The good news is that sentiment and positioning continues to persist at capitulation levels. The bad news is that the key levers to cause a “buyers panic” into the market have not yet been activated. However, that may change soon:

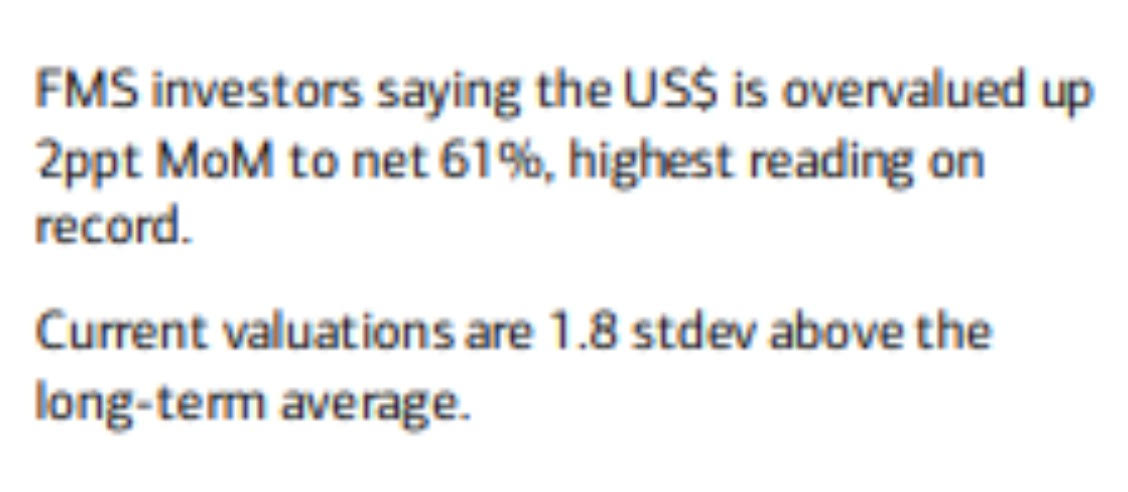

On September 21, 2022 the Fed Dot Plot told us that they intend to take short rates to 4.6% by early next year. We are currently at 3.00-3.25% which means they are anticipating 150bps more in hikes.

I don’t think they will get there without the credit markets forcing them to relent, but let’s assume they do. How bad is it? It’s so bad that the market has ALREADY PRICED IT IN. The 2yr yield closed at 4.50 today which effectively prices in the full 150bps. Anything less than that and the reversal starts.

