Last Tuesday – on the Claman Countdown – I laid out the 3 reasons I believed the worst (of the January correction) was in the rear view mirror (in the near term):

Watch in HD directly on Fox Business

While it looks “obvious” now, it was not an easy call to make in real-time. The sector we mentioned we were leaning into during the segment was Biotech.

This week we took some time to go through the Earnings Power of the top 30 holdings in the XBI Equal Weight Biotech ETF:

As was a similar case with the IBB Cap Weighted Biotech ETF (see link above), XBI’s cumulative earnings power (estimates) for 2022 dropped –0.41% in the past two months, while the ETF fell ~37% over the time frame.

We used this dislocation (fear of rate hikes) to make the sector one of our largest positions over the past week+.

Expensive Coffee Is Still Cool

In last week’s podcast|videocast AMA (Ask Me Anything) questions, one viewer asked if I thought the unionization efforts at Starbucks would hurt the stock.

On Monday morning I was invited on Cheddar News to discuss SBUX expectations ahead of earnings. The short term margin pressure – that management was expecting – came to pass in the earnings report on Tuesday night, but the stock held up very well in the face of it. A key contributing factor was that they paid employees who were at home with covid/omicron in Q4 – even though they had to bring someone else in to fill their shift. There was a meaningful amount of double-pay in the quarter due to covid. That is not expected to persist in Q2 and beyond:

Watch in HD directly on Cheddar

Glass Half Full?

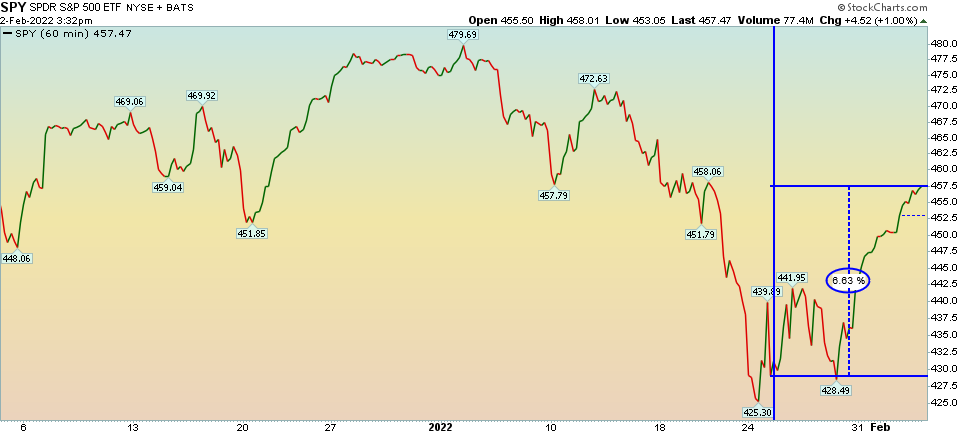

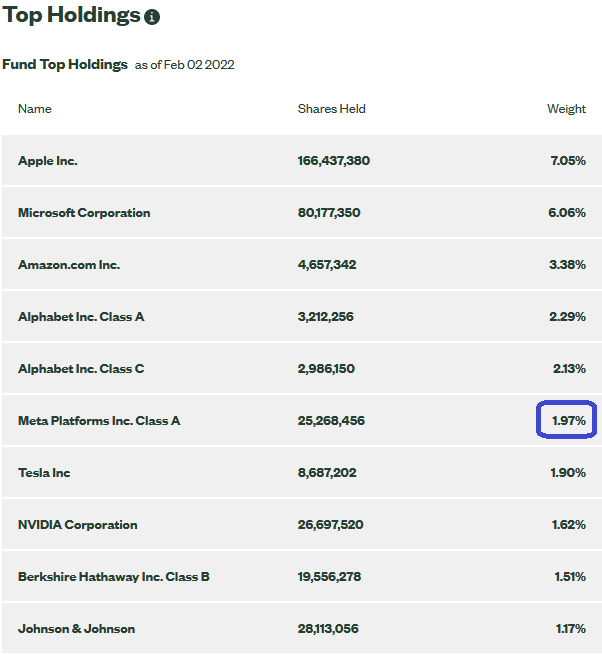

With the unfettered ~6.6% S&P rebound in the past week, it would be entirely predictable to have some short-term digestion of an aggressive move off the lows. Writing this on Wednesday night – after Facebook just missed on the bottom line and issued weak guidance – it may be just the catalyst to scare some out of their recently purchased positions in the next day or two.

