Last week, my family and I took a trip out to visit friends in Whitefish, MT for a long weekend. We had an amazing time. On the first day we went out on the lake and both me and my daughters learned how to ski behind the boat. I was able to get up and surf for a reasonable amount of time, but being on the “wrong side of the wave” made balancing harder than it needed to be:

Right now you have a similar situation for most market participants (who don’t receive our weekly podcast|videocast and Commentary)! They have missed the bulk of the recent move off the lows and now they are forced to chase.

In our June 16, 2022 weekly note we made 2 key statements:

- “Here’s a question: What if we already HAD the recession and Q2 comes in negative? How much do you think is already priced in considering the US indices already marked a bear market on Monday (down 20% on closing basis)? We think most (if not all) of a mild recession has already been priced in. The market always bottoms BEFORE the data begins to improve. By the time they announce a recession, the market bottom will already be in the rear-view mirror. That announcement could come as early as next month if we see negative Q2 GDP – or as late as mid-2023 if we don’t – but our base case is it will have been/will be shallow.”

- “While pessimism continues to climb to a new all time high – SO DO EARNINGS! One of the two will have to come down soon. My bet is that pessimism will come down more than earnings.”

Since then, the S&P 500 is up ~18.71% (but still down 10.9% ytd):

Note that because most managers are now riding BEHIND the wave and only got up on their board in early August, the smallest turbulence will cause them to “wipe out” (dump their stocks at exactly the wrong time because they are behind their benchmarks and bought too late). If you recall from the podcast|videocast from that week, we said that Hedge Fund managers were selling the most equities that week “in the hole” than ever before in history. We went on to say, “if we were not stepping in to buy this pessimism, what they hell are we doing (find a new profession)?“ We did step in, and so did the listeners of our weekly podcast|videocast. With a cushion built up off that move, we are riding ahead of the wave and any short term turbulence can be easily managed and surfed through – even if the “johnny come latelies” get wiped out again.

CNBC “Street Signs”

The most important organ in investing is the STOMACH, not the Mind.

On Monday evening (Tuesday morning Singapore Time), I joined Tanvir Gill and Will Koulouris on CNBC “Street Signs.” Thanks to Ginny Goh, Celestine Francis, Tanvir and Will for having me on. We discussed DIS, XBI, EEM, CPS, Fed Policy, USD, China, BABA & more. Pay close attention to what I say about Fed Policy/Quantitative Tightening/Jackson Hole/USD in the full interview:

Click here to watch in HD directly on CNBC

FULL INTERVIEW HERE:

Show Notes Ahead of the Segment:

Biotech (XBI) – now up 53.5% off the May lows. As our 2nd largest position, we believe the move is just beginning and should be strong over next 1-2years (in a slower GDP growth environment). Similar situation in 2015-2018 (crashed 50% in anticipation of tightening cycle, up 140% over 2 years DURING tightening cycle).

