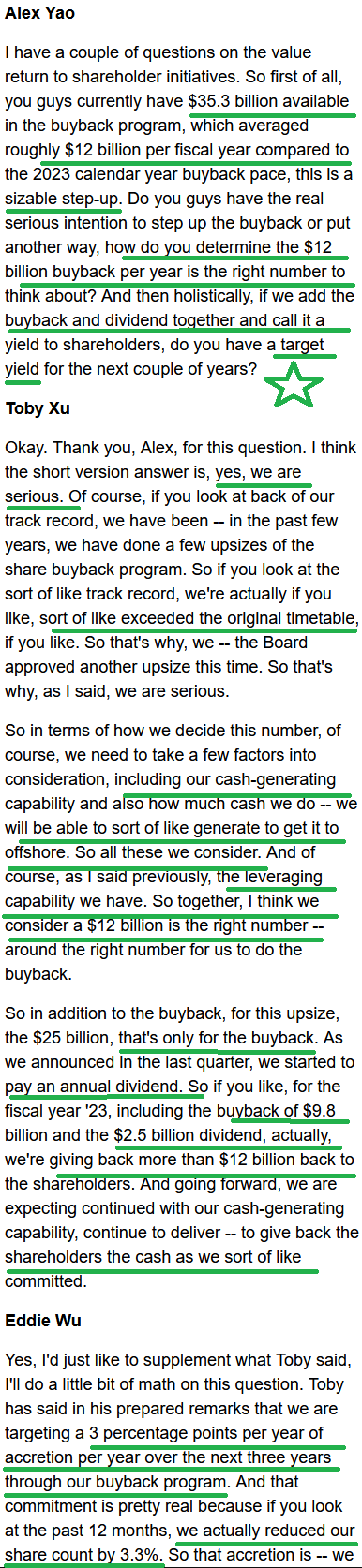

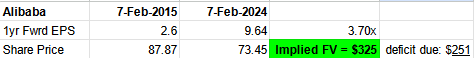

BABA Earnings

Retail Trader/Gambler, “I can’t believe the stock is down over 5%. I’ve had enough. I’m out.”

Institutional Investor, “But it’s still higher than where it was 2 days ago. Not the end of the world. Hold.”

Value Investor, “I can buy this company at 2014 prices with Revenues up 17x (in local currency) and free cash flow up 7.25x (in USD). Price is what you pay, value is what you get. Adding at the margins.”

My quick take on X (twitter):

How the “Weighing Machine” works…

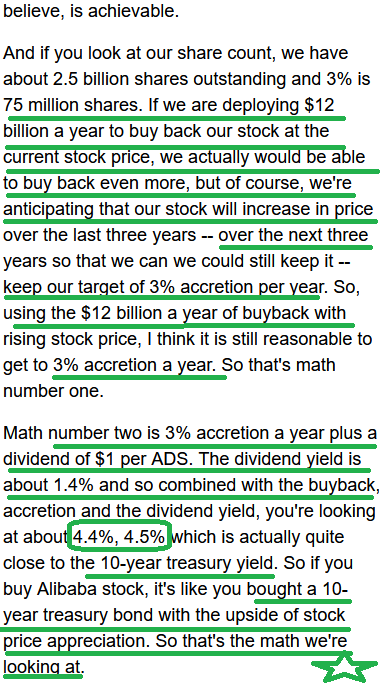

Here is a similar take to what we’ve been saying/repeating since day 1. Neither I, nor this author, are brilliant (as it relates to the following assessment). But we are smart enough to simply copy the success (investing framework) of the masters: Graham, Dodd, Buffett, Munger, etc. Remember, you don’t have to be original to be creative. This excerpt is from Albert Bridge Capital (also quoting Ben Graham) via one of our loyal podcast listeners (thanks Matt!):

While this type of analysis is not perfect, it’s roughly right. And to make a lot of money in the business you only need to be “roughly right.” Here’s one to add to the list:

The commonality you will find among the 6 examples the author listed above – and the one I listed afterward – is that there is no way to tell when fundamentals will line up with price. The key is to understand and know that sooner or later they WILL (adjusted for multiple/growth rate, etc).

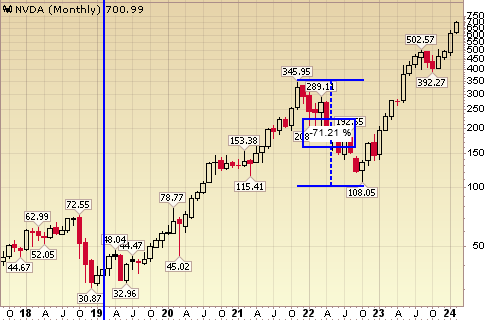

What no one talks about is what you have to “hold through” to get the big results. In his first example of NVDA, how many of you would have held through the 71% crash in 2022?

In his second example of META, how many of you would have held through the 43% crash in 2018 and the 77% crash in 2022?

In his third example of AMZN, how many of you would have held through three ~40% crashes and the ~60% crash in 2022?

In his fifth example of GOOGL, how many of you would have held through the ~50% 2022?

In his sixth example of MSFT, how many of you would have held through the ~60% crash in 2008 and ~43% crash in 2022?

In his sixth example of MSFT, how many of you would have held through the ~60% crash in 2008 and ~43% crash in 2022?