(SPY top weighted holdings: SSGA)

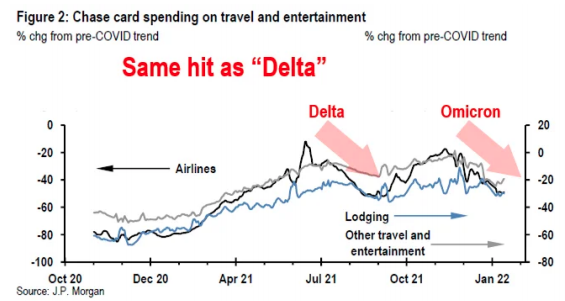

Overall however, we think the markets can work higher ahead of the March Fed meeting. The jobs report may come in weak on Friday (we saw indications of that in the ADP report today), leading market participants to re-evaluate how “hawkish” the Fed will be – given the short term impact of the virus. In other words, bad news (jobs) will be good news (Fed slows tightening pace). We saw the same consumer weakness with Delta this past Fall. Spoiler alert, they will recover:

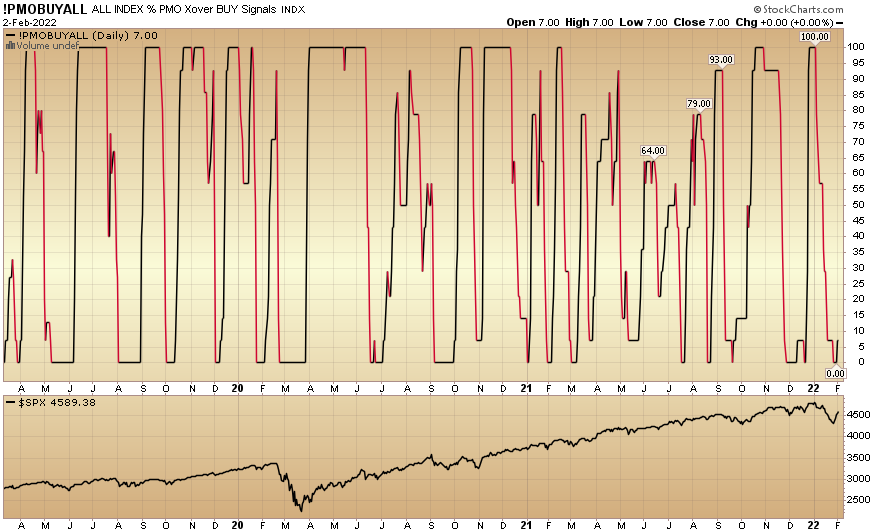

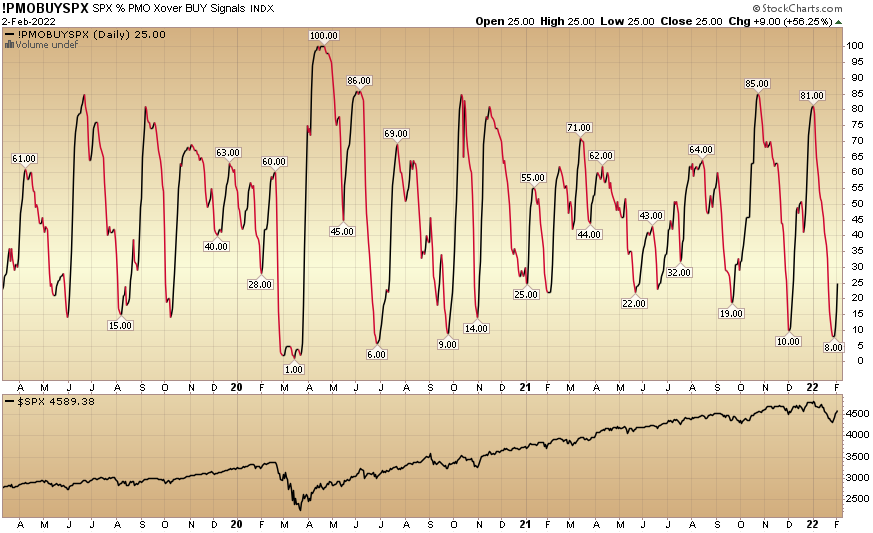