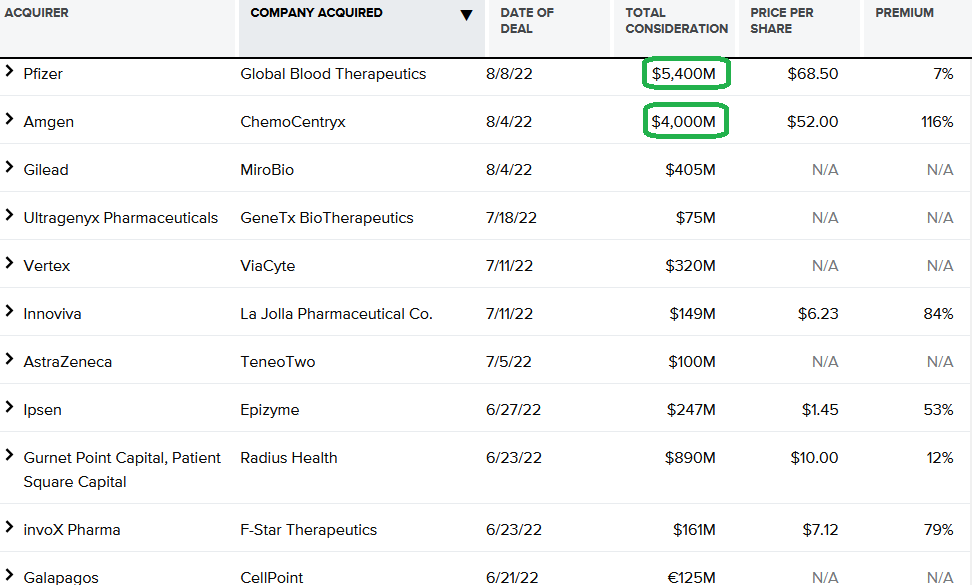

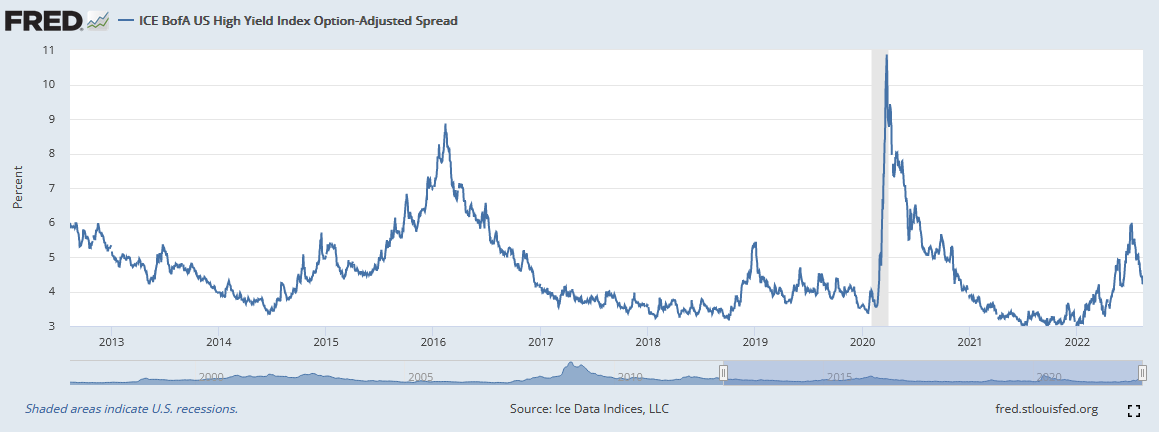

Core part of our thesis now happening (Big Pharma has record cash and little innovation with many blockbuster drugs coming off patent). “Animal Spirits” are back. Big Pharma boards have been put on notice that if they don’t purchase undervalued biotech companies (trading at multidecade low valuations) their competitors will. 6 multibillion dollar deals in last few months.

–Drug Approvals now coming online as FDA shifts focus from COVID and trials running full steam.

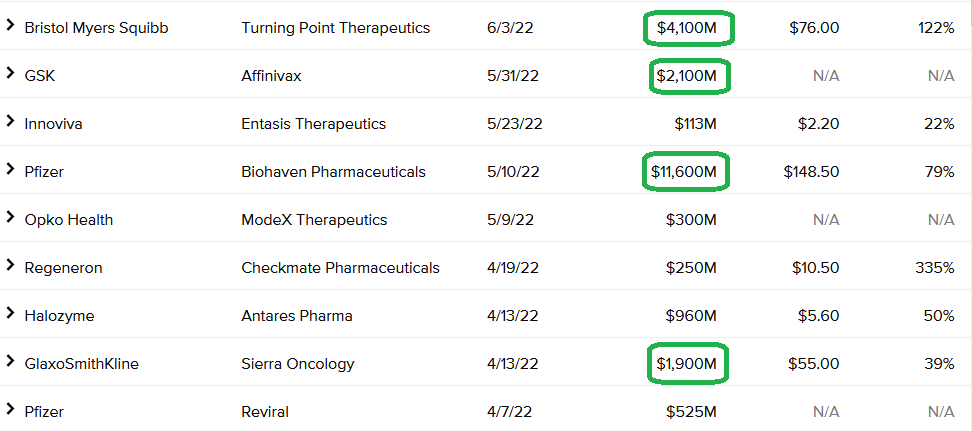

Alibaba (9988)/China – we have added size on weakness over time. Up 28.5% off March lows. Alibaba web traffic up 21% July over June.

The move to de-list five Chinese state-owned enterprises (SOEs) from the New York Stock Exchange (NYSE) signals Beijing may be willing to compromise in order to strike an audit deal with the United States.