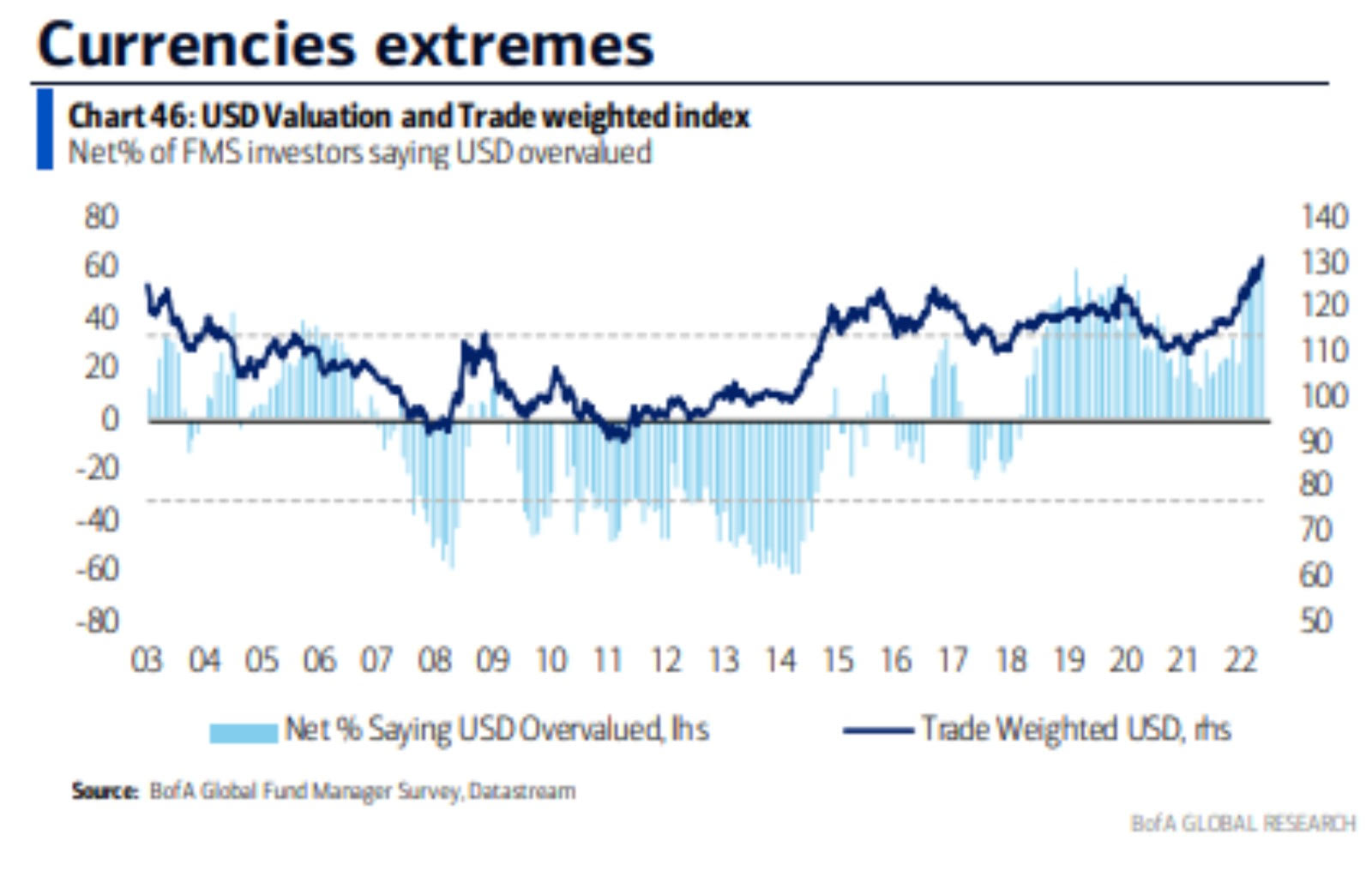

The above three charts are the keys to the market, when they stop going up (2yr yield, 10yr yield, USD) the market will go rally quickly, aggressively and massively – as no one is positioned for such a change. These three charts are all you need to watch for a sign of change. Everything else is noise right now.

The only people positioned for a stabilization in rates and a decline in the dollar are commercial hedgers. They are always early and always right. You can bet they’ll be wrong this one time, but the odds are dramatically against you:

Commercial Hedgers (the green line at the bottom of the chart above) are currently short USD – just as they were before the drops in 2019, 2017, 2015, 2013, 2012, 2010, 2009, 2005.

Commercial Hedgers (the green line at the bottom of the chart above) are currently long – just as they were before the rallies in bonds (drop in yields) in 2018, 2017, 2014, 2011, 2010, 2008, 2006, 2004, 2002, 1999. Bet against them at your own peril.

Cheddar News

On Monday morning I joined Chloe Aiello on Opening Bell for Cheddar News. Thanks to Ally Thompson, Camille Smith and Chloe for having me on:

Watch in HD directly on Cheddar

Here were my show notes ahead of the segment:

Seasonal Weakness:

Stock Market: Weakest Month of the Year is September.

US Mid-term election: Gridlock outcome is bullish for markets – no new taxes/spending/big regulation.

-Of the 23 bear markets since WWII 8 have bottomed in October.

Earnings:

S&P 500 down ~22% ytd while earnings estimates down only 4%. Analysts continue to call for collapse in estimates like Q2.

For Q3 2022 (with 7% of S&P 500 companies reporting actual results), 69% of S&P 500 companies have reported a positive EPS surprise and 67% of S&P 500 companies have reported a positive revenue surprise.

Valuation: The forward 12-month P/E ratio for the S&P 500 is 15.5. This P/E ratio is below the 5-year average (18.5) and below the 10-year average (17.1).

Like June Lows: Expectations low into earnings season. +2.8% growth (low bar, expect upside surprise).

The Fed:

-The Fed will be forced to relent when government, municipalities, households and businesses can’t refinance.

-The cost of not relenting will be much higher (economic crisis bailout) than the cost of running inflation above trend for several years – as we did post-WWII when Debt/GDP also exceeded 120%.

-Debt/GDP came down to 63% after 5 years of running inflation above-trend and the economy recovered.

