Each week during earnings season we try to update readers on a few of the positions we have discussed in our weekly notes and podcast|videocast(s).

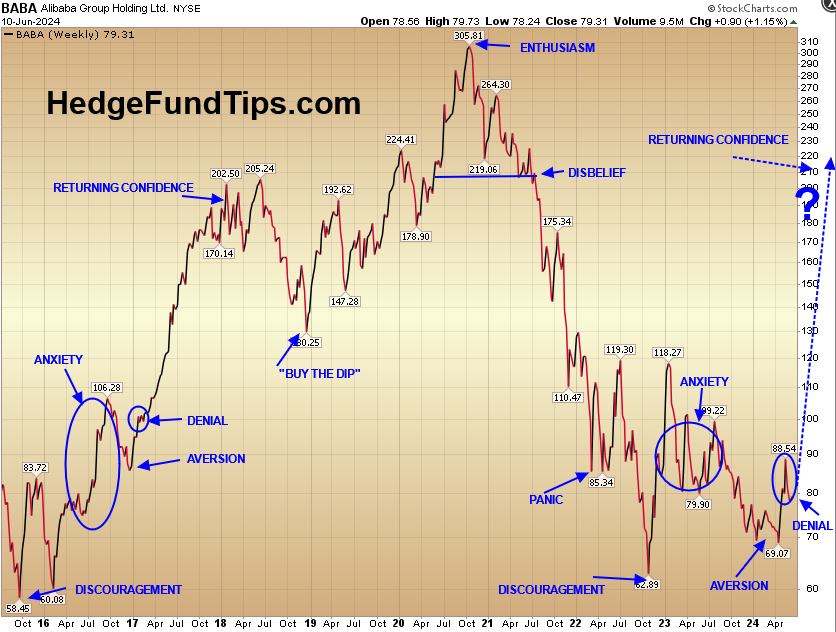

ALIBABA

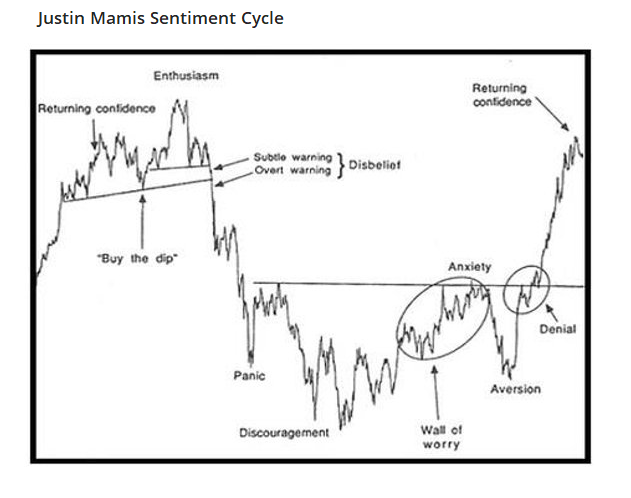

A few weeks ago we covered Alibaba earnings in detail here. For those of you on an emotional (not fundamentally based) roller coaster, let me update you on where we believe we are in the ride sequence:

In other words, it’s probably your last chance to get off the ride at the ticket booth before the fun begins. It appears we’re largely through the queasy part…

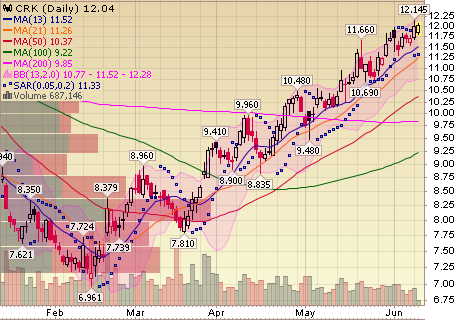

Comstock Resources

Remember when you couldn’t give away Comstock Resources stock at $7-8 in January and February (see short clip above)? Yeah, me neither. Congrats to those of you who took advantage with us. Early days, early days…