They were more worried about having the SOEs’ accounts accessed as an SOE audit might include the amount of government subsidies to the companies. Private companies have long stated that they have nothing to hide from an audit review conducted by the Public Company Accounting Oversight Board (PCAOB).

Dual Primary listing in HK could access another $30-$40B of mainland buyers of Alibaba stock before yearend through the Stock Connect (currently own ~$30B or Tencent). De-lisiting not a real factor as Tencent has done just fine without US primary listing (up 3500% since 2009).

Overhangs: ZeroCovid, SoftBank forced seller (seem to both be abating), Consumer Confidence low due to fear of recurring lockdowns.

Is someone asked you if you were interested in buying Amazon at a 66% discount with AWS growth curve just starting (China digitization ~5 yrs behind US), would you be interested?

That’s what is on the table with Alibaba – despite all of the short-term noise about delisting/covid/slow recovery etc. And by the way, you get 1/3 ownership of the largest financial services company in the Country in Ant Financial “for free.”

The most important organ in investing is the STOMACH, not the Mind.

On Monday, the People’s Bank of China cut by 0.1 percentage point two key interest rates and pumped the equivalent of $59.3 billion into the financial system to rev up lending and wider economic growth. The unexpected move marked a small step toward more support for China’s economy, and may foreshadow further cuts to borrowing costs in the months ahead.

Disney – Parks continue to have a moat with staying power. Topped Netflix on subs this quarter (221M). Still trading ~40% off highs (bargain with long term view). Loeb wants to unlock value by spinning off ESPN, buying back more stock, and cutting costs at Disney.

US Earnings/Market:

Both earnings and estimates have held up better than feared for Q2. With inflation backing off, managers who stayed in cash and didn’t believe the huge move off June the lows are now being forced back into the market. The tax on buybacks will frontload billions in buybacks before year end and put a floor in the market.

The technical recession is now in the rear-view mirror as GDP estimates for 2H are now positive. The final nail in the coffin for bears looking for new lows will be the September CPI also coming in lower than expected – resulting in the Fed doing less than expected in September.

While I did not anticipate I would be talking about Cooper Standard (CPS) on CNBC, they asked about my top US positions – so we went into detail. As eloquent as I was for the bull case on CPS, it pales in comparison to what this 40 year veteran Auto Analyst (Mike Ward of Benchmark) had to say about new car production, demand and orders over the next 18 months. Remember from our original thesis (below) CPS makes money when OEMs (GM, FORD, etc) PRODUCE and ship new cars:

Highlights:

- Auto Production will be UP 30% in Q3.

- Order book growing STRONGER despite backlog.

- Most bullish demographic car purchasing trends in history.