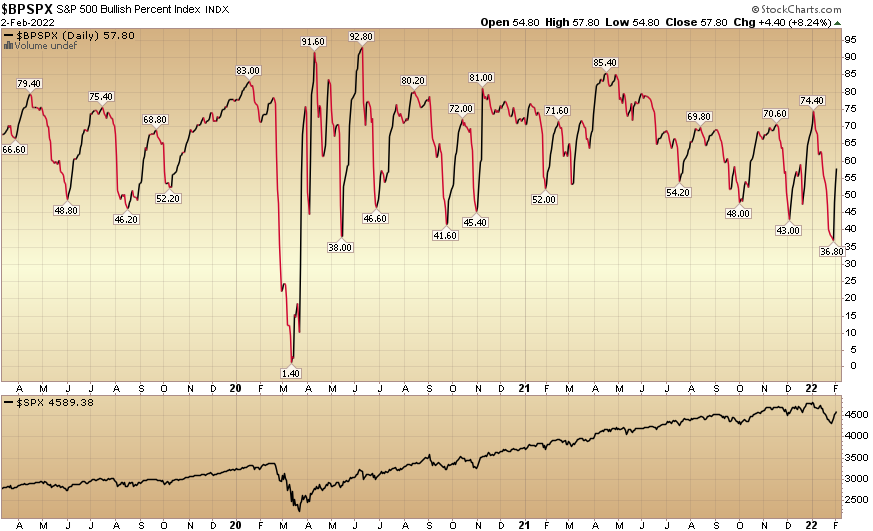

Short term indicators are also signaling that any heavy trading in FB – impacting the overall market indices – should be contained to a few sessions.

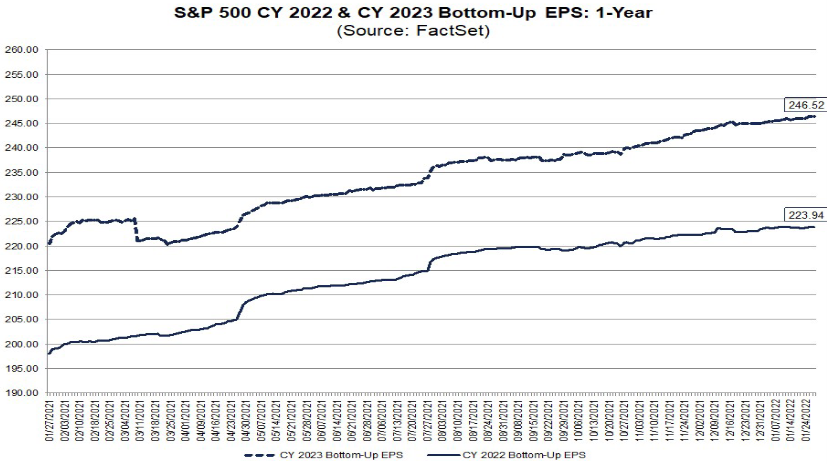

The two key driving factors are still present in the market. Earnings continue to hold up (although estimates are not improving as quickly as we would like to see). Liquidity is still abundant. Taper will run through March. In the mean time, they are still ADDING to the balance sheet. That will change, but it hasn’t changed yet.

Now onto the shorter term view for the General Market:

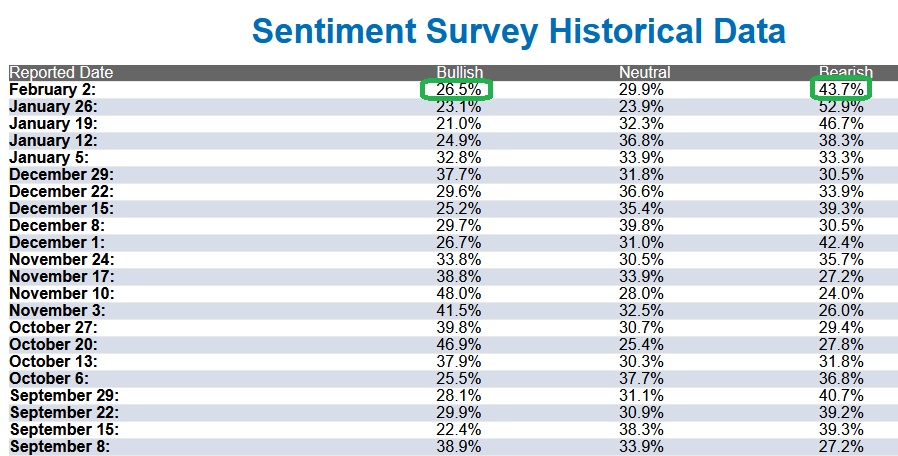

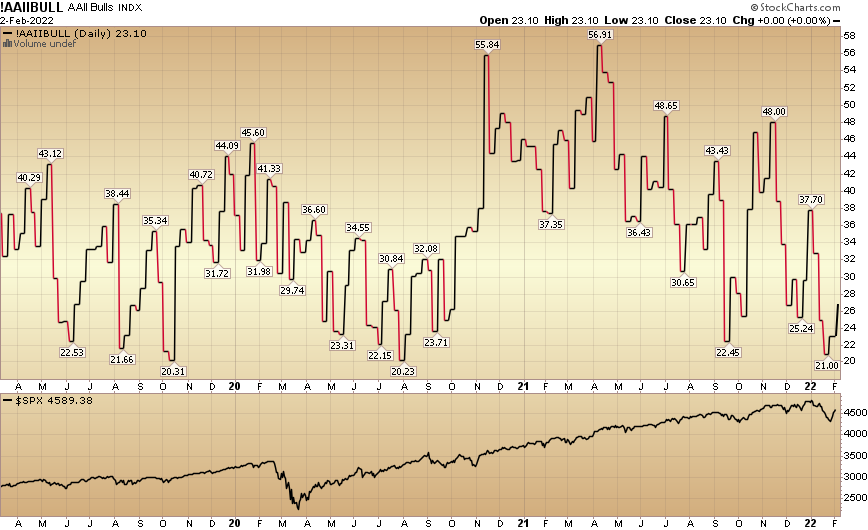

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked up to 26.5% this week from 23.1% last week. Bearish Percent dropped to 43.7% from 52.9%. Retail trader/investor sentiment is still fearful.

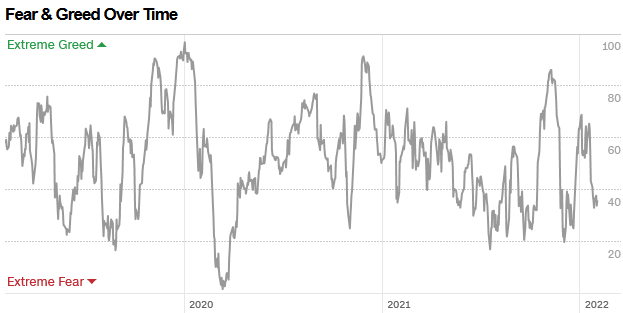

The CNN “Fear and Greed” Index flat-lined from 36 last week to 36 this week. There is still fear in the market. You can learn how this indicator is calculated and how it works here: (Video Explanation)

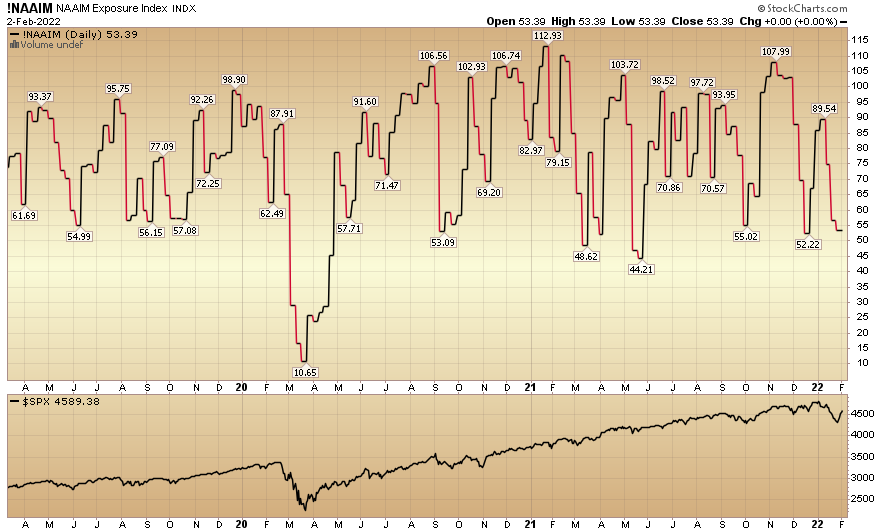

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) fell to 53.39% this week from 56.73% equity exposure last week. Managers will have to chase any strength in coming weeks.

As we said multiple times in our weekly podcast|videocast late last year and early this year, 2022 would be a much different year than 2021. We would have higher volatility (3-5% pullbacks of 2021 would become 8-10%+ corrections in 2022) and lower returns (high single digit to low double digits) in 2022. So far that has held true…

With the excess crowding into indexing in the past decade, there has to be a time when the “crowded trade” punishes its adherents. I think 2022 sets up well to be that time. General indexers will find 2022 very unsatisfying as they grind sideways with increasing volatility – for nothing more than average returns at the end of the year.

Opportunistic stock pickers that can pick stocks and sectors in distress (and be patient) will be amply rewarded – and may see some of the highest returns of their career. Time will tell…