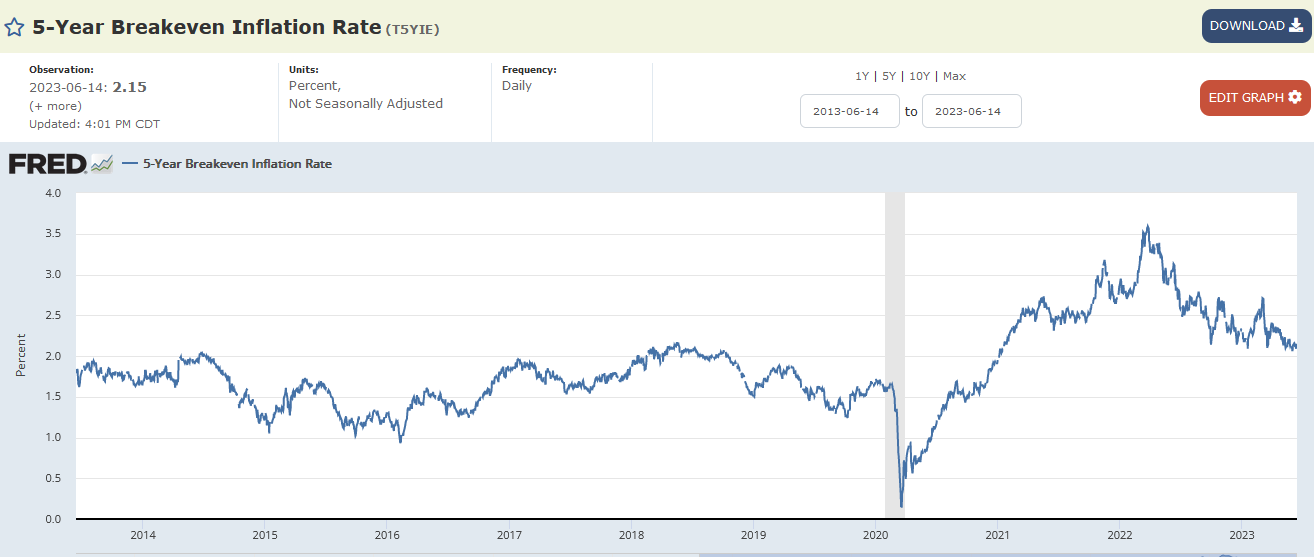

Those expecting a “dovish” skip at the Fed meeting may have been surprised by an increase in the expected terminal rate presented in the dot plot yesterday:

The FOMC took the terminal rate projections up to 5.6% from 5.1% – implying two more hikes. Nick Timiraos (WSJ “Fed Whisperer”) called their bluff in the press conference and asked why – if they are so hawkish – didn’t they simply pull the band-aid off and hike at this meeting? Powell’s general tenor was that July is a “live meeting” but projections could change (i.e. the dot plot is designed to ANCHOR inflation expectations, not kill inflation). Now that expectations are back at 2018 levels, I would say it is working:

The biggest risk is no longer inflation moving forward. The biggest risk is deflation. You cannot have debt to GDP at ~120% and enter deflation. The ONLY play is to inflate your way out of it and run inflation above 3% for 3-5 years – as we did following WWII – when we had similar debt levels.

On Monday, I joined Ann Berry on Public.com to discuss markets, the Fed and opportunities moving forward. Thanks to Mike Teich and Ann for having me on:

On Tuesday, I joined Ali Cinar of Bloomberg HT (Turkey) to discuss the Fed, Banks and opportunities moving forward. Thanks to Ali for having me on:

On Wednesday evening, I joined Phil Yin on CGTN America to discuss the impact of the Fed skip and which sectors can outperform moving forward. Thanks to Phil and Kamelia Kilawan for having me on:

Last week we said, “While I wouldn’t be surprised by some short term market consolidation, I also wouldn’t be playing for it.” Quite a few names are “overbought” and many of the short-term indicators I look at point toward taking a breather. However, at the same time, when I see positioning and sentiment so low I remain open-minded to the idea we could stay pinned for some time and push more people into the market against their will!