-So far, the ECB has had to relent with their new QE facility to buy Italian bonds, the Bank of England has had to relent by buying Gilts to bail out UK pensions, and the RBA hiked rates less than expected in Australia at their last meeting.

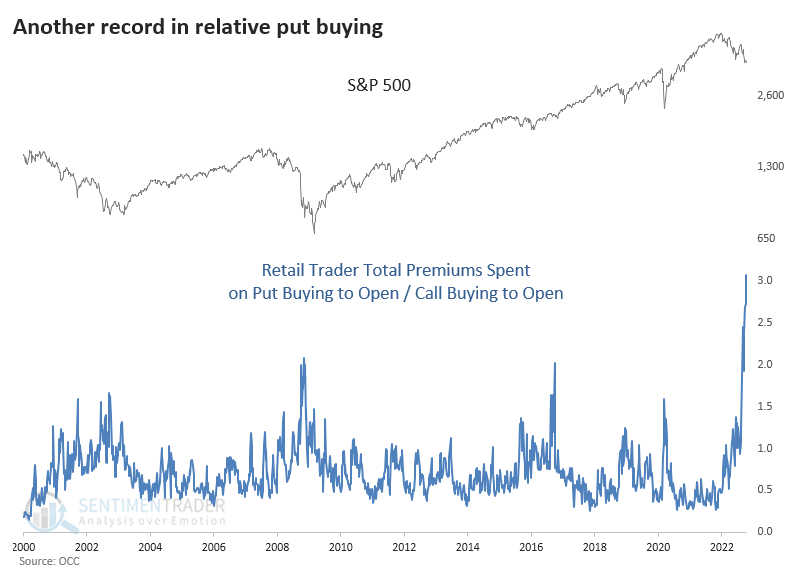

Managers Sentiment/Positioning for the Apocalypse:

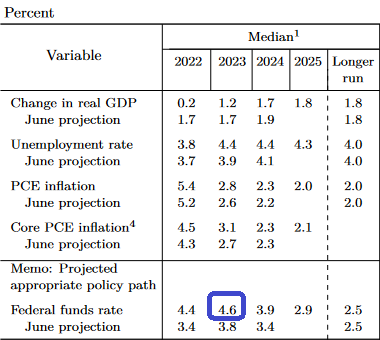

Retail Positioning: Last week, retail traders bought $19.9 billion worth of puts to open. They bought only $6.5 billion in calls to open. This is the first time in history that puts were 3x calls. Every other time close was a major low (2020, 2016, 2009, 2003)

Source: Sentiment Trader – J. Goepfert

Extreme institutional readings such as these usually presage big turnarounds in the market:

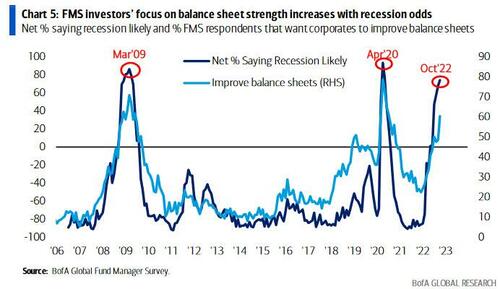

–Highest expectations for Recession since Apr 2020 and March 2009 (stock market bottom was already in in both cases).

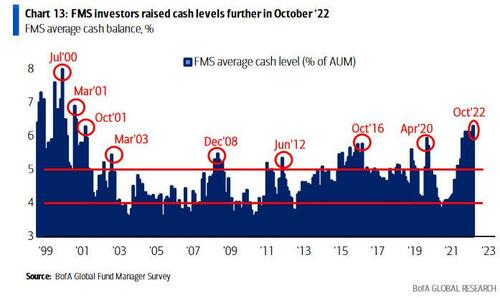

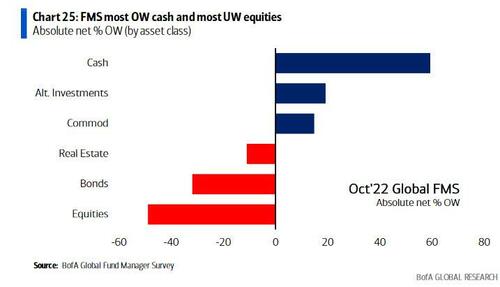

-Allocations to cash highest since 2001 (6.1%). Higher than GFC and Pandemic Lows.