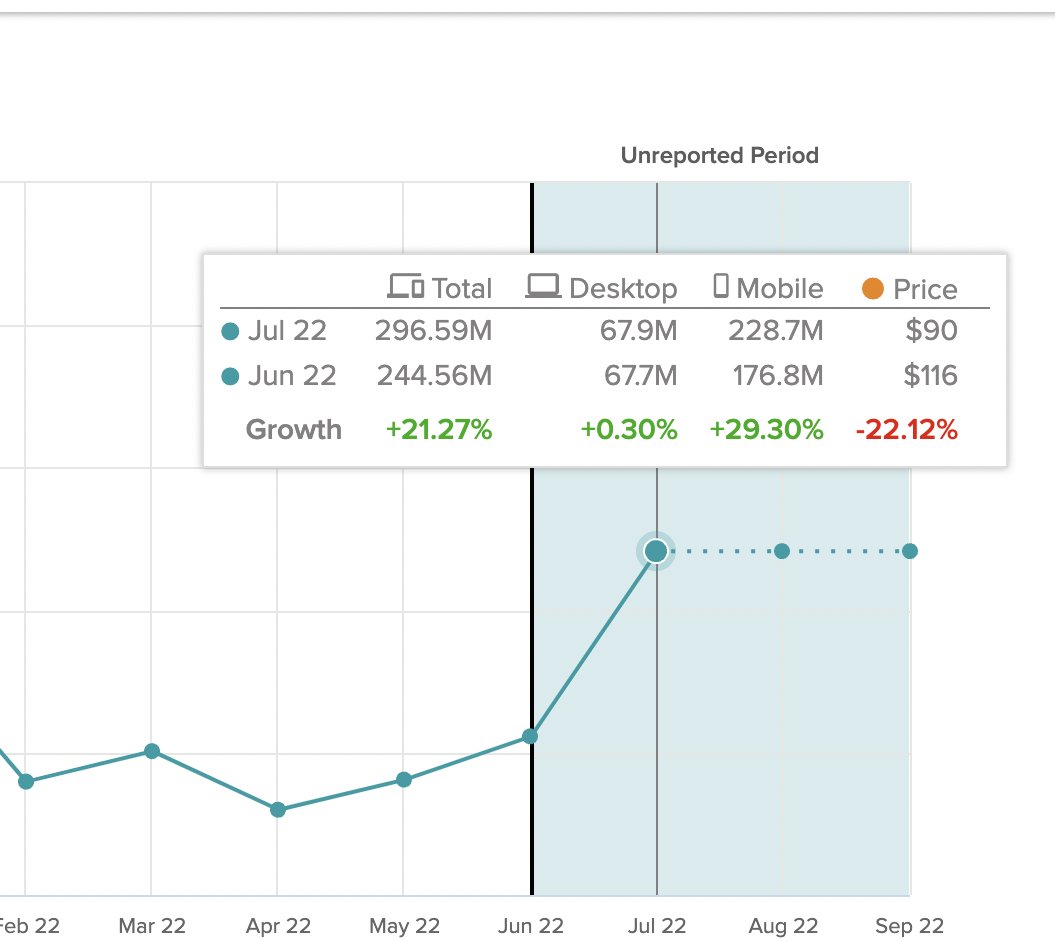

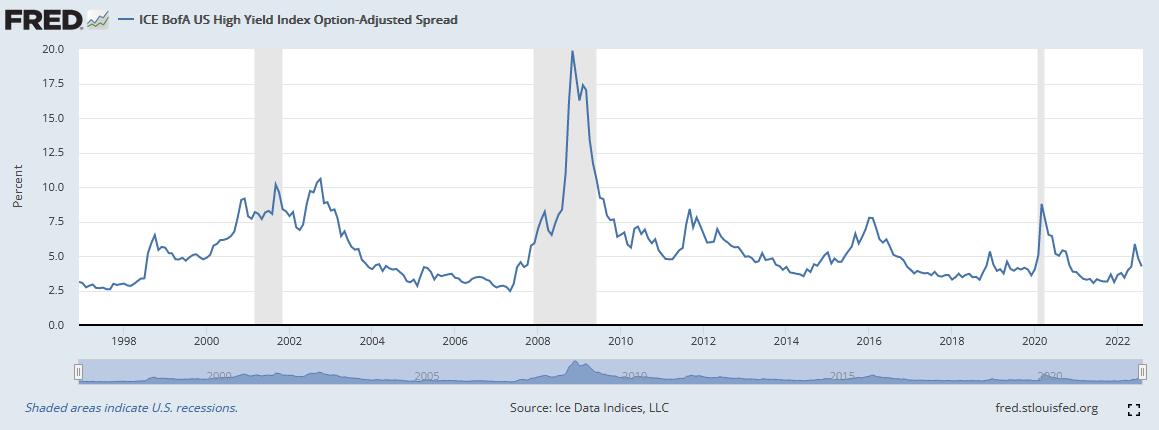

In addition to new car production turning a corner due to renewed auto-chip supply, we like what we are continuing to see in High Yield credit markets – which increases the chance the company can get refinanced in coming months:

Spreads peaked at 6% in early July and have now rolled over to 4.24% (176 bps) in the past 5 weeks alone! This looks more like a small “aftershock” (see 2018, 2011, 2005) than a new earthquake (see 2001, 2009, 2020).

Sentiment STILL Washed Out

On Tuesday, Bank of America put out its monthly “Fund Manager Survey” which surveyed 284 managers with $836B AUM. Here is my full summary:

August 2022 Bank of America Global Fund Manager Survey Results (Summary)