FED

FED

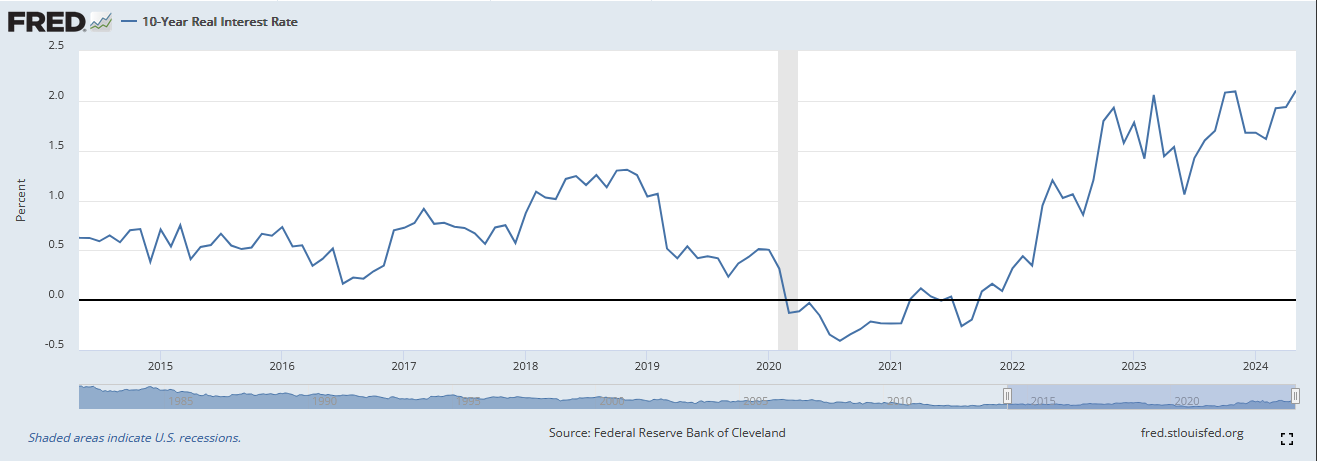

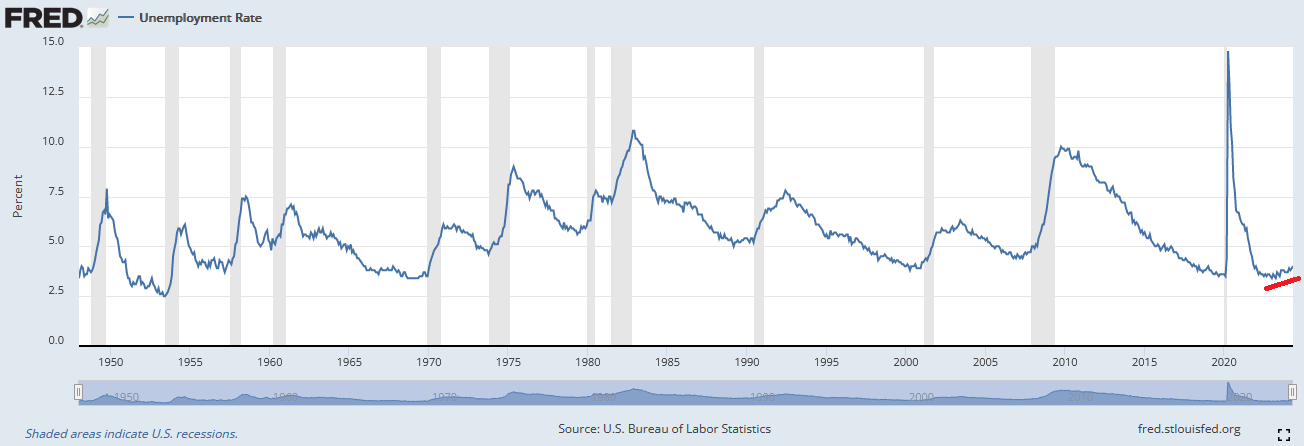

I have no idea what will happen in the short term tomorrow with Inflation Numbers or the Fed dot plot/press conference. What I do know is that we’ve started a global regime change of coordinated Central Bank policy. Just as the BoJ (Bank of Japan) was the global liquidity provider (cutting rates, printing money, buying domestic and global bonds and equity etfs) while the West tightened policy to fight inflation, the roles have now flipped. BoJ will now tighten their policy while the West provides global liquidity through slowly easing the magnitude of their restrictive policy [in English, the Fed could cut 2x and still be > 200bps too restrictive as they are currently ~233bps TOO restrictive (Fed Funds Rate – Headline CPI)]:

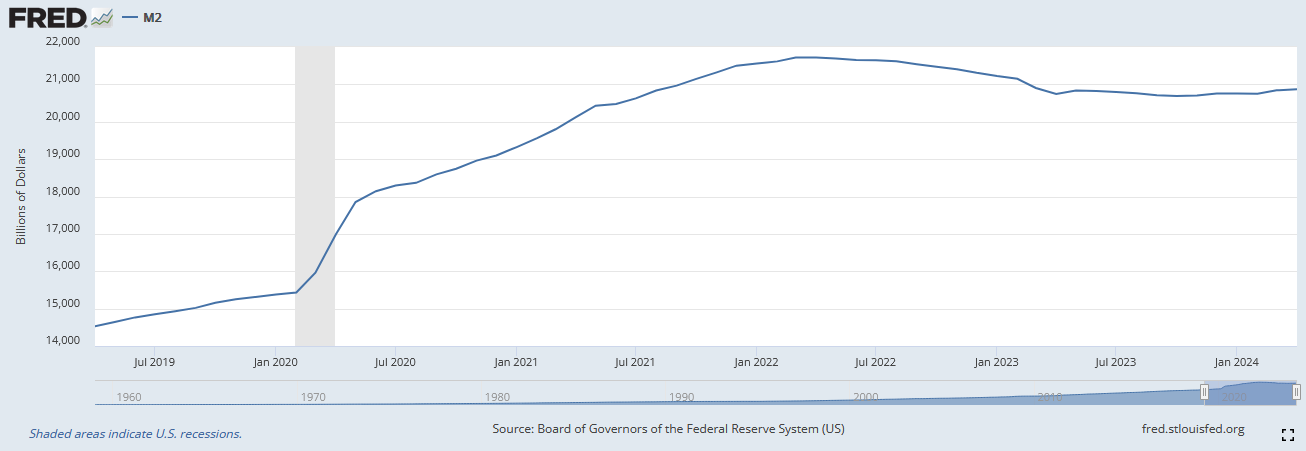

The average person will say “but prices haven’t come down so they have to keep rates high.” Keep in mind, prices ARE NOT GOING TO COME DOWN. They need only START GOING UP LESS THAN THEY HAVE BEEN. When you increase money supply by ~$6T in two years, there is no way PRICES are going BACK to 2019 levels.

Their only goal is that PRICE GROWTH goes back to 2019 levels (~+2%/yr), NOT PRICES. The only way prices could ever get back to 2019 levels is if they stayed this restrictive for too long – causing a deflationary Depression. To contract money supply and prices by that magnitude you would need to see debt defaults by an order of magnitude higher than we saw in the GFC from 2008-2009. They won’t let that happen. They learned their lesson in 2008 and acted quickly in 2020 when they were faced with a similar threat due to the world shutting down.

Their only goal is that PRICE GROWTH goes back to 2019 levels (~+2%/yr), NOT PRICES. The only way prices could ever get back to 2019 levels is if they stayed this restrictive for too long – causing a deflationary Depression. To contract money supply and prices by that magnitude you would need to see debt defaults by an order of magnitude higher than we saw in the GFC from 2008-2009. They won’t let that happen. They learned their lesson in 2008 and acted quickly in 2020 when they were faced with a similar threat due to the world shutting down.

I stand by my view that people would rather pay an extra dollar for a gallon of milk and still have a job versus prices deflating and being long-term unemployed.