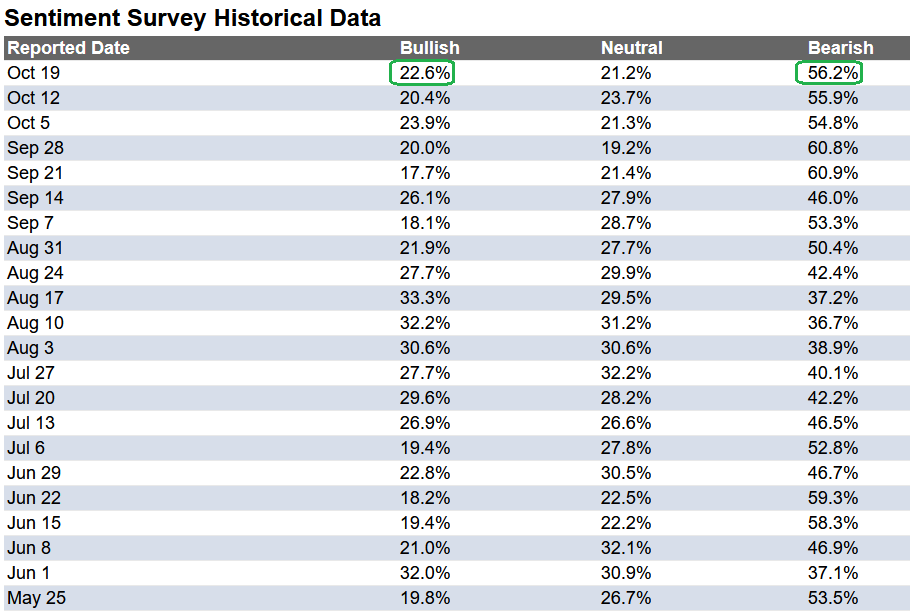

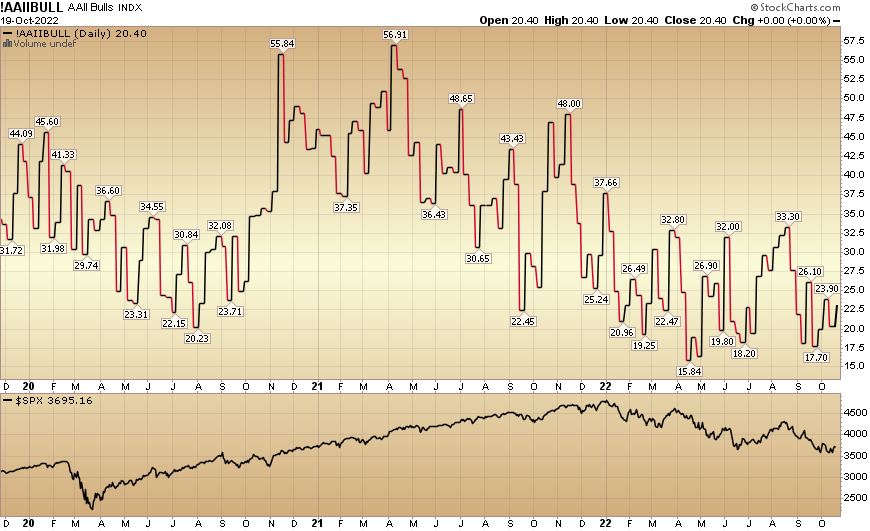

-Last AAII Sentiment Survey: 20.4% bullish. Pandemic Lows 20.23%. GFC lows 18.92%.

-If you can step in at extremes when volatility and fear are high, you will make outsized returns over time.

Take the other side. Looking out a few months, the “pain trade” is UP because no one is positioned for it.

Follow the Smart Money:

–Long S&P Futures: Commercial Hedgers aggressively long (green line at bottom of chart) as was case before rally in equities 2020, 2016, 2011, 2009:

3 Picks:

- Boeing:

Finally received big order from China Airlines for up to 24 787 Dreamliners. Operates in duopoly. Demand/business travel roaring back. Earnings expected to grow at 20%/yr next 5 years. Big earnings growth next year off low baseline. Defense business will grow. Attractive valuation for business with a competitive moat.

- Disney (down 55% off its highs):

Trading at 16.3x next year’s earnings with 38.3% growth rate for next 5 yrs estimated (off low bar).