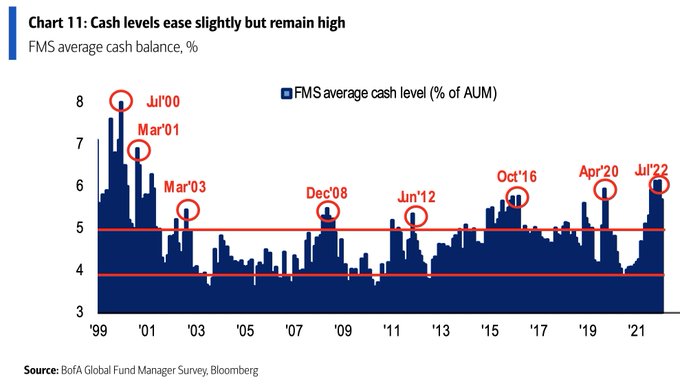

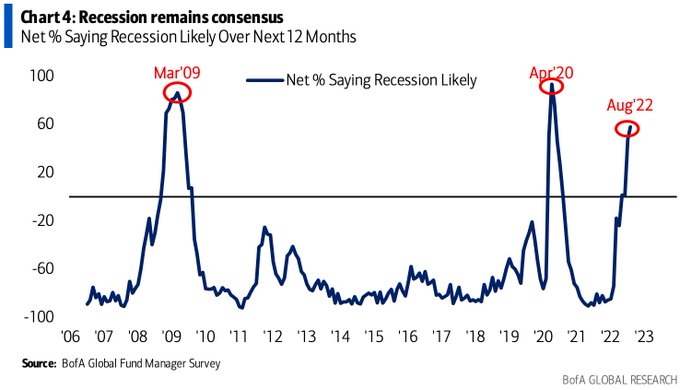

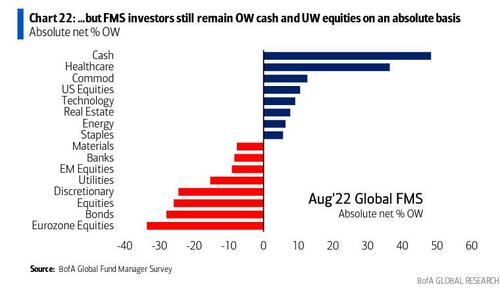

The four key points I want to focus on are:

- Despite the ~18% move off the lows in July, managers are still holding record cash (rivaling pandemic and GFC lows):

- Just as was the case in March of 2009 and April 2020, managers are still looking for a recession that ALREADY HAPPENED (in 1H):

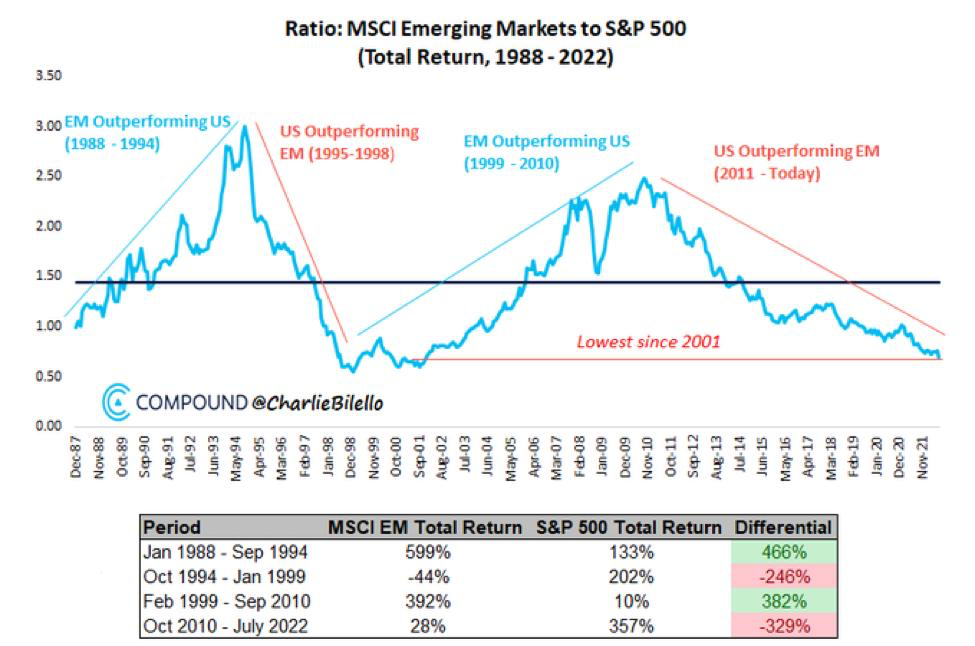

- Managers are bullish on cash and bearish on Emerging Markets. We want to take the other side of both trades:

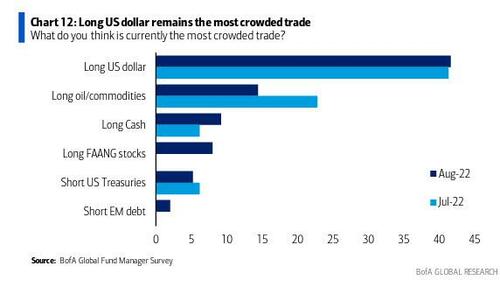

- The most crowded trade is the US Dollar:

All you need to know about the USD trade I covered in the CNBC interview above. When that changes, money will flow into Emerging Markets like there’s no tomorrow. Fed Tightening caused the rally, Fed slowing will change the tides.

Now onto the shorter term view for the General Market:

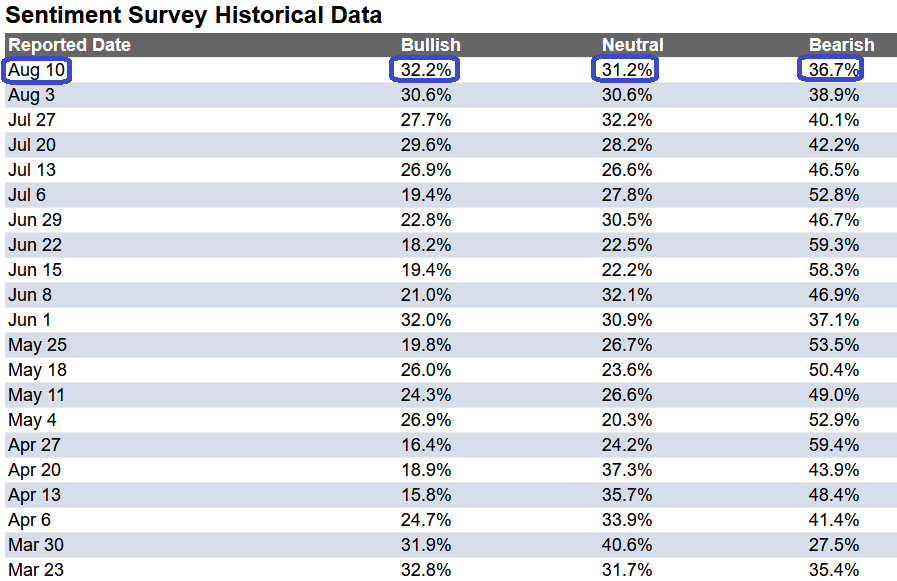

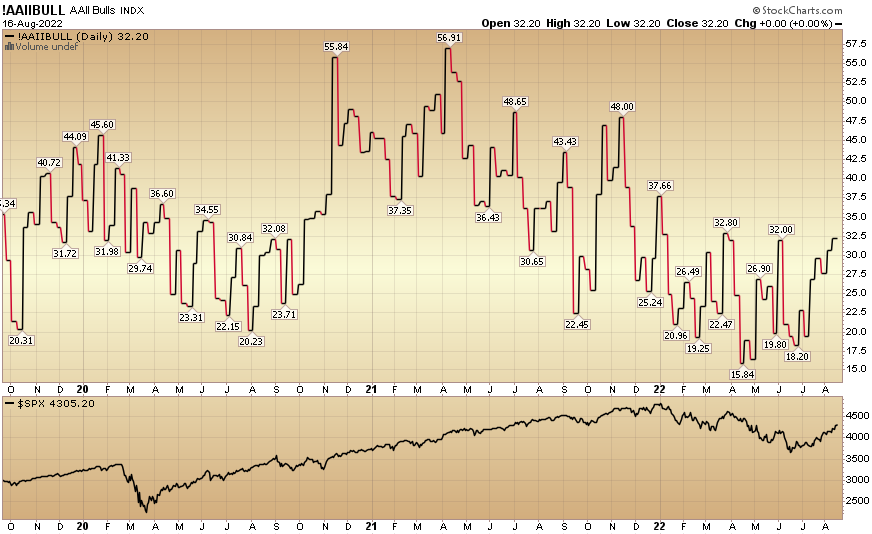

In this last week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked up to 32.2% from 30.6% the previous week. Bearish Percent dropped to 36.7% from 38.9%. Retail investors’ sentiment is neutral and likely headed higher this week.