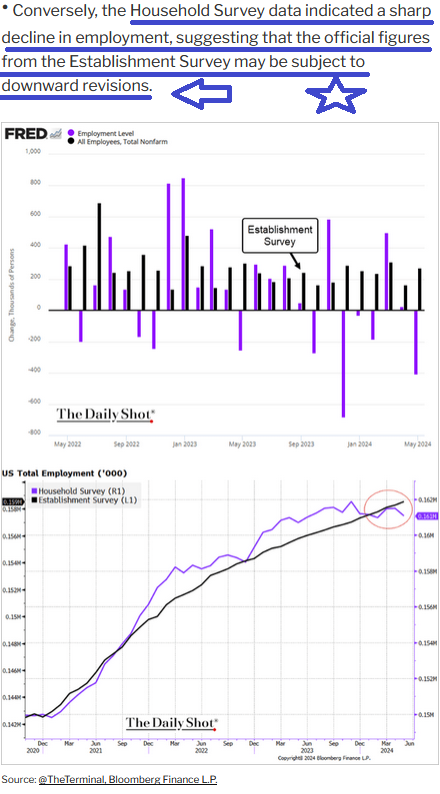

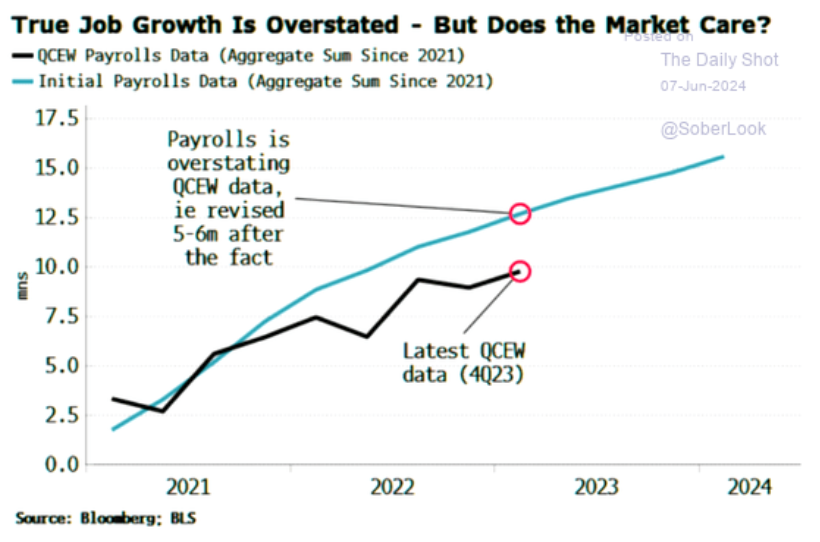

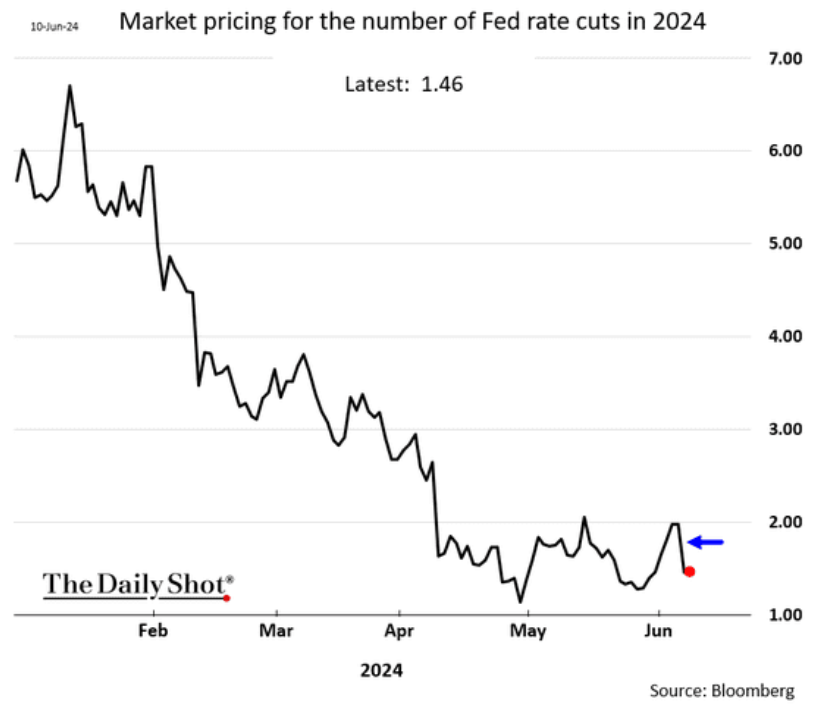

So how will they “cut” without appearing accomodative or like they are “easing?” The exact same way their colleagues have started cutting around the world in Switzerland, Sweeden, Canada, ECB, etc. With VERBAL FORWARD GUIDANCE THAT LOOKS LIKE THIS: “We are CONFIDENT that inflation is moving toward our target. Therefore, WHILE STILL BEING RESTRICTIVE (>200+ bps tighter than underlying inflation), we are going to remove a bit of restriction now (25bps) while still remaining restrictive (>175+ bps tighter than underlying inflation).” Meaning, they are not “easing/accomodative” until they have cut at least 4x (which is unlikely to be needed in this cycle if they start by Fall – or sooner). While everyone lost their minds over Friday’s “strong” jobs report, looking past the headlines told a different story. Enough “cover” for the Fed to cut this Fall?

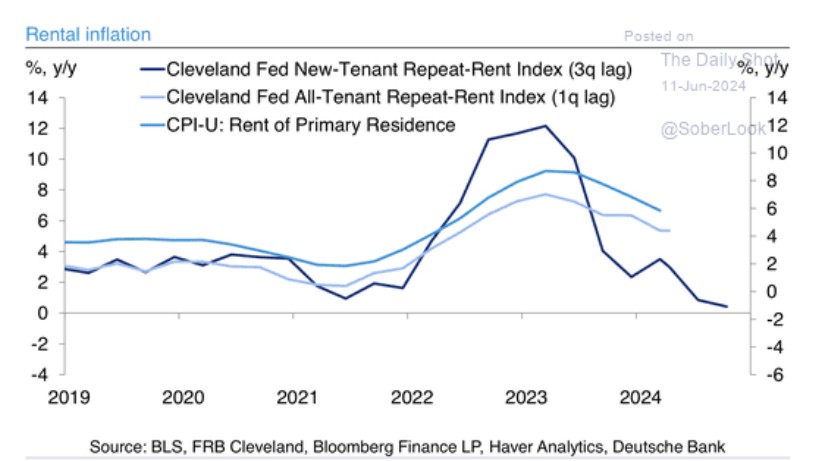

For those interested, headline (CPI) inflation (3.36%) is running at just 1.82% when you back out Auto Insurance and Owners’ Equivalent rent. If you’re of the camp (we are) that these are abnormal elevations that are set to fall meaningfully on a lagged basis, then we’re already below 2% target. We’ll find out in tomorrow’s press conference if the Fed feels similarly to the ECB (confidence in the direction toward inflation target).

For those interested, headline (CPI) inflation (3.36%) is running at just 1.82% when you back out Auto Insurance and Owners’ Equivalent rent. If you’re of the camp (we are) that these are abnormal elevations that are set to fall meaningfully on a lagged basis, then we’re already below 2% target. We’ll find out in tomorrow’s press conference if the Fed feels similarly to the ECB (confidence in the direction toward inflation target).