- JP Morgan (Fell ~40% off its highs):

Best bank in the world. Trading at 9x next year’s earnings. With 11.9% growth next year. Trading near book value.

Xi’s comments out of China

-Xi still asserted that economic development remains the Communist Party’s “top priority,” a sign the government will continue to prioritize GDP growth.

-Some China observers had expected Xi to give equal weighting to security and development, a signal that Beijing could tolerate slower economic growth in order to meet other policy goals. By sticking to earlier language, Xi’s speech suggests no real departure from economic goals.

-Xi praised Covid Zero policy on Sunday, although he didn’t reference the virus again in sections laying out plans for the future.

-The way that development and technology came so high up in the report also is reassuring. This party is not just about ideology, as some were beginning to fear, but development and economic stability stayed high on the list.

-There was a lot of emphasis on technology and innovation means the focus will likely shift away from just lowering financial risks and reducing debt growth to pouring more resources into development of high tech.

-The commitment to tech and green sectors looks strong, meaning these sectors are the rare darlings with favorable government policies.

Was Thursday the “Capitulation Low?”

I joined Phil Yin on CGTN America on Thursday night to discuss. Thank to Phil and Ryan Gallagher for having me on:

Institutional Positioning

On Tuesday, Bank of America published its monthly “Global Fund Manager Survey” which surveyed 371 managers with $1.1T AUM. I posted a summary here:

October 2022 Bank of America Global Fund Manager Survey Results (Summary)

Here are the key points:

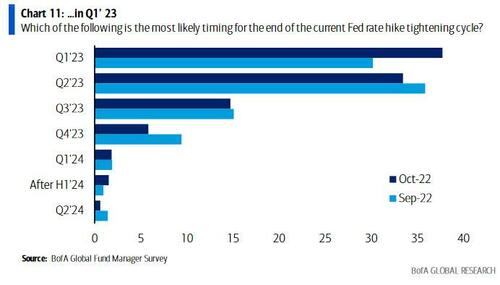

1. 38% (majority) of FMS investors expect the Fed tightening cycle to end in Q1 2023 – one quarter faster than a month ago:

This is consistent with my thoughts above – the worst case scenario is already priced in.

This is consistent with my thoughts above – the worst case scenario is already priced in.

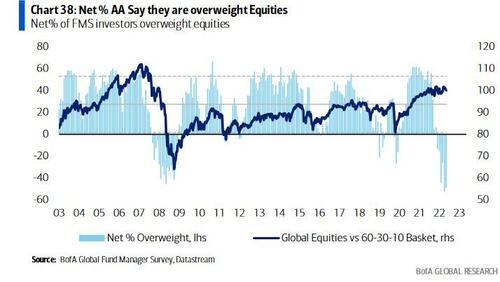

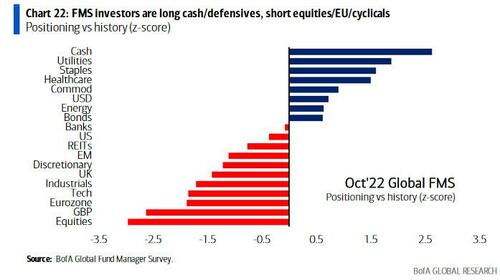

2. Investors are now 3-sigma Underweight equities, surpassing even the panic during the trough of the 2008-2009 GFC:

3. Managers are crowded into cash and out of equities. These conditions are present at every capitulation low.

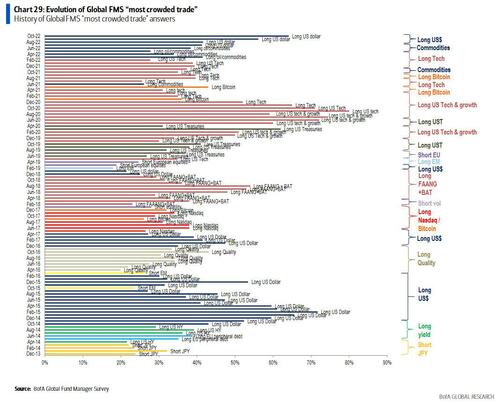

4. Long USD is the most crowded trade. As you go back through the previous most crowded trades, you will see they did not end well:

4. Long USD is the most crowded trade. As you go back through the previous most crowded trades, you will see they did not end well:

What’s Priced Into Markets

- Bad Earnings

- Balance Sheet Reduction (QT)