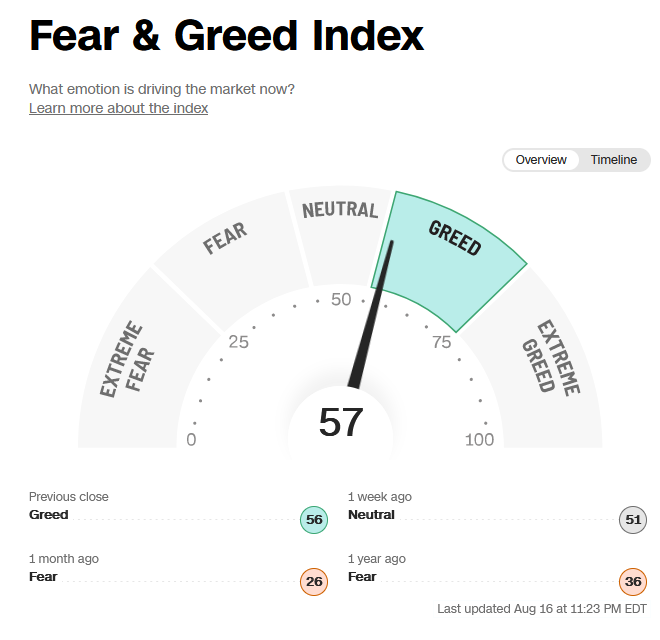

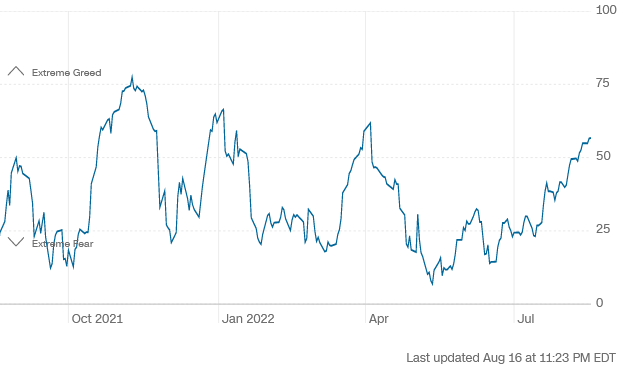

The CNN “Fear and Greed” ticked up from 49 last week to 57 this week. “Animal Spirits” are returning but nowhere near extreme. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The CNN “Fear and Greed” ticked up from 49 last week to 57 this week. “Animal Spirits” are returning but nowhere near extreme. You can learn how this indicator is calculated and how it works here: (Video Explanation)

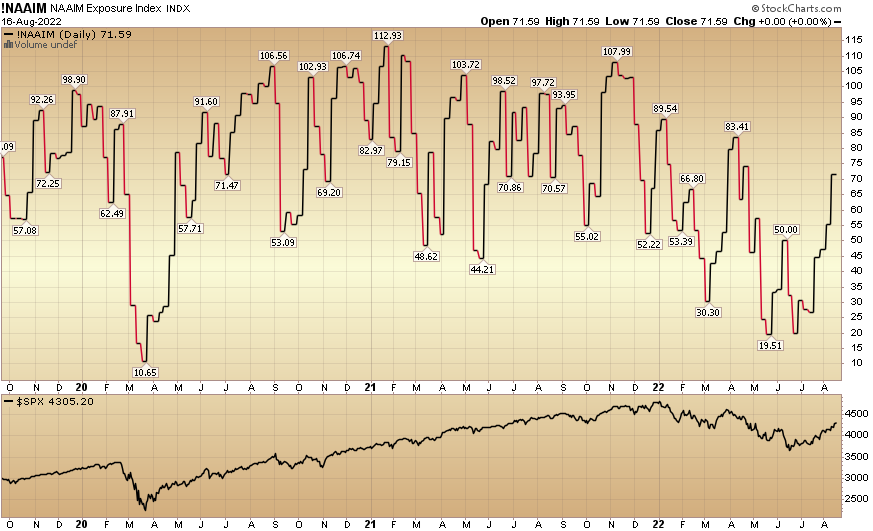

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) jumped to 71.59% this week from 55.28% equity exposure last week. Managers are now chasing as we anticipated weeks ago.

Our podcast|videocast will be out today or tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.