If you see the same script from ECB and Bank of Canada tomorrow (i.e. “confidence inflation is headed toward target”), we could be in-store for a positive surprise (sooner and more cuts than the market has priced in: 1-2 cuts in 2024) versus the negative surprise that is expected (0-1 cuts in 2024).

Always remember, the secret to happiness is low expectations:

Keep in mind, any possible good news surprise will be cloaked in very hawkish rhetoric, “removing excessive restriction, but continued restrictive policy” versus “easing and initiating accomodation.” Same effect, different words. The key will be an attempt to dampen excessive market enthusiasm.

In case you forgot, the Fed began it’s reduction of Quantitative Tightening on June 1 (despite the fact it was announced on May 1). This means that they used to allow $60B/month of treasuries roll off at maturity – meaning there was no $60B bid in the market each month to replace those securities on the balance sheet – forcing private investors to absorb this excess supply – draining demand out of “riskier” assets – like equities. As of June 1, this level was reduced from $60B per month to $25B per month.

What is the extreme significance of this in English?

It means the Fed is a BUYER of $35B more Treasuries per month than they were last month (and for the past 2 years since June 2022). So rather than draining $35B per month from risk assets to absorb the Fed’s supply, there will be an additional $35B of private money available to purchase risk assets/equities – starting this month. I’ll be keeping a close eye on whether they mention anything on this front as well. It’s actually MORE IMPORTANT THAN whether they do 0,1,2,3 cuts this year – from a market standpoint. Note the 10yr yield peaked just a few days before they made this announcement on May 1. We expect this trend to continue (in fits and starts) for the foreseeable future now that operations have commenced in the market.