This Tuesday, Bank of America published its monthly “Fund Manager Survey.” I posted a summary here:

June 2023 Bank of America Global Fund Manager Survey Results (Summary)

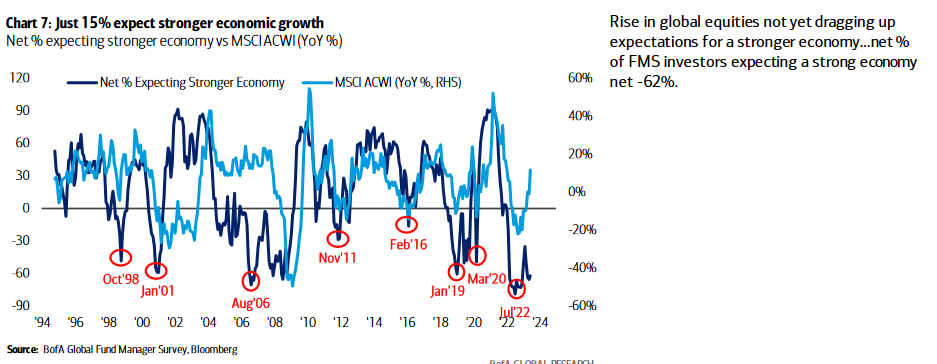

Here were the 5 key points:

1) Only 15% of managers expect stronger economic growth. These are levels not seen since the Pandemic low, GFC lows and Tech Wreck lows in 2001.

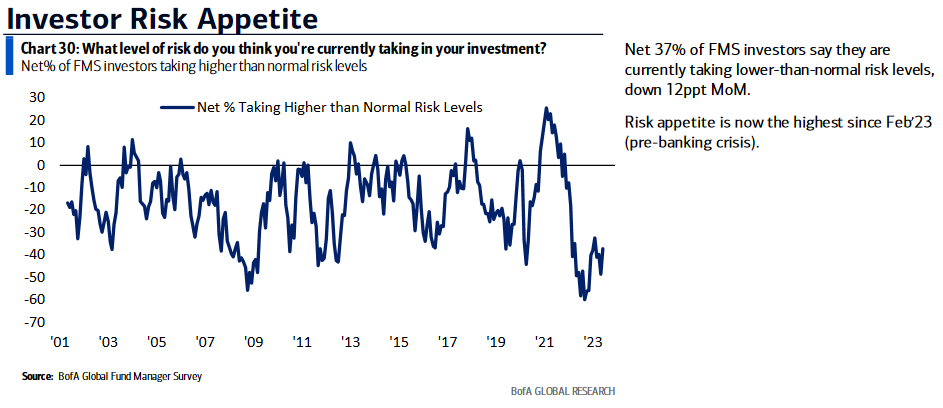

2) Managers are taking the lowest levels of risk in their portfolios since early in the 2009 recovery:

2) Managers are taking the lowest levels of risk in their portfolios since early in the 2009 recovery:

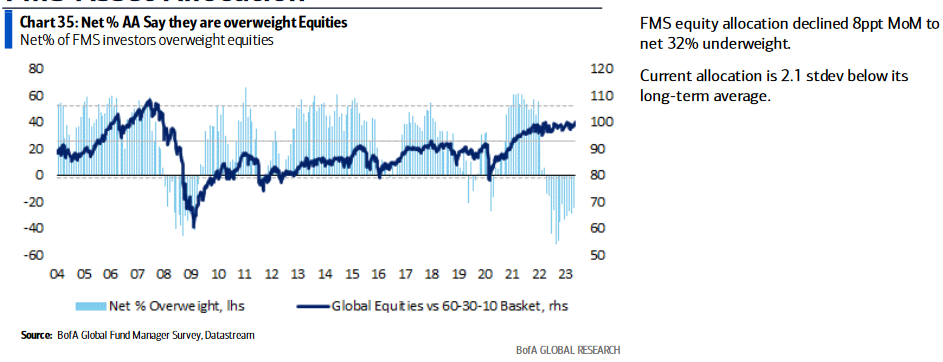

3) Equity allocations are still 2.1 SD below their long term average despite a ~25% rebound off the October lows:

3) Equity allocations are still 2.1 SD below their long term average despite a ~25% rebound off the October lows:

4) Managers remain overweight bonds and underweight equities relative to 20yr average:

4) Managers remain overweight bonds and underweight equities relative to 20yr average:

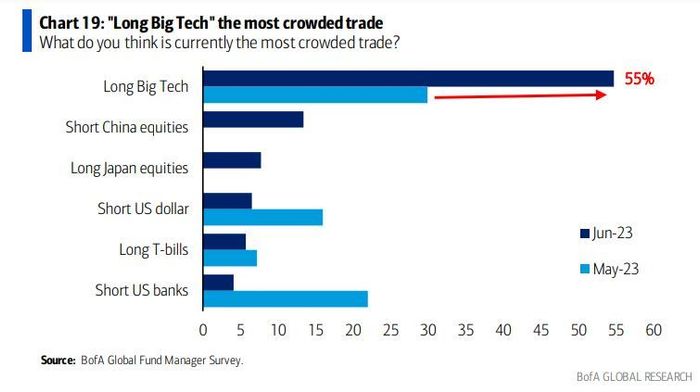

5) The most crowded trades are Long Big Tech and Short China. We expect the relative performance to flip. Big Tech will under-perform China in 2H.

Today I will join Brad Smith and Diane Kin Hall on Yahoo! Finance at ~3pm. Tune in if you are free. I will be doing two separate segments. The first one will cover general market overview and outlook. The second segment will cover two stocks we like and two to avoid. Here’s a teaser for you to tune in:

Today I will join Brad Smith and Diane Kin Hall on Yahoo! Finance at ~3pm. Tune in if you are free. I will be doing two separate segments. The first one will cover general market overview and outlook. The second segment will cover two stocks we like and two to avoid. Here’s a teaser for you to tune in:

2 Stocks We Like [both high-quality “on sale” at (80% off peak)]:

GENERAC (GNRC):

- Generac: The “Kleenex” of Home Standby Generators. 75% of market. Lowest cost, highest margin producer due to buying power. Market share 4 times the size of the next largest competitor. C&I growing from secular Telco 5G network buildout (up 30% yoy). Power Cell Energy Storage (clean energy) ~10% of sales.

- Taking 2024 estimates of $8.13, GNRC trades at 14.7x forward earnings – which is ~1/2 of its 5yr average of 29x.

- Stock Dropped ~80% from 2021 peak on inventory build (covid). De-stocking trough in Q1. Sales back-end loaded for 2H (45% 1H 55% 2H 2023).

- Days of field inventory back to 1.4x normal Q1 from 1.7x Q4. Will be normal mid-year. Cash-flow positive again in 2023.

- Long Runway: still less than 6% penetrated in single family, where U.S. House is greater than $150,000 in value. Every 1% penetration is a $3 billion market opportunity.

- There’s a tipping point when a state gets to 10% penetrated, it then accelerates. The top five states (penetration) are also almost always the top five growth states over time.

- Challenges around grid reliability continue due to age, under-investment, weather and electrification.

- Consistent compounder – double digit return on invested capital for over a decade.

- Entering Hurricane season from July 1-October 31. Weather events drive sales.

PAYPAL (PYPL):

- Fears about competition ApplePay, declining margins and FedNow payment systems.

- 435M users! 3B transactions in 2022. Transactions jumped 13% in Q1 + 2.9M new active accounts. Picked up market share in quarter.

- Growth BNPL, Venmo, use venmo on Amazon. Braintree higher volume, lower margin.

- Buying back $4B of stock in 2023.

- Taking 2024 estimates of $5.65, PYPL trades at 11.15x forward earnings – which is 1/3 of its average of 35x.

- Consistent compounder – double digit return on invested capital for over a decade.

- Over the past five years, return on invested capital has averaged 33% annually once goodwill is excluded.

- There is still plenty of runway for growth in electronic payments. Electronic payments only surpassed cash payments on a global basis a couple of years ago.

- The relative ease of using PayPal in an online transaction materially boosts conversion rates, with PayPal transactions converting at a rate of almost 90%, compared with an industry average of about 50%.

- Schulman announced he intends to step down as CEO at the end of 2023. Leadership uncertainty to be resolved in coming months.

- Activist Catalyst: Activist Elliott Investment Management has built a stake in PayPal, and the company has entered into an information sharing agreement with Elliott. Elliott’s priorities seem to center on margin improvement and higher levels of capital return.