- Another 150bps of hikes

- Supply Chain Issues

- Shortage of Labor

- Energy Price Shocks

- Record Inflation

- Drawn out War in Ukraine

What’s NOT Priced Into Markets

- Interest Rates Falling

- USD stabilizing

- Up to $1T in stock buybacks before new 1% tax hits on January 1, 2023

- Better than expected earnings (low bar)

- Historically low unemployment rate

- $750 billion stimulus hasn’t hit economy yet

- Supply Chain Improving

- Freight Rates Dropping

- Collapsing prices: Commodities, Gas, Rents, Used Cars

- Political Gridlock after November 8 election (bullish)

- Millennials (72M) housing/family formation wave JUST BEGINNING

- Less hikes than 150bps more

- A cease fire in Russia/Ukraine (low probability, but odds rise as European winter/protests approach)

Now onto the shorter term view for the General Market:

In this last week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked up to 22.6% from 20.4% the previous week. Bearish Percent ticked up to 56.2% from 55.9%. Retail Sentiment is near the levels it was at the pandemic lows (20.23) and near the Great Financial Crisis lows of (18.92).

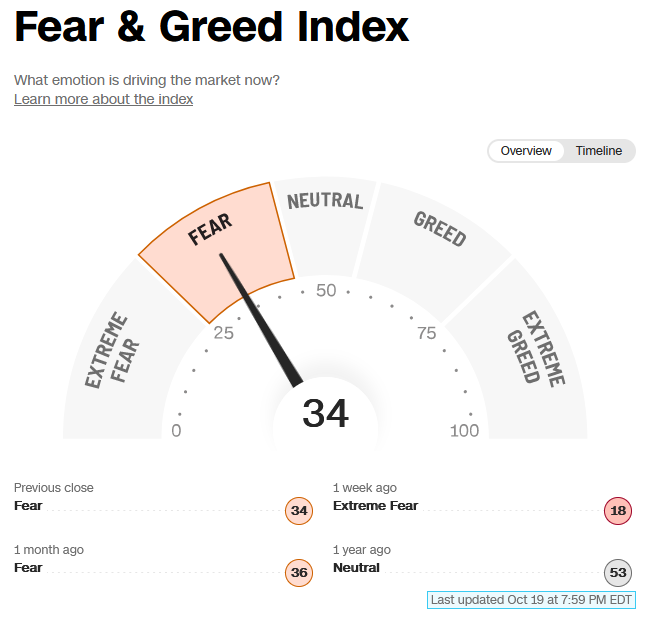

The CNN “Fear and Greed” rose from 19 last week to 34 this week. Sentiment is still fearful. You can learn how this indicator is calculated and how it works here: (Video Explanation)

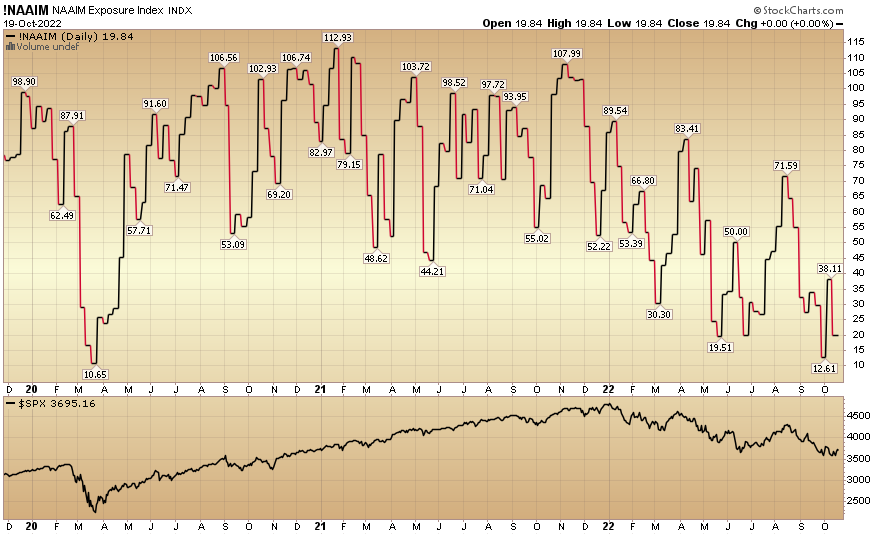

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) fell to 19.84% this week from 38.11% equity exposure last week.

Our podcast|videocast will be out on Friday this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.