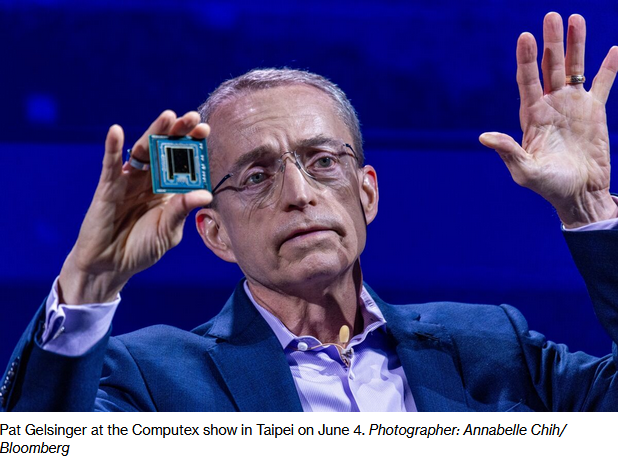

INTEL

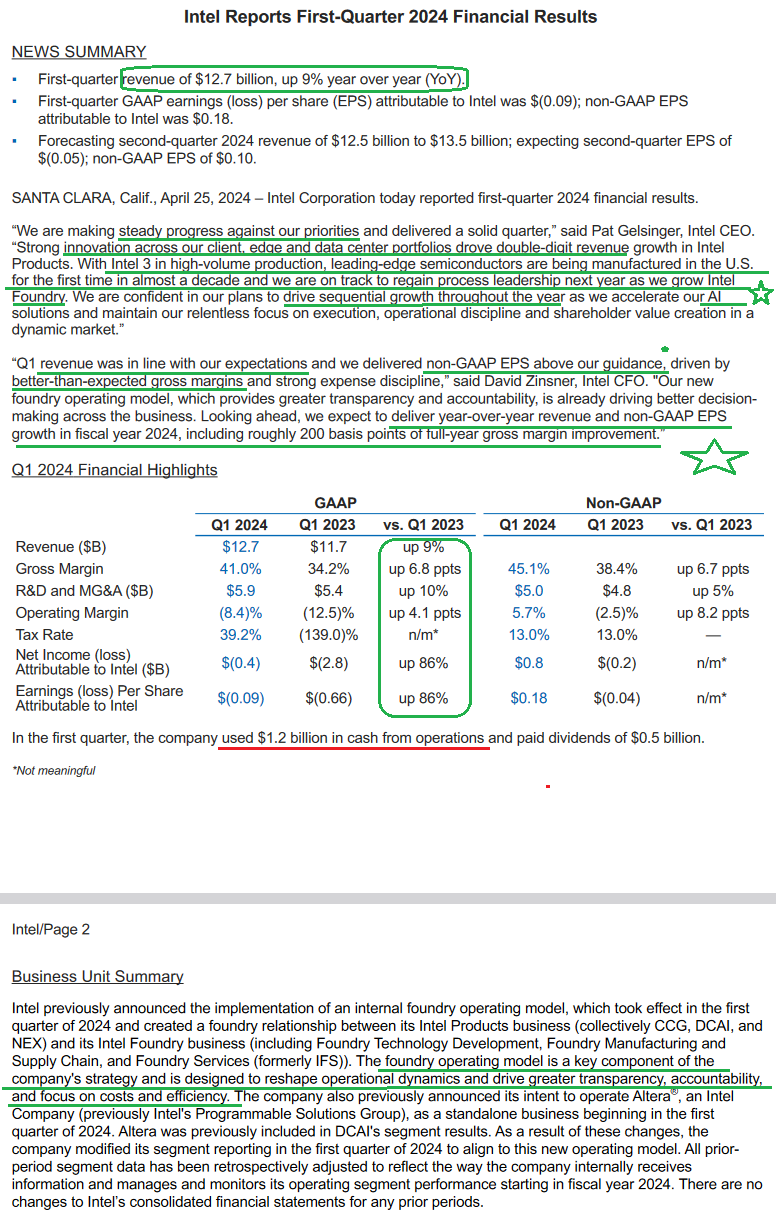

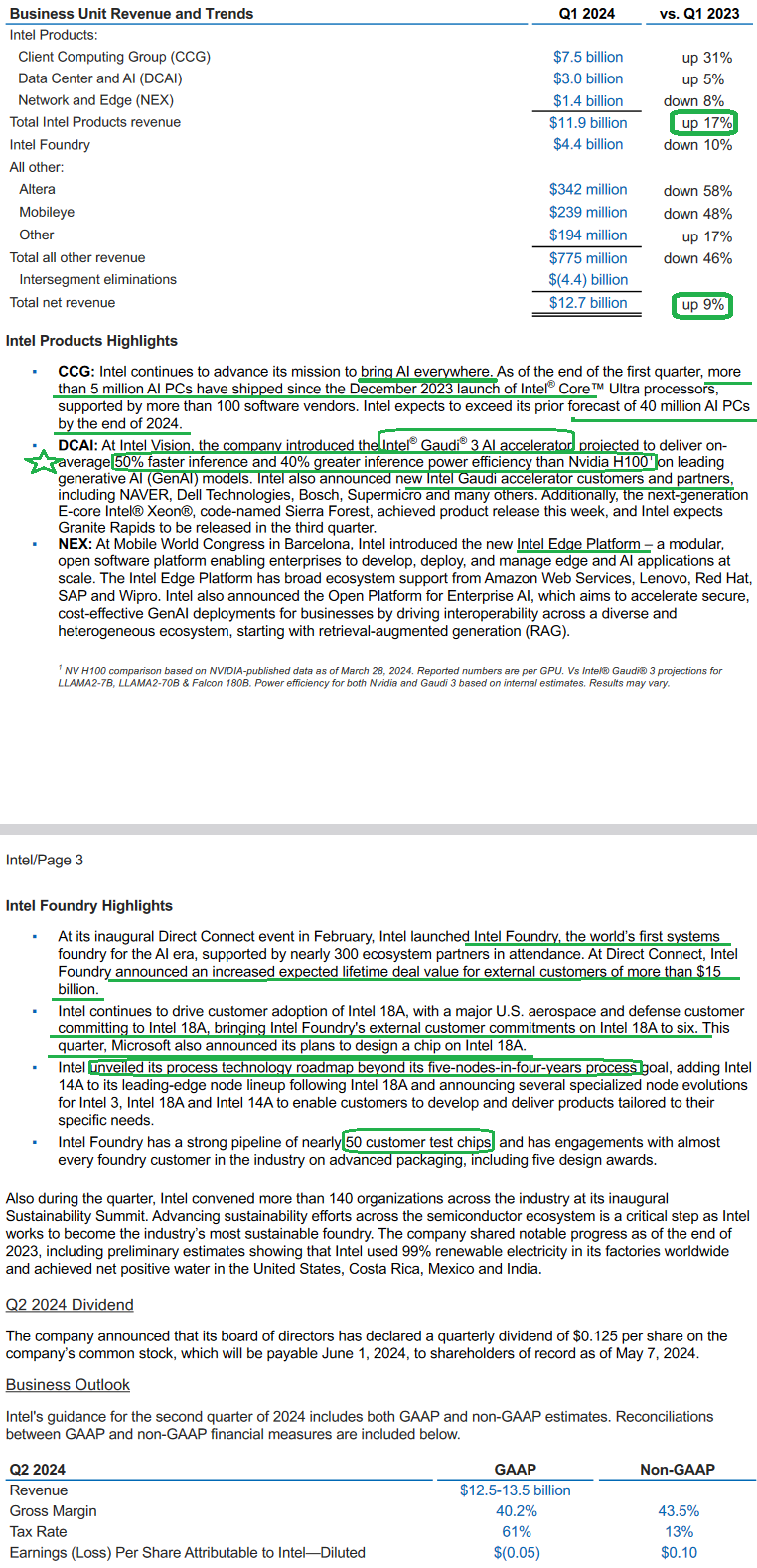

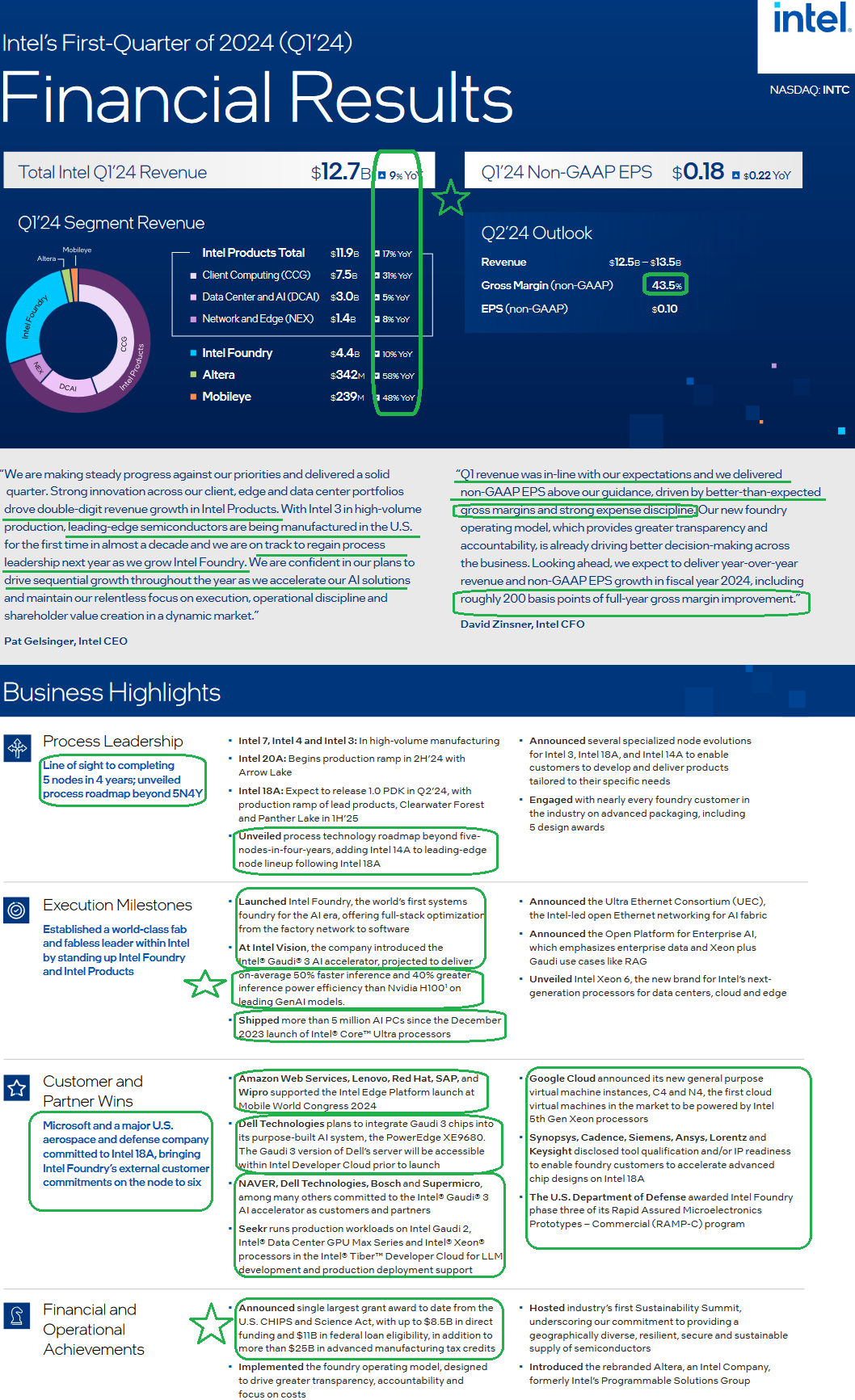

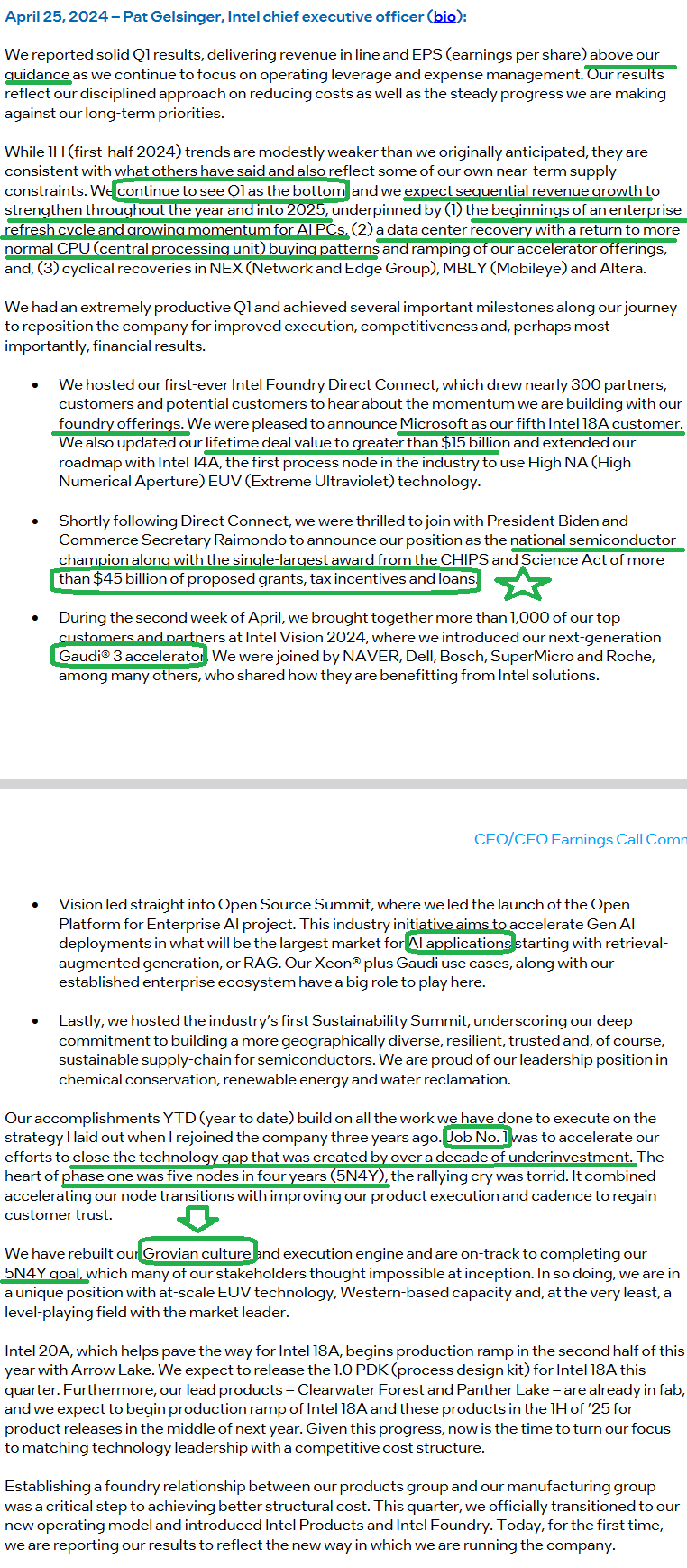

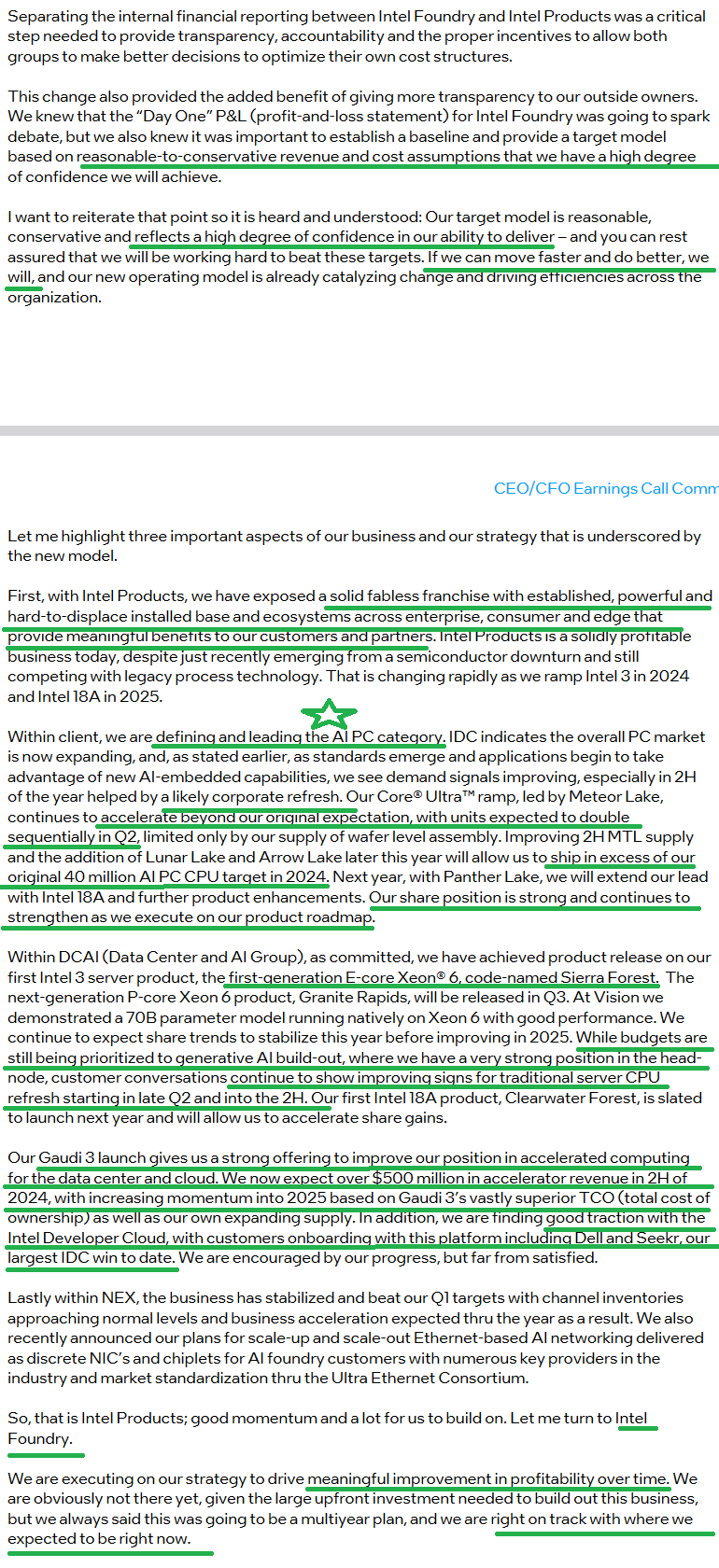

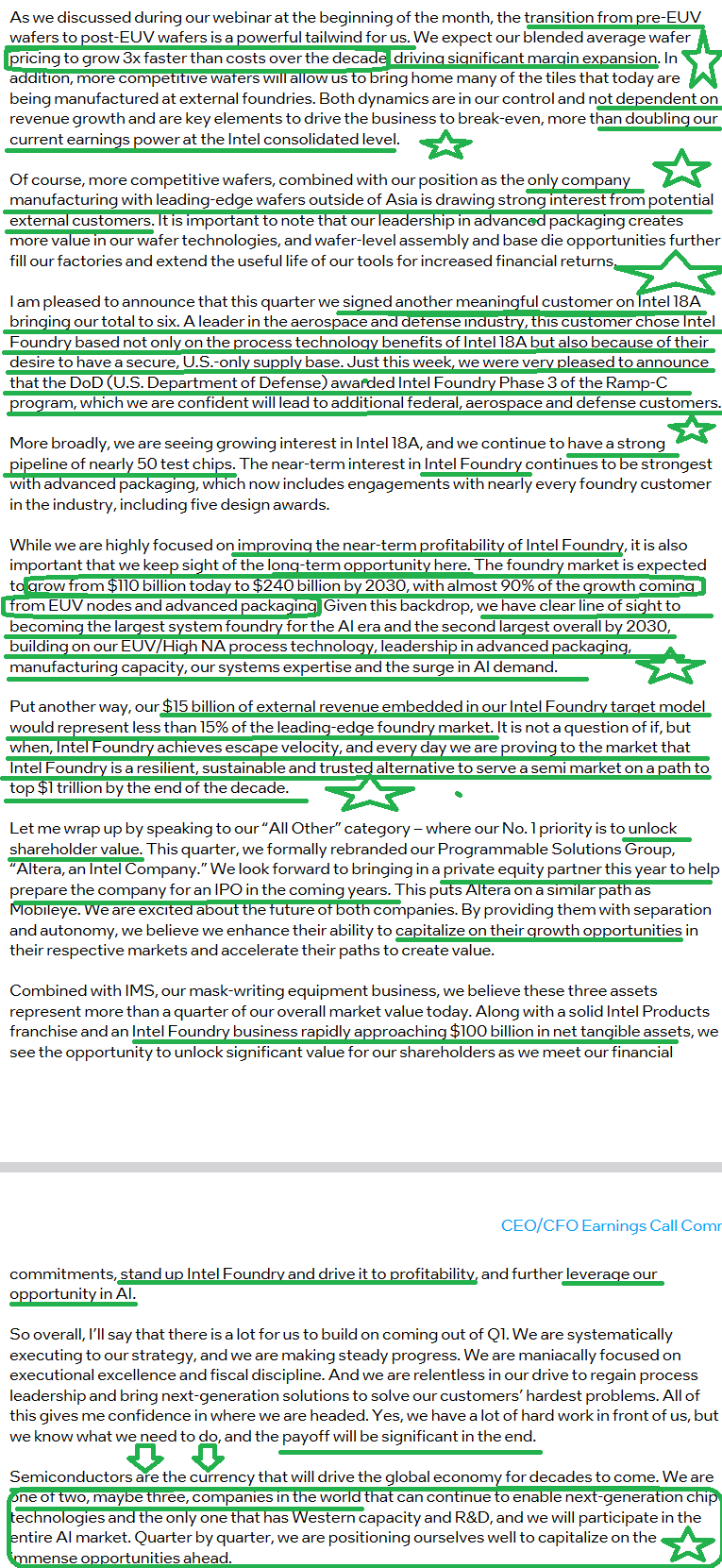

Last year we built up a position in Intel ~$25 on the basis that the legacy PC/Server business was worth ~$45-50/share and any hope on AI chips or the Foundry business was whipped cream. It took off much fast than we anticipated so we exited 2/3 of the position in the high 40’s. We anticipated a pullback with the remaining 1/3 but it was not a concern as we had already taken a lot of profit off the table. The stock has recently reverted back to the high 20’s and low 30’s which enabled us to rebuild the position we sold in the high $40’s back at lower prices. We still believe the legacy PC/Server business is worth $45-50+ per share (that is our margin of safety). However, if Pat Gelsinger is anywhere in the ballpark about what he thinks he can achieve in the Foundry business or AI chip development, the upside could be dramatically higher. We are not counting on that, but will eagerly accept and enjoy it if he delivers. More likely, the outcome will be somewhere in-between – which is well more than a double from these levels and possibly a lot more over time (our opinion, not advice see terms).