Now onto the shorter term view for the General Market:

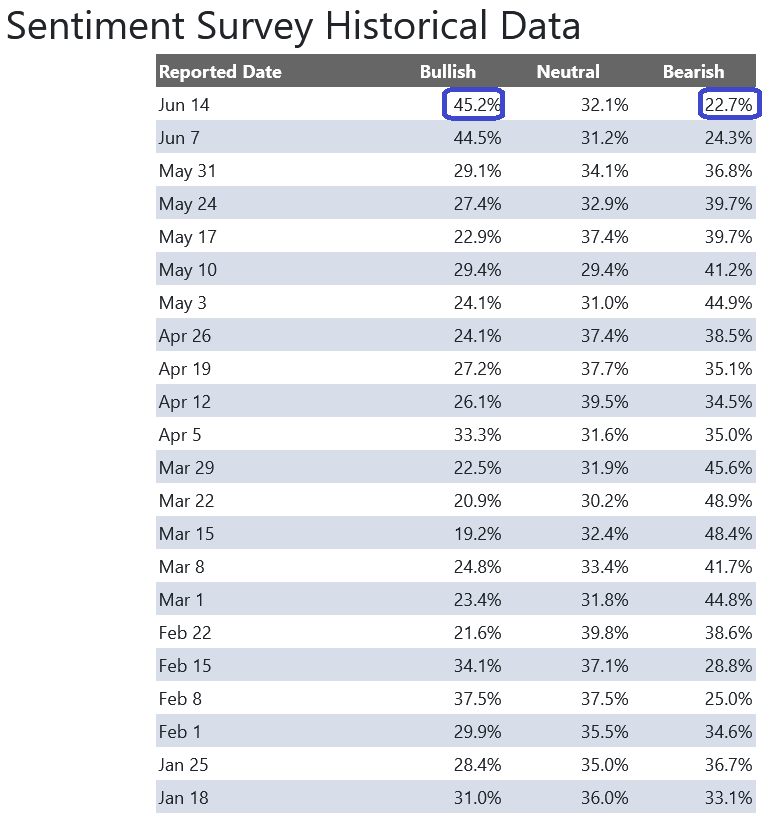

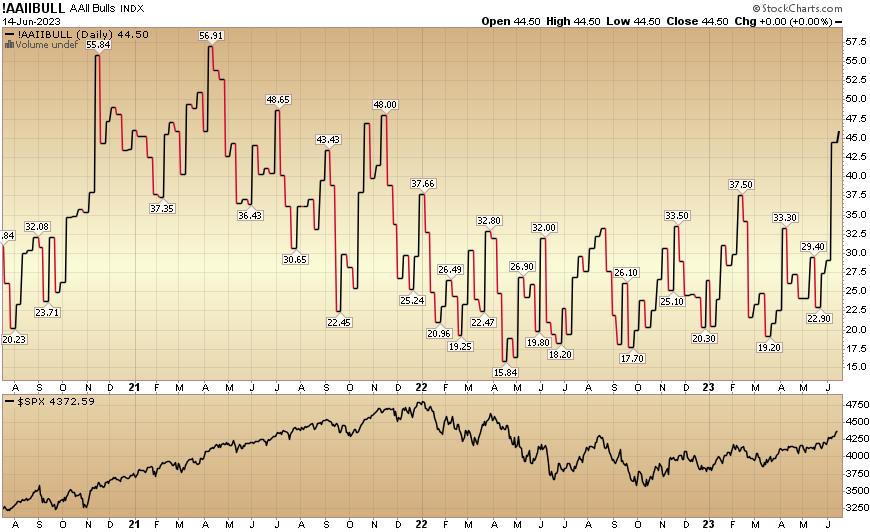

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked up to 45.2% from 44.5% the previous week. Bearish Percent dropped to 22.7% from 24.3%. The retail investor is giddy with excitement. This can stay pinned for a while before they get taken out to the woodshed.