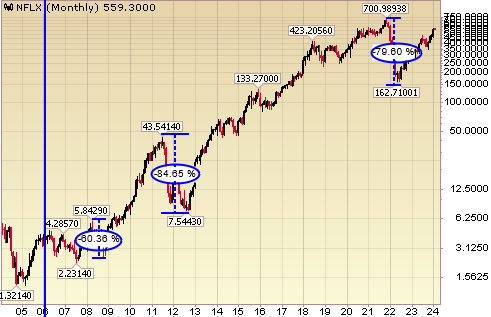

In his seventh example of NFLX, how many of you would have held through the ~60% crash in 2008 85% crash in 2012 and ~80% crash in 2022?

If the answer is “I would” you are probably already wealthy and likely a client. If the answer is no, be open to the possibility that you are selling at the wrong time yet again. You probably fall into the emotional group of “after BABA doubles I’ll become a client!” There will always be opportunities, but while you wait for that one, you’ve missed a bunch (both stock AND accompanying options overlays) that have already been more than doubles.

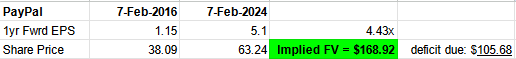

Is PayPal the next one with a “price deficit” relative to intrinsic value?

Sandbagger and Chief

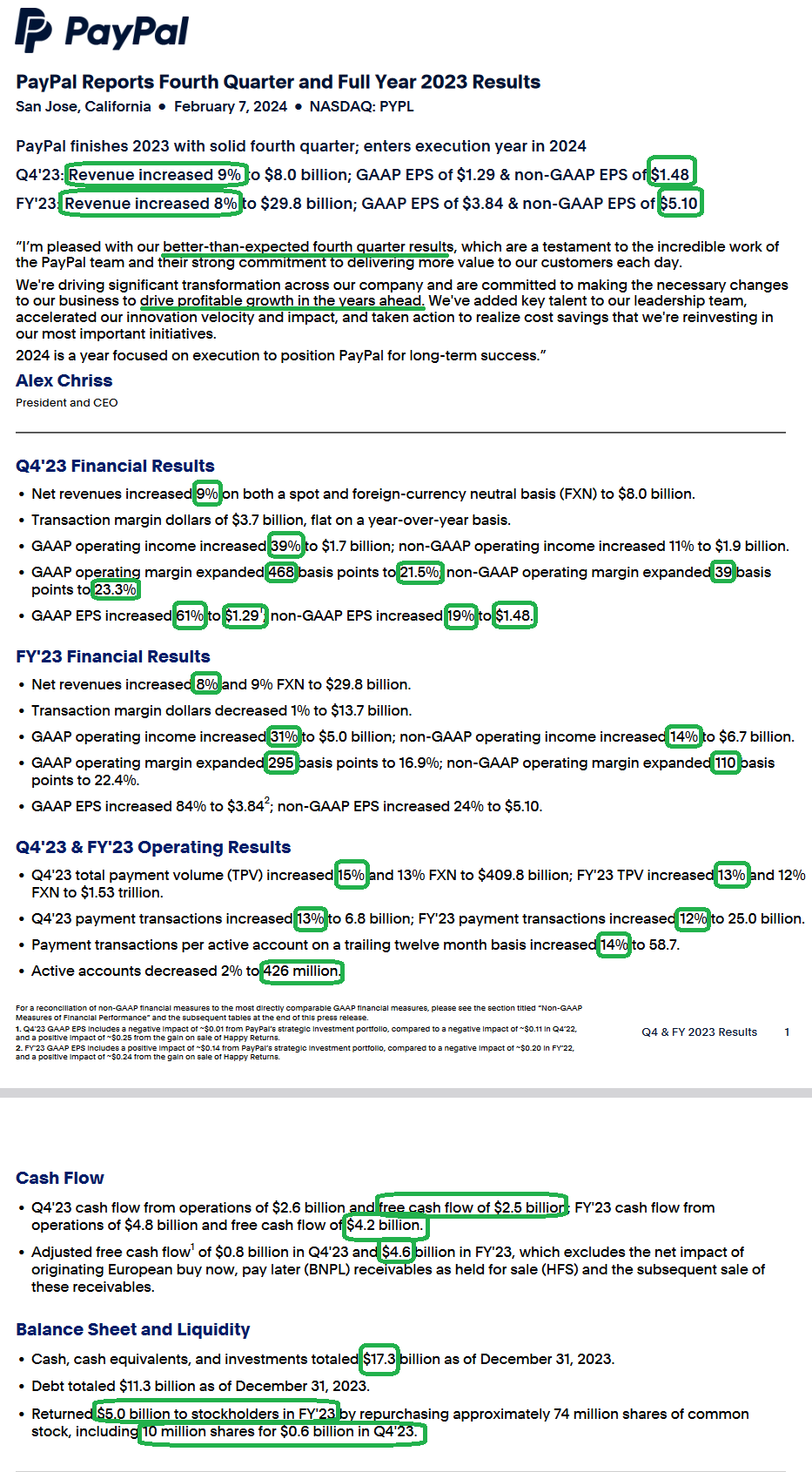

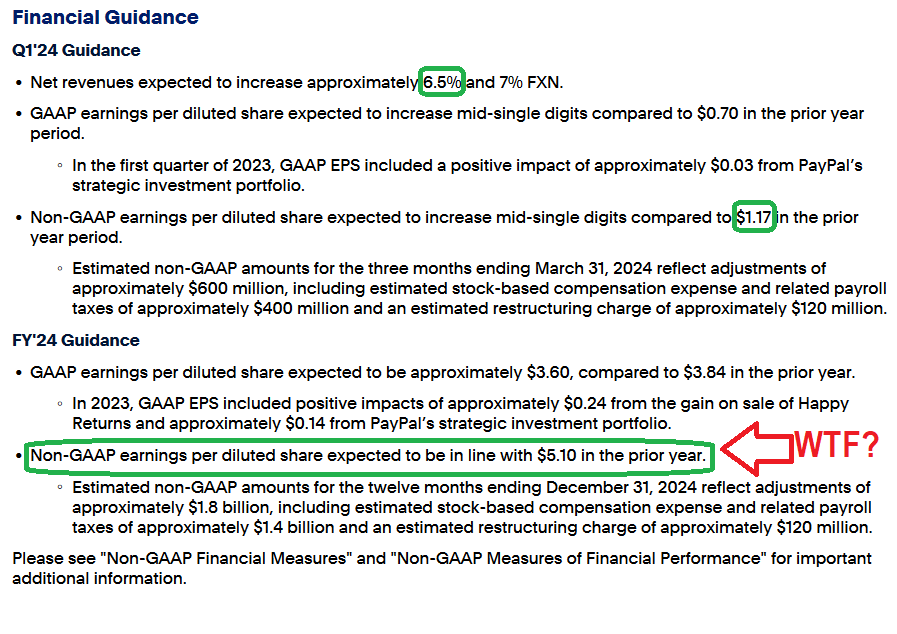

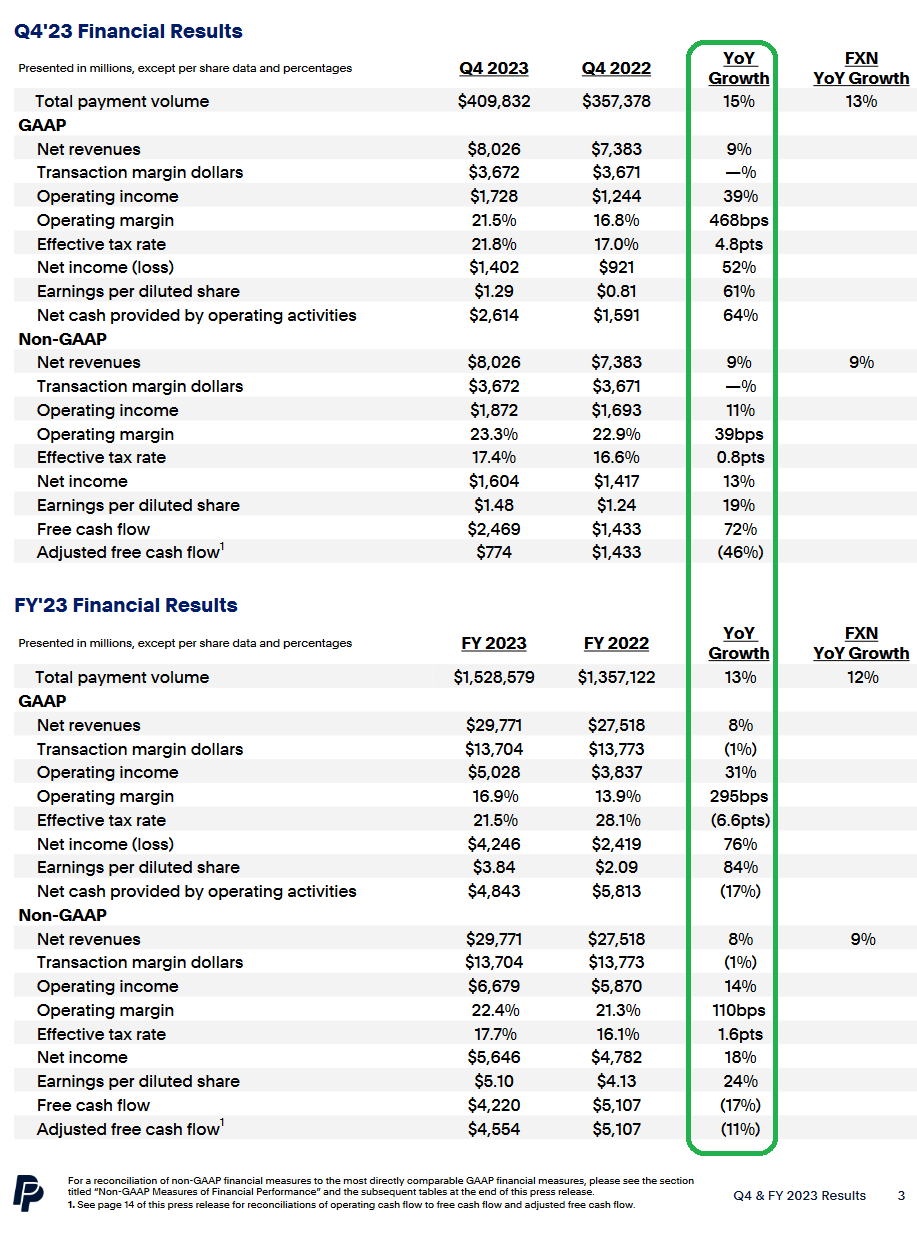

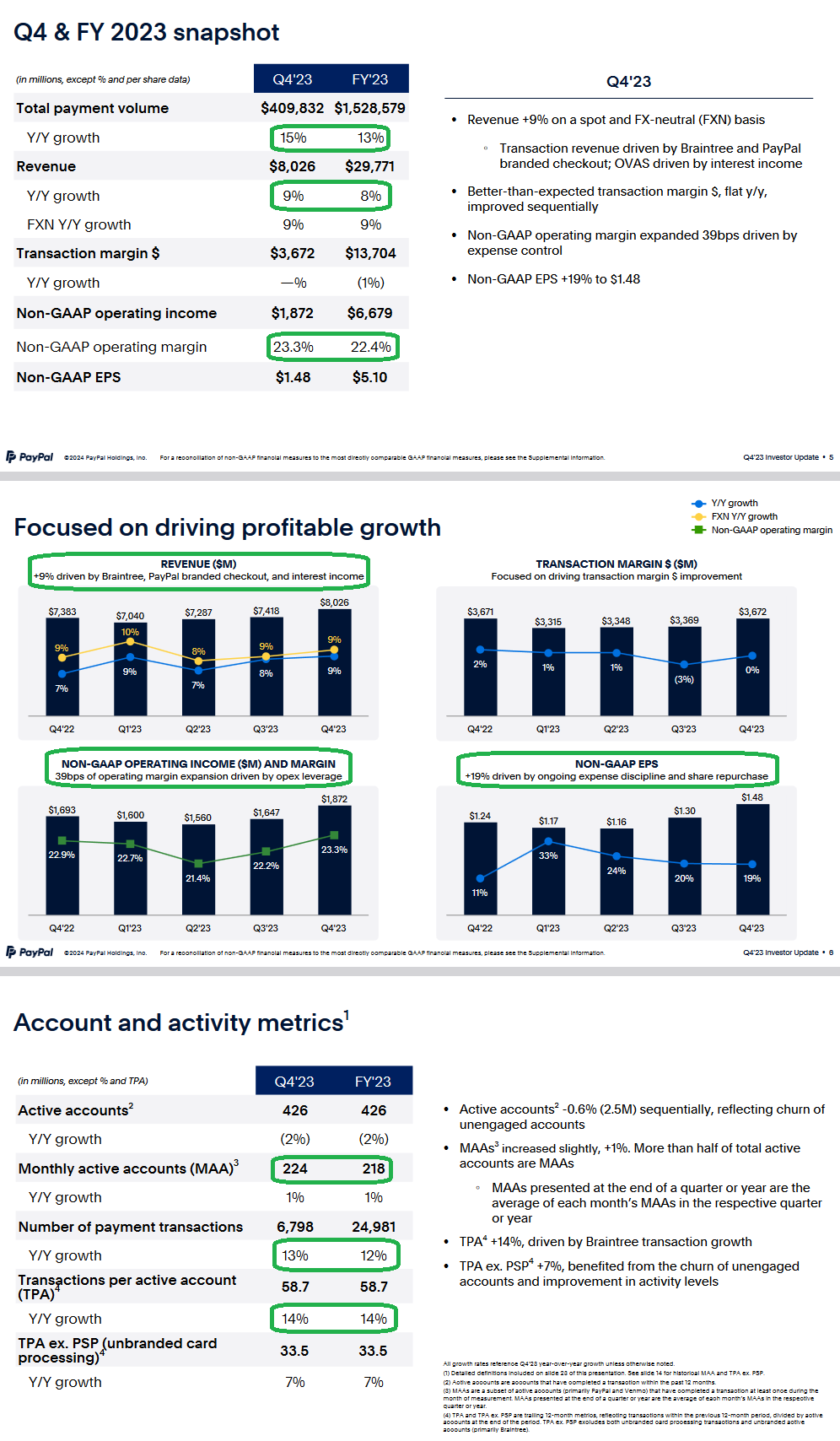

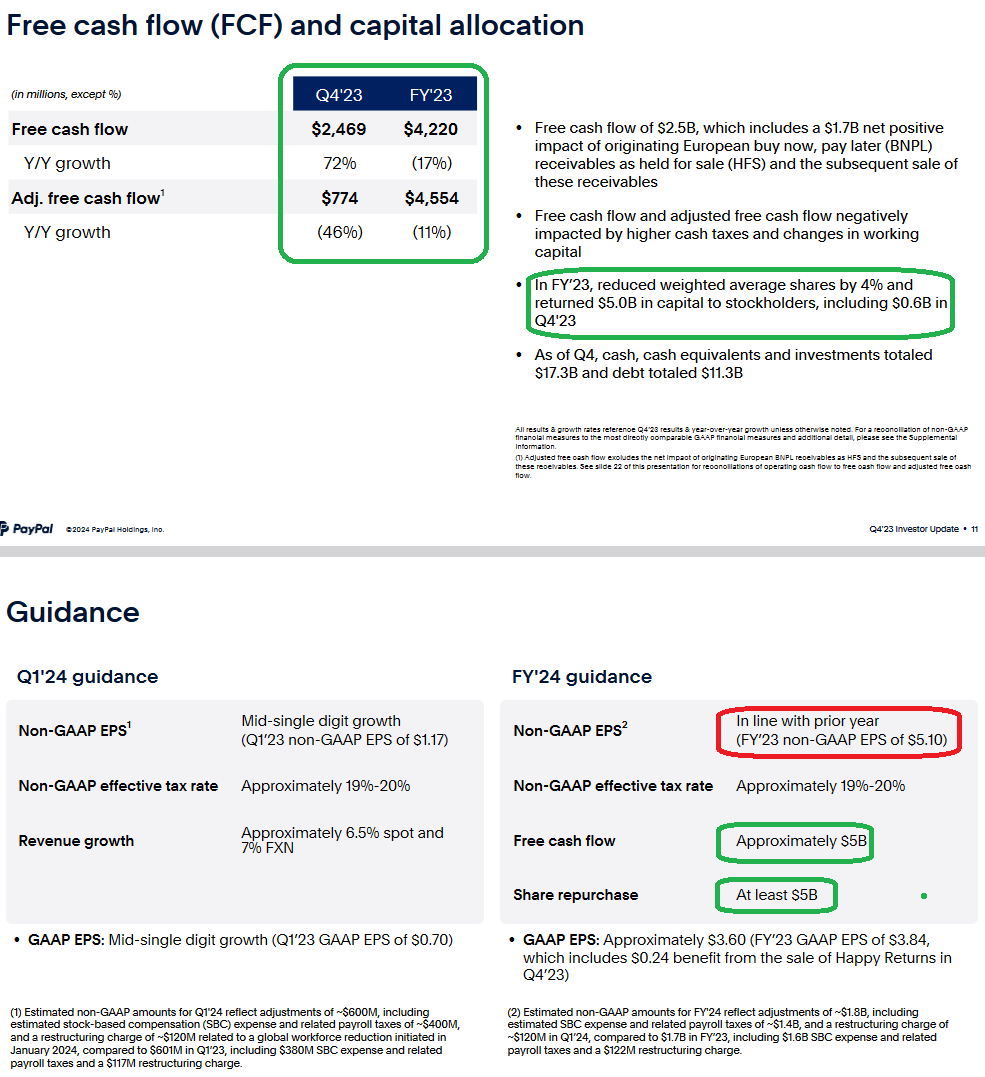

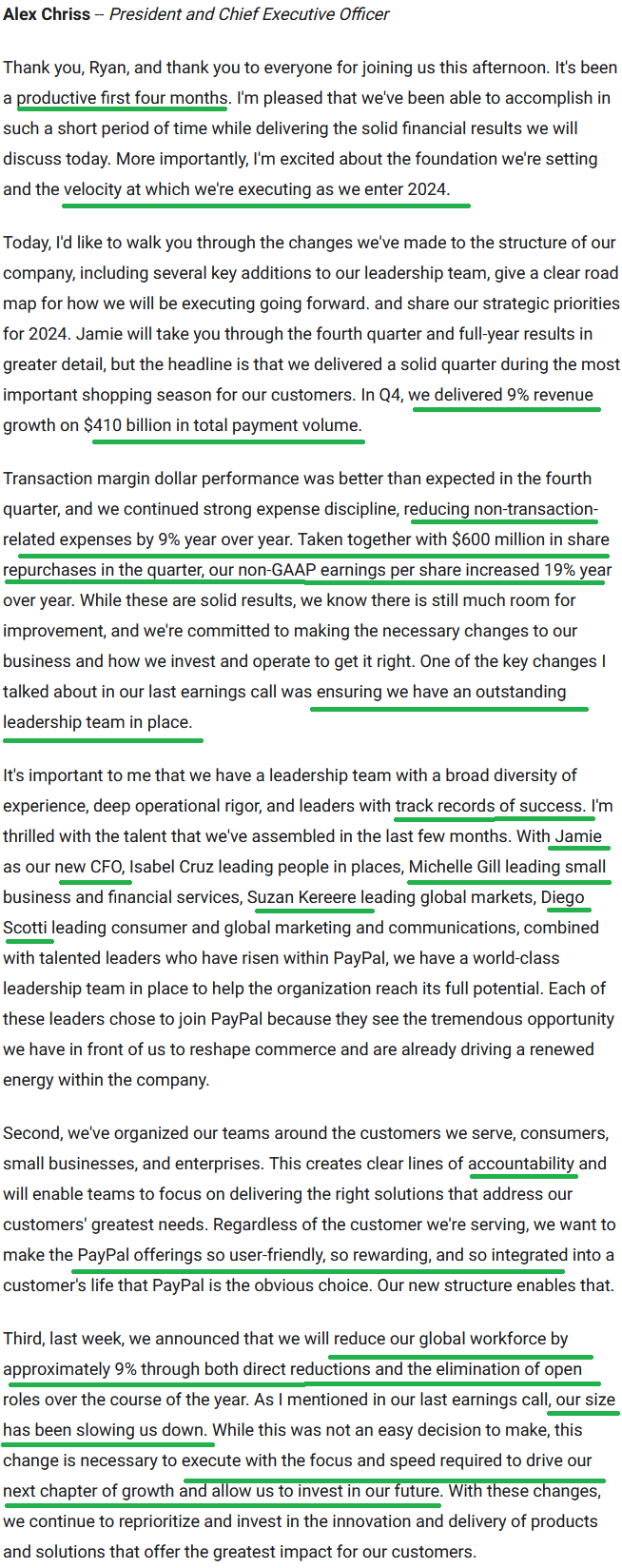

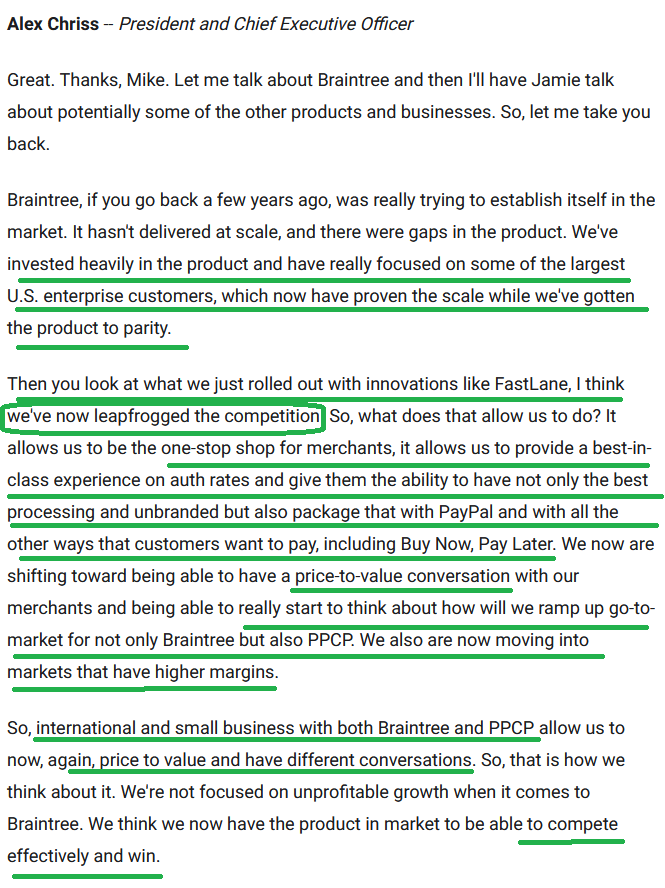