Remember when Microsoft stock did nothing for 15 years before they “reinvented” their business? I’m open to the idea the Intel CEO Gelsinger has they ability to reinvent Intel to something beyond what investors don’t know that they don’t know – similar to what Satya did at Microsoft. For Satya it was SAAS subscriptions and riding the SAAS wave. For Gelsinger it will be a Foundry duopoly and riding the AI chip wave and compute demand. Time will tell:

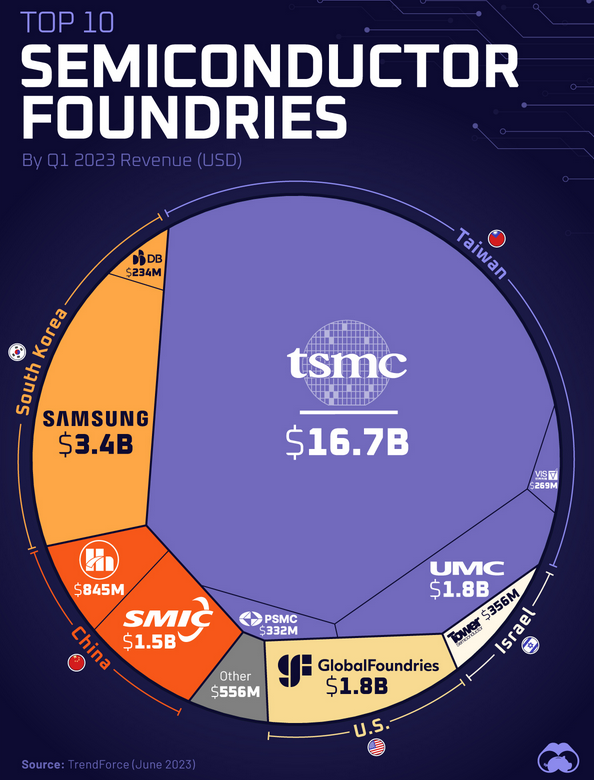

It doesn’t hurt to have the US Government as your co-investor and subsidizer-in-chief. The government is committed to reducing dependence on Taiwan Semiconductor (monopoly) and creating a duopoly (Intel). I wouldn’t bet against the richest Treasury in the world to do so. Many bet against the Government’s commitment to EVs with Tesla subsidies for many years and lost big-time.

“Intel is planning a $100-billion spending spree across four U.S. states to build and expand factories after securing $19.5 billion in federal grants and loans – and hopes to secure another $25 billion in tax breaks.” (reuters)

When all is said and done, Intel will be a chip foundry duopoly with TSMC and Western Governments will pressure business toward Intel:

Now onto the shorter term view for the General Market:

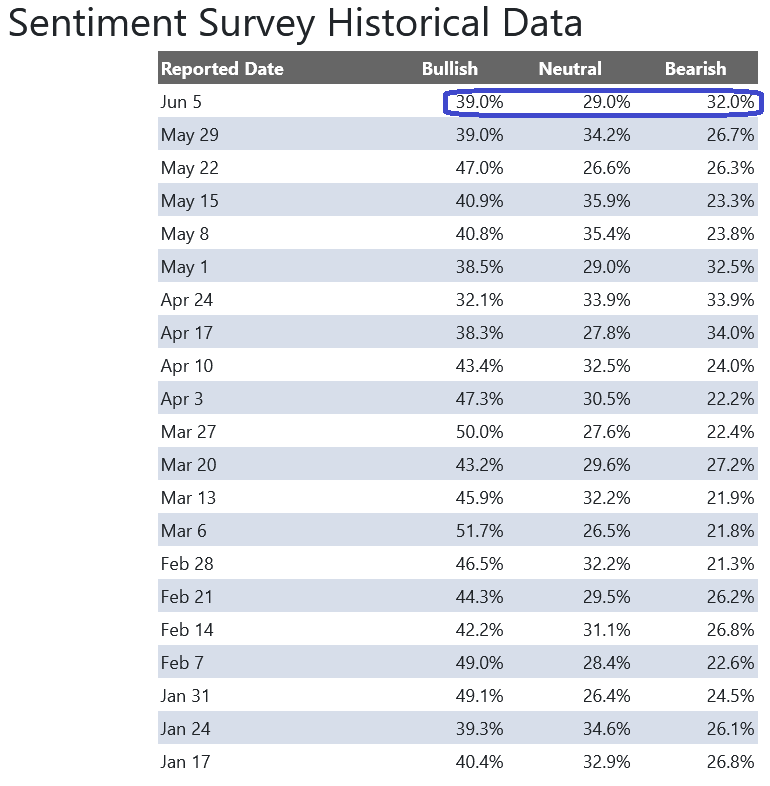

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) flat-lined to 39% from 39% the previous week. Bearish Percent rose to 32% from 26.7%.

The CNN “Fear and Greed” flat-lined from 46 last week to 46 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The CNN “Fear and Greed” flat-lined from 46 last week to 46 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

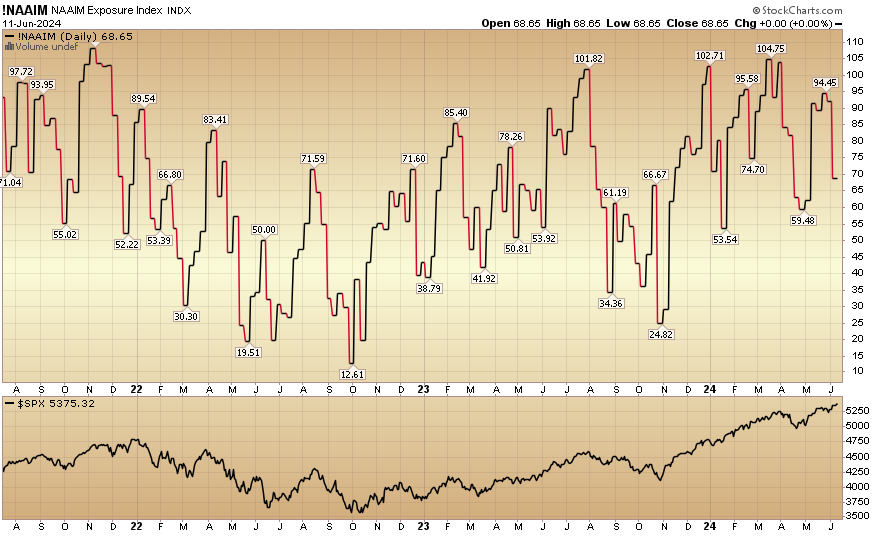

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 68.65% this week from 92.21% equity exposure last week.

Our podcast|videocast will be out late on Thursday or Friday morning. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Congratulations to all of the new clients who came in so far this year during our Q1 and Q2 openings. We are now closed to smaller accounts ($1M+) again as of early this quarter and will remain closed to smaller accounts until sometime in Q3. Larger accounts $5-10M+ can access bespoke service at their preference here.

*Opinion, Not Advice. See Terms

Not a solicitation.