Yesterday we covered the S&P 500 Percent of stocks above the 200DMA and what it potentially implied for the S&P 500 moving forward.

Today we are going to look at the Nasdaq 100 from a different angle.Rather than using the “above the 200DMA” indicator we will use the “Bullish Percent” indicator for the Nasdaq 100.

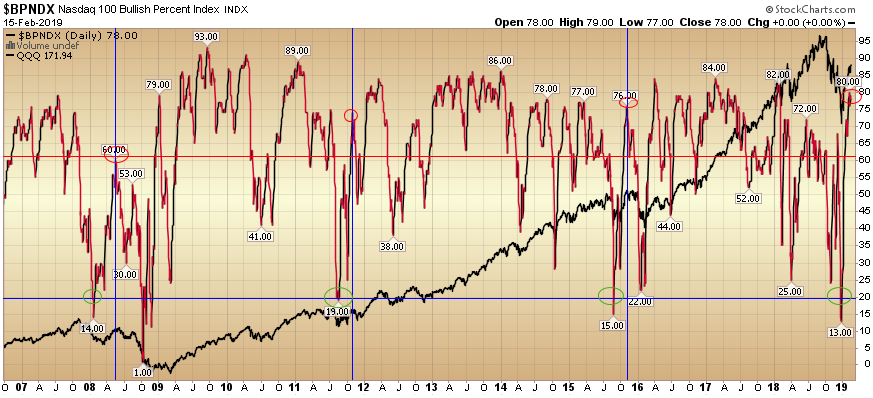

Right now, the “Bullish Percent” Nasdaq 100 is coming in at 78% (off its recent peak of 80%). The above chart is the “Bullish Percent Index” for the Nasdaq 100 (red and black line) with the Nasdaq 100 (QQQ etf) in the background (all black line).

The Bullish Percent Index, or BPI, is a breadth indicator that shows the percentage of stocks on Point & Figure Buy Signals. There is no ambiguity on P&F charts because a stock is either on a P&F Buy Signal or P&F Sell Signal. The Bullish Percent Index fluctuates between 0% and 100%.

In December, the Bullish Percent for Nasdaq 100 got below 20%. Historically (with the exception of 2008), it has paid off big time to buy a dip in this reading below 30.

Here’s what it has done: In each instance where the Nasdaq 100 “Bullish Percent” has dropped below 20%, when it rebounded back above 60%, it always dropped back again to at least 50% before resuming higher.

So what does that imply?

It implies we could see a pullback as noted by the 3 previous instances marked by the blue vertical lines. What did the pullback (retest) to the 50% (or lower) Bullish Percent mean to the Nasdaq 100 in percentage terms the last three times (Nasdaq 100/QQQ is the black line in the background of the chart)?

Example 1: From May 15, 2008 (when Bullish Percent Nasdaq 100 rebounded above 60) to September 29, 2008 (when it retested below 50), the Nasdaq 100 dropped 26.2%

Example 2: From October 28, 2011 (when Bullish Percent Nasdaq 100 rebounded above 60) to November 25, 2011 (when it retested below 50), the S&P 500 dropped 10.67%

Example 3: From November 3, 2015 (when Bullish Percent Nasdaq 100 rebounded above 60) to January 20, 2016 (when it retested below 50), the S&P 500 dropped 15.52%

A few things to keep in mind:

1. Despite the nasty retest in all three instances, the market ultimately rebounded and made significant new highs. In both 2016 and 2011 it was right away. In 2008 it took longer.

2. This sample is VERY small. The minimum you ever want to consider is 3 instances. This is the minimum and may be statistically insignificant – but worth noting.

3. As with all indicators they are to be used as a barometer, NOT a crystal ball. It is always helpful to have a handful of indicators working in the background so you can measure where you generally are in terms of extremes.

The key is taking probability advantaged trades over a series – with a positive expected outcome – and disciplined risk management and sizing to win over time.

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.