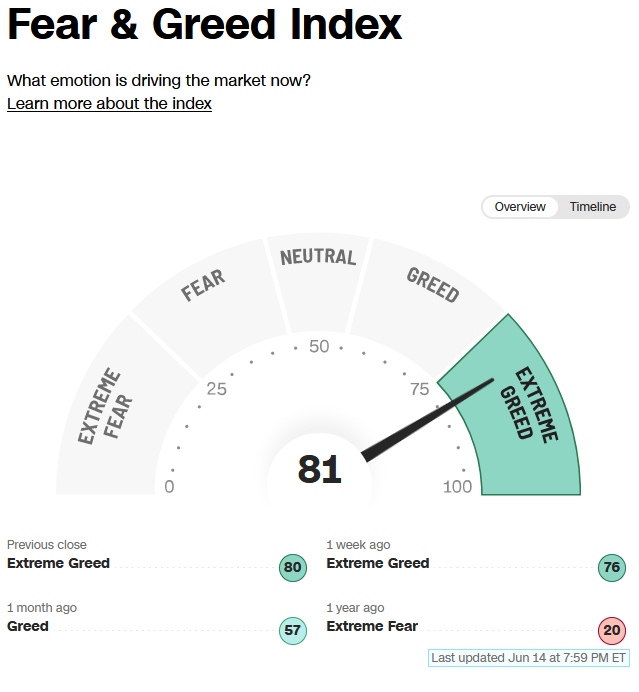

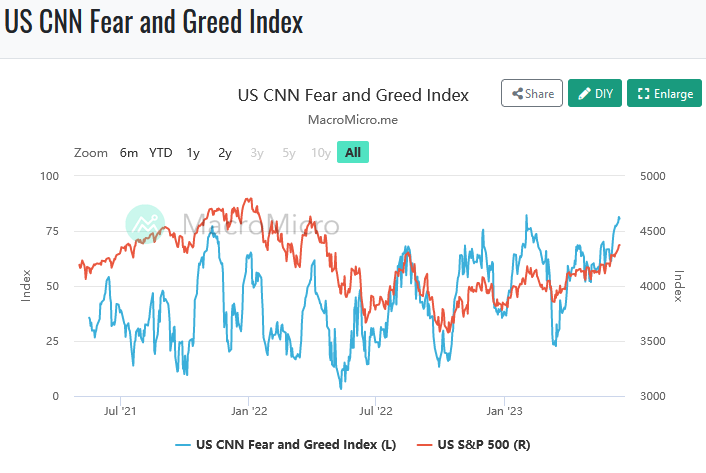

The CNN “Fear and Greed” rose from 76 last week to 81 this week. Sentiment is hot but it would not surprise me if it stays pinned for a bit to force people out of their bunkers and back into the market. You can learn how this indicator is calculated and how it works here: (Video Explanation)

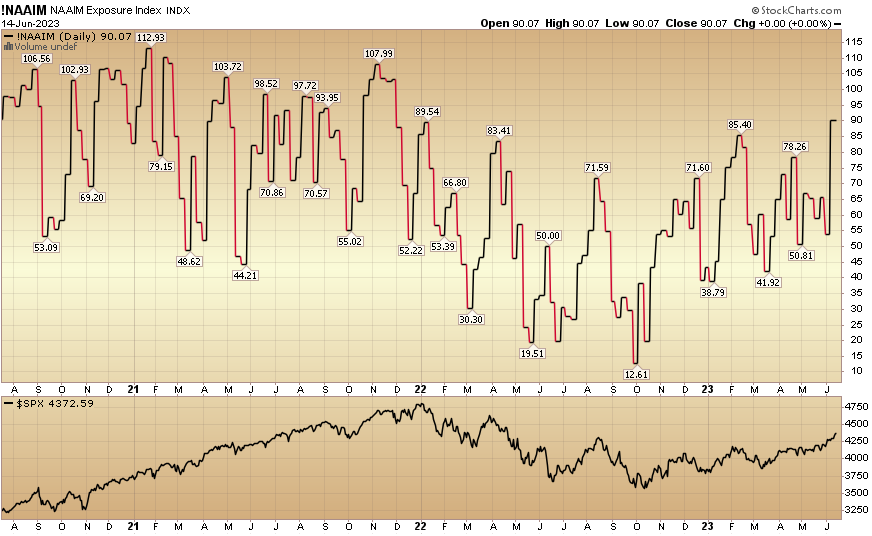

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) catapulted to 90.07% this week from 53.92% equity exposure last week. Managers are now chasing the rally.

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) catapulted to 90.07% this week from 53.92% equity exposure last week. Managers are now chasing the rally.

Our podcast|videocast will be out late today or tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Our podcast|videocast will be out late today or tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

*Opinion, not advice. See “terms” above.