After Alex Chris (New CEO of PayPal) put the investment community on notice that he would “shock the world” with his new initiatives on Jan 26 and landed an air-ball (not because it lacked substance but because it was a pre-recorded message that would take time to show results), he decided he would take a different tact with earnings.

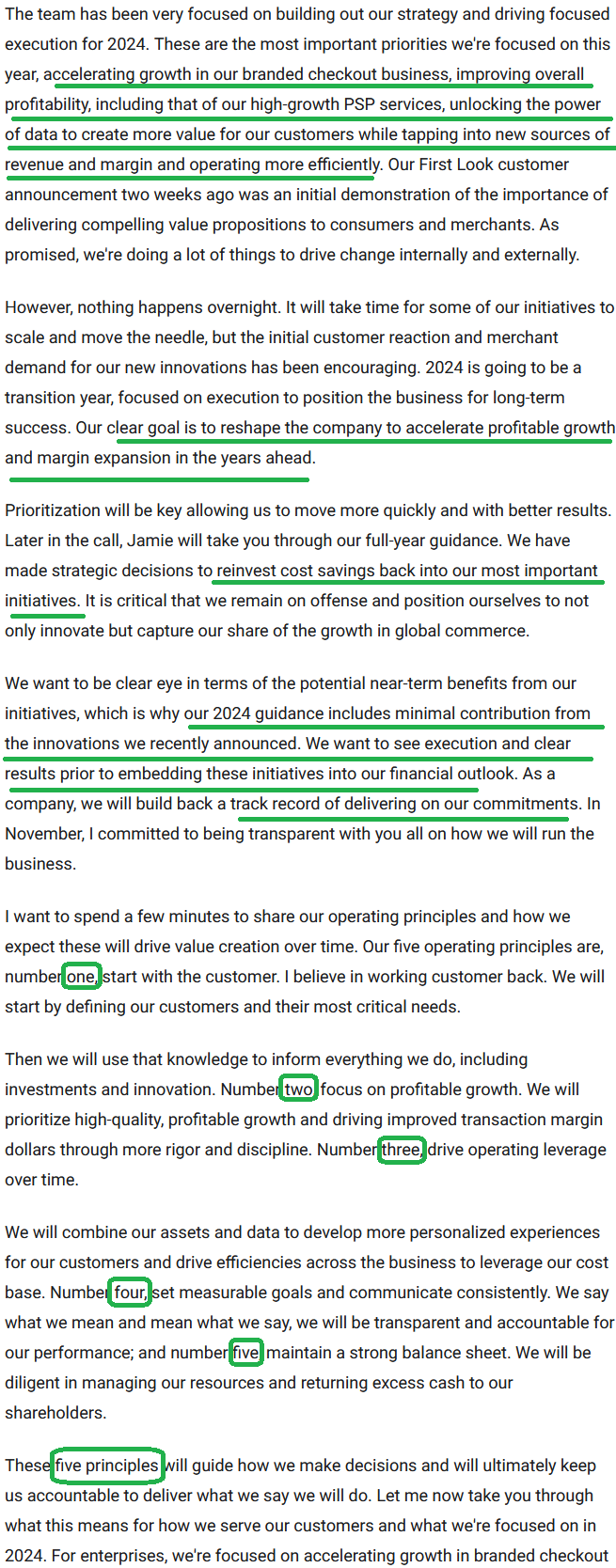

In golf, there are a group of “unscrupulous” players that never record low scores for their handicaps so they always have a high handicap and can “miraculously” win anytime they gamble on the course. This is because the other player has to give them strokes! Well, that’s what we just saw from the new CEO Andrew Chriss with his forward guidance.

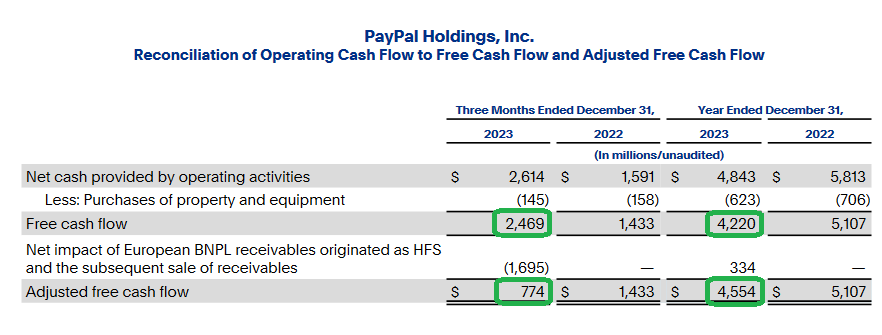

After beating on every single metric and exceeding expectations for Q4, he decided to take the FY bottom line guide down to $5.10 so he can crush every quarter moving forward. The antithesis of “shock the world.” He figured out, “the secret to happiness (both in Wall Street and in life) is low expectations” and now he will crush it moving forward.

“Under Promise and Over Deliver” to the extreme!

My bet is the new sandbagger comes in with $6.20/share+ non-GAAP EPS and blows the doors off of 2024 expectations.

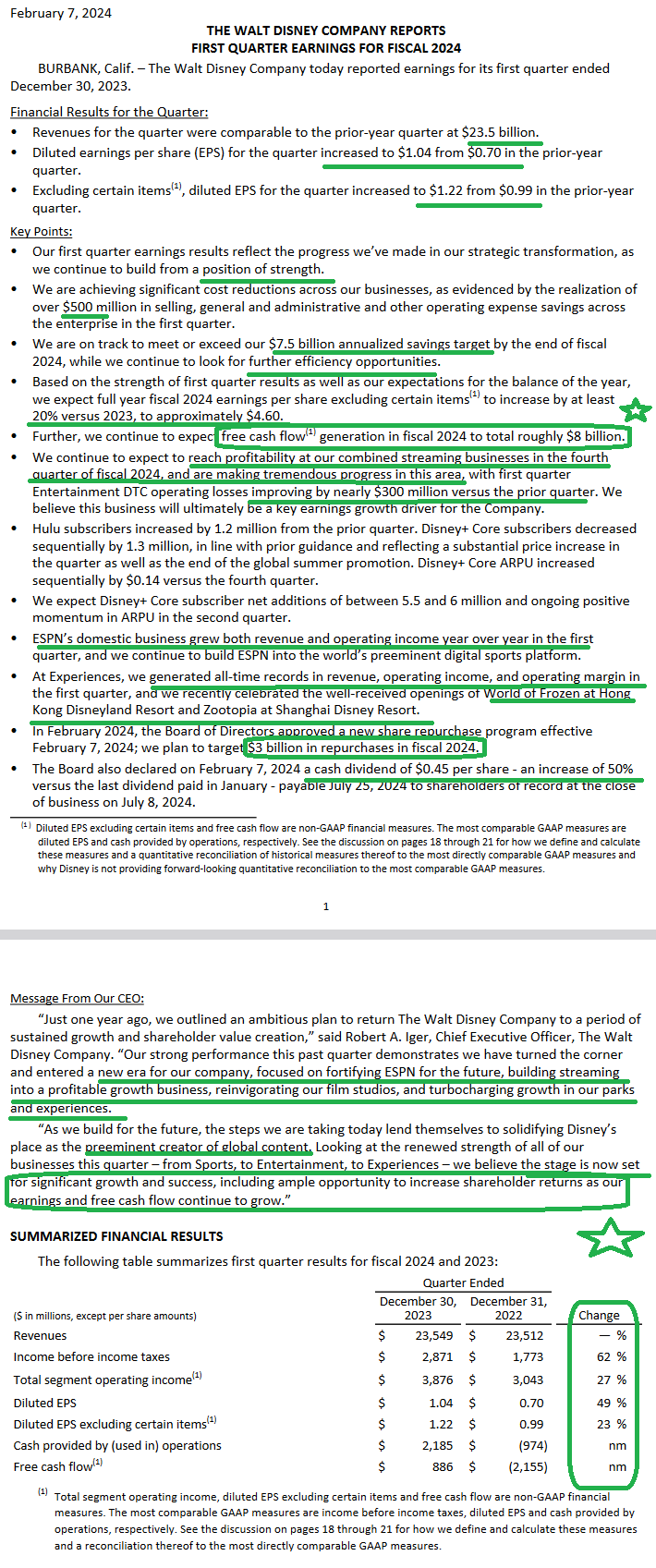

Disney Summary

Now onto the shorter term view for the General Market:

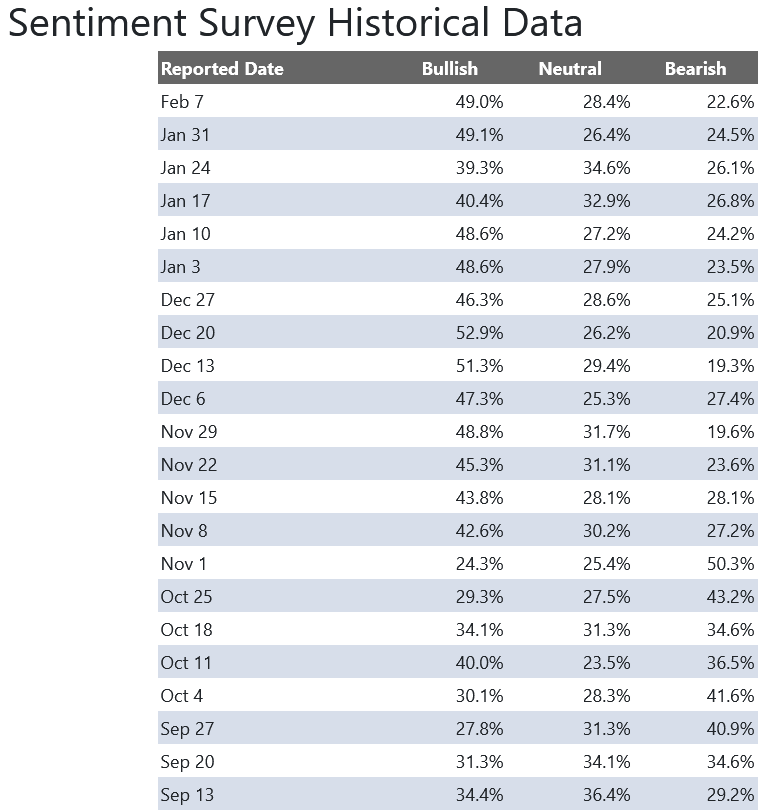

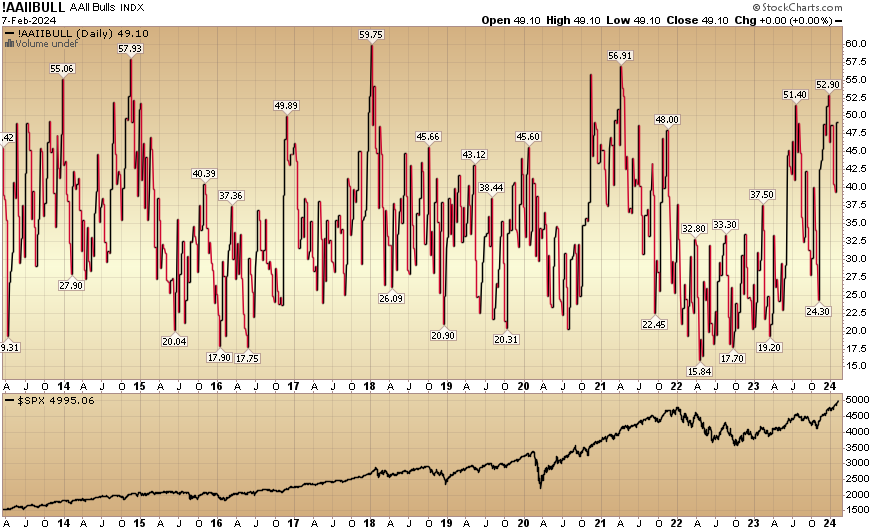

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) flat-lined to 49.0% from 349.1% the previous week. Bearish Percent ticked down to 22.6% from 24.5%. Retail investors are optimistic.

The CNN “Fear and Greed” ROSE from 65 last week to 75 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The CNN “Fear and Greed” ROSE from 65 last week to 75 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

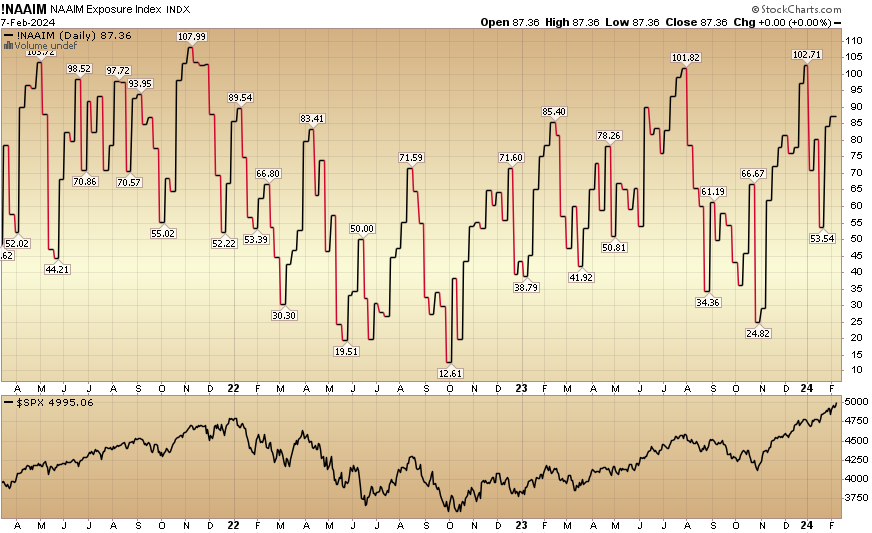

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose to 87.36% this week from 84.13% equity exposure last week.

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose to 87.36% this week from 84.13% equity exposure last week.

Our podcast|videocast will be out late today or tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

*Opinion, Not Advice. See Terms